TIDMGLAN

RNS Number : 2006J

Accel - KKR Company, LLC

14 August 2023

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION IN WHOLE OR IN PART

IN, INTO OR FROM ANY JURISDICTION WHERE TO DO SO WOULD CONSTITUTE A

VIOLATION OF THE RELEVANT LAWS OR REGULATIONS OF THAT

JURISDICTION

THIS ANNOUNCEMENT IS BEING MADE PURSUANT TO RULE 2.7 OF THE

IRISH TAKEOVER RULES

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION

FOR IMMEDIATE RELEASE

14 AUGUST 2023

RECOMMED CASH OFFER

FOR

GLANTUS HOLDINGS PLC

BY

GENESIS BIDCO LIMITED

(A NEWLY INCORPORATED PRIVATE LIMITED COMPANY WHOLLY-OWNED BY

BASWARE OY)

TO BE IMPLEMENTED BY WAY OF A SCHEME OF ARRANGEMENT UNDER

CHAPTER 1 OF PART 9 OF THE COMPANIES ACT 2014

Summary

-- The board of directors of Genesis Bidco Limited ("Bidco") and

the board of directors of Glantus Holdings plc ("Glantus" or the

"Company") are pleased to announce that they have reached agreement

on the terms of a recommended all cash offer by Bidco, which has

been unanimously recommended by the Glantus Board.

-- Pursuant to the Acquisition, Bidco, a newly incorporated

company wholly-owned by Basware Oy ("Basware"), will acquire the

entire issued and to be issued share capital of Glantus.

-- Under the terms of the Acquisition, Glantus Shareholders will be entitled to receive:

for each Glantus Share GBP0.3342 in cash

-- The Acquisition represents a premium of approximately:

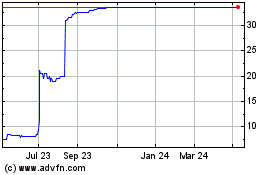

-- 197% to Glantus' Closing Price of GBP0.1125 on 4 July 2023

(being the last Business Day prior to the publication of Possible

Offer Announcement on 5 July 2023);

-- 289% to Glantus' volume weighted average share price of

approximately GBP0.0859 over the one month period ending on 4 July

2023;

-- 303% to Glantus' volume weighted average share price of

approximately GBP0.0830 over the three month period ending on 4

July 2023;

-- 315% to Glantus' volume weighted average share price of

approximately GBP0.0806 over the six month period ending on 4 July

2023; and

-- 67% to Glantus' Closing Price of GBP0.2000 on 11 August 2023

(being the last practicable date prior to the publication of this

Announcement).

-- The Acquisition values the entire issued and to be issued

share capital of Glantus at approximately GBP17.8 million on a

fully diluted basis and implies an enterprise value of GBP29.5

million.

-- If any dividend, distribution or other return of value is

authorised, declared, made or paid in respect of the Glantus Shares

on or after the date of this Announcement, Bidco reserves the right

to reduce the Consideration by the aggregate amount of such

dividend, distribution or other return of value.

-- It is intended that the Acquisition will be implemented by

means of a High Court sanctioned scheme of arrangement under

Chapter 1 of Part 9 of the Companies Act 2014 (the "Act") (or, if

Bidco elects, subject to the terms of the Transaction Agreement,

compliance with the Irish Takeover Rules and with the consent of

the Irish Takeover Panel, a Takeover Offer).

-- Commenting on the Acquisition, Maurice Healy, Chief Executive Officer of Glantus, said:

"Over recent years, Glantus has expanded operations to develop

an enviable position as a leading analytics and automation service

provider across Ireland, the UK and the US, combining a unique

customer proposition with an effective business model.

That said, the Company has faced an extraordinary challenging

period since listing in 2021. 2022 was particularly difficult and

Glantus was forced to restructure the business and enter into

negotiations with its lender due to low levels of cash resources.

While trading has improved in FY23 so far and Glantus is much

better positioned following the restructure, the Company has

significant levels of debt in a higher interest rate environment

and low levels of cash resources and confidence with public market

investors take a significant time to rebuild. These factors are all

reflected in the Company's current market capitalisation.

The Glantus Board is unanimously recommending the offer from

Bidco, as it represents a compelling opportunity for shareholders

to realise their investment in cash in the near term and is at a

very significant premium to recent share prices.

Despite recent challenges, the business has significant scope to

further expand its footprint, which we believe will be best

achieved in the private arena where Glantus can benefit from the

experience and capital of Basware as its partner, whilst

maintaining the management and wider team which have driven the

business forward to date."

Commenting on the Acquisition, Jason Kurtz, Chief Executive

Officer of Basware said:

"The acquisition of Glantus is a compelling opportunity and one

that is consistent with Basware's strategy of investing in AP

automation applications that deliver value to our customers. We

believe Glantus is an exceptional fit with our investment strategy

in terms of size, focus and business model. Partnering with a

high-quality management team will allow us to build long term

shareholder value whilst leveraging off the core domain expertise

of Glantus to create truly differentiated products and deliver

unique value to customers."

-- The Acquisition is conditional on, among other things, (i)

the approval by the Glantus Shareholders of the Scheme Meeting

Resolution; (ii) the approval by the Glantus Shareholders of the

EGM Resolutions; (iii) the sanction of the Scheme by the High

Court; and (iv) receipt of any necessary regulatory or other

approvals.

-- Having taken into account the relevant factors and applicable

risks, the Glantus Board, which has been so advised by Shore

Capital and Corporate Limited ("Shore Capital"), as financial

adviser and Rule 3 adviser to Glantus, as to the financial terms of

the Acquisition, considers the terms of the Acquisition as set out

in this Announcement to be fair and reasonable. In providing its

advice to the Glantus Board, Shore Capital has taken into account

the commercial assessments of the Glantus Board. Accordingly, the

Glantus Board unanimously recommends that Glantus Shareholders vote

in favour of the Acquisition and all of the Resolutions, as they

have irrevocably committed to do in respect of their own beneficial

holdings of, in aggregate, 18,602,137 Glantus Shares which

represent approximately 36.38% of the total issued share capital of

Glantus as of 11 August 2023 (being the last practicable date prior

to the publication of this Announcement).

-- The Scheme Document, which will contain, amongst other

things, further information about the Acquisition, notices

convening the Scheme Meeting and the Extraordinary General Meeting,

the expected timetable for completion of the Acquisition and any

actions to be taken by Glantus Shareholders, will be published as

soon as practicable and in any event, (save with the consent of the

Panel), within 28 days of this Announcement.

-- It is anticipated that the Scheme will, subject to obtaining

any necessary regulatory approvals, be declared effective in the

fourth quarter of 2023.

About Bidco and Basware

Bidco

Bidco is a limited liability company limited by shares

incorporated in Ireland for the sole purposes of implementing the

Acquisition. As at the Effective Date, it is intended that Bidco

will be owned either directly or indirectly (through one or more

holding companies) by Basware.

Bidco has not traded since incorporation, nor has it entered

into any obligations, other than in connection with the offer and

financing of the Acquisition. The current directors of Bidco are

Jason Kurtz, Martti Nurminen and Gordon MacNeill.

Basware

Basware provides solutions that help finance leaders in global

enterprises automate complex, labor-intensive invoice processes.

Its AP automation and invoicing platforms help customers achieve

efficiency while reducing errors and risks. Some of the world's

most efficient AP departments at world-class brands rely on Basware

to handle over 170 million invoices per year, often processing 89%

of invoices totally touchless.

For more information on the Basware Group, see

https://www.basware.com/.

About Glantus

Glantus is a public company registered in Ireland whose shares

have been admitted to trading on AIM since 11 May 2021. Glantus

specialises in providing data analysis and automation solutions to

businesses, helping organisations extract valuable insights from

their data, streamline processes and make informed decisions.

Glantus offers a range of software products and services that

assist with data integration, analytics, and reporting. In

addition, it offers advanced analytics capabilities, using machine

learning and artificial intelligence techniques to identify

patterns, trends, and anomalies within the data together with

automation solutions to streamline manual and repetitive tasks.

For more information on the Glantus Group, see

https://www.glantus.com/.

This summary should be read in conjunction with, and is subject

to, the full text of the following Announcement and its

appendices.

The Conditions to, and certain further terms of, the Acquisition

are set out in Appendix I to this Announcement and the Acquisition

is subject to further terms to be set out in the Scheme Document.

Certain terms used in this Announcement are defined in Appendix II

to this Announcement. Appendix III to this Announcement contains

certain sources of information and bases of calculation contained

in this Announcement.

This Announcement contains inside information and has been

issued pursuant to Article 2.1(b) of Commission Implementing

Regulation (EU) 2016/1055. The date and time of this Announcement

is the same date and time that it has been communicated to the

media.

Enquiries

Glantus Holdings

Maurice Healy, CEO

Susan O'Connor, Interim CFO + 353 862677800

Shore Capital (Financial Adviser, Nominated

Adviser and Broker to Glantus) + 44 207 408 4090

Patrick Castle

Tom Knibbs

Lucy Bowden

Yellow Jersey PR (Public Relations Advisor

to Glantus) +44 7747 788 221

Charles Goodwin

Annabelle Wills

Basware + 358 09 879171

Jason Kurtz, CEO

Martti Nurminen, CFO

Rothschild & Co (Financial Advisor to Basware

and Bidco) +44 20 7280 5000

Anton Black

Mitul Manji

Tom Guinness

Statements required by the Irish Takeover Rules

The Bidco Directors and the Basware Directors accept

responsibility for the information contained in this Announcement

other than that relating to Glantus, the Glantus Group and the

Glantus Directors and members of their immediate families, related

trusts and persons connected with them. To the best of the

knowledge and belief of the Bidco Directors and the Basware

Directors (who, in each case, have taken all reasonable care to

ensure that this is the case), the information contained in this

Announcement for which they accept responsibility is in accordance

with the facts and does not omit anything likely to affect the

import of such information.

The Glantus Directors accept responsibility for the information

contained in this Announcement relating to Glantus, the Glantus

Group and the Glantus Directors and members of their immediate

families, related trusts and persons connected with them. To the

best of the knowledge and belief of the Glantus Directors (who, in

each case, have taken all reasonable care to ensure such is the

case), the information contained in this Announcement for which

they accept responsibility is in accordance with the facts and does

not omit anything likely to affect the import of such

information.

Shore Capital, which is authorised and regulated by the FCA in

the United Kingdom, is acting exclusively for Glantus and no one

else in connection with the Acquisition and other matters referred

to in this Announcement and will not be responsible to anyone other

than Glantus for providing the protections afforded to clients of

Shore Capital, or for providing advice in connection with the

Acquisition, the content of this Announcement or any matter or

arrangement referred to herein. Neither Shore Capital nor any of

its subsidiaries or affiliates, directors, officers employees or

agents owes or accepts any duty, liability or responsibility

whatsoever (whether direct, indirect, consequential, whether in

contract, in tort, under statute or otherwise) to any person who is

not a client of Shore Capital in connection with this Announcement,

the Acquisition, any statement contained herein or otherwise.

N.M. Rothschild & Sons Limited ("Rothschild & Co"),

which is authorised and regulated by the FCA in the United Kingdom,

is acting exclusively for Bidco and Basware as financial adviser

and no one else in connection with the Acquisition and other

matters set out in this Announcement and will not be responsible to

anyone other than Bidco and Basware for providing the protections

afforded to clients of Rothschild & Co, or for providing advice

in connection with the Acquisition, the content of this

Announcement or any matter or arrangement referred to herein.

Neither Rothschild & Co nor any of its affiliates or partners,

directors, officers employees or agents owes or accepts any duty,

liability or responsibility whatsoever (whether direct, indirect,

consequential, whether in contract, in tort, under statute or

otherwise) to any person who is not a client of Rothschild & Co

in connection with this Announcement, the Acquisition, any

statement contained herein or otherwise.

Arthur Cox LLP is acting as legal adviser to Bidco and Basware

and DAC Beachcroft LLP is acting as legal adviser to Glantus.

No Offer or Solicitation

This Announcement is for information purposes only and is not

intended to, and does not, constitute or form any part of any offer

or invitation, or the solicitation of an offer, to purchase or

otherwise acquire, subscribe for, sell or otherwise dispose of any

securities or the solicitation of any vote or approval in any

jurisdiction pursuant to the Acquisition or otherwise, nor shall

there be any sale, issuance or transfer of securities in any

jurisdiction in contravention of applicable law. The Acquisition

will be made solely by means of the Scheme Document (or, if

applicable, the Takeover Offer Document), which will contain the

full terms and conditions of the Acquisition, including details of

how to vote in respect of the Acquisition. Any decision in respect

of, or other response to, the Acquisition, should be made only on

the basis of the information contained in the Scheme Document (or,

if applicable, the Takeover Offer Document).

This Announcement does not constitute a prospectus or a

prospectus equivalent document.

Cautionary Statement Regarding Forward-Looking Statements

This Announcement contains certain forward-looking statements

with respect to Bidco, Basware and Glantus. These forward-looking

statements can be identified by the fact that they do not relate

only to historical or current facts. Forward-looking statements

often use words such as "anticipate", "target", "expect",

"estimate", "intend", "plan", "believe", "will", "may", "would",

"could" or "should" or other words of similar meaning or the

negative thereof. The expectations and beliefs of Bidco, Basware

and Glantus regarding these matters may not materialise. Actual

outcomes and results may differ materially from those contemplated

by these forward looking statements as a result of uncertainties,

risks, and changes in circumstances, including but not limited to

risks and uncertainties related to: the ability of Glantus and

Bidco to consummate the Acquisition in a timely manner or at all;

the satisfaction (or waiver) of any conditions to the consummation

of the Acquisition, including with respect to the approval of

Glantus Shareholders and any required regulatory approvals;

potential delays in consummating the Acquisition; the ability of

Glantus and Bidco to timely and successfully achieve the

anticipated strategic benefits or opportunities expected as a

result of the Acquisition; the successful integration of Glantus

into the Basware Group subsequent to Completion and the timing of

such integration; the impact of changes in global, political,

economic, business, competitive, market and regulatory forces; the

occurrence of any event, change or other circumstance or condition

that could give rise to the termination of the Transaction

Agreement; adverse effects on the market price of Glantus'

securities and on the Glantus or the Basware Group's operating

results because of a failure to complete the Acquisition; and the

effect of the announcement or pendency of the Acquisition on the

Glantus or Basware business relationships, operating results and

business generally; and the costs related to the Acquisition.

These forward-looking statements involve known and unknown

risks, uncertainties and other factors which may cause the actual

results, performance or achievements of any such person, or

industry results, to be materially different from any results,

performance or achievements expressed or implied by such

forward-looking statements. These forward-looking statements are

based on numerous assumptions regarding the present and future

business strategies of such persons and the environment in which

each will operate in the future. You are cautioned not to place

undue reliance on these forward-looking statements, which speak

only as of the date hereof. All subsequent oral or written

forward-looking statements attributable to Bidco, Basware or

Glantus or any persons acting on their behalf are expressly

qualified in their entirety by the cautionary statement above.

Neither Bidco, the Basware Group nor Glantus undertake any

obligation to update publicly or revise forward-looking or other

statements contained in this Announcement, whether as a result of

new information, future events or otherwise, except to the extent

legally required.

Disclosure requirements of the Irish Takeover Rules

Under the provisions of Rule 8.3(a) of the Irish Takeover Rules,

any person who is 'interested' in 1% or more of any class of

'relevant securities' of the Company must make an 'opening position

disclosure' following the commencement of the 'offer period'. An

'opening position disclosure' must contain the details contained in

Rule 8.6(a) of the Irish Takeover Rules, including, among other

things, details of the person's 'interests' and 'short positions'

in any 'relevant securities' of the Company. An 'opening position

disclosure' by a person to whom Rule 8.3(a) applies must be made by

no later than 3:30pm. (GMT+1) on the day falling ten 'business

days' following the commencement of the 'offer period'. Relevant

persons who deal in any 'relevant securities' prior to the deadline

for making an 'opening position disclosure' must instead make a

'dealing' disclosure as described below.

Under the provisions of Rule 8.3(b) of the Irish Takeover Rules,

if any person is, or becomes, 'interested' in 1% or more of any

class of 'relevant securities' of the Company, that person must

publicly disclose all 'dealings' in any 'relevant securities' of

the Company during the 'offer period', by not later than 3:30pm.

(GMT+1) on the 'business day' following the date of the relevant

transaction.

If two or more persons co-operate on the basis of any agreement

either express or tacit, either oral or written, to acquire an

'interest' in 'relevant securities' of the Company or any

securities exchange offeror, they will be deemed to be a single

person for the purpose of Rule 8.3 of the Irish Takeover Rules.

In addition, any offeror must make an 'opening position

disclosure' by no later 12:00 noon (GMT+1) on the date falling ten

'business days' following the commencement of the 'offer period' or

the announcement that first identifies a securities exchange

offeror, as applicable, and disclose details of any 'dealings' by

it or any person 'acting in concert' with it in 'relevant

securities' during the 'offer period', by no later than 12:00 noon

(GMT+1) on the business day following the date of the transaction

(see Irish Takeover Rules 8.1, 8.2 and 8.4).

A disclosure table, giving details of the companies in whose

'relevant securities' 'dealings' should be disclosed, can be found

on the Irish Takeover Panel's website at

www.irishtakeoverpanel.ie.

'Interests in securities' arise, in summary, when a person has

long economic exposure, whether conditional or absolute, to changes

in the price of securities. In particular, a person will be treated

as having an 'interest' by virtue of the ownership or control of

securities, or by virtue of any option in respect of, or derivative

referenced to, securities.

Terms in quotation marks are defined in the Irish Takeover

Rules, which can also be found on the Irish Takeover Panel's

website. If you are in any doubt as to whether or not you are

required to disclose a dealing under Rule 8, please consult the

Irish Takeover Panel's website at www.irishtakeoverpanel.ie or

contact the Irish Takeover Panel on telephone number +353 1 678

9020.

No profit forecast, estimate or asset valuations

No statement in this Announcement is intended as a profit

forecast or estimate for any period and no statement in this

Announcement should be interpreted to mean that earnings or

earnings per share for Bidco, Basware or Glantus respectively for

the current or future financial years would necessarily match or

exceed the historical published earnings or earnings per share for

Bidco, Basware or Glantus respectively. No statement in this

Announcement constitutes an asset valuation.

Right to switch to a Takeover Offer

Bidco reserves the right to elect, subject to the terms of the

Transaction Agreement, compliance with the Irish Takeover Rules and

with the consent of the Irish Takeover Panel, to implement the

Acquisition by way of a Takeover Offer for the entire issued and to

be issued share capital of Glantus as an alternative to the Scheme.

In such an event, the Takeover Offer will be implemented on the

same terms (subject to appropriate amendments), so far as

applicable, as those which would apply to the Scheme and subject to

the amendments referred to in Appendix I to this Announcement and

in the Transaction Agreement.

Publication on website

Pursuant to Rule 26.1 of the Irish Takeover Rules, this

Announcement will be made available on Basware's website

(https://www.basware.com/) and on Glantus' website

(https://www.glantus.com/) by no later than 12:00 noon (GMT+1) on

the 'business day' following this Announcement.

Neither the content of any such website nor the content of any

other website accessible from hyperlinks on such website is

incorporated into, or forms part of, this Announcement.

Rounding

Certain figures included in this Announcement have been

subjected to rounding adjustments. Accordingly, figures shown for

the same category presented in different tables may vary slightly

and figures shown as totals in certain tables may not be an

arithmetic aggregation of the figures that precede them.

The aggregate amount payable to each Glantus Shareholder in

accordance with the Acquisition shall be rounded down to the

nearest whole pence value.

General

The laws of certain jurisdictions may affect the availability of

the Acquisition to persons who are not resident in Ireland or the

United Kingdom. Persons who are not resident in Ireland or the

United Kingdom, or who are subject to laws of any jurisdiction

other than Ireland or the United Kingdom, should inform themselves

about, and observe, any applicable legal or regulatory

requirements. Any failure to comply with any applicable legal or

regulatory requirements may constitute a violation of the laws

and/or regulations of any such jurisdiction. To the fullest extent

permitted by applicable law, the companies and persons involved in

the Acquisition disclaim any responsibility and liability for the

violation of such restrictions by any person.

This Announcement has been prepared for the purpose of complying

with the Laws of Ireland and the Irish Takeover Rules and the

information disclosed may not be the same as that which would have

been disclosed if this Announcement had been prepared in accordance

with the Laws of jurisdictions outside of Ireland. Unless otherwise

determined by Basware and Bidco or required by the Irish Takeover

Rules, and permitted by applicable Law and regulation, the

Acquisition will not be made available directly or indirectly, in,

into or from any Restricted Jurisdiction and no person may vote in

favour of the Acquisition by any use, means, instrumentality or

facilities from within a Restricted Jurisdiction or any other

jurisdiction if to do so would constitute a violation of the Laws

of that jurisdiction.

The release, publication or distribution of this Announcement in

or into certain jurisdictions may be restricted by the laws of

those jurisdictions. Accordingly, copies of this Announcement and

all other documents relating to the Acquisition are not being, and

must not be, released, published, mailed or otherwise forwarded,

distributed or sent in, into or from any Restricted Jurisdiction.

Persons receiving such documents (including, without limitation,

nominees, trustees and custodians) should observe these

restrictions. Failure to do so may constitute a violation of the

securities laws of any such jurisdiction. To the fullest extent

permitted by applicable law, Bidco, Basware and Glantus disclaim

any responsibility or liability for the violations of any such

restrictions by any person.

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION IN WHOLE OR IN PART

IN, INTO OR FROM ANY JURISDICTION WHERE TO DO SO WOULD CONSTITUTE A

VIOLATION OF THE RELEVANT LAWS OR REGULATIONS OF THAT

JURISDICTION

THIS ANNOUNCEMENT IS BEING MADE PURSUANT TO RULE 2.7 OF THE

IRISH TAKEOVER RULES

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION

FOR IMMEDIATE RELEASE

14 AUGUST 2023

RECOMMED CASH OFFER

FOR

GLANTUS HOLDINGS PLC

BY

GENESIS BIDCO LIMITED

(A NEWLY INCORPORATED PRIVATE LIMITED COMPANY WHOLLY-OWNED BY

BASWARE OY)

TO BE IMPLEMENTED BY WAY OF A SCHEME OF ARRANGEMENT UNDER

CHAPTER 1 OF PART 9 OF THE COMPANIES ACT 2014

1. Introduction

The board of directors of Genesis Bidco Limited ("Bidco") and

the board of directors of Glantus Holdings plc ("Glantus" or the

"Company") are pleased to announce that they have reached agreement

on the terms of an all cash offer by Bidco, which has been

unanimously recommended by the Glantus Board.

Bidco, a newly incorporated private limited company wholly-owned

by Basware Oy ("Basware"), will acquire the entire issued and to be

issued share capital of Glantus.

It is expected that the Acquisition will be implemented by means

of an Irish High Court-sanctioned scheme of arrangement under

Chapter 1 of Part 9 of the Companies Act 2014 (the "Act") (although

Bidco reserves the right to effect the Acquisition by way of a

Takeover Offer, subject to the terms of the Transaction Agreement,

compliance with the Irish Takeover Rules and with the consent of

the Irish Takeover Panel).

2. Summary Terms of the Acquisition

The Acquisition is subject to the Conditions set out in Appendix

I to this Announcement and to be set out in the Scheme

Document.

Under the terms of the Acquisition, which shall be subject to

the Conditions and other terms set out in this Announcement and to

further terms to be set out in the Scheme Document, each Glantus

Shareholder at the Scheme Record Time will be entitled to

receive:

for each Glantus Share GBP0.3342 in cash

The Acquisition represents a premium of approximately:

-- 197% to Glantus' Closing Price of GBP0.1125 on 4 July 2023

(being the last Business Day prior to the publication of Possible

Offer Announcement on 5 July 2023);

-- 289% to Glantus' volume weighted average share price of

approximately GBP0.0859 over the one month period ending on 4 July

2023;

-- 303% to Glantus' volume weighted average share price of

approximately GBP0.0830 over the three month period ending on 4

July 2023;

-- 315% to Glantus' volume weighted average share price of

approximately GBP0.0806 over the six month period ending on 4 July

2023; and

-- 67% to Glantus' Closing Price of GBP0.2000 on 11 August 2023

(being the last practicable date prior to the publication of this

Announcement).

The Acquisition values the entire issued and to be issued share

capital of Glantus at approximately GBP17.8 million on a fully

diluted basis and implies an enterprise value of approximately

GBP29.5 million.

Under the terms of the Scheme proposed to implement the

Acquisition, in consideration of the payment of the Consideration

by Bidco to Glantus Scheme Shareholders, the Glantus Shares will be

transferred to Bidco in accordance with the terms of the

Scheme.

The sources and bases of information contained in this

Announcement to calculate the implied value of the Acquisition are

set out in Appendix III.

3. Glantus' Background to and Reasons for Recommending the Acquisition

Background and performance since IPO

Glantus is an innovative data analysis and automation company

which was founded in 2014 with a vision to help businesses unlock

the value of their data through advanced analytics and automation

solutions. It quickly gained recognition for its expertise in data

integration, analytics, and reporting, attracting a diverse range

of global clients across various industries. Glantus was admitted

to trading on the AIM market of the London Stock Exchange ("IPO" or

"Admission") in May 2021.

The IPO provided Glantus with the necessary capital to expand

its operations, invest in research and development and accelerate

its growth trajectory. Since its IPO, the Glantus Group has

achieved some of the goals committed to at the time of the IPO

including investment in account management, sales and marketing and

has completed successful acquisitions in the US and UK.

However, more generally, the Company has experienced a number of

challenges since its IPO and FY22 was particularly challenging

which resulted in a requirement to significantly restructure the

business during the year. On 30 June 2023, in its annual financial

results for the year ended 31 December 2022, the Company stated

that:

"2022 was a challenging year for our company. Integration issues

with an acquisition and a downturn in our productivity in the U.S.

market while we transitioned our operations to Costa Rica, meant

that our run-rate billing had reduced from an expected EUR1.5m per

month to EUR1m per month. With a cost base structured for a higher

revenue than what was being achieved, we were running at a

considerable loss. Accordingly, the management team set about

adjusting the cost base to align with our run-rate billing. Over

the final three months of 2022, we removed EUR4.2m from our

annualised costs and in the first quarter of 2023 we saw the

benefits of this work as we returned to profitability".

As a result of the challenges experienced in 2022, on 14

February 2023, Glantus announced that it had raised approximately

EUR1.4 million (before expenses) from a combination of new and

existing investors by a conditional irrevocable subscription for

ordinary shares at GBP0.0925 per share, which was subsequently

approved at the Extraordinary General Meeting on 16 March 2023. The

net proceeds of the said subscription were applied to settle

certain deferred consideration payments for the acquisition of

Technology Insight Corporation and Meridian Cost Benefit Limited,

as well some remaining costs associated with the Company's recent

restructuring, and for working capital purposes.

Trading in FY 2023 has improved, and the Company provided a

trading update on 31 July 2023 for the six months to 30 June 2023

("H1 2023"). The Company announced that:

"Trading in the new financial year has been ahead of

management's expectations (all figures for 2023 below are

unaudited):

-- Jan - Apr 2023 revenues of c.EUR4.558m, adjusted EBITDA profit of c.EUR1.3m

-- Momentum has continued with revenues for May 2023 being ahead of budget at EUR1.1m

-- Realignment of cost base in 2022 has delivered much improved

adjusted EBITDA so far in 2023

The Company is pleased confirm that these trends continued for

the whole half year period and trading has remained strong. Given

the Company has continued to trade ahead of budget, the Board

expects that the Company will report half year results ahead of its

expectations."

Rationale for recommendation

The Board believes that the Company is better positioned

following the restructuring of the business in 2022 and its

business model and strategy provides a strong platform for growth.

However, the challenges encountered in 2022 have left the Company

with a low market capitalisation, low cash resources and

significant levels of debt, which are likely to impact Glantus'

ability to take advantage of growth opportunities.

Against this backdrop in considering the terms of the

Acquisition, the Directors have taken into account a number of

specific factors including:

-- the Acquisition represents an attractive premium payable in

cash for Glantus shareholders of approximately:

-- 197% to Glantus' Closing Price of GBP0.1125 on 4 July 2023

(being the last Business Day prior to the publication of Possible

Offer Announcement on 5 July 2023);

-- 289% to Glantus' volume weighted average share price of

approximately GBP0.0859 over the one month period ending on 4 July

2023;

-- 303% to Glantus' volume weighted average share price of

approximately GBP0.0830 over the three month period ending on 4

July 2023;

-- 315% to Glantus' volume weighted average share price of

approximately GBP0.0806 over the six month period ending on 4 July

2023; and

-- 67% to Glantus' Closing Price of GBP0.2000 on 11 August 2023

(being the last practicable date prior to the publication of this

Announcement);

-- the Company has significant levels of debt in a higher

interest rate environment than at the time of the IPO and low

levels of cash resources available to it;

-- the Company's low current market capitalisation and share

price means the Company is currently unable to take advantage of

the benefits of a public listing and is not able to pursue its

acquisition strategy which was stated at the time of the IPO;

-- the costs of maintaining a public listing are material to the

Company, especially given the low levels of cash resources

currently available to it; and

-- the Acquisition allows Glantus shareholders to realise their

full investment in the Company for cash in the near term at an

attractive valuation.

4. Recommendation of Glantus Board

Having considered the relevant factors and applicable risks, the

Glantus Board, which has been so advised by Shore Capital, as

financial adviser and Rule 3 adviser to Glantus, as to the

financial terms of the Acquisition, considers the terms of the

Acquisition as set out in this Announcement to be fair and

reasonable. In providing its advice to the Glantus Board, Shore

Capital has taken into account the commercial assessments of the

Glantus Board. Accordingly, the Glantus Board unanimously

recommends that Glantus Shareholders vote in favour of the

Acquisition and all of the Resolutions, as the Glantus Board have

irrevocably committed to do in respect of their own beneficial

holdings of, in aggregate, 18,602,137 Glantus Shares, which

represent approximately 36.38% of the total issued share capital of

Glantus as of 11 August 2023 (being the last practicable date prior

to the publication of this Announcement).

5. Basware Background to and Rationale for the Acquisition

Glantus was established in 2014 and over the past number of

years has expanded through organic growth and acquisitions to

emerge as a true success story in the realm of accounts payable

automation and analytics solutions and has offices in the United

States, United Kingdom, Poland and Costa Rica. Glantus today

operates in 50+ countries with customers globally.

Basware believes there is a compelling strategic and financial

rationale for undertaking the Acquisition which is expected to

deliver the following benefits:

-- by integrating Glantus' solutions, Basware would be able to

expand its suite of solutions for expense management, sourcing,

eProcurement, accounts receivable and payable and more, delivering

additional value to customers;

-- there would be a significant opportunity to generate

potential revenue by cross-selling products into complementary and

shared customers along with the supplier network; and

-- increased scale to invest additional funds into R&D and improve margins over time.

In addition to the above, following the Acquisition, Basware

believes that Glantus will benefit from Basware's skillsets,

capabilities, experience and network globally. Accordingly, Basware

and Bidco believe that the Acquisition is therefore in the best

interests of Glantus' management, employees and the many

stakeholders in the business. It also provides Glantus Shareholders

an opportunity to realise their investment at an attractive premium

in cash.

6. Irrevocable Commitments

Bidco has received irrevocable undertakings from all of the

directors of Glantus to vote in favour of the Scheme at the Scheme

Meeting and each of the EGM Resolutions to be proposed at the

Extraordinary General Meeting in respect of 18,602,137 Glantus

Shares, representing approximately 36.38% of the issued share

capital of Glantus as of 11 August 2023 (being the last practicable

date prior to the publication of this Announcement).

In addition, Bidco has received irrevocable undertakings from

Andrew Frazer, Martin Bolland, Ian Smith, Judith Nelson, Michael

Maye, Joe Keating, Gráinne McKeown, and Karl Andersson, to vote in

favour of the Scheme at the Scheme Meeting and each of the EGM

Resolutions to be proposed at the Extraordinary General Meeting in

respect of 18,386,161 Glantus Shares representing approximately

35.96% of the issued share capital of Glantus as of 11 August 2023

(being the last practicable date prior to the publication of this

Announcement).

Therefore, in aggregate, Bidco has received irrevocable

undertakings that represent approximately 72.34% of the issued

share capital of Glantus on 11 August 2023 (being the latest

practicable date prior to the publication of this

Announcement).

The irrevocable undertakings will cease to have effect on the

date on which the Scheme becomes Effective or prior to that date if

the Transaction Agreement is terminated in accordance with its

terms.

7. Information on Bidco and Basware

Bidco and Basware

Bidco is a private limited liability company incorporated in

Ireland for the purposes of the Acquisition. As at the Effective

Date, it is intended that Bidco will be owned indirectly (through

one or more holding companies) by Basware.

Bidco has not traded since incorporation, nor has it entered

into any obligations, other than in connection with the offer and

financing of the Acquisition. The current directors of Bidco are

Jason Kurtz, Martti Nurminen and Gordon MacNeill.

Basware provides solutions that help finance leaders in global

enterprises automate complex, labor-intensive invoice processes.

Its AP automation and invoicing platforms help customers achieve

efficiency while reducing errors and risks. Some of the world's

most efficient AP departments at world-class brands rely on Basware

to handle over 170 million invoices per year, often processing 89%

of invoices totally touchless.

8. Information on Glantus Holdings plc

Glantus is a public company registered in Ireland whose shares

are admitted to trading on AIM. It specializes in providing data

analysis and automation solutions to businesses with operations in

multiple jurisdictions including Ireland, the UK and the US and

customers worldwide.

9. Structure of the Acquisition

Scheme

It is intended that the Acquisition will be effected by a High

Court sanctioned scheme of arrangement in accordance with Chapter 1

of Part 9 of the Act. Under the Scheme, all Glantus Shares held by

Glantus Shareholders will be transferred to Bidco in accordance

with the Scheme and Bidco will pay the Consideration to the

relevant Glantus Scheme Shareholders.

As a result of these arrangements, Glantus will become a

wholly-owned subsidiary of Bidco.

To become Effective, the Scheme requires, amongst other things,

(i) a quorum of at least two (2) persons holding, or representing

by proxy, at least one-third in nominal value of the Glantus Shares

in issue being satisfied at the Scheme Meeting; (ii) the approval

of the Scheme Meeting Resolution by Glantus Shareholders at the

Scheme Meeting (or any adjournment of such meeting) who represent

at least three-fourths (75%) in value of the Glantus Shares held by

such Glantus Shareholders at the Voting Record Time who are present

and voting either in person or by proxy or in any other manner

permitted by the High Court or by law at the Scheme Meeting; and

(iii) the approval by Glantus Shareholders of resolutions relating

to the implementation of the Scheme at the Extraordinary General

Meeting to be held directly after the Scheme Meeting.

Application to the High Court to sanction the Scheme

Once the approvals of the Glantus Shareholders have been

obtained at the Scheme Meeting and the Extraordinary General

Meeting, and the other Conditions have been satisfied or (where

applicable) waived, an application will be made to the High Court

to sanction the Scheme under the Act.

Subject to the sanction of the High Court, the Scheme will

become Effective in accordance with its terms on delivery of a copy

of the Court Order to the Registrar of Companies. Upon the Scheme

becoming Effective, it will be binding on all Glantus Scheme

Shareholders, irrespective of whether or not they attended or voted

at the Scheme Meeting or Extraordinary General Meeting, or whether

they voted in favour of or against the Scheme.

Any Glantus Shares issued before the Scheme Record Time will be

subject to the terms of the Scheme. One of the EGM Resolutions to

be proposed at the EGM will, amongst other matters, provide that

the Company's articles of association be amended to incorporate

provisions requiring any Glantus Shares issued after the Scheme

Record Time (other than to Bidco or its affiliates), for example,

due to the crystallisation of Glantus Options, to either be subject

to the terms of the Scheme or acquired by Bidco and/or its

affiliates on the same terms as the Acquisition (other than terms

as to timings and certain formalities). The inclusion of these

provisions in the Company's articles of association will prevent

any person (other than Bidco or its affiliates) holding Glantus

Shares immediately after the Effective Time.

Full details of the Scheme to be set out in the Scheme

Document

The Scheme will be governed by the laws of Ireland. The Scheme

will be subject to the applicable requirements of the Irish

Takeover Rules and, where relevant, the applicable rules and

regulations of the Act.

The Scheme is subject to the satisfaction (or, where applicable,

waiver) of the Conditions and the full terms and conditions to be

set out in the Scheme Document. Further details of the Scheme,

including the notices of the Scheme Meeting and separate

Extraordinary General Meeting required to approve the Resolutions,

expected timetable and the action to be taken by Glantus

Shareholders, will be set out in the Scheme Document.

Conditions to the Acquisition

The Acquisition shall be subject to the Conditions and further

terms set out in full in Appendix I to this Announcement and to be

set out in the Scheme Document.

Scheme timetable and further information

The Scheme Document, which will contain, amongst other things,

further information about the Acquisition, notices convening the

Scheme Meeting and the Extraordinary General Meeting, the expected

timetable for completion and action to be taken by Glantus

Shareholders, will be published as soon as practicable.

Section 3(7) of Appendix 4 of the Irish Takeover Rules requires

that Glantus must send the Scheme Document to Glantus Shareholders

within 28 days of the announcement of a firm intention to make an

offer, being this Announcement.

It is anticipated that the Scheme will, subject to obtaining any

necessary regulatory approvals, be declared effective in the fourth

quarter of 2023.

10. Effect of the Scheme on Glantus Share Plan

In accordance with Rule 15 of the Irish Takeover Rules, Bidco

will make appropriate proposals to participants in the Glantus

Share Plan in relation to the Glantus Options. Participants will be

contacted separately, at or as soon as possible after the time of

publication of the Scheme Document, regarding the effect of the

Acquisition on the Glantus Options under the Glantus Share Plan and

the relevant details will be summarised in the Scheme Document.

The Scheme will extend to any Glantus Shares which are

unconditionally allotted or issued at or before the Scheme Record

Time, including those allotted or issued to satisfy the exercise of

options or vesting of awards under the Glantus Options.

11. Financing of the Acquisition

The consideration payable to Glantus Scheme Shareholders

pursuant to the terms of the Acquisition is to be funded from a

combination of a facility provided to Bidco by Basware's existing

lender, Golub Capital LLC, together with Basware's own cash

resources and equity investments, further details of which will be

set out in the Scheme Document.

In accordance with Rule 2.7(d) of the Irish Takeover Rules,

Rothschild & Co, as financial adviser to Bidco, is satisfied

that sufficient resources are available to Bidco to satisfy in full

the cash consideration payable to Glantus Scheme Shareholders under

the terms of the Scheme.

12. Basware's intention for the Glantus business, management,

employees, operations and governance

Bidco's strategic plans for Glantus

Following completion of the Acquisition, Bidco intends to

support the Company's management team in accelerating investment in

organic growth opportunities. As a private company, the Glantus

management team will be allowed to fully focus on executing on

their long-term strategic vision with the operational and financial

backing of Basware, whilst maintaining the culture and values of

the business which have been integral to the Company's success to

date.

Intentions for existing employment rights and pensions

Bidco attributes significant value to Glantus' existing

management and employees, believes the Acquisition is in their best

interests, and is focused on ensuring that roles and

responsibilities across the employee base remain materially

consistent while the Glantus and Basware organizations are

integrated to best serve the combined group's customer base.

Following completion of the Acquisition, Basware intends to work

with the Glantus management team to review its business and

operations and implement operational best practices to accelerate

growth and performance, enhance profitability and create greater

employment opportunities over the long term. As at the date of this

Announcement, the results of this review are uncertain, and no firm

decisions have been made by Basware in relation to specific actions

which may be taken. However, Basware would expect the existing

personnel of Glantus to continue to contribute to the business

following completion of the Acquisition, and does not intend to

initiate any material headcount changes within the current Glantus

organisation as a result of the Acquisition.

Bidco confirms that, following the Scheme becoming Effective,

the existing contractual and statutory employment rights, including

in relation to pensions, of all Glantus management and employees

will be fully safeguarded in accordance with applicable law. Bidco

does not intend to make any material change to the conditions of

employment of the current employees of Glantus.

Intentions for Headquarters, Locations and Fixed Assets

Basware does not envisage a redeployment of Glantus' fixed asset

base following completion of the Acquisition. It may, however,

identify areas of the business where investment can be increased.

However, based on diligence performed to date, Basware does not

expect the Acquisition to have a material impact on the operations,

places of business or headquarters of the Company, nor its research

and development functions.

Management incentive arrangements

Bidco has not entered into and has not had discussions on

proposals to enter into, any form of incentivisation arrangements

with members of Glantus' management. It is the intention to

consider and discuss a performance-related incentive scheme for

certain members of the Glantus management team following the

Effective Date.

Non-executive directors

The non-executive directors on the board of Glantus will resign

from Glantus on the Effective Date.

13. Delisting and Cancellation of Trading of Glantus Shares

An application will be made to the London Stock Exchange prior

to the Effective Date to cancel the admission of the Glantus Shares

to trading on AIM, with effect from shortly after the Effective

Date, subject to and following the Scheme becoming Effective.

It is intended that dealing in Glantus Shares on AIM will be

suspended after the Court Order is issued.

As soon as is reasonably practicable following the Effective

Date, it is intended that Glantus will be re-registered in Ireland

as a private company limited by shares under the relevant

provisions of the Companies Act.

14. Acquisition related arrangements

Transaction Agreement

Basware, Bidco and Glantus have entered into a transaction

agreement dated 14 August 2023 which contains certain assurances in

relation to the implementation of the Scheme and other matters

related to the Acquisition. A summary of the principal terms of the

Transaction Agreement will be set out in the Scheme Document.

The Transaction Agreement provides that where the Glantus Board

determines that a Glantus Superior Proposal has been received,

Glantus will provide Bidco with an opportunity, for a period of six

Business Days from the time of the receipt by Bidco of notice in

writing from Glantus confirming that the Glantus Board has

determined that a Glantus Superior Proposal has been received

together with details of the material terms of such Glantus

Superior Proposal, to increase or modify the Consideration such

that the Glantus Superior Proposal would not constitute a Glantus

Superior Proposal.

Expenses Reimbursement Agreement

Glantus entered into an expenses reimbursement agreement on 14

August 2023 with Basware and Bidco. Each of Shore Capital and the

Glantus Directors have confirmed in writing to the Panel that, in

the opinion of Shore Capital and the Glantus Directors

(respectively), in the context of the note to Rule 21.2 of the

Irish Takeover Rules and the Acquisition, the Expenses

Reimbursement Agreement is in the best interests of the Glantus

Shareholders. The Panel has consented to Glantus entering into the

Expenses Reimbursement Agreement.

Under the terms of the Expenses Reimbursement Agreement, Glantus

has agreed to pay to Bidco in certain circumstances set out below

an amount equal to all documented, specific and quantifiable third

party costs and expenses incurred by Bidco, or any member of the

Basware Group, or on its or their behalf, for the purposes of, in

preparation for, or in connection with the Acquisition, including

legal, financial, accounting, property and commercial due

diligence, arranging financing and engaging advisers to assist in

the process, provided that the gross amount payable by Glantus to

Bidco shall not, in any event, exceed 1% of the total value of the

issued and to be issued share capital of Glantus (including, for

the avoidance of doubt, all of the Glantus Shares to be issued

pursuant to the Glantus Share Plan) that is the subject of the

Acquisition, and excluding any shares in Glantus which are

beneficially owned by any member of the Basware Group, Bidco or any

Concert Parties of the foregoing).

The amount payable by Glantus to Bidco under such provisions of

the Expenses Reimbursement Agreement will exclude any amounts in

respect of VAT incurred by Bidco or any member of the Basware Group

attributable to such third party costs other than Irrecoverable VAT

incurred by Bidco and/or such member of the Basware Group on such

costs.

The circumstances in which such payment will be made are if:

(a) the Transaction Agreement is terminated:

(i) by Bidco for the reason that the Glantus Board or any committee thereof:

(A) withdraws (or modifies in any manner adverse to Bidco), or

fails to make when required pursuant to the Transaction Agreement

or proposes publicly to withdraw (or modify in any manner adverse

to Bidco), the Scheme Recommendation or, if applicable, the

recommendation to the holders of Glantus Shares from the Glantus

Board to accept the Takeover Offer (it being understood, for the

avoidance of doubt, that the provision by Glantus to Bidco of

notice or information in connection with a Glantus Alternative

Proposal or Glantus Superior Proposal as required or expressly

permitted by the Transaction Agreement shall not, in each case, in

and of itself, constitute a circumstance referred to in this

paragraph (A)); or

(B) otherwise takes any action or discloses a position that is

deemed to be a "Glantus Change of Recommendation" under clause

5.2(d)(ii) of the Transaction Agreement; or

(ii) by Glantus, upon written notice at any time following

delivery of a Final Recommendation Change Notice under and in

accordance with the Transaction Agreement where the Acquisition

subsequently lapses or is withdrawn; or

(b) all of the following occur:

(i) prior to the Scheme Meeting (or, in the case of a Takeover

Offer prior to the Final Closing Date), a Glantus Alternative

Proposal is formally publicly disclosed by Glantus or any person

shall have formally publicly announced an intention (whether or not

conditional) to make a Glantus Alternative Proposal and, in each

case, such disclosure or announcement is not publicly withdrawn

without qualification at least three Business Days before the date

of the Scheme Meeting or in the case of Takeover Offer, the Final

Closing Date; and

(ii) the Transaction Agreement is terminated by Bidco for the

reason that Glantus shall have breached or failed to perform in any

material respect any of its representations, warranties, covenants

or other agreements contained in the Transaction Agreement, which

material breach or failure to perform:

(A) would result in a failure of any of the Conditions; and

(B) is not reasonably capable of being cured by the End Date or,

if curable, Bidco shall have given Glantus written notice,

delivered at least 30 days prior to such termination, stating

Bidco's intention to terminate the Transaction Agreement pursuant

to clause 10.1(e) of the Transaction Agreement and the basis for

such termination and such breach, failure to perform or inaccuracy

shall not have been cured within 30 days following the delivery of

such written notice or, if earlier, by the End Date; and

(iii) a Glantus Alternative Proposal is consummated, or a

definitive agreement providing for a Glantus Alternative Proposal

is entered into (provided such Glantus Alternative Proposal is

subsequently consummated pursuant to that definitive agreement)

within 12 months after the date of the Rule 2.7 Announcement (in

each case regardless of whether such Glantus Alternative Proposal

is the same Glantus Alternative Proposal referred to in paragraph

(b)(i)); or

(c) all of the following occur:

(i) prior to the Scheme Meeting (or, in the case of a Takeover

Offer prior to the Final Closing Date), a Glantus Alternative

Proposal is formally publicly disclosed by Glantus or any person

shall have formally publicly announced an intention (whether or not

conditional) to make a Glantus Alternative Proposal and, in each

case, such disclosure or announcement is not publicly withdrawn

without qualification at least three Business Days before the date

of the Scheme Meeting or, in the case of a Takeover Offer, the

Final Closing Date; and

(ii) the Transaction Agreement is terminated by either Glantus

or Bidco for the reason that the Scheme Meeting or the EGM shall

have been completed and the Scheme Meeting Resolution or the EGM

Resolutions, as applicable, shall not have been approved by the

requisite majority of votes (or, in the case of a Takeover Offer,

the Final Closing Date having passed without the Takeover Offer

becoming unconditional as to acceptances); and

(iii) the Glantus Alternative Proposal referred to in paragraph

(c)(i) above is consummated, or a definitive agreement providing

for a Glantus Alternative Proposal is entered into (provided such

Glantus Alternative Proposal is subsequently consummated pursuant

to that definitive agreement), in each case with the person

referred to in paragraph (c)(i) within 12 months after the date of

the Rule 2.7 Announcement, or a Glantus Alternative Proposal is

consummated, or a definitive agreement providing for a Glantus

Alternative Proposal is entered into (provided such Glantus

Alternative Proposal is subsequently consummated pursuant to that

definitive agreement), with a person who is not connected in any

way to the person referred to in paragraph (c)(i) above within 12

months after the date of the Rule 2.7 Announcement.

15. Interests and Short Positions in Glantus

As at the close of business on 11 August 2023 (being the last

practicable date prior to the release of this Announcement) none of

Basware or Bidco nor, so far as Basware and Bidco are aware, any

person Acting in Concert with Basware or Bidco:

(a) had an interest in relevant securities of Glantus;

(b) had any short position in relevant securities of Glantus;

(c) had received an irrevocable commitment or letter of intent

to accept the terms of the Acquisition in respect of relevant

securities of Glantus, other than as described in this

Announcement; or

(d) had borrowed or lent any Glantus Shares.

Furthermore, no arrangement to which Rule 8.7 of the Irish

Takeover Rules applies exists between Basware, Bidco or Glantus or

a person Acting in Concert with Basware, Bidco or Glantus in

relation to Glantus Shares. For these purposes, an "arrangement to

which Rule 8.7 of the Irish Takeover Rules applies" includes any

indemnity or option arrangement, and any agreement or

understanding, formal or informal, of whatever nature, between two

or more persons relating to relevant securities which is or may be

an inducement to one or more of such persons to deal or refrain

from dealing in such securities.

In the interests of confidentiality, Basware and Bidco have each

made only limited enquiries in respect of certain parties who may

be deemed by the Irish Takeover Panel to be Acting in Concert with

it for the purposes of the Acquisition. Further enquiries will be

made to the extent necessary as soon as practicable following the

date of this Announcement and any disclosure in respect of such

parties will be included in the Scheme Document.

16. Rule 2.12 Disclosure

In accordance with Rule 2.12 of the Irish Takeover Rules,

Glantus confirms that as at the close of business on 11 August 2023

(being the last practicable date before this Announcement) it had

51,132,553 Glantus Shares in issue with voting rights, with no

Glantus Shares held in treasury. The ISIN for the Glantus Shares is

IE00BNG2V304.

At that date there were outstanding Glantus Options to subscribe

for 2,065,976 Glantus Shares* which have been granted by

Glantus.

* This figure is inclusive of 1,200,000 options which are

expected to be granted following the release of this Announcement

and prior to the Effective Date. This additional number of Glantus

Shares (2,065,976) has been calculated using the treasury method on

the basis of the maximum number of Glantus Shares that may be

issued in respect of outstanding Glantus Options under the Glantus

Share Plan less such number of Glantus Shares as is equal to the

cash proceeds of the exercise price.

17. Rule 2.7(b)(xv) Statement

Subject to the Transaction Agreement, if any dividend,

distribution or other return of value is authorised, declared, made

or paid in respect of the Glantus Shares on or after the date of

this Announcement, Bidco reserves the right to reduce the

Consideration by the aggregate amount of such dividend,

distribution or other return of value.

18. Tax

Each holder of Glantus Shares is urged to consult his, her or

its independent professional advisor regarding the tax consequences

of the Acquisition.

19. Documents

Copies of the following documents will be available, subject to

certain restrictions relating to persons resident in Restricted

Jurisdictions, promptly on Glantus' website at

https://www.glantus.com/, and on Bidco's website at

https://www.basware.com/, in any event by no later than 12:00 noon

(GMT+1) on 15 August 2023:

(a) a copy of this Announcement;

(b) Expenses Reimbursement Agreement;

(c) Transaction Agreement;

(d) the irrevocable undertakings referred to in paragraph 6 above; and

(e) the written consents of Rothschild & Co and Shore

Capital referred to in paragraph 20 below.

Neither the content of the websites referred to in this

Announcement nor the contents of any website accessible from

hyperlinks on any such website are incorporated into or form part

of this Announcement.

20. General

The Acquisition and the Scheme will be made subject to the

Conditions and the further terms to be set out in the Scheme

Document. The Scheme Document will include full details of the

Acquisition and will be accompanied by the appropriate notices of

the Scheme Meeting and separate Extraordinary General Meeting

required to approve the Resolutions and forms of proxy.

Rothschild & Co and Shore Capital have each given and not

withdrawn their consent to the publication of this Announcement

with the inclusion herein of the references to their names in the

form and context in which they appear.

The Scheme Document, notices and forms of proxy will be

despatched to Glantus Shareholders as soon as practicable and, in

any event, (save with the consent of the Irish Takeover Panel) not

later than 11 September 2023. The Scheme Document will include full

details of the Acquisition, together with the expected timetable,

and will specify the necessary action to be taken by Glantus

Shareholders in order to vote in favour of the Scheme (at the

Scheme Meeting) and the EGM Resolutions (at the Extraordinary

General Meeting).

The Acquisition will be governed by the laws of Ireland and will

be subject to the requirements of the Irish Takeover Rules and

applicable Law. This Announcement is being made pursuant to Rule

2.7 of the Irish Takeover Rules.

Appendix I to this Announcement contains the Conditions and

certain further terms of the Acquisition and the Scheme. Appendix

II to this Announcement contains definitions of certain expressions

used in this Announcement. Appendix III to this Announcement

contains further details of the sources of information and bases of

calculations set out in this Announcement.

This Announcement does not constitute a prospectus or prospectus

equivalent document.

Any response in relation to the Acquisition should be made only

on the basis of the information contained in the Scheme Document or

any document by which the Acquisition and the Scheme are made.

Glantus Shareholders are advised to carefully read the formal

documentation in relation to the Acquisition, including the Scheme

Document.

If you are in any doubt about the contents of this Announcement

or the action you should take, you are recommended to seek your own

independent financial advice immediately from your appropriately

authorised independent financial advisor.

The person responsible for making this Announcement on behalf of

Glantus is Maurice Healy, CEO.

Enquiries

Glantus Holdings

Maurice Healy, CEO

Susan O'Connor, Interim CFO + 353 862677800

Shore Capital (Nominated Adviser and Broker

to Glantus) + 44 207 408 4090

Patrick Castle

Tom Knibbs

Lucy Bowden

Yellow Jersey PR (Public Relations Advisor

to Glantus) +44 7747 788 221

Charles Goodwin

Annabelle Wills

Basware + 358 09 879171

Jason Kurtz, CEO

Martti Nurminen, CFO

Rothschild & Co (Financial Advisor to Basware

and Bidco) +44 20 7280 5000

Anton Black

Mitul Manji

Tom Guinness

Statements required by the Irish Takeover Rules

The Bidco Directors and the Basware Directors accept

responsibility for the information contained in this Announcement

other than that relating to Glantus, the Glantus Group and the

Glantus Directors and members of their immediate families, related

trusts and persons connected with them. To the best of the

knowledge and belief of the Bidco Directors (who, in each case,

have taken all reasonable care to ensure that this is the case),

the information contained in this Announcement for which they

accept responsibility is in accordance with the facts and does not

omit anything likely to affect the import of such information.

The Glantus Directors accept responsibility for the information

contained in this Announcement relating to Glantus, the Glantus

Group and the Glantus Directors and members of their immediate

families, related trusts and persons connected with them. To the

best of the knowledge and belief of the Glantus Directors (who, in

each case, have taken all reasonable care to ensure such is the

case), the information contained in this Announcement for which

they accept responsibility is in accordance with the facts and does

not omit anything likely to affect the import of such

information.

Shore Capital, which is authorised and regulated by the FCA in

the United Kingdom, is acting exclusively for Glantus and no one

else in connection with the Acquisition and other the matters

referred to in this Announcement and will not be responsible to

anyone other than Glantus for providing the protections afforded to

clients of Shore Capital, or for providing advice in connection

with the Acquisition, the content of this Announcement or any

matter or arrangement referred to herein. Neither Shore Capital nor

any of its subsidiaries or affiliates, directors, officers

employees or agents owes or accepts any duty, liability or

responsibility whatsoever (whether direct, indirect, consequential

whether in contract, in tort, under statute or otherwise) to any

person who is not a client of Shore Capital in connection with this

Announcement, the Acquisition, any statement contained herein or

otherwise. No representation or warranty, express or implied, is

made by Shore Capital as to the contents of this Announcement.

N.M. Rothschild & Sons Limited ("Rothschild & Co"),

which is authorised and regulated by the FCA in the United Kingdom,

is acting exclusively as financial adviser to Bidco and Basware and

no one else in connection with the Acquisition and other matters

set out in this Announcement and will not be responsible to anyone

other than Bidco and Basware for providing the protections afforded

to clients of Rothschild & Co, nor for providing advice in

connection with the Acquisition, the content of this Announcement

or any matter or arrangement referred to herein. Neither Rothschild

& Co nor any of its affiliates or partners, directors, officers

employees or agents owes or accepts any duty, liability or

responsibility whatsoever (whether direct, indirect, consequential,

whether in contract, in tort, under statute or otherwise) to any

person who is not a client of Rothschild & Co in connection

with this Announcement, the Acquisition, any statement contained

herein or otherwise. No representation or warranty, express or

implied, is made by Rothschild & Co as to the contents of this

Announcement.

Arthur Cox LLP is acting as legal adviser to Basware and Bidco

and DAC Beachcroft LLP is acting as legal adviser to Glantus.

This Announcement is for information purposes only and is not

intended to, and does not, constitute or form any part of any offer

or invitation, or the solicitation of an offer, to purchase or

otherwise acquire, subscribe for, sell or otherwise dispose of any

securities or the solicitation of any vote or approval in any

jurisdiction pursuant to the Acquisition or otherwise, nor shall

there be any sale, issuance or transfer of securities in any

jurisdiction in contravention of applicable law. The Acquisition

will be made solely by means of the Scheme Document (or, if

applicable, the Takeover Offer Document), which will contain the

full terms and conditions of the Acquisition, including details of

how to vote in respect of the Acquisition. Any decision in respect

of, or other response to, the Acquisition, should be made only on

the basis of the information contained in the Scheme Document (or,

if applicable, the Takeover Offer Document).

This Announcement does not constitute a prospectus or a

prospectus equivalent document.

This Announcement has been prepared for the purpose of complying

with the laws of Ireland and the Irish Takeover Rules and the

information disclosed may not be the same as that which would have

been disclosed if this Announcement had been prepared in accordance

with the laws of jurisdictions outside of Ireland.

Cautionary Statement Regarding Forward-Looking Statements

This Announcement contains certain forward-looking statements

with respect to Bidco, Basware and Glantus. These forward-looking

statements can be identified by the fact that they do not relate

only to historical or current facts. Forward-looking statements

often use words such as "anticipate", "target", "expect",

"estimate", "intend", "plan", "believe", "will", "may", "would",

"could" or "should" or other words of similar meaning or the

negative thereof. The expectations and beliefs of Bidco, Basware

and Glantus regarding these matters may not materialise. Actual

outcomes and results may differ materially from those contemplated

by these forward looking statements as a result of uncertainties,

risks, and changes in circumstances, including but not limited to

risks and uncertainties related to: the ability of Glantus and

Bidco to consummate the Acquisition in a timely manner or at all;

the satisfaction (or waiver) of any conditions to the consummation

of the Acquisition, including with respect to the approval of

Glantus Shareholders and any required regulatory approvals;

potential delays in consummating the Acquisition; the ability of

Glantus and Bidco to timely and successfully achieve the

anticipated strategic benefits or opportunities expected as a

result of the Acquisition; the successful integration of Glantus

into the Basware Group subsequent to Completion and the timing of

such integration; the impact of changes in global, political,

economic, business, competitive, market and regulatory forces; the

occurrence of any event, change or other circumstance or condition

that could give rise to the termination of the Transaction

Agreement; adverse effects on the market price of Glantus'

securities and on the Glantus or the Basware Group's operating

results because of a failure to complete the Acquisition; and the

effect of the announcement or pendency of the Acquisition on the

Glantus or Basware business relationships, operating results and

business generally; and the costs related to the Acquisition.

These forward-looking statements involve known and unknown

risks, uncertainties and other factors which may cause the actual

results, performance or achievements of any such person, or

industry results, to be materially different from any results,

performance or achievements expressed or implied by such

forward-looking statements. These forward-looking statements are

based on numerous assumptions regarding the present and future

business strategies of such persons and the environment in which

each will operate in the future. You are cautioned not to place

undue reliance on these forward-looking statements, which speak

only as of the date hereof. All subsequent oral or written

forward-looking statements attributable to Bidco, Basware or

Glantus or any persons acting on their behalf are expressly

qualified in their entirety by the cautionary statement above.

Neither Bidco, the Basware Group nor Glantus undertake any