TIDMFNTL

RNS Number : 8353M

Fintel PLC

19 September 2023

19 September 2023

Fintel plc

("Fintel", the "Company", the "Business" or the "Group")

Half year results for the six months ended 30 June 2023

Positive performance; strategic investments to accelerate future

growth

Fintel (AIM: FNTL), the leading provider of Fintech and support

services to the UK retail financial services sector, today

announces its unaudited consolidated results for the six months

ended 30 June 2023.

" Fintel delivered a positive financial and operational

performance during the first half of 2023 and continued to make

significant progress in line with its strategic plan. We have

increased investment into our technology and service platform, with

earnings enhancing acquisitions expanding our unique proposition

and driving future growth opportunities.

Our diverse client base and proposition, combined with the cash

generative nature of our business, provide resilience to tough

market conditions and ensure we are well placed to capitalise on

the growth opportunities arising from an evolving UK financial

services landscape.

Current trading remains encouraging and in line with our

expectations. Together with the strength of our balance sheet and

positive qualified M&A pipeline, we are confident of delivering

further strategic progress and accelerating growth, as we continue

to inspire better outcomes for retail financial services."

Matt Timmins, Joint CEO

HY23 HY22 Change

Core business

--------- --------- ----------

Core (1) revenue GBP27.6m GBP27.1m 2%

--------- --------- ----------

Core SaaS & subscription

revenue GBP18.8m GBP17.8m 6%

--------- --------- ----------

Core adjusted EBITDA (2) GBP8.8m GBP8.2m 8%

--------- --------- ----------

Core adjusted EBITDA margin 31.9% 30.1% 180bps

--------- --------- ----------

Fintel alternative performance

measures

--------- --------- ----------

Adjusted EBITDA GBP9.0m GBP8.7m 3%

--------- --------- ----------

Adjusted EBITDA margin 28.3% 27.0% 130pbs

--------- --------- ----------

Adjusted EPS(2) 5.0p 5.3p -6%

--------- --------- ----------

Cash conversion(3) 104% 124% -2,000bps

--------- --------- ----------

Statutory measures

--------- --------- ----------

Statutory revenue GBP31.7m GBP32.2m -2%

--------- --------- ----------

Statutory EBITDA GBP6.7m GBP8.0m -16%

--------- --------- ----------

Statutory EPS 3.2p 4.6p -30%

--------- --------- ----------

Cash position GBP13.3m GBP7.6m 75%

--------- --------- ----------

Interim dividend per share 1.1p 1.0p 10%

--------- --------- ----------

Financial highlights

-- Core (1) revenue growth to GBP27.6m (HY22: GBP27.1m) up 2%;

and up 4% on a like for like basis

-- Core adjusted EBITDA (2) increased to GBP8.8m (HY22: GBP8.2m) up 8%

-- SaaS and subscription revenue up 6% to GBP18.8m (HY22:

GBP17.8m), now representing 68% of core revenue

-- Strong liquidity with cash position of GBP13.3m (HY22:

GBP7.6m), as a result of consistently strong cash conversion (3) of

104% (HY22: 124%)

-- Strength of balance sheet together with undrawn GBP80m

Revolving Credit Facility ("RCF") provides significant financial

flexibility and headroom to capitalise on organic and M&A

opportunities

-- Statutory revenue of GBP31.7m (HY22: GBP32.2m), down 2%,

reflects both new net revenue recognition on major software

reseller contract extension in current period and reduced activity

in non-core business

-- Adjusted EBITDA (2) up 3% to GBP9.0m (HY22: GBP8.7m)

delivered during a period of significant investment

-- Solid adjusted EBITDA (2) margin of 28.3% (HY22: 27.0%), up

130bps, driven by improved revenue mix and growth on higher margin

business lines

-- Adjusted EPS(2) down 6% to 5.0 pence per share (HY22: 5.3

pence per share) driven largely by the UK wide increase in

corporation tax rate from 19% to 25%

-- Interim dividend of 1.1p (HY22: 1.0p) proposed, recognising

the strength of the underlying business

Strategic and operational highlights

-- Strategic developments and investments expected to accelerate future growth:

o Acquisition of MICAP by Defaqto extending its reach into the

tax-advantaged market, expanding both its data footprint and

research capabilities

o Acquisition of Competent Adviser, a dynamic learning platform

enabling advisers to meet increasing regulatory competency

requirements

o Investment in Plannr through Fintel Labs techn ology

incubator, expanding Fintel's technology proposition and extending

the capabilities of Defaqto Engage through a two-way

integration

o A new five-year minimum term technology contract with

long-standing supplier Intelliflo on improved terms, reducing pass

through costs and the associated revenues, and increasing EBITDA

margin

-- Maintained a steady improvement in earnings quality,

enhancing visibility of future earnings:

o Solid growth in core SaaS and Subscription revenue up 6% to

GBP18.8m (HY22: GBP17.8m), now representing 68% of core revenue

o Strong progress in conversion to Distribution as a Service

("DaaS"); 79% of Distribution Partner revenue converted to

multi-year subscription agreements (HY22: >60%; Target: 60%)

-- Enhanced and expanded proposition, driving organic growth:

o Intermediary Services

-- Expanded regulatory technology capability with four new

software distribution agreements

-- Strengthened core compliance offering including expanded

Consumer Duty support and digital compliance services

o Distribution Channels

-- Scaled Daa S proposition into mortgage and protection markets

and further growth of Strategic Asset Allocation service

-- Deepened insights for product providers with partner portal

phase two launched and digital events platform upgraded

-- Strengthened distribution agreement with BlackRock

o Fintech & Research

-- Expanded competitor intelligence and benchmarking

software

-- Launch of new financial planning software modules

-- Expanded research and insights platform

Current trading and outlook

-- Trading continues to be in line with the Board's expectations

-- Sustainable organic growth expected with expansion of

proposition and increasing technology penetration

-- Qualified M&A pipeline, underpinned by enhanced financial

resources, expected to accelerate medium term growth

-- Increased demand as a result of positive market dynamics and

structural growth drivers including regulatory pressure, demand for

technology and insights, and market consolidation and

disaggregation

Notes

(1) Core business excludes revenues from panel management and

surveying.

(2) Core adjusted EBITDA and adjusted EPS are alternative

performance measures for which a reconciliation to a GAAP measure

is provided in note 8 and note 10.

(3) Underlying operating cash flow conversion is calculated as

underlying cash flow from operations (adjusted operating profit,

adjusted for changes in working capital, depreciation,

amortisation, CAPEX and share-based payments) as a percentage of

adjusted operating profit.

Analyst Presentation

An analyst briefing is being held at 9:30am on 19 September 2023

via an online video conference facility. To register your

attendance, please contact fintel@mhpgroup.com .

For further information please contact:

Fintel plc via MHP Group

Matt Timmins (Joint Chief Executive

Officer)

Neil Stevens (Joint Chief Executive

Officer)

David Thompson (Chief Financial

Officer)

Zeus (Nominated Adviser and

Joint Broker)

Martin Green

Dan Bate

Kieran Russell +44 (0) 20 3829 5000

Investec Bank (Joint Broker)

Bruce Garrow

David Anderson

Harry Hargreaves +44 (0) 20 7597 5970

MHP Group (Financial PR) +44 (0) 20 3128 8147

Reg Hoare Fintel@mhpgroup.com

Robert Collett-Creedy

Notes to Editors

Fintel is the UK's leading fintech and support services

business, combining the largest provider of intermediary business

support, SimplyBiz, and the leading research, ratings and Fintech

business, Defaqto.

Fintel provides technology, compliance and regulatory support to

thousands of intermediary businesses, data and targeted

distribution services to hundreds of product providers and empowers

millions of consumers to make better informed financial decisions.

We serve our customers through three core divisions:

The Intermediary Services division provides technology,

compliance, and regulatory support to thousands of intermediary

businesses through a comprehensive membership model. Members

include directly authorised IFAs, Wealth Managers and Mortgage

Brokers.

The Distribution Channels division delivers market Insight and

analysis and targeted distribution strategies to financial

institutions and product providers. Clients include major Life and

Pension companies, Investment Houses, Banks, and Building

Societies.

The Fintech and Research division (Defaqto) provides market

leading software, financial information and product research to

product providers and intermediaries. Defaqto also provides product

ratings (Star Ratings) on thousands of financial products.

Financial products are expertly reviewed by the Defaqto research

team and are compared and rated based on their underlying features

and benefits. Defaqto ratings help consumers compare and buy

financial products with confidence.

For more information about Fintel, please visit the website:

www.wearefintel.com

JOINT CHIEF EXECUTIVES' STATEMENT

Overview

Fintel has performed well in the first half of the year,

delivering a positive financial performance during a period of

increased strategic investment.

As we innovate and expand our customer proposition,

profitability and earnings quality continued to improve across the

business. Core adjusted EBITDA grew 8% and SaaS and subscriptions

now represent 68% of core revenue.

The diversity of our client base and proposition positions us

resiliently and allows us to capture growth in challenging markets.

Excellent growth in our Fintech and Research division mitigated the

impact of a weaker mortgage market in our Distribution Channels

division, contributing to our core business delivering growth

across all key metrics.

In light of the performance and in recognition of the underlying

business' quality, the Board has proposed an interim dividend of

1.1p per share.

Core Business

HY23 HY22 Medium-term

target

Core Revenue Growth 2%(*) 9% 5-7%

------ ------ ------------

Adjusted EBITDA Margin 31.9% 30.1% 35-40%

------ ------ ------------

% Revenues from SaaS and

Subscriptions 68% 66% 70-80%

------ ------ ------------

*4% on a like for like basis taking into account the change in

revenue recognition on major software contract

As we enhance and expand our services and technology platform,

we continue to drive performance, increasing margin, revenue

quality and earnings in our core divisions.

-- The Intermediary Services division delivered a 15% growth in

gross profit, driven in part by the expansion of our regulatory

technology offering, and the digitisation and expansion of our core

compliance offering.

-- In the Distribution Channels division earnings quality

increased with 79% (HY22: >60%) of our partner revenue converted

to multi-year Distribution as a Service ("DaaS") contracts as we

scale our distribution solutions through expansion of the DaaS

proposition into the mortgage and protection market.

-- The Fintech and Research division delivered a 9% increase in

revenue, driven by significant growth in software and fintech

revenues, following expansion of our competitor intelligence and

benchmarking software, and enhancements to our proprietary

financial planning software.

With current trading in line with our expectations, the progress

we have delivered against our strategy and the resilience of our

membership and subscription based operating model, the Board

remains confident in achieving its medium-term strategic

ambitions.

Strategic Delivery and Priorities

The Company's value creation strategy combines selective

acquisitions and organic growth, driven by increasing regulatory

pressure, and continued technology adoption across both our

membership base and the broader market.

In 2023 we accelerated investment in the business, acquiring two

complementary businesses to Fintel and investing in Plannr

Technologies Ltd, adding significant scale and increasing our

capabilities and IP. We also continued to innovate and expand our

service and technology platform organically, delivering margin

growth, robust cash flow and capital efficiency.

During the period, we agreed a new five-year technology contract

with an existing vendor on improved terms, reducing pass through

costs and the associated revenues and increasing EBITDA margin.

Prudent capital management remains a priority, and together with

our cash resources ensures, we have the capacity to continue to

invest in our core platform, and deliver further strategic

progress.

Outlook

Fintel's long-term growth is underpinned by the evolving UK

financial services and regulatory landscape, supporting ongoing

expansion of our product and service platform. In addition, our

diverse client base and proposition provide resilience to tough

market conditions. This ensures we are well placed to capitalise on

multiple growth opportunities.

With increasing profitability and earnings quality, underpinned

by high levels of cashflow conversion, and a series of strategic

investments expanding our reach, scale and IP, we are confident of

accelerating our future growth.

Current trading remains encouraging and in line with our

expectations. Together with the strength of our balance sheet and

qualified M&A pipeline, we are confident of delivering further

strategic progress and a strong financial performance , as we

continue to inspire better outcomes for UK retail financial

services.

Neil Stevens & Matt Timmins

Joint Chief Executive Officers

FINANCIAL REVIEW

For the six months ended 30 June 2023

Period

ended Period ended

30 June 30 June

2023 2022

GBPm GBPm

-------------------------------------------- -------- --------------

Group revenue 31.7 32.2

Expenses (22.7) (23.5)

-------------------------------------------- -------- --------------

Adjusted EBITDA 9.0 8.7

Adjusted EBITDA margin % 28.3% 27.0%

Depreciation (0.2) (0.1)

Depreciation of lease asset (0.2) (0.2)

Amortisation of development expenditure and

software (0.6) (0.5)

-------------------------------------------- -------- --------------

Adjusted EBIT 8.0 7.9

Operating costs of an exceptional nature (1.5) -

Share option charges (0.8) (0.7)

Amortisation of other intangible assets (1.0) (1.0)

Net finance costs (0.2) (0.3)

-------------------------------------------- -------- --------------

Profit before tax 4.5 5.9

Taxation (1.1) (1.1)

-------------------------------------------- -------- --------------

Profit after tax 3.4 4.8

-------------------------------------------- -------- --------------

Adjusted earnings per share** ("EPS") 5.0 5.3

-------------------------------------------- -------- --------------

** Adjusted EPS excludes operating exceptional costs and

amortisation of intangible assets arising on acquisition, divided

by the average number of Ordinary Shares in issue for the

period.

Revenue

The core business performed positively during the first six

months of 2023. Core revenues grew 2% to GBP27.6m (HY22: GBP27.1m),

and 4% on a like for like basis, with growth impacted by two key

factors; firstly, the change in revenue recognition arising from

the renegotiation of a contract with an existing vendor in May 2023

to take the form of a new technology reseller contract, and

secondly the current volatility in the UK housing market has seen

commission income from our mortgage lending panel reduce by

c.20%.

Ensuring a consistent improvement in the quality and visibility

of our earnings is a key strategic focus of the Group and we

continued to deliver significant progress. SaaS and

subscription-based revenues grew 6% to GBP18.8m (HY22: GBP17.8m),

with 68% SaaS and subscription income in the core business (HY22:

66%). Additionally, 79% of Distribution Partner revenue has been

converted to multi-year subscription agreements (HY22: >60%;

Target: 60%).

On a statutory basis the Group, including the non-core property

surveying business, reported revenues declined 2% to GBP31.7m

(HY22: GBP32.2m), reflecting both new net revenue recognition on

major software reseller contract extension and reduced activity in

the non core surveying business due again to the downturn in the UK

housing market.

Divisional performance

Intermediary Services

Our Intermediary Services division provides compliance and

business services to financial intermediary firms through a

comprehensive membership model. Members, including financial

advisers, mortgage advisers and wealth managers, are regulated by

the FCA.

Intermediary Services core revenue increased 0.4% to GBP11.5m

(HY22: GBP11.4m). On a statutory basis, segment turnover remained

stable but like for like revenue increased by 5.6% allowing for

changes relating to the revenue recognition of the renegotiated

technology reseller agreement.

In the six months to 2023 the Intermediary Services division

delivered:

-- Membership fee income of GBP6.0m (HY22: GBP5.7m) - an increase of 6%;

-- Software licence income of GBP2.7m (HY22: GBP3.1m) - a

decrease of 14.0%; an increase of 5.3% on a like for like basis

allowing for change in revenue recognition following contract

renegotiation;

-- Additional services income of GBP2.8m (HY22: GBP2.6m) - an increase of 6.1%; and

-- Gross profit* of GBP5.2m (HY22: GBP4.5m) with gross profit

margin** of 45.2% (HY22: 39.3%). The improved margin reflects

increased investment in our delivery platform, and the beneficial

effect of net accounting under our new software reseller contract

from May 2023.

* Gross profit is calculated as revenue less direct operating costs.

** Gross profit margin is calculated as gross profit as a

percentage of revenue.

Distribution Channels

The Distribution Channels division delivers data, distribution

and marketing services to product providers.

Distribution Channels revenue fell 12 % to GBP9.9m (HY22:

GBP11.4m) as a result of housing market volatility.

In the six months to 30 June 2023 Distribution Channels

delivered:

-- Core commission revenues of GBP3.4m (HY22: GBP4.0m), a

decrease of 13.4% largely reflecting the current trends in the UK

housing market;

-- Marketing services revenues of GBP2.3m (HY22: GBP2.3m); an increase of 2.3%;

o DaaS has grown well to GBP1.8m (HY22: GBP1.5m), or 79%

converted versus 67% converted in the prior period. This growth has

come largely from internal conversion from non-DaaS revenues;

-- Non-core panel management and valuation services revenues of

GBP4.1m (HY22: GBP5.1m); a decrease of 18.0%, again reflecting

current UK housing market volatility; and

-- Gross profit of GBP3.6m (HY22: GBP4.5m) with gross profit margin of 36.7% (HY22: 39.2%).

Fintech and Research

Fintech and Research comprises our Defaqto business. Defaqto

provides market-leading software, financial information and product

research to product providers and financial intermediaries.

Fintech and Research revenues grew by 9.2% to GBP10.3m (HY22:

GBP9.4m), driven by further enhancements in our capabilities.

In the six months to 30 June 2023 Fintech and Research division

delivered:

-- Software revenue of GBP5.2m (HY22: GBP4.6m) - an increase of 13.1%;

-- Product ratings revenue of GBP4.5m (HY22: GBP4.2m) - an increase of 5.5%;

-- Other income of GBP0.6m (HY22: GBP0.6m) from consultancy and ad hoc work; and

-- Gross profit of GBP6.3m (HY22: GBP5.7m) with a strong gross

profit margin of 61.0% (HY22: 60.9%).

Profitability

Our adjusted EBITDA has increased by 3% in line with revenue

achieving GBP9.0m (HY22: GBP8.7m).

The resulting adjusted EBITDA margin of 28.3% (HY22: 27.0%)

compares well with prior periods due to improved revenue mix with

continued growth on higher margin business lines.

Adjusted EBITDA margin is calculated as adjusted EBITDA (as

defined in note 8), divided by revenue. Whilst adjusted EBITDA is

not a statutory measure, the Board believes it is a highly useful

measure of the underlying trade and operations, excluding one-off

and non-cash items.

Adjusted EBITDA in our core business also performed well,

increasing 8% to GBP8.8m (HY22: GBP8.2m). Core adjusted EBITDA is

the adjusted EBITDA calculated above excluding the trading results

of our non-core property surveying business.

The business continues to deliver towards its medium-term goals

and is well positioned for continued growth.

Exceptional items

These are items which are non-recurring and are adjusted on the

basis of either their size or their nature. As these items are

one-off or non-operational in nature, management considers that

their exclusion aids

understanding of the Group's underlying business

performance.

Operating costs of an exceptional nature of GBP1.5m (HY22: Nil)

comprised the following:

-- Transformation costs of GBP0.8m - includes implementation

costs to enhance Fintel's customer relationship management platform

("CRM") and a new enterprise resource planning system ("ERP"),

-- M&A pipeline costs GBP0.4m (HY22: Nil) - including costs

relating to the recent acquisition of Plannr Technologies

Limited

-- Restructuring related costs GBP0.3m (HY22: Nil)

No other costs have been treated as exceptional in the period to

30 June 2023.

Share-based payments

Share-based payment charges of GBP0.8m (HY22: GBP0.7m) have been

recognised in respect of the options in issue.

Financial income and expense

Finance costs of GBP0.3m (HY22: GBP0.3m) relate to the Group's

four-year revolving credit facility, which was fully repaid and

remains undrawn since 30 June 2022.

Finance income of GBP0.1m (HY22: Nil) relates to interest earned

on short term deposit of available funds.

Taxation

The tax charge for the period has been accrued using the tax

rate that is expected to apply to the full financial year.

The underlying tax charge of GBP1.7m for the period (HY22:

GBP1.3m) represents a full year effective tax rate of 23.7% (HY22:

20%). A blended statutory tax rate of 23.5% has been applied to

reflect the increase in the corporation tax rate from 19 % to 25%

effective 1 April 2023. All closing deferred tax balances have been

measured at 25%. As a significant UK corporation tax paying Group,

we settle our liability for corporation tax on a quarterly basis in

advance and have paid c.GBP1.8m in corporation taxes during the

6-month period.

Earnings per share

Earnings per share has been calculated based on the weighted

average number of shares in issue at each balance sheet date.

Adjusted earnings per share in the period amounted to 5.0 pence per

share (HY22: 5.3 pence per share).

Cash flow and closing cash position

At 30 June 2023 the total cash position was GBP13.3m (HY22:

GBP7.6m) with nil debt utilisation. The RCF was fully repaid and

remains undrawn since June 2022. Net cash is calculated as cash and

cash equivalents less borrowings net of amortised arrangement fees.

This represents a net cash to adjusted EBITDA ratio of 0.68 times

(HY22: 0.41 times).

Underlying operating cash flow conversion was strong at 104%

(HY22: 124%), which reduced by 2,000bps due to increased capital

investment for growth (HY23: GBP1.9m; HY22: GBP0.7m). Underlying

operating cash flow is calculated as underlying cash flow from

operations as a percentage of adjusted operating profit. Underlying

cash flow from operations is calculated as adjusted operating

profit, adjusted for changes in working capital, depreciation,

amortisation, CAPEX and share-based payments. A reconciliation of

free cash flow and underlying cash flow conversion is provided in

note 8 to the financial statements.

The Company's significant non-recurring transformation and

M&A pipeline costs, capitalised development expenditure and

acquisition consideration impact the Company's cash generation.

Dividend

Recognising the underlying financial strength of the business,

the Board proposes an interim dividend of 1.1p (HY22: 1.0p). It is

the Board's intention that this will be paid on or around 3

November 2023 to shareholders on the register on 29 September 2023.

The Board intends the ex-dividend date to be 28 September 2023.

Accounting policies

The accounting policies applied in these condensed consolidated

interim financial statements are the same as those applied in the

Group's consolidated financial statements in the 2022 Annual Report

& Accounts.

Going concern

The Directors have undertaken a comprehensive assessment to

consider the Company's ability to trade as a going concern for a

period of 18 months to February 2025.

The Directors have robustly tested the going concern assumption

in preparing these financial statements, taking into account a

number of severe but plausible downside scenarios, which would

collectively be considered remote. The Group benefits from a

deleveraged balance sheet and strong liquidity position at 30 June

2023 and the Directors remain satisfied that the going concern

basis of preparation in the financial statements is

appropriate.

On the basis of the Company's current and forecast profitability

and cash flows, and the availability of committed funding, the

Directors consider and have concluded that the Company will have

adequate resources to continue in operational existence for at

least the next 18 months. As a result, they continue to adopt a

going concern basis in the preparation of the financial

statements.

David Thompson

Chief Financial Officer

Consolidated statement of profit or loss and other comprehensive

income

for the six months 30 June 2023

2023 2023 2022 2022

2023 Underlying Year ended 2022 Underlying Year ended

Underlying Adjustments* 31 December Underlying adjustments 31 December

Note GBPm GBPm GBPm GBPm GBPm GBPm

-------------------------- ---- ---------- ------------ ----------- ---------- ----------- -----------

Revenue 6 31.7 - 31.7 32.2 - 32.2

Operating expenses 7-8 (24.5) (1.5) (26.0) (25.0) - (25.0)

Amortisation of other

intangible assets 13 - (1.0) (1.0) - (1.0) (1.0)

-------------------------- ---- ---------- ------------ ----------- ---------- ----------- -----------

Group operating profit 7.2 (2.5) 4.7 7.2 (1.0) 6.2

Finance expense 9 (0.2) - (0.2) (0.3) - (0.3)

-------------------------- ---- ---------- ------------ ----------- ---------- ----------- -----------

Profit before taxation 7.0 (2.5) 4.5 6.9 (1.0) 5.9

Taxation (1.7) 0.6 (1.1) (1.3) 0.2 (1.1)

-------------------------- ---- ---------- ------------ ----------- ---------- ----------- -----------

Profit for the financial

period 5.3 (1.9) 3.4 5.6 0.8 4.8

-------------------------- ---- ---------- ------------ ----------- ---------- ----------- -----------

Profit attributable

to shareholders:

Owners of the Company 3.3 4.7

Non-controlling interests 0.1 0.1

-------------------------- ---- ---------- ------------ ----------- ---------- ----------- -----------

3.4 4.8

-------------------------- ---- ---------- ------------ ----------- ---------- ----------- -----------

Earnings per share -

adjusted (pence) 10 5.0p 5.3p

Earnings per share -

basic (pence) 10 3.2p 4.6p

Earnings per share -

diluted (pence) 10 3.2p 4.5p

-------------------------- ---- ---------- ------------ ----------- ---------- ----------- -----------

There are no items to be included in other comprehensive income

in the current or preceding period.

Consolidated statement of financial position

as at 30 June 2023

Unaudited 30 June Unaudited 30 June

2023 2022

------------------- -------------------

Note GBPm GBPm GBPm GBPm

---------------------------------- ---- ---------- ------- ---------- -------

Non-current assets

Fixed asset investment 11 1.0 -

Property, plant and equipment 12 1.3 1.3

Lease assets 12 2.0 3.5

Intangible assets and goodwill 13 95.2 95.7

Trade and other receivables 1.1 2.6

---------------------------------- ---- ---------- ------- ---------- -------

Total non-current assets 100.6 103.1

---------------------------------- ---- ---------- ------- ---------- -------

Current assets

Trade and other receivables 11.6 9.6

Current tax asset 0.5 -

Cash and cash equivalents 13.3 7.6

---------------------------------- ---- ---------- ------- ---------- -------

Total current assets 25.4 17.2

---------------------------------- ---- ---------- ------- ---------- -------

Total assets 126.0 120.3

---------------------------------- ---- ---------- ------- ---------- -------

Equity and liabilities

Equity

Share capital 15 1.0 1.0

Share premium account 15 67.0 65.8

Other reserves 17 (50.6) (51.8)

Retained earnings 81.8 76.7

---------------------------------- ---- ---------- ------- ---------- -------

Equity attributable to the owners

of the Company 99.2 91.7

Non-controlling interest 0.4 0.3

---------------------------------- ---- ---------- ------- ---------- -------

Total equity 99.6 92.0

---------------------------------- ---- ---------- ------- ---------- -------

Liabilities

Current liabilities

Trade and other payables 19.5 17.6

Lease liabilities 14 0.4 0.5

Current tax liabilities - 2.2

---------------------------------- ---- ---------- ------- ---------- -------

Total current liabilities 19.9 20.3

---------------------------------- ---- ---------- ------- ---------- -------

Non-current liabilities

Lease liabilities 14 1.7 3.0

Deferred tax liabilities 4.8 5.0

---------------------------------- ---- ---------- ------- ---------- -------

Total non-current liabilities 6.5 8.0

---------------------------------- ---- ---------- ------- ---------- -------

Total liabilities 26.4 28.3

---------------------------------- ---- ---------- ------- ---------- -------

Total equity and liabilities 126.0 120.3

---------------------------------- ---- ---------- ------- ---------- -------

Consolidated statement of changes in equity

for the six months ended 30 June 2023

Non-

Share Share Other controlling Retained Total

capital premium reserves interest earnings equity

GBPm GBPm GBPm GBPm GBPm GBPm

----------------------------- ------- ------- -------- ------------ -------- ------

Balance at 30 June 2022 1.0 65.8 (51.8) 0.3 76.7 92.0

Total comprehensive income

for the period

Profit for the period - - - 0.2 5.1 5.3

----------------------------- ------- ------- -------- ------------ -------- ------

Total comprehensive income

for the period - - - 0.2 5.1 5.3

----------------------------- ------- ------- -------- ------------ -------- ------

Transactions with owners,

recorded directly in equity

Issue of shares - 1.0 - - - 1.0

Dividends - - - - (1.1) (1.1)

Share option charge - - 0.6 - - 0.6

Release of share option

reserve on exercise - - (0.1) - 0.1 -

----------------------------- ------- ------- -------- ------------ -------- ------

Total contributions by and

distributions to owners - 1.0 0.5 - (1.0) 0.5

----------------------------- ------- ------- -------- ------------ -------- ------

Balance at 31 December 2022 1.0 66.8 (51.3) 0.5 80.8 97.8

----------------------------- ------- ------- -------- ------------ -------- ------

Balance at 1 January 2023 1.0 66.8 (51.3) 0.5 80.8 97.8

Total comprehensive income

for the period

Profit for the period - - - 0.1 3.3 3.4

----------------------------- ------- ------- -------- ------------ -------- ------

Total comprehensive income

for the period - - - 0.1 3.3 3.4

----------------------------- ------- ------- -------- ------------ -------- ------

Transactions with owners,

recorded directly in equity

Issue of shares - 0.2 - - - 0.2

Dividends - - - (0.2) (2.4) (2.6)

Share option charge - - 0.8 - - 0.8

Release of share option

reserve on exercise - - (0.1) - 0.1 -

----------------------------- ------- ------- -------- ------------ -------- ------

Total contributions by and

distributions to owners - 0.2 0.7 (0.2) (2.3) (1.6)

----------------------------- ------- ------- -------- ------------ -------- ------

Balance at 30 June 2023 1.0 67.0 (50.6) 0.4 81.8 99.6

----------------------------- ------- ------- -------- ------------ -------- ------

Consolidated statement of cash flows

for the period to 30 June 2023

Period Period

ended ended

30 June 30 June

2023 2022

Note GBPm GBPm

----------------------------------------------------- ---- ------- -------

Net cash generated from operating activities 18 6.1 8.4

----------------------------------------------------- ---- ------- -------

Cash flows from investing activities

Fixed asset investment (1.0) -

Purchase of property, plant and equipment (0.3) (0.1)

Development expenditure (1.6) (0.6)

Finance income 0.1 -

----------------------------------------------------- ---- ------- -------

Net cash flows (used in)/from investing activities (2.8) (0.7)

----------------------------------------------------- ---- ------- -------

Cash flows from financing activities

Finance costs (0.2) (0.2)

Loan repayments made - (7.0)

Payment of lease liability (0.2) (0.3)

Issue of share capital 0.2 0.2

Dividends paid (2.6) (2.2)

----------------------------------------------------- ---- ------- -------

Net cash flows used in financing activities (2.8) (9.5)

----------------------------------------------------- ---- ------- -------

Net increase/(decrease) in cash and cash equivalents 0.5 (1.8)

Cash and cash equivalents at start of period 12.8 9.4

----------------------------------------------------- ---- ------- -------

Cash and cash equivalents at end of period 13.3 7.6

----------------------------------------------------- ---- ------- -------

Operating costs of an exceptional nature, as per note 7, are

included in net cash generated from operating activities.

During the period Fintel Labs Limited acquired 25% of the share

capital of financial technology company, Plannr Technologies

Limited. The investment is included in net cash from investing

activities.

NOTES TO THE INTERIM FINANCIAL INFORMATION

1 Reporting entity

Fintel plc (formerly the Simply Biz Group Limited) is a company

domiciled in the UK. These condensed consolidated interim financial

statements ("interim financial statements") as at and for the six

months ended 30 June 2023 comprise Fintel and its subsidiaries

(together referred to as "the Company"). The Company is the leading

provider of digital, data led and expert services to product

providers, intermediaries, and consumers to help them navigate the

increasingly complex world of retail financial services. Fintel

provides technology, compliance and regulatory support to thousands

of intermediary businesses, data and targeted distribution services

to hundreds of product providers and empowers millions of consumers

to make better informed financial decisions.

2 General information and basis of preparation

These interim financial statements have been prepared in

accordance with IAS 34 Interim financial reporting and should be

read in conjunction with the Company's last annual consolidated

financial statements as at and for the year ended 31 December 2022

("last annual financial statements"). They do not include all the

information required for a complete set of IFRS financial

statements. However, selected explanatory notes are included to

explain events and transactions that are significant to an

understanding of the Company's financial position and performance

since the last annual financial statements.

The financial information set out in these interim financial

statements for the six months ended 30 June 2023 and the

comparative figures for the six months ended 30 June 2022 are

unaudited. The comparative financial information for the period

ended 31 December 2022 in this interim report does not constitute

statutory accounts for that period under 435 of the Companies Act

2006.

Statutory accounts for the period ended 31 December 2022 have

been delivered to the Registrar of Companies. The auditors' report

on the accounts for 31 December 2022 was unqualified, did not draw

attention to any matters by way of emphasis, and did not contain a

statement under 498(2) or 498(3) of the Companies Act 2006.

The interim financial statements comprise the financial

statements of the Company and its subsidiaries at 30 June 2023.

Subsidiaries are consolidated from the date of acquisition, being

the date on which the Company obtained control, and continue to be

consolidated until the date when such control ceases.

The interim financial statements incorporate the results of

business combinations using the acquisition method. In the

consolidated balance sheet, the acquiree's identifiable assets,

liabilities and contingent liabilities are initially recognised at

their fair values at the acquisition date.

These interim financial statements were authorised for issue by

the Company's Board of Directors on 18 September 2023.

3 Critical accounting estimates and judgements

In preparing these interim financial statements, management has

made judgements and estimates that affect the application of

accounting policies and the reported amounts of assets and

liabilities, income, and expense. Actual results may differ from

these estimates.

The significant judgements made by management in applying the

Company's accounting policies and the key sources of estimation

uncertainty were the same as those described in the last annual

financial statements.

4 Changes in significant accounting policies

The accounting policies applied in these condensed consolidated

interim financial statements are the same as those applied in the

Company's consolidated financial statements in the 2022 Annual

Report & Accounts.

5 Going concern

The Board has concluded that it is appropriate to adopt the

going concern basis, having undertaken a rigorous review of

financial forecasts and available resources.

The Directors have robustly tested the going concern assumption

in preparing these financial statements, taking into account the

Group's strong liquidity position at 30 June 2023 and a number of

severe but plausible downside scenarios have been modelled, which

collectively would be considered remote, and remain satisfied that

the going concern basis of preparation is appropriate.

6 Segmental information

During the period, the Company was domiciled in the UK and all

revenue is derived from external customers in the United

Kingdom.

The Group has three operating segments, which are considered to

be reportable segments under IFRS. The three reportable segments

are:

-- Intermediary Services;

-- Distribution Channels; and

-- Fintech and Research.

Intermediary Services provides compliance and regulation

services to individual financial intermediary Member Firms,

including directly authorised IFAs, directly authorised mortgage

advisers, workplace consultants and directly authorised wealth

managers.

Distribution Channels provides marketing and promotion, product

panelling and co-manufacturing services to financial institutions.

This division of the Group also undertakes survey panelling and

surveying work for mortgage lenders.

The Fintech and Research segment provides proprietary advice

technology for over 8,000 users; independent ratings and reviews of

over 14,000 financial products and funds, licensed by over 300

brands; and research of over 43,000 financial products and

funds.

The reportable segments are derived on a product/customer type

basis. Management has applied its judgement on the application of

IFRS 8, with operating segments reported in a manner consistent

with the internal reporting produced to the Chief Operating

Decision Maker ("CODM").

For the purpose of making decisions about resource allocation

and performance assessment, it is the operating results of the

three core divisions listed above that are monitored by management

and the Group's CODM, being the Fintel plc Board. It is these

divisions, therefore, that are defined as the Group's reportable

operating segments.

Segmental information is provided for gross profit and adjusted

EBITDA, which are the measures used when reporting to the CODM The

tables below present the segmental information.

Admin and

Intermediary Distribution Fintech support

Services Channels and Research costs Group

Period ended 30 June 2023 GBPm GBPm GBPm GBPm GBPm

---------------------------------- ------------ ------------ ------------- --------- ------

Revenue 11.5 9.9 10.3 - 31.7

Direct operating costs (6.3) (6.3) (4.0) - (16.6)

---------------------------------- ------------ ------------ ------------- --------- ------

Gross profit 5.2 3.6 6.3 - 15.1

Administrative and support

costs (6.1) (6.1)

---------------------------------- ------------ ------------ ------------- --------- ------

Adjusted EBITDA 9.0

Operating costs of an exceptional

nature (1.5)

Amortisation of other intangible

assets (1.0)

Amortisation of development

costs and software (0.6)

Depreciation (0.2)

Depreciation of lease assets (0.2)

Share option charge (0.8)

---------------------------------- ------------ ------------ ------------- --------- ------

Operating profit 4.7

---------------------------------- ------------ ------------ ------------- --------- ------

Net finance costs (0.2)

---------------------------------- ------------ ------------ ------------- --------- ------

Profit before tax 4.5

---------------------------------- ------------ ------------ ------------- --------- ------

Fintech

Intermediary Distribution and Admin and

support

Services Channels Research costs Group

Period ended 30 June 2022 GBPm GBPm GBPm GBPm GBPm

--------------------------------- ------------ ------------ -------- --------- ------

Revenue 11.4 11.4 9.4 - 32.2

Direct operating costs (6.9) (6.9) (3.7) - (17.5)

--------------------------------- ------------ ------------ -------- --------- ------

Gross profit 4.5 4.5 5.7 - 14.7

Administrative and support

costs (6.0) (6.0)

--------------------------------- ------------ ------------ -------- --------- ------

Adjusted EBITDA 8.7

Amortisation of other intangible

assets (1.0)

Amortisation of development

costs and software (0.5)

Depreciation (0.1)

Depreciation of lease assets (0.2)

Share option charge (0.7)

--------------------------------- ------------ ------------ -------- --------- ------

Operating profit 6.2

--------------------------------- ------------ ------------ -------- --------- ------

Net finance costs (0.3)

--------------------------------- ------------ ------------ -------- --------- ------

Profit before tax 5.9

--------------------------------- ------------ ------------ -------- --------- ------

In determining the trading performance of the operating segments

central costs have been presented separately in the current period.

Segmental performance in the prior period has been presented

consistently on the same basis.

The statement of financial position is not analysed between the

reporting segments by management and the CODM considers the Group

statement of financial position as a whole.

No customer has generated more than 10% of total revenue during

the period covered by the financial information.

7 Operating profit

Operating profit for the period has been arrived at after

charging:

Period

ended Period ended

30 June 30 June

2023 2022

GBPm GBPm

---------------------------------------- ------- ------------

Depreciation of tangible assets - owned 0.2 0.1

Depreciation of lease assets 0.2 0.2

---------------------------------------- ------- ------------

Underlying adjustments

Underlying adjustments include amortisation of other intangible

assets and operating and finance costs of an exceptional

nature.

Period

ended Period ended

30 June 30 June

2023 2022

GBPm GBPm

----------------------------------------- ------- ------------

Exceptional costs - operating

Transformation 0.8 -

M&A pipeline costs 0.4 -

Restructuring 0.3 -

Other underlying adjustments

Amortisation of other intangible assets 1.0 1.0

Underlying adjustments - before tax 2.5 1.0

These are items which are non-recurring and are adjusted on the

basis of either their size or their nature. As these items are

one-off or non-operational in nature, management considers that

their exclusion aids understanding of the Group's underlying

business performance.

Operating costs of an exceptional nature of GBP1.5m (HY22: Nil)

comprise the following:

-- Transformation costs of GBP0.8m - includes implementation

costs to enhance Fintel's customer relationship management platform

("CRM") and a new enterprise resource planning system ("ERP")

-- M&A pipeline costs GBP0.4m (HY22: Nil) - including costs

relating to the recent acquisition of Plannr Technologies

Limited

-- Restructuring related costs GBP0.3m (HY22: Nil)

No other costs have been treated as exceptional in the period to

30 June 2023.

8 Reconciliation of GAAP to non-GAAP measures

The Group uses a number of "non-GAAP" figures as comparable key

performance measures, as they exclude the impact of items that are

non-cash items and also items that are not considered part of

ongoing underlying trade. Amortisation of other intangible assets

has been excluded on the basis that it is a non-cash amount,

relating to acquisitions in prior periods. The Group's "non-GAAP"

measures are not defined performance measures in IFRS. The Group's

definition of the reporting measures may not be comparable with

similarly titled performance measures in other entities.

Adjusted EBITDA is calculated as follows:

Period

ended Period ended

30 June 30 June

2023 2022

GBPm GBPm

--------------------------------------------------- ------- ------------

Operating profit 4.7 6.2

Add back:

Depreciation (note 12) 0.2 0.1

Depreciation of lease assets (note 12) 0.2 0.2

Amortisation of other intangible assets (note

13) 1.0 1.0

Amortisation of development costs and software

(note 13) 0.6 0.5

--------------------------------------------------- ------- ------------

EBITDA 6.7 8.0

Add back:

Share option charge 0.8 0.7

Operating costs of exceptional nature (note 7) 1.5 -

--------------------------------------------------- ------- ------------

Adjusted EBITDA 9.0 8.7

--------------------------------------------------- ------- ------------

Adjusted EBITDA of non-core surveying business 0.2 0.5

--------------------------------------------------- ------- ------------

Core adjusted EBITDA 8.8 8.2

--------------------------------------------------- ------- ------------

Operating costs of an exceptional nature have been excluded as

they are not considered part of the underlying trade. Share option

charges have been excluded from adjusted EBITDA as a non-cash

item.

Adjusted operating profit is calculated as follows:

Period ended Period ended

30 June 30 June

2023 2022

GBPm GBPm

--------------------------------------------------- ------------ ------------

Operating profit 4.7 6.2

Add back:

Operating costs of exceptional nature (note 7) 1.5 -

Amortisation of other intangible assets (note

13) 1.0 1.0

--------------------------------------------------- ------------ ------------

Adjusted operating profit 7.2 7.2

--------------------------------------------------- ------------ ------------

Adjusted profit before tax is calculated as follows:

Period

ended Period ended

30 June 30 June

2023 2022

GBPm GBPm

--------------------------------------------------- ------- ------------

Profit before tax 4.5 5.9

Add back:

Operating costs of exceptional nature (note 7) 1.5 -

Amortisation of other intangible assets (note

13) 1.0 1.0

--------------------------------------------------- ------- ------------

Adjusted profit before tax 7.0 6.9

--------------------------------------------------- ------- ------------

Adjusted profit after tax is calculated as follows:

Period

ended Period ended

30 June 30 June

2023 2022

GBPm GBPm

----------------------------------------------------- ------- ------------

Profit after tax 3.4 4.8

Add back:

Operating costs of exceptional nature (note 7),

net of tax 1.2 -

Amortisation of other intangible assets (note

13), net of deferred tax 0.7 0.8

Profit attributable to non-controlling interests (0.1) (0.1)

----------------------------------------------------- ------- ------------

Adjusted profit after tax 5.2 5.5

----------------------------------------------------- ------- ------------

Free cash flow conversion is calculated as follows:

Period

ended Period ended

30 June 30 June

2023 2022

GBPm GBPm

--------------------------------------------------- ------- ------------

Adjusted operating profit 7.2 7.2

Adjusted for:

Depreciation of tangible assets 0.2 0.1

Depreciation of lease assets 0.2 0.2

Amortisation of development costs and software 0.6 0.5

Share option charge 0.8 0.7

--------------------------------------------------- ------- ------------

Adjusted EBITDA 9.0 8.7

--------------------------------------------------- ------- ------------

Net changes in working capital 0.4 0.9

Purchase of property, plant and equipment (0.3) (0.1)

Development expenditure (1.6) (0.6)

--------------------------------------------------- ------- ------------

Underlying cash flow from operations 7.5 8.9

--------------------------------------------------- ------- ------------

Underlying operating cash flow conversion 104% 124%

--------------------------------------------------- ------- ------------

Net interest paid (0.1) (0.2)

Income tax paid (1.8) (1.3)

Payments of lease liability (0.2) (0.3)

--------------------------------------------------- ------- ------------

Free cash flow 5.4 7.1

Adjusted EBITDA 9.0 8.7

--------------------------------------------------- ------- ------------

Free cash flow conversion 60% 82%

--------------------------------------------------- ------- ------------

9 Net finance expense

Finance Interest - expense

Period

ended Period ended

30 June 30 June

2023 2022

GBPm GBPm

------------------------------------------------------- ------- ------------

Interest payable on financial liabilities at amortised

cost 0.3 0.2

Finance charge on lease liability - 0.1

------------------------------------------------------- ------- ------------

Total finance expense 0.3 0.3

------------------------------------------------------- ------- ------------

Finance Interest - income

Period

ended Period ended

30 June 30 June

2023 2022

GBPm GBPm

------------------------- ------- ------------

Bank interest receivable 0.1 -

------------------------- ------- ------------

Total finance income 0.1 -

------------------------- ------- ------------

10 Earnings per share

Period ended Period ended

30 June 30 June

Basic earnings per share 2023 2022

---------------------------------------------- ------------ ------------

Profit attributable to equity shareholders of

the parent (GBPm) 3.3 4.7

---------------------------------------------- ------------ ------------

Weighted average number of shares in issue 103,705,423 102,952,665

---------------------------------------------- ------------ ------------

Basic profit per share (pence) 3.2 4.6

---------------------------------------------- ------------ ------------

Period

ended Period ended

30 June 30 June

Diluted earnings per share 2023 2022

------------------------------------------------------ ----------- ------------

Profit attributable to equity shareholders of the

parent (GBPm) 3.3 4.7

------------------------------------------------------ ----------- ------------

Weighted average number of shares in issue 103,705,423 102,952,665

Diluted weighted average number of shares and options

for the period 734,382 751,573

------------------------------------------------------ ----------- ------------

104,439,805 103,704,238

------------------------------------------------------ ----------- ------------

Diluted profit per share (pence) 3.2 4.5

------------------------------------------------------ ----------- ------------

Period ended Period ended

30 June 30 June

Adjusted basic earnings per share 2023 2022

------------------------------------------- ------------ ------------

Adjusted profit after tax (note 8) (GBPm) 5.2 5.5

------------------------------------------- ------------ ------------

Weighted average number of shares in issue 103,705,423 102,952,665

------------------------------------------- ------------ ------------

Adjusted earnings per share (pence) 5.0 5.3

------------------------------------------- ------------ ------------

11 Fixed asset investment

Fixed Asset

Investment

GBPm

-------------------- -----------

At 31 December 2022 -

Additions 1.0

-------------------- -----------

At 30 June 2023 1.0

-------------------- -----------

On 8 March, Fintel Labs Limited acquired a non-controlling

interest in Plannr Technologies Limited, acquiring 25% of Ordinary

Shares in exchange for GBP1.0m consideration. The acquisition is

recorded at cost and subsequently recorded at fair value through

other comprehensive income.

12 Property, plant and equipment

Leased assets Owned assets

-------------------------- -----------------------------

Plant and Leasehold Office

Property equipment Total Improvement Equipment Total

Group GBPm GBPm GBPm GBPm GBPm GBPm

---------------------------- -------- --------- ----- ----------- --------- -----

Cost

At 1 January 2022 4.0 0.9 4.9 0.9 1.8 2.7

Additions - 0.1 0.1 - 0.1 0.1

Disposals - - - - - -

---------------------------- -------- --------- ----- ----------- --------- -----

At 30 June 2022 4.0 1.0 5.0 0.9 1.9 2.8

Additions - - - - 0.1 0.1

Revaluation of lease (1.1) - (1.1) - - -

---------------------------- -------- --------- ----- ----------- --------- -----

At 31 December 2022 2.9 1.0 3.9 0.9 2.0 2.9

Additions - - - - 0.3 0.3

At 30 June 2023 2.9 1.0 3.9 0.9 2.3 3.2

---------------------------- -------- --------- ----- ----------- --------- -----

Depreciation and impairment

At 1 January 2022 0.7 0.6 1.3 0.1 1.3 1.4

Depreciation charge

for the period 0.1 0.1 0.2 - 0.1 0.1

---------------------------- -------- --------- ----- ----------- --------- -----

At 30 June 2022 0.8 0.7 1.5 0.1 1.4 1.5

Depreciation charge

for the period 0.2 - 0.2 0.1 0.1 0.2

At 31 December 2022 1.0 0.7 1.7 0.2 1.5 1.7

Depreciation charge

for the period 0.1 0.1 0.2 0.1 0.1 0.2

---------------------------- -------- --------- ----- ----------- --------- -----

At 30 June 2023 1.1 0.8 1.9 0.3 1.6 1.9

---------------------------- -------- --------- ----- ----------- --------- -----

Net book value

At 31 June 2023 1.8 0.2 2.0 0.6 0.7 1.3

---------------------------- -------- --------- ----- ----------- --------- -----

At 30 June 2022 3.2 0.3 3.5 0.8 0.5 1.3

---------------------------- -------- --------- ----- ----------- --------- -----

Leased property includes the Group's head office for which the

lease was entered into during 2020. The lease had a non-cancellable

term of 10 years, and also contained an option to extend the lease

for a further 5 years beyond the non-cancellable term, and an

option to purchase the building exercisable until January 2023.

During 2022 management reassessed the likelihood of calling in the

option to buy. The lease was revalued during 2022 which resulted in

a reduction of the lease liability and right-of-use asset of

GBP1.1m. The lease asset is being depreciated across the

non-cancellable term of the lease and the option to buy has since

lapsed.

Plant and equipment includes IT equipment and motor

vehicles.

13 Intangible assets

Total other

Intellectual intangible Development

Goodwill Brand property assets expenditure Total

Group GBPm GBPm GBPm GBPm GBPm GBPm

---------------------------- -------- ----- ------------ ----------- ------------ -----

Cost

At 1 January 2022 72.4 3.1 24.4 27.5 3.7 103.6

Additions - - - - 0.6 0.6

---------------------------- -------- ----- ------------ ----------- ------------ -----

At 30 June 2022 72.4 3.1 24.4 27.5 4.3 104.2

Additions - - - - 1.1 1.1

---------------------------- -------- ----- ------------ ----------- ------------ -----

At 31 December 2022 72.4 3.1 24.4 27.5 5.4 105.3

---------------------------- -------- ----- ------------ ----------- ------------ -----

Additions - - - - 1.6 1.6

---------------------------- -------- ----- ------------ ----------- ------------ -----

At 30 June 2023 72.4 3.1 24.4 27.5 7.0 106.9

---------------------------- -------- ----- ------------ ----------- ------------ -----

Amortisation and impairment

At 1 January 2022 0.2 0.8 4.8 5.6 1.2 7.0

Charge in the period - 0.2 0.8 1.0 0.5 1.5

---------------------------- -------- ----- ------------ ----------- ------------ -----

At 30 June 2022 0.2 1.0 5.6 6.6 1.7 8.5

Charge in the period - 0.2 0.8 1.0 0.6 1.6

---------------------------- -------- ----- ------------ ----------- ------------ -----

At 31 December 2022 0.2 1.2 6.4 7.6 2.3 10.1

Charge in the period - 0.2 0.8 1.0 0.6 1.6

---------------------------- -------- ----- ------------ ----------- ------------ -----

At 30 June 2023 0.2 1.4 7.2 8.6 2.9 11.7

---------------------------- -------- ----- ------------ ----------- ------------ -----

Net book value

At 30 June 2023 72.2 1.7 17.2 18.9 4.1 95.2

---------------------------- -------- ----- ------------ ----------- ------------ -----

At 30 June 2022 72.2 2.1 18.8 20.9 2.6 95.7

---------------------------- -------- ----- ------------ ----------- ------------ -----

Capitalised development expenditure relates to the development

of the software platform in Defaqto Limited.

The carrying amount of goodwill is allocated across operating

segments, which are deemed to be cash-generating units ("CGUs") as

follows:

Period

ended Period ended

30 June 30 June

2023 2022

GBPm GBPm

---------------------- ------- ------------

Intermediary Services 12.7 12.7

Distribution Channels 11.5 11.5

Fintech and Research 48.0 48.0

---------------------- ------- ------------

72.2 72.2

---------------------- ------- ------------

Goodwill is determined to have an indefinite useful economic

life. The Group has determined that, for the purposes of impairment

testing, each segment is a cash-generating unit ("CGU"). The

recoverable amounts for the CGUs are predominantly based on value

in use, which is calculated on the cash flows expected to be

generated using the latest projected data available over a

five-year period, plus a terminal value estimate.

14 Interest-bearing loans and borrowings

This note provides information about the contractual terms of

the Group's and Company's interest-bearing loans and

borrowings.

Period ended Period ended

30 June 30 June

2023 2022

GBPm GBPm

---------------- ------------ ------------

Current

Lease liability 0.4 0.5

---------------- ------------ ------------

0.4 0.5

Non-current

Lease liability 1.7 3.0

---------------- ------------ ------------

2.1 3.5

---------------- ------------ ------------

The Company has access to a GBP80m Revolving Credit Facility,

which is linked to the Sterling Overnight Interbank Average Rate

("SONIA"). The committed credit facilities are available at pre

agreed margins of between 1.50% and 2.40%, dependent on the net

leverage of the company. The facility remains fully undrawn.

15 Capital and reserves

Share capital

Ordinary

Shares

----------------------------------------------------- -----------

Number of fully paid shares (nominal value GBP0.01):

At 30 June 2022 103,011,962

Issue of share capital 636,983

----------------------------------------------------- -----------

At 31 December 2022 103,648,945

Issue of share capital 123,270

----------------------------------------------------- -----------

At 30 June 2023 103,772,215

----------------------------------------------------- -----------

Share

premium

GBPm

----------------------- -------

At 30 June 2022 65.8

Issue of share capital 1.1

----------------------- -------

At 31 December 2022 66.8

Issue of share capital 0.2

----------------------- -------

At 30 June 2023 67.0

----------------------- -------

16 Share-based payment arrangements

There have been no material changes to the share-based payment

arrangements in the period to those disclosed in the annual report

and accounts for the period ended 31 December 2022 other than as

disclosed below:

CSOP 2018

During the current period, 17647 awards were exercised. 8,823

awards under the plan have been forfeited as a result of bad

leavers

SAYE 2018

During the current period, 10,588 awards were exercised. No

awards were forfeited as a result of bad leavers.

SAYE 2019

During the current period, 83,152 awards were exercised. No

awards were forfeited as a result of bad leavers.

SAYE 2021

During the current period, 1,960 awards were exercised. The

awards forfeited totalled 14,503 as a result of bad leavers.

17 Other reserves

Merger Share option

reserve reserve Total

Group GBPm GBPm GBPm

-------------------------------- ------- ------------ ------

At 30 June 2022 (53.9) 2.1 (51.8)

Share option charge - 0.6 0.6

Release of share option reserve - (0.1) (0.1)

-------------------------------- ------- ------------ ------

At 31 December 2022 (53.9) 2.6 (51.3)

Share option charge - 0.8 0.8

Release of share option reserve - (0.1) (0.1)

-------------------------------- ------- ------------ ------

At 30 June 2023 (53.9) 3.3 (50.6)

-------------------------------- ------- ------------ ------

18 Notes to the cash flow statement

Period

ended Period ended

30 June 30 June

2023 2022

GBPm GBPm

--------------------------------------------------------- ------- ------------

Cash flow from operating activities

Profit after taxation 3.4 4.8

Add back:

Finance income (0.1) -

Finance cost 0.3 0.3

Taxation 1.1 1.1

--------------------------------------------------------- ------- ------------

4.7 6.2

--------------------------------------------------------- ------- ------------

Adjustments for:

Amortisation of development expenditure and software

(note 13) 0.6 0.5

Depreciation of lease asset 0.2 0.2

Depreciation of property, plant and equipment 0.2 0.1

Amortisation of other intangible assets 1.0 1.0

Share option charge 0.8 0.7

--------------------------------------------------------- ------- ------------

Operating cash flow before movements in working capital 7.5 8.7

Decrease/(increase) in receivables (0.2) 0.3

Increase in trade and other payables 0.6 0.7

--------------------------------------------------------- ------- ------------

Cash generated from operations 7.9 9.7

Income taxes paid (1.8) (1.3)

--------------------------------------------------------- ------- ------------

Net cash generated from operating activities 6.1 8.4

--------------------------------------------------------- ------- ------------

19 Subsequent events

On 7 July 2023 Regulus Bidco Limited, the parent company of

Defaqto, acquired 100 % share capital of MI Capital Research

Limited (MICAP). Initial consideration of GBP3.0m has been paid,

with a further GBP1.0m deferred for one year and GBP0.5m contingent

on certain trading criteria being met. The acquisition of MICAP

will extend Defaqto's reach into the tax-advantage market expanding

its data footprint and research capabilities.

On 27 July 2023, Fintel IQ Limited acquired Competent Adviser

Training Limited, the UK's fastest growing digital knowledge and

competence management system, acquiring 100% of Ordinary Shares in

exchange for GBP2.5m consideration and a GBP0.5m contingent earnout

based on trading performance. The acquisition forms part of the

Group's strategy to strengthen its technology and data

proposition.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR GPUUPBUPWGBR

(END) Dow Jones Newswires

September 19, 2023 02:00 ET (06:00 GMT)

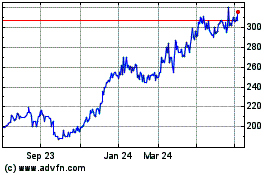

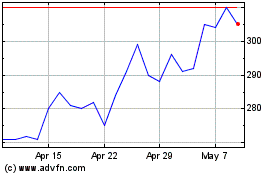

Fintel (LSE:FNTL)

Historical Stock Chart

From Apr 2024 to May 2024

Fintel (LSE:FNTL)

Historical Stock Chart

From May 2023 to May 2024