TIDMQIF

RNS Number : 6298D

Qatar Investment Fund PLC

28 October 2015

28 October 2015

Qatar Investment Fund plc ("QIF" or the "Company")

Q3 2015 Investment Report

Qatar Investment Fund plc (LSE: QIF), today issues its Q3 2015

Investment Report for the period 1 July 2015 to 30 September 2015,

a pdf copy of which can be obtained from QIF's website at:

www.qatarinvestmentfund.com.

QIF was established to capitalize on the investment

opportunities in Qatar and the Gulf Cooperation Council ("GCC")

region, arising from the economic growth being experienced in the

area. The Company invests in quoted Qatari equities listed on the

Qatar Exchange ("QE") in addition to companies soon to be listed,

with a possible allocation of up to 15% in other listed companies

elsewhere in the GCC region. The Investment Adviser invests using a

top-down screening process combined with fundamental industry and

company analysis

QIF Quarterly Report - Q3 2015

3 months ended 30 September 2015

Highlights

Ø Qatar Investment Fund Plc's ("QIF") net asset value (NAV) per

share fell 4.6% during the first nine months of 2015, while the

Qatar Exchange (QE) index fell 6.7%.

Ø Qatari economy continues to diversify and grow:

Ø GDP is expected to grow 4.7% in 2015 and 6.4% in 2016 and

2017.

Ø Non-hydrocarbon sector grew by 9.1% while hydrocarbon sector

was flat, expanding by 0.9% in Q2 2015.

Ø Profits of Qatari listed companies up 12.5% in H1 2015.

Ø Credit growth was 9.9% between December 2014 and August 2015,

led by the private sector (up 16.7%).

Ø Qatari economy is well positioned to weather lower oil prices,

as macroeconomic fundamentals remain strong.

Performance and Portfolio Structure

Please refer to the report on the Company's website

www.qatarinvestmentfund.com/publications/quarterly-reports/ for a

chart depicting the NAV per share compared to the QIF share

price.

Global markets, led by emerging equities and currencies, saw

substantial falls during the quarter over Chinese and emerging

market growth worries, the surprise devaluation of the yuan, and

lower crude oil prices. All Gulf Cooperation Council ("GCC")

markets fell in the quarter. QIF's NAV declined 6.6% during the

quarter as holdings such as Industries Qatar (-14.6%), Gulf

International Services (-18.8%) and Masraf Al Rayan (-7.5%)

impacted portfolio performance.

As at 30 September 2015, the QIF share price was at a 12.7%

discount to NAV per share.

Historic Performance against the QE Index

2007 2008 2009 2010 2011 2012 2013 2014 2015

5M 9M

----------- ------ ------- ------ ------ ------ ------ ------ ------ ------

QIF NAV* 13.9% -36.4% 10.4% 29.9% 1.3% -4.7% 24.2% 20.6% -4.6%

----------- ------ ------- ------ ------ ------ ------ ------ ------ ------

QE Index 27.0% -28.8% 1.1% 24.8% 1.1% -4.8% 24.2% 18.4% -6.7%

----------- ------ ------- ------ ------ ------ ------ ------ ------ ------

QIF Share

Price 15.5% -67.5% 97.3% 23.0% -2.3% 2.4% 26.4% 17.4% -7.4%

----------- ------ ------- ------ ------ ------ ------ ------ ------ ------

*Net of dividends paid

Source: Bloomberg, Qatar Insurance Company

Portfolio Structure

Top 10 Holdings

Company Name Sector % Share of

NAV

--------------------- ------------------- -----------

Qatar National Banks & Financial

Bank Services 18.8%

--------------------- ------------------- -----------

Industries Qatar Industry 13.2%

--------------------- ------------------- -----------

Banks & Financial

Masraf Al Rayan Services 11.9%

--------------------- ------------------- -----------

Banks & Financial

Qatar Islamic Bank Services 8.5%

--------------------- ------------------- -----------

Commercial Bank Banks & Financial

of Qatar Services 7.9%

--------------------- ------------------- -----------

Qatar Electricity

& Water Co Industry 6.5%

--------------------- ------------------- -----------

Gulf International

Services Industry 4.9%

--------------------- ------------------- -----------

Banks & Financial

Doha Bank Services 4.6%

--------------------- ------------------- -----------

Qatar Gas Transport Transportation 4.1%

--------------------- ------------------- -----------

Barwa Real Estate Real Estate 3.5%

--------------------- ------------------- -----------

During the quarter, Qatar Gas Transport (Nakilat) replaced Qatar

Navigation (Milaha) in QIF's top 10 holdings. The Investment

Adviser took profits on Milaha as the company began to look

overvalued.

Country Allocation

At 30 September, QIF had 20 holdings: 18 in Qatar and two in

UAE, unchanged from the previous quarter. Cash was 1.1% on NAV (Q2

2015: 2.2%).

Qatar remains the Investment Adviser's preferred market in the

GCC, due to the stable politics, sizeable hydrocarbon reserves,

non-hydrocarbon sector economic growth, combined with attractive

market valuations and high dividend yield.

Sector Allocation

Please refer to the report on the Company's website

www.qatarinvestmentfund.com/publications/quarterly-reports/ for a

chart depicting the overall portfolio allocation by sector as at 30

September 2015.

QIF remains overweight in the Qatari banking sector (including

financial services) at 53.7% (Q2 2015: 51.4%) versus 43.2% for the

QE index. According to Qatar Central Bank data published at the end

of August, the banking sector has grown 5.5% so far in 2015, driven

by loan growth of 9.9%. The banking sector will benefit from the

government's infrastructure development fueling lending growth,

from a rising domestic population and from international

expansion.

QIF's second largest allocation is to the industrial sector at

24.6% (Q2 2015: 25.7%), notably Industries Qatar (13.2% of NAV).

The Investment Adviser reduced exposure to Industries Qatar and

Gulf International Services as crude oil prices remain low, while

increasing its holding in Qatar Electricity and Water.

QIF's real estate weighting reduced to 6.6% from 8.8% in Q2.

Exposure to the telecom sector remained broadly unchanged, while

transportation increased from 5.1% to 8.0%. Exposure to the

consumer and services sector decreased from 3.2% in Q2 to 2.9% at

the end of Q3.

Regional Market Overview

The Bloomberg GCC 200 index fell 11.9% during the period, while

Saudi Arabia was down 18.5%. Dubai fell 12.1%, led by double-digit

declines in the real estate, industrial and investment &

financial services sectors. Markets in Oman, Kuwait and Bahrain

were down 9.9%, 7.7% and 6.7%, respectively.

Qatar fell 6.0% and emerged as the second best performer in the

GCC. All sectors closed lower, led by the industrial (-13.4%) and

telecom (-12.9%) sectors.

Index provider FTSE Russell announced an upgrade of Qatar to its

Secondary Emerging Market index and MSCI increased weightings of

some Qatari stocks in its Emerging Markets index. As a result,

Qatar should see increased foreign fund flows.

In August, the MSCI Emerging Markets index fell 9.2%, although

Qatar fell just 1.9% compared to Dubai's -11.6% and Saudi's

-17.3%.

The Investment Adviser believes that in the current environment

of lower oil prices, the Qatari market is well placed to outperform

its GCC peers, thanks to strong macro-economic fundamentals

including a relatively low fiscal breakeven oil price, the

accumulation of significant cash reserves over many years and low

levels of public debt.

Qatari banking sector growth was the fastest in the GCC

region

Qatar's banking sector grew at a CAGR of 15.3% from 2010-14.

Over the period, banking asset penetration (banking assets as a %

of nominal GDP) in Qatar improved from 125% of GDP to 132%. With

Qatari banking asset growth expected to remain faster than GDP

growth, the asset penetration is likely to continue to

increase.

Please refer to the report on the Company's website

www.qatarinvestmentfund.com/publications/quarterly-reports/ for a

chart depicting GCC Banking Sector Asset Growth (CAGR,

2010-14).

Qatar banking profits remained strong in 2014, with return on

average equity of 16.5% and return on average assets of 2.1%. In

addition, Qatari banks have been successful in maintaining an

efficient cost base and low NPLs (1.7% in 2014).

Banking and financial services sector profit grew 8.2% in the

first half of 2015. Banking sector profits grew 9.6% while the

financial services sector reported losses during the period. Growth

in lending, up 6.5% year to date till June 2015, primarily in the

private sector (+13.5%), helped the rise. Qatar National Bank

reported profits up 10.2%, while Qatar Islamic Bank profits rose

23.4%.

The Qatari banking sector growth is expected to remain healthy,

driven by increased lending due to project financing and higher

demand from a growing population. Despite strong growth in lending,

asset quality is expected to remain good, backed by healthy

economic environment.

Private sector credit growth remained strong

Credit growth in Qatar remains good, with loans by Qatari banks

growing 9.9% in the year to August 2015. Private sector credit

growth rose 16.7% and total deposits grew 4.0%, while public sector

loans declined 1.0% during the same period. The banking sector

loans to deposit ratio stood at 115% at the end of August 2015

compared to 109% at the end of December 2014.

(MORE TO FOLLOW) Dow Jones Newswires

October 28, 2015 03:00 ET (07:00 GMT)

The Investment Adviser believes that credit growth should remain

encouraging, underpinned by infrastructure spending,

non-hydrocarbon sector growth and a growing population.

Qatar: corporate profits up

Profits of Qatari listed companies grew 12.5% during the first

six months of 2015 driven by increases in the banking &

financial, transportation and the real estate sectors. However,

profit growth during the quarter was slower at 3.0% that at the

same period in 2014.

Sector profitability (net profit/loss in US$000s)

Sectors H1 2014 H1 2015 % Change Q2 2014 Q2 2015 % Change

--------------------- ---------- ---------- --------- ---------- ---------- ---------

Banking & Financial 2,631,557 2,848,026 8.2% 1,354,451 1,469,507 8.5%

--------------------- ---------- ---------- --------- ---------- ---------- ---------

Insurance 230,572 226,665 -1.7% 105,953 100,921 -4.7%

--------------------- ---------- ---------- --------- ---------- ---------- ---------

Industrial 1,674,425 1,406,706 -16.0% 853,240 788,387 -7.6%

--------------------- ---------- ---------- --------- ---------- ---------- ---------

Services & Consumer

Goods 255,534 254,198 -0.5% 146,649 137,464 -6.3%

--------------------- ---------- ---------- --------- ---------- ---------- ---------

Real Estate 410,460 1,352,343 229.5% 138,599 235,519 69.9%

--------------------- ---------- ---------- --------- ---------- ---------- ---------

Telecoms* 468,140 275,381 -41.2% 224,557 137,699 -38.7%

--------------------- ---------- ---------- --------- ---------- ---------- ---------

Transportation 283,187 337,591 19.2% 122,531 165,237 34.9%

--------------------- ---------- ---------- --------- ---------- ---------- ---------

Total 5,953,876 6,700,909 12.5% 2,945,979 3,034,733 3.0%

--------------------- ---------- ---------- --------- ---------- ---------- ---------

* Excluding Vodafone Qatar because of 31 March year end

Source: Qatar Exchange

Insurance sector profits declined 1.7% driven by a 9.1% fall in

profits at Qatar Insurance Company. Additionally, Doha Insurance

and Al Kaleej Takaful reported 17.5% and 36.6% falls in net profits

whilst Qatar General Insurance and Reinsurance Company reported a

129% profit rise.

Profits in the Industrials sector declined 16.0% during the

first half of the year. The fall was mainly due to a 14.6% drop in

profit of Industries Qatar (IQ) as a result of petrochemical

product price deflation. Gulf International Services and Mesaieed

Petrochemical Holdings also reported 17.0% and 55.2% falls in their

net profits.

Profits in the services & consumer goods sector declined

marginally by 0.5%, with Qatar Fuel Company reporting a 2.1% growth

in profits.

The real estate sector reported the strongest profit growth, up

threefold compared to the same period last year. Barwa Real Estate

Company profits rose 1451.6%, with income of QAR2.7 billion from

the sale of properties in Q1 2015.

The telecom sector comprises Vodafone Qatar and Ooredoo.

Vodafone Qatar was excluded from this profit comparison, since its

fiscal year ends on 31 March. Ooredoo reported a 41.2% fall in

profit for H1 2015, mainly due to competitive pressure, adverse

currency impact and the challenging economic environment of some of

its operating countries.

Transportation sector profits climbed 19.2%, with all three

companies in the sector reporting higher profits. The largest

contributor, Qatar Navigation, increased profits by 25.6%.

Recent Developments

Changes to QE Index constituents and weightings

Following the semi-annual review of QE indices, from 1 October

2015, Qatari Investors Group has been replaced by Al Meera Consumer

Goods Company. Ahli Bank has been removed from both the QE All

Share Index and QE Banks and Financial Services index. Zad Holding

has been included in QE Al Rayan Islamic index bringing its

constituents to 18.

FTSE upgrades Qatar to secondary emerging market

FTSE Russell has upgraded the Qatari market to Secondary

Emerging Market from the Frontier index, from September 2016. This

upgrade will be implemented in two tranches. The first 50% will be

implemented during the review of FTSE Global Equity Index Series

(GEIS) in September 2016 and the remaining 50% will be included

during the March 2017 review.

The Investment Adviser believes that an upgrade by FTSE should

enhance liquidity in the Qatari market. A similar trend was seen

during past upgrades of the market by MSCI and S&P. By way of

example, following the upgrade by FTSE to Secondary Emerging

Markets status, the Qatari market is estimated to attract US$1

billion of inflows as c.US$70 billion worth of funds currently

passively track the FTSE Emerging Markets Index.

GCC banks applying for licenses to operate within the region

According to reports, at least ten banks from GCC countries have

applied for licenses to the Qatar Central Bank and are expected to

receive approval to operate in Qatar by the end of this year. Key

applicants include First Gulf Bank from the UAE, Bank Muscat from

Oman, in addition to further Saudi and Kuwaiti banks.

Qatar National Bank was recently granted a license to open a

branch in Saudi Arabia.

Double-digit growth in Qatar's real estate transactions

The value of Qatar's real estate transactions grew 32.4% to

QAR45.9 billion during first nine months of 2015 compared to same

period last year. This growth was mainly driven by the government's

investment in infrastructure development. By the end of 2015, the

total value of real estate transactions is expected to reach QAR70

billion, 25% higher than 2014. The Investment Adviser expects that

with continuing commitment from the Qatari government to

infrastructure spending, real estate transactions will see growth

until 2022.

US$220 billion of projects expected over the next 10 years

According to the latest S&P report, Qatar is expected to

award large-scale projects worth US$220 billion over the next 10

years and will prioritize existing development projects as oil

prices remain low. Qatar will focus on investment in

infrastructure, education and health over the next decade with the

majority of projects planned for completion prior to the 2022 FIFA

World Cup in Qatar. Continued infrastructure spending will support

medium to long term economic growth in the country, however,

considering the lower oil price environment there could be a

reduction in fiscal and external balances.

Macroeconomic Update

Qatar's economy continued to grow in Q2 with GDP rising 4.8%,

according to the Ministry of Development Planning and Statistics

(MDPS). Non-hydrocarbon sector GDP grew 9.1%, mainly driven by

double digit expansion in construction, trade, hospitality and

finance sectors. Lower oil prices meant hydrocarbon sector GDP

growth was 0.9%.

The Investment Adviser believes that GDP growth is set to

continue, fueled by the expansion of the non-hydrocarbon sector

with demand for domestic goods and services remaining strong. QNB

Group estimates GDP growth of 4.7% in 2015 rising to 6.4% in 2016

and 2017. The non-hydrocarbon sector is estimated to grow c.10% per

annum between 2015 and 2017. Hydrocarbon GDP is likely to decline

by 0.5% in 2015 as oil fields continue to mature but it is

estimated to expand 2.7% in 2016 and 2.4% in 2017 on account of

increased output from the Barzan project. With a fall in revenue

and increased capital spending, Qatar may experience small fiscal

deficits in 2015-16, before registering a surplus in 2017 when oil

prices are expected to strengthen.

Qatar's population rose 5.0% at the end of September 2015

compared to December 2014. This growth is expected to continue in

the coming years, as project spending related to the FIFA World Cup

continues to attract expatriate workers. The Investment Adviser

believes that this should maintain consumption growth providing

necessary impetus to domestic consumer companies.

Valuation

Market Market Cap. PE (x) PB (x) Dividend Yield

(%)

-------------- ------------ -------------- ------- ---------------

US$ Mn 2015E 2016E 2015E 2015E

-------------- ------------ ------ ------ ------- ---------------

Qatar 140,552 13.1 11.9 1.9 4.6%

-------------- ------------ ------ ------ ------- ---------------

Saudi Arabia 447,436 14.1 11.9 1.7 3.5%

-------------- ------------ ------ ------ ------- ---------------

Dubai 86,711 12.4 10.1 1.5 3.4%

-------------- ------------ ------ ------ ------- ---------------

Abu Dhabi 123,874 10.9 9.9 1.6 5.1%

-------------- ------------ ------ ------ ------- ---------------

Oman 17,118 10.1 9.5 1.3 4.4%

-------------- ------------ ------ ------ ------- ---------------

Source: Bloomberg, Prices as at 5 October 2015

Outlook

The Investment Adviser believes that the Qatari economy is well

positioned to weather lower oil prices as other macroeconomic

fundamentals remain strong. The long term prospects of the economy

are underpinned by government infrastructure spending (US$220

billion forecast to be spent over the next 10 years) and a growing

population. Additionally, accelerating non-hydrocarbon growth

should help offset lower oil and gas revenues, while benefitting

financial services, transport, communications, and real estate

sectors.

(MORE TO FOLLOW) Dow Jones Newswires

October 28, 2015 03:00 ET (07:00 GMT)

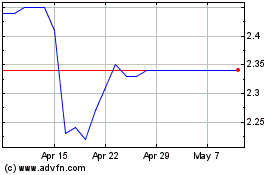

Gulf Investment (LSE:GIF)

Historical Stock Chart

From Oct 2024 to Nov 2024

Gulf Investment (LSE:GIF)

Historical Stock Chart

From Nov 2023 to Nov 2024