TIDMGDP

RNS Number : 0486X

Goldplat plc

18 December 2023

Goldplat plc / Ticker: GDP / Index: AIM / Sector: Mining &

Exploration

18 December 2023

Goldplat plc

('Goldplat', the 'Group' or 'the Company')

Audited Results for the year ended 30 June 2023

Goldplat plc, (AIM:GDP) the AIM listed Mining Services Group,

with international gold recovery operations located in South Africa

and Ghana, servicing the African and South American Mining

Industry, is pleased to announce its audited results for the year

ended 30 June 2023.

The Company's annual report and accounts are available on the

Company's website at http://www.goldplat.com/downloads and hard

copies will be posted by 19 December 2023 to shareholders that have

elected to receive printed copies.

As announced on 4 December 2023, Resolution 1 to be put to

shareholders at the Annual General Meeting of the Company being

held on 29 December 2023, to receive the report of the Directors of

the Company and the audited financial statements of the Company for

the year ended 30 June 2023, will be adjourned in order to give

shareholders the requisite notice. The date of the adjourned

meeting will be confirmed in due course.

For further information visit www.goldplat.com, follow on

Twitter @GoldPlatGDP or contact:

Werner Klingenberg Goldplat Plc Tel: +27 (0) 82 051 1071

(CEO)

Colin Aaronson / Samantha Grant Thornton UK LLP Tel: +44 (0) 20 7383

Harrison / Enzo Aliaj (Nominated Adviser) 5100

James Bavister / Andrew WH Ireland Limited Tel: +44 (0) 207 220

de Andrade (Broker) 1666

Tim Thompson / Mark Flagstaff Strategic Tel: +44 (0) 207 129

Edwards / Fergus Mellon and Investor Communications 1474

goldplat@flagstaffcomms.com

The information contained within this announcement is deemed to

constitute inside information as stipulated under the retained EU

law version of the Market Abuse Regulation (EU) No. 596/2014 (the

"UK MAR") which is part of UK law by virtue of the European Union

(Withdrawal) Act 2018. The information is disclosed in accordance

with the Company's obligations under Article 17 of the UK MAR. Upon

the publication of this announcement, this inside information is

now considered to be in the public domain.

Chairman's Statement

Goldplat PLC's precious metals processing facilities continued

to show resilience by achieving creditable trading results during

the 30 June 2023 year, during which it experienced some unique

challenges.

Our portfolio of core assets consists of two gold recovery

operations, in South Africa and Ghana, with plans to extend

operations to Brazil. These operations recover gold and platinum

group metals ('PGM') from by-products of current and historical

mining processing, thereby providing mines with an environmentally

friendly and cost-efficient way of removing waste material.

Looking at the trading results of Goldplat PLC ("the Company" or

"Goldplat") and its subsidiaries, together referred to as "the

Group", profit for the year remained strong at GBP3,068,000 (2022 -

GBP3,963,000), resulting in a return on invested capital (Profit

after Taxation divided by Total Equity) of 17.8% (2022 - 22.3%).

Cash generation across the Group continued to be robust with net

cash flows from operating activities of GBP3,343,000 (2022 -

GBP2,997,000) and net year end cash of GBP2,781,000 (2022 -

GBP3,895,000).

During the year the Group's operations have been impacted

by:

-- Increased electricity supply cuts in South Africa;

-- Slow turnaround of debtors due to delays from a smelter in Europe; and

-- Delays in export of material out of Ghana during the last

quarter due to finalisation of the renewal of our Gold License.

The above matters have been mitigated after the financial year

end through utilising other smelters and the approval of the Gold

License in Ghana. In addition, we are in the process of installing

back-up diesel generation power in South Africa.

We remain focussed on long term visibility of earnings in the

recovery businesses by increasing visibility of resources through

the strengthening of partnership relationships and improved

processing methods, whilst positioning ourselves as a service group

focussed on key elements of primary producers' Environmental,

Social and Governance (ESG) initiatives. Our key focus will remain

on extracting value from gold bearing by-products whilst we

investigate broadening the commodity spaces in which we operate and

add value.

As indicated in the prior year, the Company will continue to

return cash in excess of operating and development requirements to

shareholders. Due to the challenges experienced during the year,

resulting in significant working capital requirements, the capital

invested into a new tailings storage facility ("TSF") in South

Africa and future capital requirements to maintain operations as

well as processing of the old TSF, the Company did not distribute

any cash to shareholders during the year. We will continue to

evaluate this position and, when appropriate, will distribute cash

through either share repurchases or dividends, whichever the Board

believes will add the most value, to the shareholders.

Goldplat has a pivotal role to play in the circular economy that

extends to the extraction of minerals to re-processing of what

would typically be dumped as waste materials. It also extends to

responsible mining and business practices that underpin Goldplat as

a sustainable partner for large mining groups.

As referred to in the Strategic Report, the business has adopted

certain sustainability reporting principles in the current year

including profiling material matters through the application of

double materiality and linking these material issues to strategic

responses and performance metrics.

As a starting point, we have conducted materiality assessments

to identify where our highest level of sustainability impact could

be and in turn, linking these matters to our strategic response,

policies and performance management. We are committed to creating

measurable value for all our stakeholders towards a just and

socio-economic sustainable future.

Goldplat will continue developing its integrated sustainability

strategy and reporting practices. This process is ongoing, and the

Board will continue to monitor our obligations and make sure that

we meet or exceed expectations as we continue to create and

preserve value for all our stakeholders.

During the year the Group strengthened its executive management

team with the appointment of a Chief Operating Officer (COO),

Douglas Davidson, and Chief Financial Officer (CFO), Brent Doster.

The executive management team is well positioned to execute the

Company's strategy.

The Israel-Hamas and Russian-Ukraine conflict will continue to

pose challenges to global supply chains and whilst Goldplat has no

activities directly connected with Russia, Ukraine or the Middle

East, the long-term effect of the conflict on the Group remains

uncertain.

We look forward to continuing and building on the successes of

the past few years and increasingly realising and growing the

intrinsic value of Goldplat. I wish to thank all Goldplat's

employees, as well as my fellow directors, our advisors and our

shareholders for their efforts as we look forward to the coming

years with enthusiasm.

Gerard Kemp

Chairman

15 December 2023

CEO Report

Overview of operations

Goldplat is a mining services company, specialising in the

recovery of gold and other precious metals, from by-products,

contaminated soil and other precious metal material from mining and

other industries. Goldplat has a pivotal role to play in the

circular economy that extends the extraction of minerals to

re--processing of what would typically be dumped as waste

materials. Goldplat has two market leading operations in South

Africa and Ghana focused on providing an economic method for mines

to dispose of waste materials while at the same time adhering to

their environmental obligations.

Goldplat has been providing these services for more than 20

years mainly to the mining industry in Africa, but more recently

also in South America. Goldplat's extraction processes and multiple

process lines enable it to keep materials separate, which provides

a high degree of flexibility when proposing a solution for a

particular type of material. The processes which are employed

include roasting in a rotary kiln, crushing, milling, thickening,

flotation, gravity concentration, leaching, CIL, elution and

smelting of bullion. Goldplat recovery operations recover between

1,500 ounces to 2,500 ounces monthly through its various circuits

and under different contracts. The grade, recovery, margins and

terms of contracts can differ significantly based on the nature of

the material supplied and processed. At a minimum, 50% of material

produced is exposed to the fluctuation in the gold price, with the

remainder of the production being offset by corresponding changes

in raw material costs.

The strategy of the Company, which also drives the key

performance indicators of management, is to return value to the

shareholders by creating sustainable cash flow and profitability

through:

-- growing its customer base in Southern Africa, West Africa, South America and further afield;

-- strengthening its license to operate in the jurisdictions in which it operates;

-- forming strategic partnerships with other industry participants;

-- leveraging its role in the circular economy to diversifying

into processing of platinum group metals ("PGM"), coal and other

commodities contaminated material;

-- ensuring the sustainability of its operations from an

environmental, social and governance perspective; and

-- optimising the value to be extracted from the processing of its 2.2-million-ton, TSF.

Goldplat's highly experienced and successful management team has

a proven track record in creating value from contaminated gold and

other precious metals-bearing material.

The Group follows the responsible gold guidelines as set-out by

the London Bullion Mark Association ("LBMA") and our processes are

audited on a bi-annual basis, to provide further comfort to its

suppliers, partners and customers.

Goldplat has a JORC defined resource (see the announcement dated

29 January 2016 for further information) over part of its active

TSF at its operation in South Africa of 1.43 million tons at

1.78g/t for 81,959 ounces of gold.

Since the resource estimate was completed, more than 1,000,000

tons of material have been deposited on the TSF.

Operating results

The recovery operations continued to deliver strong results with

profit after tax attributable to owners of the Company of

GBP2,798,000 (2022 - GBP3,555,000), a decrease of 21.3% from the

previous financial year.

The decrease was driven by increased electricity supply cuts in

South Africa, delays at the smelters in Europe and being unable to

export material from Ghana due to the delays in the finalisation of

Ghana's gold export license.

Before the 2020 financial year, the cashflow generated was

invested in sustaining and growing our mining portfolio in Africa,

which we exited during the 2021 financial year. Since then, the

Group has been focussed on the recovery operations to increase

visibility of earnings through:

-- Growing its customer base and its raw material supply on site;

-- Securing its license to operate through maintain licenses and contained conditions; and

-- Securing and extending our role in the circular economy by

expanding our business into other commodities.

Growing the customer base

During the year the Group retained all major woodchips and

byproduct suppliers and secured additional supplies of material in

Ghana and South America. A major supplier is defined as a supplier

that supplied a material amount of raw material to the operations

during the last financial year.

During previous years we removed low-grade surfaces sources from

various sites owned by different entities, whilst during the year

we secured a contract with DRDGOLD Limited ("DRDGOLD"), which

provides us access to certain low-grade soils. As a result, we have

removed material from fewer suppliers, although the quantity

available from DRDGOLD has meant that our security of supply for

our milling and carbon-in-leach circuits increased to more than 5

years.

The nature of these materials to be removed from DRDGOLD will

vary in terms of the gold grade contained and the recoverability of

the gold contained through our circuits. The analysis and

processing of these materials to date has indicated that it will be

viable to remove and process at current cost and price

parameters.

Securing pipeline and

developing alternative

reclamation resources Units 2023 2022

-------------------------- ------- ------------------- -------------------

Product type South Africa Ghana South Africa Ghana

----------------------------------- ------------ ----- ------------ -----

Low-grade surface sources Number 1 0 5 0

Woodchips Number 6 0 6 0

By-products Number 5 12 5 6

-------------------------- ------- ------------ ----- ------------ -----

The percentage contribution on different feed products to

operating margins in South Africa does fluctuate from month to

month but on average each product type contributes a third of the

margins for Goldplat Recovery SA ("GPL"), highlighting each

product's significance to the operations. In Ghana, Gold Recovery

Ghana ("GRG") margin is derived only from the different types of

by-products generated by current mining activities.

Although GPL has retained all contracts during the year the

consolidation continues in the South African gold industry; mines

are closing or are becoming more efficient in their processing,

resulting in reduced volumes and grade of woodchips and by-products

received.

As a result, GPL focus is to increase its share of the market in

South Africa, securing business of a major mining group in South

Africa it is not servicing currently and looking to neighbouring

countries to supplement current feedstock.

The focus of GRG in Ghana remains on opening the West African

market, specifically securing more feedstock out of Ivory Coast,

Mali and other countries. After year-end GRG received its first

supply from a mining group in Ivory Coast which provides additional

confidence on future supply out of this jurisdiction.

The Group continues to investigate and research different types

of discard and waste sources from industry to increase the

flexibility in the types of material it processes.

License to operate

Due to the nature of the recovery services the Group provides

and the commodities we recover, we require various licenses to

operate and need to comply with the conditions of these

licenses.

During the year the group continued to invest cost and capital

to maintain these licenses and to ensure our operations comply with

these licenses.

During the year GRG renewed the Minerals Commission - License to

Purchase and Deal in Gold and the Environmental Protection

Authority License. The delay in the renewal of the License to

Purchase and Deal in Gold in Ghana had a significant impact on

GRG's ability to export material and as a result secure material

from suppliers.

The Department of Water and Sanitation of the Republic of South

Africa has authorised the water use licence of GPL during June 2022

which includes the extraction and use of water in its recovery

processes and the impact of its disposal of tailings on a new TSF,

according to the conditions set out in the licence, which is valid

for 12 years. This has enabled GPL to construct a new TSF that will

provide an additional seven years of deposition capacity.

Below is a summary of some of the major licenses required by

operations to operate in current jurisdictions:

License to

operate Valid until 2023 2022

----------------- ---------------- ------------------------------------- -------------------------------------

South Africa Ghana South Africa Ghana

---------------------------------- ---------------- ------------------- ---------------- -------------------

November

Current licenses 2040* Precious Metals Precious Metals

Refining License Refining License

---------------------------------- ---------------- ------------------- ---------------- -------------------

January 2024 Air Emissions Air Emissions

License License

---------------------------------- ---------------- ------------------- ---------------- -------------------

Expired* Mining Right Mining Right

(expired May (expired

2023) May 2023)

---------------------------------- ---------------- ------------------- ---------------- -------------------

Annual Radio-active Radio-active

License License

---------------------------------- ---------------- ------------------- ---------------- -------------------

2034 Water Use Water Use

License License

---------------------------------- ---------------- ------------------- ---------------- -------------------

Annual Precious Metals Precious Metals

Import Permit Import Permit

---------------------------------- ---------------- ------------------- ---------------- -------------------

Annual Precious Metals Precious Metals

Export Permit Export Permit

---------------------------------- ---------------- ------------------- ---------------- -------------------

Annual Ghana Freezone Ghana Freezone

Authority Authority

---------------------------------- ---------------- ------------------- ---------------- -------------------

May 2026 Minerals Commission Minerals Commission

- License - License

to Purchase to Purchase

and Deal in and Deal in

Gold Gold

---------------------------------- ---------------- ------------------- ---------------- -------------------

18 December Environmental Environmental

2025 Protection Protection

Authority Authority

License License

---------------------------------- ---------------- ------------------- ---------------- -------------------

New application Waste License

---------------------------------- ---------------- ------------------- ---------------- -------------------

* GPL does not require a mining right in South Africa to

continue its operation and is conducting its operations under a

Precious Metals Refining License which only expires in November

2040. As GPL does not have an identified mineral deposit and does

not extract any ore from a mineral deposit, it could not renew its

mining right per the Department of Mineral Resources and Energy

('DMRE'). We have applied to the relevant Government authorities to

convert the existing environmental management plan in place to an

integrated environmental authorization and waste management

licence. We await their response.

Circular economy

Goldplat has a pivotal role to play in the circular economy that

extends to the extraction of minerals to re-processing of what

would typically be dumped as waste materials. It also extends to

responsible mining and business practices that underpin Goldplat as

a sustainability partner for large mining groups.

During the year all of our operating profit was derived from the

processing of discards or waste materials from historic or current

mining activities.

Goldplat believes that it can extend this pivotal role it is

playing in the circular economy to the gold industry in South

America and into other commodities including the platinum and coal

mining industry in South Africa.

As a result, we made a strategic investment of GBP150,000 to

obtain the usage of a small spiral plant for our gold operations in

South Africa and acquired a 15% shareholding in a fine coal

recovery technology company. Goldplat has an option to invest an

additional GBP1.5m, which will increase our shareholding in that

business to above 50%. This investment would be used to

operationalize the technology through the construction of a fine

coal washing plant in Mpumalanga, South Africa.

Management is still evaluating this option which would provide

us diversification in our recovery operations into a different

commodity, namely coal, of which significant resources are

available in South Africa, with opportunities not just for

processing but also for environmental rehabilitation.

During the year we invested capital to increase our ability to

process precious metal group minerals and engaged with potential

partners that can assist in increasing supply of material out of

the PGM industry.

In addition, the Group has decided to acquire land in South

America, specifically Brazil, a process which has not been

completed to date, at a value of circa GBP103,000. The decision was

driven by the need to establish an address in South America from

which we can service our clients. In time we plan to increase

operational plant capacity in Brazil to provide solutions for lower

grade material not processable at our other plants due to the cost

of transport to those facilities.

Tailings Facility

With the approval of the water use license, GPL constructed a

new TSF, which is adjacent to the current TSF, which was completed

in August 2023 and is currently being commissioned over a period of

9 months. The new TSF has sufficient capacity to store the tailings

we will produce in our current operations for the next seven

years.

The new TSF has been constructed by using regulated synthetic

liner and design drainage which should enable more process water to

be re-used in the plant and reduce seepage and contamination of

ground water.

The new TSF allows us to divert all deposition from the current

facility, which will provide us with the ability to use the current

facility to recover the JORC resource through DRDGOLD. The

processing of our old TSF remains dependent on the approval of the

water use license over certain areas for the installation of a

pipeline to the DRDGOLD process facility. The application process

is ongoing with engineering designs being finalised with final

application to be done before end of December 2023. Approval is

estimated to be received within Q4 of the 2024 financial year.

DRDGOLD and Goldplat Plc are currently in the process of

evaluating different variables that will impact on the processing

of the TSF, as well as the commercials of doing so; this process

will be completed alongside the water use license. To enable us to

process the current TSF through a DRDGOLD facility, we will require

approval to install a pipeline to this DRDGOLD processing facility

(as indicated in paragraph above) and will need to finalise

commercial agreements with DRDGOLD.

Electricity Supply

During the year, the South African operation lost circa 13% of

its production hours due to electricity supply outages, which has a

significant impact on our lower grade circuits. The lower grade

circuits operate continuously, and any hours lost result in a loss

of production.

Due to the increased uncertainty of electricity supply in the

medium term, we have decided to invest in diesel generators which

will be able to sustain operations in South Africa during

electricity cuts. The capital cost of these investments will be

GBP750,000 and will be financed over 36 months with one of our

local banks. Based on 25% of available hours expected to be lost

during the next 24 months, we expect that the capital cost of the

generators will be recovered within 24 months. During this year, we

will also continue to investigate other options to secure

electricity supply, for example additional connections to the local

Municipality Grid or a new direct connection to Eskom (South Africa

Electricity Generator and Supplier); however, the timelines of

these options remain uncertain and unclear.

The diesel generators are expected to be operational by the end

of January 2024.

Anumso Gold Project - Ghana ('AG')

The gold mining license under the Anumso Gold ('AG') project

expired during March 2021 and was not renewed as was the intention

of the Company and the joint venture partner, Desert Gold Ventures

Inc. The investment in AG was disclosed as a discontinued operation

during the 2021 year. In that year we were informed that mineral

right fees since 2013 were outstanding, which is still being

disputed. None of the joint venture partners intend to capitalise

the AG project to settle the claim and current AG liabilities

exceed its assets by the minerals right fees outstanding. The

Company's share of outstanding minerals right fees is GBP369,000

and this has been accrued in prior years.

Outlook

Our focus during the year has been, and will continue to be:

-- to open up and expand our market share in West Africa and further into the rest of Africa;

-- to acquire land in Brazil, and expand our service delivery,

specifically on lower grade material in Brazil and elsewhere in

South America;

-- increase our market share in South Africa and increase client base in neighbouring countries;

-- to reduce the of cost of production, specifically on our CIL circuits in South Africa;

-- to agree commercial terms on the reprocessing of the TSF with

DRDGOLD and finalise the regulatory requirements to allow us to

pump material through a pipeline to the DRDGOLD facility;

-- leveraging our strength and capabilities through the

processing of other precious metals and commodities.

The recovery operations have nearly always been cashflow

generative and during the year we have utilised some of this

cashflow to build the new TSF in South Africa, support working

capital levels as a result of delays in renewal of our Gold licence

in Ghana and delays experienced on payment from a smelter in

Europe. The Company will remain focused on sharing future cashflows

with shareholders, specifically distributing cash surplus (above

Group's operational requirements and growth plans) to

shareholders.

The South African operations will continue to serve the South

African gold industry and will focus on sustaining profitability

from old mining clean-ups and as part of its diversification

strategy will continue investing capital into processing PGM's.

We are working with DRDGOLD to find the most economic methods to

reprocess TSF (which has a JORC Compliant Resource of 81,959

ounces) and receiving environmental approval for a pipeline which

will be required to transport material to a facility for

processing.

Goldplat recognises the cyclical nature of the recovery

operations as well as the risks inherent in relying on short-term

contracts for the supply of materials for processing, particularly

in South Africa where the gold industry is in slow longer term

decline. These risks can be mitigated by improving our operational

capacities and efficiencies to enable us to treat a wider range of

lower grade materials and leveraging on our strategic partnerships

in industry to increase security of supply. We will continue to

seek materials in wider geographic areas. We shall also keep

looking beyond our current recovery operations for further

opportunities to apply our skillsets and resources.

Conclusion

The last few years involved a lot of changes in Goldplat's

business as we have set out to increase sustainability and growth

of our recovery operations. I would like to compliment Goldplat's

employees, its advisors, my fellow directors and the Company's

shareholders not just for their efforts and support, but for how

they have embraced the changes and remained focused on the

opportunities they bring. This year we have seen the benefit of

these changes and the Board is looking forward to building on this

year's successes, creating opportunities from the ever changing

environment and returning value to shareholders.

Werner Klingenberg

Chief Executive Officer

15 December 2023

CFO Report

Overview

Goldplat delivered another year of good results despite delays

at the smelters in Europe, delays in finalising our gold export

license in Ghana, increased electricity supply cuts in South Africa

and inflationary pressures.

Goldplat achieved a profit after tax of GBP3,068,000 (2022 -

GBP3,963,000), a decrease of 22.6% from the previous year.

Revenue decreased by 3% to GBP41,881,000, whilst the average

gold price during the year remained constant at USD1,829/oz (2022 -

USD1,833/oz).

The margins of the Group depend upon the volume, quality and

type of material received, the metals contained in such material,

processing methods required to recover the metals, the final

recovery of metals from such material, the contract terms, metals

prices and foreign currency movements. During the year, the gross

profit margin decreased from 23.1% to 17.7%, which was driven by

high volume of high-grade low-margin batches processed in Ghana and

impact of electricity supply cuts in South Africa, where less gold

was produced for the same fixed costs expensed. This was

exacerbated by foreign exchange losses, which increased by

GBP685,000.

The table below on the operating performance of the two recovery

operations combined (excluding other Group and head office cost,

foreign exchange gains & losses, finance cost and taxes)

reflects the ability of the recovery operations in South Africa and

Ghana to produce profitably at various gold prices and production

levels for the last 5 years.

2023 2022 2021 2020 2019

----------------------- ----- ----- ----- ----- -----

Average Gold Price per

oz in

US$ for the year 1,829 1,833 1,846 1,560 1,263

----------------------- ----- ----- ----- ----- -----

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------------------ ------- ------- ------- ------- -------

Revenue 41,881 43,222 35,400 24,809 21,769

Gross Profit 7,422 9,994 6,199 7,312 3,114

Other (Loss)/Income (96) 53 56 0 0

Administrative Costs 3,021 2,332 1,694 1,977 861

------------------------ ------- ------- ------- ------- -------

Operating Profit Before

Finance Costs 4,305 7,715 4,561 5,335 2,253

------------------------ ------- ------- ------- ------- -------

Financial review

The major functional currencies for the Group subsidiaries are

the South African Rand (ZAR) and the Ghana Cedi (GHS) whilst the

presentation currency of the group is Pounds Sterling (GBP). The

average exchange rates for the year are used to convert the

Statement of Profit or Loss and Other Comprehensive Income for each

subsidiary to Sterling.

As set out in the table below, the average ZAR and GHS weakened

against the Pound Sterling by 5.8% and 55.0% respectively. The

exchange rates as at the end of the year are used to convert the

balance in the statement of Financial Position. As set out in the

table below, the ZAR and GHS closing rate depreciated by 20.6% and

49.3% respectively, which resulted in the GBP3,231,000 loss on

exchange differences on translation during the year.

2023 2022 Variance

GBP GBP %

------------------------------------------ ----- ----- --------

South African Rand

(ZAR) Average 21.43 20.26 5.8%

Ghanaian Cedi (GHS) Average 13.7 8.84 55.0%

South African Rand

(ZAR) Closing 30 June 2023 23.87 19.80 20.6%

Ghanaian Cedi (GHS) Closing 30 June 2023 14.60 9.78 49.3%

-------------------- --------------------- ----- ----- --------

Apart from the gold price, the Group's performance is impacted

by the fluctuation of its functional currencies against the USD in

which a majority of our sales are recognised. The average exchange

rates for the year used in the conversion of operating currencies

against the USD during the year under review are set out in the

table below:

2023 2022 Variance

USD USD %

---------------------------------- ----- ----- --------

South African Rand (ZAR) Average 17.78 15.23 16.7%

Ghanaian Cedi (GHS) Average 11.37 6.66 70.7%

------------------------- -------- ----- ----- --------

Personnel

Personnel expenses increased by 11.6% to GBP5,214,000 (2022 -

GBP4,674,000) during the year as a result of an increase in

production personnel from 394 to 415. The increase in personnel has

been driven by an increase in production units and the construction

of the tailings facility in South Africa. We spent a total of

GBP89,000 on various training programmes for our personnel.

Net finance loss

The net finance loss for the year can be broken down into the

following:

2023 2022

Interest component GBP GBP

------------------------------------------ --------- -----------

Interest receivable 69,000 0

Interest payable (283,000) (207,000)

Interest on pre-financing of sales (956,000) (449,000)

Intercompany foreign exchange income/loss 510,000 (157,000)

Operating foreign exchange losses (221,000) (1,071,000)

------------------------------------------ --------- -----------

Net Finance Costs (881,000) (1,884,000)

------------------------------------------ --------- -----------

Net finance costs decreased to GBP881,000 (2022 - GBP1,884,000)

during the year as a result of:

-- Decrease in foreign exchange losses in operations of from

GBP1,071,000 to GBP221,000. During the prior year we had a large

foreign exchange loss in Ghana due to the depreciation of the GHS

against the USD during that year. As we pre-finance a portion of

our sales to the smelters, the exchange rate on the day we receive

most of our funds was lower than the exchange rate on the day we

recognise the sale in our records.

-- The Group has a USD loan outstanding to South Africa, at year

end the value was GBP1,183,000 (2022 - GBP2,395,000). Due to the

ZAR weakening against the USD and the USD strengthening against the

GBP, an unrealized profit was created in the Group, which was the

major contributor to the intercompany foreign exchange income of

GBP510,000.

As a result of delay in finalization of batches at a smelter in

Europe, the balance prefinanced increased and the year it remained

outstanding increased, resulting in an increase in interest on

pre-financing of sales to GBP956,000 (2022 - GBP449,000).

The interest payable on borrowings relates to buy-back of the

minority share in GPL during the previous year and increased as a

result of the increase in the prime overdraft rate in South Africa

during the current year.

Taxation

During the year the income tax expense decreased by more than

80%. This has resulted in a decrease in the effective tax rate from

24.7% to 8.3%, which was driven by the following:

-- Decrease in taxation rate of 15.59% for GPL, to 9.84%, due to

a change in the mining tax rate formula and a decrease in profits

resulting in a lower taxation rate based on mining tax formula

applied in South Africa;

-- Decrease in GPL profits before taxation from GBP4,648,000 to GBP2,781,000.

GRG is registered as a Free Zone company in Ghana and was taxed

at 15% (2022: 15%) during the current year.

During the year, the dividend from GPL to the Company incurred a

withholding dividend taxation charge of 5%. The withholding

dividend tax for the year was GBP69,000 (2022 - GBP71,000).

Other comprehensive income

During the year the Group experienced a loss in foreign exchange

translation reserve of GBP3,231,000 and was primarily made up

of:

-- Foreign exchange translation loss in GRG of GBP1,259,000 as a

result of devaluation of the GHS during the year against the GBP by

49.3%; and

-- Foreign exchange translation loss in GPL of GBP2,169,000 as a

result of devaluation of the ZAR during the year against the GBP by

20.6%.

Property, plant & equipment

During the year we spent GBP1,911,000 on the acquisition and

construction of plant and equipment, mainly at GPL in South

Africa.

We incurred GBP1,480,000 in GPL, with the main contributors to

the capital expenditure in the current year being capital incurred

on the new TSF project of GBP969,000 and the refurbishment of our

oldest CIL circuit of GBP302,000.

We incurred GBP430,000 in GRG, of which GBP263,000 related to

the new milling, gravity and flotation circuit increase recoveries

from material received. This plant will start operating by Q3 of

2024 financial year. A further GBP123,000 on yellow equipment and

GBP44,000 was incurred on the extension and improvements to our

laboratory.

Intangible Assets

The intangible assets relate to the goodwill on the investment

held in GMR and GPL. The balance has been assessed for impairment

by establishing the recoverable amount through a value-in-use

calculation, the detail of which has been disclosed in note 5 of

the financial statements.

Right-of-use asset

The right-of-use assets decreased during the year by GBP224,000.

The primary reason for the decrease is due to assets with a value

of GBP230,000 that were transferred to property, plant and

equipment, as they are now owned by GPL.

The Group acquired plant and machinery and vehicles on finance

leases for GBP146,000.

The remainder of the changes relate to amortisation for the year

and foreign exchange movements as indicated in note 19 of the

financial statements.

Investment in Caracal Gold

During the year the Company sold all its shares in Caracal for a

total consideration of GBP681,000.

Receivable on Kilimapesa sale

GMR is entitled to receive a further 1% net smelter royalty on

all production from Kilimapesa up to a maximum of $1,500,000, on

any future production from Kilimapesa. As at the end of the year,

based on production at Kilimapesa, GBP601,000 is receivable.

Loan receivable

As part of the repurchase of the minority's share, shares were

also issued to a new minority in South Africa, in the 2022 year,

Aurelian, a portion of which is payable from dividend proceeds. The

balance outstanding is GBP164,000.

Inventories

The increase of GBP8,086,000 in the inventory balance, relates

mainly to an increase of GBP7,991,000 in inventory at GRG.

2023 2022

GBP GBP

--------------------------------------- ---------- ----------

Precious Metals on Hand and in Process 16,618,000 8,186,000

Raw Materials 2,462,000 2,730,000

Consumable Stores 1,054,000 1,132,000

--------------------------------------- ---------- ----------

20,134,000 12,048,000

--------------------------------------- ---------- ----------

The increase in GRG inventory relates mainly to an increase in

precious metals on hand and in process of GBP7,938,000 driven by

the inability to export material due to delays in the renewal of

the gold export license.

The raw material stock is only held in South Africa, and relates

to the low-grade material processed through our Carbon-In-Leach

('CIL') circuits. During the year we've processed some of the high

grade, higher cost material, but stock levels remained the same.

With the agreement reached with DRDGOLD, by which we can remove and

process materials on DRDGOLD premises, we have not just increased

the availability of raw material for processing, but also put GPL

in a position to operate with lower levels of raw materials at our

premises.

Trade and other receivables

The Group's trade and other receivables fluctuates based on

grade and volume of batches and material processed during different

periods of the year in the two operating entities.

Apart from the gold bullion produced in South Africa, on which

payment is received within 14 days, for the remainder of the

concentrates we produce, the payment terms on average are between 4

to 6 months.

During the year, the trade and other receivables increased by

GBP19,303,000, of which GBP11,328,000 relates to an increase in GRG

and GBP7,710,000 to an increase in GPL.

The increase in GRG was mainly due to the delay in outturn of

batches delivered to a smelter in Europe. In GPL, the reason for

the increase was similar although larger volumes of material

delivered to the smelters closer to the end of the financial year

also contributed to the year-on-year increase.

Provisions

In terms of section 54 of the regulations of the Minerals

Resource and Petroleum Act of 2002, in South Africa, a Quantum of

Financial Provisioning is required for activities performed under

mining lease. The Quantum was reassessed during the current year

and increased by GBP78,000.

Deferred tax liabilities

The deferred tax liabilities decreased during the year from

GBP1,013,000 to GBP531,000. The decrease is a result of a reduction

in the taxation rate used during the current year in South Africa

decreasing from 25.43% to 9.84%. The reduction in tax rate is

because the South African subsidiary is taxed on a mining formula

tax, which is driven by profitability margins and capital spend.

Due to reduction in profitability and increase in capital invested,

the tax rate reduced.

Interest bearing borrowings

In the prior year, GPL entered into a ZAR denominated bank

facility of ZAR 60 million (approximately GBP3.02 million) with

Nedbank, to finance the repurchase of shares from minorities in

South Africa. The full ZAR 60 million was drawn during the first

half of the prior year and the principal on the bank facility is

repayable monthly over 36 months. The interest payable on the

facility is the South African Prime Rate plus 1.75%.

GPL provided security over its debtors as well as a negative

pledge over its moveable and any immovable property, with a general

notarial bond registered over all movable assets. The Group entered

into a limited suretyship for ZAR 60 million, in favour of

Nedbank.

The balance outstanding on the reporting date was GBP1,183,000

of which GBP898,000 is repayable in the next 12 months.

Refer to note 18 of the financial statements for further

disclosure.

Trade and other payables

The increase in trade and other payables of GBP28,225,000, was

mainly driven by delays at a smelter in Europe and also the delay

of export material in Ghana, due to delay in the renewal of our

gold export licence.

In general, we pay our suppliers before we recover the value

from material processed and delivered to smelters or refiners.

Suppliers are either paid in full or a percentage of the balance is

paid until we receive our final results from refiners or smelters.

We receive external funding for material delivered to smelters to

finance this gap between receipts and payments. During the year the

balance funded increased as a result of delays at smelter in Europe

to GBP19,054,099 (2022 - GBP7,421,000).

The delay in exports resulted in increases in stock holding and

as result contributed to an increase in raw material accruals

payable to suppliers to GBP17,799,000 (GBP4,638,000).

Conclusion

Looking forward, we expect inventory, trade and other payables

and trade and other receivables to reduce as we start exporting in

the first quarter of the new financial year in Ghana and realizing

profits on these sales. We remain focused on generating cash to

fund our capital spend on compliance projects as well as the

generators and creating value for our shareholders.

Brent Doster

Chief Financial Officer

15 December 2023

Statements of Financial Position - Group

Group Group

Figures in GBP'000 2023 2022

--------------------------------------- ------- -------

Assets

Non-current assets

Property, plant and equipment 5,265 4,763

Right-of-use assets 352 576

Intangible assets 4,664 4,664

Investment in subsidiary or associate 1 1

Unlisted investments 63 -

Receivable on Kilimapesa sale 571 556

Other loans and receivables 145 189

--------------------------------------- ------- -------

Total non-current assets 11,061 10,749

Current assets

Inventories 20,134 12,048

Trade and other receivables 29,205 9,902

Current tax assets 58 100

Receivable on Kilimapesa sale 30 142

Investment in Caracal Gold - 727

Other loans and receivables 19 8

Cash and cash equivalents 2,977 3,895

--------------------------------------- ------- -------

Total current assets 52,423 26,822

--------------------------------------- ------- -------

Total assets 63,484 37,571

--------------------------------------- ------- -------

Equity and liabilities

Equity

Share capital 1,678 1,678

Share premium 11,562 11,562

Capital Redemption Reserve 53 53

Retained income 12,328 9,530

Foreign exchange reserve (9,401) (6,170)

--------------------------------------- ------- -------

Total equity attributable to owners

of the parent 16,220 16,653

Non-controlling interests 1,033 1,150

--------------------------------------- ------- -------

Total equity 17,253 17,803

Liabilities

Non-current liabilities

Provisions 743 811

Deferred tax liabilities 531 1,013

Interest bearing borrowings 285 1,417

Lease liabilities 37 111

Loan from group company - -

-------------------------------------- ------- -------

Total non-current liabilities 1,596 3,352

--------------------------------------- ------- -------

Current liabilities

Provisions 207 208

Trade and other payables 43,196 14,971

Interest bearing borrowings 898 978

Lease liabilities 139 259

Bank overdraft 195 -

--------------------------------------- ------- -------

Total current liabilities 44,635 16,416

--------------------------------------- ------- -------

Total liabilities 46,231 19,768

--------------------------------------- ------- -------

Total equity and liabilities 63,484 37,571

--------------------------------------- ------- -------

Statements of Profit or Loss and Other Comprehensive Income -

Group

Group Group

Figures in GBP'000 2023 2022

----------------------------------------------- -------- --------

Revenue 41,881 43,222

Cost of sales (34,459) (33,228)

----------------------------------------------- -------- --------

Gross profit 7,422 9,994

Other income / (loss) (96) 53

Administrative expenses (3,021) (2,332)

----------------------------------------------- -------- --------

Profit from operating activities 4,305 7,715

Finance costs (881) (1,884)

----------------------------------------------- -------- --------

Profit before tax 3,424 5,831

Income tax expense (356) (1,868)

----------------------------------------------- -------- --------

Profit for the year 3,068 3,963

----------------------------------------------- -------- --------

Profit for the year attributable to:

Owners of Parent 2,798 3,555

Non-controlling interest 270 408

----------------------------------------------- -------- --------

3,068 3,963

---------------------------------------------- -------- --------

Other comprehensive loss net of tax

Exchange differences on translation

relating to the parent

Losses on exchange differences on translation (3,231) (522)

----------------------------------------------- -------- --------

Total Exchange differences on translation (3,231) (522)

Exchange differences relating to the

non-controlling interest

Losses on exchange differences on translation (203) (5)

----------------------------------------------- -------- --------

Total other comprehensive income that

will be reclassified to profit or loss (3,434) (527)

----------------------------------------------- -------- --------

Total other comprehensive loss net

of tax (3,434) (527)

----------------------------------------------- -------- --------

Total comprehensive (loss) / income (366) 3,436

----------------------------------------------- -------- --------

Comprehensive (loss) / income attributable

to:

Comprehensive (loss) / income, attributable

to owners of parent (432) 3,033

Comprehensive income, attributable

to non-controlling interests 66 403

----------------------------------------------- -------- --------

(366) 3,436

---------------------------------------------- -------- --------

Earnings per share attributable to

owners of the parent during the year

Basic earnings per share

Basic earnings per share 1.67 2.08

----------------------------------------------- -------- --------

Diluted earnings per share

Diluted earnings per share 1.65 2.05

----------------------------------------------- -------- --------

Statement of Changes in Equity - Group

Foreign Attributable

Share currency to owners Non-

Figures in Share Share Redemption translation Retained of the controlling

GBP'000 Capital premium Reserve reserve income parent interests Total

--------------------- -------- -------- ----------- ------------ -------- ------------ ------------ -------

Balance at

1 July 2021 1,698 11,491 - (5,258) 6,846 14,777 3,637 18,414

Changes in

equity

Profit for the

year - - - - 3,555 3,555 408 3,963

Other comprehensive

income - - - (522) - (522) (5) (527)

--------------------- -------- -------- ----------- ------------ -------- ------------ ------------ -------

Total comprehensive

income for the

year - - - (522) 3,555 3,033 403 3,436

Non-controlling

interests in

subsidiary dividend - - - - - - (139) (139)

Decrease of

Non--Controlling

Interest (21.30%) - - - (500) 3,589 3,089 (3,089) -

Increase of

Non--Controlling

Interest (4.67%) - - - 110 (787) (677) 677 -

Decrease of

Non--Controlling

Interest (4.24%) - - - (100) 715 615 (615) -

Increase of

Non--Controlling

Interest (4.24%) - - - 100 (715) (615) 615 -

Cost of share

repurchase in

subsidiary (21.30%) - - - (3,999) (3,999) (413) (4,412)

Proceeds on

issue of shares

in subsidiary

(4.67%) - - - 716 716 74 790

Cost of share

repurchase in

subsidiary (4.24%) - - - (653) (653) (68) (721)

Proceeds on

issue of shares

in subsidiary

(4.24%) - - - - 653 653 68 721

Cost of Share

Options Issued - - - 11 11 - 11

Cost of Company

Shares Repurchase (53) - 53 (401) (401) - (401)

Shares issued

from options

exercised 33 71 - - - 104 - 104

--------------------- -------- -------- ----------- ------------ -------- ------------ ------------ -------

Balance at

30 June 2022 1,678 11,562 53 (6,170) 9,530 16,653 1,150 17,803

--------------------- -------- -------- ----------- ------------ -------- ------------ ------------ -------

Balance at

1 July 2022 1,678 11,562 53 (6,170) 9,530 16,653 1,150 17,803

--------------------- -------- -------- ----------- ------------ -------- ------------ ------------ -------

Foreign Attributable

Share currency to owners Non-

Figures Share Share Redemption translation Retained of the controlling

in GBP'000 Capital premium Reserve reserve income parent interests Total

-------------------- -------- -------- ----------- ------------ -------- ------------ ------------ -------

Changes

in equity

Profit for

the year - - - - 2,798 2,798 270 3,068

Other comprehensive

loss - - - (3,231) - (3,231) (203) (3,434)

--------------------- -------- -------- ----------- ------------ -------- ------------ ------------ -------

Total comprehensive

income for

the year - - - (3,231) 2,798 (433) 67 (366)

Non-controlling

interests

in subsidiary

dividend - - - - - - (184) (184)

--------------------- -------- -------- ----------- ------------ -------- ------------ ------------ -------

Balance

at 30 June

2023 1,678 11,562 53 (9,401) 12,328 16,220 1,033 17,253

--------------------- -------- -------- ----------- ------------ -------- ------------ ------------ -------

Statements of Cash Flows - Group

Group Group

Figures in GBP'000 2023 2022

---------------------------------------------- ------- -------

Net cash flows from operations 4,511 6,471

Finance cost paid (521) (1,884)

Income taxes paid (647) (1,590)

---------------------------------------------- ------- -------

Net cash flows from operating activities 3,343 2,997

---------------------------------------------- ------- -------

Cash flows used in investing activities

Proceeds from sale of Kilimapesa - 312

Proceeds from sale of Caracal 727 -

Other cash payments to acquire equity

or debt instruments of other entities (126) -

Proceeds from sale of property, plant

and equipment 30 142

---------------------------------------------- ------- -------

Acquisition of property, plant and equipment (1,911) (850)

Cost of Share Repurchase from Minority

Shareholder in Subsidiary - (3,791)

---------------------------------------------- ------- -------

Cash flows used in investing activities (1,280) (4,187)

---------------------------------------------- ------- -------

Cash flows (used in) / from financing

activities

Proceeds from drawdown of interest-bearing

borrowings - 3,031

Proceeds from issue of shares in Subsidiary

to Minority Shareholder - 247

Proceeds from exercise of share options - 104

Payment of interest-bearing borrowings (1,620) (673)

Cost of Share Repurchase in Company - (401)

Repayments of other financial liabilities - -

Repayment of leases (287) (367)

Payment of dividend by subsidiary to

non-controlling interest (185) (139)

---------------------------------------------- ------- -------

Cash flows (used in) / from financing

activities (2,092) 1,802

---------------------------------------------- ------- -------

Net (decrease) / increase in cash and

cash equivalents (29) 612

Cash and cash equivalents at beginning

of the year 3,895 3,459

Foreign exchange movement on opening

balance (1,085) (176)

---------------------------------------------- ------- -------

Cash and cash equivalents at end of

the year 2,781 3,895

---------------------------------------------- ------- -------

Accounting Policies

1. General information

Goldplat plc is a public company limited by shares domiciled and

registered in England and Wales.

The address of the Company's registered office is Salisbury

House, London Wall, London, the United Kingdom EC2M 5PS. The Group

primarily operates as a producer of precious metals on the African

continent.

2. Basis of preparation and summary of significant accounting

policies

Statement of compliance

The consolidated and separate financial statements have been

prepared in accordance with UK - adopted International Accounting

Standards ("IAS") and the Companies Act 2006 as applicable to

entities reporting in accordance with IAS; as applicable to

entities reporting in accordance with IFRS.

Basis of measurement

The consolidated financial statements have been prepared on the

historical cost basis, except for derivative financial instruments

that have been measured at fair value.

Functional and presentation currency

These consolidated financial statements are presented in Pounds

Sterling, which is considered by the directors to be the most

appropriate presentation currency to assist the users of the

financial statements. All financial information presented in GBP

has been rounded to the nearest thousand, except when otherwise

indicated.

The Group's subsidiaries' functional currency is considered to

be the South African Rand (ZAR), Ghana Cedi (GHS) and the Company's

functional currency is Pounds Sterling (GBP) as these currencies

mainly influences sales prices and expenses.

Use of estimates and judgements

The preparation of the consolidated and separate financial

statements in conformity with UK - adopted IAS requires management

to make judgements, estimates and assumptions that affect the

application of accounting policies and the reported amounts of

assets, liabilities, income and expenses. The estimates and

associated assumptions are based on historical experience and

various other factors that are believed to be reasonable under the

circumstances, the results of which form the basis of making

judgements about carrying values of assets and liabilities that are

not readily apparent from other sources. Actual results may differ

from these estimates.

Estimates and underlying assumptions are reviewed on an ongoing

basis. Revisions to accounting estimates are recognised in the

period in which the estimates are revised if the revision affects

only that period, or in the period of revision and future periods

of the revision if it affects both current and future periods.

Critical estimates and assumptions that have the most

significant effect on the amounts recognised in the consolidated

financial statements and/or have a significant risk of resulting in

a material adjustment within the next financial year are as

follows:

-- Carrying value of goodwill GBP4,664,000 (2022: GBP4,664,000)

-- Inventory - precious metals on hand and in process to the

value of GBP16,618,000 (2022: GBP8,186,000)

-- Rehabilitation provision GBP743,000 (2022: GBP811,000)

-- Useful economic lives

-- Estimated revenue to the value of GBP27,531,000 (2022: GBP8,620,000)

3. Share capital, premium and redemption reserve

3.1 Authorised and issued share capital

Group Group

Figures in GBP'000 2023 2022

------------------- ------ ------

Issued

Ordinary shares 1,678 1,678

------------------- ------ ------

1,678 1,678

Share premium 11,562 11,562

------------------- ------ ------

13,240 13,240

------------------- ------ ------

3.2 Reserves

Ordinary shares

All shares rank equally with regard to the Company's residual

assets. The holders of ordinary shares are entitled to receive

dividends as declared from time to time and are entitled to one

vote per share at meetings of the Company.

Share premium

Represents excess paid above nominal value on historical shares

issued.

Exchange reserve

The exchange reserve comprises all foreign currency differences

arising from the translation of the financial statements of foreign

operations.

Non-controlling interest

Relates to the portion of equity owned by minority

shareholders.

Capital Redemption Reserve

Portion of share capital repurchased by the Company.

4. Employee benefits expense

Group Group

Figures in GBP'000 2023 2022

------------------------------------------- ----- -----

Wages and salaries 4,416 4,009

Performance based payments 522 424

National insurance and unemployment

fund 64 57

Skills development levy 43 37

Medical aid contributions 36 36

Group life contributions 64 58

Provident funds 69 53

------------------------------------------- ----- -----

Total 5,214 4,674

------------------------------------------- ----- -----

The average number of employees (including

directors) during the year was:

Directors 5 7

Administrative personnel 38 26

Production personnel 415 394

------------------------------------------- ----- -----

458 427

------------------------------------------- ----- -----

Directors emoluments Executive Non-executive Total

-------------------- --------- ------------- -----

2023

Wages and salaries 178 - 178

Fees - 141 141

Other benefits 62 - 62

-------------------- --------- ------------- -----

Total 240 141 381

-------------------- --------- ------------- -----

2022

Wages and salaries 181 - 181

Fees - 149 149

Other benefits 3 - 3

-------------------- --------- ------------- -----

Total 184 149 333

-------------------- --------- ------------- -----

Emoluments disclosed above include the following amounts paid to

the highest director:

2023 2022

----------------------------------- ---- ----

Emoluments for qualifying services 240 184

----------------------------------- ---- ----

Key management apart from the Directors, the emoluments paid to

key management personnel amounted to 2023 : GBP793,000 (2022:

GBP806,000).

5. Earnings per share

5.1 Basic earnings per share

The earnings and weighted average number of ordinary shares used

in the calculation of basic earnings per share are as follows:

Group Group

Figures in GBP'000 2023 2022

------------------------------------------- ------- -------

Earnings used in the calculation of basic

earnings per share 2,798 3,555

------------------------------------------- ------- -------

Weighted average number of ordinary shares

used in the calculation of basic earnings

per share 167,783 171,018

------------------------------------------- ------- -------

5.2 Diluted earnings per share

The earnings used in the calculation of diluted earnings per

share are as follows:

Group Group

Figures in GBP'000 2023 2022

------------------------------------------------ ------- -------

Earnings used in the calculation of basic

earnings per share 2,798 3,555

------------------------------------------------ ------- -------

The weighted average number of ordinary shares

for the purpose of diluted earnings per share

reconciles to the weighted average number

of ordinary shares used in the calculation

of basic earnings per share as follows:

Weighted average number of ordinary shares

used in the calculation of basic earnings

per share 167,783 171,018

------------------------------------------------ ------- -------

Adjusted for - Dilutive effect of share options 1,899 2,039

------------------------------------------------ ------- -------

Weighted average number of ordinary shares

used in the calculation of diluted earnings

per share 169,682 173,057

------------------------------------------------ ------- -------

6. Related parties

Other related parties

Entity name 2023 Holding 2022 Holding

--------------------------------- -------------- --------------

Gold Mineral Resources Limited 100% Direct 100% Direct

Goldplat Recovery (Pty) Ltd 91% Direct 91% Direct

Gold Recovery Ghana Limited 100% Indirect 100% Indirect

Anumso Gold Limited 49% Indirect 49% Indirect

Nyieme Gold SARL 100% Indirect 100% Indirect

Midas Gold SARL 100% Indirect 100% Indirect

Gold Recovery Brasil Recuperacao 100% Direct 100% Direct

Gold Recovery Peru SAC 100% Indirect 100% Indirect

GRG Tolling Ltd 100% Indirect 100% Indirect

--------------------------------- ---- -------- ---- --------

Major inter-company transactions

Nature of transaction 2023 2022

-------------------------------------------------------- ----- -----

Goldplat Recovery to Gold Goods, equipment and

Recovery Ghana services supplied 679 334

Goldplat Recovery to Gold Goods, equipment and

Mineral Resources services supplied 91 489

Goldplat Recovery to Gold

Mineral Resources Interest received (149) (120)

Goldplat Recovery to NMT

Capital Management fees - 1

Goldplat Recovery to NMT

Group Managements fees - 1

Goldplat Plc to Gold Mineral

Resources Management fees - -

Goldplat Recovery to Aurelian

Capital Trade and other payables 1 138

Goldplat Recovery to Aurelian Dividends Receivable

Capital - Aurelian 150 275

Goldplat Recovery to Aurelian

Capital Management fees 17 15

Goldplat Plc Directors 141 149

------------------------------ ------------------------- ----- -----

7. Subsequent events

There are no events subsequent to 30 June 2023 that will have a

material effect on the consolidated financial statements.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR TABRTMTTBBBJ

(END) Dow Jones Newswires

December 18, 2023 02:00 ET (07:00 GMT)

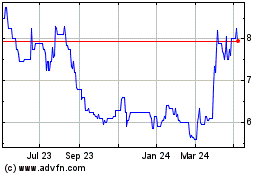

Goldplat (LSE:GDP)

Historical Stock Chart

From Mar 2024 to Apr 2024

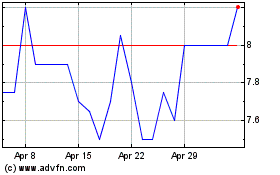

Goldplat (LSE:GDP)

Historical Stock Chart

From Apr 2023 to Apr 2024