Update on discussions with financial stakeholders (1166474)

08 February 2021 - 6:00PM

UK Regulatory

Global Ports Holding PLC (GPH)

Update on discussions with financial stakeholders

08-Feb-2021 / 07:00 GMT/BST

Dissemination of a Regulatory Announcement, transmitted by EQS Group.

The issuer is solely responsible for the content of this announcement.

=----------------------------------------------------------------------------------------------------------------------

Global Ports Holding Plc

Update on discussions with financial stakeholders

Global Ports Holding Plc ("GPH"), the world's largest independent cruise port operator, provides an update in

connection with the refinancing (the "Refinancing") of the USD250,000,000 8.125% Senior Unsecured Notes due 2021 (the "

Notes") issued by its wholly owned subsidiary Global Liman Isletmeleri A.S. (the "Issuer") announced by GPH on 7

January 2021 and in respect of which the Practice Statement Letter was distributed on 19 January 2021.

The spread of COVID-19 and the recent developments surrounding the global pandemic have had material negative impacts

on all aspects of the Group's business and indeed at times during 2020 there was a complete suspension of cruise

industry activity. This has resulted in high levels of cancellation and a suspension of cruise vessel sailings in most

regions until conditions permit them to resume. As a result of these challenging trading conditions triggered by these

events, the Group experienced a rapid negative impact on its business.

The continued magnitude, duration and speed of the global pandemic, and the Group's ability to estimate the impact of

such an event on its future prospects, is uncertain. The extent to which COVID-19 will continue to impact the Group's

results will depend on future developments, which a cannot be predicted, including new information which may emerge

concerning the severity of COVID-19 and the actions taken or being continued to contain it or treat its impact. The

Group cannot predict when global cruise operations are likely to resume or when or if its cruise port operations will

generate revenue at the levels observed before the onset of the pandemic.

The entire aggregate principal amount of the Notes remains outstanding as of the date of this notice and will, together

with accrued and unpaid interest and Additional Amounts (if any), become due on 14 November 2021 (the "Existing Notes

Maturity Date"). Interest is due and payable on the Notes each 14 May and 14 November; the next interest payment on the

Notes is due on 14 May 2021.

As a result of the impact of the COVID-19 pandemic on the Group's liquidity, as described above, the Group does not

expect to be able to repay the Notes (including accrued and unpaid interest and Additional Amounts (if any) thereon) in

full on the Existing Notes Maturity Date.

To this end, the Issuer announced on 7 January 2021 and in respect of which the Practice Statement Letter was

distributed on 19 January 2021 that it is contemplating a scheme of arrangement (the "Scheme") in connection with the

Refinancing.

In connection with the Scheme, the Issuer has entered into discussions with certain key existing Noteholders (the

"AHG") who collectively hold approximately 40% per cent of the outstanding Notes and have formed an ad hoc committee in

order that they may evaluate the proposed Refinancing.

This announcement is being made under the terms of confidentiality agreements between the Issuer and the individual

members of the AHG, which require that the Company make public any material non-public information provided to them in

the course of the negotiation.

Current status of discussion

No agreement has been reached with the AHG and on 4 February 2021 the Issuer received a counterproposal from the AHG,

which it is currently considering.

Additional information

The Company refers to the updated Noteholder Presentation which has been uploaded to its website on 5 February 2021.

CONTACT

Alison Chilcott

Email: alisonc@globalportsholding.com

Martin Brown

Email: martinb@globalportsholding.com

Disclaimer:

This notice does not constitute an offer to distribute, issue or sell, or a solicitation of an offer to subscribe for

or purchase, any securities being offered in connection with the Refinancing or any other securities or right or

interest therein in any jurisdiction in which such distribution, issue, sale or solicitation is not permitted and this

notice may not be used for or in connection with an offer to, or the solicitation by, any person in any jurisdiction or

in any circumstances in which such offer or solicitation is not authorised or to any person to whom it is unlawful to

make such offer or solicitation. Accordingly, neither the securities being offered in connection with the Refinancing

nor any other securities may be offered or sold directly or indirectly and neither this notice nor any prospectus,

offering circular, form of application, advertisement, other offering or solicitation materials nor other information

may be issued, distributed or published in any country or jurisdiction except in circumstances that will result in

compliance with all applicable laws, orders, rules and regulations.

No component of the securities issued pursuant to the Refinancing has been or will be registered under any relevant

securities laws of Australia, Canada, Japan, New Zealand, South Africa, or other relevant jurisdictions. No public

offering of securities will be made in Australia, New Zealand, South Africa, Canada, or Japan.

The securities being offered in connection with the Refinancing have not been and will not be registered under the US

Securities Act of 1933, as amended (the "US Securities Act") and the issuance thereof will be made pursuant to an

exemption from, or in a transaction not subject to, the registration requirements of the US Securities Act.

This announcement may include statements that are, or may be deemed to be, "forward-looking statements". These

forward-looking statements may be identified by the use of forward-looking terminology, including the terms "believes",

"estimates", "plans", "projects", "anticipates", "expects", "intends", "may", "will" or "should" or, in each case,

their negative or other variations or comparable terminology, or by discussions of strategy, plans, objectives, goals,

future events or intentions. These forward-looking statements include all matters that are not historical facts and

involve predictions. Forward-looking statements may and often do differ materially from actual results. Any

forward-looking statements reflect the Issuer's current view with respect to future events and are subject to risks

relating to future events and other risks, uncertainties and assumptions relating to the Issuer's business, results of

operations, financial position, prospects, growth or strategies and the industry in which it operates. Forward-looking

statements speak only as of the date they are made and cannot be relied upon as a guide to future performance. Save as

required by law or regulation, the Issuer disclaims any obligation or undertaking to release publicly any updates or

revisions to any forward-looking statements in this announcement that may occur due to any change in its expectations

or to reflect events or circumstances after the date of this announcement.

No party accepts any responsibility or liability whatsoever for any loss or damage occasioned to any person arising out

of the process described in this notice.

=----------------------------------------------------------------------------------------------------------------------

ISIN: GB00BD2ZT390

Category Code: SOA

TIDM: GPH

LEI Code: 213800BMNG6351VR5X06

Sequence No.: 93081

EQS News ID: 1166474

End of Announcement EQS News Service

=------------------------------------------------------------------------------------

(END) Dow Jones Newswires

February 08, 2021 02:00 ET (07:00 GMT)

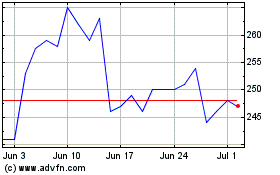

Global Ports (LSE:GPH)

Historical Stock Chart

From Mar 2024 to Apr 2024

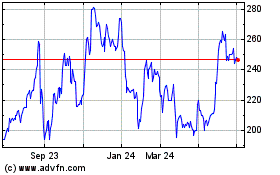

Global Ports (LSE:GPH)

Historical Stock Chart

From Apr 2023 to Apr 2024