TIDMCTEA

RNS Number : 9093Z

Catenae Innovation PLC

17 January 2024

Catenae Innovation PLC

("Catenae", the "Company" or the "Group")

Further re: Convertible Loan

Notice of Annual General Meeting

Proposed Change of Name

Proposed Share Capital Reorganisation

Catenae Innovation PLC (AIM: CTEA), the AIM quoted provider of

digital media and technology, announces an update on its

convertible loan funding and posting of a circular to shareholders

convening an annual general meeting providing details, inter alia,

of a proposed change of name to Catenai plc, proposed capital

organisation and increase of authorisation to issue shares on a non

pre-emptive basis, which will require the approval of

shareholders.

Convertible Loan Update

Further to the announcement on 30 September 2022, the Company

has renewed its GBP250,000 convertible loan note facility

("Convertible Loan" or "Facility") with Sanderson Capital Partners

Limited ("Sanderson Capital") for a further 12 months (to January

2025). To date, the Company has drawn down GBP131,000 of the

Facility, being GBP81,000 under the previous Facility and GBP50,000

under the renewed Facility.

Pursuant to the Facility, the Company will issue Sanderson

Capital GBP50,000 worth of new ordinary shares in the Company at a

price of the lower of the closing middle price on the 15 January

2024 or the price of the next fundraise ("Facility Price").

The drawdown of GBP81,000 under the previous agreement is

carried forward and the Company will pay 10% of this amount in new

ordinary shares at the Facility Price as a drawdown fee.

Sanderson Capital will also receive warrants equalling one-half

option on the total amount to be drawn down on the Facility (i.e

GBP125,000 worth of warrants). The warrants will be exercisable for

36 months from the date of issue with an exercise price equal to

the Facility Price ("Warrants").

The Company has the right to buy-back any outstanding drawdown

amount at any time ("Buy-Back Right") with a 5% penalty fee. Should

the Company exercise its Buy-Back Right, it will pay Sanderson

Capital 105% of the amount it is buying back and Sanderson Capital

will then have the option to convert up to 60% of the drawdown

amount the Company is buying back into shares in the Company at a

conversion price of the lower of the closing middle price on 15

January 2024(4) , 90% of the 5-day volume weighted average price

prior to conversion or the price of the next fundraise.

The share and warrant issuances to Sanderson Capital detailed

above are subject to the Board receiving shareholder approval at

the Company's forthcoming Annual General Meeting and will be issued

to Sanderson Capital such that Sanderson Capital do not hold more

than 29.9% of the Company's issued share capital.

Notice of Annual General Meeting

The Company also announces that its Annual General Meeting

("AGM") will be held on 9 February 2024 at 12pm at the offices of

RWK Goodman LLP at 69 Carter Lane, London, EC4V 5EQ. The Company

has posted a circular (the "Circular") and a notice convening the

AGM.

The Circular includes, inter alia, details of both a proposed

name change to Catenai plc and a proposed share capital

reorganisation ("Share Capital Reorganisation"). A form of proxy

will accompany the Circular.

A copy of the Circular will shortly be available to download

from the Company's website at:

https://www.catenaeinnovation.com/investors/financial-reports

The text from the Chairman's letter as well as the definitions

are set out in Appendix I.

Electronic Communication Consent Request Letter

Going forward the Company intends to supply all notices,

documents and information ("Documents and Information") to

shareholders via electronic means, including a designated

shareholder portal operated by its Registrar (through which

shareholders' will also be able to vote at general meetings). The

Directors believe that increased use of electronic communications

will deliver significant savings to the Company in terms of

administration, printing and postage costs, as well as speeding up

the provision of information to shareholders. The reduced use of

paper will also have environmental benefits. To allow the Company

to supply Documents and Information to shareholders via electronic

means, the Company has sent to all shareholders a letter requesting

consent to electronic communication. A copy of the letter will be

available on the Company's website shortly.

EXPECTED TIMETABLE OF PRINCIPAL EVENTS

2024

Latest time and date for receipt 12:00pm on 7 February

of the Forms of Proxy

Annual General Meeting 12:00pm on 9 February

Latest date for dealings in Existing 9 February

Ordinary Shares

Record Date 7pm on 6 February

Admission effective and commencement 12 February

of dealings in the New Ordinary

Shares

CREST accounts credited with 12 February

the New Ordinary Shares in uncertificated

form

Despatch of definitive certificates 14 February

for New Ordinary Shares (in certificated

form)

Notes:

(1) References to times in the above are to London time (unless

otherwise stated).

(2) The dates set out in the timetable above may be subject to

change.

(3) If any of the above times or dates should change, the

revised times and/or dates will be notified by an announcement to a

regulatory information service.

STATISTICS**

Conversion ratio of Existing Ordinary Five Existing Ordinary

Shares to Consolidated Shares Shares : one Consolidated

Share

Number of Existing Ordinary Shares in

issue at the date of this Document 285,038,925*

Total expected number of New Ordinary

Shares in issue following the Capital

Reorganisation 57,007,785

Total expected number of New Deferred

Shares in issue following the Capital

Reorganisation 57,007,785

*Based on the register of members of the Company as at close of

business on 16 January 2024.

**In addition, there are 83,333,332 ordinary shares of 0.1p each

held in the Company's share reserve as disclosed in the Company's

annual accounts for the period ended 31 December 2022.

The Company will be applying for a new ISIN and SEDOL codes,

which will be notified by way of a regulatory news

announcement.

The Company continues to carefully manage its working capital

position.

This announcement contains inside information for the purposes

of the UK Market Abuse Regulation. The person who arranged for

release of this announcement on behalf of the Company was Guy

Meyer, Chief Executive Officer of the Company and the Directors of

the Company are responsible for the release of this

announcement.

For further information please contact:

+44 (0)191 580

Catenae Innovation PLC 8545

Guy Meyer, Chief Executive Officer

Cairn Financial Advisers LLP (Nominated Adviser) +44(0)20 7213 0880

Liam Murray / Jo Turner

+44 (0)20 7186

Shard Capital Partners LLP (Broker) 9952

Damon Heath

Notes to Editors:

About Catenae Innovation PLC

Catenae Innovation is an AIM quoted provider of digital media

and technology services. The Company specialises in Distributed

Ledger Technology solutions that solve commercial challenges and

create opportunities for its clients. The Company has an

experienced IT team of project managers and integrators who have

deployed systems across corporate, government and educational

sectors.

www.catenaeinnovation.com

Appendix I

1. Introduction

As announced on 4 December 2023, the Company settled its legal

dispute in relation to Hyperneph Software Limited and can now look

forward to the year ahead, to continuing to grow existing revenue

streams and also to pursue acquisition opportunities with a simpler

corporate structure.

For the year ended 31 December 2023, the Board considered 15

opportunities and, whilst the Company's revenues for the year have

been below expectations, the Company remains upbeat about existing

commercial opportunities. The Company first announced that it had

received an order from SaxaVord Space Port ("SaxaVord"), previously

known as the Shetland Space Centre) as part of a three-phase

project to deliver a digital dashboard solution on 9 August 2021.

The Company has

been EURn discussions for additional work with another business

unit at SaxaVord. On 17 December 2023 SaxaVord was granted a

license by the UK's Civil Aviation Authority to operate as the UK's

first vertical launch spaceport. The license includes authorisation

to launch up to 30 rocket launches per year from the site making

SaxaVord the UK's as well as Western Europe's first vertical launch

site.

On 29 September 2023, the Company announced its half-year

results for the period ended 30 June 2023 which included an update

on the convertible loan facility entered into between the Company

and Sanderson Capital Partners Limited ("Sanderson Capital") (first

announced on 30 September 2022). As at 30 June 2023, an advance of

GBP30,000 had been received against the GBP125,000 and no shares or

warrants issued to Sanderson Capital. As at 28 September 2023, a

total advance of GBP61,000 had been received against the GBP125,000

and no shares or warrants had been issued to Sanderson Capital.

The Company is appreciative of Sanderson Capital's continued

support and confirms that it has renewed its GBP250,000 convertible

loan note facility ("Facility") with Sanderson Capital for a

further 12 months (to January 2025). As at the date of this letter,

the Company has drawn down GBP131,000 of the Facility, being

GBP81,000 under the previous Facility and GBP50,000 under the

renewed Facility.

Pursuant to the Facility, the Company will issue Sanderson

Capital GBP50,000 worth of new ordinary shares in the Company at a

price of the lower of the closing middle price on the 15 January

2024 or the price of the next fundraise ("Facility Price").

The drawdown of GBP81,000 under the previous agreement is

carried forward and the Company will pay 10% of this amount in new

ordinary shares at the Facility Price as a drawdown fee.

Sanderson Capital will also receive warrants equalling one-half

option on the total amount to be drawn down on the Facility (i.e

GBP125,000 worth of warrants). The warrants will be exercisable for

36 months from the date of issue with an exercise price equal to

the Facility Price ("Warrants").

The Company has the right to buy-back any outstanding drawdown

amount at any time ("Buy-Back Right") with a 5% penalty fee. Should

the Company exercise its Buy-Back Right, it will pay Sanderson

Capital 105% of the amount it is buying back and Sanderson Capital

will then have the option to convert up to 60% of the drawdown

amount the Company is buying back into shares in the Company at a

conversion price of the lower of the closing middle price on 15

January 2025, 90% of the 5-day volume weighted average price prior

to conversion or the price of the next fundraise.

The share and warrant issuances to Sanderson Capital detailed

above are subject to the Board receiving shareholder approval at

the Company's forthcoming Annual General Meeting and will be issued

to Sanderson Capital such that Sanderson Capital do not hold more

than 29.9% of the Company's issued share capital.

2. Purpose of the Capital Reorganisation

The Company is proposing to undertake a share capital

reorganisation in order to issue New Ordinary Shares to Sanderson

Capital and to have the ability to raise further funds from new

investors in the future. The Company's share price is currently

trading close to the nominal value of its Existing Ordinary Shares

- a company is unable to issue new ordinary shares at a price below

its nominal value.

In the medium term the Company will need to raise further

capital to strengthen its working capital position in addition to

the Facility provided by Sanderson Capital. If a placing with

investors were to occur it would likely happen at a price below the

current par value of the Existing Ordinary Shares.

The Capital Reorganisation is subject to shareholder approval at

the Annual General Meeting, notice of which is set out at the end

of this Document. The purpose of this Document is to provide

Shareholders with details of the Capital Reorganisation and to

explain why the Directors are recommending that Shareholders vote

in favour of the Capital Reorganisation at the Annual General

Meeting.

The structure of the Capital Reorganisation is such that the

Company will continue to meet the statutory requirement of having

GBP50,000 minimum nominal value of issued share capital.

3. Proposed Capital Reorganisation

The proposed Capital Reorganisation will comprise two

elements:

(4) The Consolidation

Every five Existing Ordinary Shares of 0.2 pence each will be

consolidated into one Consolidated Shares of 1 pence each.

(b) The Sub-Division

Immediately following the Consolidation, each Consolidated Share

will then be sub-divided into one New Ordinary Share of 0.2 pence

each and one New Deferred Share of 0.8 pence each.

The Capital Reorganisation requires the passing of the

Resolutions at the Annual General Meeting, which is to be held at

12pm on 9 February 2024 at RWK Goodman LLP, 69 Carter Lane, London,

EC4V 5EQ.

If the Resolutions are passed, the Capital Reorganisation will

become effective immediately following close of business on that

date.

4. Consolidation

At the Annual General Meeting, the Directors are inviting

Shareholders to approve the Resolutions, which will authorise the

Consolidation, pursuant to which every five Existing Ordinary

Shares will be consolidated into one Consolidated Share, and the

subsequent sub-division.

As all of the Existing Ordinary Shares are proposed to be

consolidated, the proportion of issued ordinary shareholdings in

the Company held by each Shareholder immediately before and

immediately after the Consolidation will, save for fractional

entitlements, remain unchanged.

In the event the number of Existing Ordinary Shares attributed

to a Shareholder is not exactly divisible by 5, the Consolidation

will generate an entitlement to a fraction of a Consolidated Share.

On the Sub-Division, such fractional entitlements will be carried

over to the relevant New Ordinary Shares, but not the New Deferred

Shares and the New Ordinary Shares, which comprise fractional

entitlements, will then be sold on the open market (see further

explanation at paragraph 7 ).

Accordingly, following the implementation of the Capital

Reorganisation, any Shareholder who as a result of the

Consolidation, has a fractional entitlement to any New Ordinary

Shares, will not have a proportionate shareholding of New Ordinary

Shares exactly equal to their proportionate holding of Existing

Ordinary Shares.

Furthermore, any Shareholders holding fewer than 5 Existing

Ordinary Shares as at the Record Date will cease to be a

shareholder of the Company. The minimum threshold to receive

Consolidated Shares will be 5 Existing Ordinary Shares.

5. Sub-Division

Immediately following the Consolidation, each Consolidated Share

will be sub-divided into one New Ordinary Share of 0.2 pence each

and one New Deferred Share of 0.8 pence each.

Where there are fractional entitlements to a Consolidated Share,

the Board considers it fair that upon Sub-Division, the same

fractional entitlements to a Consolidated Share will apply to each

New Ordinary Share, but not a New Deferred Share.

The record date for the Sub-Division will be the same as for the

Consolidation, which is 7 p.m. on 9 February 2024.

6. Effects of the Capital Reorganisation

For purely illustrative purposes, examples of the effects of the

Capital Reorganisation are set out below:

Existing Ordinary New Ordinary Share Deferred Share

Shares

1,000,000 200,000 200,000

25,000 5,000 5,000

500 100 100

------------------ ------------------- ---------------

The example below shows a fractional entitlement, the value of

which will depend on the market value of the New Ordinary Shares at

the time of sale.

Existing Ordinary New Ordinary New Deferred Fractional

Shares

15,213 3,042 3,042 0.6

------------------ ------------- ------------- -----------

Application will be made for the New Ordinary Shares to be

admitted to trading on AIM and dealings in the New Ordinary Shares

are expected to commence on or around 12 February 2024, subject to

obtaining the new ISIN and admission of the New Ordinary Shares by

CREST.

7. Fractional entitlements to Consolidated Shares

As set out above, the Consolidation will give rise to fractional

entitlement to a Consolidated Share where any holding is not

precisely divisible by five. On Sub-Division of any such

Consolidated Share, which occurs immediately thereafter, the same

fractional entitlement will apply to each New Ordinary Share, but

not a New Deferred Share then arising. As regards to the New

Ordinary Shares, no certificates regarding fractional entitlements

will be issued. Instead, any New Ordinary Shares, in respect of

which there are fractional entitlements, will be aggregated and

sold in the market for the best price reasonably obtainable on

behalf of Fractional Shareholders entitled to fractions.

The Company will distribute the proceeds of sale in due

proportion to any such Fractional Shareholders in accordance with

article 19 of the Articles. In the event that the net proceeds of

sale amount to GBP3 or less per holder, the Board is of the view

that, as a result of the disproportionate costs, it would not be in

the best interests of the Company to distribute such proceeds of

sale, which instead shall be retained for the benefit of the

Company in accordance with article 19 of the Articles.

For the avoidance of doubt, the Company is only responsible for

dealing with fractions arising on registered holdings. For

Shareholders whose shares are held in the nominee accounts of UK

stockbrokers, the effect of the Capital Reorganisation on their

individual shareholdings will be administered by the stockbroker or

nominee in whose account the relevant shares are held. The effect

is expected to be the same as for shareholdings registered in

beneficial names, however it is the stockbroker's or nominee's

responsibility to deal with fractions arising within their customer

accounts and not the Company's.

8. Resulting Share Capital

The issued share capital of the Company immediately following

the Capital Reorganisation, is expected to comprise 57,007,785 New

Ordinary Shares, 57,007,785 New Deferred Shares and 32,236,017

Existing Deferred Shares.

9. Rights attaching to New Ordinary Shares and the Deferred Shares

The New Ordinary Shares arising upon implementation of the

Capital Reorganisation will have the same rights as the Existing

Ordinary Shares, including voting, dividend and other rights and as

set out in the Articles.

The New Deferred Shares arising upon implementation of the

Capital Reorganisation will have the same rights as the Existing

Deferred Shares, including no dividend or voting rights and, upon a

return of capital, the right only to receive the amount paid up

thereon after the holders of ordinary shares in the capital of the

Company have received the aggregate amount paid up thereon and as

set out in the Articles.

10. Effects on Options and Other Instruments

The entitlements to New Ordinary Shares of holders of securities

or instruments convertible into New Ordinary Shares (such as share

options) are expected to be adjusted to reflect the Capital

Reorganisation.

11. General Meeting

You will find set out at the end of this Document a notice

convening the Annual General Meeting to be held at RWK Goodman LLP,

69 Carter Lane, London, EC4V 5EQ at 12pm on 9 February 2024.

The Resolutions to be proposed at the Annual General Meeting are

as follows:

(a) Resolutions 1 to 5: Resolutions in respect of accepting the

annual accounts of the Company, re-appointing the Directors who

retire as Directors by rotation and re-appointing the Company's

auditors (Ordinary Resolutions)

Ordinary Resolutions are proposed to approve routine business at

the Annual General Meeting

(b) Resolution 6: Capital Reorganisation (Ordinary Resolution)

An ordinary resolution is proposed to approve the Capital

Reorganisation. The Board considers it desirable to effect the

Capital Reorganisation as, in the Board's opinion, it should

improve the liquidity and marketability of New Ordinary Shares.

(4) EUR) Resolution 7: Grant the directors the authority to

allot shares and grant rights (Ordinary Resolution)

(4) An ordinary resolution is required to grant the Board the

authority to allot shares and grant rights to subscribe for shares

in the capital of the Company in accordance with section 551 of the

Companies Act 200(d) Resolution 8: Disapply the statutory

pre-emption rights in relation to the allotment of shares and

granting of rights to subscribe for shares (Special Resolution)

A special resolution is required to disapply the statutory

pre-emption rights in relation to the allotment and issue of shares

in the capital of the CompanEUR

(e) Resolution 9: Change the Company's name (Special Resolution)

A special resolution to approve changing the Company's name to

Catenai plc.

(f) Resolution 10: Amendments to the Company's articles of association (Special Resolution)

A Special Resolution to approve amendments to the Company's

articles of association.

12. United Kingdom taxation in relation to the Capital Reorganisation

For the purposes of UK taxation of chargeable gains, a

Shareholder should not be treated as making a disposal of all or

part of his holding of Existing Ordinary Shares by reason of the

Consolidation. The New Ordinary Shares should be treated as the

same asset, and as having been acquired at the same time and at the

same aggregate cost as, the holding of Existing Ordinary Shares

from which they derive. On a subsequent disposal of the whole or

part of the New Ordinary Shares comprised in the new holding, a

shareholder may, depending on his or her circumstances, be subject

to tax on the amount of any chargeable gain realised.

13. Action to be taken

You are requested to register your votes by completing, scanning

and then submitting a Form of Proxy (enclosed with the Annual

General Meeting notice below) to the Registrar at:

proxy@avenir-registrars.co.uk as soon as possible. Even if you

intend to attend the Annual General Meeting you are encouraged to

complete and return a Form of Proxy. The Form of Proxy must be

received by the Registrar not less than 48 hours (excluding

weekends and bank holidays) before the time fixed for the Annual

General Meeting (or any adjournment thereof). You may also vote by

completing and posting a Form of Proxy to the Registrar at: Avenir

Registrars Ltd, 5 St Johns Lane, London, EC1M 4BH.

The completion and return of a Form of Proxy will not prevent

you from attending the Annual General Meeting and voting in person

if you subsequently wish to do so.

Shareholders are reminded that, if their shares are held in the

name of a nominee, only that nominee or its duly appointed proxy

can be counted in the quorum at the Annual General Meeting.

Separate processes exist for CREST votes to be cast within the

CREST system.

If you are in any doubt as to what action you should take, you

are recommended to seek your own personal financial advice from

your broker, bank manager, solicitor, accountant or other

independent financial adviser authorised under the Financial

Services and Markets Act 2000 (as amended) if you are resident in

the United Kingdom or, if not, from another appropriately

authorised independent financial adviser, immediately.

If you need any help with voting please contact the Registrar,

Avenir Registrars Ltd on +44 20 7692 5500, or by email at

proxy@avenir-registrars.co.uk .

14. Electronic Communications

Going forward the Company intends to supply all notices,

documents and information (" Documents and Information" ) to

shareholders via electronic means, including a designated

shareholder portal operated by its Registrar (through which

shareholders' will also be able to vote at general meetings). The

Directors believe that increased use of electronic communications

will deliver significant savings to the Company in terms of

administration, printing and postage costs, as well as speeding up

the provision of information to shareholders. The reduced use of

paper will also have environmental benefits. To allow the Company

to supply Documents and Information to you via electronic means you

are required to give your consent to the same. You are requested to

read the enclosed letter entitled "Request to send or supply

documents and information via a website and/ or in electronic form"

and either fill out the enclosed reply slip as instructed or email

details of your email address and mobile number to John Farthing,

the company secretary.( john.farthing@catenaeinnovation.com ).

15. Recommendation

The Directors consider that the Capital Reorganisation is fair

and reasonable and is in the best interests of the Company and its

Shareholders as a whole. The Directors therefore recommend you vote

in favour of all of the Resolutions.

The Directors intend to vote in favour of all of the Resolutions

in respect of their own beneficial holdings of Existing Ordinary

Shares. Such shareholdings comprise 44,069,515 Existing Ordinary

Shares representing approximately 15.46% per cent. of the total

Existing Ordinary Shares.

Yours faithfully

Brian Thompson

Chairman

DEFINITIONS

"Admission" admission of the New Ordinary Shares to

trading on AIM and such admission becoming

effective in accordance with the AIM Rules;

"AIM Rules" the AIM Rules for Companies and the AIM

Rules for Nominated Advisers, as issued

by the London Stock Exchange from time

to time;

"AIM" the AIM market operated by the London

Stock Exchange;

"Annual General Meeting" the general meeting of the Company to

be held at RWK Goodman LLP, 69 Carter

Lane, London, EC4V 5EQ on 9 February 2024

at 12pm , notice of which is set out at

the end of this Document;

"Articles" the articles of association of the Company

at the date of this Document;

"Board" the board of directors of the Company;

"Capital Reorganisation" the proposed Consolidation and the Sub-Division;

"Certificated" or in the description of a share or other security

"Certificated Form" which is not in uncertificated form (that

is, not in CREST);

"Company" or "Catenae Catenae Innovation plc (registered under

Innovation" company number 04689130), to be renamed

as "Catenai plc" pursuant to the proposed

resolutions being considered at the Annual

General Meeting;

"Consolidated Shares" ordinary shares of 1 pence each in the

Company to be created following the Consolidation;

"Consolidation" the proposed consolidation of every five

Existing Ordinary Shares of 0.2 pence

each into one Consolidated Share of 1

pence each;

"CREST" the relevant system (as defined in the

CREST Regulations) in respect of which

Euroclear is the operator (as defined

in the CREST Regulations);

"CREST Regulations" the Uncertificated Securities Regulations

2001 (SI 2001/3755), as amended;

"Directors" the directors of the Company uthorizedhorised

committee thereof;

"Document" this document;

"Euroclear" Euroclear UK & International Limited,

the operator of CREST;

"Existing Deferred the existing deferred shares of 9.8 pence

Shares" each in the capital of the Company;

"Existing Ordinary the ordinary shares of 0.2 pence each

Shares" in issue as at the date of this Document;

"Form of Proxy" the form of proxy for use by Shareholders

in connection with the Annual General

Meeting;

"Fractional Shareholders" Shareholders entitled to fractions of

shares as a result of the Capital Reorganisation;

"London Stock Exchange" London Stock Exchange Group plc;

"New Deferred Shares the deferred shares of 0.8 pence each

in the capital of the Company to be created

following the Sub-Division;

"New Ordinary Shares" the ordinary shares of 0.2 pence each

in the capital of the Company to be created

following the Sub-Division;

"Record Date" 7:00 p.m. on 6 February 2024 ;

"Registrar" Avenir Registrars Ltd;

"Resolutions" the resolutions to be proposed at the

Annual General Meeting, details of which

are set out in this Document;

"Shareholder(s)" a holder of Existing Ordinary Shares;

"Sub-Division" the sub-division of each Consolidated

Share of 1 pence each into one New Ordinary

Share of 0.2 pence each and one New Deferred

Share of 0.8 pence each; and

"United Kingdom" or the United Kingdom of Great Britain and

"UK" Northern Ireland.

All references in this Document to "GBP" or "pence" are to the

lawful currency of the UK

(4) To note this date was misstated in the Circular as 15

January 2025

Caution regarding forward looking statements

Certain statements in this announcement, are, or may be deemed

to be, forward looking statements. Forward looking statements are

identi ed by their use of terms and phrases such as "believe",

"could", "should" "envisage", "estimate", "intend", "may", "plan",

"potentially", "expect", "will" or the negative of those,

variations or comparable expressions, including references to

assumptions. These forward looking statements are not based on

historical facts but rather on the Directors' current expectations

and assumptions regarding the Company's future growth, results of

operations, performance, future capital and other expenditures

(including the amount, nature and sources of funding thereof),

competitive advantages, business prospects and opportunities. Such

forward looking statements re ect the Directors' current beliefs

and assumptions and are based on information currently available to

the Directors.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

NOAQKABBFBKDQDD

(END) Dow Jones Newswires

January 17, 2024 02:00 ET (07:00 GMT)

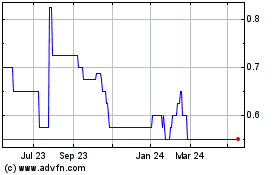

Catenae Innovation (LSE:CTEA)

Historical Stock Chart

From Jan 2025 to Feb 2025

Catenae Innovation (LSE:CTEA)

Historical Stock Chart

From Feb 2024 to Feb 2025