TIDMGKP

RNS Number : 0576H

Gulf Keystone Petroleum Ltd.

14 May 2014

Not for release, publication or distribution, directly or

indirectly, in whole or in part in or into the United States or any

jurisdiction other than the United Kingdom and Bermuda where to do

so would constitute a contravention of the relevant laws or

regulations of such jurisdiction. This announcement (and the

information contained herein) does not contain or constitute an

offer to sell or the solicitation of an offer to purchase, nor

shall there be any sale of securities in any jurisdiction where

such offer, solicitation or sale would constitute a contravention

of the relevant laws or regulations of such jurisdiction.

14 May 2014

Gulf Keystone Petroleum Ltd. (LSE: GKP)

Interim Management Statement

Gulf Keystone Petroleum Limited ("Gulf Keystone" or "the

Company") is pleased to present the Company's first Interim

Management Statement for the period from 1 January 2014 to

today.

Overview

On 25 March 2014, Gulf Keystone's common shares were admitted,

with a standard listing, to the Official List of the United Kingdom

Listing Authority and to trading on the London Stock Exchange plc's

("LSE") main market for listed securities ("Main Market"). The move

from AIM to the Main Market was a significant milestone in the

growth and transition of Gulf Keystone from an independent oil and

gas explorer to an established exploration and production

company.

On 17 April 2014, Gulf Keystone closed on a US$250 million debt

financing that will fully fund the Company and its development plan

into 2015. Under that plan, the Company expects to achieve an

increase of production from Shaikan PF-1 and PF-2 to 40,000 gross

barrels of oil per day ("bopd") by year-end 2014 from the current

level of 15,000-16,000 gross bopd. Currently, average Shaikan

production for the year to December 2014 is expected to be

equivalent to approximately 20,000-25,000 gross bopd.

Gulf Keystone commenced Shaikan crude oil exports by truck to

Turkey in December 2013 and the first export sales in late January

2014. In Q1 2014, gross export deliveries by truck totalled 836,205

barrels. Gross domestic sales in Q1 2014 totalled 24,767 barrels,

with sales realisations of US$42 per barrel and further 7,163

barrels of gross domestic sales in April 2014. Production revenues

are expected to increase significantly in H2 2014.

In May 2014, Gulf Keystone received a US$6.46 million gross

payment for the first Shaikan crude oil export sales. The Company

records revenue in its accounts on a cash received basis resulting

in a time lag between the physical production and shipment of crude

oil and payment. The time lag can be significant with an

approximate US$24 million net outstanding to the Company, after the

first payment of US$6.46 million gross received in May 2014, from

the commencement of oil sales in January 2014 to date. This

therefore gives rise to uncertainty in the timing of revenue

recognition and guidance for 2014. At this time, revenue guidance

for 2014 is in the range of US$150 million to US$180 million which

reflects the Company's current view on cash payment and current

production levels.

Production and Infrastructure

-- Shaikan PF-1 is currently producing from three wells, Shaikan-1, -3 and -4.

-- Hook-up of Shaikan-8 and Shaikan-7 to PF-1 is expected later

in 2014; flowlines are being ordered.

-- Shaikan PF-2 has been commissioned and the start-up process

has commenced with live oil flowing from Shaikan-5 to the

production facility, which will also be producing from Shaikan-2

and -10.

-- Flowlines are being ordered for an additional development

well to be drilled and hooked-up to Shaikan PF-2.

Exploration

-- Due to a number of mechanical failures in the course of the

drilling operations, the Shaikan-7 deep exploration well has not

been able to achieve its objective and will now be converted into a

Jurassic producer and tied into Shaikan PF-1. Based on well logs,

Shaikan-7 should become a prolific producing well and the full cost

of the well should be recovered within six months from first

production.

-- A new deep exploration well to test the previously undrilled

deep Triassic and potentially Permian horizons, which is a

commitment under the approved Shaikan Field Development Plan, will

be added to the drilling schedule.

Development and Appraisal

-- Appraisal of the Sheikh Adi discovery is ongoing with Sheikh

Adi-3 currently drilling ahead at 2,150 metres after having

experienced some mechanical difficulties.

-- Early production from the Bijell Extended Well Test Facility

on the Akri-Bijeel block commenced in March 2014 expected to

ramp-up to 10,000 bopd by the end of 2014.

-- Field Development Plan for the Bijell and Bakrman discoveries

on the Akri-Bijell block has been submitted to the Kurdistan

Regional Government's Ministry of Natural Resources by MOL

Hungarian Oil & Gas plc, the operator.

-- Appraisal of the Bijell and Bakrman discoveries is ongoing

with wells operating at Bijell-2, -4, -6 and Bakrman-2

respectively.

Finance

-- Successful debt offering of US$250 million in three-year

senior unsecured notes due April 2017, privately placed in

accordance with Reg S/144A with institutional investors in Europe,

the US and Asia.

-- As of 30 April 2014, cash, cash equivalents and liquid

investments of approximately US$270 million.

Corporate

-- Mr Chris Garrett retired from his position as the Company's

Vice President Operations after 10 years with Gulf Keystone. Mr

John Stafford, previously Geology and Geophysics Manager, has been

appointed Vice President Operations effective 3 May 2014.

-- Gulf Keystone's Annual General Meeting will be held on 17 July 2014 in Paris, France.

Enquiries:

Gulf Keystone Petroleum: +44 (0) 20 7514 1400

Simon Murray, Non-Executive Chairman

Todd Kozel, Chief Executive Officer

Anastasia Vvedenskaya,

Head of Investor Relations

The Dilenschneider Group +44 (0) 7795484387

Terence Franklin

or visit: www.gulfkeystone.com

Notes to Editors:

-- Gulf Keystone Petroleum Ltd. (LSE: GKP) is an independent oil

and gas exploration, development and production company focused on

exploration in the Kurdistan Region of Iraq.

-- Gulf Keystone Petroleum International (GKPI) holds Production

Sharing Contracts for four exploration blocks in Kurdistan, the

Shaikan, Sheikh Adi, Ber Bahr and Akri-Bijeel blocks.

-- GKPI is the Operator of the Shaikan Block, which is a major

commercial discovery, with a working interest of 75% and is

partnered with Kalegran Ltd. (a 100% subsidiary of MOL Hungarian

Oil and Gas plc.) and Texas Keystone Inc., which have working

interests of 20% and 5% respectively. Texas Keystone Inc. holds its

interest in trust for Gulf Keystone, pending transfer of its

interest to the Company.

-- Gulf Keystone is moving into the large-scale phased

development of the Shaikan field targeting 100,000 bopd of

production capacity during Phase 1 of the Shaikan Field Development

Plan following its approval in June 2013.

Disclaimer

This announcement contains certain forward-looking statements.

These statements are made by the Company's Directors in good faith

based on the information available to them up to the time of their

approval of this announcement but such statements should be treated

with caution due to inherent uncertainties, including both economic

and business factors, underlying such forward-looking information.

This announcement has been prepared solely to provide additional

information to shareholders to assess the Group's strategies and

the potential for those strategies to succeed. This announcement

should not be relied on by any other party or for any other

purpose.

This communication and the information contained herein is not

an offer of securities for sale in the United States. Securities

may not be offered or sold in the United States unless they are

registered or are exempt from registration. Any public offering of

securities to be made in the United States would be made by means

of a prospectus that would contain detailed information about the

company and its management, as well as financial statements. The

company does not intend to register any portion of this offering in

the United States or to conduct a public offering in the United

States or any other jurisdiction. Any public offering of securities

to be made in the United States would be made by means of a

prospectus that would contain detailed information about the

Company and its management, as well as financial statements. Copies

of this communication are not being, and should not be, distributed

in or sent into the United States.

This communication is directed only at (i) persons who are

outside the United Kingdom or (ii) persons who have professional

experience in matters relating to investments falling within

Article 19(2) of the Financial Services and Markets Act 2000

(Financial Promotion) Order 2005, as amended from time to time (the

Order) or (iii) high net worth entities, and other persons to whom

it may lawfully be communicated, falling within Article 49(2) of

the Order or (iv) certified high net worth individuals and

certified and self-certified sophisticated investors as described

in Articles 48, 50, and 50A respectively of the Order or (v)

persons to whom this communication may otherwise be lawfully

communicated (all such persons together being referred to as

relevant persons). Any investment activity to which this

communication relates will only be available to and will only be

engaged with, relevant persons. Any person who is not a relevant

person should not act or rely on this document or any of its

contents.

This communication is distributed in any member state of the

European Economic Area which applies Directive 2003/71/EC (this

Directive together with any implementing measures in any member

state, the Prospectus Directive) only to those persons who are

qualified investors for the purposes of the Prospectus Directive in

such member state, and such other persons as this document may be

addressed on legal grounds, and no person that is not a relevant

person or qualified investor may act or rely on this document or

any of its contents.

This information is provided by RNS

The company news service from the London Stock Exchange

END

IMSGGUUWAUPCUCC

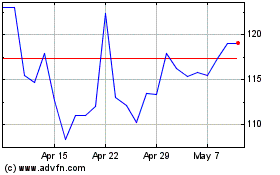

Gulf Keystone Petroleum (LSE:GKP)

Historical Stock Chart

From Dec 2024 to Jan 2025

Gulf Keystone Petroleum (LSE:GKP)

Historical Stock Chart

From Jan 2024 to Jan 2025