TIDMCTEA

RNS Number : 2322B

Catenae Innovation PLC

30 September 2022

30 September 2022

Catenae Innovation PLC

("Catenae", the "Company" or the "Group")

Half Year Results

Convertible Loan

Catenae Innovation PLC (AIM: CTEA), the AIM quoted provider of

digital media and technology, announces its half-yearly report for

the six months ended 31 March 2022.

Financial overview

-- Loss of GBP287,168 in the period under review (2021:

GBP586,798) with revenues of GBP17,500 (2021: GBP12,308).

-- Net asset position GBP110,033 (2021: GBP1,035,493).

Operational overview

-- In January 2022, the Company completed the ISO 27001

accreditation audit on behalf of the International Standards

Organisation (ISO), ensuring that the Company retained its

accreditation.

-- In March 2022, the Company secured the renewal of the

Charlton Athletic Community Trust 'On Side' licence and support

agreement with a contract value of GBP37,500 to be paid over the

next three years. The Company received an additional GBP1,000

upfront payment for the migration to a new server.

-- The Company continued its participation with the UK

Government's Department for Digital, Culture, Media and Sport

("DCMS") in the development of the Digital Identity and Trust

Attributes Framework Policy.

-- The Company also promoted itself at Construction Industry

events in London and Birmingham, focusing on its digital identity

solutions.

Post period end

-- In May 2022, the Company secured a c.GBP95,000 Digital

Technology Solution purchase order with Saxavord UK Space Port. It

is anticipated that c.GBP66,400 of this purchase order will be

recognised as revenue in the second half of the current financial

year.

Convertible Loan

The Company also announces that, post period end, it has entered

into an agreement for a convertible loan facility for up to

GBP250,000 ("Convertible Loan") with Sanderson Capital Partners

Limited ("Sanderson Capital"), which will consist of an initial

drawdown of GBP125,000 followed by a further drawdown expected

three months thereafter.

At each drawdown, the Company will issue new ordinary shares to

Sanderson Capital equal to 10 percent of the drawdown value at an

issue price of the 10-day volume weighted average price prior to

the date of drawdown. A further announcement will be made on the

date of each drawdown event.

Sanderson Capital will be able to convert part or all of the

Convertible Loan facility in minimum increments of GBP5,000, with

the conversion price being fixed at the lower of i) 0.25p; or ii)

90% of the 5-day volume weighted average price from the first day

of dealings of the Company's restoration to trading on AIM. The

Convertible Loan facility is interest-free.

As part of the Convertible Loan facility agreement, Sanderson

Capital will be issued new ordinary shares and a warrant over new

ordinary shares in the Company, of which the issue price and

exercise price will be the closing mid-price of the Company's

ordinary shares on the first day of dealings following the lifting

of the suspension and restoration to trading of the Company's

ordinary shares on AIM.

The new ordinary shares and warrant over new ordinary shares

will be issued after the next general meeting of the Company and a

further announcement setting out the details will be made at the

time of issue.

Guy Meyer, Chief Executive Officer of Catenae, said:

"Given the challenging trading conditions as a result of the

Covid-19 pandemic and market uncertainty, the Company has been very

prudent with our resources and has focused on securing contract

wins.

" Our acquisition of Hyperneph has proved disappointing, but the

board remains optimistic about the prospects of recouping monies

committed as a result of that transaction.

"Catenae's ongoing consultation with DCMS in the development of

the Digital Identity and Trust Attributes Framework Policy reflects

the Company's standing in the sector. Our investment in software IP

development also contributes to the future-proofing of our

competitive product set offerings, not just within the Geo-spatial

sector.

"We look forward to keeping the market updated on how these

opportunities progress."

This announcement contains inside information for the purposes

of the UK Market Abuse Regulation. The person who arranged for

release of this announcement on behalf of the Company was Guy

Meyer, Chief Executive Officer of the Company and the Directors of

the Company are responsible for the release of this

announcement.

For further information please contact:

+44 (0)191 580

Catenae Innovation PLC 8545

Guy Meyer, Chief Executive Officer

Cairn Financial Advisers LLP (Nominated Adviser) +44(0)20 7213 0880

Liam Murray / Jo Turner

+44 (0)20 7186

Shard Capital Partners LLP (Broker) 9952

Damon Heath

+44 (0)20 3004

Yellow Jersey PR (PR & IR) 9512

Sarah Hollins / James Lingfield

Notes to Editors:

About Catenae Innovation PLC

Catenae Innovation is an AIM quoted provider of digital media

and technology services. The Company specialises in Distributed

Ledger Technology solutions that solve commercial challenges and

create opportunities for its clients. The Company has an

experienced IT team of project managers and integrators who have

deployed systems across corporate, government and educational

sectors.

www.catenaeinnovation.com

Consolidated Statement of Comprehensive Income

For the Period Ended 31 March 2022

Unaudited Unaudited Audited

six months ended six months year

31 March ended ended

2022 31 March 30 Sept

2021 2021

GBP

GBP GBP

Revenue 17,500 12,308 30,210

Cost of sales (6,000) - (14,400)

------------------ ------------ --------------

Gross profit 11,500 12,308 15,810

Administrative expenses (298,668) (599,116) (939,027)

Impairment losses - - (318,629)

Loss from operations (287,168) (586,808) (1,241,846)

Net Finance income/(expense) - 10 (10)

Loss before taxation (287,168) (586,798) (1,241,836)

Taxation - - (5,112)

------------------ ------------ --------------

Total comprehensive loss for the year (287,168) (586,798) (1,246,948)

------------------ ------------ --------------

Loss attributable to:

Owners of the parent (280,260) - (1,257,149)

Non-controlling interest (6,908) - 10,201

Consolidated Statement of Financial Position

For the Period Ended 31 March 2022

Unaudited Unaudited Audited

six months six months year

ended ended ended

31 March 31 March 30 Sept

2022 2021 2021

GBP GBP GBP

Non-current assets

Tangible Assets 6,518 - 6,828

Intangible assets 1 1 1

6,519 1 6,829

Current assets

Trade and other receivables 30,514 47,475 45,236

Cash and cash equivalents 337,183 1,254,445 605,082

------------- ------------- -------------

367,697 1,301,920 650,318

Current liabilities

Trade and other payables (264,183) (248,428) (275,221)

(264,183) (248,428) (275,221)

Non-current liabilities

Interest-bearing loans - (18,000) -

Total Liabilities (264,183) (266,428) (275,221)

Net Assets/(Liabilities) 110,033 1,035,493 381,926

------------- ------------- -------------

Non-controlling Interest 4,610 - 11,518

Capital and reserves

attributable to equity

holders of the company

Ordinary share capital 570,078 551,773 562,441

Deferred share capital 3,159,130 3,159,130 3,159,130

Share premium account 19,665,458 19,663,223 19,657,821

Share reserve (83,333) (83,333) (83,333)

Merger reserve 11,119,585 11,119,585 11,119,585

Capital Redemption Reserve 2,732,904 2,732,904 2,732,904

Retained losses (37,058,399) (36,107,789) (36,778,140)

------------- ------------- -------------

Total Equity 110,033 1,035,493 381,926

------------- ------------- -------------

Consolidated Statement of Cash Flows

For the Period Ended 31 March 2022

Unaudited Unaudited Audited

six months six months year

ended ended ended

31 March 31 March 30 Sept

2022 2021 2021

GBP GBP GBP

Loss for the period (287,168) (586,798) (1,246,948)

Adjustments for :

Impairment of investments - - 318,629

Net bank and other interest

(income) / charges - (10) (10)

Issue of share options - - -

/ warrant charge

Services settled by the

issue of shares - 48,000 72,704

Net (loss) before changes

in working capital (287,168) (538,808) (855,625)

(Increase) / decrease in

trade and other receivables 15,034 (34,766) (24,633)

(Decrease) / increase in

trade and other

payables (11,038) (5,898) (112,896)

------------ ------------ --------------

Cash from operations (283,172) (579,472) (993,154)

Interest received - 10 10

Interest paid - - -

Net cash flows from operating

activities (283,172) (579,462) (993,144)

------------ ------------ --------------

Investing activities

Investment in subsidiary - - 217,500

------------ ------------ --------------

Net cash flows from investing

activities - - (217,500)

------------ ------------ --------------

Financing Activities

Issue of ordinary share

capital 15,273 1,119,864 1,119,683

Repayment of loans - - (18,000)

New loans raised - - -

------------ ------------ --------------

Net cash flows from financing

activities 15,273 1,119,864 1,101,683

------------ ------------ --------------

Net increase / (decrease)

in cash (267,899) 540,402 (108,961)

Cash and cash equivalents

at beginning of period 605,082 714,043 714,043

Cash and cash equivalents

at end of period 337,183 1,254,445 605,082

------------ ------------ --------------

Company Statement of Financial Position

For the Period Ended 31 March 2022

Unaudited Unaudited Audited

six months six months year

ended ended ended

31 March 31 March 30 Sept

2022 2021 2021

GBP

GBP GBP

Non-current assets

Intangible assets 1 1 1

1 1 1

Current assets

Trade and other receivables 24,242 47,475 45,237

Cash and cash equivalents 332,209 1,254,445 539,842

------------- ------------- -------------

356,451 1,301,920 585,079

Current liabilities

Trade and other payables (255,828) (248,428) (226,660)

(255,828) (248,428) (226,660)

Non-current liabilities

Interest-bearing loans - (18,000) -

Total Liabilities (255,828) (266,428) (226,660)

Net Assets/(Liabilities) 100,624 1,035,493 358,420

------------- ------------- -------------

Capital and reserves

attributable to equity

holders of the company

Ordinary share capital 570,078 551,773 562,441

Deferred share capital 3,159,130 3,159,130 3,159,130

Share premium account 19,665,457 19,663,223 19,657,821

Share reserve (83,333) (83,333) (83,333)

Merger reserve 11,119,585 11,119,585 11,119,585

Capital Redemption Reserve 2,732,904 2,732,904 2,732,904

Retained losses (37,063,197) (36,107,789) (36,790,128)

------------- ------------- -------------

Total Equity 100,624 1,035,493 358,420

------------- ------------- -------------

Company Statement of Cash Flows

For the Period Ended 31 March 2022

Unaudited Unaudited Audited

six months six months year

ended ended ended

31 March 31 March 30 Sept

2022 2021 2021

GBP

GBP GBP

Loss for the period (273,069) (586,798) (1,269,137)

Adjustments for :

Impairment of investment 320,000

Net bank and other interest

(income) / charges - (10) (10)

Issue of share options - - -

/ warrant charge

Services settled by the

issue of shares - 48,000 72,704

Net (loss) before changes

in working capital (273,069) (538,808) (876,443)

(Increase) / decrease in

trade and other receivables 20,995 (34,766) (24,633)

(Decrease) / increase in

trade and other

payables 29,168 (5,898) (157,318)

------------ ------------ --------------

Cash from operations (222,906) (579,472) (1,058,394)

Interest received - 10 10

Interest paid - - -

Net cash flows from operating

activities (222,906) (579,462) (1,058,384)

------------ ------------ --------------

Investing activities

Investment in subsidiary - - (217,500)

------------ ------------ --------------

Net cash flows from investing

activities - - (217,500)

------------ ------------ --------------

Financing Activities

Issue of ordinary share

capital 15,273 1,119,864 1,119,683

Repayment of loans - - (18,000)

New loans raised - - -

------------ ------------ --------------

Net cash flows from financing

activities 15,273 1,119,864 1,101,683

------------ ------------ --------------

Net increase / (decrease)

in cash (207,633) 540,402 (174,201)

Cash and cash equivalents

at beginning of period 539,842 714,043 714,043

Cash and cash equivalents

at end of period 332,209 1,254,445 539,842

------------ ------------ --------------

Caution regarding forward looking statements

Certain statements in this announcement, are, or may be deemed

to be, forward looking statements. Forward looking statements are

identi ed by their use of terms and phrases such as "believe",

"could", "should" "envisage", "estimate", "intend", "may", "plan",

"potentially", "expect", "will" or the negative of those,

variations or comparable expressions, including references to

assumptions. These forward looking statements are not based on

historical facts but rather on the Directors' current expectations

and assumptions regarding the Company's future growth, results of

operations, performance, future capital and other expenditures

(including the amount, nature and sources of funding thereof),

competitive advantages, business prospects and opportunities. Such

forward looking statements re ect the Directors' current beliefs

and assumptions and are based on information currently available to

the Directors.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR EKLFLLKLEBBE

(END) Dow Jones Newswires

September 30, 2022 02:00 ET (06:00 GMT)

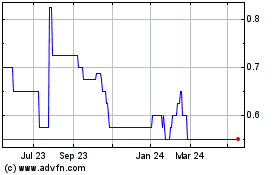

Catenae Innovation (LSE:CTEA)

Historical Stock Chart

From Oct 2024 to Nov 2024

Catenae Innovation (LSE:CTEA)

Historical Stock Chart

From Nov 2023 to Nov 2024