TIDMBIDS

RNS Number : 1716V

Bidstack Group PLC

08 August 2022

30 Jun 2021

Certain information contained within this Announcement is deemed

by the Company to constitute inside information as stipulated under

the Market Abuse Regulation (EU) No. 596/2014 ("MAR") as applied in

the United Kingdom. Upon publication of this Announcement, this

information is now considered to be in the public domain.

8 August 2022

Bidstack Group Plc

("Bidstack" or the "Company" or the "Group")

Interim Results for the six months ended 30 June 2022

Strong revenue and margin growth, increasingly diversified

offering, positive outlook in line with FY22 market

expectations

Bidstack Group Plc (AIM: BIDS), the in-game brand activation

platform, is pleased to announce its unaudited results for the six

months ended 30 June 2022.

Financial Update

-- Revenue of GBP2,046k (H1 2021: GBP820k)

-- Gross margin improvement to 39.9% (H1 2021: 34.5%)

-- Period end cash balance GBP3,672k (30 June 2021: GBP695k)

Post Period End Highlights

-- Received non-trading cash receipt of GBP1.3m in July relating

to a research and development tax credit for the year ended 31

December 2021;

-- Announced first enterprise software deal with a leading

Asia-Pacific mobile marketing technology company for a term of

three-years which diversifies revenue;

-- Expansion of the global network of media partners with UAE

based MMP World Wide who will license Bidstack's technology as a

buyer;

-- Roll-out of open-market place (OMP) in-game advertising

solutions to accelerate brand spend.

Operational Highlights

-- Appointment of David Reeves to the Board as Chairman

Designate to succeed Donald Stewart on 1 September 2022;

-- PubGuard, Bidstack's ad-quality platform, secured a minimum

two-year licence agreement with Azerion providing exclusive

representation in reselling PubGuard's brand safety technology

whilst also utilising the software across its group of

companies;

-- Inventory of games now 110 titles (H1 2021: 30) with over

100m monthly active users available to Bidstack's network of global

media partners; and

-- New ad-format "rewarded video" launched during H1 2022

growing the breadth of monetisation solutions available to

developers and publishers alongside "in-game" and "in-menu".

Outlook

-- Revenue from the Azerion media sales partnership is

anticipated to accelerate into H2 2022 in line with contractual

commitments;

-- New products scheduled to be launched in H2 2022 intended to

enable Bidstack's publishers and developers to maximise

monetisation alongside the addition of new measurement tools and

enhanced platform management including data and reporting;

-- Interactive Advertising Bureau (IAB) and Media Rating Council

(MRC) Measurement Guidelines now in public consultation to

establish robust standards. These standards are expected to

increase the confidence of media buyers to purchase in-game

advertising through open marketplace, which is expected to be a

significant catalyst for frictionless growth; and

-- Robust pipeline for further enterprise software sales as

Bidstack diversifies its business towards new opportunities in

technology licensing to publishers, developers, platforms and

rights holders beyond FY22.

James Draper, CEO of Bidstack said:

"As I mentioned in our trading update on 6 July 2022, the first

six months of FY22 has seen the Company put in place further

foundations for longer term growth, as our Group revenues begin to

accelerate.

"Our wider product offering and suite of tools, organic growth

and the commencement of our commercial relationship with Azerion

has created a 2.5x increase in first half revenue year-on-year to

over GBP2m. Given our full year revenues for 2021 of GBP2.6m, this

represents a significant acceleration of turnover. In addition, our

gross margin has also trended up year-on-year.

"Our two-year agreement with Azerion began in March and, after

an initial integration and on-boarding phase, is now progressing in

line with management's expectations. As previously mentioned,

Azerion is giving Bidstack's media segment and gaming advertising

network a greatly increased representation across markets new to

the Group.

"I am also pleased that our relationship with Azerion has

deepened with their confirmation as the exclusive reseller of our

PubGuard product over the next two years. This is a great

commercial start for our technology division.

"As we announced on 11 July, our technology division has signed

a three year commercial agreement with a leading Asia-Pacific

mobile marketing technology company which will white-label our

supply side platform to create their own in-game advertising

business. This is expected to create a passive, recurring revenue

stream for the Group going forward.

"Bidstack Group is proud to be a pioneer with our industry

bodies; the IAB and MRC. They are now releasing standardisation

guidelines for campaign measurement. This is an important

development, as a universally approved standard for measuring

campaign success will enable media planners to push more spend into

in-game advertising.

"In H2 22 we will continue exploring enterprise software sales.

Our vision has always been to create a platform that generates

recurring and automated revenues through our suite of tools,

designed to help our gaming publishers' customers monetise brand

activations. We have many exciting new products, adding to our

"always-on revenue" suite of tools for publishers that are expected

to be rolled out in Q3 22.

"We are all very aware of the uncertainty caused by the

challenging global economic climate. However, we remain confident

that the video game sector will remain strong and that demand for

monetisation through advertising-spend will continue to increase,

from game developers and publishers.

"I believe we remain well placed to benefit as our market

continues to mature and I look forward to providing further

updates."

Chairman's Statement

H1 2022 Trading

Bidstack's first six months of the year have been positive. The

Group's financial indicators, such as year-on-year revenue, gross

margin and cash are extremely encouraging. On the 1 March 2022, the

$30m two-year minimum revenue guarantee with Azerion commenced. The

onboarding of sales teams across key markets such as the UK,

Germany, France, Spain, Netherlands, Italy, Nordics, Portugal and

Belgium has commenced in-line with expectations and will accelerate

into H2 2022.

Bidstack has grown its publisher and developer network to over

110 titles with access to over 100m monthly active users as we

continue building our portfolio of titles providing significant

cross-selling opportunities across our breadth of ad-formats, which

now includes rewarded video in addition to in-game and in-menu. The

combination of brand awareness and performance ad-formats provides

the publishers and developers with a holistic monetisation solution

to generate sustainable revenue.

During the first half, Bidstack has also started to see success

with its enterprise sales efforts with the licensing of our

PubGuard technology to Azerion over two years. The Directors

believe this should be a positive mix-driver for gross margin as

these are technology-only contracts. The commercial pipeline for

further technology deals is strong across a diversified set of

customers and geographical footprint. The Directors believe that

these transactions will contribute meaningfully to revenues in

FY23.

Board Appointments

On the 17 June 2022, we announced the appointment of David

Reeves to Bidstack's Board as Chairman Designate. To ensure an

orderly handover before David assumes the role of Chairman on 1

September 2022, I will remain Chairman while David serves on the

Board as a Non-Executive Director. Following this, I will move to a

Non-Executive Director role and continue to serve on the Audit and

Remuneration Committees.

David has over 30 years' global experience in senior management

roles within multinational companies across the video games

industry. He launched Sony PlayStation in Germany, Switzerland

& Austria in 1995 and in 1999, he was appointed Executive Vice

President of Sony Computer Entertainment (Europe) and President and

CEO EMEA in 2003. In 2010, David was appointed as COO of Capcom

(Europe). David has his own consulting Company DRC Consulting Ltd,

is Co-Founder of E Fundamentals, a SaaS company providing

e-commerce analytics services and is Chairman of Comcarde Ltd, an

Edinburgh based fintech company.

David served as Senior Non-Executive Director and Chairman of

the Remuneration Committee for AIM-quoted Keywords Studios.

Keywords Studios is an international technical services provider to

the global video games industry, established in 1998. It provides

integrated art creation, marketing services, game development,

testing, localization audio and player support services across more

than 50 languages and 16 games platforms to a blue-chip client base

of over 950 clients across the globe. Following the completion of

nine years' service as a Non-Executive Director he retired from

this position on 20 May 2022.

Outlook & Future Prospects

The second half of the year has commenced strongly with the

announcement of Bidstack's first white-label contract with a

leading Asia-Pacific based mobile marketing technology company for

a term of three years. The company has contracted to utilise

Bidstack Technologies' supply side platform ("SSP") to create their

own in-game advertising business adding both advertisers and

publishers and developers, which is expected to create a passive,

recurring revenue stream for the Group going forward. This also

provides Bidstack with direct exposure to the Asia-Pacific market

which includes half of video gamers worldwide.

The Directors' believe that the roll-out of further Bidstack

products will also help additional revenue generation. These

include the launch of our open-market place (OMP) for in-game

advertising which is intended to accelerate brand spend. This is

supported also by the positive developments with the Interactive

Advertising Bureau (IAB) and Media Rating Council (MRC) Measurement

Guidelines which provides further confidence to media buyers.

The Board is pleased with Bidstack's progress in the first half

and expects that revenues for FY22 will be in line with market

expectations, primarily reflecting the increased commitments

arising under the Azerion contract for the second half.

The Board continues to believe that Bidstack is well

established, both in terms of product and revenue generation, as a

leading player for in-game brand activation. Bidstack continues to

focus on cash management, gross margins and operating expenses.

-S-

Contacts

Bidstack Group Plc

James Draper, CEO via Buchanan

SPARK Advisory Partners Limited (Nomad) +44 (0) 203 368

Mark Brady / Neil Baldwin / James Keeshan 3550

Stifel Nicolaus Europe Limited (Broker) +44 (0) 20 7710

Fred Walsh / Tom Marsh 7600

Buchanan Communications Limited

Chris Lane / Stephanie Whitmore / Kim

van Beeck +44 (0) 20 7466

bidstack@buchanan.uk.com 5000

Consolidated statement of comprehensive income

for the six months ended 30 June 2022

Note

Unaudited Unaudited Audited

6 months 6 months year

ended ended ended

30 Jun 2022 30 Jun 2021 31 Dec 2021

GBP GBP GBP

Revenue 2,045,986 820,136 2,623,413

Cost of sales (1,229,225) (537,309) (1,674,190)

------------- ------------ -------------

Gross profit 816,761 282,827 949,223

Administrative expenses (4,507,501) (3,915,874) (8,681,927)

Exceptional Items - - (222,555)

------------- ------------ -------------

Total Administrative Expenses (4,507,501) (3,915,874) (8,904,482)

Operating loss (3,690,740) (3,633,047) (7,955,259)

Finance income 96 60 180

Finance costs (1,442) (160) (3,392)

------------- ------------ -------------

Loss before taxation (3,692,086) (3,633,147) (7,958,471)

Taxation 938,184 744,756 1,661,027

------------- ------------ -------------

Loss for the period (2,753,902) (2,888,391) (6,297,444)

Other comprehensive income

Total other comprehensive (loss)/income (10,675) - 10,589

------------- ------------ -------------

Total comprehensive loss for

the period (2,764,577) (2,888,391) (6,286,855)

============= ============ =============

Loss per share - basic and diluted

(pence) 3 (0.30) (0.74) (1.21)

The above consolidated statement of profit and loss and other

comprehensive loss for the period relates to continuing operations

for the Group.

Consolidated statement of financial position

as at 30 June 2022

Note Unaudited Unaudited Audited

30 Jun 2022 30 Jun 2021 31 Dec 2021

ASSETS GBP GBP GBP

Non-current assets

Right of use asset 5,600 649 7,280

Intangible assets 233,162 264,357 248,760

Property, plant and

equipment 45,841 41,277 46,519

------------- ------------ -------------

Total non-current assets 284,603 306,283 302,559

============= ============ =============

Current assets

Trade and other receivables 4,284,584 1,229,387 2,752,036

Cash and cash equivalents 3,671,976 694,544 7,086,906

-------------

Total current assets 7,956,560 1,923,931 9,838,942

=============

Total assets 8,241,163 2,230,214 10,141,501

============= ============ =============

EQUITY AND LIABILITIES

Equity

Share capital 4 8,950,048 6,234,261 8,950,048

Share premium account 35,375,326 27,984,716 35,375,326

Share-based payment

reserve 2,328,400 1,497,826 1,589,965

Merger relief reserve 6,508,673 6,508,673 6,508,673

Reverse acquisition

reserve (23,320,632) (23,320,632) (23,320,632)

Warrant reserve 71,480 71,480 71,480

Exchange reserve (86) - 10,589

Accumulated losses (24,630,248) (18,467,293) (21,876,346)

-------------

Total equity 5,282,961 509,031 7,309,103

============= ============ =============

Non - Current liabilities

Lease liability 2,416 675 4,180

------------- ------------ -------------

Total non -current

liabilities 2,416 675 4,180

============= ============ =============

Current liabilities

Trade and other payables 2,952,597 1,720,508 2,824,920

Lease liability 3,189 - 3,298

------------- ------------

Total current liabilities 2,955,786 1,720,508 2,828,218

============= ============ =============

Total equity and liabilities 8,241,163 2,230,214 10,141,501

============= ============ =============

The interim financial report was approved by the board of

Directors on 8 August 22 and signed on its behalf by:

Donald Stewart

Chairman of Bidstack Group Plc

Consolidated statement of changes in equity

for the six months ended 30 June 2022

Share-based Merger Reverse Warrant

Share Share payment relief acquisition Exchange reserve Accumulated Total

capital premium reserve reserve reserve reserve losses equity

GBP GBP GBP GBP GBP GBP GBP GBP GBP

Balance as at

1 January

2022 8,950,048 35,375,326 1,589,965 6,508,673 (23,320,632) 10,589 71,480 (21,876,346) 7,309,103

Comprehensive

income for

the period

Loss and total

comprehensive

income for

the year - - - - - (10,675) - (2,753,902) (2,764,577)

--------- ---------- ----------- --------- -------------- -------- ------- ------------ -------------

Total

comprehensive

expense - - - - - (10,675) - (2,753,902) (2,764,577)

--------- ---------- ----------- --------- -------------- -------- ------- ------------ -------------

Transactions

with owners

Issue of - - - -

shares - - - - -

Costs of - - - -

raising equity - - - - -

Share-based

payments - - 738,435 - - - - - 738,435

--------- ---------- ----------- --------- -------------- -------- ------- ------------

Total

transaction

with

owners - - 738,435 - - - - - 738,435

Balance as at

30 June 2022 8,950,048 35,375,326 2,328,400 6,508,673 (23,320,632) (86) 71,480 (24,630,248) 5,282,961

========= ========== =========== ========= ============== ======== ======= ============ =============

Consolidated statement of changes in equity

for the six months ended 30 June 2021

Share-based Merger Reverse

Share Share payment relief acquisition Exchange Warrant Accumulated Total

capital premium reserve reserve reserve reserve reserve losses Equity

GBP GBP GBP GBP GBP GBP GBP GBP GBP

Balance as at

1 January

2021 6,234,261 27,984,716 1,282,556 6,508,673 (23,320,632) - 71,480 (15,578,902) 3,182,152

Comprehensive

income for

the period

Loss and total

comprehensive

income for

the year - - - - - - - (2,888,391) (2,888,391)

--------- ---------- ----------- --------- -------------- -------- ------- ------------ -----------

Total

comprehensive

expense - - - - - - - (2,888,391) (2,888,391)

--------- ---------- ----------- --------- -------------- -------- ------- ------------ -----------

Transactions

with owners

Issue of - - - -

shares - - - - -

Costs of - -

raising equity - - - - - - -

Share-based

payments - - 215,270 - - - - - 215,270

--------- ---------- ----------- --------- -------------- -------- ------- ------------ -----------

Total

transaction

with

owners - - 215,270 - - - - - 215,270

Balance as at

30 June 2021 6,234,261 27,984,716 1,497,826 6,508,673 (23,320,632) - 71,480 (18,467,293) 509,031

========= ========== =========== ========= ============== ======== ======= ============ ===========

Consolidated statement of changes in equity

for the year ended 31 December 2021

Share-based Merger Reverse

Share Share payment relief acquisition Exchange Warrant Accumulated Total

capital premium reserve reserve reserve reserve reserve losses equity

GBP GBP GBP GBP GBP GBP GBP GBP GBP

Balance as at

1 January

2021 6,234,261 27,984,716 1,282,556 6,508,673 (23,320,632) - 71,480 (15,578,902) 3,182,152

Comprehensive

income

for the period

Loss and total

comprehensive

income for

the year (6,297,444) (6,297,444)

--------- ---------- ----------- --------- -------------- -------- ------- ------------ -----------

Total

comprehensive

expense - - - - - - - (6,297,444) (6,297,444)

--------- ---------- ----------- --------- -------------- -------- ------- ------------ -----------

Transactions

with owners

Issue of

shares 2,715,787 8,147,363 - - - - - - 10,863,150

Costs of

raising

equity - (756,753) - - - - - - (756,753)

Share-based

payments - - 307,409 - - - - - 307,409

Total other

comprehensive

income - - - - - 10,589 - - 10,589

--------- ---------- ----------- --------- -------------- -------- ------- ------------ -----------

Total

transaction

with

owners 2,715,787 7,390,610 307,409 - - 10,589 - - 10,424,395

--------- ---------- ----------- --------- -------------- -------- ------- ------------ -----------

Balance as at

31 December

2021 8,950,048 35,375,326 1,589,965 6,508,673 (23,320,632) 10,589 71,480 (21,876,346) 7,309,103

========= ========== =========== ========= ============== ======== ======= ============ ===========

Consolidated statement of cash flows

6 months ended Year ended

6 months ended 30 Jun 2021 31 Dec

30 Jun 2022 2021

GBP GBP GBP

Cash flows from operating activities

Loss before taxation (2,753,902) (2,888,391) (7,958,471)

Adjustments for:

Amortisation - Intangibles 15,598 15,598 31,195

Amortisation - Right of use asset 1,680 6,928 10,377

Depreciation 13,140 9,442 24,160

Equity settled share-based payments 738,435 215,270 307,409

Doubtful debts expense - - (2,073)

Interest received (96) (60) (180)

Interest paid 1,442 160 3,392

Exchange differences on translation of

foreign operations (10,675) - 10,589

-------------- --------------

(1,994,378) (2,641,053) (7,573,602)

Changes in working capital

(Increase)/decrease in trade and other

receivables (1,532,550) 1,161,913 409,468

Increase/(decrease) in trade and other

payables 127,679 (143,231) 961,182

-------------- -------------- -----------

Cash used in operations (3,399,249) (1,622,371) (6,202,952)

Taxation Received - - 892,895

-------------- -------------- -----------

Net cash used in operations (3,399,249) (1,622,371) (5,310,057)

Cash flow from investing activities

Investment in intangible assets - - -

Investment in property, plant and equipment (12,462) (22,331) (42,291)

-------------- -------------- -----------

Net cash flow (used in)/ generated from

investing activities (12,462) (22,331) (42,291)

Cash flow from financing activities

Proceeds from issue of share capital - - 10,863,150

Cost of issue - - (756,753)

Principal movement on lease liabilities (1,872) (7,768) (11,045)

Interest received 96 60 180

Interest paid on lease liabilities (1,443) (160) (3,392)

-------------- --------------

Net cash generated from financing activities (3,219) (7,868) 10,092,140

(Decrease)/Increase in cash and cash

equivalents in the period (3,414,930) (1,652,570) 4,739,792

Cash and cash equivalents at beginning

of period 7,086,906 2,347,114 2,347,114

Cash and cash equivalents at the end

of the period 3,671,976 694,544 7,086,906

============== ============== ===========

for the period ended 30 June 2022

Notes to the consolidated interim financial report

1 Summary of significant accounting policies

Basis of preparation

The Company is a public limited company which is admitted to

trading on the AIM Market of the London Stock Exchange and is

incorporated and domiciled in the UK. The address of the registered

office is Plexal Here East, 14 East Bay Lane, London, United

Kingdom, E15 2GW. The registered number of the company is

04466195.

The consolidated interim financial report consolidates those of

the Company and its trading subsidiary, Bidstack Limited (together

the "Group"). The financial information presented in this interim

report have been prepared using accounting policies that are

expected to be applied in the preparation of the financial

statements for the year ending 31 December 2022.

These policies are in accordance with International Financial

Reporting Standards (IFRSs) and International Financial Reporting

Interpretation Committee (IFRIC) interpretations as endorsed by the

European Union ("IFRS-EU"), and those parts of the Companies Act

applicable to companies reporting under IFRS.

The interim results have been prepared on a going concern basis

which assumes that the Group will be able to continue trading for

the foreseeable future. Although an operating loss has been

reported for the reporting period and an operating loss is expected

to be incurred in the 12 months subsequent to the date of this

report, the Directors believe, having considered all available

information, including the cash resources currently available to

the Group and the Company's proven ability to raise further equity

funds from its supportive shareholder base, that the Group will

have sufficient funds to meet its expected committed and

contractual expenditure for the foreseeable future. Thus, the

Directors continue to adopt the going concern basis of accounting

in preparing the interim financial report for the period ended 30

June 2022.

2 Summary of significant accounting policies

The accounting policies applied by the Group in this

consolidated interim financial report are the same as those applied

by the Group in its consolidated financial statements as at and for

the year ended 31 December 2021.

3 Loss per share

Basic and diluted loss per share

The calculation of basic and diluted loss per share is based

upon the loss of GBP2,764,577 (2021: loss of GBP2,888,391) and the

weighted average number of ordinary shares in issue for the year of

931,531,573 (2021: 388,374,057).

The loss incurred by the Group means that the effect of any

outstanding warrants and options would be considered anti-dilutive

and is ignored for the purposes of the loss per share

calculation.

4 Share capital and reserves

Allotted, called up and fully Ordinary Share capital

paid 0.5p shares

No. GBP

At 1 January 2021 388,374,057 6,234,261

Exercised warrants - -

Exercised options - -

Issue of shares 543,157,516 2,715,787

Issue of consideration shares - -

As at 31 December 2021 931,531,573 8,950,048

-------------------------------- ------------ -------------

Issue of shares - -

As at 30 June 2022 931,531,573 8,950,048

================================ ============ =============

All ordinary shares are equally eligible to receive dividends

and the repayment of capital and represent equal votes at meetings

of shareholders.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR FDLLBLVLXBBX

(END) Dow Jones Newswires

August 08, 2022 02:00 ET (06:00 GMT)

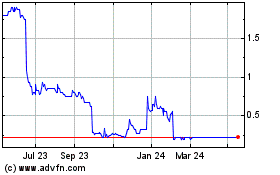

Bidstack (LSE:BIDS)

Historical Stock Chart

From Jun 2024 to Jul 2024

Bidstack (LSE:BIDS)

Historical Stock Chart

From Jul 2023 to Jul 2024