TIDMCGEO

RNS Number : 7481F

Georgia Capital PLC

09 November 2022

FINANCIAL PERFORMANCE HIGHLIGHTS (IFRS) [1]

GEL '000, unless otherwise Sep-22 Jun-22 Change Dec-21 Change

noted

Georgia Capital NAV overview

NAV per share, GEL 57.04 52.71 8.2% 63.03 -9.5%

NAV per share, GBP 18.55 14.78 25.5% 15.10 22.8%

Net Asset Value (NAV) 2,484,804 2,332,561 6.5% 2,883,622 -13.8%

Liquid assets and loans issued 632,930 688,741 -8.1% 426,531 48.4%

-2.6 -7.5

NCC ratio [2] 24.4% 27.0% ppts 31.9% ppts

Georgia Capital Performance 3Q22 3Q21 Change 9M22 9M21 Change

Total portfolio value creation 169,906 244,631 -30.5% (295,360) 585,080 NMF

of which, listed and observable

businesses 142,450 66,246 NMF (46,611) 110,082 NMF

of which, private businesses 27,456 178,385 -84.6% (248,749) 474,998 NMF

Investments 12,792 6,542 95.5% 156,948 17,130 NMF

of which, conversion of

issued loans into equity - - NMF 142,584 - NMF

Divestments - - NMF (557,568) - NMF

Buybacks 15,256 9,335 63.4% 68,796 12,534 NMF

Dividend income 32,019 30,000 6.7% 66,440 44,430 49.5%

Net income / (loss) 162,013 229,849 -29.5% (339,666) 553,148 NMF

Private portfolio companies'

performance(1, [3]) 3Q22 3Q21 Change 9M22 9M21 Change

Large portfolio companies

Revenue 303,066 316,092 -4.1% 924,989 915,335 1.1%

EBITDA 36,714 45,050 -18.5% 111,827 126,384 -11.5%

Net operating cash flow 34,947 57,537 -39.3% 98,223 98,247 NMF

Investment stage portfolio

companies

Revenue 39,586 42,050 -5.9% 124,707 120,982 3.1%

EBITDA 13,951 15,473 -9.8% 44,001 47,100 -6.6%

Net operating cash flow 18,987 21,809 -12.9% 43,586 43,482 0.2%

Total portfolio [4]

Revenue 494,671 447,250 10.6% 1,400,099 1,275,344 9.8%

EBITDA 69,581 68,377 1.8% 186,139 201,011 -7.4%

Net operating cash flow 69,891 88,744 -21.2% 153,376 163,135 -6.0%

KEY POINTS

Ø NAV per share (GEL) up 8.2% in 3Q22, following stabilisation

in 2Q22, driven by strong growth in BOG value

Ø NAV per share (GBP) increased 25.5% in 3Q22, reflecting the

16.0% appreciation of GEL against GBP during the third quarter and

strong growth in GEL terms

Ø Net Capital Commitment (NCC) ratio decreased by 2.6 ppts to

24.4% in 3Q22, resulting from strong growth in the portfolio value

and GEL's appreciation against US$

Ø GEL 32.0 million regular dividend income from the portfolio

companies in 3Q22 (GEL 66.4 million in 9M22)

Ø US$ 102 million GCAP Eurobonds re-purchased to date, including

$29 million through the Modified Dutch Auction ("MDA") in October

2022, of which, US$ 65 million were cancelled

Conference call: An investor/analyst conference call will be

held on 9 November 2022, at 13:00 UK / 14:00 CET / 08:00 US Eastern

Time. Please register at the Registration link to attend the event.

Further details about the webinar are available on the Group's

webpage .

CHAIRMAN AND CEO'S STATEMENT

Our 3Q22 results demonstrate the significant strategic,

operational and financial progress of Georgia Capital, and reflect

the high level of resilience of our portfolio companies, bolstered

by the outstanding growth of the Georgian economy.

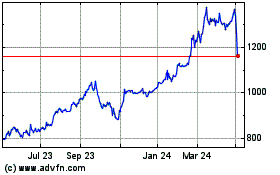

3 Q22 NAV per share was up 8.2%. The NAV per share growth in

3Q22 resulted mainly from positive value creation across our

portfolio companies. In 3Q22, BoG's share price demonstrated a

strong recovery (up 52.2% q-o-q), leading to GEL 142.5 million

value creation (6.1 ppts positive impact on the NAV per share). The

value creation across our private portfolio amounted to GEL 27.5

million (1.2 ppts impact), demonstrating solid growth. The NAV per

share growth was further supported by share buybacks and GEL's

appreciation against US$ (+1.4 ppts impact), partially offset by

management platform related costs and net interest expense (-0.8

ppts impact). In GBP terms, the NAV per share growth in 3Q22 was

significant - up 25.5% - reflecting the 16.0% appreciation of GEL

against GBP during the quarter.

As discussed in more detail in this report, healthy performance

in our non-healthcare businesses enabled us to manage the value

creation across the private portfolio notwithstanding a GEL 35.9

million value reduction in our Hospitals and Clinics &

Diagnostics businesses. Substantially lower COVID cases in Georgia

led to the suspension of COVID contracts by the Government in 1Q22.

As a result, we have been restructuring the cost base of our

COVID-earmarked hospitals. Together with slow summer admissions,

this negatively impacted the performance of our healthcare

businesses in 2Q22 and 3Q22. We expect this effect to be temporary

and that performance will rebound over the next few quarters as the

businesses complete the transition to a more normal post-pandemic

operating and demand environment.

We have once again demonstrated our superior access to capital.

In October 2022, our renewable energy and housing businesses

successfully completed bond placements on the Georgian capital

market. The transactions, completed during challenging debt capital

market conditions, represent milestone achievements for the

businesses.

Ø Our renewable energy business closed a US$ 80 million green

secured bond offering, which represents the largest-ever corporate

bond placement in Georgia. The notes are US$-denominated with

5-year bullet maturity (callable after two years) and carry a 7.00%

coupon. The proceeds of the notes were fully used to refinance the

shareholder loan from GCAP, provided for redeeming the renewable

energy business' portion of GGU's US$ 250 million 7.75%

Eurobond.

Ø Our housing business issued a US$ 35 million 2-year bond,

carrying an 8.5% coupon. Full proceeds of the notes were used to

refinance the 3-year 7.5% coupon US$ 35 million local bonds that

matured on 7 October 2022.

Strong progress on our key strategic priority of deleveraging

GCAP. In 3Q22, the NCC ratio decreased by 2.6 ppts to 24.4%. The

decrease resulted from a combination of factors: a) solid liquidity

[5] of GEL 633 million (US$ 223 million) at GCAP, including GEL

32.0 million dividend income from the portfolio companies in 3Q22,

b) a 61.4% decrease in GCAP's bank guarantee on the borrowings of

the beer business, reflecting the recent strong operating

performance of the business, c) growth in the portfolio value,

reflecting the strong value creation of our portfolio companies in

3Q22, and d) a 4.5% decrease in the gross debt balance due to GEL's

appreciation against US$.

In October 2022, we conducted a Modified Dutch Auction through

which we bought back US$ 29.2 million GCAP Eurobonds. In addition

to the tendered amount, we had accumulated US$ 72.9 million GCAP

Eurobonds through repurchases on the open market. Upon completion

of the MDA we cancelled US$ 65.0 million notes, decreasing our

outstanding gross debt balance to US$ 300.0 million and leaving US$

37.1 GCAP Eurobonds in our treasury. The transaction is in line

with our key strategic priority to deleverage Georgia Capital's

balance sheet. On a pro-forma basis, reflecting the results of the

Modified Dutch Auction as well as the subsequent movements in BoG's

share price and foreign exchange rates, the NCC ratio reduced

further to 22.2% as of 30-Sep-22.

From a macroeconomic perspective , the economy has continued to

deliver double-digit growth so far in 2022, with real GDP expanding

y-o-y by an estimated 10. 2 % in 9M22, following 10.4% real GDP

growth in 2021. On the external side, strong foreign demand

throughout the year has been supplemented by substantial remittance

inflows, with money transfers up by 65% y-o-y in 9M22. Merchandise

exports grew by 37% y-o-y in 9M22, and tourism revenues reached 98%

of 2019 levels in 9M22, including 122% in July-September 2022,

reflecting the global resumption of travel as well as significant

migration, especially from Russia. On the domestic side, credit

expansion has also been robust, as the commercial bank loan

portfolio grew by 13.7% y-o-y as of September 2022 (on a constant

currency basis). Additionally, while fiscal support has moderated,

Georgia's fiscal stance remains expansionary, with current

expenditures growing by 9% and capital expenditures expanding by

15% y-o-y in 9M22. Despite US$ strengthening globally, the Georgian

Lari (GEL) has sustained its appreciation trend since mid-2021 and,

compared to the beginning of 2022, had appreciated by 13.0% against

the US dollar as of 8 November 2022. This appreciation is driven by

the growing demand for Georgian exports, robust remittance and

migration inflows, tight monetary policy, accelerated foreign

currency lending and the strong tourism recovery. The fiscal

deficit is projected to shrink to around 3.2% in 2022, as a result

of the higher-than-expected growth, and is expected to return to

under 3% of GDP in 2023. The National Bank of Georgia (NBG) has

maintained a tight monetary stance with the refinancing rate set at

11% since March 2022, reaffirming its commitment to pursue a tight

monetary

policy until the current inflationary pressures subside.

Inflation was 11.5% in September 2022, and 12.5% on average in

January-September 2022, although it is expected to decelerate

gradually during 2023.

Outlook. I continue to be extremely impressed by the leadership

teams of our portfolio companies and how successfully they have

handled the considerable uncertainties created by the

Russia-Ukraine war and remain cautiously optimistic about the

emerging opportunities that lie ahead. Our strategic priorities

continue to be at the heart of our planning and execution. We have

made good progress in deleveraging the business towards our

targeted Net Capital Commitment ratio of 15%, and to reduce and

maintain our portfolio companies' individually targeted leverage

levels. I am pleased with the progress we have made in the

achievement of our strategic priorities, while consistently growing

NAV per share on the back of capital light investments. With the

recent extension of my CEO contract, I am equally excited about the

opportunity to help lead the Company into the next phase of its

journey. Based on our proven governance and highly experienced

Board, further strengthened by Neil Janin's recent appointment as

an independent non-executive director, I believe Georgia Capital is

extremely well-positioned to continue delivering consistent NAV per

share growth over the medium to long term.

Irakli Gilauri, Chairman and CEO

DISCUSSION OF GROUP RESULTS

The discussion below analyses the Group's unaudited net asset

value at 3 0 - Sep -22 and its income for the third quarter and

nine-month period then ended on an IFRS basis (see "Basis of

Presentation" on page 26 below).

Net Asset Value (NAV) Statement

NAV statement summarises the Group's IFRS equity value (which we

refer to as Net Asset Value or NAV in the NAV Statement below) at

the opening and closing dates for the third quarter (30- Jun -22

and 3 0 - Sep -22). The NAV Statement below breaks down NAV into

its components and provides a roll forward of the related changes

between the reporting periods. For the NAV Statement for the nine

months of 2022 see page 26.

NAV STATEMENT 3Q 22

GEL '000, Jun-22 1. 2a. 2b. 2c. 3. 4. Sep Change

unless Value Investment Buyback Dividend Operating Liquidity/ -22 %

otherwise noted creation and expenses FX/Other

([6]) Divestments

Listed and

Observable

Portfolio

Companies

---------------- ------------ --------- ------------ ---------- --------- ---------- ----------- ------------ --------

Bank of Georgia

(BoG) 455,719 142,450 - - - - - 598,169 31.3%

---------------- ------------ --------- ------------ ---------- --------- ---------- ----------- ------------ --------

Water Utility 153,000 - - - - - - 153,000 0.0%

---------------- ------------ --------- ------------ ---------- --------- ---------- ----------- ------------ --------

Total Listed

and

Observable

Portfolio

Value 608,719 142,450 - - - - - 751,169 23.4%

---------------- ------------ --------- ------------ ---------- --------- ---------- ----------- ------------ --------

Listed and

Observable

Portfolio

value change

% 23.4% 0.0% 0.0% 0.0% 0.0% 0.0% 23.4%

---------------- ------------ --------- ------------ ---------- --------- ---------- ----------- ------------ --------

Private

Portfolio

Companies

---------------- ------------ --------- ------------ ---------- --------- ---------- ----------- ------------ --------

Large Companies 1,389,193 4,897 - - (30,034) - - 1,364,056 -1.8%

---------------- ------------ --------- ------------ ---------- --------- ---------- ----------- ------------ --------

Retail

(Pharmacy) 671,027 22,229 - - (16,018) - - 677,238 0.9%

---------------- ------------ --------- ------------ ---------- --------- ---------- ----------- ------------ --------

Hospitals 478,046 (32,804) - - (13,015) - - 432,227 -9.6%

---------------- ------------ --------- ------------ ---------- --------- ---------- ----------- ------------ --------

Insurance (P&C

and

Medical) 240,120 15,472 - - (1,001) - - 254,591 6.0%

---------------- ------------ --------- ------------ ---------- --------- ---------- ----------- ------------ --------

Of which,

P&C

Insurance 199,810 14,090 - - - - - 213,900 7.1%

---------------- ------------ --------- ------------ ---------- --------- ---------- ----------- ------------ --------

Of which,

Medical

Insurance 40,310 1,382 - - (1,001) - - 40,691 0.9%

---------------- ------------ --------- ------------ ---------- --------- ---------- ----------- ------------ --------

Investment

Stage

Companies 443,967 7,950 4,392 - (1,985) - 256 454,580 2.4%

---------------- ------------ --------- ------------ ---------- --------- ---------- ----------- ------------ --------

Renewable

Energy 172,168 3,753 - - (1,985) - 256 174,192 1.2%

---------------- ------------ --------- ------------ ---------- --------- ---------- ----------- ------------ --------

Education 151,753 7,287 4,392 - - - - 163,432 7.7%

---------------- ------------ --------- ------------ ---------- --------- ---------- ----------- ------------ --------

Clinics and

Diagnostics 120,046 (3,090) - - - - - 116,956 -2.6%

---------------- ------------ --------- ------------ ---------- --------- ---------- ----------- ------------ --------

Other Companies 263,534 14,609 8,400 - - - 512 287,055 8.9%

---------------- ------------ --------- ------------ ---------- --------- ---------- ----------- ------------ --------

Total Private

Portfolio

Value 2,096,694 27,456 12,792 - (32,019) - 768 2,105,691 0.4%

---------------- ------------ --------- ------------ ---------- --------- ---------- ----------- ------------ --------

Private

Portfolio

value change % 1.3% 0.6% 0.0% -1.5% 0.0% 0.0% 0.4%

---------------- ------------ --------- ------------ ---------- --------- ---------- ----------- ------------ --------

Total Portfolio

Value (1) 2,705,413 169,906 12,792 - (32,019) - 768 2,856,860 5.6%

---------------- ------------ --------- ------------ ---------- --------- ---------- ----------- ------------ --------

Total Portfolio

value change % 6.3% 0.5% 0.0% -1.2% 0.0% 0.0% 5.6%

---------------- ------------ --------- ------------ ---------- --------- ---------- ----------- ------------ --------

Net Debt (2) (365,914) - (12,792) (15,256) 32,019 (5,095) (29,022) (396,060) 8.2%

---------------- ------------ --------- ------------ ---------- --------- ---------- ----------- ------------ --------

of which,

Cash and

liquid funds 663,367 - (12,792) (15,256) 54,817 (5,095) (305,397) 379,644 -42.8%

---------------- ------------ --------- ------------ ---------- --------- ---------- ----------- ------------ --------

of which,

Loans

issued 25,374 - - - - - 227,912 253,286 NMF

---------------- ------------ --------- ------------ ---------- --------- ---------- ----------- ------------ --------

of which,

Accrued

dividend

income 22,798 - - - (22,798) - - - -100.0%

---------------- ------------ --------- ------------ ---------- --------- ---------- ----------- ------------ --------

of which,

Gross

Debt (1,077,453) - - - - - 48,463 (1,028,990) -4.5%

---------------- ------------ --------- ------------ ---------- --------- ---------- ----------- ------------ --------

Net other

assets/

(liabilities) 35,668

(3) (6,938) - - - - (4,726) [7] 24,004 NMF

---------------- ------------ --------- ------------ ---------- --------- ---------- ----------- ------------ --------

of which,

share-based

comp. - - - - - (4,726) 4,726 - 0.0%

---------------- ------------ --------- ------------ ---------- --------- ---------- ----------- ------------ --------

Net Asset Value

(1)+(2)+(3) 2,332,561 169,906 - (15,256) - (9,821) 7,414 2,484,804 6.5%

---------------- ------------ --------- ------------ ---------- --------- ---------- ----------- ------------ --------

NAV change % 7.3% 0.0% -0.7% 0.0% -0.4% 0.3% 6.5%

---------------- ------------ --------- ------------ ---------- --------- ---------- ----------- ------------ --------

Shares

outstanding(6) 44,249,747 - - (689,014) - - - 43,560,733 -1.6%

---------------- ------------ --------- ------------ ---------- --------- ---------- ----------- ------------ --------

Net Asset Value

per share, GEL 52.71 3.84 0.00 0.49 0.00 (0.22) 0.21 57.04 8.2%

---------------- ------------ --------- ------------ ---------- --------- ---------- ----------- ------------ --------

NAV per share,

GEL

change % 7.3% 0.0% 0.9% 0.0% -0.4% 0.4% 8.2%

---------------- ------------ --------- ------------ ---------- --------- ---------- ----------- ------------ --------

An 8.2% increase in NAV per share (GEL) in 3Q22 reflects both

increased valuation of BoG and value creation across our private

portfolio companies with a positive 6.1 ppts and 1.2 ppts impact on

the NAV per share, respectively. The NAV per share growth was

further supported by share buybacks (+0.9 ppts impact) and GEL's

appreciation against US$, resulting in a foreign currency gain of

GEL 12.1 million on GCAP net debt (+0.5 ppts impact). The NAV per

share growth was slightly offset by management platform related

costs and net interest expense with negative 0.4 ppts and 0.4 ppts

impact, respectively.

Portfolio overview

Total portfolio value increased by GEL 151.4 million (5.6%) to

GEL 2.9 billion in 3Q22:

-- The value of the listed and observable portfolio was up by

GEL 142.5 million (23.4%), resulting from the strong recovery in

BoG's share price.

-- The value of the private portfolio increased by GEL 9.0

million (0.4%). This mainly reflects the net impact of a) GEL 27.5

million value creation, b) investments of GEL 12.8 million, and c)

a decrease of GEL 32.0 million due to dividends paid to GCAP.

Consequently, as of 30-Sep-22, the listed and observable

portfolio value totalled GEL 751.2 million (26.3% of the total

portfolio value), and the private portfolio value amounted to GEL

2.1 billion (73.7% of the total).

1) Value creation

Total portfolio value creation amounted to GEL 169.9 million in

3Q22.

-- A GEL 142.5 million value creation from the listed and

observable portfolio was attributable to a 52.2% increase in BoG's

share price, partially offset by GEL's appreciation against GBP by

16.0% in 3Q22.

-- The value creation in the private portfolio amounted to GEL

27.5 million in 3Q22, reflecting:

o GEL 109.7 million operating-performance related value

reduction, mainly driven by the developments across our healthcare

businesses (Hospitals and Clinics and Diagnostics), as described in

detail on pages 6-7.

o GEL 137.1 million value creation due to GEL's appreciation

against both US$ and EUR and changes in valuation multiples in

3Q22, resulting from the resilience of the Georgian economy in

almost all economic data points and the strong outlook for our

private portfolio companies.

The table below summarises value creation drivers in our

businesses in 3 Q22:

Portfolio Businesses Operating Performance Greenfields Multiple Change Value Creation

([8]) / and FX ([10])

buy-outs

/ exits

([9])

--------------------------- ---------------------- ------------ ---------------- ---------------

GEL '000, unless

otherwise noted (1) (2) (3) (1)+(2)+(3)

--------------------------- ---------------------- ------------ ---------------- ---------------

Listed and Observable 142,450

--------------------------- ---------------------- ------------ ---------------- ---------------

BoG 142,450

--------------------------- ---------------------- ------------ ---------------- ---------------

Water Utility -

--------------------------- ---------------------- ------------ ---------------- ---------------

Private (109,662) - 137,118 27,456

--------------------------- ---------------------- ------------ ---------------- ---------------

Large Portfolio

Companies (79,919) - 84,816 4,897

--------------------------- ---------------------- ------------ ---------------- ---------------

Retail (pharmacy) (13,682) - 35,911 22,229

--------------------------- ---------------------- ------------ ---------------- ---------------

Hospitals (92,162) - 59,358 (32,804)

--------------------------- ---------------------- ------------ ---------------- ---------------

Insurance (P&C and

Medical) 25,925 - (10,453) 15,472

--------------------------- ---------------------- ------------ ---------------- ---------------

Of which, P&C Insurance 19,539 - (5,449) 14,090

--------------------------- ---------------------- ------------ ---------------- ---------------

Of which, Medical

Insurance 6,386 - (5,004) 1,382

--------------------------- ---------------------- ------------ ---------------- ---------------

Investment Stage

Portfolio Companies (18,687) - 26,637 7,950

--------------------------- ---------------------- ------------ ---------------- ---------------

Renewable Energy 22,920 - (19,167) 3,753

--------------------------- ---------------------- ------------ ---------------- ---------------

Education 10,844 - (3,557) 7,287

--------------------------- ---------------------- ------------ ---------------- ---------------

Clinics and Diagnostics (52,451) - 49,361 (3,090)

--------------------------- ---------------------- ------------ ---------------- ---------------

Other (11,056) - 25,665 14,609

--------------------------- ---------------------- ------------ ---------------- ---------------

Total portfolio (109,662) - 137,118 169,906

--------------------------- ---------------------- ------------ ---------------- ---------------

Valuation overview [11]

In 3Q22, our private large and investment stage portfolio

companies were valued internally by incorporating the portfolio

companies' 3Q22 results, in line with International Private Equity

Valuation ("IPEV") guidelines and methodology deployed in 1H22 by

an independent valuation company. The independent valuation

assessments, which serve as the basis for Georgia Capital's

estimate of fair value, were performed by applying a combination of

an income approach (DCF) and a market approach (listed peer

multiples and, in some cases, precedent transactions). The

independent valuations of large and investment stage businesses are

performed on a semi-annual basis. In line with our strategy, from

time to time we may receive offers from interested buyers for our

private portfolio companies, which would be considered in the

overall valuation assessment, where appropriate.

The enterprise value and equity value development of our

businesses in 3 Q22 are summarised in the following table:

Enterprise Value Equity Value

(EV)

-------------------------- ------------------------------- --------------------------------------------

GEL '000, unless 30-Sep-22 30-Jun-22 Change 30-Sep-22 30-Jun-22 Change % share

otherwise noted % % in total

portfolio

-------------------------- ---------- ---------- ------- ---------- ---------- ------- -----------

Listed and Observable

portfolio 751,169 608,719 23.4% 26.3%

-------------------------- ---------- ---------- ------- ---------- ---------- ------- -----------

BoG 598,169 455,719 31.3% 20.9%

-------------------------- ---------- ---------- ------- ---------- ---------- ------- -----------

Water Utility 153,000 153,000 0.0% 5.4%

-------------------------- ---------- ---------- ------- ---------- ---------- ------- -----------

Private portfolio 3,229,308 3,236,186 -0.2% 2,105,691 2,096,694 0.4% 73.7%

-------------------------- ---------- ---------- ------- ---------- ---------- ------- -----------

Large portfolio

companies 1,810,508 1,821,489 -0.6% 1,364,056 1,389,193 -1.8% 47.7%

Retail (pharmacy) 923,623 915,257 0.9% 677,238 671,027 0.9% 23.7%

Hospitals 646,175 678,687 -4.8% 432,227 478,046 -9.6% 15.1%

Insurance (P&C and

Medical) 240,710 227,545 5.8% 254,591 240,120 6.0% 8.9%

Of which, P&C Insurance 213,900 199,810 7.1% 213,900 199,810 7.1% 7.5%

Of which, Medical

Insurance 26,810 27,735 -3.3% 40,691 40,310 0.9% 1.4%

-------------------------- ---------- ---------- ------- ---------- ---------- ------- -----------

Investment stage

portfolio companies 795,249 792,525 0.3% 454,580 443,967 2.4% 15.9%

-------------------------- ---------- ---------- ------- ---------- ---------- ------- -----------

Renewable Energy 416,536 421,002 -1.1% 174,192 172,168 1.2% 6.1%

Education [12] 194,827 182,688 6.6% 163,432 151,753 7.7% 5.7%

Clinics and Diagnostics 183,886 188,835 -2.6% 116,956 120,046 -2.6% 4.1%

-------------------------- ---------- ---------- ------- ---------- ---------- ------- -----------

Other 623,551 622,172 0.2% 287,055 263,534 8.9% 10.0%

-------------------------- ---------- ---------- ------- ---------- ---------- ------- -----------

Total portfolio 2,856,860 2,705,413 5.6% 100.0%

-------------------------- ---------- ---------- ------- ---------- ---------- ------- -----------

Private large portfolio companies (47.7% of total portfolio

value)

Retail (Pharmacy) (23.7% of total portfolio value) - the

Enterprise Value (EV) of Retail (Pharmacy) was up by 0.9% to GEL

923.6 million in 3Q22, reflecting the continued strong outlook of

the business driven by the expansion of the retail chain and

resilience of Georgian economy. 3Q22 revenues were down by 1.8%

y-o-y in 3Q22, reflecting a) the recalibration of product prices

due to GEL's appreciation against foreign currencies (the FX effect

is directly transmitted into the pricing as c.70% of the inventory

purchases are denominated in foreign currencies) and b) continuing

gradual transfer of the hospitals business' procurement department

from pharmacy to hospitals (which began in January 2021 and is

expected to complete by the end of 2022). EBITDA (excl. IFRS 16)

was down by 11.9% y-o-y in 3Q22, reflecting the increased operating

expenses in line with the expansion of the retail (pharmacy)

business and inflation. See page 14 for details. Consequently, LTM

EBITDA (incl. IFRS 16) was down by 2.1% to GEL 107.4 million in

3Q22. Net debt (incl. IFRS 16) remained largely flat, down by 0.7%

q-o-q to GEL 158.4 million in 3Q22. The business paid a GEL 16.0

million dividend to GCAP in 3Q22. As a result, the fair value of

GCAP's stake in Retail (Pharmacy) amounted to GEL 677.2 million, up

by 0.9% y-o-y in 3Q22. The implied LTM EV/EBITDA valuation multiple

(incl. IFRS 16) increased to 8.6x as at 30-Sep-22 (up from 8.3x as

of 30-Jun-22).

Hospitals (15.1% of total portfolio value) - Hospitals' EV

decreased by 4.8% to GEL 646.2 million in 3Q22. Revenues were down

by 18.1% y-o-y in 3Q22, reflecting the temporary impact from the

suspension of COVID contracts by the Government in 1Q22.

Restructuring the cost base of COVID hospitals and phasing out from

Government contracts temporarily suppressed business margins, which

translated into a 7.1 ppts y-o-y decrease in the 3Q22 EBITDA margin

(excl. IFRS 16). Consequently, EBITDA (excl. IFRS 16) was down

44.9% y-o-y in 3Q22. See page 16 for details. Net debt, which

reflects GEL 13.0 million dividend payment to GCAP in 3Q22, was up

by 8.5% q-o-q to GEL 182.9 million as of 30-Sep-22. LTM EBITDA

(incl. IFRS 16) decreased by 12.6% to GEL 56.7 million in 3Q22 as

the business completes the transition to the post-pandemic

environment. As a result, the equity value of the business was

assessed at GEL 432.2 million, down 9.6% q-o-q in 3Q22, translating

into an implied LTM EV/EBITDA multiple (incl. IFRS 16) of 11.4x at

30-Sep-22 (up from 10.5x at 30-Jun-22 due to the temporary decrease

in the LTM EBITDA from transition into the post-pandemic

environment ).

Insurance (P&C and Medical) (8.9% of total portfolio value)

- The insurance business combines: a) P&C Insurance valued at

GEL 213.9 million and b) Medical Insurance valued at GEL 40.7

million.

P&C Insurance - Net premiums earned increased by 20.5% y-o-y

to GEL 27.3 million in 3Q22, mainly reflecting the growth in the

credit life and agricultural insurance lines. The combined ratio

was down 2.7 ppts y-o-y in 3Q22, reflecting a) a 3.9 ppts decrease

in loss ratio on the back of the robust revenue growth, supported

by a reduced number of COVID-19-related credit life insurance

claims and b) a 1.3 ppts increase in expense ratio due to the

increase in salaries and other operating expenses in line with the

business growth. Consequently, 3Q22 net income was up 38.5% y-o-y

to GEL 6.6 million. See page 17 for details. LTM net income [13]

was up by 10.1% to GEL 20.0 million in 3Q22. As a result, the

equity value of the P&C insurance business was assessed at GEL

213.9 million at 30-Sep-22 (up 7.1% q-o-q). The implied LTM P/E

valuation multiple stood at 10.7x in 3Q22 (down from 11.0x in

2Q22).

Medical Insurance - Net premium earned increased by 2.7% y-o-y

to GEL19.4 million in 3Q22, reflecting the net impact of c.5%

increase in the prices of insurance policies and related decrease

in the number of insured clients for the same period ( down 4.9%

y-o-y as of 30-Sep-22 ) . The combined ratio was down by 1.0 ppts

y-o-y to 90.7%, resulting from the 1.5 ppts y-o-y decrease in the

loss ratio in 3Q22. Consequently, the net income of the medical

insurance business was up by 28.9% y-o-y to GEL 2.3 million in

3Q22. See page 17 for details. LTM net income [14] was up by 15.3%

to GEL 3.2 million in 3Q22. The business paid GEL 1.0 million

dividends to GCAP. As a result, the equity value of the business

was assessed at GEL 40.7 million at 30-Sep-22 (up 0.9% q-o-q). The

implied LTM P/E valuation multiple was at 12.7x in 3Q22, down from

14.5x in 2Q22.

Private investment stage portfolio companies (15.9% of total

portfolio value)

Renewable Energy (6.1% of total portfolio value) - EV in US$

terms was up by 2.2% to US$ 146.9 million in 3Q22 (down 1.1% to GEL

416.5 million in GEL terms, reflecting the local currency

appreciation against US$ during the quarter). In US$ terms, revenue

and EBITDA were up 23.9% and 30.4% y-o-y in 3Q22, respectively,

reflecting an increase in both the average electricity selling

price (up 8.8% y-o-y) and the electricity generation (up 19.1%

y-o-y) in 3Q22. Revenue and EBITDA in GEL terms were up by 12.5%

and 18.4% y-o-y, respectively, in 3Q22. See page 20 for details.

The pipeline renewable energy projects continued to be measured at

an equity investment cost of GEL 40.9 million in aggregate. Net

debt was down by 2.6% to GEL 242.3 million in 3Q22, also reflecting

the currency movements (in US$ terms, the net debt remained largely

flat, up by 0.6% q-o-q to US$ 85.5 million). The business paid GEL

2.0 million dividends to GCAP in 3Q22. As a result, the equity

value of Renewable Energy was assessed at GEL 174.2 million in 3Q22

(up by 1.2% q-o-q), (up 4.5% q-o-q to US$ 61.4 in US$ terms). The

blended EV/EBITDA valuation multiple of the operational assets

stood at 10.7x in 3Q22, down from 11.1x in 2Q22.

Education (5.7% of total portfolio value) - EV of Education was

up by 6.6% to GEL 194.8 million in 3Q22, reflecting the strong

operating performance of the business. Strong intakes and a ramp-up

of utilization, in line with both the organic growth and expansion

of the business, led to a 100 .9% and 83.3% y-o-y increase in

revenue and EBITDA in 3Q22, respectively. In 3Q22, GCAP invested

GEL 4.4 million in Education predominantly for capacity expansion

of Buckswood (mid-scale segment) and Green School (affordable

segment). See page 21 for details. LTM EBITDA was up 10.2% to GEL

13.2 million in 3Q22. Net debt was down by 16.8% to GEL 7.4 million

in 3Q22, reflecting GEL's appreciation against foreign currencies

during the quarter. As a result, the GCAP's stake in the education

business was valued at GEL 163.4 million in 3Q22 (up 7.7% q-o-q).

This translated into the implied valuation multiple of 14.8x in

3Q22, down from 15.3x in 2Q22. The forward-looking implied

valuation multiple is estimated at 11.8x for the 2023-2024 academic

year.

Clinics and Diagnostics (4.1% of total portfolio value) - The EV

of the business decreased by 2.6% to GEL 183.9 million in 3Q22.

Similar to the hospitals business, our clinics business was also

impacted by the suspension of COVID contracts by the Government,

which led to a 20.1% y-o-y decrease in revenues in 3Q22. The

revenue of our diagnostics business, which apart from regular lab

tests is actively engaged in COVID-19 testing, was impacted by

substantially lower COVID cases and was down by 49.4% y-o-y in

3Q22. Consequently, the combined 3Q22 revenue of the clinics and

diagnostics business was down by 30.1% y-o-y leading to a 78.6%

y-o-y decrease in 3Q22 EBITDA (excl. IFRS 16). See page 22 for

details. LTM EBITDA (incl. IFRS 16) of the business was down by

24.2% to GEL 14.5 million in 3Q22. As a result, the equity value of

the business was assessed at GEL 117.0 million, down 2.6% q-o-q in

3Q22, translating into an implied LTM EV/EBITDA multiple (incl.

IFRS 16) of 12.7x at 30-Sep-22, up from 9.8x at 30-Jun-22.

Other businesses (10.0% of total portfolio value) - The "other"

private portfolio (Auto Service, Beverages, Housing Development and

Hospitality businesses) is valued based on LTM EV/EBITDA except the

housing development (DCF), wine business (DCF) and hospitality

businesses (NAV). See performance highlights of other businesses on

page 25. The portfolio had a combined value of GEL 287.1 million at

30-Sep-22, up by 8.9% q-o-q. The increase in the portfolio value

mainly reflects a) GEL 14.6 million value creation predominantly

resulting from the positive developments across our beer and auto

services businesses and b) GEL 8.4 million investment in Housing

Development for the bridge financing of the business.

Listed and observable portfolio companies (26.3% of total

portfolio value)

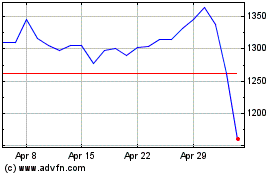

BOG ( 20.9% of total portfolio value) - In 2Q22, BoG delivered

an annualised ROAE of 32.8% and strong 10.2% loan book growth

y-o-y. The loan book growth was largely driven by continued strong

loan origination levels in all segments, but predominantly in the

consumer, MSME and corporate portfolios. In 3Q22, BoG's share price

demonstrated a robust recovery and was up by 52.2 % q-o-q to GBP

19.88 at 30-Sep-22. The positive impact of BOG's share price

performance on our valuations was partially offset by GEL's

appreciation against GBP by 16.0% in 3Q22. As a result, the market

value of our equity stake in BoG increased by 20.9% to GEL 598.2

million in 3Q22. GCAP received GEL 22.8 million dividends from the

Bank In 3Q22. In addition, on 20-Oct-22, GCAP received GEL 18.1

million interim dividends from BoG, up 24.8% compared to interim

dividends received in 2021. Under its ongoing share buyback and

cancellation programme, the Bank repurchased 1.0 million shares in

3Q22, which led to an increase in GCAP's holding in BoG to 20.3% at

30-Sep-22 (up from 19.9% at 30-Jun-22). BoG's public announcement

of their 3Q22 results, when published, will be available on BoG's

website .

Water Utility ( 5.4% of total portfolio value) - In 3Q22, the

fair value of GCAP's 20% holding in the water utility business,

where GCAP has a clear exit path through a put and call structure

at pre-agreed EBITDA multiples [15] , remained unchanged at GEL

153.0 million. In 1H22, GCAP's stake was valued by the application

of the put option valuation to the normalised [16] LTM EBITDA of

the business as at 30-Jun-22.

2) Investments [17]

In 3Q22, GCAP invested GEL 12.8 million in private portfolio

companies.

-- GEL 4.4 million was allocated to the education business

predominantly for the capacity expansion of the existing campus of

Buckswood (mid-scale segment), the development of the land and

building of the existing campuses of Green School (affordable

segment), the buyout of 9% minority shareholders in one of the

Green School campuses (GCAP's stake increased to 90%) as well as

earnout payments to minority shareholders.

-- GEL 8.4 million was invested in Housing Development for the

bridge financing of the business.

3) Share buybacks

During 3Q22, 689,014 shares were bought back for a total

consideration of GEL 15.3 million.

-- 126,153 shares were repurchased for the management trust.

-- 562,861 shares were repurchased under the US$ 25 million

share buyback and cancellation programme. The total value of shares

repurchased under the programme amounted to GEL 12.2 million (US$

4.4 million) in 3Q22.

4) Dividends [18]

In 3Q22, Georgia Capital recorded GEL 32.0 million regular

dividend income from portfolio companies, of which:

-- GEL 16.0 million was collected from Retail (Pharmacy),

-- GEL 13.0 million from Hospitals,

-- GEL 2.0 million from Renewable Energy,

-- GEL 1.0 million from Medical Insurance.

9M22 NAV STATEMENT HIGHLIGHTS

GEL '000, unless Dec-21 1. 2a. 2b. 2c. 3. 4. Sep Change

otherwise noted Value Investment Buyback Dividend Operating Liquidity/ -22 %

creation and expenses FX/Other

([19]) divestments

Total Listed and

Observable

Portfolio

Value 681,186 (46,611) 139,392 - (22,798) - - 751,169 10.3%

----------------- ----------- ---------- ------------ ------------ --------- ---------- ----------- ----------- -------

Listed and

Observable

Portfolio value

change

% -6.8% 20.5% 0.0% -3.3% 0.0% 0.0% 10.3%

----------------- ----------- ---------- ------------ ------------ --------- ---------- ----------- ----------- -------

Total Private

Portfolio

Companies 2,935,045 (248,749) (540,012) - (43,642) - 3,049 2,105,691 -28.3%

----------------- ----------- ---------- ------------ ------------ --------- ---------- ----------- ----------- -------

Of which, Large

Companies 2,249,260 (151,657) (696,960) - (37,408) - 821 1,364,056 -39.4%

----------------- ----------- ---------- ------------ ------------ --------- ---------- ----------- ----------- -------

Of which,

Investment

Stage

Companies 461,140 (7,020) 5,951 - (6,234) - 743 454,580 -1.4%

----------------- ----------- ---------- ------------ ------------ --------- ---------- ----------- ----------- -------

Of which,

Other

Companies 224,645 (90,072) 150,997 - - - 1,485 287,055 27.8%

----------------- ----------- ---------- ------------ ------------ --------- ---------- ----------- ----------- -------

Private

Portfolio

value change % -8.5% -18.4% 0.0% -1.5% 0.0% 0.1% -28.3%

----------------- ----------- ---------- ------------ ------------ --------- ---------- ----------- ----------- -------

Total Portfolio

Value (1) 3,616,231 (295,360) (400,620) - (66,440) - 3,049 2,856,860 -21.0%

----------------- ----------- ---------- ------------ ------------ --------- ---------- ----------- ----------- -------

Total Portfolio

value change % -8.2% -11.1% 0.0% -1.8% 0.0% 0.1% -21.0%

----------------- ----------- ---------- ------------ ------------ --------- ---------- ----------- ----------- -------

Net Debt (2) (711,074) - 400,627 (68,796) 66,440 (16,046) (73,211) (396,060) -44.3%

----------------- ----------- ---------- ------------ ------------ --------- ---------- ----------- ----------- -------

Net Asset Value

(1)+(2)+(3) 2,883,622 (295,360) - (68,796) - (29,521) (5,141) 2,484,804 -13.8%

----------------- ----------- ---------- ------------ ------------ --------- ---------- ----------- ----------- -------

NAV change % -10.2% 0.0% -2.4% 0.0% -1.0% -0.2% -13.8%

----------------- ----------- ---------- ------------ ------------ --------- ---------- ----------- ----------- -------

Shares

outstanding(19) 45,752,362 - - (2,855,592) - - 663,963 43,560,733 -4.8%

----------------- ----------- ---------- ------------ ------------ --------- ---------- ----------- ----------- -------

Net Asset Value

per share, GEL 63.03 (6.46) (0.00) 2.59 (0.00) (0.65) (1.46) 57.04 -9.5%

----------------- ----------- ---------- ------------ ------------ --------- ---------- ----------- ----------- -------

NAV per share,

GEL

change % -10.2% 0.0% 4.1% 0.0% -1.0% -2.3% -9.5%

----------------- ----------- ---------- ------------ ------------ --------- ---------- ----------- ----------- -------

NAV per share (GEL) decreased by 9.5% in 9M22, reflecting a)

value reduction across our listed and observable and private

portfolio companies with a 1.6 ppts and 8.6 ppts negative impact on

the NAV per share, respectively, and b) management platform related

costs (-1.0 ppts impact) and net interest expenses (-1.0 ppts

impact). The NAV per share decrease was partially offset by share

buybacks (+4.1 ppts impact) and GEL's appreciation against US$ by

9.3%, resulting in a foreign currency gain of GEL 26.6 million on

GCAP net debt (+0.9 ppts impact).

Portfolio overview

The total portfolio value decreased by GEL 759.4 million (21.0%)

in 9M22.

-- The value of the water utility business decreased by GEL

544.0, reflecting the net impact of the disposal of an 80% equity

interest in the business and the application of the put option

valuation to GCAP's remaining 20% holding in the business, the

latter leading to GEL 13.6 million value creation in 9M22.

-- The value of GCAP's holding in BoG was down by GEL 83.0

million, reflecting GEL 60.2 million negative value creation and

GEL 22.8 million dividend receipt from the Bank in 9M22.

-- The value of the private portfolio decreased by GEL 132.4 million in 9M22.

1) Value creation

Total portfolio value reduction amounted to GEL 295.4 million in

9M22.

-- 19.2% increase in BoG's share price was fully offset by GEL's

35.7% appreciation against GBP in 9M22, resulting in a GEL 60.2

million negative value creation.

-- The negative value creation across our private portfolio

amounted to GEL 248.7 million, resulting from a) GEL 286.7 million

operating performance related value reduction and b) GEL 38.0

million value creation due to the changes in foreign exchange rates

(GEL 22.8 million) and valuation multiples (GEL 15.2 million) in

9M22.

a) Operating performance related value decrease reflects the

organic transition of our healthcare businesses to the

post-pandemic environment as described earlier in this report and

the spillover effect of the Russia-Ukraine war on our wine (c. 60%

sales exposure to Russia and Ukraine in 2021) and housing

businesses (significant growth in construction materials

costs).

b) The value creation due to changes in valuation multiples and

FX reflects the strong outlook of our private portfolio companies,

supported by the resilience of the Georgian economy,

notwithstanding the continued uncertainties surrounding the

regional geopolitical tensions, the latter leading to approximately

2.0-3.0 ppts increase in discount rates and the reduction of listed

peer multiples in 9M22.

The table below summarises value creation drivers in our

businesses in 9M 22:

Portfolio Businesses Operating Performance Greenfields Multiple Change Value Creation

([20]) / and FX ([22])

buy-outs

/ exits

([21])

-------------------------------------- ---------------------- ------------ ---------------- ---------------

GEL '000, unless otherwise noted (1) (2) (3) (1)+(2)+(3)

-------------------------------------- ---------------------- ------------ ---------------- ---------------

Listed and Observable (46,611)

-------------------------------------- ---------------------- ------------ ---------------- ---------------

BoG (60,219)

-------------------------------------- ---------------------- ------------ ---------------- ---------------

Water Utility 13,608

-------------------------------------- ---------------------- ------------ ---------------- ---------------

Private (286,742) (13) 38,006 (248,749)

-------------------------------------- ---------------------- ------------ ---------------- ---------------

Large Portfolio Companies (131,214) - (20,443) (151,657)

-------------------------------------- ---------------------- ------------ ---------------- ---------------

Retail (pharmacy) 38,944 - (56,073) (17,129)

-------------------------------------- ---------------------- ------------ ---------------- ---------------

Hospitals (195,794) - 67,221 (128,573)

-------------------------------------- ---------------------- ------------ ---------------- ---------------

Insurance (P&C and Medical) 25,636 - (31,591) (5,955)

-------------------------------------- ---------------------- ------------ ---------------- ---------------

Of which, P&C Insurance 31,862 - (22,914) 8,948

-------------------------------------- ---------------------- ------------ ---------------- ---------------

Of which, Medical Insurance (6,226) - (8,677) (14,903)

-------------------------------------- ---------------------- ------------ ---------------- ---------------

Investment Stage Portfolio Companies (32,150) - 25,130 (7,020)

-------------------------------------- ---------------------- ------------ ---------------- ---------------

Renewable Energy 30,591 - (24,591) 6,000

-------------------------------------- ---------------------- ------------ ---------------- ---------------

Education 37,273 - (9,245) 28,028

-------------------------------------- ---------------------- ------------ ---------------- ---------------

Clinics and Diagnostics (100,014) - 58,966 (41,048)

-------------------------------------- ---------------------- ------------ ---------------- ---------------

Other (123,378) (13) 33,319 (90,072)

-------------------------------------- ---------------------- ------------ ---------------- ---------------

Total portfolio (286,742) (13) 38,006 (295,360)

-------------------------------------- ---------------------- ------------ ---------------- ---------------

The enterprise value and equity value development of our

businesses in 9M 22 are summarised in the following table:

Enterprise Value Equity Value

(EV)

-------------------------- ------------------------------- --------------------------------------------

GEL '000, unless 30-Sep-22 31-Dec-21 Change 30-Sep-22 31-Dec-21 Change % share

otherwise noted % % in total

portfolio

-------------------------- ---------- ---------- ------- ---------- ---------- ------- -----------

Listed and Observable

portfolio 751,169 681,186 10.3% 26.3%

-------------------------- ---------- ---------- ------- ---------- ---------- ------- -----------

BoG 598,169 681,186 -12.2% 20.9%

-------------------------- ---------- ---------- ------- ---------- ---------- ------- -----------

Water Utility 153,000 - NMF 5.4%

-------------------------- ---------- ---------- ------- ---------- ---------- ------- -----------

Private portfolio 3,229,308 4,633,145 -30.3% 2,105,691 2,935,045 -28.3% 73.7%

-------------------------- ---------- ---------- ------- ---------- ---------- ------- -----------

Large portfolio

companies 1,810,508 3,126,186 -42.1% 1,364,056 2,249,260 -39.4% 47.7%

Retail (pharmacy) 923,623 952,269 -3.0% 677,238 710,385 -4.7% 23.7%

Hospitals 646,175 791,756 -18.4% 432,227 573,815 -24.7% 15.1%

Water Utility - 1,129,902 NMF - 696,960 NMF NMF

Insurance (P&C and

Medical) 240,710 252,259 -4.6% 254,591 268,100 -5.0% 8.9%

Of which, P&C Insurance 213,900 211,505 1.1% 213,900 211,505 1.1% 7.5%

Of which, Medical

Insurance 26,810 40,754 -34.2% 40,691 56,595 -28.1% 1.4%

-------------------------- ---------- ---------- ------- ---------- ---------- ------- -----------

Investment stage

portfolio companies 795,249 779,824 2.0% 454,580 461,140 -1.4% 15.9%

-------------------------- ---------- ---------- ------- ---------- ---------- ------- -----------

Renewable Energy 416,536 428,248 -2.7% 174,192 173,288 0.5% 6.1%

Education [23] 194,827 139,947 39.2% 163,432 129,848 25.9% 5.7%

Clinics and Diagnostics 183,886 211,629 -13.1% 116,956 158,004 -26.0% 4.1%

-------------------------- ---------- ---------- ------- ---------- ---------- ------- -----------

Other 623,551 727,135 -14.2% 287,055 224,645 27.8% 10.0%

-------------------------- ---------- ---------- ------- ---------- ---------- ------- -----------

Total portfolio 2,856,860 3,616,231 -21.0% 100.0%

-------------------------- ---------- ---------- ------- ---------- ---------- ------- -----------

2) Investments [24]

In 9M22, GCAP's cash investments amounted to GEL 14.4 million,

of which:

-- GEL 5.6 million was invested in the education business, in

line with GCAP's capital allocation outlook.

-- GEL 8.4 million was allocated to Housing Development for the bridge financing of business.

The investments presented in the 9M22 NAV statement also reflect

the following non-cash operations: a) the transfer of the remaining

20% equity interest in the water utility business to the listed and

observable portfolio (GEL 139.4 million) and b) the conversion of

loans issued predominantly to our beverages and real estate

businesses into equity (GEL 142.6 million).

3) Share buybacks

During 9M22, 2,855,592 shares were bought back for a total

consideration of GEL 68.8 million.

-- 603,251 shares were repurchased for the management trust.

-- 2,252,341 shares were repurchased under the US$ 25 million

share buyback and cancellation programme. The total value of shares

repurchased under the programme amounted to GEL 54.3 million (US$

18.1 million) in 9M22.

Since the commencement of the buyback programme in August 2021,

3,075,923 shares (6.4% of issued capital) have been repurchased and

cancelled. The total value of shares amounted to GEL 76.2 million

(US$ 25.0 million).

4) Dividends [25]

In 9M22, Georgia Capital collected GEL 66.4 million dividends in

aggregate from the portfolio companies, of which:

-- GEL 22.8 million was received from BoG,

-- GEL 16.0 million from Retail (Pharmacy),

-- GEL 13.0 million from Hospitals,

-- GEL 7.4 million from P&C Insurance,

-- GEL 6.2 million from Renewable Energy,

-- GEL 1.0 million from Medical Insurance.

Net Capital Commitment (NCC) overview

Below we describe the components of Net Capital Commitment (NCC)

as of 30 September 2022 and as of 30 June 2022. NCC represents an

aggregated view of all confirmed, agreed and expected capital

outflows at the GCAP HoldCo level.

Components of NCC 30-Sep-22 30-Jun-22 Change 31-Dec-21 Change

GEL '000, unless otherwise

noted

Cash at banks 147,010 359,262 -59.1% 132,580 10.9%

-------------------------------- ------------ ------------ ------- -------------- -------

Liquid funds 232,634 304,105 -23.5% 139,737 66.5%

-------------------------------- ------------ ------------ ------- -------------- -------

Of which, Internationally

listed debt securities 229,336 300,967 -23.8% 137,215 67.1%

-------------------------------- ------------ ------------ ------- -------------- -------

Of which, Locally listed

debt securities 3,298 3,138 5.1% 2,522 30.8%

-------------------------------- ------------ ------------ ------- -------------- -------

Total cash and liquid

funds 379,644 663,367 -42.8% 272,317 39.4%

-------------------------------- ------------ ------------ ------- -------------- -------

Loans issued [26] 253,284 25,374 NMF 21,540 NMF

-------------------------------- ------------ ------------ ------- -------------- -------

Accrued dividend income - 22,798 NMF - NMF

-------------------------------- ------------ ------------ ------- -------------- -------

Gross debt (1,028,990) (1,077,453) -4.5% (1,137,605) -9.5%

-------------------------------- ------------ ------------ ------- -------------- -------

Net debt (1) (396,062) (365,914) 8.2% (843,748) -53.1%

-------------------------------- ------------ ------------ ------- -------------- -------

Guarantees issued (2) (17,588) (45,615) -61.4% (55,297) -68.2%

-------------------------------- ------------ ------------ ------- -------------- -------

Net debt and guarantees

issued (3)=(1)+(2) (413,650) (411,529) 0.5% (899,045) -54.0%

-------------------------------- ------------ ------------ ------- -------------- -------

Planned investments (5) (149,195) (158,675) -6.0% (131,933) 13.1%

-------------------------------- ------------ ------------ ------- -------------- -------

of which, planned investments

in Renewable Energy (85,208) (88,024) -3.2% (101,834) -16.3%

-------------------------------- ------------ ------------ ------- -------------- -------

of which, planned investments

in Education (63,987) (70,651) -9.4% (30,099) NMF

-------------------------------- ------------ ------------ ------- -------------- -------

Announced Buybacks (6) - (12,597) NMF (9,330) NMF

-------------------------------- ------------ ------------ ------- -------------- -------

Contingency/liquidity

buffer (7) (141,760) (146,444) -3.2% (154,880) -8.5%

-------------------------------- ------------ ------------ ------- -------------- -------

Total planned investments,

announced buybacks and

contingency/liquidity buffer

(8)=(5)+(6)+(7) (290,955) (317,716) -8.4% (296,143) -1.8%

-------------------------------- ------------ ------------ ------- -------------- -------

Net capital commitment (704,60

(3)+(8) 5 ) (729,245) -3.4% (1,195,188) -41.0%

2,885,210

Portfolio value [27] 2,705,413 6.6% 3,748,905(26) -23.0%

-2.6 -7.5

NCC ratio 24.4% 27.0% ppts 31.9% ppts

-------------------------------- ------------ ------------ ------- -------------- -------

Cash and liquid funds . Total cash and liquid funds' balance was

down by 42.8% to GEL 379.6 million (US$ 133.9 million) in 3Q22. The

decrease was mainly driven by a) GEL 234.4 million in issued loans,

b) a GEL 32.0 million coupon payment in 3Q22, c) a GEL 16.7 million

cash outflow for buybacks, d) GEL 12.8 million capital allocations

and e) GEL's appreciation in 3Q22, as more than 90% of the cash and

liquid funds were denominated in foreign currencies. The decrease

was partially offset by the dividend and interest receipts of GEL

54.8 and GEL 6.5 million in 3Q22, respectively.

Internationally listed debt securities balance includes

dollar-denominated Eurobonds issued by Georgian corporates to

generate yield on GCAP's liquid funds. As at 30-Sep-22, the balance

amounted to GEL 229.3 million, of which GEL 185.2 million (US$ 65.3

million) was allocated to GCAP's Eurobond.

In 9M22, total cash and liquid funds' balance was up 39.4% in

9M22, reflecting a) the receipt of GEL 526.7 million (US$ 173

million) cash proceeds (net of transaction fees) in 1Q22 from the

disposal of an 80% equity interest in the water utility business,

b) dividend and interest receipts of GEL 66.4 million and GEL 20.1

million, respectively. The increase was partially offset by a) GEL

248.7 million loans issued to our private portfolio companies, b)

GEL 70.0 million coupon payment and c) GEL 74.8 million cash

outflow for buybacks.

Loans issued(26) . Issued loans' balance primarily refers to

loans issued to our private portfolio companies and are lent at

market terms. The increase in issued loans' balance both in 3Q22

and 9M22 reflects US$ 90 million (GEL 261.3 million) financing

provided to the renewable energy business to redeem the renewable

energy business's portion of GGU's US$ 250.0 million Green Eurobond

in September 2022. Out of US$ 90 million, a US$ 80 million

shareholder loan from GCAP was repaid by the business in October

2022 from the proceeds of a US$ 80 million green secured bond

placement on the local market. The remaining US$ 10 million (GEL

28.4 million), which is currently presented under the net other

assets/ (liabilities) balance on our 3Q22 NAV statement, is

intended to be converted into a quasi-equity type instrument in

4Q22.

Gross debt. At 30-Sep-22 the outstanding balance of US$ 365

million six-year Eurobonds due in March 2024 was GEL 1,029.0

million, down 4.5% in 3Q22 and down 9.5% in 9M22, reflecting the

GEL's appreciation against US$. As a result of the Modified Dutch

Auction, completed in October 2022, and the subsequent cancellation

of the US$ 65 million GCAP Eurobond, as described earlier in this

report, the outstanding balance of GCAP's Eurobonds decreased to

US$ 300 million in 4Q22.

Guarantees issued. The balance reflects GCAP's guarantee on the

borrowing of the beer business. Due to the recent strong operating

performance of the business, GCAP's guarantee decreased by EUR 8.4

million to EUR 6.4 million in 3Q22.

Planned investments. Planned investments' balance represents

expected investments in renewable energy and education businesses

over the next 2-3 years. The balance was down by 6.0% due to the

investments in the education business in 3Q22 as well as GEL's

appreciation during the quarter.

Announced buybacks . The decrease in the announced buybacks'

balance reflects the completion of the US$ 25 million share buyback

and cancellation programme, as described on pages 7 and 9.

Contingency/liquidity buffer. The balance reflects the cash and

liquid assets in the amount of US$ 50 million, held by GCAP at all

times, for contingency/liquidity purposes. The balance remained

unchanged in US$ terms as at 30-Sep-22.

As a result of the movements described above, NCC was down by

3.4% to GEL 704.6 million (US$ 248.5 million), translating into a

24.4% NCC ratio as at 30-Sep-22 (down by 2.6 ppts q-o-q).

Calculated on a pro-forma basis to reflect the subsequent

movements in BoG's share price and foreign exchange rates, as well

as the results of the Modified Dutch Auction, conducted in Oct-22,

the NCC ratio was down to 22.2% as of 30-Sep-22.

INCOME STATEMENT (ADJUSTED IFRS / APM)

Net income under IFRS was GEL 164.5 million in 3Q22 (GEL 234.5

million net income in 3Q21). Net loss was GEL 344.6 million in 9M22

(GEL 559.7 million net income in 9M21). The IFRS income statement

is prepared on the Georgia Capital PLC level and the results of all

operations of the Georgian holding company JSC Georgia Capital are

presented as one line item. As we conduct almost all of our

operations through JSC Georgia Capital, through which we hold all

of our portfolio companies, the IFRS results provide little

transparency on the underlying trends.

Accordingly, to enable a more granular analysis of those trends,

the following adjusted income statement presents the Group's

results of operations for the period ending September 30 as an

aggregation of (i) the results of GCAP (the two holding companies

Georgia Capital PLC and JSC Georgia Capital, taken together) and

(ii) the fair value change in the value of portfolio companies

during the reporting period. For details on the methodology

underlying the preparation of the adjusted income statement, please

refer to page 98 in Georgia Capital PLC 2021 Annual report.

INCOME STATEMENT (Adjusted IFRS/APM)

GEL '000, unless otherwise

noted 3 Q22 3 Q21 Change 9M 22 9M 21 Change

================================ ========= ========= ======= ========== ========= =======

Dividend income 32,019 30,000 6.7% 66,440 44,430 49.5%

================================ ========= ========= ======= ========== ========= =======

Interest income 8,165 6,267 30.3% 26,315 16,884 55.9%

================================ ========= ========= ======= ========== ========= =======

Realised / unrealised

(loss)/gain on liquid

funds (1,719) (547) NMF (13,154) 967 NMF

================================ ========= ========= ======= ========== ========= =======

Interest expense (16,573) (19,519) -15.1% (54,253) (57,039) -4.9%

================================ ========= ========= ======= ========== ========= =======

Gross operating income 21,892 16,201 35.1% 25,348 5,242 NMF

================================ ========= ========= ======= ========== ========= =======

Operating expenses (9,821) (8,888) 10.5% (29,521) (26,984) 9.4%

================================ ========= ========= ======= ========== ========= =======

GCAP net operating

income/(loss) 12,071 7,313 65.1% (4,173) (21,742) -80.8%

================================ ========= ========= ======= ========== ========= =======

Fair value changes

of portfolio companies

================================ ========= ========= ======= ========== ========= =======

Listed and Observable

Portfolio Companies 142,450 66,246 NMF (69,409) 110,082 NMF

================================ ========= ========= ======= ========== ========= =======

Of which, Bank of Georgia

Group PLC 142,450 66,246 NMF (83,017) 110,082 NMF

================================ ========= ========= ======= ========== ========= =======

Of which, Water Utility - - NMF 13,608 - NMF

================================ ========= ========= ======= ========== ========= =======

Private Portfolio companies (4,563) 148,385 NMF (292,391) 430,568 NMF

================================ ========= ========= ======= ========== ========= =======

Large Portfolio Companies (25,137) 152,482 NMF (189,065) 354,337 NMF

================================ ========= ========= ======= ========== ========= =======

Of which, Retail (pharmacy) 6,211 37,224 -83.3% (33,147) 64,881 NMF

================================ ========= ========= ======= ========== ========= =======

Of which, Hospitals (45,819) 30,371 NMF (141,588) 121,260 NMF

================================ ========= ========= ======= ========== ========= =======

Of which, Water Utility - 71,260 NMF - 147,357 NMF

================================ ========= ========= ======= ========== ========= =======

Of which, Insurance

(P&C and Medical) 14,471 13,627 6.2% (14,330) 20,839 NMF

================================ ========= ========= ======= ========== ========= =======

Investment Stage Portfolio

Companies 5,965 (6,818) NMF (13,254) 47,297 NMF

================================ ========= ========= ======= ========== ========= =======

Of which, Renewable

energy 1,768 (13,000) NMF (234) (5,368) -95.6%

================================ ========= ========= ======= ========== ========= =======

Of which, Education 7,287 (1,595) NMF 28,028 21,612 29.7%

================================ ========= ========= ======= ========== ========= =======

Of which, Clinics and

Diagnostics (3,090) 7,777 NMF (41,048) 31,053 NMF

================================ ========= ========= ======= ========== ========= =======

Other businesses 14,609 2,721 NMF (90,072) 28,934 NMF

================================ ========= ========= ======= ========== ========= =======

Total investment return 137,887 214,631 -35.8% (361,800) 540,650 NMF

================================ ========= ========= ======= ========== ========= =======

Income/(loss) before

foreign exchange movements

and non-recurring expenses 149,958 221,944 -32.4% (365,973) 518,908 NMF

================================ ========= ========= ======= ========== ========= =======

Net foreign currency

gain 12,137 7,932 53.0% 26,585 34,485 -22.9%

================================ ========= ========= ======= ========== ========= =======

Non-recurring expenses (82) (27) NMF (278) (245) 13.5%

================================ ========= ========= ======= ========== ========= =======

Net income/(loss) 162,013 229,849 -29.5% (339,666) 553,148 NMF

================================ ========= ========= ======= ========== ========= =======

Gross operating income of GEL 21.9 million in 3Q22 reflects a

6.7% and 30.3% increase in dividend and interest income,

respectively, which was further supported by a decrease in interest

expenses due to GEL's y-o-y appreciation against US$. Gross

operating income of GEL 25.3 million in 9M22 also reflects

increased dividend and interest inflows, which was partially offset

by GEL 13.2 million realised and unrealised loss on liquid funds

held by GCAP - which was mostly unrealised due to the market

volatility driven by the regional geopolitical instability. The

significant interest income growth in 3Q22 and 9M22 was mainly due

to the increased average liquid funds balance in 2022.

GCAP earned an average yield of 3.7% on the average balance of

liquid assets of GEL 442.8 million in 9M22 (3.3% on GEL 242.5

million in 9M21).

The components of GCAP's operating expenses are shown in the

table below.

GCAP Operating Expenses Components

GEL '000, unless otherwise

noted 3Q22 3Q21 Change 9M22 9M21 Change

Administrative expenses

([28]) (2,693) (2,613) 3.1% (8,780) (8,453) 3.9%

Management expenses

- cash-based ([29]) (2,402) (2,484) -3.3% (7,266) (7,481) -2.9%

Management expenses

- share-based ([30]) (4,726) (3,791) 24.7% (13,475) (11,050) 21.9%

Total operating expenses (9,821) (8,888) 10.5% (29,521) (26,984) 9.4%

Of which, fund type

expense ([31]) (2,597) (2,947) -11.9% (8,681) (9,340) -7.1%

Of which, management

fee type expenses ([32]) (7,224) (5,941) 21.6% (20,840) (17,644) 18.1%

GCAP management fee expenses have a self-targeted cap of 2% of

Georgia Capital's market capitalisation. The LTM management fee

expense ratio was 3.18% at 30-Sep-22 (1.96% [33] as of 30-Sep-21).

The total LTM operating expense ratio (which includes fund type

expenses) was 4.57% at 30-Sep-22 (3.00%(33) at 30-Sep-21). The

increase in the LTM management fee expense ratio and the total LTM

operating expense ratio mainly reflects the movements in GCAP's

market capitalisation.

Total investment return represents the increase (decrease) in

the fair value of our portfolio. Total investment return was GEL

137.9 million in 3Q22, mainly reflecting the growth in the value of

our listed business. In 9M22, total investment return was negative

GEL 361.8 million reflecting the decrease in the value of listed

and private businesses, as described earlier in this report. We

discuss valuation drivers for our businesses on pages 5-7. The

performance of each of our private large and investment stage

portfolio companies is discussed on pages 14-24.

GCAP's net foreign currency liability balance amounted to c.US$

139 million (GEL 394 million) at 30-Sep-22. Net foreign currency

gain was GEL 12.1 million in 3 Q22 and GEL 26.6 million in 9M22. As

a result of the movements described above, GCAP's adjusted IFRS net

income was GEL 162.0 million in 3Q22 (GEL 339.7 million net loss in

9M22).

DISCUSSION OF PORTFOLIO COMPANIES' RESULTS (STAND-ALONE

IFRS)

The following sections present the IFRS results and business

development extracted from the individual portfolio company's IFRS

accounts for large and investment stage entities, where 3Q22, 9M22,

3Q21 and 9M21 portfolio company's accounts and respective IFRS

numbers are unaudited. We present key IFRS financial highlights,

operating metrics and ratios along with the commentary explaining

the developments behind the numbers. For the majority of our

portfolio companies the fair value of our equity investment is

determined by the application of an income approach (DCF) and a

market approach (listed peer multiples and precedent transactions).

Under the discounted cash flow (DCF) valuation method, fair value

is estimated by deriving the present value of the business using

reasonable assumptions of expected future cash flows and the

terminal value, and the appropriate risk-adjusted discount rate

that quantifies the risk inherent to the business. Under the market

approach, listed peer group earnings multiples are applied to the

trailing twelve months (LTM) stand-alone IFRS earnings of the

relevant business. As such, the stand-alone IFRS results and

developments driving the IFRS earnings of our portfolio companies

are key drivers of their valuations within GCAP's financial

statements. See "Basis of Presentation" on page 26 for more

background.

LARGE PORTFOLIO COMPANIES

Discussion of Retail (pharmacy) Business Results

The retail (pharmacy) business, where GCAP owns a 77% equity

interest through GHG [34] , is the largest pharmaceuticals retailer

and wholesaler in Georgia, with a 35 % market share by revenue. The

business consists of a retail pharmacy chain and a wholesale

business that sells pharmaceuticals and medical supplies to

hospitals and other pharmacies. The business operates a total of

368 pharmacies (of which 359 are in Georgia and 9 are in Armenia)

and 10 franchise stores.

3Q22 & 9M22 performance (GEL '000), Retail (pharmacy)

[35]

INCOME STATEMENT HIGHLIGHTS 3Q22 3Q21 Change 9M22 9M21 Change

Revenue, net 189,809 193,317 -1.8% 580,711 566,134 2.6%

Of which, retail 148,398 145,129 2.3% 453,015 415,581 9.0%

Of which, wholesale 41,411 48,188 -14.1% 127,696 150,553 -15.2%

Gross Profit 56,461 53,035 6.5% 171,303 143,207 19.6%

Gross profit margin 29.7% 27.4% 2.3ppts 29.5% 25.3% 4.2ppts

Operating expenses (ex. (38,40 (114,7

IFRS 16) 3 ) (32,541) 18.0% 79 ) (89,476) 28.3%

18,05 56,5

EBITDA (ex. IFRS 16) 8 20,494 -11.9% 24 53,731 5.2%

EBITDA margin, (ex.

IFRS 16) 9.5% 10.6% -1.1ppts 9.7% 9.5% 0.2ppts

Net profit (ex. IFRS 14,68 51,

16) 3 17,728 -17.2% 205 47,278 8.3%

CASH FLOW HIGHLIGHTS

Cash flow from operating

activities (ex. IFRS

16) 19,268 26,182 -26.4% 54,480 39,733 37.1%

EBITDA to cash conversion 106.7% 127.8% -21.1ppts 96.4% 73.9% 22.5ppts

Cash flow used in investing

activities [36] (8,887) (7,736) 14.9% (54,558) (13,363) NMF

Free cash flow, (ex.

IFRS 16) [37] 15,822 22,398 -29.4% (3,921) 29,067 NMF

Cash flow used in financing

activities (ex. IFRS

16) (5,059) (9,349) -45.9% 10,107 (25,670) NMF

BALANCE SHEET HIGHLIGHTS 30-Sep-22 30-Jun-22 Change 31-Dec-21 Change

Total assets 545,461 532,014 2.5% 522,814 4.3%

Of which, cash and bank

deposits 63,273 58,230 8.7% 54,616 15.9%

Of which, securities

and loans issued 21,526 14,464 48.8% 20,922 2.9%

Total liabilities 496,415 480,294 3.4% 497,954 -0.3%

Of which, borrowings 131,124 116,126 12.9% 89,844 45.9%

Of which, lease liabilities 107,110 111,051 -3.5% 104,613 2.4%

Total equity 49,046 51,720 -5.2% 24,860 97.3%

INCOME STATEMENT HIGHLIGHTS

Ø 3 Q22 total revenue (down 1.8%) reflects the recalibration of

product prices due to the GEL's appreciation against the basket of

foreign currencies (the FX effect is directly transmitted into the

pricing as c.70% of the inventory purchases are denominated in

foreign currencies).

Ø The 14.1% decline in the wholesale business line in 3Q22 was

due to the continuing gradual transfer of the hospitals business'

procurement department from pharma to hospitals (which began in

January 2021 and is expected to complete by the end of 2022). This

also translated into a reduction in revenue from wholesale in

9M22.

Ø The growth in retail revenues in both 3Q22 and 9M22 reflects

a) continued expansion of the pharmacy chain and franchise stores,

b) improvement in the economic activities, partially offset by c)

the recalibration of product prices.

o Retail revenue share in total revenue was 78.2% in 3Q22 and

78.0% in 9M22 (75.1% in 3Q21 and 73.4% in 9M21).

o Revenue from para-pharmacy, as a percentage of retail revenue,

was 37.4% in 3Q22 and 35.7% in 9M22 (35.8% in 3Q21 and 34.7% in

9M21).

Ø Robust gross profit margins of 29.7% and 29.5% in 3Q22 and

9M22, respectively (up 2.3 ppts and 4.2 ppts y-o-y, respectively),

reflect the increased sales of high-margin para-pharmacy products

in the retail business line, as well as focus on growing profitable

parts of the wholesale business line, notwithstanding the y-o-y

revenue reduction.

o Gross margin growth was supported by increased marketing

activities as well as the strong economic recovery compared to

2021, when due to the increased competition and the general macro

backdrop business margins were subdued.

Ø Negative operating leverage (operating expenses up 18.0% in

3Q22 and up 28.3% in 9M22) reflects increases in salary and utility

expenditures associated with the openings of new pharmacies and

franchise stores in Azerbaijan and Armenia. 9M22 salary expense

growth also reflects the base effect impact of the state income tax

subsidy for low-salary range employees which was in effect in 1H21

(the subsidy was in place from May 2020 - June 2021).

Ø EBITDA margin stood at 9.5% in 3Q22 (down 1.1 ppts y-o-y) and

9.7% in 9M22 (up 0.2 ppts y-o-y). Excluding the impact of the state

income tax subsidy in 2021, the EBITDA margin (excl. IFRS 16) was

up 0.7 ppts in 9M22, y-o-y.

Ø Interest expense was down 64.3% in 3Q22 and down 47.1% in 9M22

y-o-y, due to the lower average net debt balance (excl. IFRS 16)

during respective periods.

Ø Overall, the business posted GEL 14.7 million net profit

excluding IFRS 16 in 3Q22 and GEL 51.2 million in 9M22, which also

reflects one-off costs associated with the termination of contracts