LONDON MARKETS: U.K. Stocks Falter; 'fundamental Value' Seen In Utilities

29 August 2018 - 8:02PM

Dow Jones News

By Anneken Tappe

Centrica, United Utilities gain; Fresnillo falls

The U.K. stock market faltered Wednesday as Brexit risk came

into focus once again.

Utilities were firmer, however, as Citigroup said it was seeing

"fundamental value" in the sector.

How are benchmarks performing?

The FTSE 100 Index pulled back after closing Tuesday's session

up 0.5%

(http://www.marketwatch.com/story/ftse-100-climbs-led-by-mining-stocks-2018-08-28)

for its best daily gain since Aug. 16. It was last down 0.4% at

7,587.48.

Continental European stocks traded around break-even

(http://www.marketwatch.com/story/european-shares-tick-higher-but-uk-stocks-dip-2018-08-29),

and U.S. stocks showed little enthusiasm as well

(http://www.marketwatch.com/story/stocks-aim-for-4th-straight-daily-gain-sp-nasdaq-again-poised-for-records-2018-08-29).

The British pound was little changed against the U.S. dollar,

buying $1.2874.

What is driving the market?

European stock action was muted in what is traditionally one of

the quietest weeks of the year. Some optimism over global trade

remained from President Donald Trump's announcement earlier this

week over a trade deal with Mexico.

Investor worries about Brexit negotiations were in focus as

Brussels and London now aim to finalize their divorce agreement by

mid-November

(http://www.marketwatch.com/story/deadline-for-brexit-talks-is-being-pushed-back-again-bloomberg-2018-08-29),

later than the previous October deadline, according to a Bloomberg

report. The U.K. officially exits the European Union in late March

next year, leaving little time to finalize and agreement that will

govern the island's relationship with the mainland afterward.

The scenario of a "no-deal Brexit", in which case no agreement

can be reached beforehand, is causing investors to worry about

possible downside risk, though Prime Minister Theresa May Tuesday

said it "wouldn't e the end of the world."

Stocks in focus

Distribution and outsourcing company Bunzl PLC (BZLFY) was

leading gainers in the FTSE 100, rising 3%. Investors continued to

asses the company's first-half results reported Tuesday

(http://www.marketwatch.com/story/bunzl-6-mo-pretax-profit-up-8-sales-top-forecast-2018-08-28)

that showed revenue growth of 5% year-over-year, while adjusted

earnings per share grew 8% in the same period.

But U.K. utilities were the main focus.

"After several years of exuberant pricing of U.K. utilities, the

table has turned in the face of political, regulatory and macro

risks," wrote Citi research analyst Jenny Ping in a note. "While we

expect a turbulent ride in the months ahead given the uncertainties

of Brexit and questions over the stability of the current U.K.

government, we cannot ignore the fact that we are starting to see

fundamental value."

Among Ping's top buy recommendations in the sector are Centrica

PLC(CNA.LN), which she said should benefit from the recent rally in

commodity prices as well as earnings visibility, as well as United

Utilities PLC(UU.LN), which she said has seen operational fears

overdone in its share price. Both companies were among the biggest

blue-chip gainers: United Utilities and Centrica PLC rose 1.9% and

2.2%, respectively.

Citi's buy calls also included National Grid PLC (NG.LN). "U.K.

risks are now firmly in the shares and we believe exposure to

improving U.S. business should also provide hedge in case of

further political turbulence."

Decliners included grocery delivery business Ocado Group PLC

(OCDO.LN), which was down 2.3%.

Metals and mining multinational Fresnillo (FRES.LN) dropped

2.3%, following an upbeat Tuesday session.

Meanwhile, Aston Martin, the maker of James Bond's cars, is

eyeing a billion-pound London IPO, according to The Wall Street

Journal

(http://www.marketwatch.com/story/aston-martin-eyes-billion-pound-ipo-in-london-2018-08-29).

(END) Dow Jones Newswires

August 29, 2018 05:47 ET (09:47 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

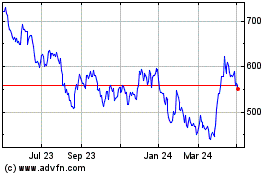

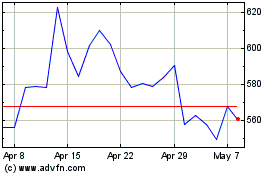

Fresnillo (LSE:FRES)

Historical Stock Chart

From Apr 2024 to May 2024

Fresnillo (LSE:FRES)

Historical Stock Chart

From May 2023 to May 2024