TIDMCASP

RNS Number : 6551B

Caspian Sunrise plc

15 February 2022

Caspian Sunrise PLC

("Caspian Sunrise" or the "Company")

PROPOSED US$6.2 MILLION DEBT CONVERSION

APPROVAL OF WAIVER OF OBLIGATIONS UNDER RULE 9 OF THE CITY CODE

ON TAKEOVERS AND MERGERS

AND

NOTICE OF GENERAL MEETING

Caspian Sunrise, the Kazakhstan based oil and gas exploration

and production company, is pleased to announce that it will shortly

be posting to Shareholders a Circular regarding a proposed Debt

Conversion in respect of the Company's Oraziman Family Loan of

approximately US$6.2m, first announced in August 2021.

The Independent Directors have, subject to Independent Caspian

Sunrise Shareholder approval and regulatory consent, agreed to

convert the Oraziman Family loan of approximately US$6.2m into

139,729,446 Ordinary Shares in the Company to be issued to Aibek

Oraziman and Aidana Urazimanova pursuant to the Debt Conversion, as

detailed below.

This will result in the Oraziman Family Concert Party

shareholding increasing from 45% to 48.41%.

Clive Carver, Chairman commented

"On completion of the Debt Conversion the Group will be free of

debt and therefore better placed to further develop the Group's

assets and to commence dividend payments."

Caspian Sunrise PLC

Clive Carver

Chairman +7 727 375 0202

WH Ireland, Nominated Adviser & Broker

James Joyce +44 (0) 207 220 1666

Andrew de Andrade

This announcement has been posted to:

www.caspiansunrise.com/investors

The information contained within this announcement is deemed by

the Company to constitute inside information under the Market Abuse

Regulation (EU) No. 596/2014.

The Circular will be made available on the Company's website at

www.caspiansunrise.com .

Extracts from the Circular are included below:

EXPECTED TIMETABLE OF PRINCIPAL EVENTS

Publication of this Circular and the Notice of General Meeting 15 February 2022

Latest time and date for receipt of Forms of Proxy 7 March

2022

General Meeting 9 March 2022

Completion of the Debt Conversion 9 March 2022

Admission of the Conversion Shares and commencement of dealing in 15 March 2022

such shares on AIM

Notes:

1. The times and dates set out in this document that fall after

the date of this document are based on the Company's current

expectations and are subject to change.

2. The timetable assumes that there is no adjournment of the

General Meeting. If the date scheduled for the General Meeting

changes, the revised date and / or time will be notified to

Shareholders by a further Shareholder letter.

3. All times shown are London times unless otherwise stated.

STATISTICS

Issued share capital

Number of Ordinary Shares as at 11 February

2022 (being the

latest practicable date prior to the publication

of this Circular) 2,110,772,114

Conversion statistics*, **

Aggregate consideration payable by the Company US$ 6,215,166

pursuant to the Debt Conversion (to be satisfied

by the issue of the Conversion Shares at the

Issue Price)

Number of Conversion Shares proposed to be

issued pursuant to the Debt Conversion 139,729,446

Issue price per Conversion Share 3.2 pence

Number of issued Ordinary Shares Enlarged

Share Capital following completion of the

Debt Conversion 2,250,501,560

Conversion Shares as a percentage of the Enlarged

Share Capital 6.21%

*These figures set out the maximum Conversion Shares to be

issued on the assumption that (i) the Waiver Resolution contained

within this Circular is passed at the General Meeting and the Debt

Conversion completes in accordance with the terms set out in this

Circular; and (ii) there are no changes to the share capital of the

company between the date of this circular and the date of the

conversion of Oraziman Family Loan

** US$ : GBP exchange rate for the purposes of calculating

consideration payable US$1.39 : GBP1.00

Being the prevailing rate at the date on which the conditional

Debt Conversion agreement was signed

DEFINITIONS

"Admission" the admission of the Conversion

Shares to trading on AIM becoming

effective in accordance with

the AIM Rules

"Admission Document" the admission document published

by the Company relating to

the acquisition of 59% of Eragon,

dated 31 January 2008

"AGM" the Company's annual general

meeting held on 23 July 2021

"AIM" the AIM market operated by

the London Stock Exchange

"AIM Rules" the AIM Rules for Companies

issued by the London Stock

Exchange

"Akku Investments" an investment advisory company

registered in Almaty, Kazakhstan

that manages the Oraziman Family

Concert Party's shareholding

in Caspian Sunrise, which is

owned equally by Aibek Oraziman

and Aidana Urazimanova with

Kuat Oraziman as the sole director.

"Baverstock" Baverstock GmbH, a company

organised under the laws of

Switzerland with a registered

office c/o Acton Treuhand AG,

Innere Gueterstrasse 4, 6300

Zug, Switzerland, which merged

with the Company in February

2017

"Baverstock Quota Holders" those persons historically

beneficially entitled to, in

aggregate, the whole of the

issued quotas in the capital

of Baverstock, being Kuat Oraziman,

Dosbol Zholdybayev, Dae Han

New Pharm Co. Ltd and Cody

Star Investment

"BNG" the Kazakh subsoil use contract

in respect of the BNG contract

area, which is located in the

west of Kazakhstan 40 kilometres

southeast of Tengiz on the

edge of the Mangistau Oblast,

covering an area of 1,561 square

kilometres, and the oil and

gas assets and operations carried

out therein

"Board" or "Directors" the board of directors of the

Company as at the date of this

Circular consisting of Clive

Carver, Edmund Limerick, Aibek

Oraziman, Kuat Oraziman and

"Caspian Explorer Vendors" Seokwoo Shin

Mr Altynbek Bolatzhan, Mr Aibek

Oraziman, Mr Alibek Mugaila,

Mr Berik Bemuratov and Mr Kang

Junyoung

"Circular" this document

"Companies Act" or "Act" the Companies Act 2006 as amended

"Company" or "Caspian Sunrise" Caspian Sunrise PLC, formerly

or "CS" or "CASP" Roxi Petroleum Plc

"Conversion Shares" the 139,729,446 new Ordinary

Shares proposed to be issued

to the Aibek Oraziman and Aidana

Urazimanova in consideration

of the Debt Conversion at the

Issue Price

"CREST" the computerised settlement

system (as defined in the CREST

Regulations) operated by Euroclear

which facilitates the transfer

of shares in uncertificated

form

"CREST Regulations" the Uncertificated Securities

Regulations 2001 (SI 2001/3755)

including any enactment or

subordinated legislation which

amends or supersedes those

regulations or any such enactment

or subordinate legislation

for the time being

"Debt Conversion" the release and conversion

of the Oraziman Family Loan

into the Conversion Shares

at the Issue Price

"Enlarged Share Capital" the Issued Ordinary Shares

and the Conversion Shares.

"Eragon" Eragon Petroleum Limited, a

company incorporated in England

and Wales with company number

06162215

"Euroclear" Euroclear UK & Ireland Limited,

the operator of CREST

"FCA" the Financial Conduct Authority

"Form of Proxy" the form of proxy for use by

Shareholders at the General

Meeting

"General Meeting" or "GM" the general meeting of the

Company convened by the Notice,

to be held at the offices of

Taylor Wessing LLP, 5 New Street

Square, London EC4A 3TW on

9 March 2022 at 11:00 a.m.

"Group" Caspian Sunrise PLC and its

subsidiaries

"Independent Directors" the Directors other than Aibek

Oraziman and Kuat Oraziman

(being Clive Carver, Edmund

Limerick and Seokwoo Shin)

"Independent Shareholders" the Shareholders other than

members of the Oraziman Family

Concert Party and the Wider

Concert Party

"Issued Ordinary Shares" the 2,110,772,114 Ordinary

Shares in issue as at 11 February

2022 (being the latest practicable

date prior to the publication

of this Circular)

"Issue Price" 3.2 pence per Conversion Share

"Link Group" the trading name of Link Market

Services Ltd

"London Stock Exchange"

London Stock Exchange plc

"Merger Circular" the circular dated 27 February

2017 issued by the Company

"Notice" the notice of general meeting

which is set out at the end

of this Circular

"Ordinary Shares" the ordinary shares of 1 pence

each in the capital of the

Company

"Oraziman Family Concert Party" Aibek Oraziman, Aidana Urazimanova,

Kuat Oraziman, Altynbek Boltazhan,

Boltazhan Kerimbayev and the

estate of the late Rafik Oraziman

"Oraziman Family Loan" or "Loan" the aggregate amount of US$

6,215,166 (consisting of principal

of US$ 5,070,244, interest

of US$ 544,537 and unpaid salary

of US$ 600,385) owed by the

Company and certain other Group

companies to the Oraziman Family

Concert Party as at 5 August

2021 (being the latest practicable

date prior to the Debt Conversion

agreement was entered into).

Interest accruing after that

date will be settled in cash.

"Panel" the Panel on Takeovers and

Mergers

"Related Party Transaction" as defined under the AIM Rules

for Companies. The Debt Conversion

comprises a Related Party Transaction

as further described in this

Circular

"Relationship Agreement" the agreement dated 20 January

2020 between the Company and

members of the Oraziman Family

Concert Party, summarised in

Part II of this Circular

"Securities Act" US Securities Act of 1933,

as amended

"Shareholders" the holders of Ordinary Shares

"subsidiary" or "subsidiary have the meanings given to

undertaking" them by the Act

"Takeover Code" the City Code on Takeovers

and Mergers

"Waiver" the waiver granted by the Panel

(conditional on the approval

of the Waiver Resolution by

the Independent Shareholders

on a poll) of the obligation

of the Oraziman Family Concert

Party to make an offer under

Rule 9 of the Takeover Code

on the allotment and issue

to it (or members of it) of

the Conversion Shares

"Waiver Resolution" the ordinary resolution of

the Independent Shareholders

to approve the Waiver in respect

of the issue and allotment

of the Conversion Shares, to

be proposed on a poll at the

General Meeting and set out

in the Notice

"WH Ireland" WH Ireland Limited, the Company's

Nominated Adviser and Broker

for the purposes of the AIM

Rules and independent financial

adviser for the purposes of

Rule 3 of the Takeover Code

"Wider Concert Party" the Oraziman Family Concert

Party & Dae Han New Pharm Co.

Ltd, Raushan Sagdiyeva, Kang

Junyoung, Dosbol Zholdybayev,

Zhanat Bukenova, Daulet Beisenov

and Chang Min Seok

"UK" the United Kingdom of Great

Britain and Northern Ireland

"GBP" or "Pounds" the lawful currency of the

United Kingdom

"US$" the lawful currency of the

United States of America

" " the lawful currency of the

Republic of Korea

LETTER FROM THE CHAIRMAN

(Incorporated and registered in England & Wales under the

Companies Acts 1985 and 1989 registered No. 05966431)

Directors : Registered Office :

Clive Carver (Chairman) Caspian Sunrise PLC

Kuat Oraziman (Chief Executive 5 New Street Square

Officer) London

Seokwoo Shin (Chief Operating EC4A 3TW

Officer)

Edmund Limerick (Non-Executive

Director)

Aibek Oraziman (Non-Executive

Director)

15 February 2022

To Shareholders and, for information purposes only, to the

holders of options under the Caspian Sunrise PLC share option

schemes

Dear Sir or Madam

1. INTRODUCTION

The purpose of this Circular is to:

-- explain the background to and the reasons for the Debt

Conversion and associated Waiver Resolution; and

-- explain why the Independent Directors consider the Debt

Conversion and Waiver Resolution to be in the best interests of the

Company and the Independent Shareholders as a whole and why the

Independent Directors unanimously recommend that the Independent

Shareholders vote in favour of the Waiver Resolution at the General

Meeting.

The Debt Conversion is the conversion of approximately US$6.2

million of debt due to the Oraziman Family Concert Party by the

Company and other members of the Group, into new Ordinary Shares in

the capital of the Company to be issued to Aibek Oraziman and

Aidana Urazimanova and the associated Waiver Resolution which, if

approved would waive the obligation under Rule 9 of the Takeover

Code for the Oraziman Family Concert Party Concert Party or any

member of the Oraziman Family Concert Party to make a general offer

to Shareholders as a result of the allotment and issue to it of the

Conversion Shares .

In the event that the Waiver Resolution is passed and the Debt

Conversion is completed, the aggregate shareholding of the Oraziman

Family Concert Party in Caspian Sunrise will increase from its

current level of approximately 45.00% (comprising 949,815,346

Ordinary Shares) to 48.41% (comprising 1,089,544,792 Ordinary

Shares) of the Enlarged Share Capital.

The Panel has, subject to the approval of Independent

Shareholders of the Waiver Resolution, agreed to a waiver of the

obligations that would otherwise arise on the Oraziman family

Concert Party to make a mandatory offer under Rule 9 of the

Takeover Code (commonly referred to as a "whitewash"), as further

detailed in this document.

Reasons to vote in favour of the Proposals

The Board wishes to start making regular dividend payments. This

would not only reward long term shareholders but is also likely to

attract investors for whom regular dividend payments are an

important investment criterion.

As the Group's business matures and enters what the Board

expects to be a cash generative phase in the Group's development

the Board is targeting declaring the first dividend payments in

2022.

The support provided from the Oraziman Family Concert Party in

recent years, which was vital in the Company's survival, has left

the Group with approximately US$6.2 million of short-term debt,

repayable on demand.

The Directors would deem it imprudent to commence dividend

payments with US$6.2 million of debt repayable on demand. Approval

of the Debt Conversion will both eliminate the US$6.2 million debt

and remove a future obstacle to dividends. On 6 August 2021, the

Company announced it had agreed with the Oraziman Family Concert

Party, conditional on approval of the Waiver Resolution, to convert

the Oraziman Family Loan owed by the Group, which is repayable on

demand into 139,729,446 at a price of 3.2p per share, which was a

12.50% premium to the market price at the time.

The conversion of this debt into new Ordinary Shares, is

regarded as a Related Party Transaction.

Independent Shareholders are being asked to approve the Waiver

Resolution to waive the requirement that would otherwise arise on

the Oraziman Family Concert Party, in converting the Oraziman

Family Loan, to make a general offer for the Company under Rule 9

of the Takeover Code.

The Oraziman Family Concert Party have supported the Group in

recent years when other sources of funding have not been available.

The Loan has grown steadily to the point that it would take a very

significant part of the Group's operational income to repay.

Should Independent Shareholders not approve the Debt Conversion,

funds that would have been available for further development of the

Group's assets would instead be diverted to repay the Loan and the

commencement of dividend payments would be delayed until such time

as sufficient distributable reserves were created.

Concentration of ownership

Following completion of the Debt Conversion the Oraziman Family

Concert Party would increase their aggregate holding in the Company

from 949,815,346 Ordinary Shares (45.00% of the Issued Ordinary

Shares) to 1,089,544,792 Ordinary Shares (48.41% of the Enlarged

Share Capital).

The Independent Directors do not consider that this

concentration of ownership materially changes the control which the

Oraziman Family Concert Party could already exert on the Company

and do not believe it will be detrimental to the future of the

Company.

Further, the Company already has in place a formal relationship

agreement with the Oraziman Family Concert Party to prevent its use

of their controlling stake against the interest of Shareholders

generally, including Independent Shareholders. Further details of

the relationship agreement are set out in the "Relationship

Agreement" paragraph below in Part II of this Circular.

The Wider Concert Party, which includes the Oraziman Family

Concert Party, currently holds 1,321,188,992 Ordinary Shares

(representing 62.59% of the Issued Ordinary Shares) which would

increase to approximately 1,460,918,437 (Ordinary Shares

(representing 64.92% of the Enlarged Share Capital) as a result of

the Debt Conversion.

Information on the concert parties

There are two concert parties. The first is the Wider Concert

Party, of which the Oraziman Family Concert Party forms part. The

Wider Concert Party already holds more than 50% of the Company's

voting rights and as such does not require the approval of either

the Panel or Independent Shareholders to acquire additional

shares.

The second is the Oraziman Family Concert Party, which is a sub

concert party of the Wider Concert Party.

For the purposes of the Takeover Code, members of both the

Oraziman Family Concert Party and the Wider Concert Party are

treated as acting in concert, as defined by the Takeover Code, with

regard to their interests in the issued share capital of the

Company. Further information on this and the Takeover Code can be

found in Part III of this Circular.

BACKGROUND ON THE WIDER CONCERT PARTY

On 29 February 2008, Shareholders approved the acquisition by

the Company of 59% of the issued share capital of Eragon, a company

with a number of oil and gas assets in Kazakhstan, including the

BNG contract area, which is the Company's principal commercial

asset. The remaining 41% of the issued share capital of Eragon was

then held by Baverstock for the benefit of the original Baverstock

Quota holders, the largest of which was Kuat Oraziman, Chief

Executive Officer of the Company. Further details of such

acquisition are set out in the Company's Admission Document.

The Company subsequently obtained 100% ownership of the share

capital of Eragon by way of the reduction of share capital in

Eragon, which entailed the cancellation of the whole of the 41% of

the issued share capital of Eragon held by Baverstock for the

benefit of the Baverstock Quota holders, in consideration of the

issue and allotment to Baverstock (for the benefit of the

Baverstock Quota holders) of 651,436,544 new Ordinary Shares,

thereby giving the Company full operational control and 99%

ownership of its principal commercial asset. This transaction

united 99% of BNG under the Company's ownership. Further details of

this transaction are set out in the Merger Circular.

The Baverstock Quota holders were treated as acting in concert,

as defined by the Takeover Code, with a number of other

Shareholders of the Company, including Kuat Oraziman and his

family, resulting in the Wider Concert Party as it is currently

constituted. The shares in the Company were all subsequently

distributed directly to the Baverstock quota holders.

Further information of the transactions which led to the

formation of the Wider Concert Party, is included in the following

Company circulars:

-- Eragon Acquisition, dated 29 February 2008;

-- Proposed Baverstock Merger dated 27 February 2017;

-- Proposed Acquisition of Caspian Explorer dated 21 January 2020; and

-- the Admission Document

which are available on the Company's website at

https://www.caspiansunrise.com.

Kuat Oraziman is treated as acting in concert with his immediate

family comprising Aibek Oraziman (adult son), Aidana Urazimanova

(adult daughter), Altynbek Boltazhan (nephew) and Boltazhan

Kerimbayev (brother-in-law) and the Estate of the late Rafik

Oraziman, along with Dae Han New Pharm Co. Ltd, Raushan Sagdiyeva,

Dosbol Zholdybayev, Chang Min Seok, Kang Junyoung, , Zhanat

Bukenova and Daulet Beisenov.

A brief description of the Wider Concert Party members

Mr Kuat Oraziman is a Kazakh national. Mr Oraziman has nearly 31

years of business experience in Kazakhstan and abroad and nearly 29

years of oil and gas experience in Kazakhstan. Kuat Oraziman's

experience has included the operation of import and export

businesses, the establishment and operation of an international

brewery in Kazakhstan, and the Kazakhstan representative of

Phillips and Stork. Since 1991 Kuat Oraziman has been a director of

ADA Oil LLP. Kuat Oraziman also holds a doctorate in science and is

a trained geologist. He was appointed to the board of Roxi

Petroleum as a Non-Executive Director in November 2006, became an

Executive Director in 2008 and was appointed Chief Executive

Officer in 2012.

Mr Aibek Oraziman is the adult son of Kuat Oraziman. He has more

than 12 years oil and gas experience, including 3 years in the

field at Aktobe, Kazakhstan working for a local company. He was

appointed to the Caspian Sunrise board on 21 August 2020 as a

non-executive director and holds approximately 22.4% of the

Company's voting rights.

Aidana Urazimanova is the adult daughter of Kuat Oraziman. She

holds approximately 17.8% of the Company's voting rights. She plays

no role in the day to day business of the Company.

Altynbek Boltazhan is the adult nephew of Kuat Oraziman. He

works in the oil & gas industry in Kazakhstan but not presently

for Caspian Sunrise. He holds approximately 1.3% of the Company's

voting rights.

Boltazhan Kerimbayev is the brother-in-law of Kuat Oraziman and

a Kazakh national. He plays no role in the day to day business of

the Company and has no other business connections with Kuat

Oraziman.

Dae Han New Pharm Co. Ltd. is a Korean-registered pharmaceutical

company. It is listed on the Korean Stock Exchange and has a

current market capitalisation of approximately US$130 million.

Directors Mr Wan Jin Lee, Mr WonSuk Lee

and Mr Oh-Gyeong Kwon

Registered office 66 Jeyakgongdan 1-gil Hyangnam-eup

Hwaseong-si Korea, Republic

of (South)

-----------------------------------

Place of incorporation South Korea

-----------------------------------

Registration number 229-81-10729

-----------------------------------

In the latest financial period for the 12 months to 31 December

2020 Dae Han New Pharm Co. Ltd. reported revenues of 150 million, a

loss after tax of 10 million and net assets of 57 million.

Mrs Raushan Sagdiyeva, a Kazakh national. She plays no role in

the day to day business of the Group.

Kang Junyoung, is a Korean national and one of the vendors of

the Caspian Explorer. He was previously the captain of the Caspian

Explorer drilling vessel. He plays no role in the day to day

business of the Group.

Mr Dosbol Zholdybayev is a Kazakh national who worked with and

for Caspian Sunrise previously. He plays no role in the day to day

business of the Group.

Mr Chang Min Seok, the owner of Cody Star Investment Limited,

which is a private company that is registered in the British Virgin

Islands, the sole director of which is Haejung Rah. Cody Star was a

former quota holder in Baverstock, one of the original investors in

the BNG Contract Area. He plays no role in the day to day business

of the Group.

Mrs Zhanat Bukenova is a Kazakh national. She loaned US$500,000

to the Company on 10 October 2010. Since then she has played no

role in the Group's business.

Mr Daulet Beisenov is a Kazakh national. Mr Beisenov has nearly

31 years of business experience in Kazakhstan and abroad. Mr

Beisenov's experience has included the operation of import and

export businesses and the establishment and operation of service

orientated businesses including various hotels and restaurants,

much of which was together with Mr Kuat Oraziman. He plays no role

in day to day business of the Group.

The following table sets out the members of the Wider Concert

Party and their respective holdings in Caspian Sunrise PLC.

Other than as disclosed above, there are no further

relationships (personal, financial and commercial), arrangements

and understandings between Wider Concert Party members or the

directors of the Company.

Concert Party Member Ordinary Shares Ordinary Shares held

currently held after the Debt Conversion

Number % Number %

-------------- ------ ------------------- --------

Kuat Oraziman nil nil nil nil

-------------- ------ ------------------- --------

Aibek Oraziman 472,982,144 22.41 542,846,867 24.12

-------------- ------ ------------------- --------

Aidana Urazimanova 376,828,317 17.85 446,693,040 19.85

-------------- ------ ------------------- --------

the Estate of the

late Rafik Oraziman 57,369,124 2.72 57,369,124 2.55

-------------- ------ ------------------- --------

Altynbek Boltazhan 26,851,612 1.27 26,851,612 1.19

-------------- ------ ------------------- --------

Boltazhan Kerimbayev 15,784,149 0.75 15,784,149 0.70

-------------- ------ ------------------- --------

Oraziman Family

Concert Party Total 949,815,346 45.00 1,089,544,792 48.41

-------------- ------ ------------------- --------

Dae Han New Pharm

Co. Ltd 224,830,964 10.65 224,830,964 9.99

-------------- ------ ------------------- --------

Raushan Sagdiyeva 66,425,290 3.15 66,425,290 2.95

-------------- ------ ------------------- --------

Kang Junyoung 16,025,641 0.76 16,025,641 0.71

-------------- ------ ------------------- --------

Dosbol Zholdybayev 34,341,130 1.63 34,341,130 1.53

-------------- ------ ------------------- --------

Chang Min Seok 16,112,884 0.76 16,112,884 0.72

-------------- ------ ------------------- --------

Zhanat Bukenova 11,993,000 0.57 11,993,000 0.53

-------------- ------ ------------------- --------

Daulet Beisenov 1,644,737 0.08 1,644,737 0.07

-------------- ------ ------------------- --------

Total Wider Concert

Party 1,321,188,992 62.59 1,460,918,437 64.92

-------------- ------ ------------------- --------

Notes:

The currently held Ordinary Shares noted in the table above held

by the various members of the Oraziman Family Concert Party are

held beneficially by the family member concerned. The underlying

shareholdings are managed by Akku Investments, a Kazakh entity with

Kuat Oraziman as the sole director and decision maker. 100,021,432

Conversion Shares will be issued to Akku Investments and 19,854,007

and 19,854,007 will be issued directly to Aibek Oraziman and Aidana

Urazimanova respectively. Aibek Oraziman and Aidana Urazimanova are

the sole beneficiaries of Akku Investments and own the Ordinary

Shares of Akku Investments equally.

Kuat Oraziman also holds 3,000,000 options over Ordinary

Shares.

A full breakdown of rights to subscribe held by the Directors of

Caspian Sunrise PLC is included in Part III of this Circular in

Paragraph 3 entitled: "Interests and Dealings".

Under Rule 9 of the Takeover Code, any person who acquires an

interest (as such term is defined in the Takeover Code) in shares

which, taken together with the shares in which he and persons

acting in concert with him are interested, carry 30% or more of the

voting rights in a company which is subject to the Takeover Code,

is normally required to make a general offer to all of the

remaining shareholders to acquire their shares. Similarly, when any

person, together with persons acting in concert with him, is

interested in shares which in aggregate carry not less than 30% of

the voting rights but does not hold shares carrying more than 50%

of the voting rights of such a company, a general offer will

normally be required if any further interests in shares are

acquired by any such person. These limits apply to the entire

concert party as well as the total beneficial holdings of

individual members. Such an offer would have to be made in cash at

a price not less than the highest price paid by him, or by any

member of the group of persons acting in concert with him, for any

interest in shares in the Company during the 12 months prior to the

announcement of the offer.

Prior to and upon completion of the Debt Conversion, the

Oraziman Family Concert Party will be interested in Ordinary Shares

carrying more than 30% of the company's voting rights but will hold

less than 50% of the Company's voting share capital, and, for as

long as members continue to be treated as acting in concert a

general offer will normally be required if any further interest in

shares is acquired by any members of the Oraziman Family Concert

Party, or any person acting in concert with it. The individual

members of the Oraziman Family Concert Party will not be able to

increase their percentage interests in shares through or between a

Rule 9 threshold without Panel consent.

Prior to and upon completion of the Debt Conversion and issue of

the Conversion Shares, the Wider Concert Party will hold more than

50% of the Company's voting share capital, and, for as long as it

continues to be treated as acting in concert, any further increase

in that aggregate interest in shares by the Wider Concert Party

will not be subject to the provisions of Rule 9 of the Takeover

Code, although individual members of the Wider Concert Party and

the Oraziman Family Concert Party will not be able to increase

their percentage interests in shares through or between a Rule 9

threshold without Panel consent.

The Panel has agreed, subject to the Waiver Resolution being

passed on a poll by the Independent Shareholders at the General

Meeting, to waive the requirement under Rule 9 of the Takeover Code

for the Oraziman Family Concert Party to make a mandatory offer for

the Ordinary Shares they do not already own, as would otherwise

arise from the issue of further shares in the Company pursuant to

the Debt Conversion. The Wider Concert Party, of which the Oraziman

Family Concert Party is part, will be disenfranchised from voting

on the Waiver Resolution and have undertaken to the Company not to

vote on the Waiver Resolution.

In the event that the Waiver Resolution is approved at the

General Meeting, neither the Oraziman Family Concert Party, the

Wider Concert Party nor any of their respective connected persons

or other persons acting in concert with it will be restricted from

making an offer for the Company.

Relationship Agreement

On 20 January 2020, the Company and the members of the Oraziman

Family Concert Party other than Altynbek Boltazhan and Boltazhan

Kerimbayev entered into a relationship agreement pursuant to which

those members of the Oraziman Family Concert Party undertook to the

Company and WH Ireland, in or acting in their capacities as

Shareholders and not in any other capacity that they would use the

voting powers attaching to the shares held by them, amongst other

things, to ensure no directors are appointed or removed without the

consent of the board, ensure the board comprises at least 2

independent directors and to ensure that any committee of the board

of the Company is comprised of a majority of Independent

Directors.

On 10 February 2022, Altynbek Boltazhan & Boltazhan

Kerimbayev signed the Relationship Agreement.

Each member of the Oraziman Family Concert Party also agreed not

to do anything that would have the effect of preventing the Company

from complying with the AIM Rules or other applicable laws or seek

to cancel the admission of the Ordinary Shares to trading on AIM.

Further, transactions between the Company and any member of the

Oraziman Family Concert Party, in or acting in their capacities as

Shareholders and not in any other capacity must be approved by a

majority of Independent Directors. The relationship agreement, as

amended, will be effective from the Admission of the Conversion

Shares until such time as the Oraziman Family Concert Party ceases

to hold, in aggregate, 20 per cent. or more of the aggregate voting

rights in the Company. The relationship agreement is governed by

English law and the courts of England have exclusive jurisdiction

to settle any dispute arising in connection with the relationship

agreement.

Waiver of the obligation to make a mandatory offer under Rule 9

of the Takeover Code

The Panel has agreed, subject to the Waiver Resolution being

passed on a poll by the Independent Shareholders at the General

Meeting, to waive the requirement under Rule 9 of the Takeover Code

for the Oraziman Family Concert Party to make a mandatory offer for

the Ordinary Shares they do not already own, which would otherwise

arise as a result of the issue of the Conversion Shares. The Wider

Concert Party, of which the Oraziman Family Concert Party is part,

will be disenfranchised from voting on the Waiver Resolution and

have undertaken to the Company not to vote on the Waiver

Resolution.

Related Party Transactions

The Debt Conversion is considered a Related Party Transaction

pursuant to the AIM Rules for Companies.

The Independent Directors consider, having consulted with WH

Ireland, that the terms of the proposed Debt Conversion are fair

and reasonable insofar as shareholders of Caspian Sunrise and the

Company are concerned.

Existing authorities to allot new Ordinary Shares

The Company will satisfy the consideration payable for the Debt

Conversion by the issue of, in aggregate, 139,729,446 new Ordinary

Shares, which would be issued to Aibek Oraziman and Aidana

Urazimanova, members of the Oraziman Family Concert Party.

The Company will issue and allot the Conversion Shares under the

existing authorities and powers granted by Shareholders at the AGM,

and accordingly no specific authorisation or disapplication of

pre-emption rights is being sought at the General Meeting in

connection with such share issuance.

2. GENERAL MEETING

You will find set out at the end of this Circular the Notice

convening the General Meeting to be held at the offices of Taylor

Wessing LLP, 5 New Street Square, London EC4A 3TW at 11:00a.m. on 9

March 2022, at which the Waiver Resolution will be proposed.

Waiver Resolution

The Waiver Resolution required in order for the Debt Conversion

to proceed. It will be proposed as an ordinary resolution to be

voted on a poll by Independent Shareholders only in accordance with

the requirements of the Panel.

Approval of the Waiver Resolution would waive the obligation

under Rule 9 of the Takeover Code for the Oraziman Family Concert

Party or any member of the Oraziman Family Concert Party to make a

general offer to Shareholders as a result of the allotment and

issue to it of the Conversion Shares.

All Shareholders may attend the General Meeting. The Oraziman

Family Concert Party members and the Wider Concert Party members

will not be permitted to vote on the Waiver Resolution.

3. ACTION TO BE TAKEN

A Form of Proxy for use in connection with the General Meeting

is enclosed. Whether or not you intend to attend the General

Meeting, it is important, particularly in view of the fact that the

Waiver Resolution to be put to the General Meeting will be

determined by a poll of Independent Shareholders, that you duly

complete, execute and return the enclosed Form of Proxy, by hand or

by post, to Link Group, PXS 1, 10th Floor, 29 Wellington Street,

Leeds, LS1 4DL in accordance with the instructions printed thereon.

To be valid, the completed Form of Proxy must be returned as soon

as possible and, in any event, so as to arrive not less than 48

hours before the time for holding the General Meeting. Completion

and return of the Form of Proxy will not prevent Shareholders from

attending and voting at the General Meeting in person should they

wish to do so.

Admission, Settlement, Dealing and Total Voting Rights

It is expected that Admission of the Conversion Shares will

become effective and that dealings in the Conversion Shares will

commence on 15 March 2022, conditional on, and subsequent to, the

passing of the Waiver Resolution.

The Conversion Shares, when issued, will rank pari passu in all

respects with the Existing Ordinary Shares. The total number of

Ordinary Shares in issue following the issue of the Conversion

Shares will be 2,250,501,560.

The Company has no shares in treasury, therefore (subject to any

further share issuance prior to Admission in respect of all of such

shares) this figure may be used by Shareholders, from Admission in

respect of all of such shares, as the denominator for the

calculations by which they will determine if they are required to

notify their interest in, or a change in their interest in, the

share capital of the Company under the FCA's Disclosure Guidance

and Transparency Rules.

4. RECOMMATION

The Takeover Code requires the Independent Directors to obtain

competent independent advice regarding the merits of the Debt

Conversion and the associated Waiver Resolution. Accordingly, WH

Ireland has provided formal advice to the Independent Directors

regarding the Debt Conversion and associated Waiver Resolution. WH

Ireland confirms that it, and any person who is or is presumed to

be acting in concert with it, is independent of the Oraziman Family

Concert Party and the Wider Concert Party and has no personal,

financial or commercial relationship or arrangements or

understandings with either the Oraziman Family Concert Party or the

Wider Concert Party which it believes would compromise its

independence.

The Independent Directors, who have been so advised by WH

Ireland, consider the Debt Conversion and associated Waiver

Resolution to be fair and reasonable and in the best interests of

the Independent Shareholders and the Company as a whole. In

providing advice to the Independent Directors, WH Ireland has taken

into account the Independent Directors' commercial assessments of

the Debt Conversion and associated Waiver Resolution. Kuat Oraziman

and Aibek Oraziman, being Directors of the Company who are also

included in the Oraziman Family Concert Party and the Wider Concert

Party, are not considered to be Independent Directors and therefore

are not included in the Board recommendation relating to the Debt

Conversion and associated Waiver Resolution.

Accordingly, the Independent Directors unanimously recommend

that Independent Shareholders vote in favour of the Waiver

Resolution, at the General Meeting as they intend to do in respect

of their entire holdings which amount to 10,156,583 Ordinary Shares

(representing approximately 0.48 per cent. of the Issued Ordinary

Shares).

Yours faithfully

Clive Carver

Chairman

ADDITIONAL INFORMATION

1. RESPONSIBILITY

1.1 Each of the Directors, whose names appear in paragraph 2

below, accepts responsibility for the information (including any

expressions of opinions) contained in this Circular, save for the

Waiver Resolution recommendation of the Independent Directors set

out in Part II in paragraph 4 entitled "Recommendation", for which

the Independent Directors are solely responsible and save for any

information relating to the Oraziman Family Concert Party and the

Wider Concert Party, the intentions of the Oraziman Family Concert

Party and the Wider Concert Party, for which responsibility is

accepted on the basis set out in paragraph 1.2 below. To the best

of the knowledge and belief of the Directors (who have taken all

reasonable care to ensure that such is the case) the information

contained in this Circular is in accordance with the facts and does

not omit anything likely to affect the import of such

information.

1.2 Each of the Independent Directors, accepts responsibility

for the Waiver Resolution recommendation of the Independent

Directors set out in Part II in paragraph 4 entitled

"Recommendation", for which the Independent Directors are solely

responsible. To the best of the knowledge and belief of the

Independent Directors (who have taken all reasonable care to ensure

that such is the case) the information contained in the Waiver

Resolution recommendation is in accordance with the facts and does

not omit anything likely to affect the import of such

information.

1.3 The members of the Oraziman Family Concert Party and the

Wider Concert Party, whose names appear in Part II of this document

accept responsibility for the information (including any

expressions of opinions) contained in this Circular relating to

themselves. To the best of the knowledge and belief of the members

of the Oraziman Family Concert Party and members of the Wider

Concert Party, who have taken all reasonable care to ensure that

such is the case, the information contained in this Circular for

which they are responsible is in accordance with the facts and does

not omit anything likely to affect the import of such

information.

2. THE DIRECTORS OF CASPIAN SUNRISE PLC

The current Directors of Caspian Sunrise PLC are:

Clive Carver Chairman

Kuat Oraziman Chief Executive Officer

Seokwoo Shin Chief Operating Officer

Edmund Limerick Senior Non-executive director

Aibek Oraziman Non-executive director

3. INTERESTS AND DEALINGS

3.1 Definitions

For the purposes of this Part III and Part IV, the following

definitions shall apply

(a) "acting in concert" has the meaning attributed to it in the

Takeover Code;

(b) "arrangement" includes any indemnity or option arrangements,

or any agreement or understanding, formal or informal, of whatever

nature, relating to the relevant securities which may be an

inducement to deal or refrain from dealing;

(c) "associate" includes (without limitation) in relation to a

company:

(i) its parent, subsidiaries and fellow subsidiaries, its

associated companies and companies of which any such companies are

associated companies (for this purpose ownership or control of 20

per cent. or more of the equity share capital of a company is

regarded as the test of associated company status);

(ii) its connected advisers (as defined in the Takeover Code) or

the connected advisers to a company covered in (i) above, including

persons (other than exempt principal traders or exempt fund

managers) controlling, controlled by or under the same control as

such connected advisers;

(iii) its directors (together with their close relatives and

related trusts);

(iv) its pension funds or the pension funds of a company covered

in (i) above; and

(v) its employee benefit trusts or those of a company covered in

(i) above;

(d) "borrowed or lent" includes for these purposes any financial

collateral arrangement of the kind referred to in Note 4 on Rule

4.6 of the Takeover Code, but excludes any borrowed Ordinary Shares

which have either been redelivered or accepted for redelivery;

(e) "connected persons" means in relation to a director, those

persons whose interests in Ordinary Shares the director would be

required to disclose pursuant to Part 22 of the Companies Act and

related regulations and includes any spouse, civil partner, infants

(including step children), relevant trusts and any company in which

a director holds at least 20 per cent. of its voting capital;

(f) "dealing" or "dealt" includes:

(i) acquiring or disposing of relevant securities, of the right

(whether conditional or absolute) to exercise or direct the

exercise of the voting rights attaching to relevant securities, or

of general control of relevant securities;

(ii) taking, granting, acquiring, disposing of, entering into,

closing out, terminating, exercising (by either party) or varying

an option (including a traded option contract) in respect of any

relevant securities;

(iii) subscribing or agreeing to subscribe for relevant

securities (whether in respect of new or existing securities);

(iv) exercising or converting, whether in respect of new or

existing relevant securities, any relevant securities carrying

conversion or subscription rights;

(v) acquiring, disposing of, entering into, closing out,

exercising (by either party) of any rights under, or varying, a

derivative referenced, directly or indirectly, to relevant

securities;

(vi) entering into, terminating or varying the terms of any

agreement to purchase or sell relevant securities;

(vii) redeeming or purchasing, or taking or exercising an option

over, any of its own relevant securities by the offeree company or

an offeror; and

(viii) any other action resulting, or which may result, in an

increase or decrease in the number of relevant securities in which

a person is interested or in respect of which he has a short

position;

(g) a person having an "interest" in relevant securities

includes where a person:

(i) owns securities;

(ii) has the right (whether conditional or absolute) to exercise

or direct the exercise of the voting rights attaching to securities

or has general control of them;

(iii) by virtue of any agreement to purchase, option or

derivative, has the right or option to acquire securities or call

for their delivery or is under an obligation to take delivery of

them, whether the right, option or obligation is conditional or

absolute and whether it is in the money or otherwise; or

(iv) is party to any derivative whose value is determined by

reference to the prices of securities and which results, or may

result, in his having a long position in them;

(h) "relevant securities" includes:

(i) securities of an offeree company which are being offered for

or which carry voting rights;

(ii) equity share capital of the offeree company and an

offeror;

(iii) securities of an offeror which carry substantially the

same rights as any to be issued as consideration for the offer;

and

(iv) securities of an offeree company and an offeror carrying

conversion or subscription rights into any of the foregoing.

(i ) "short position" means any short position (whether

conditional or absolute and whether in the money or otherwise)

including any short position under a derivative, any agreement to

sell or any delivery obligation or right to require any other

person to purchase or take delivery.

3.2 Interests and dealings of the directors of the Company

The interests of each of the Directors in the ordinary share

capital of the Company (all of which are beneficial), and the

existence of which is known to the Directors or could with

reasonable diligence be ascertained by them as at 11 February 2022

(being the latest practicable date prior to the publication of this

Circular) are set out below:

Director Number of % of Issued

Ordinary Shares Voting Shares

held

Clive Carver 2,245,000 0.11

Kuat Oraziman nil nil

Seekwoo Shin nil nil

Edmund Limerick 7,911,583 0.37

Aibek Oraziman 472,982,144 22.41

Total 483,138,727 22.89

The current interests of the Directors in share options

agreements are as follows:

Director Number of Share % of Diluted Issued

Options held Voting Shares

Clive Carver 5,400,000 0.26

Kuat Oraziman 3,000,000 0.14

Seekwoo Shin 2,500,000 0.12

Edmund Limerick 2,750,000 0.13

Aibek Oraziman nil nil

Total 13,650,000 0.65

On 26 November 2021 the Board, other than Clive Carver, agreed

to extend the exercise date of options held by Clive Carver over

2,400,000 Ordinary Shares exercisable at 4p per share from 14

December 2021 to 14 December 2023.

On 10 January 2022 the Company issued 2,500,000 options to

Seokwoo Shin and 1,000,000 options to Edmund Limerick exercisable

at 5.5p per share and valid until 9 January 2032.

Except as disclosed above, none of the directors of the Company,

other than the dealing disclosed in 3.3 below, have dealt in

relevant securities of the Company in the 12 months prior to

publication of this Circular.

3.3 Interests and Dealings of both the Oraziman Family Concert

Party and the Wider Concert Party

Dealings by members of the Oraziman Family Concert Party members

within the last 12 months prior to publication of this Circular are

as follows:

On 6 August 2021, Kuat Oraziman gifted 41,485,330 Ordinary

Shares equally to Aibek Oraziman and Aidana Urazimanova,

accordingly Kuat Oraziman no longer holds any Ordinary Shares in

the Company.

On 19 January 2022, Kairat Satylganov, previously a member of

the Wider Concert Party, sold all his 221,625,001 shares at a price

of 4.2p per share as follows: 73,875,001 to Alyazeyah Ahmed Al

Marri, 73,875,000 to Meera Ahmed Al Marri and 73,875,000 to Hamda

Ahmed Al Marri. None of the buyers are members of the Wider Concert

Party. Upon the sale of Kairat Satylganov's shares he was removed

from the Wider Concert Party.

Other than as disclosed immediately above, there have been no

other dealings by the Oraziman Family Concert Party members within

the last 12 months.

Notwithstanding that the acquisition of voting shares (in this

case, as a result of the Debt Conversion) is made conditional upon

the prior approval of a majority of the Company's Shareholders

independent of the transaction at a general meeting of the Company

the Panel will not normally waive an obligation under Rule 9 if the

person to whom the new securities are to be issued (in this case

members of the Oraziman Family Concert Party), or any person acting

in concert with it, has acquired any interest in shares in the

Company in the 12 months preceding the date of this document but

subsequent to negotiations, discussions or the reaching of

understandings or agreements with the directors of the Company in

relation to the proposed issue of new securities. In addition, the

waiver will be invalidated if any such acquisitions of interests in

shares are made in the period between the publication of this

document and the General Meeting.

The Panel has considered the transactions detailed above and, in

these specific circumstances, has confirmed that the dealings by

the Oraziman Family Concert Party members detailed above will not

prejudice the grant of the Waiver.

Save as disclosed in paragraph 3 of this Part III of this

document, no member of the Oraziman Family Concert Party or Wider

Concert Party, nor any close relatives, related trusts or connected

persons, nor any person acting in concert with any member of the

Oraziman Concert Party or Wider Concert Party owns or controls or

is interested, directly or indirectly in, or has borrowed or lent

(save for any borrowed securities which have either been on-lent or

sold), has rights to subscribe for, or has any short position

(whether conditional or absolute and whether in the money or

otherwise), including any short position under a derivative, any

agreement to sell or any delivery obligation or right to require

another person to purchase or take delivery in, any relevant

securities of the Company, nor has any such person dealt therein

during the 12 month period prior to the publication of this

Circular.

Save as disclosed in paragraph 3 of this Part III of this

document, neither any of the Directors nor any of their close

relatives or related trusts (so far as the Directors are aware

having made due enquiry) nor any person acting in concert with the

Company is interested, directly or indirectly, has rights to

subscribe to, or has any short position in relevant securities of

the Company, nor has any such person dealt therein during the 12

month period prior to the publication of this Circular.

Neither the Company, the Directors, nor any person acting in

concert with the Company has borrowed or lent any relevant

securities (save for any borrowed securities which have either been

redelivered or accepted for redelivery).

There is no arrangement relating to relevant securities which

exists between any member of the Oraziman Concert Party or Wider

Concert Party, or their respective groups or, so far as the members

of the Oraziman Concert Party and Wider Concert Party are aware,

any person acting in concert with any member of the Concert Party

or their respective groups, and any other person, nor between the

Company or, so far as Company is aware, any person acting in

concert with the Company and any other person.

4. INTENTIONS OF THE ORAZIMAN FAMILY CONCERT PARTY

The current aggregate holding of the Oraziman Family Concert

Party is 949,815,346 Ordinary Shares representing 45.00% of the

Issued Ordinary Shares. The current aggregate holding of the Wider

Concert Party is 1,321,188,992 Ordinary Shares representing 62.59%

of the Issued Ordinary Shares.

The Oraziman Family Concert Party, as part of the Wider Concert

Party, is not intending to seek any changes to the Board and have

confirmed that it would be their intention that, following any

increase in their proportionate shareholding as a result of the

issue of the Conversion Shares, the business of the Group would be

continued in the same manner as at present, with no changes. As a

result, there will be no repercussions on employment or the

location of Caspian Sunrise's places of business and no

redeployment of Caspian Sunrise's existing fixed assets. Likewise,

no changes will be made regarding the Company's place of business

or headquarters and headquarters' functions.

The Oraziman Family Concert Party has confirmed that it is not

intending to seek any changes in respect of: (i) the future

business of the Company (including any research and development

functions) (ii) the Board, nor the Company's plans with respect to

the continued employment of employees and management of the Company

and its subsidiaries or their headcount (including to the

conditions of employment or in the balance of skills and functions

of employees and management); (iii) the strategic plans for the

Company and their likely repercussions on employment and on the

locations of the Company's place of business, including the

location of the Company's headquarters and headquarters functions;

(iv) employer contributions into any of the Company's pension

schemes, the accrual of benefits for existing members, nor the

admission of new members; (v) redeployment of the Company's fixed

assets; or (vi) the maintenance of the Company's Ordinary Shares

being admitted to trading on AIM.

The Independent Directors believe and have considered as part of

forming their recommendation to vote in favour of the Waiver

Resolution as stated in Part II Paragraph 4 of this circular, that

the Debt Conversion will not result in any changes in respect of:

(i) the future business of the Company (including any research and

development functions) (ii) the Board, nor the Company's plans with

respect to the continued employment of employees and management of

the Company and its subsidiaries or their headcount (including to

the conditions of employment or in the balance of skills and

functions of employees and management); (iii) the strategic plans

for the Company and their likely repercussions on employment and on

the locations of the Company's place of business, including the

location of the Company's headquarters and headquarters functions;

(iv) employer contributions into any of the Company's pension

schemes, the accrual of benefits for existing members, nor the

admission of new members; (v) redeployment of the Company's fixed

assets; or (vi) the maintenance of the Company's Ordinary Shares

being admitted to trading on AIM.

5. OPERATIONAL STATUS AND CURRENT TRADING

Caspian Sunrise is a Kazakhstan based oil and gas exploration

and production company established in October 2006 and listed on

the Alternative Investment Market of the London Stock Exchange in

May 2007. Caspian Sunrise's current principal asset is its 99%

interest in the BNG Contract Area in the Pre Caspian basin in

Western Kazakhstan. Additionally, Caspian has interests in the 3A

Best Contract Area and owns the Caspian Explorer, a shallow water

drilling vessel designed for use in the Caspian Sea.

The latest operational update was issued by the Company on 25

January 2022 and can be found at

https://www.caspiansunrise.com/investors/announcements-alerts/ and

is discussed further in Part III paragraph 8.5.

6. DIRECTORS' SERVICE AGREEMENTS

6.1 Details of the service contracts for the Board of Caspian Sunrise PLC are as follows:

(a) Clive Carver

Clive Carver entered into a service agreement dated 20 March

2019 in connection with his relocation to the UAE.

Under the terms of the agreement following the date of the grant

of the MJF Export licence, Clive has been paid at the rate of

US$504,000 per annum. He is also eligible to receive an annual

performance related bonus which will be determined at the

discretion of the Company's remuneration committee. Clive is

entitled to be covered by a policy of directors' and officers'

liability insurance to be provided by the Company.

However, from May 2020 Clive has agreed to limit his monthly

remuneration to US$10,000.

Additionally, Clive is entitled to receive the ex-pat benefit of

a contribution towards housing costs and the use of a car which is

unquantified in the agreement.

Clive's service agreement has a rolling term 12-month notice

period.

There are no profit sharing arrangements, early termination

payments, and incentive payments in relation to the Waiver

Resolution or any other arrangements to be disclosed.

(b) Kuat Oraziman

On 6 December 2019, Kuat Oraziman's base pay was increased to

US$300,000 per annum under a variation to his existing service

agreement dated 19 June 2018. He is also eligible to receive an

annual performance related bonus which will be determined at the

discretion of the Company's remuneration committee. Kuat is

entitled to be covered by a policy of directors' and officers'

liability insurance to be provided by the Company

However, from May 2020 Kuat has agreed to limit his monthly

remuneration to US$10,000. Kuat has not received any payments under

his Service agreement for several years with the reduced amounts

due being added to the Oraziman Family Loan.

Kuat's service agreement has a rolling term12-month notice

period.

There are no profit sharing arrangements, early termination

payments, and incentive payments in relation to the Waiver

Resolution or any other arrangements to be disclosed.

(c) Seokwoo Shin

Seokwoo Shin was appointed to the board as Chief Operating

Officer on 1 December 2020 subject to regulatory confirmation.

Under his service agreement he is entitled to receive US$108,000

per annum.

Additionally, he is entitled to receive the ex-pat benefit of a

contribution towards housing costs which is unquantified in the

agreement.

Seokwoo's service agreement has a rolling term 12-month notice

period.

However from May 2020, Mr Shin has agreed to limit his monthly

remuneration to US$4,500.

There are no profit sharing arrangements, early termination

payments and incentive payments in relation to the Waiver

Resolution or any other arrangements to be disclosed.

(d) Edmund Limerick

Under an agreement dated 28 August 2019, Edmund Limerick is paid

a base amount of GBP45,000 per annum to serve as a non-executive

director. Additionally, he receives two further payments of

GBP5,000 each for chairing the Audit Committee and the Remuneration

Committee.

However, from May 2020 Edmund has agreed to limit his annual

remuneration to GBP13,750.

Edmund's contract has a rolling term 6 month notice period.

There are no profit sharing arrangements, early termination

payments and incentive payments in relation to the Waiver

Resolution or any other arrangements to be disclosed.

(e) Aibek Oraziman

Under an agreement dated 28 August 2019, Aibek Oraziman is paid

a base amount of GBP45,000 per annum to serve as a non-executive

director.

However, from May 2020 Aibek has agreed to limit his annual

remuneration to GBP11,250. Aibek has not received any payments

under his Service agreement for several years with the reduced

amounts due being added to the Oraziman Family Loan.

Aibek's contract has a rolling term 3 month notice period.

There are no profit sharing arrangements, early termination

payments and incentive payments in relation to the Waiver

Resolution or any other arrangements to be disclosed.

6.2 Long term incentives

In addition to their service agreements, in May 2019 Clive

Carver and Kuat Oraziman became entitled to incentive payments

linked to the Company's future share price and market

capitalisation, such that for each US$500 million added to the

market capitalisation above a base figure of US$300 million and

provided the share price for a 30 day period equals or exceeds set

share price targets starting at 17.23p should the Company's market

capitalisation increase to US$800 million and then increasing by

3.44p for each additional US$500 million increase in the Company's

market capitalisation. In which case both Clive Carver and Kuat

Oraziman are entitled to cash pay payments of US$3 million each for

each combined market capitalisation and share price thresholds

crossed.

None of the above Directors has entered into or amended their

service agreements with the Company in the last six months.

7. MIDDLE MARKET QUOTATIONS

Set out below are the closing middle-market quotations for the

Ordinary Shares for the first dealing day of each of the six months

immediately preceding the date of this Circular and for 11 February

2022, (being the latest practicable date prior to the publication

of this Circular).

Date Price per Ordinary Share

(pence)

1 July 2021 2.20

1 August 2021 2.85

1 September 2021 3.20

1 October 2021 3.80

1 November 2021 4.15

1 December 2021 4.05

1 January 2022 4.95

1 February 2022 3.85

11 February 2022 4.35

8. GENERAL

8.1 WH Ireland is Caspian Sunrise PLC's Nominated Adviser and

Broker and is considered as acting in concert with Caspian Sunrise

PLC for the purposes of the Takeover Code and this circular. Kuat

Oraziman and Raushan Sagdiyeva have share trading accounts with WH

Ireland's wealth management division.

8.2 WH Ireland has given and has not withdrawn its written

consent to the issue of this Circular with the inclusion herein of

the references to its name and its advice to the Independent

Directors in the form and context in which they appear.

8.3 Save as disclosed above, there is no personal, financial or

commercial relationship, arrangement or understanding between the

Oraziman Family Concert Party, the Wider Concert Party or the

Company and WH Ireland.

8.4 There is no agreement, arrangement, or understanding

(including any compensation arrangement) between the Oraziman

Family Concert Party, the Wider Concert Party or any person acting

in concert with any of them and any of the Directors, recent

directors, Shareholders, or recent shareholders of the Company, or

any person interested or recently interested in Ordinary Shares of

the Company having any connection with or dependence upon the

proposals set out in this Circular.

8.5 There has been no significant change in the financial or

trading position of Caspian Sunrise PLC since the publication of

the Company's interim results for the period ended 30 June 2021

save as set out in Regulatory News Service announcements below.

On 6 January 2022 the Company announced that "The Company notes

the current political unrest in Kazakhstan and the anti-government

protests. The Company has decided to temporarily suspend its

drilling and production activities in response to the ongoing

political uncertainty. Further announcements will be made in due

course as the position becomes clearer."

On 10 January 2022, the Company announced the resumption of

drilling and production activities and issued a further operational

announcement on 25 January 2022.

These announcements followed two trading updates issued on 22

and 23 December 2021 which detailed improved operational

performance of the group.

8.6 No agreement, arrangement or understanding exists whereby

any Ordinary Shares in Caspian Sunrise PLC acquired by any member

of the Oraziman Family Concert Party or the Wider Concert Party

will be transferred to any other person.

9. FINANCIAL INFORMATION ON CASPIAN SUNRISE PLC

Below is a table setting out the location of certain financial

information contained within the 2019 and 2020 Annual Report and

Accounts:

2020 2019

Page Number Page Number

Revenue 40 46

Net profit/loss before

tax 40 46

Tax charge 40 46

Net profit/loss after

tax 40 46

Amount absorbed by dividends N/A N/A

Earnings per share 40 46

Dividends per share N/A N/A

Group statement of financial

position 44 50

Group statement of cash

flows 46 52

Significant accounting

policies and major notes

to accounts 47 53

The Company's Annual Report and Accounts for the year ended 31

December 2019 can be found at the following website:

https://www.caspiansunrise.com/wp-content/uploads/2020/06/CS-accounts-2019-Final-25-6-2020.pdf

The Company's Annual Report and Accounts for the year ended 31

December 2020 can be found at the following website:

https://wp-caspiansunrise-2020.s3.eu-west-2.amazonaws.com/media/2021/06/29065925/Caspian-Sunrise-plc-2020-Report-Accounts-final.pdf

The Company's interim results for the 6 months ended 30 June

2021 can be found at the following website:

https://polaris.brighterir.com/public/caspian_sunrise/news/rns/story/wkldd1x

The above financial information has been incorporated into the

Circular by reference in accordance with Rule 24.15 of the Takeover

Code.

A Shareholder, person with information rights or person to whom

this Circular has been sent may request a copy of the above

information in hard copy form (hard copies will not be provided

unless requested). Hard copies may be requested by writing to

Caspian Sunrise PLC, 5 New Street Square, London, EC4A 3TW, phone

number: 020 7300 7000.

10. MATERIAL CONTRACTS

The following contracts, not being contracts entered into in the

ordinary course, have been entered into by the Company or other

members of the Group in the two years prior to the date of this

Circular, or are subsisting agreements which are included within,

or which relate to, the assets and liabilities of the Company

(notwithstanding whether such agreements are within the ordinary

course or were entered into outside of the two years immediately

preceding the publication of this Circular) and are, or may be,

material:

Debt Conversion Agreements

The agreement in respect of the Debt Conversion dated 5 August

2021 between the Company and Akku Investments LLP on behalf of the

Oraziman Family Concert Party, pursuant to which the Company has

agreed to repay the Oraziman Family Loan, such repayment to be

satisfied by the issue to Aibek Oraziman and Aidana Urazimanova of

the Conversion Shares at the Issue Price.

The Relationship Agreement

On 20 January 2020, the Company and Kuat Oraziman, Aibek

Oraziman, Aidana Urazimanova and subsequently on 10 February 2022,

Altynbek Bolatzhan & Boltazhan Kerimbayev entered into an

agreement to ensure that the Group is able to carry on its business

independently of the Oraziman Family Concert Party and that

transactions entered into between the Group and members of the

Oraziman Family Concert Party will be on arm's length terms and a

normal commercial basis.

Placing Agreement

On 5 August 2020, The Company entered into a Placing Agreement

with WH Ireland in connection with a placing of 36,363,629 new

Ordinary Shares at a price of 2.75p per share to raise before

expenses GBP1 million for the Company for which WH Ireland was

compensated GBP50,000. The Placing Agreement included standard

warranties provided by the Company in favour of WH Ireland.

The 3A Best Farm-out Agreement

On 19 May 2021, Eragon Petroleum FZE, a 100% subsidiary of

Caspian Sunrise plc, entered into a framework agreement with

Espelisai Operating LLP under which Eragon Petroleum FZE agreed to

sell to Espelisai Operating LLP15% of the shares held by Eragon

Petroleum FZE in 3A Best Group JSC in exchange for an investment by

Espelisai Operating LLP which invested US$2.5 million into 3A Best

Group JSC.

The agreement also provided an option to Espelisai Operating LLP

to acquire the remaining 85% of the shares in 3A Best Group JSC,

subject if required under the AIM Rules to the prior approval of

Caspian Sunrise shareholders.

The agreement was conditional on the renewal of the 3A Best

subsoil licence by the appropriate Kazakh authorities.

Documents available for inspection

Copies of this Circular and the following documents will be

available for inspection on the Company's website,

https://www.caspiansunrise.com/ up to and including 9 March 2022

and at the General Meeting to be held on that day:

-- the Memorandum and Articles of Association of the Company;

-- the audited consolidated accounts of the Company for the

financial years ended 31 December 2020 and 2019;

-- the interim results for the six-month period to 30 June 2021;

-- this Circular;

-- Conversion agreement referred to above; and

-- Merger Circular

NOTICE OF GENERAL MEETING

NOTICE IS HEREBY GIVEN that a general meeting of the Company

will be held at the offices of Taylor Wessing LLP, 5 New Street

Square, London EC4A 3TW at 11:00 a.m. on 9 March 2022.

In this notice, words and phrases that are defined in the

circular to shareholders dated 15 February 2022 have the same

meanings unless the context requires otherwise.

The general meeting will be held for the purpose of considering

and, if thought fit, passing the following resolution of which will

be proposed as an ordinary resolution (to be voted on a poll by

Independent Shareholders only in accordance with the requirements

of the Panel on Takeovers and Mergers (the "Panel").

Ordinary resolution

1. THAT the waiver granted by the Panel of the obligation that

would otherwise arise on the members of the Oraziman Family Concert

Party to make a general offer to the Shareholders of the Company

pursuant to rule 9 of the Takeover Code as a result of the issue to

them of the Conversion Shares, as described in the circular of

which this notice forms part, is hereby approved.

By Order of the Board

Clive Carver

Chairman

15 February 2022

Registered Office: Caspian Sunrise PLC, 5 New Street Square,

London EC4A 3TW

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCSFAESLEESEDE

(END) Dow Jones Newswires

February 15, 2022 02:00 ET (07:00 GMT)

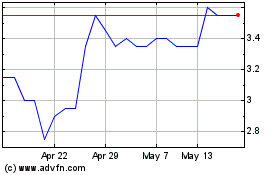

Caspian Sunrise (LSE:CASP)

Historical Stock Chart

From Dec 2024 to Jan 2025

Caspian Sunrise (LSE:CASP)

Historical Stock Chart

From Jan 2024 to Jan 2025