Antofagasta Copper Output Up But Eyes Lower End of Output Range-Update

27 July 2016 - 8:58PM

Dow Jones News

(Update, adds detail).

By Alex MacDonald

LONDON--Antofagasta PLC (ANTO.LN) said Wednesday that copper

output rose in the second quarter compared with the same period a

year earlier but said its full-year output would now be at the

bottom end of its previous guidance. The FTSE-100 miner said it

produced 166,200 metric tons of copper in the three months ended

June 30, 2016, up 5.9% from the same quarter a year ago due to

higher production from last year's purchase of a 50% stake in the

Zaldivar mine and the ramp up of the new Antucoya mine, which

reached commercial production in the second quarter.

Gold production, on the other hand, fell 4.2% on year to 52,800

troy ounces in the second quarter while molybdenum production

dropped 38% on the year to 1,600 tons during the same period due to

lower grades at Los Pelambres.

Net cash cost also fell 22% on the year to $1.25 a pound of

copper in the second quarter due to higher output, improved cost

performance and the weaker Chilean Peso against the U.S.

dollar.

The company said it now expects to reach the lower end of its

710,000-740,000 tons of copper output guidance this year with

production for the year weighted to the second half.

"Installation of the tailings thickeners at Centinela and the

ramp-up of Antucoya are proceeding within their planned ranges, but

inherent risks will persist until both projects are completed," the

company said.

Net cash cost for the year is now forecast to be lower at $1.30

a pound for the year versus $1.35 a pound previously. This is due

in part to the deferral of waste stripping at its flagship Los

Pelambres mine and accounting changes in how it estimates certain

costs. This will be offset by a $112 million increase in captial

expenditure related to mine development.

At 1011 GMT, Antofagasta's shares were up 0.2% at 488.2 pence a

share. It was "a bit of a mixed quarter," said BMO Capital Markets

in a note. Second quarter output missed the bank's forecast by 9%

while cash costs beat expecation by 5%. Berenberg Mining analyst

Fawzi Hanano said in a note that Antofagasta may find it

challenging to significantly ramp up output in the second half of

the year to beat the bottom end of the 2016 output guidance

range.

"We commend the company's operators for solid cost control, but

we believe that a production guidance downgrade remains on the

cards and we expect this at the Q3 operating results," Mr. Hanano

said.

-Write to Alex MacDonald at alex.macdonald@wsj.com

(END) Dow Jones Newswires

July 27, 2016 06:43 ET (10:43 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

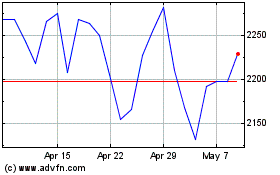

Antofagasta (LSE:ANTO)

Historical Stock Chart

From Apr 2024 to May 2024

Antofagasta (LSE:ANTO)

Historical Stock Chart

From May 2023 to May 2024