Galileo Resources PLC Agreement to acquire further interest in BCV (5884V)

10 August 2022 - 9:45PM

UK Regulatory

TIDMGLR

RNS Number : 5884V

Galileo Resources PLC

10 August 2022

For immediate release

10 August 2022

Galileo Resources Plc

("Galileo" or "the Company")

Agreement to acquire a further 29% shareholding in

Lithium & Gold Projects, Zimbabwe

Galileo Resources plc ("Galileo "or the "Company") further to

its announcement of 7 March 2022 is pleased to provide details

regarding an addendum dated 9 August 2022 (the "Addendum") to an

agreement dated 21 January 2022 between BC Ventures and Cordoba

Investments Limited (the "Principal Agreement") to acquire a 51%

interest in B.C. Ventures Limited ("BC Ventures") which was

assigned to the Company on 4 March 2022 (the "Deed of Assignment").

Under the Addendum, Galileo is to acquire a 29% shareholding in BC

Ventures (the "Share Acquisition") for the issue of 50,000,000

Galileo Resources plc shares (the "Consideration Shares"), BC

Ventures is the owner of a highly prospective lithium project in

Southwest Zimbabwe (the " Kamativi Lithium Project" ) and two gold

licenses (the "Bulawayo Gold Project") close to Bulawayo (the

"Projects") through its wholly owned Zimbabwe subsidiary

Sinamatella Investments (Private) Limited.

Highlights

-- The 29% shareholding in BC Ventures is being acquired by the

Company by the issue of the Consideration Shares which is expected

to complete once the closing formalities have been completed in

relation to the Share Acquisition which is expected to occur during

August 2022.

-- Following the Share Acquisition and satisfaction of the

conditions of the Principal Agreement, Galileo would hold an 80%

interest in BC Ventures

-- The Consideration Shares will be issued at 1.2 pence per

share which is a premium of 4.4% to the closing share price of 1.15

pence per share on Monday 8 August 2022.

-- The Consideration Shares will be subject to a 12-month lock

up and 12-month orderly market arrangements detailed below.

Colin Bird Chairman & CEO said: " The issue of the

Consideration Shares is at a premium to the current share price and

subject to lock up arrangements. The Board believes that it is

important that the interests of the members of a joint venture are

aligned to the same mission. The issue of the Consideration Shares

to acquire 29% of BC Ventures has very much achieved this objective

and we look forward to working with the BC Ventures shareholders to

unlock the Zimbabwean Projects' value.

Summary of Addendum

The Addendum was entered into on 9 August 2022 and amends the

terms of the Principal Agreement as below:

1. The Company is to acquire 29% of BC Ventures in consideration

of the issue of the Consideration Shares to Angus Kynaston Forbes

or his nominee;

2. The Consideration Shares are subject to the following lockup

and orderly market arrangements and cannot be sold during the

lockup periods. During the orderly market period the Option

Consideration Shares shall first be offered for sale by Galileo's

company broker at a price no lower than the Galileo Shares have

traded in the previous five days (the "Nominated Price") and if not

sold by Galileo's company broker within 30 days may be sold via

another broker at the Nominated Price or higher

Percentage of Option Lock Up Period Orderly Market

Considerations Period

Shares

-------------------------------- -------------------------- --------------------------

100% 12 months 12 months

3. The period for the expenditure of US$1.5M to be incurred by

the Company under the Principal Agreement to acquire 51% of BC

Ventures has been extended six months to 21 July 2024.

4. All provisions of (i) the Principal Agreement, and (ii) the

Deed of Assignment as included in the announcement of 7 March 2022

remain unamended and in full force and effect. As such Galileo's

share of any pro rata costs will be 80% post completion reflecting

its revised equity interest.

Further information in relation to BC Ventures: BC Ventures is

privately owned and registered in the Bahamas and was established

as a mineral exploration (prospect generator) company and remained

dormant until 7 March 2022 when the Deed of Assignment was signed

and had never previously traded or operated commercially and owns

100% of Sinamatella Investments (Private) Limited ("Sinamatella").

Sinamatella was incorporated in Zimbabwe to apply for mineral

exploration licenses and was awarded Exclusive Prospecting Orders

(EPOs) 1782, 1783 and 1784 on 12 March 2021 which are its only

assets. Since the issue of the EPOs Sinamatella have paid the EPO

application and initial year's licence fees of Zimbabwe Dollars

119,896 (approx. US$1,000) and commenced exploration activities as

per Galileo's announcements of 26 April 2022.

You can also follow Galileo on Twitter: @GalileoResource

For further information, please contact: Galileo Resources

PLC

Colin Bird, Chairman Tel +44 (0) 20 7581

4477

Beaumont Cornish Limited - Nomad Tel +44 (0) 20 7628

Roland Cornish/James Biddle 3396

----------------------

Novum Securities Limited - Joint

Broker

Colin Rowbury /Jon Belliss +44 (0) 20 7399 9400

----------------------

Shard Capital Partners LLP - Tel +44 (0) 20 7186

Joint Broker 9952

Damon Heath

----------------------

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulations (EU) No. 596/2014 as it forms part of

UK Domestic Law by virtue of the European Union (Withdrawal) Act

2018 ("UK MAR").

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

AGRBKKBQDBKDBFD

(END) Dow Jones Newswires

August 10, 2022 07:45 ET (11:45 GMT)

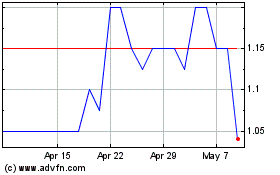

Galileo Resources (LSE:GLR)

Historical Stock Chart

From Mar 2024 to Apr 2024

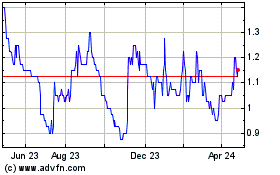

Galileo Resources (LSE:GLR)

Historical Stock Chart

From Apr 2023 to Apr 2024