TIDMBRSD

RNS Number : 9709M

Brandshield Systems PLC

19 September 2023

19 September 2023

BrandShield Systems plc

("BrandShield," the "Company," or the "Group")

Half year results for the six months ended 30 June 2023

Annualised Recurring Revenue, up 45% in H1 2023, continues to

underpin operational progress

BrandShield Systems plc (AIM: BRSD), a leading provider of

cybersecurity solutions for brand oriented digital risk protection

("DRP"), announces its results for the six months ended 30 June

2023 ('H1 2023').

Financial highlights

-- H1 2023 Annualised Recurring Revenue(1) ("ARR") up 46% to $9.71m (H1 2022: $6.67m)

-- Positive momentum continued with the August 2023 ARR figure

reaching $ 9.85 m, up 36 % vs. $7.26m in August 2022 .

-- Delivered revenue growth of 56.3% to $4.42m in H1 2023 (H1 2022: $2.83m)

-- Loss for the period decreased by 53% to $2.05m in H1 2023 (H1 2022: $4.37m)

-- As part of operational improvements Gross profit increased

from 48% in H1 2022 and 54% in December 2022 to 68% in H1 2023

-- Cash of $1.35m at period end (31 Dec 2022: $2.60m)

(1) Annualised Recurring Revenue is a non-GAAP measure and an

industry specific measure

Operational highlights

-- Strong new business momentum achieved in the first half of

2023, with the Company securing 45 new customer wins in the period

to take its total number of customers to 209. This growth continued

post-period end, and as at end of August 2023, BrandShield services

214 customers

-- Ongoing sales and marketing initiatives continues to support

the growth in the Company's customer footprint, expanding the

Group's presence across in key growth sectors such as

pharmaceutical, retail, ecommerce and finance

-- B randShield consolidated its position as one of the leading

Digital Risk Protection ("DRP") Provider

o BrandShield named the third best DRP service provider globally

in a 2022 review by Frost & Sullivan ("F&S") the global

business consultancy group.

o BrandShield recognised with the 2023 Global Digital Risk

Protection New Product Innovation and Best Practices Award by

F&S

Post period-end and Outlook

-- The Company has made a solid start to H2 2023 and looks

forward to reporting another period of both operational and

financial progress

-- Recent focus on reducing cash burn is having a marked impact

on gross margins as the Company continues to grow towards becoming

cash flow positive

Yoav Keren, Chief Executive Officer of BrandShield,

commented:

"I am pleased to report another solid six months of trading from

BrandShield, in which we continue to deliver record levels of ARR,

up 46% to $9.7 million p.a., underpinning our confidence in the

business.

Our ongoing sales and marketing efforts, alongside the growing

reputation that BrandShield continues to build across the industry

for innovation and product excellence, as highlighted by Frost

& Sullivan earlier in the year, continues to drive customer

growth.

We have made a solid start to H2 2023 and look forward to

reporting another period of both operational and financial

progress."

Enquiries:

BrandShield Systems plc

Yoav Keren, CEO +44 (0)20 3143 8300

Spark Advisory Partners Limited (Nominated

Adviser)

Neil Baldwin / Andrew Emmott / James Keeshan +44 (0)20 3368 3554

Shore Capital (Broker)

Toby Gibbs / James Thomas / Rachel Goldstein

(Corporate Advisory)

Henry Willcocks (Corporate Broking) +44 (0)20 7408 4090

Vigo Consulting (Financial Public Relations)

Jeremy Garcia / Kendall Hill / Peter Jacob

brandshield@vigoconsulting.com +44 (0)20 7390 0237

About BrandShield

Brandshield is a provider of cybersecurity solutions from brand

protection to online threat hunting. BrandShield detects online

threats and takes them down. The Company's client base is a growing

list of organisations including Fortune 500 and FTSE100 companies.

By utilising AI and big-data analysis, BrandShield monitors,

detects, and removes online threats facing companies. These threats

include social phishing, executive impersonation, fraud, brand

abuse, and counterfeits.

Chief Executive Officer's Review

Introduction

Given that the Company continues to grow quickly, the focus for

the first half of 2023 remained on continuing the rapid expansion

of BrandShield's offering worldwide. The Company's Annualised

Recurring Revenue ("ARR") grew to $9.71m, representing a 15%

increase relative to December 2022, and 46% higher than the same

period in the prior year. ARR is the key performance indicator

("KPI") for the Group, however there has been a concurrent effort

to reduce cash burn which has increased gross profits markedly and

continues to propel the BrandShield towards becoming cash flow

positive. Consequently, Gross profit increased from 48% in H1 2022

and 54% in December 2022 to 68% in H1 2023, and Loss for the period

decreased by 53% to $2.05m in H1 2023 (H1 2022: $4.37m).

As in previous periods, the Company's growth was underpinned by

the conversion of clients across a broad range of sectors and the

ongoing investment in and expansion of the Company's marketing and

sales functions. It is anticipated this will continue to impact

strong growth in client capture in H2 of 2023 which traditionally

shows the highest increases in new business.

Revenues for the six months ended 30 June 2023 increased 56.3%

to $4.42m (H1 2022: $2.83m). As at 30 June 2023, the Group had cash

of $1.35 million (31 Dec 2022: $2.60m).

As at 30 June 2023, the loss includes Share Based Payments of

$0.81m; the Company recognised the expense in the income statement

according to the fair value of the share options and warrants

determined using the Black-Scholes valuation model.

BrandShield's unique proposition

BrandShield's technology is well-placed to lead the ongoing

transition to a more digitised economy as enterprises continue to

recognise the importance of increasing their online protection by

securing comprehensive DRP solutions from external providers to

complement internal cybersecurity operations. Frost and Sullivan

("F&S") recognised the strong performance and dynamic

capabilities of BrandShield's solutions in its 2022 Digital Risk

Protection Services Report in which it awarded the Company 3(rd)

place globally. F&S highlighted BrandShield's innovation,

growth and its ease of use for clients, whilst commending the

Company for its extensive brand protection capabilities and

effectiveness in detecting and eliminating a wide range of

cyberthreats from phishing to brand impersonation.

F&S expects the DRP market to reach $917.7m in 2026,

expanding at a compound growth rate of 39.7%, and BrandShield is

uniquely placed to exploit this significant market size expansion

through leveraging the following key strengths:

-- A mature product, creating higher barriers to entry

-- Ongoing investment in R&D to ensure market leadership is maintained

-- AI/ML powered technology

-- Strong threat network detection capabilities

-- Unique image recognition and Optical Character Recognition

("OCR") - focusing on detection of emerging threats on social media

and ecommerce marketplaces

-- Big data investigation tools with multi-brand and platform capabilities

-- Strong takedown capabilities across all digital threats

-- Multi-layered approach to detection and successful takedown of online threats

-- BrandShield 3.0 user interface which F&S described as

enabling legal, marketing and cyber-security teams to collaborate

more efficiently and mitigate threats on all fronts

Strategy

The Company remains in a strong growth phase in which the focus

continues to be on client conversion and driving ARR but set within

the context of driving gross margins through a reduction in cash

burn. The growth to 209 clients at the end of H1 2023 is strong

evidence of the Company's ability to convert new clients whilst

retaining, and also delivering upsells to, existing clients who

have remained with BrandShield for several years. Retention of

existing clients is an ever-increasing focus of the team and an

area of strategic importance for the Company given the

well-publicised global financial headwinds and macroeconomic

pressures facing corporates.

Product innovation is a key pillar of the Company's overarching

growth strategy, as evidenced by the launch of 'BrandShield 3.0' in

2022 which has helped elevate BrandShield's DRP offering, increase

its operational efficiency and improve gross margins. The Company

invests considerably in R&D, boasting a highly experienced team

dedicated to developing cutting-edge products and innovative add-on

features, as well as creating ongoing automations to improve

efficiencies. This has not only helped the Company generate

significant cross-sell and upsell opportunities but continues to

underpin new customer engagement. Concurrently, BrandShield

continues to monitor the evolution of AI technology, ensuring it

responds rapidly to industry trends, so its solutions remain at the

forefront of market innovation.

Although BrandShield is primarily focused on its core US and

European client base, it is becoming increasingly recognised as a

leading global player in DRP across Asia. The business is set up to

scale on a global basis and is able to service brands across all

geographies without the requirement to incur additional operating

expenses in those regions.

Outlook

The Company has executed on its plan to reinforce sales and

marketing teams across the globe and at the same time re-structured

a number of operational functions to increase gross margin. These

initiatives have laid the foundation for continued expansion into a

rapidly growing market and the transition to becoming cash flow

generative. The opportunity to seize market share in a fast-growing

sector remains the overriding focus and the Board looks forward to

reporting on full year trading after what it believes will be a

strong H2 2023 performance.

Yoav Keren

Chief Executive Officer

20 September 2023

UNAUDITED CONDENSED CONSOLIDATED INTERIM FINANCIAL INFORMATION

ON BRANDSHIELD SYSTEMS PLC FOR THE 6 MONTH PERIODED 30 JUNE

2023

CONSOLIDATED INCOME STATEMENT

For the periods ended 30 June

Unaudited Period

ended 30 June Unaudited Period

2023 ended 30 June 2022

Note $ $

----------------------------- ---- ---------------- -------------------

Revenue 2 4,420,266 2,828,073

Cost of sales (1,400,761) (1,469,009)

Gross profit 3,019,505 1,359,064

---------------- -------------------

Research and Development

expenses 3 (1,512,988) (1,648,081)

Sales and Marketing expenses 3 (2,506,113) (1,810,787)

Operating expenses 3 (1,497,047) (2,044,349)

---------------- -------------------

(5,516,148) (5,503,217)

---------------- -------------------

Loss from operations (2,496,643) (4,144,153)

---------------- -------------------

Net finance income (expense) 351,634 30,376

Loss before tax (2,848,277) (4,113,777)

---------------- -------------------

Tax expense - -

Loss for the period (2,848,277) (4,113,777)

================ ===================

Basic and diluted loss

per share (cent) 4 (0.017) (0.032)

================ ===================

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

For the periods ended 30 June

Unaudited Period

ended 30 June Unaudited Period

2023 ended 30 June 2022

$ $

---------------------------- ---------------- -------------------

Loss for the period (2,848,288) (4,113,777)

Other comprehensive income:

Items that will or may

be reclassified to profit

or loss:

Other comprehensive(loss)

/ income 799,615 (222,714)

---------------- -------------------

Total comprehensive loss (2,048,673) (4,336,491)

================ ===================

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

As at 30 June

Unaudited Period

ended 30 June Audited Year ended

2023 December 31, 2022

Note $ $

------------------------------ ---- ---------------- ------------------

Non-current assets

Property, plant and equipment 176,843 180,777

Right of use asset-office

lease 904,515 1,080,599

Financial assets at fair

value through profit or

loss 12 3,840,920 3,663,072

---------------- ------------------

4,922,278 4,924,448

---------------- ------------------

Current assets

Trade and other receivables 5 2,170,011 2,791,518

Financial assets at fair

value through profit or

loss 19,180 18,220

Other financial assets 15,148 14,447

Cash and cash equivalents 6 1,352,922 2,605,605

Restricted cash 425,471 372,707

Assets classified as held

for sale 266,356 254,023

---------------- ------------------

4,249,088 6,056,520

---------------- ------------------

Total assets 9,171,366 10,980,968

================ ==================

Current liabilities

Short term loan and bank

overdraft 7 2,166,560 2,278,645

Trade and other payables 8 5,721,156 5,969,822

Lease liability- current 314,758 321,727

---------------- ------------------

8,202,474 8,570,194

---------------- ------------------

Non-current liabilities

Lease liability - non-current 596,250 795,557

Other payables 28,560 30,079

---------------- ------------------

624,850 825,636

---------------- ------------------

Total liabilities 8,827,324 9,395,830

================ ------------------

Net assets 344,042 1,585,138

================ ==================

Equity attributable to

owners of the parent

Share capital 11 9,929,842 9,929,842

Share premium 11 32,060,989 32,060,989

Reverse acquisition reserve (20,653,597) (20,653,597)

Other reserves 6,292,217 4,685,025

Retained earnings (27,285,409) (24,437,121)

Total equity 344,042 1,585,138

================ ==================

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

Unaudited

Reverse

Share premium acquisition Other Retained

Share capital reserve reserves earnings Total

$ $ $ $ $

------------------------ ------------- --------------- -------------- -------------- ------------ -----------

Balance as at 1 January

2022 9,299,228 27,686,289 (20,653,597) 4,340,744 (18,393,526) 2,279,168

------------- --------------- -------------- -------------- ------------ -----------

Prior year adjustment - - - (1,125,999) 1,125,999 -

Loss for the period

ended 30 June 2022 - - - - (4,113,777) (4,113,777)

Share based payments - - - 1,202,546 - 1,202,546

Issue of share capital 300,803 2,976,840 - - - 3,277,642

Exchange differences

on translation - - - (222,714) - (222,714)

Balance as at 30 June

2022 9,600,031 30,663,129 (20,653,597) 4,194,607 (21,381,304) 2,422,866

Reverse

Share premium acquisition Other Retained

Share capital reserve reserves earnings Total

$ $ $ $ $ $

------------------------ ------------- --------------- -------------- -------------- ------------ -----------

Balance as at 1 January

2023 9,929,842 32,060,989 (20,653,597) 4,685,025 (24,437,121) 1,585,138

------------- --------------- -------------- -------------- ------------ -----------

Loss for the period

ended 30 June 2023 - - (2,848,288) (2,848,288)

Issue of share capital - - -

Share based payments - - 807,577 - 807,577

Exchange differences

on translation - - 799,615 - 799,615

------------- --------------- -------------- -------------- ------------ -----------

Balance as at 30 June

2023 9,929,842 32,060,989 (20,653,597) 6,292,217 (27,285,409) 344,042

------------- --------------- -------------- -------------- ------------ -----------

UNAUDITED CONSOLIDATED CASH FLOW STATEMENTS

For the periods ended 30 June

Unaudited Period Unaudited Period

ended 30 June ended 30 June

2023 2022

$ $

------------------------------------- ---------------- ----------------

Cash flows from operating activities

Loss for the year (2,848,288) (4,113,777)

Adjustments for:

Depreciation 13,513 15,615

Depreciation of the right of

use 176,084 -

Share based payment expense 807,577 1,202,546

Foreign exchange on operations 503,711 245,090

Decrease (Increase) in trade

and other receivables 620,806 (751,202)

Increase in other financial

assets - (120,128)

Increase in restricted cash (52,764) (178,631)

Increase (Decrease) in trade

and other payables (248,665) 1,229,390

---------------- ----------------

Net cash flows from operating

activities (1,028,026) (2,471,097)

---------------- ----------------

Investing activities

Purchase of property, plant

and equipment (18,382) (199,607)

---------------- ----------------

Net cash used in investing

activities (18,382) (199,607)

---------------- ----------------

Financing activities

Proceeds from loans and borrowings - 377,136

Repayment of right of use lease

obligation (206,275) -

Proceeds from issue of ordinary

shares - 3,277,642

---------------- ----------------

Net cash (used in)/generated

from financing activities (206,275) 3,654,778

---------------- ----------------

Net (decrease) / increase in

cash and cash equivalents (1,252,683) 984,074

Cash and cash equivalents at

beginning of period 2,605,605 1,194,275

Foreign exchange differences - -

on cash

---------------- ----------------

Cash and cash equivalents at

end of period 1,352,922 2,178,349

================ ================

Non-cash transactions

The Company operates an equity-settled, share-based scheme under

which the Company receives services from employees as consideration

for equity instruments (options) of the Company. The value of the

employee services received is expensed in the Income Statement and

its value is determined by reference to the fair value of the

options granted, calculated using the Black-Scholes model.

NOTES TO THE FINANCIAL INFORMATION

1. General information and basis of preparation

The principal activity of BrandShield Systems plc (the

'Company') is the development of a digital risk protection solution

to prevent, detect and remove online threats, through its research

and development centre in Israel.

Basis of preparation

The condensed consolidated interim financial statements

("Interim Financial Statements") of the Group have been prepared in

accordance with the AIM Rules for Companies and UK adopted

international accounting standards and the Companies Act 2006. They

have been prepared under the assumption that the Group operates on

a going concern basis. As permitted, the Group has chosen not to

fully adopt IAS 34 in preparing the Interim Financial Statements.

The Interim Financial Statements have been prepared under the

historical cost convention, as modified by the revaluation of

financial assets at fair value through profit or loss.

The Interim Financial Information has been prepared under the

same basis of preparation and accounting policies as adopted in the

audited annual financial statements for the period to 31 December

2022, which were authorised by the Board on 2 July 2023. The

Interim Financial Statements should be read in conjunction with

these annual financial statements.

The interim financial information is presented in US

Dollars.

Going concern

The financial statements have been prepared on the assumption

that the group will continue as going concern. Under the going

concern assumption, an entity is ordinarily viewed as continuing in

business for the foreseeable future with neither the intention nor

the necessity of liquidation, ceasing trading or seeking protection

from creditors pursuant to laws or regulations.

The wording included in the going concern policy and relevant

disclosures within the Annual Report for the year ended 31 December

2022 is still applicable to the group as at 30 June 2023.

Critical accounting estimates

The preparation of Interim Financial Statements in conformity

with IFRS requires the use of certain critical accounting

estimates. It also requires management to exercise its judgement in

the process of applying the Company's accounting policies. The key

assumptions used in preparation of the Interim Financial

Information are in conformity with the assumptions used in the

annual financial statements unless otherwise stated.

Accounting policies

The same accounting policies, presentation and methods of

computation have been followed in the Interim Financial Statements

as were applied in the Company's audited annual financial

statements.

The company started implementing IFRS 16 for a new leasing

agreement (starting FY2022 reports).

There are no new standards issued but not yet effective that

have been early adopted or are expected to have a material impact

on the Company.

2. Revenue

Revenue is generated from the sale of Digital Risk Protection

solutions. In the period ended 30 June 2023, 93 % of sales were

made overseas (The period ended 30 June 2022: 96%). The majority of

overseas sales are made in the USA.

3. Research and Development expenses

Unaudited Period Unaudited Period

ended 30 June ended 30 June

2023 2022

$ $

-------------------- ---------------- ----------------

Salaries (854,478) (817,191)

Share based payment (322,210) (488,592)

Other expenses (336,300) (342,298)

---------------- ----------------

(1,512,988) (1,648,081)

---------------- ----------------

Sales and marketing expenses

Unaudited Period Unaudited Period

ended 30 June ended 30 June

2023 2022

$ $

-------------------------- ---------------- ----------------

Salaries (1,348,390) (658,121)

Advertising and Marketing (1,008,436) (950,831)

Share based payment (149,287) (201,835)

(2,506,113) (1,810,787)

---------------- ----------------

Operation expenses

Unaudited Period Unaudited Period

ended 30 June ended 30 June

2023 2022

$ $

----------------------------- ---------------- ----------------

Salaries (513,128) (523,567)

Share based payment (320,170) (493,692)

Rent and utilities - (258,891)

Depreciation of the right of

use (176,084) -

Other expenses (487,665) (768,199)

---------------- ----------------

(1,497,047) (2,044,349)

---------------- ----------------

4. Loss per share

Basic loss per share is calculated by dividing the profit

attributable to equity holders of the Company by the weighted

average number of ordinary shares in issue during the year.

Unaudited Period Unaudited Period

ended 30 June ended 30 June

2023 2022

$ $

------------------------------------ ---------------- ----------------

Loss attributable to equity holders

of the Company 2,848,288 4,113,777

Weighted average number of shares 170,331,874 129,171,159

---------------- ----------------

Loss per share (cents) (0.017) (0.032)

---------------- ----------------

Since the Company is loss making, the share options, warrants

and convertible loans currently in issue are non-dilutive.

5. Trade and other receivables

Unaudited

Period ended 30 Audited Year ended

June 2023 31 December 2022

$ $

------------------------------ ---------------- ------------------

Trade receivables 2,092,412 2,607,551

Other receivables and prepaid

expenses 77,599 183,967

---------------- ------------------

2,170,011 2,791,518

---------------- ------------------

6. Cash and cash equivalents

Unaudited Period Audited Year ended

ended 30 June 2023 31 December 2022

$ $

-------------------------- ------------------- ------------------

Cash and cash equivalents 1,325,922 2,605,605

------------------- ------------------

1,325,9 22 2,605,605

------------------- ------------------

7. Short term loan and bank overdraft

BrandShield Ltd has an agreement with Leumi Bank to provide a

revolving credit line facility of up to 8 million NIS (c. $2.2

million) for 24 months, ending on 26 September 2023, the renewal of

which is in the process of being negotiated by the Company. The

credit line bears a competitive interest rate. The facility allows

drawdown of up to four times Monthly Revenue (net of churn) and

includes covenants of a type typical of such an agreement.

8. Trade and other payables

Unaudited Period Audited Year ended

ended 30 June 2023 31 December 2022

$ $

----------------------- ------------------- ------------------

Trade payables 837,713 671,657

Salaries, accruals and

taxes 907,697 1,068,291

Royalties Payable 394,030 426,706

Deferred revenue 3,581,716 3,581,903

5,721,156 5,969,822

------------------- ------------------

9. Related party transactions

BrandShield Limited is connected to its predecessor Domain the

Net Technologies Limited (the "Related Party"), a company

registered in Israel. BrandShield Limited demerged from the Related

Party in 2013 and has directors in common. Furthermore, the two

parties share several operational costs, including sharing rental

costs. There is a formal agreement between the Company and its

related party (signed 17 May 2020).

BrandShield Limited is connected to its parent company

BrandShield Systems plc. There is a formal service agreement

between the two companies (signed 25 July 2021).

BrandShield Limited is connected to its subsidiary BrandShield

Inc.

10. Share based payments

The Company operates an equity-settled, share-based scheme under

which the Company receives services from employees as consideration

for equity instruments (options and warrants) of the Company. The

fair value of the third-party suppliers' services received in

exchange for the grant of the options is recognised as an expense

in the Income Statement or charged to equity depending on the

nature of the service provided. The value of the employee services

received is expensed in the Income Statement and its value is

determined by reference to the fair value of the options

granted:

-- including any market performance conditions.

-- excluding the impact of any service and non-market

performance vesting conditions (for example, profitability or sales

growth targets, or remaining an employee of the entity over a

specified time period); and

-- including the impact of any non-vesting conditions (for

example, the requirement for employees to save).

The fair value of the share options and warrants are determined

using the Black-Scholes valuation model at the date of grant.

Non-market vesting conditions are included in assumptions about

the number of options that are expected to vest. The total expense

or charge is recognised over the vesting period, which is the

period over which all of the specified vesting conditions are to be

satisfied. At the end of each reporting period, the entity revises

its estimates of the number of options that are expected to vest

based on the non-market vesting conditions. It recognises the

impact of the revision to original estimates, if any, in the Income

Statement or equity as appropriate, with a corresponding adjustment

to a separate reserve in equity.

When the options are exercised, the Company issues new shares.

The proceeds received, net of any directly attributable transaction

costs, are credited to share capital (nominal value) and share

premium when the options are exercised.

11. Share capital and share premium

Ordinary shares are classified as equity. Incremental costs

directly attributable to the issue of new ordinary shares or

options are shown in equity as a deduction, net of tax, from the

proceeds.

Number of Number of

Ordinary Deferred Share

shares shares capital Share premium Total

$ $ $

------------------- ----------- ---------- --------- --------------- ----------

As at 1 January

2022 117,950,921 32,385,056 9,299,228 27,686,289 36,985,517

----------- ---------- --------- --------------- ----------

Issue of shares 23,214,286 - 300,803 2,976,839 3,277,642

----------- ---------- --------- --------------- ----------

As at 30 June 2022 141,165,207 32,385,056 9,600,031 30,663,128 40,263,159

----------- ---------- --------- --------------- ----------

As at 1 January

2023 170,331,874 32,385,056 9,929,842 32,060,989 41,990,831

Issue of shares - - - - -

----------- ---------- --------- --------------- ----------

As at 30 June 2023 170,331,874 32,385,056 9,929,842 32,060,989 41,990,831

----------- ---------- --------- --------------- ----------

12. Financial assets at fair value through profit and loss

The Company reviews the fair value of its unquoted equity

instruments at each Statement of Financial Position date. This

requires management to make an estimate of the value of the

unquoted securities in the absence of an active market.

The Company follows the guidance of IFRS 9 to determine when an

investment at fair value through profit or loss is impaired. This

determination requires significant judgement. In making this

judgement, the Company evaluates, among other factors, the duration

and extent to which the fair value of an investment is less than

its cost; and the financial health of the short-term business

outlook for the investee, including factors such as industry and

sector performance and operational and financing cash flow.

Management also considers external indicators such as technological

advances and trends, commodity prices, investment performance and

demand for the underlying commodity. Financial assets held at fair

value through profit or loss are assessed individually.

Unaudited Period Audited Year ended

ended 30 June 31 December 2022

2023

$ $

----------------- ---------------- ------------------

Opening balance 3,663,072 4,112,107

Foreign exchange 177,848 (449,035)

---------------- ------------------

Closing balance 3,840,920 3,663,072

================ ==================

Financial assets include the following:

Unlisted securities Unaudited Period Audited Year ended

ended 30 June 31 December 2022

2023

$ $

-------------------- ---------------- ------------------

UK 3,840,920 3,663,072

3,840,920 3,663,072

---------------- ------------------

At 30 June 2023, the Directors' view of fair value of the

Company's investment in WeShop Ltd is $3,840,920 ($3,663,072 at 31

December 2022). This remains in line with the aggregate cost of

investment. While WeShop remains pre-revenue, the Directors

continue to believe that social commerce represents an exciting and

authentic digital shopping opportunity, particularly post Covid-19

which has driven more traffic online and away from the high street.

While the Directors are hopeful of a deliverable transaction at an

attractive valuation, they consider it prudent to continue to fair

value the asset at cost.

13. Subsequent events

No subsequent events were identified between the reporting

period and issue of the interim financial information.

14.Availability of Interim Report

The interim report is available on www.brandshield.com

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR EAKNNFESDEFA

(END) Dow Jones Newswires

September 19, 2023 12:09 ET (16:09 GMT)

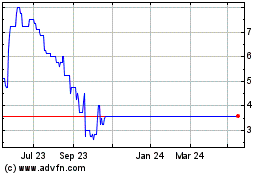

Brandshield Systems (LSE:BRSD)

Historical Stock Chart

From Jan 2025 to Feb 2025

Brandshield Systems (LSE:BRSD)

Historical Stock Chart

From Feb 2024 to Feb 2025