TIDMBBGI

BBGI Global Infrastructure S.A.

06 September 2023

BBGI Global Infrastructure (BBGI)

06/09/2023

Results analysis from Kepler Trust Intelligence

NAV total returns for BBGI fell modestly by 1.4% in the first

half of 2023. This was mainly due to foreign exchange movements and

a change in the discount rate, itself largely caused by interest

rate hikes in the UK impacting UK assets, which are 33% of BBGI's

portfolio. Despite this small decline, the trust has delivered a

strong track record of 8.8% annualised NAV total returns since IPO

in 2011. At the end of the period, the shares traded on a 6.6%

discount to NAV.

The negative valuation effects on the trust's NAV were partly

mitigated by increased deposit and inflation rates. BBGI's

proportional share of cash holdings in portfolio companies stood at

approximately GBP385m as at 30/06/2023. Interest paid on these

holdings has risen substantially over the past two years and

averaged approximately 4.5% during the period. Changes in short and

long-term deposit rate assumptions resulted in an increase to NAV

of approximately 1.2%.

BBGI's discount rate increased by 0.3% to 7.2% during the

period. The weighted average risk-free rate of the BBGI portfolio

stayed flat during the period at 3.8%. As such, the trust's

discount rate includes a 3.4% risk premium, arguably a conservative

figure given the resilient availability-style assets the trust

invests in and their high-quality inflation linkage.

BBGI Chair Sarah Whitney said: "As an internally-managed

investment company, our leadership team's alignment of interest

with our shareholders is clear. In this period of economic

volatility, we will continue to be disciplined in our approach to

capital allocation and will only consider transactions that are

accretive to our shareholders. BBGI has not been immune to the

uncertain market and economic backdrop that has impacted investor

sentiment on almost all UK listed investment companies."

Kepler View

BBGI Global Infrastructure (BBGI) provides investors with access

to a portfolio comprised solely of availability-style assets,

backed by AAA/AA government and government-backed counterparties.

These are public infrastructure assets that generate revenue as

long as they are available for use, meaning they are not subject to

the price elasticity of demand or the regulatory risks that demand

and regulatory-based assets can be susceptible to. The contracts

underpinning these investments have strong inflation linkage, which

acts in a mechanical way, as cash flows increase in line with a

relevant price index.

Despite seeing a small fall in its NAV, performance in the first

half of this year in many ways demonstrated how resilient BBGI's

portfolio can be. The large majority of the small NAV decline was

attributable to changes in FX rates that were not fully covered by

the trust's hedging strategy, and a 50bps increase in UK interest

rates. With the UK currently representing about a third of the BBGI

portfolio, this fed into a higher discount rate for the portfolio

as a whole, which rose from 6.9% to 7.2% in the first half of the

year. As much as investors may like them to, it is hard to see what

BBGI could have done to offset these macroeconomic performance

drivers.

With a weighted average risk-free rate of 3.8% across the BBGI

portfolio, the trust's current discount rate means there is an

implied risk premium of 3.4%. With the trust trading at an 11.6%

discount to NAV as at 31/08/2023 , we think the trust offers a

compelling mix of downside protection and upside potential. The

trust's high quality inflation linkage and AA/AAA counterparties

offer strong protection against further volatility and unexpected

inflation spikes. At the same time, if we are entering a more

benign environment and have reached the end of the rate hiking

cycle, the trust's high dividend yield may start to look more

attractive again, potentially resulting in a tightening of the

discount.

CLICK HERE TO READ THE FULL REPORT

Visit Kepler Trust Intelligence for more high quality

independent investment trust research.

Important information

This report has been issued by Kepler Partners LLP. The analyst

who has prepared this report is aware that Kepler Partners LLP has

a relationship with the company covered in this report and/or a

conflict of interest which may impair the objectivity of the

research.

Past performance is not a reliable indicator of future results.

The value of investments can fall as well as rise and you may get

back less than you invested when you decide to sell your

investments. It is strongly recommended that if you are a private

investor independent financial advice should be taken before making

any investment or financial decision.

Kepler Partners is not authorised to make recommendations to

retail clients. This report has been issued by Kepler Partners LLP,

is based on factual information only, is solely for information

purposes only and any views contained in it must not be construed

as investment or tax advice or a recommendation to buy, sell or

take any action in relation to any investment.

The information provided on this website is not intended for

distribution to, or use by, any person or entity in any

jurisdiction or country where such distribution or use would be

contrary to law or regulation or which would subject Kepler

Partners LLP to any registration requirement within such

jurisdiction or country. In particular, this website is exclusively

for non-US Persons. Persons who access this information are

required to inform themselves and to comply with any such

restrictions.

The information contained in this website is not intended to

constitute, and should not be construed as, investment advice. No

representation or warranty, express or implied, is given by any

person as to the accuracy or completeness of the information and no

responsibility or liability is accepted for the accuracy or

sufficiency of any of the information, for any errors, omissions or

misstatements, negligent or otherwise. Any views and opinions,

whilst given in good faith, are subject to change without

notice.

This is not an official confirmation of terms and is not a

recommendation, offer or solicitation to buy or sell or take any

action in relation to any investment mentioned herein. Any prices

or quotations contained herein are indicative only.

Kepler Partners LLP (including its partners, employees and

representatives) or a connected person may have positions in or

options on the securities detailed in this report, and may buy,

sell or offer to purchase or sell such securities from time to

time, but will at all times be subject to restrictions imposed by

the firm's internal rules. A copy of the firm's Conflict of

Interest policy is available on request.

PLEASE SEE ALSO OUR TERMS AND CONDITIONS

Kepler Partners LLP is authorised and regulated by the Financial

Conduct Authority (FRN 480590), registered in England and Wales at

70 Conduit Street, London W1S 2GF with registered number

OC334771.

This information is provided by Reach, the non-regulatory press

release distribution service of RNS, part of the London Stock

Exchange. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

NRAMZGGLKVMGFZM

(END) Dow Jones Newswires

September 06, 2023 11:14 ET (15:14 GMT)

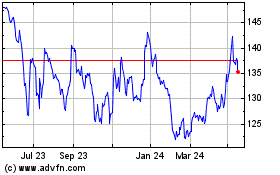

Bbgi Global Infrastructure (LSE:BBGI)

Historical Stock Chart

From Dec 2024 to Jan 2025

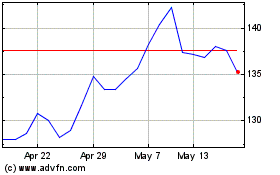

Bbgi Global Infrastructure (LSE:BBGI)

Historical Stock Chart

From Jan 2024 to Jan 2025