TIDMGIF

RNS Number : 6773X

Gulf Investment Fund PLC

27 December 2023

Legal Entity Identifier: 2138009DIENFWKC3PW84

27 December 2023

Gulf Investment Fund plc

(the "Company")

2023 Annual General Meeting Results

The Board of Gulf Investment Fund plc (GIF.L) announces that at

the Annual General Meeting ("AGM") held at 2.00 pm on 22 December

2023, all resolutions were duly passed on a poll. The results are

shown below.

Resolution 1 (Ordinary Resolution)

The Report of the Investment Manager and Investment Adviser,

Report of the Directors, Directors' Remuneration Report, Report of

the Independent Auditors and the Audited Financial Statements of

the Company for the year to 30 June 2023 were approved with

17,560,834 votes cast in favour, 7,892 votes cast against and 4,722

abstentions.

Resolution 2 (Ordinary Resolution)

The final dividend of USD 4.05 cents per ordinary share for the

year ended 30 June 2023 was approved with 17,560,834 votes cast in

favour, 7,892 votes cast against and 4,722 abstentions.

Resolution 3 (Ordinary Resolution)

KPMG Audit LLC Isle of Man were re-appointed as auditors of the

Company for the year ending 30 June 2024 with 17,555,868 votes cast

in favour, 11,421 votes cast against and 6,159 abstentions.

Resolution 4 (Ordinary Resolution)

Mr David Humbles who retires in accordance with the Articles of

Association was re-elected a director of the Company with

17,555,834 votes cast in favour, 9,951 votes cast against and 7,663

abstentions.

Resolution 5 (Ordinary Resolution)

Mr Patrick Grant who retires in accordance with the Articles of

Association was elected a director of the Company with 17,555,834

votes cast in favour, 9,951 votes cast against and 7,663

abstentions.

Resolution 6 (Ordinary Resolution)

That the Company generally and unconditionally be authorised to

make market purchases of shares of US$0.01 each provided that: (a)

the maximum aggregate number of shares that may be purchased is

6,011,470 (being the equivalent of 14.99% of the Company's issued

share capital as at 28 November 2023); (b) the minimum price

(excluding expenses) which may be paid for each share is US$0.01

being the nominal value per share; (c) the maximum price (excluding

expenses) which may be paid for each share is the higher of: (i)

105 per cent of the average market value of a share in the Company

for the five business days prior to the day the purchase is made;

and (ii) the value of a share calculated on the basis of the higher

of the price quoted for (I) the last independent trade of and (II)

the highest current independent bid for, any number of the

Company's shares on the trading venue where the purchase is carried

out; and (d) the authority conferred by this resolution shall

expire on 31 December 2024 or, if earlier, at the conclusion of the

Company's next annual general meeting save that the Company may,

before the expiry of the authority granted by this resolution,

enter into a contract to purchase shares which will or may be

executed wholly or partly after the expiry of such authority. All

Shares purchased pursuant to the above authority shall be either:

(i) held, sold, transferred or otherwise dealt with as treasury

shares; or (ii) cancelled immediately upon completion of the

purchase. The resolution was passed with 17,558,775 votes cast in

favour, 9,951 votes cast against and 4,722 abstentions.

Resolution 7 (Ordinary Resolution)

That the Company shall continue as a closed ended investment

company was approved with 17,559,287 votes cast in favour, 9,439

votes cast against and 4,722 abstentions.

Resolution 8 (Special Resolution)

That the provisions of Article 5A.2 of the Company's Articles of

Association requiring equity securities proposed to be issued for

cash, first to be offered to the members in proportion as nearly as

practicable to the number of existing equity securities held by

them respectively be and are hereby disapplied in relation to the

allotment or sale of Shares up to an aggregate maximum of 4,010,320

Shares, such authority to expire at the conclusion of the next

annual general meeting of the Company but so that the Company may,

before such expiry, make offers or agreements which would or might

require Shares to be allotted or sold or rights to subscribe for or

convert securities into Shares to be granted after such expiry and

the Directors may allot or sell Shares or grant rights to subscribe

for or convert securities into Shares pursuant to any such offer or

agreement as if this authority had not expired. The resolution was

passed with 17,208,287 votes cast in favour, 9,439 votes cast

against and 355,722 abstentions.

Resolution 9 (Ordinary Resolution)

THAT, the waiver granted by the Panel on Takeovers and Mergers

as described in the circular issued by the Company to its

shareholders on 28 November 2023 which contained the notice of

meeting (the "Circular"), of any requirement under Rule 9 of the

Takeover Code on the Investment Adviser to make a general offer to

the Shareholders of the Company as a result of the 2024 Tender

Offers was approved with 17,558,287 votes cast in favour, 9,439

votes cast against and 5,722 abstentions.

Resolution 10 (Ordinary Resolution)

THAT, subject to the passing of Resolution 9, in addition to any

existing authorities, the Company be and is hereby authorised to

make market purchases (within the meaning of section 13 of the

Companies Act 1992) of its Shares pursuant to the 2024 tender

offers on the terms set out in the Circular (the "2024 Tender

Offers") provided that: (a) the maximum number of Shares hereby

authorised to be purchased shall be 40,103,204; (b) the price which

may be paid for a Share shall be the Tender Price as defined in the

Circular (which in each case shall be both the maximum and the

minimum price); (c) unless renewed, the authority hereby conferred

shall expire on the earlier of (i) the completion of the September

2024 Tender Offer or (ii) one year from the date of passing of this

resolution; (d) the Company may make a contract or contracts to

purchase Shares under the authority hereby conferred prior to the

expiry of such authority which will or may be executed wholly or

partly after the expiry of such authority and may make a purchase

of Shares in pursuance of any such contract or contracts; and (e)

subject to the provisions of the Companies Acts, any of the Shares

so acquired will be cancelled. The resolution was passed with

17,558,775 votes cast in favour, 9,951 votes cast against and 4,722

abstentions.

A copy of the results will be submitted to the National Storage

Mechanism and will be available for inspection at

https://data.fca.org.uk/#/nsm/nationalstoragemechanism .

The total number of votes cast was 17,573,448 which represents

43.82% of the Company's total voting rights.

As disclosed in the Circular, in the event that the 2024 Tender

Offers become wholly unconditional and assuming that: (i) the

Investment Adviser does not participate in either of the 2024

Tender Offers (which it has confirmed it does not intend to do);

(ii) the Investment Adviser does not acquire any additional Shares

prior to the implementation of either of the 2024 Tender Offers;

(iii) the aggregate number of Shares that are validly tendered by

all other Shareholders represents the maximum number of Shares that

can be tendered under the 2024 Tender Offers whilst still

satisfying the 2024 Minimum Size Condition; and (iv) there are no

other changes to the Share Capital such that the aggregate number

of Shares in issue following completion of either of the 2024

Tender Offers will be equal to 38,000,000, it is expected that the

Investment Adviser will retain an interest in 17,319,758 Shares and

the Investment Adviser's interest in the voting rights of the

Company will increase to approximately 45.58 per cent.

For further information:

Anderson Whamond

Gulf Investment Fund plc +44 (0) 1624 630 400

Frazer Pickering/Suzanne Jones

Apex Corporate Services (IOM) Limited +44 (0) 1624 630 400

Alex Collins/Atholl Tweedie

Panmure Gordon +44 (0) 20 7886 2500

William Clutterbuck

Maitland/AMO +44 (0) 7785 292 617

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

RAGFESFMFEDSEFE

(END) Dow Jones Newswires

December 27, 2023 02:00 ET (07:00 GMT)

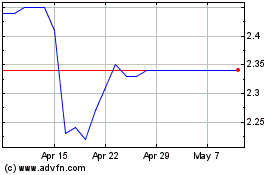

Gulf Investment (LSE:GIF)

Historical Stock Chart

From Mar 2024 to Apr 2024

Gulf Investment (LSE:GIF)

Historical Stock Chart

From Apr 2023 to Apr 2024