TIDMBRU2

RNS Number : 3833D

Bruntwood Bond 2 PLC

18 February 2020

The information contained herein may only be released, published

or distributed in the United Kingdom, the Republic of Ireland, the

Isle of Man, Jersey and the Bailiwick of Guernsey in accordance

with applicable regulatory requirements. The information contained

herein is not for release, publication or distribution in or into

the United States, Australia, Canada, Japan, South Africa or in any

other jurisdiction where it is unlawful to distribute this

document.

THIS ANNOUNCEMENT RELATES TO THE DISCLOSURE OF INFORMATION THAT

QUALIFIED OR MAY HAVE QUALIFIED AS INSIDE INFORMATION WITHIN THE

MEANING OF ARTICLE 7(10) OF THE MARKET ABUSE REGULATION (EU)

596/2014.

SEE "IMPORTANT INFORMATION" BELOW

18 February 2020

BRUNTWOOD BOND 2 PLC (THE "ISSUER")

6 PER CENT. STERLING NOTES DUE 2025 (the "Bonds")

guaranteed by

BRUNTWOOD LIMITED and BRUNTWOOD MANAGEMENT SERVICES LIMITED

Sizing Announcement

Terms used herein shall have the meaning given to them in the

Exchange Offer Memorandum and Prospectus published on 28 January

2020 (the "Exchange Offer Memorandum and Prospectus") relating to

the Bonds (as defined below).

This announcement constitutes the Sizing Announcement referred

in the Exchange Offer Memorandum and Prospectus relating to (i) the

proposed offer and issue (the "Cash Offer") by the Issuer of its

6.00 per cent. bonds due 2025 for cash (the "New Bonds"); and (ii)

the Issuer's invitation to exchange (the "Exchange Offer")

Bruntwood Investments plc's outstanding sterling denominated 6.00

per cent. bonds due 2020 (ISIN: XS0947705215) (the "Existing 2020

Bonds") for the Issuer's 6.00 per cent. bonds due 2025 (the

"Exchange New Bonds" and, together with the New Bonds, the

"Bonds"). The Bonds will be issued as one series on the Issue Date

(as specified below) with ISIN XS2104011304.

The Exchange Offer Memorandum and Prospectus is available for

viewing on Bruntwood's website ( https://bruntwood.co.uk/ ) and on

the National Storage Mechanism at https://www.morningstar.co.uk/NSM

.

The Exchange Offer for the Bonds expired at 12 Noon on 18

February 2020 and the Offer Period relating to the Cash Offer

expired at 11 a.m. on 7 February 2020 and accordingly Bonds can no

longer be subscribed for nor be obtained by way of application for

exchange. Accordingly, this announcement is not an offer to

subscribe, tender, sell or exchange any securities.

The Issuer confirms the following in relation to the offer and

issue of Bonds

Issue Date: 25 February 2020

Aggregate Nominal Amount: GBP110,000,000 (of which, GBP58,000,000

were subscribed pursuant to the

Cash Offer, GBP32,872,600 were

subscribed pursuant to the Exchange

Offer and GBP19,127,400 are being

retained in treasury by the Issuer).

Estimated Net Proceeds GBP89,509,511 (being the Aggregate

Nominal Amount of the Bonds at

the Issue Price of 100% less

the fees payable to the Joint

Lead Managers)

Estimated Total Expenses GBP1,363,089 (being the fees

payable to the Joint Lead Managers

described in estimated net proceeds

above but excluding other expenses,

such as expenses relating to

admission to trading of the Bonds)

Authorised Distributors AJ Bell Securities Limited

Equiniti Financial Services Limited

Redmayne-Bentley LLP

iDealing.com Limited

Hargreaves Lansdown Asset Management

In relation to the Exchange Offer, the aggregate nominal amount

of Existing 2020 Bonds accepted for exchange by the Issuer is

GBP32,872,600. Accordingly, the aggregate nominal amount of

Existing 2020 Bonds remaining outstanding (and falling due to be

repaid by Bruntwood Investments plc on 24 July 2020) after the

Exchange Offer will be GBP17,127,400.

GBP19,127,400 nominal amount of Bonds due to be issued (the

"Retained Bonds") on the Issue Date are being retained in treasury

by the Issuer. The Issuer has undertaken not to offer or to agree

to sell any Retained Bonds (i) prior to 26 August 2020, at any

price and (ii) on or after 26 August 2020, at a price of less than

100 per cent. of their nominal amount.

-Ends-

For further information, please see Bruntwood's website at

https://bruntwood.co.uk/ or contact:

Kevin Crotty (Chief Financial Officer) +44 (0) 161 212 2222

Sean Davies (Director of Financing

& Investment) +44 (0) 161 212 2222

David Shilson (Lucid Issuer Services) +44 (0) 2077 040 880

IMPORTANT INFORMATION

This announcement is released by Bruntwood Bond 2 PLC and

contains information that qualified or may have qualified as inside

information for the purposes of Article 7 of the Market Abuse

Regulation (EU) 596/2014 (MAR), encompassing information relating

to an offer of securities, as described above. For the purposes of

MAR and Article 2 of Commission Implementing Regulation (EU)

2016/1055, this announcement is made by Kevin Crotty, Chief

Financial Officer for Bruntwood Bond 2 PLC.

The Exchange Offer Memorandum and Prospectus is available for

viewing at

https://bruntwood.co.uk/our-performance/disclaimer/retail-bond-information/

.

Please note that the information contained in the Exchange Offer

Memorandum and Prospectus may be addressed to and/or targeted at

persons who are residents of particular countries (specified in the

Exchange Offer Memorandum and Prospectus) only and is not intended

for use and should not be relied upon by any person outside these

countries and/or to whom the offer contained in the Exchange Offer

Memorandum and Prospectus is not addressed. Prior to relying on the

information contained in the Exchange Offer Memorandum and

Prospectus you must ascertain from the Exchange Offer Memorandum

and Prospectus whether or not you are part of the intended

addressees of the information contained therein.

The distribution of this announcement and other information in

connection with any offer of securities and/or the solicitation of

offers for securities in certain jurisdictions may be restricted by

law and persons who come into possession of this announcement or

any document or other information referred to herein should inform

themselves about and observe any such restriction. Any failure to

comply with these restrictions may constitute a violation of the

securities laws of any jurisdiction.

This announcement does not constitute or form part of any offer

or invitation to sell, or any solicitation of any offer to purchase

any securities. This announcement does not constitute and shall

not, in any circumstances, constitute a public offering nor an

invitation to the public in connection with any offer within the

meaning of Regulation EU 2017/1129 (the "Prospectus Regulation").

Any offer and sale of any securities will be made in compliance

with the requirements of the Prospectus Regulation.

Any securities referred to herein will not be registered under

the U.S. Securities Act of 1933 (the "Securities Act"). Subject to

certain exceptions, such securities may not be offered, sold or

delivered within the United States. The Notes, which are in bearer

form, are subject to U.S. tax law requirements. Any securities

referred to herein would be offered and sold outside of the United

States in reliance on Regulation S of the Securities Act. There

will be no public offering in the United States.

MiFID Product Governance - Solely for the purposes of the

manufacturers' product approval process, the target market

assessment in respect of the Bonds has led to the conclusion that:

(i) the target market for the Bonds is eligible counterparties,

professional clients and retail clients, each as defined in

Directive 2014/65/EU (as amended, "MiFID II") and (ii) all channels

for distribution of the Bonds are appropriate, subject to the

distributor's suitability and appropriateness obligations under

MiFID II, as applicable. Any person subsequently offering, selling

or recommending the Bonds (a "distributor") should take into

consideration the manufacturers' target market assessment; however,

a distributor subject to MiFID II is responsible for undertaking

its own target market assessment in respect of the Bonds (by either

adopting or refining the manufacturer target market assessment) and

determining appropriate distribution channels, subject to the

distributor's suitability and appropriateness obligations under

MiFID II, as applicable.

Legal Entity Identifier: 213800ZX2CGN7UUXYC31

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

NRATPMATMTIBBFM

(END) Dow Jones Newswires

February 18, 2020 10:50 ET (15:50 GMT)

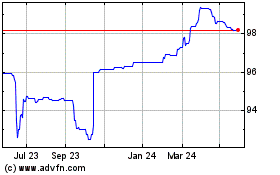

Bruntwood Bd 6% (LSE:BRU2)

Historical Stock Chart

From Nov 2024 to Dec 2024

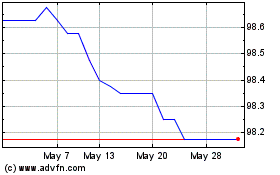

Bruntwood Bd 6% (LSE:BRU2)

Historical Stock Chart

From Dec 2023 to Dec 2024