Launch of Scheme of Arranagement

19 February 2021 - 12:43AM

UK Regulatory

Global Ports Holding PLC (GPH)

Launch of Scheme of Arranagement

18-Feb-2021 / 13:43 GMT/BST

Dissemination of a Regulatory Announcement, transmitted by EQS Group.

The issuer is solely responsible for the content of this announcement.

=----------------------------------------------------------------------------------------------------------------------

Global Ports Holding Plc

Launch of Scheme of Arrangement

Global Ports Holding Plc ("GPH"), the world's largest independent cruise port operator, announces today that its wholly

owned subsidiary Port Finance Investment Limited (the "Company") has launched a scheme of arrangement (the "Scheme") in

connection with the refinancing (the "Refinancing") of the USD250,000,000 8.125% Senior Unsecured Notes due 2021 issued

by Global Liman Isletmeleri A.S. (the "Notes") announced by GPH on 7 January 2021 and in respect of which the Practice

Statement Letter was distributed on 19 January 2021.

A hearing was held on 17 February 2021 at the Business and Property Courts of the High Court of Justice of England and

Wales pursuant to which the Company was granted an order to convene a meeting (the "Scheme Meeting") of Scheme

Creditors to consider and, if thought fit, approve the Scheme and the Refinancing. The Scheme Meeting will be held

virtually using Microsoft Teams or similar on 26 March 2021 at 4:00pm (London time). Scheme Creditors will be provided

with access details to attend the virtual meeting and will be notified if the date changes. Notice of the Scheme

Meeting will today be sent to Scheme Creditors.

Reasons for the Refinancing

The spread of COVID-19 and the recent developments surrounding the global pandemic have had material negative impacts

on all aspects of the Group's business and indeed at times during 2020 there was a complete suspension of cruise

industry activity. This has resulted in high levels of cancellation and a suspension of cruise vessel sailings in most

regions until conditions permit them to resume. As a result of these challenging trading conditions triggered by these

events, the Group experienced a rapid negative impact on its business.

The continued magnitude, duration and speed of the global pandemic, and the Group's ability to estimate the impact of

such an event on its future prospects, is uncertain. The extent to which COVID-19 will continue to impact the Group's

results will depend on future developments, which cannot be predicted, including new information which may emerge

concerning the severity of COVID-19 and the actions taken or being continued to contain it or treat its impact. The

Group cannot predict when global cruise operations are likely to resume or when or if its cruise port operations will

generate revenue at the levels observed before the onset of the pandemic.

The entire aggregate principal amount of the Notes remains outstanding as of the date of this notice and will, together

with accrued and unpaid interest and Additional Amounts (if any), become due on 14 November 2021 (the "Existing Notes

Maturity Date"). Interest is due and payable on the Notes each 14 May and 14 November; the next interest payment on the

Notes is due on 14 May 2021.

As a result of the impact of the COVID-19 pandemic on the Group's liquidity, as described above, the Group does not

expect to be able to repay the Notes (including accrued and unpaid interest and Additional Amounts (if any) thereon) in

full on the Existing Notes Maturity Date.

Accordingly, through the Scheme and the Refinancing, the Group is taking steps to stabilise its liquidity position and

manage its long-term debt obligations by effectively extending the Existing Notes Maturity Date, reducing the principal

amount thereof to the extent Scheme Creditors elect to participate in the Cash Option, and amending the terms thereof

to, among other things, change the interest rate and form of interest for certain periods, in each case, as further

described in the Explanatory Statement.

Expected key dates and times in connection with the Scheme and the Refinancing are set out below. It should be noted

that these times and dates are indicative only and will depend on, amongst other things, the date of the Scheme

Sanction Hearing.

Event Time and Date Notes

Explanatory

Statement The date on which the explanatory statement in connection

made 18 February 2021 with the Scheme (the "Explanatory Statement") is made

available to available to the Scheme Creditors.

Scheme

Creditors

5:00 p.m. (London Time) on 4 March 2021

subject to extension by the Scheme Company The latest time for a Scheme Creditor to vote in favour of

as described herein. the Scheme by submitting a validly completed Scheme Creditor

Letter and related Custody Instruction to be eligible to

receive a Consent Fee, and for those Scheme Creditors holding

Early Bird positions in the Notes through DTC, to transfer their

Deadline If the Scheme Company elects in its sole positions into an existing securities account with Euroclear

discretion to extend the Early Bird or Clearstream (which may include a Euroclear or Clearstream

Deadline, it will notify the Scheme securities account held in DTC) so as to be eligible to

Creditors by issuing a notice to Scheme receive any Consent Fee.

Creditors through the Clearing Systems and

making it available on the Scheme Website.

Latest time and date for receipt of Custody Instructions

delivered by Account Holders which will "block" the Notes in

Custody the Clearing Systems, and for those Scheme Creditors holding

Instructions 9:00 a.m. (London time) on 23 March 2021 positions in the Notes through DTC, to transfer their

Deadline positions into an existing securities account with Euroclear

or Clearstream (which may include a Euroclear or Clearstream

securities account held in DTC) so as to be eligible to

receive any Cash Option Entitlements.

Latest time and date for receipt of Scheme Creditor Letters

by the Information Agent in order for Scheme Creditors'

Scheme voting instructions to be taken into account for the purposes

Creditor of the Scheme Meeting.

Letter 9:00 a.m. (London time) on 24 March 2021

Deadline

The Scheme Creditor Letter Deadline will also serve as the

record time for determining the value of Scheme Claims.

Scheme 4:00 p.m. (London time) on 26 March 2021 Virtual meeting at which Scheme Creditors will vote (in

Meeting person, via videoconference link, or by proxy) on the Scheme.

Hearing at which the Court will be requested to sanction the

Scheme by the Scheme Company.

(Anticipated)

Scheme

Sanction 31 March 2021 (at the earliest)

Hearing A notice regarding the date and time of the hearing will be

announced on the Irish Stock Exchange, distributed to Scheme

Creditors through the Clearing Systems and uploaded to the

Scheme Website once the hearing has been scheduled.

As previously noted, a group of Noteholders have formed an ad

hoc committee in order that they may evaluate the proposed

Refinancing. On 4 February 2021, the Company received a

counterproposal from the ad hoc group, which it is currently in the

process of evaluating. Negotiations between the Company and the ad

hoc group may result in amendments to the terms of the proposed

Refinancing being made prior to the Scheme Meeting and amendments

to the timetable.

The Refinancing may not be completed on the terms described in

the Explanatory Statement, or at all. Certain factors that are

outside of the Group's control may result in delays to the

completion of the Refinancing or material changes to the terms of

the Refinancing, the Amended Indenture and/or the New Notes. If the

Company elects to modify the terms of any features of the

Refinancing (or the Refinancing generally) then the Group will

notify the Scheme Creditors in accordance with the procedures set

out in the Explanatory Statement.

The Explanatory Statement also comprises an offer to Scheme

Creditors to make elections pursuant to the Scheme with respect to

the Cash Option whereby Scheme Creditors may elect to receive cash

for all or part of the New Notes Entitlement that they are entitled

to receive pursuant to the Scheme. Scheme Creditors should refer to

the Explanatory Statement for additional information regarding

participation in the Cash Option.

(MORE TO FOLLOW) Dow Jones Newswires

February 18, 2021 08:43 ET (13:43 GMT)

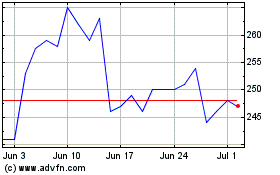

Global Ports (LSE:GPH)

Historical Stock Chart

From Mar 2024 to Apr 2024

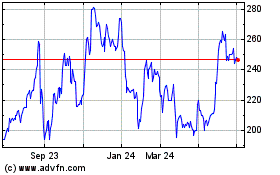

Global Ports (LSE:GPH)

Historical Stock Chart

From Apr 2023 to Apr 2024