TIDMGMS

RNS Number : 4598N

Gulf Marine Services PLC

09 August 2017

Gulf Marine Services PLC

('Gulf Marine Services', 'GMS', 'the Company' or 'the

Group')

Amendments to bank facility agreement

Gulf Marine Services (LSE: GMS), the leading provider of

advanced self-propelled self-elevating support vessels (SESVs)

serving the offshore oil, gas and renewable energy sectors,

announces that the Group has amended its bank facility agreement,

with the following revised financial covenants:

Covenant Test Maximum Net Leverage Minimum Interest

Date Ratio(1) Cover Ratio(2)

--------------- ----------------------- -------------------

Amended Previous Amended Previous

--------------- ---------- ----------- -------- ---------

30 June 2017 5.5 5.0 3.0 3.0

--------------- ---------- ----------- -------- ---------

31 December

2017 6.5 5.0 2.5 3.0

--------------- ---------- ----------- -------- ---------

30 June 2018 6.5 5.0 2.5 3.0

--------------- ---------- ----------- -------- ---------

31 December

2018 5.0 4.0 3.0 3.0

--------------- ---------- ----------- -------- ---------

30 June 2019

onwards 4.0 4.0 3.0 3.0

--------------- ---------- ----------- -------- ---------

Certain restrictions would be applied on dividend payments and

capital expenditure should the net leverage ratio be above

specified levels.

Duncan Anderson, Chief Executive Officer of GMS, said:

"We are pleased to have the support of our banking syndicate and

appreciate its confidence in our business. The covenant amendments

provide us with the operational and financial flexibility to focus

on executing our strategic plan and delivering significant

efficiencies for our clients."

This announcement contains inside information.

John Brown

Company Secretary (responsible for arranging the release of this

announcement)

Gulf Marine Services PLC

9 August 2017

(1) Net Leverage Ratio: the ratio of net debt (bank borrowings

less cash), to EBITDA for the previous twelve months.

(2) Interest Cover Ratio: the ratio of EBITDA to net finance

charges for the previous twelve months.

Enquiries

For further information please contact:

Gulf Marine Services

PLC Brunswick

Duncan Anderson Patrick Handley -

John Brown UK

Tel: +971 (2) 5028888 Will Medvei - UK

Anne Toomey Tel: +44 (0) 20 7404

Tel: +44 (0) 1296 5959

622736 Jade Mamarbachi -

UAE

Tel: +971 (0) 50 600

3829

Notes to Editors:

Gulf Marine Services PLC ('GMS', 'the Company' or 'the Group'),

a company listed on the London Stock Exchange, was founded in Abu

Dhabi in 1977 and has become the leading provider of advanced

self-propelled self-elevating support vessels (SESVs) in the world.

The fleet serves the oil, gas and renewable energy industries from

its offices in the United Arab Emirates, Saudi Arabia, Malaysia and

the United Kingdom. The Group's assets are capable of serving

clients' requirements across the globe, including the Middle East,

South East Asia, West Africa and Europe.

The GMS SESV fleet of 14 vessels is amongst the youngest in the

industry, with an average age of eight years. The vessels support

GMS' clients in a broad range of offshore oil and gas platform

refurbishment and maintenance activities, well intervention work

and offshore wind turbine maintenance work (which are opex-led

activities), as well as offshore oil and gas platform installation

and decommissioning and offshore wind turbine installation (which

are capex-led activities).

The SESVs are four-legged vessels and are self-propelled, which

means they do not require tugs or similar support vessels for moves

between locations in the field; this makes them significantly more

cost-effective and time-efficient than conventional offshore

support vessels without self-propulsion. They have a large deck

space, crane capacity and accommodation facilities that can be

adapted to the requirements of the Group's clients. A well workover

cantilever system that has been developed for the Large Class

vessels will be available to clients for the first time in 2017.

Developed in partnership with leading Norwegian designer Dwellop

A.S., the innovative cantilever allows GMS to significantly

increase the level and type of well intervention activities that

can be carried out from these vessels to include operations that

have traditionally been performed by more expensive non-propelled

drilling rigs.

The fleet is categorised by size into Large Class vessels

(operating in water depth of up to 80m, with crane capacity of up

to 400 tonnes and accommodation for up to 300 people), Mid-Size

Class vessels (operating in water depth up to 55m, with crane

capacity of up to 150 tonnes and accommodation for up to 300

people) and Small Class vessels (operating in water depth of up to

45m, with crane capacity of up to 45 tonnes and accommodation for

up to 300 people).

Demand for GMS' vessels is predominantly driven by their premium

and cost-effective capabilities, underpinned by the need to

maintain ageing oil and gas infrastructure and the increasing use

of enhanced oil recovery techniques to offset declining production

profiles.

Gulf Marine Services PLC's Legal Entity Identifier is

213800IGS2QE89SAJF77

www.gmsuae.com

Disclaimer

The content of the Gulf Marine Services PLC website should not

be considered to form a part of or be incorporated into this

announcement.

Cautionary Statement

This announcement includes statements that are forward-looking

in nature. All statements other than statements of historical fact

are capable of interpretation as forward-looking statements. These

statements may generally, but not always, be identified by the use

of words such as 'will', 'should', 'could', 'estimate', 'goals',

'outlook', 'probably', 'project', 'risks', 'schedule', 'seek',

'target', 'expects', 'is expected to', 'aims', 'may', 'objective',

'is likely to', 'intends', 'believes', 'anticipates', 'plans', 'we

see' or similar expressions. By their nature these forward-looking

statements involve numerous assumptions, risks and uncertainties,

both general and specific, as they relate to events and depend on

circumstances that might occur in the future.

Accordingly, the actual results, operations, performance or

achievements of the Company and its subsidiaries may be materially

different from any future results, operations, performance or

achievements expressed or implied by such forward-looking

statements, due to known and unknown risks, uncertainties and other

factors. Neither Gulf Marine Services PLC nor any of its

subsidiaries undertake any obligation to publicly update or revise

any forward-looking statement as a result of new information,

future events or other information. No part of this announcement

constitutes, or shall be taken to constitute, an invitation or

inducement to invest the Company or any other entity, and must not

be relied upon in any way in connection with any investment

decision. All written and oral forward-looking statements

attributable to the Company or to persons acting on the Company's

behalf are expressly qualified in their entirety by the cautionary

statements referred to above.

This information is provided by RNS

The company news service from the London Stock Exchange

END

AGRDMGGRRRGGNZM

(END) Dow Jones Newswires

August 09, 2017 02:00 ET (06:00 GMT)

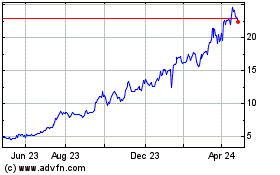

Gulf Marine Services (LSE:GMS)

Historical Stock Chart

From Apr 2024 to May 2024

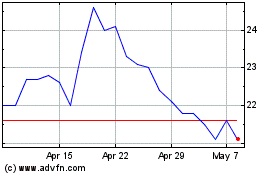

Gulf Marine Services (LSE:GMS)

Historical Stock Chart

From May 2023 to May 2024