GCP Asset Backed Income Fund Ltd Additional Listing (0772P)

24 May 2018 - 4:02PM

UK Regulatory

TIDMGABI TIDMTTM

RNS Number : 0772P

GCP Asset Backed Income Fund Ltd

24 May 2018

GCP Asset Backed Income Fund Limited

(the "Company" or "GCP Asset Backed")

LEI: 213800FBBZCQMP73A815

Additional Listing

24 May 2018

GCP Asset Backed, which invests in asset back loans, has made an

application for 160,232 ordinary shares of no par value each in the

Company to be admitted to the premium segment of the Official List

of the Financial Conduct Authority and to trading on the London

Stock Exchange. It is expected that these new ordinary shares will

be admitted to trading on 5 June 2018.

The application is being made pursuant to the scrip dividend

alternative in lieu of cash for the interim dividend for the period

from 1 January 2018 to 31 March 2018 (the "Q1 Dividend"). Elections

for a scrip dividend were received in respect of 3.4% of the

ordinary shares in issue as at the record date of 4 May 2018. When

issued, these ordinary shares will rank pari passu with the

existing ordinary shares.

Further details of the scrip dividend alternative can be found

in the Scrip Dividend Circular 2018 which was published by the

Company on 26 April 2018, a copy of which is available for

inspection at www.morningstar.co.uk/uk/NSM and on the Company's

website at

www.graviscapital.com/funds/gcp-asset-backed/literature.

Following admission of the new ordinary shares, the Company's

issued share capital will consist of 316,759,911 ordinary shares of

no par value each and therefore, the total number of issued shares

with voting rights will be 316,759,911.

The above figure of 316,759,911 may be used by shareholders as

the denominator for the calculations by which they will determine

if they are required to notify their interest in, or of a change to

their interest in, the Company under the FCA's Disclosure Guidance

and Transparency Rules.

For further information, please contact:

Gravis Capital Management Limited +44 (0) 20 3405 8500

David Conlon davidconlon@graviscapital.com

Philip Kent philip.kent@graviscapital.com

Dion Di Miceli dion.dimiceil@graviscapital.com

Cenkos Securities plc +44 (0) 20 7397 8900

Tom Scrivens tscrivens@cenkos.com

Oliver Packard opackard@cenkos.com

Sapna Shah sshah@cenkos.com

Buchanan +44 (0) 20 7466 5000

Charles Ryland charlesr@buchanan.uk.com

Henry Wilson henryw@buchanan.uk.com

Notes to Editors

The Company

GCP Asset Backed is a closed ended investment company traded on

the Main Market of the London Stock Exchange. Its investment

objective is to generate attractive risk-adjusted returns primarily

through regular, growing distributions and modest capital

appreciation over the long term.

The Company seeks to meet its investment objective by making

investments in a diversified portfolio of predominantly UK based

asset backed loans which have contracted, predictable medium to

long term cash flows and/or physical assets.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

ALSPGUUWAUPRGCW

(END) Dow Jones Newswires

May 24, 2018 02:02 ET (06:02 GMT)

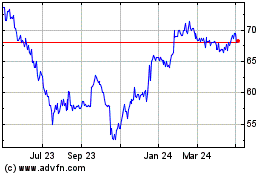

Gcp Asset Backed Income (LSE:GABI)

Historical Stock Chart

From Mar 2024 to May 2024

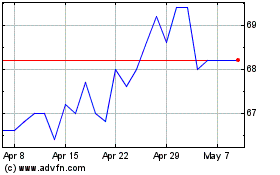

Gcp Asset Backed Income (LSE:GABI)

Historical Stock Chart

From May 2023 to May 2024