Georgia Capital PLC Renewable Energy issues US$ 80 million bonds (6913C)

13 October 2022 - 1:25AM

UK Regulatory

TIDMCGEO

RNS Number : 6913C

Georgia Capital PLC

12 October 2022

London, 12 October 2022

Renewable Energy issues US$ 80 million green secured bonds on

the local market

Georgia Capital PLC (the "Group" or "GCAP") announces that

Georgian Renewable Power Operations JSC ("GRPO"), the holding

company of the Group's operational renewable energy assets

(previously owned by Georgia Global Utilities JSC ("GGU")),

successfully closed a US$ 80 million green secured bond offering

(the "Notes") on 12 October 2022. The Notes are US$-denominated

with 5-year bullet maturity (callable after two years) and carry a

7.00% coupon. The bonds were issued and sold at par value. The

proceeds of the Notes were fully used to refinance the shareholder

loan from GCAP, provided for redeeming the renewable energy

business' portion of GGU's US$ 250,000,000 7.75% Eurobond in

September 2022. The Notes are expected to be listed on the Georgian

Stock Exchange.

GRPO obtained a Second Party Opinion from Sustainalytics, a

leading provider of environmental, social and governance ("ESG")

research and analysis, for its Green Bond Framework. Galt and

Taggart JSC and TBC Capital LLC acted as placement agents for the

transaction. BLC Law Office and Dentons acted as legal advisors of

the anchor investors, and EY LLC acted as the financial auditor of

the issuer. The issuance was supported by long-standing partners of

the business - the Dutch Development Bank/ Nederlandse

Financierings-Maatschappij voor Ontwikkelingslanden N.V. ("FMO"),

the Asian Development Bank ("ADB"), the International Finance

Corporation ("IFC"), and the European Bank for Reconstruction and

Development ("EBRD"). FMO, ADB, and IFC acted as anchor banks for

the transaction.

Irakli Gilauri , Chairman and CEO of Georgia Capital commented:

"I am delighted to announce that GRPO has successfully completed

the largest ever corporate bond placement in Georgia. The issuance

of the first-ever green secured bonds provides significant

contribution to the development of the Georgian capital market. The

transaction, completed during the current challenging market

conditions, represents a milestone achievement for the business and

once again demonstrates our superior access to capital. I would

like to thank FMO, IFC, EBRD and ADB, our long-standing partners,

for supporting us in this transaction."

Name of authorised official of issuer responsible for making

notification: Giorgi Alpaidze, Chief Financial Officer

About Georgia Capital PLC

Georgia Capital is a platform for buying, building and

developing businesses in Georgia with holdings in sectors that are

expected to benefit from the continued growth and further

diversification of the Georgian economy. The Group's focus is

typically on larger-scale investment opportunities in Georgia,

which have the potential to reach at least GEL 300 million equity

value over 3-5 years from the initial investment and to monetise

them through exits, as investments mature. Georgia Capital

currently has the following portfolio businesses: (i) a retail

(pharmacy) business, (ii) a hospitals business, (iii) an insurance

business (P&C and medical insurance); (iv) a clinics and

diagnostics business, (v) a renewable energy business (hydro and

wind assets) and (vi) an education business; Georgia Capital also

holds other small private businesses across different industries in

Georgia; a 20% equity stake in the water utility business and a 20%

equity stake in LSE premium-listed Bank of Georgia Group PLC

("BoG"), a leading universal bank in Georgia.

JSC Georgia Capital has, as

of the date hereof, the following

credit ratings:

S&P Global 'B+'/FC & 'B+'/LC

Moody's B1/CFR & B1/PDR

About Georgian Renewable Power Operations

Georgian Renewable Power Operations , part of the Georgian

Renewable Power Holding (GRPH), is one of the leading renewable

energy platforms in Georgia. The company owns and operates a 71 MW

installed capacity of commissioned renewable energy assets,

including 4 hydro power plants and the only wind farm in

Georgia.

For further information, please visit www.georgiacapital.ge or

contact:

Irakli Gilauri Giorgi Alpaidze Michael Oliver Shalva Bukia

Chairman and Chief Executive Chief Financial Officer Adviser to the Chairman & CEO Head of Investor Relations

ir@gcap.ge +995 322 005 000 +44 203 178 4034 + 995 322 005 045

ir@gcap.ge ir@gcap.ge ir@gcap.ge

This news report is presented for general informational purposes

only and should not be construed as an offer to sell or the

solicitation of an offer to buy any securities

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCFFLFLEEESEES

(END) Dow Jones Newswires

October 12, 2022 10:25 ET (14:25 GMT)

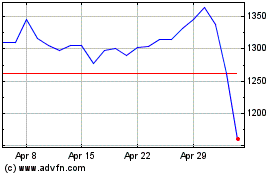

Georgia Capital (LSE:CGEO)

Historical Stock Chart

From Mar 2024 to Apr 2024

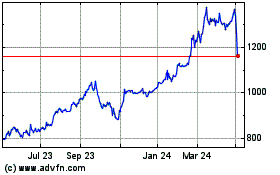

Georgia Capital (LSE:CGEO)

Historical Stock Chart

From Apr 2023 to Apr 2024