Alfa Financial Software Hldgs PLC Launch of Share Buyback Programme (7350Y)

18 January 2022 - 6:00PM

UK Regulatory

TIDMALFA

RNS Number : 7350Y

Alfa Financial Software Hldgs PLC

18 January 2022

18 January 2022

Alfa Financial Software Holdings PLC

Launch of Share Buyback Programme

Alfa Financial Software Holdings PLC ("Alfa" or the "Company"),

a leading developer of mission-critical software for the asset

finance industry announces that it will launch a share buyback

programme (the "Programme").

Introduction

As we noted in the pre-close trading update last week, Alfa has

closed 2021 strongly and is confident in its prospects for 2022.

The business continues to be highly cash positive after returning

GBP77m of capital to shareholders through special and ordinary

dividends since November 2020 and retains significant net cash

balances. Future cash projections show continued generation of more

cash than the Company needs for its growth plans. As a result, the

Board has concluded that going forward, a buyback programme should

be combined with our ordinary regular dividend as a balanced

approach for returning capital to shareholders.

Under the terms of the resolution passed at the Company's annual

general meeting on 10 May 2021 (the "2021 AGM"), the Company has

the authority to buy back up to 10% or 30 million of its ordinary

shares.

Terms of the share buyback

The Company has entered into an arrangement with Barclays Bank

PLC, acting through its investment bank ("Barclays") to purchase

ordinary shares in the Company up to an aggregate purchase price of

GBP18 million over the next 18 months, which at an illustrative

share price of 200p would equate to 9 million shares or 3% of

Alfa's issued share capital. The total number of shares acquired

under the Programme will vary depending on the share price at the

time of the relevant purchase. Share purchases will be made by

Barclays on the Company's behalf and, in the case of any purchases

made during closed periods, shall be made independently of and

uninfluenced by the Company.

The purpose of these share purchases is to reduce the Company's

share capital (any shares repurchased for this purposed will be

cancelled) and to enable the Company to meet obligations arising

from share option programmes (any shares repurchased for this

purpose will be held in treasury). The Company's current intention

is to satisfy all share options and share savings plans with shares

purchased on the market and not to issue any new shares to satisfy

future option exercises.

The Programme will be subject to the terms of the arrangement

with Barclays and in any case will be effected in a manner

consistent with (i) the general authority vested in the Company to

repurchase shares granted by the Company's shareholders at the 2021

AGM and, following the expiration of such authority, any subsequent

buyback authority granted during the arrangement (the aggregate

number of ordinary shares authorised to be purchased by the Company

shall be less than 15% of the Company's ordinary share capital at

the date of such authority), (ii) Chapter 12 of the United Kingdom

Listing Rules, which require that the maximum price paid be limited

to be no more than the lower of (a) 105% of the average middle

market closing price of the Company's ordinary shares for the five

business days before the purchase is made, and (b) the higher of

the price of the last independent trade and the highest current

independent bid on the trading venue where the purchase is carried

out, and (iii) the provisions of the Market Abuse Regulation

596/2014/EU (as it forms part of UK domestic law by virtue of the

European Union (Withdrawal) Act 2018) dealing with buyback

programmes.

Andrew Denton, Chief Executive Officer of Alfa said:

"I am delighted that the strong momentum we have developed in

the business, our confidence in our prospects and the strong cash

generation characteristics of our business, have enabled us to

increase returns to shareholders by supplementing our regular

dividend with the launch of this share buyback programme".

Enquiries

Alfa Financial Software Holdings

PLC

Andrew Denton, Chief Executive

Officer

Duncan Magrath, Chief Financial

Officer +44 (0)20 7588 1800

Tulchan Communications LLP

James Macey White

Victoria Boxall +44 (0)20 7353 4200

Notes to Editors

Alfa has been delivering software systems and consultancy

services to the global asset and automotive finance industry since

1990. Our best practice methodologies and specialised knowledge of

asset finance facilitates delivery of large software

implementations and highly complex business change projects. With

an excellent delivery track record spanning three decades, Alfa's

experience and performance is unrivalled in the industry.

Alfa Systems, our class-leading technology platform, is at the

heart of some of the world's largest asset finance companies. Key

to the business case for each implementation is Alfa Systems'

ability to replace multiple customer systems with our single

platform. Alfa Systems supports both retail and corporate business

for auto, equipment, wholesale and dealer finance on a

multijurisdictional basis, including leases/loans, originations and

servicing. An end-to-end solution with integrated workflow and

automated processing using business rules, Alfa Systems provides

compelling solutions to asset finance companies.

Alfa Systems is currently used by customers or has live

implementations in 26 countries and Alfa has offices in Europe,

Australasia and North America. For more information, visit

www.alfasystems.com.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

POSBKOBNFBKDBDD

(END) Dow Jones Newswires

January 18, 2022 02:00 ET (07:00 GMT)

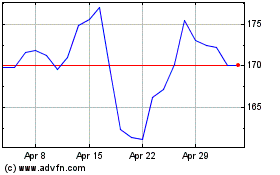

Alfa Financial Software (LSE:ALFA)

Historical Stock Chart

From Apr 2024 to May 2024

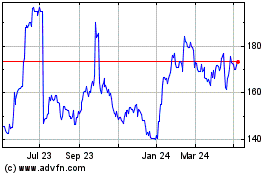

Alfa Financial Software (LSE:ALFA)

Historical Stock Chart

From May 2023 to May 2024