TIDMFAN

RNS Number : 7016W

Volution Group plc

11 November 2014

11 November 2014

Volution Group plc

Annual Report and Accounts 2014 and Notice of Annual General

Meeting

Volution Group plc ("Volution" or the "Company", LSE: FAN), a

leading supplier of ventilation products to the residential

construction market, announces that following the release by

Volution on 23 October 2014 of the Company's Preliminary Results

Announcement for the year ended 31 July 2014, it has today posted

and made available to shareholders on its website

(http://www.volutiongroupplc.com/) the documents listed below:

-- Annual Report and Accounts 2014

-- Notice of Annual General Meeting 2014

-- Form of Proxy for the Annual General Meeting 2014

Copies of these documents are also being submitted to the

National Storage Mechanism and will shortly be available for

inspection at: http://www.hemscott.com/nsm.do

The Company's first Annual General Meeting will be held at

11.00am on 17 December 2014 at The Lincoln Centre, 18 Lincoln's Inn

Fields, London WC2A 3ED.

A condensed set of financial statements and information on

important events that have occurred during the year ended 31 July

2014 and their impact on the financial statements, were included in

the Company's Preliminary Results Announcement made on 23 October

2014, which is available on the Company's website referred to

above. That information together with the information set out below

in the appendices to this announcement (which is extracted from the

Annual Report and Accounts 2014), constitute the material required

by Disclosure & Transparency Rule 6.3.5(2)(b) which is required

to be communicated to the media in full unedited text through a

Regulatory Information Service. This announcement is not a

substitute for reading the full Annual Report and Accounts

2014.

- ends -

Enquiries:

Volution Group plc

Michael Anscombe, Company Secretary +44 (0) 1293 441662

Notes to Editors:

Volution Group plc (LSE: FAN) is a leading supplier of

ventilation products to the residential construction market in the

UK, Sweden and Germany.

The Group sold approximately 20 million ventilation products and

accessories in the financial year ended 31 July 2014. It consists

of five key brands, focused primarily on the UK, Swedish and German

ventilation markets - Vent-Axia, Manrose, Fresh, PAX and inVENTer -

and operates through two divisions: the Ventilation Group, which

principally supplies ventilation products for residential

construction applications in the UK, Sweden and Germany and

ventilation products for commercial construction applications in

the UK; and Torin-Sifan, which supplies motors, fans and blowers to

OEMs of heating and ventilation products for both residential and

commercial construction applications in Europe.

For more information, please go to:

http://www.volutiongroupplc.com/

Appendices

Appendix A: Directors' Responsibility Statement

The following Directors' Responsibility Statement is extracted

from page 66 of the Annual Report and Accounts 2014 and is repeated

in this announcement solely for the purpose of complying with DTR

6.3.5 (2) (b). The statement relates to the full Annual Report and

Accounts 2014 and not the extracted information contained in this

announcement:

The Directors are responsible for preparing the Annual Report

and the Group and parent company financial statements in accordance

with applicable law and regulations.

Company law requires the Directors to prepare Group and parent

company financial statements for each financial year. Under that

law they are required to prepare the Group financial statements in

accordance with IFRSs as adopted by the EU and applicable law and

have elected to prepare the parent company financial statements in

accordance with IFRSs as adopted by the EU.

Under company law the Directors must not approve the financial

statements unless they are satisfied that they give a true and fair

view of the state of affairs of the Group and parent company and of

their profit or loss for that period. In preparing each of the

Group and parent company financial statements, the Directors are

required to:

-- select suitable accounting policies and then apply them consistently;

-- make judgements and estimates that are reasonable and prudent;

-- state whether the Group and parent company financial statements

have been prepared in accordance with IFRSs as adopted by

the EU; and

-- prepare the financial statements on the going concern basis

unless it is inappropriate to presume that the Group and the

parent company will continue in business.

The Directors are responsible for keeping adequate accounting

records that are sufficient to show and explain the parent

company's transactions and disclose with reasonable accuracy at any

time the financial position of the parent company and enable them

to ensure that its financial statements comply with the Companies

Act 2006. They have general responsibility for taking such steps as

are reasonably open to them to safeguard the assets of the Group

and to prevent and detect fraud and other irregularities.

Under applicable law and regulations, the Directors are also

responsible for preparing a strategic report, directors' report,

directors' remuneration report and corporate governance statement

that complies with that law and those regulations.

The Directors are responsible for the maintenance and integrity

of the corporate and financial information included on the

Company's website. Legislation in the UK governing the preparation

and dissemination of financial statements may differ from

legislation in other jurisdictions.

We confirm that to the best of our knowledge:

--the financial statements, prepared in accordance with the

applicable set of accounting standards, give a true and fair view

of the assets, liabilities, financial position and loss of the

Group and the undertakings included in the consolidation taken as a

whole; and

--the Strategic Report and the Directors' Report include a fair

review of the development and performance of the business and the

position of the issuer and the undertakings included in the

consolidation taken as a whole, together with a description of the

principal risks and uncertainties that they face; and

--the Annual Report, taken as a whole, is fair, balanced and

understandable and provides the information necessary for

shareholders to assess the Company's performance, business model

and strategy.

By order of the Board

Ronnie George

Chief Executive Officer

23 October 2014

Ian Dew

Chief Financial Officer

23 October 2014

Appendix B: Principal Risks and Uncertainties

The following is extracted from pages 24 to 27 of the Annual

Report and Accounts 2014 and is repeated in this announcement

solely for the purpose of complying with DTR 6.3.5 (2) (b). The

information relates to the full Annual Report and Accounts 2014 and

not the extracted information contained in this announcement:

The Group believes that the table below outlines the principal

risks and uncertainties that our business faces. Occurrence of any

of these risks may significantly impact the business or impair the

achievement of our strategic goals.

Risk Impact Strategic consequence Mitigation

----------------------- --------------------------- -------------------------- ----------------------------

Economic risk

A decline in Demand for our Our ability to Geographic spread

general economic products serving achieve our ambition from our international

activity and/or the residential for continuing acquisition strategy

a specific decline and commercial organic growth helps to mitigate

in activity in RMI and new build would be adversely the impact of

the construction markets would affected. local fluctuations

industry. decline. This in economic activity.

would result New product development,

in a reduction the breadth of

in revenue and our product portfolio

profitability. and the strength

and specialisation

of our sales forces

should allow us

to outperform

the market against

a general decline.

We are heavily

exposed to the

RMI market which

is more resilient

to the effects

of general economic

decline.

Our business is

not capital intensive

and our operational

flexibility allows

us to react quickly

to the impact

of a decline in

volume.

----------------------- --------------------------- -------------------------- ----------------------------

Foreign exchange risk

The exchange The commerciality Our ambition Significant transactional

rates between of transactions to grow internationally risks are hedged

currencies that denominated in through acquisition by using forward

we use may move currencies other exposes us to currency contracts

adversely. than the functional increasing levels to fix exchange

currency of our of translational rates for the

businesses and/or foreign exchange ensuing financial

the perceived risk. year.

performance of Revaluation of

foreign subsidiaries foreign currency

in our Sterling denominated assets

denominated Group and liabilities

accounts may are partially

be adversely hedged by corresponding

affected by changes foreign currency

in exchange rates. bank debt.

----------------------- --------------------------- -------------------------- ----------------------------

Acquisitions

We may fail to Revenue and profitability Our strategic The ventilation

identify suitable would not grow ambition to grow industry in Europe

acquisition targets in line with by acquisition is fragmented

at an acceptable management's may be compromised. with many opportunities

price or we may ambitions and to court acquisition

fail to consummate investor expectations. targets.

or properly integrate Failure to properly Senior management

the acquisition. integrate a business has a clear understanding

may distract of potential targets

senior management in the industry

from other priorities and a track record

and adversely of three acquisitions

affect revenue over the past

and profitability. two years.

Financial performance Management is

could be impacted experienced in

by failure to integrating new

integrate acquisitions. businesses into

the Group.

----------------------- --------------------------- -------------------------- ----------------------------

Innovation

We may fail to Scarce development Our organic growth Our product innovation

innovate commercially resource may ambitions depend is driven by a

or technically be misdirected in part upon deep understanding

viable products and costs incurred our ability to of the ventilation

to maintain and unnecessarily. innovate new market and its

develop our product Failure to innovate and improved economic and regulatory

leadership position. may result in products to meet drivers. The Group

an ageing product and create market starts with a

portfolio which needs. In the clear marketing

falls behind medium term, brief before embarking

that of our competition. failure to innovate on product development.

may result in

a decline in

sales and profitability.

----------------------- --------------------------- -------------------------- ----------------------------

Supplies

Raw materials Sales and profitability Organic growth We establish long-term

or components may be reduced may be reduced. relationships

may become difficult during the period Our product development with key suppliers

to source because of constraint. efforts may be to promote continuity

of material scarcity Prices for the redirected to of supply and

or disruption input material find alternative where possible

of supply. may increase materials and we have alternative

and our costs components. sources identified.

may increase.

----------------------- --------------------------- -------------------------- ----------------------------

People

Our continuing Skilled and experienced Our competitiveness Regular employee

success depends employees may and growth potential, appraisals allow

on retaining decide to leave both organic two-way feedback

key personnel the Group, potentially and inorganic, on performance

and attracting moving to a competitor. could be adversely and ambition.

skilled individuals. Any aspect of effected. A senior management

the business development programme

could be impacted was initiated

with resultant in 2013 to provide

reduction in key employees

prospects, sales with the skills

and profitability. needed to grow

within the business

and to enhance

their contribution

to the business.

The Group aims

to reward and

incentivise employees

competitively.

----------------------- --------------------------- -------------------------- ----------------------------

IT systems

We may be adversely Failure of our We could temporarily Disaster recovery

affected by a IT and communication lose sales and and data backup

breakdown in systems could market share processes are

our IT systems affect any or and could potentially in place, operated

or a failure all of our business damage our reputation diligently and

to properly implement processes and for customer tested regularly.

any new systems. have significant service. A significant

impact on our Enterprise Resource

ability to trade, Planning system

collect cash upgrade is underway

and make payments. managed by a dedicated

team of experienced

senior employees

from the business.

A disaster failover

site is being

implemented to

cover this upgrade.

----------------------- --------------------------- -------------------------- ----------------------------

Customers

A significant Any deterioration Our organic growth We have strong

amount of our in our relationship ambitions would brands, recognised

revenue is derived with a significant be adversely and valued by

from a small customer could affected. our end users

number of customers have an adverse and this gives

and from our significant effect us continued traction

relationships on our revenue through our distribution

with heating to that customer. channels and with

and ventilation consultants and

consultants. specifiers.

We have a very

wide range of

ventilation and

ancillary products

that enhance our

brand proposition

and make us a

convenient "one-stop-shop"

supplier.

We continue to

develop new and

existing products

to support our

product portfolio

and brand reputation.

We provide an

excellent level

of customer service.

----------------------- --------------------------- -------------------------- ----------------------------

Legal and regulatory environment

Changes in laws The shift towards Our organic growth We participate

or regulation higher value-added ambitions may in trade bodies

relating to the and more energy-efficient be adversely that help to influence

carbon efficiency products may affected. the regulatory

of buildings not develop as We may need to environment in

or the efficiency anticipated resulting review our acquisition which we operate

of electrical in lower sales criteria to and as a consequence

products may and profit growth. reflect the dynamics we are also well

change. If our products of a new regulatory placed to understand

are not compliant environment. future trends

and we fail to We may have to in our industry.

develop new products redirect our We are active

in a timely manner new product development in new product

we may lose revenue activity. development and

and market share have the resource

to our competitors. to react to and

anticipate necessary

changes in the

specification

of our products.

----------------------- --------------------------- -------------------------- ----------------------------

Appendix C: Related Party Transactions

The following description of related party transactions

involving the Company and its subsidiaries during the financial

year ended 31 July 2014 is extracted from pages 109 to 110 of the

Annual Report and Accounts 2014 and is repeated in this

announcement solely for the purpose of complying with DTR 6.3.5

(2)(b):

Transactions between Volution Group plc and its subsidiaries,

and transactions between subsidiaries, are eliminated on

consolidation and are not disclosed in this note. A breakdown of

transactions between the Group and its related parties are

disclosed below.

No related party loan note balances exist at 31 July 2014. In

December 2013, the Group repaid GBP40,006,000 of the loan notes

back to the principal shareholders GBP34,628,000 and interest of

GBP5,378,000. Immediately prior to admission to the London Stock

Exchange in June 2014 the remaining loan notes issued by Windmill

Midco were novated to Windmill Topco and then subsequently

converted into shares in Windmill Topco. The deposits held by

Windmill Holdings BV and Windmill Holdings Cooperatief UA were

repaid in July 2014.

Amounts

owed by Amounts

At 31 July 2013 related owed to

Loan Deposit Interest parties related parties

Related parties GBP000 GBP000 GBP000 GBP000 GBP000

------------------------------ ------- ------- -------- -------- ----------------

Windmill Holdings BV 103,354 - 12,673 - 116,027

Adrian Barden 73 - 10 - 83

Marcel Klepfisch 49 - 6 - 55

Chris Lebeer 492 - 60 - 552

Ronnie George 295 - 36 - 331

Windmill Holdings BV - 10 - 10 -

Windmill Holdings Cooperatief

U A - 10 - 10 -

------------------------------ ------- ------- -------- -------- ----------------

Total 104,263 20 12,785 20 117,048

------------------------------ ------- ------- -------- -------- ----------------

The amounts disclosed above represent the historic carrying

value of loan amounts owed to related parties. The terms and

conditions of the loans notes are disclosed in note 26. The

deposits are held by Windmill Holdings BV and Windmill Holdings

Cooperatief UA and do not carry any repayment terms.

Amounts

owed by Amounts

At 1 August 2012 related owed to

Loan Deposit Interest parties related parties

Related parties GBP000 GBP000 GBP000 GBP000 GBP000

------------------------------ ------- ------- -------- -------- ----------------

Windmill Holdings BV 103,846 - 4,074 - 107,920

Windmill Holdings BV - 10 - 10 -

Windmill Holdings Cooperatief

U A - 10 - 10 -

Adrian Barden 73 - 4 - 77

Marcel Klepfisch 49 - 2 - 51

Ronnie George 295 - 11 - 306

------------------------------ ------- ------- -------- -------- ----------------

Total 104,263 20 4,091 20 108,354

------------------------------ ------- ------- -------- -------- ----------------

There were no material transactions or balances between the

Company and its key management personnel or members of their close

family. At the end of the period, key management personnel did not

owe the Company any amounts.

Other disclosures on Directors' remuneration required by the

Companies Act 2006 and those specified for the audit by the

Directors' Remuneration Report Regulation 2013 are included in the

Directors' Remuneration Report.

Other transactions with related parties include the

following:

-- the Group incurred costs of GBP168,000 (2013: GBP114,000) from Windmill

Holdings BV (the direct controlling party) and Windmill Cooperatief

U A (an intermediate parent undertaking) for management services; and

-- the Group incurred costs of GBP246,000 from 1 August 2013 to 22 June

2014 (2013: GBP294,000) from Marcel Klepfisch, Adrian Barden and Chris

Lebeer for their services as Non-Executive Directors. Following the

re-organisation and the listing on the London Stock Exchange, the Group

Board of Directors changed and the Group incurred a further cost from

23 June 2014 to 31 July 2014 of GBP36,000 from Peter Hill, Tony Reading,

Paul Hollingworth and Adrian Barden for their services as Non-Executive

Directors.

Non-Executive Director Paul Hollingworth is also a non-executive

director of Electrocomponents plc. During the year, the Group sold

goods to Electrocomponents plc amounting to GBP194,000 (2013:

GBP170,000). At the year end, amounts owing by Electrocomponents

plc were GBP35,000 (2013: GBP2,000). During the year the Group

purchased goods from Electrocomponents plc amounting to GBP99,000

(2013: GBP87,000). At the year end, amounts owed to

Electrocomponents plc were GBP13,000 (2013: GBP12,000).

Compensation of key management personnel

2014 2013

GBP000 GBP000

----------------------------- ------- -------

Short-term employee benefits 2,697 709

Termination benefits 203 -

----------------------------- ------- -------

2,900 709

----------------------------- ------- -------

Key management personnel is defined as the CEO, CFO and the

individuals that report directly to the CEO

This information is provided by RNS

The company news service from the London Stock Exchange

END

ACSUAOKRSRAAARA

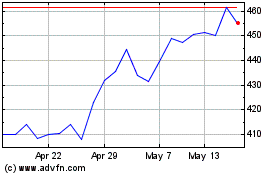

Volution (LSE:FAN)

Historical Stock Chart

From Jun 2024 to Jul 2024

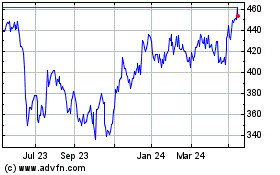

Volution (LSE:FAN)

Historical Stock Chart

From Jul 2023 to Jul 2024