Gamma Communications PLC Full year growth expectations remain unchanged (4498M)

12 January 2023 - 6:00PM

UK Regulatory

TIDMGAMA

RNS Number : 4498M

Gamma Communications PLC

12 January 2023

12 January 2023

Gamma Communications plc

Trading Update

Full year adj. EBITDA and adj. EPS growth expectations remain

unchanged*

Gamma Communications plc ("Gamma"), a leading provider of

Unified Communication as a Service ("UCaaS") products, announces a

trading update for the year ended 31 December 2022.

Trading

The UK business has continued to perform strongly throughout the

year in both the Indirect and Direct channels, with healthy demand

for our broadening UCaaS portfolio and products enabling Microsoft

Teams. The strength of our financial performance more than offset

the UK inflationary pressures, and the minor industry-wide hardware

supply delays in the Direct channel were actively managed and

resolved within the year.

In Europe, UCaaS product revenue growth continues to offset the

expected and continuing decline in lower margin traditional

revenues. The overall growth of our European UCaaS business

continues in line with the market but the individual performance

varies reflecting the different market conditions in each country.

Our largest European business, Germany, continues to perform well,

leading the UCaaS product growth across our European geographic

footprint. During the year, our German business won a number of

1000+ cloud seat regional customers which underpinned its

anticipated double-digit percentage UCaaS seat growth and overall

UCaaS revenue growth. The Netherlands business continues to make

steady progress within its more mature market. Our smaller Spanish

business has been impacted by the challenging local market economic

conditions. Therefore, following a recent and ongoing review, the

Board anticipates that the achievement of future business

performance targets may take longer than originally forecast. This,

combined with the increase in discount rates, will likely result in

the need to impair the goodwill carried in relation to the Spanish

2020 VozTelecom acquisition in the audited results for the year

ended 31 December 2022. This will be a non-cash adjusted item.

Cash

The closing net cash balance was GBP92.2m (2021: GBP49.5m),

demonstrating Gamma's continued high operating profit cash

conversion. The sizeable GBP42.7m net cash increase year on year

was achieved even after allowing for GBP13.3m paid to shareholders

in dividends (2021: GBP11.7m), a year-on-year increase of 13.7%.,

the Neotel Spanish bolt-on acquisition (GBP4.4m paid in period) and

a modest increase in group capex investment in product development

compared to 2021.

Financial Performance

Overall, we anticipate reporting a group financial performance

which will demonstrate significant year on year growth and an

adjusted EBITDA and adjusted EPS for the year ended 31 December

2022 in line with the Board's previous expectations*. Market

consensus has increased since the Half year report, published in

September, but we expect to report adjusted EBITDA in the upper

half of the updated range, and adjusted EPS within the range.**

Overview of the year

Some of the key highlights from the year include:

Growth in core Cloud PBX seats in UK in line with previous

years; attachment volumes for supplementary products continue to

grow and ARPUs have been maintained.

Significant contract wins, including the Department of Work and

Pensions and DEFRA for Microsoft Teams, The AA for mobility

services and Central Bedfordshire and Colchester Borough councils

for UCaaS and CCaaS.

Investment in our own products as well as enabling systems.

There were product launches of CircleLoop (digital cloud based

small business phone system) in both the Netherlands and Germany;

and of Operator Connect for Teams in the Netherlands. We have also

started programmes to update both our HR and Finance systems across

the Group.

The Board expects to announce results for the year ended 31

December 2022 on Tuesday 21 March 2023.

Note: Company compiled range is based on known sell-side analyst

estimates.

* At the H1 Trading update (2 August 2022) the Board reiterated

their expectation that adjusted EBITDA and adjusted EPS for the

year ending 31 December 2022 would be in the upper half of the

analysts' range: The range being adjusted EBITDA GBP102.3m -

GBP106.8m and adjusted EPS 67.1 pence - 74.6 pence. The Board's

expectations remain unchanged.

** The latest known sell-side analyst estimates for the full

year ended 31 December 2022 are adjusted EBITDA GBP102.7m -

GBP107.0m and adjusted EPS 70.1 pence - 74.8 pence.

Andrew Belshaw, Chief Executive, commented:

"Our staff and partners have delivered another set of strong

results for Gamma. The positive, UK driven, momentum in the first

half continued throughout the year, more than offsetting the cost

headwinds created by the increased inflationary environment.

Although market conditions remain challenging in Europe, Gamma,

led by its robustly performing German business, continues to grow

its UCaaS footprint. The recent bolt-on Neotel acquisition in Spain

helps deliver greater operational scale which we expect will lead

to improved performance in that market.

Demand for UCaaS products continues to grow across all our

markets and segments. Gamma is well positioned with its strong

relationships, evolving product set and resilient recurring revenue

model. This, alongside the high margins and cash generation the

group enjoys, will allow Gamma to continue to deliver and grow

through the testing macroeconomic environment in 2023."

END

Gamma Communications plc Tel: +44 (0) 333 014 0000

Andrew Belshaw, Chief Executive

Officer

Bill Castell, Chief Financial

Officer

Tulchan Communications LLP Tel: +44 (0) 207 353 4200

James Macey White / Matt Low

Investec Bank plc (NOMAD Tel: +44 (0) 207 597 5970

& Broker)

Patrick Robb / Virginia Bull

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTBRGDBLDBDGXB

(END) Dow Jones Newswires

January 12, 2023 02:00 ET (07:00 GMT)

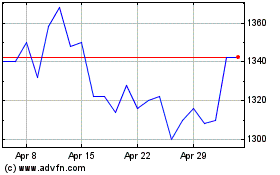

Gamma Communications (LSE:GAMA)

Historical Stock Chart

From Mar 2024 to Apr 2024

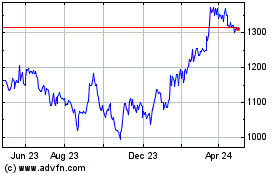

Gamma Communications (LSE:GAMA)

Historical Stock Chart

From Apr 2023 to Apr 2024