TIDMCCEP

RNS Number : 9437R

Coca-Cola Europacific Partners plc

01 November 2023

1 November 2023

COCA-COLA EUROPACIFIC PARTNERS

Trading update for the third quarter ended 29 September 2023

& Interim Dividend Declaration

Solid performance, reaffirming FY guidance

Change vs 2022

Revenue Volume Revenue Comparable([2], Revenue FXN([2],[3]) Revenue

(UC)([1]) per [8]) Volume per revenue

UC([1],[2],[3]) UC([1],[2],[3])

========= ======= ========== ========== =============== =============== =============== ============ =======

Q3 2023 Europe EUR3,956m 705m EUR5.65 (4.0)% 9.0% 4.5% 3.5%

========= ------- ========== ========== =============== =============== =============== ============ =======

API EUR851m 141m EUR6.74 (7.0)% 10.5% 3.0% (8.0)%

================= ========== ========== =============== =============== =============== ============ =======

CCEP EUR4,807m 846m EUR5.83 (4.5)% 9.0% 4.0% 1.5%

================= ========== ========== =============== =============== =============== ============ =======

YTD 2023 Europe EUR11,061m 2,012m EUR5.57 0.0% 9.0% 9.0% 7.5%

========= ------- ========== ========== =============== =============== =============== ============ =======

API EUR2,723m 465m EUR6.25 (6.0)% 12.0% 5.5% (1.0)%

================= ========== ========== =============== =============== =============== ============ =======

CCEP EUR13,784m 2,477m EUR5.69 (1.0)% 9.5% 8.5% 6.0%

================= ========== ========== =============== =============== =============== ============ =======

Damian Gammell, Chief Executive Officer, said:

"2023 continues to be a strong year for CCEP reflecting great

brands, solid in-market execution and strong customer

relationships. Our focus on revenue and margin growth management,

along with our price and promotion strategy, drove solid gains in

revenue per unit case. Transactions outpaced volume and we grew

both share and household penetration across our markets. Given our

strong year to date performance, we are reaffirming our full year

guidance and declaring a full year dividend up almost 10% on last

year. This demonstrates the strength of our business and ability to

continue to deliver shareholder value.

"In the third quarter, we also delivered top line growth despite

mixed summer weather across Europe and the ongoing execution of our

long-term transformation strategy in Indonesia. We delivered

fantastic activation, including during the Women's World Cup,

supporting strong underlying volume growth in Australia and New

Zealand.

"Looking to next year and beyond, we remain confident in the

resilience of our categories, despite ongoing macroeconomic and

geopolitical volatility. We continue to actively manage our pricing

and promotional spend to remain affordable and relevant to our

consumers, alongside our focus on productivity and free cash flow.

All supported by our talented and engaged colleagues, and our

strong relationships with our brand partners and customers.

Finally, we have been working closely with The Coca-Cola Company

and Aboitiz([4]) on the proposed acquisition of Coca-Cola Beverages

Philippines([5]) , aligned with our aim of driving sustainable and

stronger growth through diversification and scale. We remain on

track to close early next year and look forward to sharing more in

due course."

Note: All footnotes included after the 'About CCEP' section

Q3 & YTD HIGHLIGHTS([2])

Revenue

Q3 Reported +1.5%; Fx-neutral +4.0%

-- Delivered more revenue growth YTD for our retail customers

than any of our FMCG peers in Europe & our NARTD peers in

Australia & New Zealand (NZ)([6])

-- NARTD YTD value share gains([6]) across measured channels

both in-store (+10bps) & online (+100bps), & increased

household penetration in Europe (+50bps)([7])

-- YTD transactions ahead of volume growth in Europe, Australia & NZ

(--) Q3 comparable volume -4.5%([8])

By geography:

-- Europe -4.0%([8]) reflecting solid in-market execution offset

by mixed summer weather & cycling strong comparables (Q3'22

comparable volume +12.0%)

-- API -7.0%([8]) solid in-market execution driving continued

volume growth in Australia & NZ offset by the strategic SKU

portfolio rationalisation & softer consumer spending in

Indonesia

By channel: Away from Home (AFH) -5.0%([8]) & Home

-4.5%([8]) both in line with volumes

-- Strong revenue per unit case +9.0%([1],[3]) (Europe: +9.0%;

API: +10.5%) driven by positive headline price increases &

promotional optimisation alongside favourable brand mix

Dividend

-- Declaring second half interim dividend per share of EUR1.17 (to be paid in December 2023)

-- Resulting in full year dividend per share of EUR1.84, +9.5%

vs 2022, maintaining annualised total dividend payout ratio of

approximately 50%([9])

Proposal to jointly acquire Coca-Cola Beverages Philippines,

Inc. with Aboitiz Equity Ventures Inc.

-- On track to close early next year, updates to follow in due course

Other

-- Re-affirming FY23 guidance (see below)

-- Recognised as Top Employer in Europe by the Top Employers Institute

-- Appointed Deutsche Numis as house brokers to CCEP in September 2023

SUSTAINABILITY HIGHLIGHTS

-- Received approval from the Science Based Targets initiative

(SBTi) of CCEP's long-term 2040 net zero and 2030 greenhouse gas

reduction targets

-- Entered into CCEP Ventures partnership with Swansea

University to explore CO upcycling technology for the creation of

ethylene, a key component of plastic bottle caps

-- Achieved carbon neutral certification for a further six

manufacturing sites (five in Iberia and one in NZ), now a global

total of 13 sites

FY23 GUIDANCE([2])

The outlook for FY23 reflects our current assessment of market

conditions. Unless stated otherwise, guidance is on a comparable

& FX-neutral basis. FX is expected to decrease FX-neutral

guidance by approximately 250 basis points for the full year

(previously 200 basis points)

Revenue: comparable growth of 8-9% (unchanged)

Cost of sales per unit case : comparable growth of 8%

(unchanged)

-- Commodity inflation expected to be 8% (unchanged)

-- FY23 hedge coverage at >98%

Operating profit: comparable growth of 12-13% (unchanged)

Comparable effective tax rate: 24% (unchanged)

Free cash flow: at least EUR1.7bn (unchanged)

Third-Quarter & Year-To-Date Revenue Performance by Geography([2])

Note: All values are unaudited and all references to volumes are

on a comparable basis. All changes are versus 2022 equivalent

period unless stated otherwise

Q3 YTD

------------------------------------------- ----------------------------------------------

Fx-neutral Fx-neutral

EUR million % change % change EUR million % change % change

====================== ================= =========== =========== ================ ============= =============

Great Britain 853 3.0 % 3.0 % 2,423 5.5 % 8.5 %

---------------------- ----------------- ----------- ----------- ---------------- ------------- -------------

France([10]) 586 3.0 % 3.0 % 1,786 12.5 % 12.5 %

---------------------- ----------------- ----------- ----------- ---------------- ------------- -------------

Germany 800 9.0 % 9.0 % 2,258 11.5 % 11.5 %

====================== ================= =========== =========== ================ ============= =============

Iberia([11]) 1,029 6.0 % 6.0 % 2,570 10.0 % 10.0 %

====================== ================= =========== =========== ================ ============= =============

(4.5) (1.0)

Northern Europe([12]) 688 % % 2,024 0.0 % 3.5 %

====================== ================= =========== =========== ================ ============= =============

Total Europe 3,956 3.5 % 4.5 % 11,061 7.5 % 9.0 %

(8.0) (1.0)

API([13]) 851 % 3.0 % 2,723 % 5.5 %

====================== ================= =========== =========== ================ ============= =============

Total CCEP 4,807 1.5 % 4.0 % 13,784 6.0 % 8.5 %

====================== ================= =========== =========== ================ ============= =============

France

-- Q3 volume decline reflects strong comps & mixed summer weather this year.

-- Fuze Tea continued to perform well achieving double-digit

volume growth (+26%). Monster, Sprite & Powerade also

outperformed.

-- Revenue/UC([14]) growth driven by headline price increase implemented in the first quarter.

Germany

-- Q3 volume growth reflects continued strong trading in the

Home channel supported by great execution.

-- Continued growth in Coca-Cola Zero Sugar & Fanta.

Monster, Fuze Tea & Powerade achieved double-digit volume

growth.

-- Revenue/UC([14]) growth driven by favourable price from the

annualisation of the second headline price increase last year &

further price implemented in Q3. Positive brand mix also

contributed to the growth e.g. Monster volume +42.0%.

Great Britain

-- Q3 volume decline reflects strong comps & mixed weather

during key summer months (July & August).

-- High single digit growth in Coca-Cola Zero Sugar & Monster achieved double-digit growth.

-- Revenue/UC([14]) growth driven by headline price increase

implemented at the end of the second quarter. Positive brand mix

also contributed to the growth e.g. Monster volume growth +10.0%

& launch of Jack Daniel's & Coca-Cola.

Iberia

-- Q3 volume decline reflects strong comps & strategic

de-listings within Spain's bulk water portfolio. AFH benefiting

from strong tourism, trending ahead of pre-pandemic levels.

-- Coca-Cola Zero Sugar, Sprite & Monster performed well.

Royal Bliss achieved double-digit growth (+43%), supported by

launch in Portugal.

-- Revenue/UC([14]) growth driven by headline price, implemented

in the first quarter & positive mix.

Northern Europe

-- Q3 volume decline reflects strong comps (cycling double-digit

volume growth) & mixed summer weather this year.

-- Monster, Powerade & Aquarius outperformed achieving double-digit volume growth.

-- Revenue/UC([14]) growth driven by headline price increase

implemented across the markets this year (Netherlands in Q3).

API

-- Australia & NZ grew Q3 volumes despite strategic

de-listings within Australia's bulk water portfolio, supported by

solid execution, including great Women's World Cup activation.

Overall volume decline reflects the strategic SKU rationalisation

& softer consumer spending in Indonesia.

-- Coca-Cola Zero Sugar, Monster & Powerade outperformed.

-- Encouraging start to the launch of Coca-Cola Zero Sugar & Sprite Zero in Indonesia.

-- Revenue/UC([14]) growth driven by headline price increase

implemented across all markets during the first half.

Third-Quarter & Year-To-Date Volume Performance by Category([2],[8])

Note: All values are unaudited and all references to volumes are

on a comparable basis. All changes are versus 2022 equivalent

period unless stated otherwise

Q3 YTD

% of % Change % of % Change

Total Total

============================================ ============== ============= ============== ===========

(3.5) (0.5)

Sparkling 84.0 % % 84.5 % %

(4.0) (0.5)

Coca-Cola(R) 58.0 % % 58.5 % %

============================================ ============== ============= ============== ===========

(3.0)

Flavours, Mixers & Energy 26.0 % % 26.0 % 0.0 %

============================================ ============== ============= ============== ===========

(6.0)

Stills 16.0 % (10.0)% 15.5 % %

(8.0)

Hydration 8.0 % (13.5)% 8.0 % %

============================================ ============== ============= ============== ===========

(6.5) (3.5)

RTD Tea, RTD Coffee, Juices & Other([15]) 8.0 % % 7.5 % %

============================================ ============== ============= ============== ===========

100.0 (4.5) 100.0 (1.0)

Total % % % %

============================================ ============== ============= ============== ===========

Coca-Cola(R)

-- Q3 Europe -4.5% reflecting tough comps & mixed summer

weather. API growth +1.0% supported by strong in-market activation

of Women's World Cup across Australia & NZ.

-- Q3 Coca-Cola Original Taste -4.0% reflecting tough comps & mixed summer weather in Europe.

-- Coca-Cola Zero Sugar continued to grow (+1.0%) across our

markets in Q3 & gained value share([6]) of Total Cola +50bps,

led by GB +140bps.

Flavours, Mixers & Energy

-- Q3 Fanta -6.0% cycling tough comps (Q3'22 +20%([16]) ) & mixed summer weather in Europe.

-- Q3 Energy +12.0% led by Monster, continuing to gain

distribution & share through exciting innovation, e.g. launch

of Monster Green Zero Sugar in GB.

Hydration

-- Q3 Water -21.5% driven by strategic portfolio choices (SKU

rationalisation in Indonesia, the exit of large PET packs in

Germany (Vio) & Iberia (Aquabona), & Mount Franklin bulk

pack in Australia). Mixed summer weather in Europe also

contributing.

-- Q3 Sports +5.5% growth in Powerade across all markets([17]) .

RTD Tea, RTD Coffee, Juices & Other([15])

-- Q3 Juice drinks -12.0% reflecting strategic SKU

rationalisation in Indonesia & mixed weather impacting Capri

Sun in GB & France.

-- Q3 RTD Tea/Coffee -2.0% reflecting strategic SKU

rationalisation in Indonesia, partially offset by continued growth

in Fuze Tea across Europe (+14.5%).

-- Jack Daniel's & Coca-Cola performing well, e.g. now #1

ARTD([18]) value brand in GB([19]) after launch 6 months ago.

Conference Call

-- 1 November 2023 at 12:00 GMT, 13:00 CEST & 8:00a.m. EDT; accessible via www.cocacolaep.com

-- Replay & transcript will be available at www.cocacolaep.com as soon as possible

Dividend

-- The CCEP Board of Directors declared a second half interim dividend of EUR1.17 per share

-- The interim dividend is payable 5 December 2023 to those

shareholders of record on 17 November 2023

-- CCEP will pay the interim dividend in euros to holders of

shares on Euronext Amsterdam, the Spanish Stock Exchanges &

London Stock Exchange

-- Other publicly held shares will be converted into an

equivalent US dollar amount using exchange rates issued by

WM/Reuters taken at 16:00 GMT on 1 November 2023. This translated

amount will be posted on our website here:

https://ir.cocacolaep.com/shareholder-information-and-tools/dividends

Financial Calendar

-- Q4 & FY Results 2023: 20 February 2024

-- Financial calendar available here: https://ir.cocacolaep.com/financial-calendar/

Contacts

Investor Relations

Sarah Willett Awais Khan Raj Sidhu

sarah.willett@ccep.com awais.khan@ccep.com raj.sidhu@ccep.com

Media Relations

ccep@portland-communications.com

About CCEP

Coca-Cola Europacific Partners is one of the world's leading

consumer goods companies. We make, move and sell some of the

world's most loved brands - serving 600 million consumers and

helping 2 million customers across 30 countries grow.

We combine the strength and scale of a large, multi-national

business with an expert, local knowledge of the customers we serve

and communities we support.

The Company is currently listed on Euronext Amsterdam, the

NASDAQ Global Select Market, London Stock Exchange and on the

Spanish Stock Exchanges, trading under the symbol CCEP.

For more information about CCEP, please visit www.cocacolaep.com

& follow CCEP on Twitter at @CocaColaEP.

___________________

1. A unit case equals approximately 5.678 litres or 24 8-ounce servings

2. Refer to 'Note Regarding the Presentation of Alternative

Performance Measures' for further details & to 'Supplementary

Financial Information' for a reconciliation of reported to

comparable results; Change percentages against prior year

equivalent period unless stated otherwise

3. Comparable & FX-neutral

4. Aboitiz Equity Ventures Inc.

5. Coca-Cola Beverages Philippines, Inc.

6. External data sources: Nielsen & IRI Period 9 YTD

7. Increased households (+50bps) P9 YTD for GB, Germany, Spain,

France, Netherlands, P8 YTD for Belgium

8. No selling day shift in Q3 or YTD; CCEP reported volume -4.5% in Q3 & -1.0% in YTD

9. Dividends subject to Board approval

10. Includes France & Monaco

11. Includes Spain, Portugal & Andorra

12. Includes Belgium, Luxembourg, the Netherlands, Norway, Sweden & Iceland

13. Includes Australia, New Zealand & the Pacific Islands, Indonesia & Papua New Guinea

14. Revenue per unit case

15. RTD refers to ready to drink; Other includes Alcohol & Coffee

16. Pro-forma & comparable basis

17. In all listed markets, Powerade not listed in Indonesia

18. ARTD refers to alcohol ready to drink

19. Combined portfolio of Jack Daniels & Coca-Cola and Jack

Daniels & Coca-Cola Zero Sugar, external data source Nielsen

last 4 weeks ending 9 September 2023

Forward-Looking Statements

This document contains statements, estimates or projections that

constitute "forward-looking statements" concerning the financial

condition, performance, results, guidance and outlook, dividends,

consequences of mergers, acquisitions, joint ventures, and

divestitures, including the proposed joint venture with Aboitiz

Equity Ventures Inc. (AEV) and acquisition of Coca-Cola Beverages

Philippines, Inc. (CCBPI), strategy and objectives of Coca-Cola

Europacific Partners plc and its subsidiaries (together CCEP or the

Group). Generally, the words "ambition", "target", "aim",

"believe", "expect", "intend", "estimate", "anticipate", "project",

"plan", "seek", "may", "could", "would", "should", "might", "will",

"forecast", "outlook", "guidance", "possible", "potential",

"predict", "objective" and similar expressions identify

forward-looking statements, which generally are not historical in

nature.

Forward-looking statements are subject to certain risks that

could cause actual results to differ materially from CCEP's

historical experience and present expectations or projections. As a

result, undue reliance should not be placed on forward-looking

statements, which speak only as of the date on which they are made.

These risks include but are not limited to:

1. those set forth in the "Risk Factors" section of CCEP's 2022

Annual Report on Form 20-F filed with the SEC on 17 March 2023 and

as updated and supplemented with the additional information set

forth in the "Principal Risks and Risk Factors" section of the H1

2023 Half-year Report filed with the SEC on 2 August 2023;

2. risks and uncertainties relating to the global supply chain

and distribution, including impact from war in Ukraine and

increasing geopolitical tensions and conflicts including in the

Middle East and Asia Pacific region, such as the risk that the

business will not be able to guarantee sufficient supply of raw

materials, supplies, finished goods, natural gas and oil and

increased state-sponsored cyber risks;

3. risks and uncertainties relating to the global economy and/or

a potential recession in one or more countries, including risks

from elevated inflation, price increases, price elasticity,

disposable income of consumers and employees, pressure on and from

suppliers, increased fraud, and the perception or manifestation of

a global economic downturn;

4. risks and uncertainties relating to potential global energy

crisis, with potential interruptions and shortages in the global

energy supply, specifically the natural gas supply in our

territories. Energy shortages at our sites, our suppliers and

customers could cause interruptions to our supply chain and

capability to meet our production and distribution targets;

5. risks and uncertainties relating to potential water use

reductions due to regulations by national and regional authorities

leading to a potential temporary decrease in production volume;

and

6. risks and uncertainties relating to the proposed joint

venture with AEV and acquisition of CCBPI, including the risk that

the proposed transactions may not be consummated on the currently

contemplated terms or at all, or that our integration of CCBPI's

business and operations may not be successful or may be more

difficult, time consuming or costly than expected.

Due to these risks, CCEP's actual future financial condition,

results of operations, and business activities, including its

results, dividend payments, capital and leverage ratios, growth,

including growth in revenue, cost of sales per unit case and

operating profit, free cash flow, market share, tax rate,

efficiency savings, achievement of sustainability goals, including

net zero emissions and recycling initiatives, capital expenditures,

our agreements relating to and results of the proposed joint

venture with AEV and acquisition of CCBPI, and ability to remain in

compliance with existing and future regulatory compliance, may

differ materially from the plans, goals, expectations and guidance

set out in forward-looking statements. These risks may also

adversely affect CCEP's share price. Additional risks that may

impact CCEP's future financial condition and performance are

identified in filings with the SEC which are available on the SEC's

website at www.sec.gov. CCEP does not undertake any obligation to

publicly update or revise any forward-looking statements, whether

as a result of new information, future events, or otherwise, except

as required under applicable rules, laws and regulations. Any or

all of the forward-looking statements contained in this filing and

in any other of CCEP's public statements may prove to be

incorrect.

Note Regarding the Presentation of Alternative Performance Measures

We use certain alternative performance measures (non-IFRS

performance measures) to make financial, operating and planning

decisions and to evaluate and report performance. We believe these

measures provide useful information to investors and as such, where

clearly identified, we have included certain alternative

performance measures in this document to allow investors to better

analyse our business performance and allow for greater

comparability. To do so, we have excluded items affecting the

comparability of period-over-period financial performance as

described below. The alternative performance measures included

herein should be read in conjunction with and do not replace the

directly reconcilable IFRS measures.

For purposes of this document, the following terms are

defined:

"As reported" are results extracted from our consolidated

financial statements.

"Comparable" is defined as results excluding items impacting

comparability, which include restructuring charges, income arising

from the ownership of certain mineral rights in Australia, gain on

sale of sub-strata and associated mineral rights in Australia, net

impact related to European flooding and acquisition and integration

related costs. Comparable volume is also adjusted for selling

days.

"Fx-neutral" or "FXN" is defined as period results excluding the

impact of foreign exchange rate changes. Foreign exchange impact is

calculated by recasting current year results at prior year exchange

rates.

"Capex" or "Capital expenditures" is defined as purchases of

property, plant and equipment and capitalised software, plus

payments of principal on lease obligations, less proceeds from

disposals of property, plant and equipment. Capex is used as a

measure to ensure that cash spending on capital investment is in

line with the Group's overall strategy for the use of cash.

"Free cash flow" is defined as net cash flows from operating

activities less capital expenditures (as defined above) and

interest paid. Free cash flow is used as a measure of the Group's

cash generation from operating activities, taking into account

investments in property, plant and equipment and non-discretionary

lease and interest payments. Free cash flow is not intended to

represent residual cash flow available for discretionary

expenditures.

"Dividend payout ratio" is defined as dividends as a proportion

of comparable profit after tax.

Additionally, within this document, we provide certain

forward-looking non-IFRS financial Information, which management

uses for planning and measuring performance. We are not able to

reconcile forward-looking non-IFRS measures to reported measures

without unreasonable efforts because it is not possible to predict

with a reasonable degree of certainty the actual impact or exact

timing of items that may impact comparability throughout year.

Unless otherwise stated, percent amounts are rounded to the

nearest 0.5%.

Supplemental Financial Information - Revenue

Revenue

Third-Quarter Ended Nine Months Ended

===========

Revenue 29 Sept 30 Sept % Change 29 Sept 30 Sept % Change

CCEP 2023 2022 2023 2022

In millions

of

EUR, except

per

case data

which

is

calculated

prior to

rounding.

FX impact

calculated

by

recasting

current

year

results at

prior year

rates.

=========== ====================== ====================== ========== ====================== ====================== ==========

As reported

and

comparable 4,807 4,745 1.5 % 13,784 13,025 6.0 %

Adjust:

Impact

of fx

changes 129 n/a n/a 317 n/a n/a

Comparable

and

fx-neutral 4,936 4,745 4.0 % 14,101 13,025 8.5 %

Revenue per

unit

case 5.83 5.35 9.0 % 5.69 5.20 9.5 %

Third-Quarter Ended Nine Months Ended

=========== ----------------------------------------------------------- ----------------------------------------------------------

Revenue 29 Sept 30 Sept % Change 29 Sept 30 Sept % Change

Europe 2023 2022 2023 2022

In millions

of

EUR, except

per

case data

which

is

calculated

prior to

rounding.

FX impact

calculated

by

recasting

current

year

results at

prior year

rates.

=========== ======================= ====================== ========== ====================== ====================== ==========

As reported

and

comparable 3,956 3,820 3.5 % 11,061 10,271 7.5 %

Adjust:

Impact

of fx

changes 28 n/a n/a 134 n/a n/a

Comparable

and

fx-neutral 3,984 3,820 4.5 % 11,195 10,271 9.0 %

Revenue per

unit

case 5.65 5.19 9.0 % 5.57 5.11 9.0 %

Third-Quarter Ended Nine Months Ended

=========== ------------------------------------------------------------- -------------------------------------------------------------

Revenue API 29 Sept 30 Sept % Change 29 Sept 30 Sept % Change

In millions 2023 2022 2023 2022

of

EUR, except

per

case data

which

is

calculated

prior to

rounding.

FX impact

calculated

by

recasting

current

year

results at

prior year

rates.

=========== ====================== ====================== ============= ====================== ====================== =============

As reported

and

comparable 851 925 (8.0) % 2,723 2,754 (1.0) %

Adjust:

Impact

of fx

changes 101 n/a n/a 183 n/a n/a

Comparable

and

fx-neutral 952 925 3.0 % 2,906 2,754 5.5 %

Revenue per

unit

case 6.74 6.11 10.5 % 6.25 5.58 12.0 %

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTFLFFAISLLVIV

(END) Dow Jones Newswires

November 01, 2023 03:00 ET (07:00 GMT)

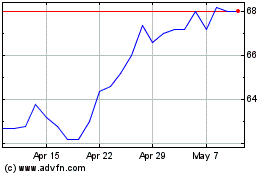

Coca-cola Europacific Pa... (LSE:CCEP)

Historical Stock Chart

From Apr 2024 to May 2024

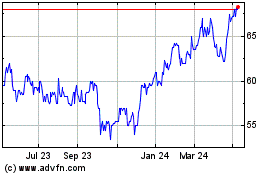

Coca-cola Europacific Pa... (LSE:CCEP)

Historical Stock Chart

From May 2023 to May 2024