TIDMBOIL

RNS Number : 7915D

Baron Oil PLC

24 October 2022

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION FOR THE PURPOSES

OF REGULATION 11 OF THE MARKET ABUSE (AMMENT) (EU EXIT) REGULATIONS

2019/310.

24 October 2022

Baron Oil Plc

("Baron", or the "Company")

Chuditch PSC Update

Significant increases in management's aggregate Gas-in-Place and

Recoverable Gas Resource estimates

Baron Oil Plc (AIM:BOIL), the AIM-quoted oil and gas exploration

and appraisal company, is pleased to provide a further update on

the TL-SO-19-16 Production Sharing Contract, offshore Timor-Leste

("Chuditch", the "Chuditch PSC" or "PSC") and the preliminary

interpretation of the reprocessed Chuditch 3D seismic data.

Chuditch Highlights

-- Best case aggregate gross Gas-In-Place estimate of

approximately 5,500 BCF versus an equivalent estimate of 3,889 BCF

prior to 3D seismic data reprocessing

-- Best case Recoverable Resource estimate of 3,625 BCF, using

preliminary gas recovery factors of between 50% and 75%, versus an

equivalent estimate of 2,924 BCF prior to 3D seismic data

reprocessing

-- Chuditch-1 gas discovery best case Recoverable Resource

estimate of 1,350 BCF is materially larger and may independently

represent a Liquefied Natural Gas ("LNG") scale resource

-- ERCE engaged to prepare a Competent Person's Report ("CPR") -

potential for contingent resources to be assigned to the Chuditch-1

discovery

-- Chuditch SW prospect Gas-In-Place estimate has increased, but

greater structural complexity may imply a lower recovery factor

-- Extension of sizable Chuditch NE Lead onto 3D seismic data area confirmed

-- The previously unevaluated 'Quokka' Lead extends onto the 3D seismic data area

Technical Update

Preliminary interpretation of the Chuditch PSC reprocessed 3D

seismic data is leading to significant increases in management's

aggregate Gas-in-Place and Recoverable Gas Resource estimates (the

"Update") compared to the previous independent Prospective Resource

estimates by THREE60 Energy (the "2021 Report", 14 July 2021).

The preliminary interpretation has led to a significant uplift

in seismic imaging quality and has significantly reduced subsurface

risk. Mapping indicates a greater concentration of resources into

the Chuditch-1 discovery in a simplified and robust structure with

relatively high gas recovery expected. The adjacent prospectivity

has evolved; its understanding is now more robust, including

confirmation of leads extending onto the 3D seismic data area.

Consultancy group ERCE has been engaged to prepare a CPR to

provide an independent validation of Baron's internal resource

estimates to a SPE PRMS compliant standard, which will include a

probabilistic estimate of Resources and revised risk factors.

Revised Gas-in-Place and Recoverable Gas Resource estimates,

gross for the Chuditch PSC, are detailed in the table below:

Previous Resource Estimates Current Provisional in-house

Probabilistic Best Cases Deterministic Best Case Estimates

Gross Attributable to Licence (2)

Gas BCF Gross Attributable to Licence

Gas BCF

Status Gas-in-Place Recovery Prospective Gas-in-Place Recovery Recoverable

(2) Factor Resource (2, 3, 4) Factor Gas (2,

(1) 3, 4)

------------- -------------- --------- ------------

Chuditch-1

Discovery 951 75% 713 1,800 75% 1,350

------------- ------------ -------------- --------- ------------

Chuditch

West Prospect 540 405 merged into Chuditch-1 Discovery

------------- ------------ ---------------------------------------

Chuditch

North Prospect 473 355 not present on improved data

------------- ------------ ---------------------------------------

Chuditch

NE Lead(5) 1,293 970 1,950 67% 1,300

------------- ------------ -------------- --------- ------------

Chuditch

SW Prospect 642 482 1,150 50% 575

------------- --------- ------------ -------------- --------- ------------

Quokka lead

(5) not evaluated 600 67% 400

-------------------------------------- -------------- --------- ------------

Aggregate 3,899 75% 2,924 5,500 65.9% 3,625

------------- --------- ------------ -------------- --------- ------------

SundaGas Banda Unipessoal Lda. ("SundaGas"), a wholly owned

subsidiary of Baron, is the operator of the Chuditch PSC and holds

a 75% effective interest in the Chuditch PSC. Revised Gas-in-Place

and Recoverable Gas Resource estimates, net attributable to Baron,

for the Chuditch PSC are therefore as detailed in the table

below:

Previous Resource Estimates Current Provisional in-house

Probabilistic Best Cases Deterministic Best Case Estimates

Net Attributable to Baron (2)

Gas BCF Net Attributable to Baron

Gas BCF

-----------------

Status Gas-in-Place Recovery Prospective Gas-in-Place Recovery Recoverable

(2) Factor Resource (2, 3, 4) Factor Gas (2,

(1) 3, 4)

------------- --------- ------------ -------------- --------- ------------

Chuditch-1

Discovery 713 75% 535 1,350 75% 1,013

------------- ------------ -------------- --------- ------------

Chuditch

West Prospect 405 304 merged into Chuditch-1 Discovery

------------- ------------ ---------------------------------------

Chuditch

North Prospect 355 266 not present on improved data

------------- ------------ ---------------------------------------

Chuditch

NE Lead(5) 970 727 1,462 67% 975

------------- ------------ -------------- --------- ------------

Chuditch

SW Prospect 482 361 863 50% 431

------------- --------- ------------ -------------- --------- ------------

Quokka lead

(5) not evaluated 450 67% 300

-------------------------------------- -------------- --------- ------------

Aggregate 2,924 75% 2,193 4,125 65.9% 2,718

------------- --------- ------------ -------------- --------- ------------

Notes

1: Volume estimates use definitions and guidelines set out in the

2018 Petroleum Resources Management System prepared by the Society

of Petroleum Engineers (SPE PRMS)

2: Not SPE PRMS compliant*

3: Condensate yield

not included

4: Rounded deterministic technical best cases

5: Chuditch NE & Quokka: partial 3D seismic coverage

Other Chuditch PSC Matters

PSC Extension

As announced on 18 October 2022, SundaGas was granted a

six-month extension to Contract Year Two of the PSC which now

expires on or before 18 June 2023.

Development and gas commercialisation

As the preliminary subsurface interpretation is indicating an

uncomplicated structural configuration for Chuditch, and subject to

an ongoing revision of the Chuditch engineering concept study, a

simpler field development concept is likely. The apparent increase

in gas resources in the Chuditch-1 discovery itself suggests that a

single appraisal well will suffice to determine commerciality of

the project without the need for immediate follow-on exploration

wells.

Multiple potential export solutions for gas have been previously

identified which are not dependent on any single concept or route.

The fastest development and export option is expected to be to

utilise a hybrid floating and platform LNG system, which does not

require export pipelines or border crossings.

A revision of the Chuditch engineering concept study has

commenced. It is anticipated that this work will illustrate and

quantify a fast-track development pathway that targets first

production in 2028.

Management estimates of project economics continue to be

attractive at current and long term average gas prices in Asia.

Development strategies for handling carbon dioxide could include

Carbon Capture and Storage ("CCS") at Bayu-Undan or for disposal

within the Chuditch PSC. SundaGas aspires to achieve net zero LNG

through long term supply arrangements with buyers that have an

effective Scope 3 strategy.

Farmout

The Company continues to evaluate options to secure further

investment for the Chuditch project, including an ongoing farmout

process, which is accelerating with the availability of the revised

interpretation. The Company remains in talks with multiple

potentially interested parties.

The combination of the PSC extension, availability of the new

reprocessed 3D seismic data, and the external validation of

Resources that are to be provided via the CPR will be of

significant benefit to this process as we move into 2023.

Investor Webinar

Baron will hold an investor webinar for existing and potential

shareholders at 6.00 p.m. (London time) on 26 October 2022.

Those wishing to attend should register via the following link

after which they will be provided with log in details:

https://us02web.zoom.us/webinar/register/WN_B-Rp7LJDRbGzCLh8IqIkag

There will be the opportunity for participants to ask questions

at the end of the presentation. Questions can also be emailed to

baronoil@investor-focus.co.uk ahead of the presentation.

For further information, please contact:

Baron Oil Plc +44 (0) 20 7117 2849

Andy Yeo, Chief Executive

Allenby Capital Limited +44 (0) 20 3328 5656

Nominated Adviser and Broker

Alex Brearley, Nick Harriss, Nick Athanas (Corporate

Finance)

Kelly Gardiner (Sales and Corporate Broking)

IFC Advisory Limited +44 (0) 20 3934 6630

Financial PR and IR baronoil@investor-focus.co.uk

Tim Metcalfe, Florence Chandler

Qualified Person's Statement

Pursuant to the requirements of the AIM Rules - Note for Mining

and Oil and Gas Companies ("AIM MOG"), the technical information

and resource reporting contained in this announcement has been

reviewed by Jon Ford BSc, Fellow of the Geological Society,

Technical Director of the Company. Mr Ford has more than 40 years'

experience as a petroleum geoscientist. He has compiled, read and

approved the technical disclosure in this regulatory announcement

and indicated where it does not comply with the Society of

Petroleum Engineers' SPE PRMS standard.

* The Update supplements the previous SPE PRMS compliant 2021

Report. However, the Update has not been prepared to the standards

set forth in the SPE PRMS or in accordance with an appropriate

Standard as set out in the AIM MOG Note. The CPR commissioned by

the Company will be SPE PRMS compliant.

The updated Gas-in-Place and Recoverable Resource estimates

included in the Update are not directly comparable to those in the

2021 Report or those required under SPE PRMS.

Glossary

BCF Billion cubic feet

Gas-in-Place Volume of natural gas estimated to exist originally in naturally

occurring reservoirs

LNG Liquefied natural gas

MMBtu Million British thermal units

Prospective Resource Quantities of petroleum that are estimated to exist originally in

naturally occurring reservoirs,

as of a given date. Crude oil in-place, natural gas in-place, and

natural bitumen in-place

are defined in the same manner

Recoverable Gas Resource or Recoverable Resource Quantities of gas which are estimated to be potentially recoverable

from discoveries, prospects

and leads

The Society of Petroleum Engineers' ("SPE") Petroleum Resources

Management System ("PRMS"):

a system developed for consistent and reliable definition,

classification, and estimation

of hydrocarbon resources prepared by the Oil and Gas Reserves

Committee of SPE and approved

by the SPE Board in June 2018 following input from six sponsoring

societies: the World Petroleum

Council, the American Association of Petroleum Geologists, the

Society of Petroleum Evaluation

Engineers, the Society of Exploration Geophysicists, the European

Association of Geoscientists

and Engineers, and the Society of Petrophysicists and Well Log

Analysts. Quantities of petroleum

estimated, as of a given date, to be potentially recoverable from

undiscovered accumulations

by application of future development projects. The total quantity of

petroleum that is estimated

to exist originally in naturally occurring reservoirs, as of a given

date. Crude oil in-place,

natural gas in-place, and natural bitumen in-place are defined in

the same manner

TCF Trillion cubic feet

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDBKNBBFBDDOKB

(END) Dow Jones Newswires

October 24, 2022 02:00 ET (06:00 GMT)

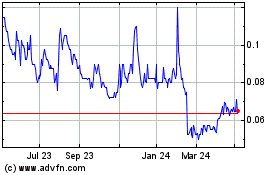

Baron Oil (LSE:BOIL)

Historical Stock Chart

From Mar 2024 to Apr 2024

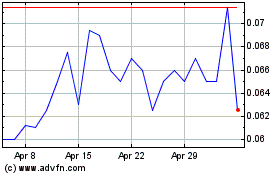

Baron Oil (LSE:BOIL)

Historical Stock Chart

From Apr 2023 to Apr 2024