Antofagasta Reports Weak 1Q as Drought Continues in Northern Chile -- Commodity Comment

21 April 2022 - 5:37PM

Dow Jones News

By Jaime Llinares Taboada

Antofagasta PLC said Thursday that its performance in the first

quarter was as weak as expected, as the Los Pelambres copper mine

continues to be affected by the drought in Chile. Here's what the

FTSE 100 red metal producer had to say:

On 1Q production:

"Copper production in Q1 2022 at 138,800 tonnes was in line with

guidance and is expected to increase quarter-on-quarter during the

year. Production was 24.2% lower than in the same quarter in 2021

and 22.4% lower than in Q4 2021 mainly due to the expected

temporary reduction in throughput at Los Pelambres because of the

drought and lower grades at Centinela Concentrates. Throughput at

Los Pelambres was 39.9% lower than in Q1 2021 and 27.7% lower than

in Q4 2021, and the grades at Centinela Concentrates were 26.7% and

25.4% lower respectively."

"Gold production was 38,400 ounces in Q1 2022, 35.0% lower than

in the same period in 2021 and 40.8% lower than in 4Q 2021, mainly

due to expected lower grades at Centinela."

"Molybdenum production in the quarter was 2,000 tonnes, a

decrease of 1,000 tonnes compared to the same period in 2021 due to

lower grades and throughput at Los Pelambres, and 100 tonnes lower

than in Q4 2021."

On 1Q costs:

"Cash costs before by-product credits in Q1 2022 were $2.34/lb,

in line with expectations and 66c/lb higher than in the same period

last year mainly due to the temporary decrease in production.

Higher input prices, particularly for diesel and sulphuric acid,

and general inflation were largely offset by the weaker Chilean

peso. Compared to the previous quarter, costs increased by 21.9% on

lower copper production due to lower grades and throughput."

"Net cash costs were $1.75/lb in Q1 2022, compared to $1.16/lb

in Q1 2021 and $1.35/lb in the previous quarter, reflecting the

increase in cash costs before by-product credits, slightly offset

by higher by-product credits."

On 2022 guidance:

"Guidance for the year is unchanged. Group copper production for

the full year is expected to be 660-690,000 tonnes, reflecting

lower expected grades at Centinela Concentrates and the temporarily

reduced throughput at Los Pelambres. Guidance assumes there is no

precipitation until the rainy season and the desalination plant at

Los Pelambres starts operating in H2 2022. As previously announced,

copper production during the year is expected to be lowest in Q1

and to increase quarter-on-quarter thereafter."

"The drought has continued at Los Pelambres with no

precipitation during the quarter. Strict water management protocols

are in place to optimise water usage and mitigate the impact of low

water availability."

"Cash cost guidance before and after by-product credits is also

unchanged at $2.00/lb and $1.55/lb respectively."

"The review of the Los Pelambres expansion project has been

completed and group capital expenditure for the year is expected to

be $1.9 billion. This is at the top end of the original guidance

range of $1.7-1.9 billion."

On growth projects:

"The Los Pelambres expansion project was 73% complete as at the

end of the quarter."

"A detailed review of the project schedule and costs has

recently been completed. The revised capital cost estimate

resulting from the review is $2.2 billion (up from $1.7 billion).

Of this increase, approximately $220 million is related to the

impact of Covid-19 on costs and the construction schedule, $170

million to general inflation, including increased input prices,

wages, labour incentives and logistics costs, with the balance

reflecting other adjustments to implementation plans and an updated

contingency provision."

"The completion schedule remains unchanged with the desalination

plant expected to be completed in H2 2022 and the expanded

concentrator plant in early 2023."

"The Zaldivar Chloride Leach project was completed in January

2022, on schedule and on budget and is now being commissioned."

Write to Jaime Llinares Taboada at jaime.llinares@wsj.com;

@JaimeLlinaresT

(END) Dow Jones Newswires

April 21, 2022 03:22 ET (07:22 GMT)

Copyright (c) 2022 Dow Jones & Company, Inc.

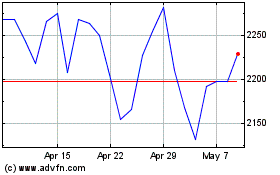

Antofagasta (LSE:ANTO)

Historical Stock Chart

From Mar 2024 to Apr 2024

Antofagasta (LSE:ANTO)

Historical Stock Chart

From Apr 2023 to Apr 2024