Acquisition(s)

11 July 2006 - 5:10PM

UK Regulatory

11 July 2006

First Artist Corporation plc ("First Artist" or the "Company")

ACQUISITIONS OF PROACTIVE SCANDINAVIA A/S AND N.C.I. MANAGEMENT LIMITED

AND

PLACING OF NEW ORDINARY SHARES TO RAISE APPROXIMATELY �1.0 MILLION

First Artist Corporation plc (AIM: FAN), the acquisitive sports and

entertainment group, announces the acquisitions (conditional in one case on the

completion of a placing by the Company) of Proactive Scandinavia A/s

("Proactive Scandinavia") from Formation Group plc (AIM:FRM) ("Formation") for

�1.75 million plus both the net asset value of Proactive Scandinavia as at 31

May 2006, estimated to be approximately �250,000 to be paid in cash on

completion and �250,000 payable in 2 instalments to Karsten Aarbrink, Proactive

Scandinavia's continuing executive director (the "Proactive Acquisition") and

N.C.I. Management Limited ("NCI") from Nicola Ibison for a maximum

consideration of �1.75 million (the "NCI Acquisition"), together (the

"Acquisitions").

In addition, the Company announces today the placing of 16,758,334 new ordinary

shares of 0.25 pence each in the share capital of the Company (the "Placing

Shares") by Arbuthnot Securities Limited with institutional and other investors

(including certain executive directors of the Company) at a price of 6 pence

per Placing Share to raise approximately �1.0 million before expenses (the

"Placing"). The Placing Shares represent approximately 18.7 per cent. of the

existing issued share capital of the Company. The net proceeds of the Placing

will be used for the Acquisitions and for working capital purposes. The balance

of the cash consideration payable for the Acquisitions will be financed from

new banking facilities.

The Board anticipates that each of the Acquisitions will be earnings enhancing

immediately.

Proactive Scandinavia

Proactive Scandinavia is an established football management agency based in

Copenhagen, Denmark and is currently owned by Formation. Proactive Scandinavia

has 13 staff with offices in Denmark and Norway, a presence in Portugal and

also operates in Germany, Holland, Sweden and Belgium. It has 8 registered

football agents, representing over 90 players in both the UK and across Europe

including Thomas Gravesen and Claus Jensen. In the year to 31 August 2005,

Proactive Scandinavia reported audited turnover of approximately �1.6million

and operating profit of approximately �0.3 million. As at 31 August 2005,

Proactive Scandinavia had net assets of approximately �0.5 million.

The Proactive Acquisition will expand the Company's existing football agency

businesses, provide it with a North European base and strengthen First Artist's

position as a leading force in the European football market. On completion of

the Proactive Acquisition, the Company will pay �1.75 million in cash to

Formation and, in addition, will pay �150,000 in cash to Karsten Aabrink with a

further �100,000 being payable by the Company to him on the first anniversary

of completion. Karsten Aabrink has agreed a new two year service contract,

subject to termination by 12 months' notice thereafter. It is intended that

Proactive Scandinavia will be re-named First Artist Scandinavia A/S following

completion.

On completion of the Proactive Acquisition, the Company will pay to Formation

approximately �130,000 being equal to a sum advanced by Formation to Proactive

Scandinavia.

NCI

NCI is one of the UK's leading entertainment agencies. It was established by

former GMTV producer Nicola Ibison in 1997 and currently represents over 50 TV

presenters and journalists. Based in central London with 7 employees, NCI is a

full service agency handling, book deals, PR and radio. In the year to 31 March

2006, NCI reported turnover of �0.73 million and operating profit of �0.37

million. As at 31 March 2006, NCI had net assets of approximately �0.13

million.

NCI will complement First Artist's existing Entertainment Division led by

Corinne Goodall to create one entertainment agency with approximately 100

clients (as at completion) having a particular strength in brokering deals for

TV presenters. Other members of the First Artist group are expected to benefit

from the NCI Acquisition as it is expected to create opportunities both for its

existing events division, The Finishing Touch (Corporate Events) Limited, and

its financial advisory business, ABG Financial Management Limited, which

specialises in providing financial advice to celebrities, professional

sportspeople and other high net worth individuals. Nicola Ibison will become

Managing Director of First Artist's combined entertainment division with

Corinne Goodall becoming Deputy Managing Director.

The consideration payable by the Company in respect of the NCI Acquisition will

be settled by the aggregate of the following (subject to a maximum

consideration payable of �1.75 million):

* initial cash consideration of �650,000;

* an amount equal to NCI's net assets on completion (forecast to be

approximately �210,000), payable in cash;

* by the issue by the Company to Nicola Ibison of 500,000 new ordinary shares

of 0.25 pence each in the capital of the Company ("Ordinary Shares") at a

deemed rate of 10 pence per share, representing approximately 0.5 per cent.

of the Company's existing issued share capital (the "Acquisition Shares");

* further payments to be satisfied by a combination of unsecured loan notes

and the allotment of Ordinary Shares, depending on the combined NCI/First

Artist existing Entertainment Division achieving certain performance

targets in each of the next three years.

Under the Placing, Jon Smith (Chief Executive), Richard Hughes (Finance

Director), Phil Smith (Executive Director) and Vincenzo Morabito (Executive

Director) have each conditionally subscribed for 166,667 Placing Shares at the

Placing Price. On completion of the Placing, Jon Smith will hold 11,610,110

Ordinary Shares, representing 10.88 per cent. of the Company's enlarged

ordinary share capital following Admission, Richard Hughes will hold 900,000

Ordinary Shares, representing 0.84 per cent. of the Company's enlarged ordinary

share capital following Admission, Phil Smith will hold 8,219,089 Ordinary

Shares, representing 7.70 per cent. of the Company's enlarged ordinary share

capital following Admission, and Vincenzo Morabito will hold 8,219,090 Ordinary

Shares, representing 7.70 per cent. of the Company's enlarged ordinary share

capital following Admission.

Application has been made to the London Stock Exchange for the Acquisition

Shares and the Placing Shares (together the "New Ordinary Shares") to be

admitted to trading on the Alternative Investment Market of the London Stock

Exchange ("AIM"). The New Ordinary Shares will rank pari passu with the

existing Ordinary Shares. The Placing is conditional, inter alia, on the

admission of the New Ordinary Shares to AIM becoming effective ("Admission"),

which is expected to occur on 14 July 2006, when dealings in the New Ordinary

Shares are expected to commence. Following Admission, the Company will have

106,700,571 Ordinary Shares in issue.

Commenting on the Acquisitions and the Placing, Jon Smith, Chief Executive of

First Artist, said,

"We are pleased to be delivering on our declared strategy of acquiring

complementary businesses that strengthen the Group's position in the sports and

entertainment arenas. The Acquisitions expand significantly our position in

both the football agency and celebrity representation industries. We now look

forward to the two-way flow of opportunities across our celebrity

representation, sports representation, event management and wealth management

divisions as a result of the Acquisitions. We will continue to identify and

acquire relevant businesses as they present themselves.

"Furthermore, we are delighted with the success of the Placing and we welcome

our new investors and thank our existing shareholders for their continued

support."

For further information please contact:

First Artist Corporation plc 020 8900 1818

Jon Smith, Chief Executive

Richard Hughes, Finance Director

Arbuthnot Securities 020 7012 2000

Tom Griffiths/Andrew Fullerton

gth media relations

Toby Hall/Jade Mamarbachi 020 7153 8039/8035

END

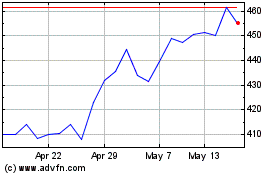

Volution (LSE:FAN)

Historical Stock Chart

From Jun 2024 to Jul 2024

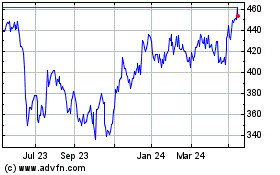

Volution (LSE:FAN)

Historical Stock Chart

From Jul 2023 to Jul 2024