AO World plc Trading Statement (9522A)

30 March 2017 - 5:01PM

UK Regulatory

TIDMAO.

RNS Number : 9522A

AO World plc

30 March 2017

AO World plc

PRE-CLOSE STATEMENT

30 March 2017

AO World plc ("the Company" or "AO"), a leading online retailer

of electricals in the UK, today gives a pre-close trading update

for its full financial year; the 12 months to 31 March 2017

("FY2017").

Full year trading for FY2017 is expected to be in line with our

range of expectations, with Group revenue expected to be c.GBP700m,

up c.17% year-on-year. Our existing Adjusted EBITDA guidance range

is tightened to GBP-2.4 to GBP0m and Group cash as at 31 March 2017

is expected to be at least GBP27m.

UK

In our UK business, revenue is expected to be c.GBP629m, with

expected own-brand revenue growth of c.16% year on year, with

own-brand revenue growth of 10% in Q3 and expected growth of c.13%

in Q4 (as against the same quarter in the prior year). Brand

awareness has continued to improve, and we believe this will be

further underpinned by becoming headline sponsor to ITV's

"Britain's Got Talent" 2017. We also launched into a new category,

computing, which has started to trade well. We have also

successfully started recycling Waste Electrical and Electronic

Equipment (WEEE) through our facility in Telford.

Europe

In our Europe business, revenue is expected to be c.GBP71m, with

expected Q4 growth of c.58% in local currency. During H1, we

consolidated our operations in Bergheim which has given us a solid

base for the business to grow, and allowed the anticipated

acceleration of growth during H2. During the period, we have

successfully launched the audio visual category in Germany and in

March 2016, we started trading in the Netherlands.

Outlook

The Board broadly expects the patterns of trading seen in the

second half of FY2017 to continue into the year ahead, with UK

business profits largely being reinvested in our European

operations.

The UK business will continue to benefit from positive

operational leverage as we scale and grow, increase brand awareness

and deliver our 4C's strategy. The Board continues to be cautious

given the uncertain UK economic outlook, currency impacts on

supplier pricing and the possible effect on consumer demand.

In our Europe business, we are on track to achieve a positive

Adjusted EBITDA run-rate* and revenue run-rate* of c.EUR250m by

FY2021 (in existing territories of Germany and Netherlands) with

operational leverage, which is expected to be generated largely

from warehousing and delivery, weighted largely to the latter

period. We expect limited further capex to realise plans in

existing territories.

AO has today separately announced a placing of up to 9.99% of

its share capital.

Our next update to the market will be our preliminary statement

on 6 June 2017.

* Adjusted EBITDA is defined by the Group as profit/(loss)

before tax, depreciation, amortisation, net finance income and

"adjustments"

- Adjustments is defined by the Group as set up costs relating

to overseas expansion and share-based payment charges / credits

attributable to exceptional LTIP awards which the Board consider

one-off in nature

- Run-rate means one month's figures annualised

For further information, please contact:

AO World plc +44 (0)1204 672400

Mark Higgins ir@ao.com

Chief Financial Officer

Tulchan Communications +44(0) 20 7353 4200

Susanna Voyle ao@tulchangroup.com

Michelle Clarke

This information is provided by RNS

The company news service from the London Stock Exchange

END

TSTEAEDNAEDXEAF

(END) Dow Jones Newswires

March 30, 2017 02:01 ET (06:01 GMT)

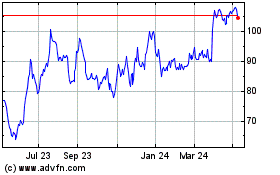

Ao World (LSE:AO.)

Historical Stock Chart

From Jun 2024 to Jul 2024

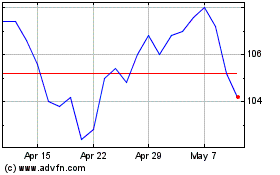

Ao World (LSE:AO.)

Historical Stock Chart

From Jul 2023 to Jul 2024