TIDMGLR

RNS Number : 4564L

Galileo Resources PLC

05 September 2023

5 September 2023

Galileo Resources Plc

("Galileo" or the "Company")

Zambian Exploration Licence joint venture

Issue of Equity & TVR

The Board of Galileo Resources Plc ("Galileo" or the "Company")

is pleased to announce that the Company has entered into a joint

venture agreement with Cooperlemon Consultancy Limited in relation

to the exploration for copper at large scale exploration license

28001-HQ-LEL in Northwest Zambia (the "Licence").

Highlights

-- Licence 28001 - HQ - LEL runs along the Angolan-Zambian

border and is closely associated with the perceived Western

Foreland geological district boundary that potentially hosts Kamoa

- Kakula deposits in Northwest Zambia.

-- The licence is 52,000 hectares area covering ground in a

district where the Company believes there is scope for the

discovery of Kamoa-style mineralisation.

-- There has been limited exploration to date and initial

fieldwork will commence within 60 days on the Licence with a view

to defining potential drill targets as soon as possible.

Colin Bird, Executive Chairman said : "This acquisition is

consistent with our policy of acquiring opportunity projects where

potential outweighs entry in reliable jurisdictions. The Project is

well-positioned in the emerging NW part of Zambia which is showing

potential not dissimilar to its' Democratic Republic of the Congo

neighbour Kamoa and Ivanhoe exploration areas known as the Western

Foreland. We intend to aggressively pursue this project to test the

potential for near-surface mineralisation as well as the much

postulated Kamoa-style mineralisation. Once targets are generated

we will proceed to drilling as soon as we are able and hopefully

before the rainy season commences. We will keep shareholders posted

as progress occurs".

Joint Venture Agreement

Galileo yesterday entered into a joint venture agreement with

Cooperlemon Consultancy Limited ("Cooperlemon") in relation to the

exploration for copper at large scale exploration license

28001-HQ-LEL in Northwest Zambia (the "Licence"). Under the joint

venture agreement ("JV Agreement"), Galileo has agreed the

following key terms:

Earn-in and Phase 1 exploration budget : Galileo will earn a 65%

interest in the joint venture by;

i) An immediate cash payment of US$230,000 to Cooperlemon;

ii) funding exploration expenditure over an initial eighteen

month period ("Phase 1") on the Licence of not less than

US$750,000. Exploration is expected to commence in September /

October 2023, and will comprise both physical activity within the

Licence boundaries (including but not limited to mapping, soil

geochemistry, geophysics and drilling), and desktop studies,

laboratory analysis and interpretation of data and results. Galileo

anticipates funding this exploration expenditure from existing

resources; and

iii) for the issue of 2,500,000 Galileo Resources plc shares

(the "Consideration Shares") at a price of 1.175 pence per share

being the closing Galileo share price on 4 September 2023

(totalling GBP29,375). The Consideration Shares are subject to a

three month lock up arrangement and thereafter a further three

months orderly market arrangement. Under the orderly market

arrangement, the Consideration Shares can be sold via the Company's

broker at a price determined by the vendor (the "Nominated Sale

Price") which shall not be less than the lower of i) the 10 day

VWAP and ii) the closing bid price on the day before the fixing of

the Nominated Sale Price and the Company's broker will have 10

business days to sell the shares at the Nominated Sale Price.

If the Phase 1 exploration results are successful and prove the

continuity of mineralisation at grades suggesting the potential for

the future development of a Mineral Resource of not less than

500,000 tonnes of contained copper, consistent with economic

recovery at the depth of discovery with a minimum internal rate of

return of not less than 25% and a payback period not exceeding 42

months (including the recovery of capital expenditure), then there

will be a second two year exploration period ("Phase 2").

Phase 2 exploration budget: The Phase 2 exploration expenditure

of US$1.5 million will also be funded by Galileo who will be the

operator of the Licence for the duration of the Agreement.

Consequence of Trade Sale: If there is a trade or any other sale

of the Licence and / or the Joint Venture during Phase 1 of the

joint venture then Galileo will be deemed to have a 55% interest in

the Joint Venture. A sale requires the agreement of both Galileo

and Cooperlemon.

Mine Development : In the event the Licence advances to a point

where they are commercially viable and suitable for development

then the licence will be moved to a corporate entity to be owned

75% by Galileo and 25% by Cooperlemon, and it will be the

responsibility of the newly formed corporate entity to raise all

capital for mine development and future operations.

Further information on the Licence

Licence No: 28001-HQ-LEL, which comprises 52,083 hectares and

expires on 31 May 2025, is held by L and I Investments Limited ("L

and I"), a private Zambian company which with Cooperlemon is under

the common control of local Zambian parties. The Licence is located

in North-West Zambia along the Angolan-Zambian border. L and I has

agreed with Galileo to be bound by the terms and the conditions of

the JV Agreement with Cooperlemon (who is acting on their behalf)

as though they were a party to the JV Agreement.

Geology, location and prospectivity

The style of mineralisation and associated geology and structure

responsible for the Kamoa-Kakula deposit operated by Ivanhoe Mines

may extend into the North-West Zambia.

The Western Foreland succession determines the geology of the

region and the Licence lies within the area where the Western

Foreland lithology necessary for Kamoa-style mineralisation can

reasonably be expected to occur.

Application to trading on AIM: Application will be made to the

London Stock Exchange for a total of 2,500,000 new Galileo Shares

to be admitted to trading on AIM which rank pari passu to the

existing ordinary shares in the Company. It is expected that

Admission will become effective and that dealings in the new

Galileo Shares will commence at 8.00 a.m. on 12 September 2023.

Total Voting Rights : On Admission, the number of Ordinary

Shares in issue will be 1,163,188,453 (the "Enlarged Share

Capital") which may be used by shareholders in the Company as the

denominator for the calculations by which they will determine if

they are required to notify their interest in, or a change to their

interest in, Galileo under the Financial Conduct Authority's

Disclosure Guidance and Transparency Rules.

Further information is available from the Company's website

which details the company's project portfolio as well as a copy of

this announcement: www.Galileoresources.com

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulation (EU) No. 596/2014 as it forms part of

UK Domestic Law by virtue of the European Union (Withdrawal) Act

2018 ("UK MAR").

The person who arranged for the release of this announcement on

behalf of the Company was Colin Bird, Executive Chairman and

Director.

You can also follow Galileo on Twitter: @GalileoResource

For further information, please contact: Galileo Resources

PLC

Tel +44 (0) 20

Colin Bird, Chairman 7581 4477

Beaumont Cornish Limited - Nomad Tel +44 (0) 20

Roland Cornish/James Biddle 7628 3396

Novum Securities Limited - Joint Broker +44 (0) 20 7399

Colin Rowbury /Jon Belliss 9400

Shard Capital Partners LLP - Joint Broker Tel +44 (0) 20

Damon Heath 7186 9952

Qualified Person:

Colin Bird: The technical information contained in this

announcement has been reviewed, verified, and approved by Colin

Bird, C.Eng, FIMMM, South African and UK Certified Mine Manager and

Director of Galileo Resources plc, with more than 40 years'

experience mainly in hard rock mining.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCUPUWCBUPWGPA

(END) Dow Jones Newswires

September 05, 2023 08:46 ET (12:46 GMT)

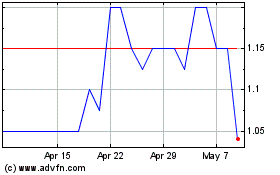

Galileo Resources (LSE:GLR)

Historical Stock Chart

From Mar 2024 to Apr 2024

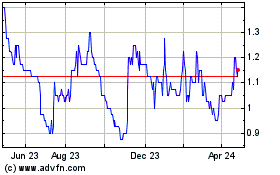

Galileo Resources (LSE:GLR)

Historical Stock Chart

From Apr 2023 to Apr 2024