TIDMGHE

RNS Number : 7534E

Gresham House PLC

15 March 2022

15 March 2022

Gresham House plc

("Gresham House", the "Company" or the "Group")

Acquisition of Burlington Real Estate further enhancing our

presence in Ireland

Gresham House (AIM: GHE), the specialist alternative asset

manager, is pleased to announce the acquisition of Burlington RE

Property Management Limited ("Burlington Real Estate"), one of

Ireland's premier independent commercial property asset and

development management companies, for an initial consideration of

EUR1.8 million (the "Acquisition").

Based in Dublin, Republic of Ireland, Burlington Real Estate was

established in 2012 by John Bruder and Niall Kavanagh, who together

have 60 years' combined experience in the Irish property industry.

Burlington Real Estate has had a successful strategic partnership

with Gresham House Ireland (formerly Appian Asset Management) for

over five years, as Investment Advisor to the MSCI award-winning

Appian Burlington Property Fund which invests in office, retail and

industrial properties in the greater Dublin area and major regional

urban centres. Burlington Real Estate manages or advises assets of

EUR340 million as at 31 December 2021, which will bring pro forma

assets managed or advised by Gresham House in Ireland to c.EUR750

million as at 31 December 2021.

The Acquisition forms part of Gresham House's ongoing

international expansion plans, as set out in its five-year strategy

GH25 and is the Group's second acquisition in Ireland, following

the completion of the Appian Asset Management transaction last

summer. It consolidates the existing relationship between our two

businesses to achieve long-term alignment and is expected to be

earnings enhancing for the Group with potential further value

creation through synergies and identified growth initiatives.

The Burlington Real Estate team will become part of the Gresham

House Group going forward, and its 14 employees, including John

Bruder and Niall Kavanagh, will join Gresham House's wider Real

Estate activities in Ireland. Burlington Real Estate will remain

the advisor to the Appian Burlington Property Fund and the recently

launched Gresham House Credit Union Income Fund which invests in

social housing in Ireland.

There will be no change to current operations within Burlington

Real Estate, and we expect a seamless transition for Burlington

Real Estate's clients. Looking ahead we anticipate the broader

suite of products and opportunities available across the Gresham

House platform may be of interest to some clients and thereby an

opportunity to drive further growth and enhancement of value for

our business in Ireland.

Patrick Lawless, Managing Director, Gresham House Ireland

commented:

"Having worked closely with John and the team at Burlington Real

Estate for over five years in their capacity as Advisor to our

property fund, we see a strong cultural fit with the Gresham House

Group and our ambitions in Ireland."

The initial consideration of EUR1.8 million will be paid by the

Group to the sellers of Burlington (the "Sellers"). In addition,

the Sellers have agreed to subscribe for 73,177 new ordinary shares

of 25p each in the capital of the Company ("Ordinary Shares"), in

aggregate, (the "Subscription Shares") at a price of GBP8.42 per

Subscription Share. The Subscription Shares will be subject to the

terms of a lock-in deed that will, subject to certain exceptions,

restrict dealing in the Subscription Shares.

An application will be made to London Stock Exchange plc for the

Subscription Shares to be admitted to trading on AIM. The

Subscription Shares will be issued credited as fully paid and will

rank pari passu with the existing Ordinary Shares, including the

right to receive all dividends and other distributions (if any)

declared, made or paid on or in respect of such shares after the

date of their issue.

It is expected that admission of the Subscription Shares to

trading on AIM ("Admission") will become effective and that

dealings in the Subscription Shares will commence on AIM at 8.00am

on 21 March 2022.

Following Admission, the Company will have a total of 38,073,996

Ordinary Shares in issue. With effect from Admission, this figure

may be used by shareholders as the denominator for the calculations

by which they will determine if they are required to notify their

interest in, or a change to their interest in the Company, under

the Disclosure Guidance and Transparency Rules of the Financial

Conduct Authority.

-ends-

Gresham House plc

Tony Dalwood, Chief Executive

Kevin Acton, Chief Financial Officer +44 (0)20 3837 6271

Houston gh@houston.co.uk

Alexander Clelland +44 (0)20 4529 0549

Kay Larsen

Gordon MRM ray@gordonmrm.ie

Ray Gordon 00 353 87 2417373

Canaccord Genuity Limited - Nominated Adviser

and Joint Broker

Bobbie Hilliam

Georgina McCooke +44 (0)20 7523 8000

Jefferies International Limited - Financial

Adviser and Joint Broker

Paul Nicholls

Max Jones +44 (0)20 7029 8000

This announcement does not constitute an offer to buy, acquire

or subscribe for (or the solicitation of an offer to buy, acquire

or subscribe for), Ordinary Shares or an offer to buy, acquire or

subscribe for (or the solicitation of an offer to buy, acquire or

subscribe for), the Subscription Shares.

This announcement includes statements that are, or may be deemed

to be, "forward-looking statements". These forward-looking

statements can be identified by the use of forward-looking

terminology, including the terms "believes", "estimates", "plans",

"projects", "anticipates", "expects", "intends", "may", "will", or

"should" or, in each case, their negative or other variations or

comparable terminology. These forward-looking statements include

matters that are not historical facts. They appear in a number of

places throughout this announcement and include statements

regarding the Directors' current intentions, beliefs or

expectations concerning, among other things, the Group's results of

operations, financial condition, liquidity, prospects, growth,

strategies, and the Group's markets.

By their nature, forward-looking statements involve risk and

uncertainty because they relate to future events and circumstances.

Actual results and developments could differ materially from those

expressed or implied by the forward-looking statements.

Forward-looking statements may and often do differ materially

from actual results. Any forward-looking statements in this

announcement are based on certain factors and assumptions,

including the Directors' current view with respect to future events

and are subject to risks relating to future events and other risks,

uncertainties and assumptions relating to the Group's operations,

results of operations, growth strategy and liquidity. Whilst the

Directors consider these assumptions to be reasonable based upon

information currently available, they may prove to be incorrect.

Save as required by law or by the AIM Rules for Companies, the

Company undertakes no obligation to publicly release the results of

any revisions to any forward-looking statements in this

announcement that may occur due to any change in the Directors'

expectations or to reflect events or circumstances after the date

of this announcement.

About Gresham House

Gresham House is a specialist alternative asset management

group, dedicated to sustainable investments across a range of

strategies, with expertise across forestry, housing,

infrastructure, renewable energy and battery storage, public and

private equity.

Our origins stretch back to 1857, while our focus is on the

future and the long term. Quoted on the London Stock Exchange

(GHE:LN) we actively manage c.GBP6.5bn of assets (as at 31 December

2021) on behalf of institutions, family offices, charities and

endowments, private individuals, and their advisers. We act

responsibly within a culture of empowerment that encourages

individual flair and entrepreneurial thinking.

As a signatory to the UN-supported Principles for Responsible

Investment (PRI), our vision is to always make a positive social or

environmental impact, while delivering on our commitments to

shareholders, employees and investors.

About Gresham House Ireland

Gresham House Ireland was originally established in December

2002 as Appian Asset Management and rebranded following its

acquisition by Gresham House plc in June 2021. Gresham House

Ireland is regulated by the Central Bank of Ireland under the

Alternative Investment Fund Management Directive (AIFMD) and has

EUR393mn (GBP330mn) in AUM (as at 31 December 2021). Gresham House

Ireland is the manager of five funds which invest globally across

traditional and alternative asset classes including equities,

property, infrastructure, commodities, and forestry.

www.greshamhouse.com

www.greshamhouse.ie

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

ACQFFFFVVVISLIF

(END) Dow Jones Newswires

March 15, 2022 03:29 ET (07:29 GMT)

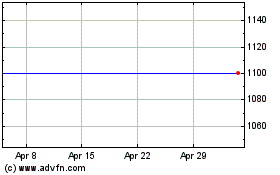

Gresham House (LSE:GHE)

Historical Stock Chart

From Mar 2024 to Apr 2024

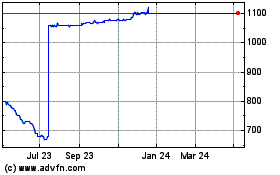

Gresham House (LSE:GHE)

Historical Stock Chart

From Apr 2023 to Apr 2024