Gfinity PLC Disposal (6425V)

05 December 2023 - 6:00PM

UK Regulatory

TIDMGFIN

RNS Number : 6425V

Gfinity PLC

05 December 2023

For immediate release

5 December 2023

Gfinity PLC

("Gfinity" or the "Company")

Disposal

The Board of Gfinity plc (AIM:GFIN) announces that the Company

has today disposed of the remaining business and assets of its

former Esports Solutions Division ("Disposal").

Background

As previously announced in February 2023, given the inconsistent

nature of service delivery work, and also the high cost to the

Company of delivering a true end-to-end esports solution and the

resources required to support clients in their activations around

the globe, Gfinity had decided to partner with a US esports

business to jointly deliver solutions on a profit-share basis and

no fixed cost and as a result, had decided to close the Gfinity

Arena in Fulham. Subsequently, on 6 June 2023, the Company

announced that the Board had decided to close down its Esports

Solutions Division as the market for esports remained soft and the

directors saw limited profitable growth opportunities and had

further resolved to focus solely on the media division.

Disposal

Ingenuity Loop Limited ("Ingenuity Loop" or the "Buyer"), a

newly formed company owned by media investor Mike Luckwell, has

agreed to buy the remaining business and assets of the Esports

Solutions Division for an upfront cash payment of GBP15,000 as a

contribution to costs incurred by the Esports Solutions Division

since August 2023 (including transaction costs) and a 15% equity

interest in the Buyer. The Buyer has an option to buy Gfinity's 15%

interest in Ingenuity for GBP200,000 in cash at any time in the

first 12 months following completion of the sale. Neville Upton,

Non-executive Chairman of the Company, has agreed to join Ingenuity

Loop as Chief Executive and will not receive a salary until

Ingenuity Loop is profitable. In return, Neville Upton will have an

equity interest of approximately 41.65% in Ingenuity Loop on

completion.

Under the proposed terms of the Disposal, the Buyer will have

the licence for a transitionary period of up to four years to trade

as "Gfinity Esports Solutions" provided that the Buyer is not

permitted to make any public announcements using the Gfinity

trading name and there are standard provisions protecting Gfinity

if in any way the Gfinity brand is brought into disrepute by the

Buyer.

The Disposal sale and purchase agreement includes standard drag

and tag provisions and warranties by Gfinity capped at the value of

the consideration.

Related Party

As Neville Upton has an interest in the Buyer, the Disposal is a

related party transaction pursuant to Rule 13 of the AIM Rules for

Companies. Accordingly, the Independent Directors (being the Board

other than Neville Upton) consider, having consulted with the

Company's nominated adviser, that the Disposal is fair and

reasonable insofar as Gfinity's Shareholders are concerned. In

particular, the Independent Directors have taken into account

that:

- Since June 2023, the Esports Solutions Division has been

closed down and all the employees bar-one have been made redundant.

The liability in respect of the remaining employee is being

transferred to the Buyer and there is the potential for a cash

consideration of GBP200,000 on exercise of the call option by the

Buyer;

- Following the cessation of the Formula 1 contract, Gfinity

does not have available cash, internal expertise, or shareholder

support to re-generate the Esports Solutions Division;

- In the current financial year ending 30 June 2024, the Esports

Solutions Division revenue is currently expected to be GBPnil;

and

- There are no other potential purchasers of the Esports

Solutions Division and in the absence of the sale, Gfinity would

not receive any value for the Esports Solutions Division.

Further AIM Disclosures

The Esports Solutions Division was formerly operated as a

division within Gfinity and not as a separate legal and accounting

entity. Accordingly, there are no standalone accounts for the

business and the following has been extracted from the Company's

internal management accounts. In the last published audited

accounts for the year ended 30 June 2022, the Esports Solutions

Division turnover amounted to GBP2.0 million and the gross margin

amounted to GBP0.9 million, which was however, substantially

accounted for by the Formula 1 contract and which ended in March

2023. In the period since closure in June 2023, turnover has been

GBPnil and the remainder of the Esports Solutions Division has been

loss making. As at 31 December 2022, the Esports Solutions

Division's unaudited total assets amounted to GBP0.10 million and

GBPnil as at 30 June 2023 following closure of the division and

release of the Gfinity Arena in Fulham.

The Esports Solutions Division has one employee.

The initial cash consideration and in due course any proceeds on

exercise of the call option by the Buyer will be used for general

working capital.

Other Information

Further information is available from the Company's website

which details the company's project portfolio as well as a copy of

this announcement: www.gfinityplc.com

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulations (EU) No. 596/2014 as it forms part of

UK Domestic Law by virtue of the European Union (Withdrawal) Act

2018 ("UK MAR").

The person who arranged for the release of this announcement on

behalf of the Company was David Halley, Chief Executive.

Enquiries:

Gfinity Plc David Halley ir@gfinity.net

Beaumont Cornish Limited Roland Cornish +44 (0)207 628 3369

Nominated Adviser Michael Cornish www.beaumontcornish.co.uk

and Broker

ENDS

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

DISEAAALEDEDFAA

(END) Dow Jones Newswires

December 05, 2023 02:00 ET (07:00 GMT)

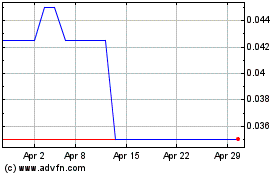

Gfinity (LSE:GFIN)

Historical Stock Chart

From Nov 2024 to Dec 2024

Gfinity (LSE:GFIN)

Historical Stock Chart

From Dec 2023 to Dec 2024