Global Opportunities Trust Plc - Portfolio Holdings as at 31 January 2025

25 February 2025 - 2:32AM

UK Regulatory

Global Opportunities Trust Plc -

Portfolio Holdings as at 31 January 2025

PR Newswire

LONDON, United Kingdom, February 24

Global

Opportunities Trust plc (`the

Company')

Legal

Entity Identifier:

2138005T5CT5ITZ7ZX58

Monthly Portfolio Update

As at 31 January 2025, the Net Assets

of the Company were £112.6m.

Portfolio Holdings as at 31 January

2025

|

Rank

|

Company

|

Sector

|

Country of

Incorporation

|

% of Net Assets

|

|

1

|

AVI

Japanese Special Situations Fund*

|

Financials

|

Japan

|

12.2

|

|

2

|

Volunteer

Park Capital Fund SCSp**

|

Financials

|

Luxembourg

|

7.3

|

|

3

|

Unilever

|

Consumer

Staples

|

United

Kingdom

|

3.2

|

|

4

|

TotalEnergies

|

Energy

|

France

|

3.0

|

|

5

|

Imperial

Brands

|

Consumer

Staples

|

United

Kingdom

|

2.7

|

|

6

|

Alibaba

Group

|

Consumer

Discretionary

|

Hong

Kong

|

2.5

|

|

7

|

Lloyds

Banking Group

|

Financials

|

United

Kingdom

|

2.4

|

|

8

|

Tesco

|

Consumer

Staples

|

United

Kingdom

|

2.3

|

|

9

|

Jet2

|

Industrials

|

United

Kingdom

|

2.3

|

|

10

|

Dassault

Aviation

|

Industrials

|

France

|

2.2

|

|

11

|

ENI

|

Energy

|

Italy

|

2.2

|

|

12

|

RTX

|

Industrials

|

United

States

|

2.1

|

|

13

|

Orange

|

Communication

Services

|

France

|

2.0

|

|

14

|

Panasonic

|

Consumer

Discretionary

|

Japan

|

2.0

|

|

15

|

Qinetiq

|

Industrials

|

United

Kingdom

|

2.0

|

|

16

|

Sanofi

|

Health

Care

|

France

|

1.8

|

|

17

|

Samsung

Electronics

|

Information

Technology

|

South

Korea

|

1.6

|

|

18

|

General

Dynamics

|

Industrials

|

United

States

|

1.6

|

|

19

|

Breedon

Group

|

Materials

|

United

Kingdom

|

1.5

|

|

20

|

Whitbread

|

Consumer

Discretionary

|

United

Kingdom

|

1.4

|

|

21

|

Verizon

Communications

|

Communication

Services

|

United

States

|

1.3

|

|

22

|

Nestle

|

Consumer

Staples

|

Switzerland

|

1.1

|

|

23

|

Intel

|

Information

Technology

|

United

States

|

1.1

|

|

24

|

Philips

|

Health

Care

|

Netherlands

|

0.9

|

|

25

|

Azelis

Group

|

Materials

|

Belgium

|

0.9

|

|

26

|

Bakkafrost

|

Consumer

Staples

|

Denmark

|

0.8

|

|

27

|

Kalmar

|

Industrials

|

Finland

|

0.8

|

|

28

|

Danieli

|

Industrials

|

Italy

|

0.8

|

|

29

|

Terveystalo

|

Health

Care

|

Finland

|

0.4

|

|

|

|

Total equity investments

|

66.4

|

|

|

|

Cash and other net assets

|

33.6

|

|

|

|

Net assets

|

100.0

|

* Sub-Fund of Gateway UCITS Funds PLC

**Luxembourg Special Limited Partnership

Geographical Distribution as at 31

January 2025

|

|

% of Net Assets

|

|

United Kingdom

|

17.7

|

|

Europe ex UK

|

17.0

|

|

Japan

|

14.2

|

|

Americas: Private Equity Fund

|

7.3

|

|

Americas: Direct Equities

|

6.1

|

|

Asia Pacific ex Japan

|

4.1

|

|

Liquidity funds, cash and other net assets

|

33.6

|

|

|

100.0

|

|

|

|

Sector Distribution as at 31 January

2025

|

|

% of Net Assets

|

|

Financials:

Japan Fund

|

12.2

|

|

Financials:

Private Equity Fund

|

7.3

|

|

Financials:

Direct Equities

|

2.4

|

|

Total

Financials

|

21.9

|

|

Industrials

|

11.7

|

|

Consumer

Staples

|

10.2

|

|

Consumer

Discretionary

|

5.8

|

|

Energy

|

5.2

|

|

Communication

Services

|

3.4

|

|

Health

Care

|

3.2

|

|

Information

Technology

|

2.7

|

|

Materials

|

2.3

|

|

Liquidity funds, cash and other net assets

|

33.6

|

|

|

100.0

|

The geographical distribution is based on each investment's

principal stock exchange listing or domicile, except in instances

where this would not give a proper indication of where its

activities predominate.

The portfolio holdings and distribution of assets can also be

viewed on the Company's website at globalopportunitiestrust.com

For further information please contact:

Juniper Partners Limited

Company Secretary

Telephone: 0131

378 0500

24 February 2025

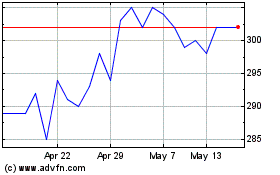

Global Opportunities (LSE:GOT)

Historical Stock Chart

From Jan 2025 to Feb 2025

Global Opportunities (LSE:GOT)

Historical Stock Chart

From Feb 2024 to Feb 2025