TIDMGRP

RNS Number : 7081A

Greencoat Renewables PLC

27 September 2022

GREENCOAT RENEWABLES PLC

(the "Company")

NOTICE OF EXTRAORDINARY GENERAL MEETING

Dublin, London, 27 September 2022 Greencoat Renewables PLC

("Greencoat Renewables" or the "Company"), announces that an

Extraordinary General Meeting of Greencoat Renewables PLC will be

held at Davy House, 49 Dawson Street, Dublin 2, Ireland on 13

October 2022 at 10.00 a.m. (the "EGM").

The business of the EGM will be to consider proposed amendments

to the Company's Investment Policy (pursuant to the Resolution set

out in the Notice of EGM (the " Resolution ")) to remove the

percentage limits on the value of investments that the Company is

permitted or required to make in wind energy assets or solar PV

assets in Ireland and in Other Relevant Countries.

Under the current Investment Policy, investments by the Company

in operational wind energy assets and wind energy assets under

construction in Ireland must represent, in aggregate, not less than

60 per cent. of the Gross Asset Value (calculated immediately

following each investment). The Company is further permitted to

invest in aggregate, up to 40 per cent. of the Gross Asset Value

(calculated immediately following each investment) in operational

wind energy assets or operational solar PV assets in Ireland and

Other Relevant Countries.

In light of the increasing scope in the acquisition pipeline

across Continental Europe, the Board is proposing a change to the

Investment Policy regarding the 40% limit on non-Ireland

investments, in order to support the Company's continued

diversification in Europe, providing access to a wider set of

opportunities. Given the accelerating opportunity in Continental

Europe, a shareholder consultation process on a change to the

current 40% limit on investments outside of Ireland was undertaken,

to ensure that the Group is well placed to deliver on its growth

potential with the full range of opportunities available in the

market.

As noted in the Company's interim report, the rationale for this

proposed change is to support the Company's continued

diversification in Europe, providing access to a wider set of

growth opportunities and to further our strategy of securing

consistent cashflows and enhancing returns. In the 12 months to 30

June 2022, the Company added 281MW of net capacity outside of

Ireland and 50MW of net capacity within Ireland, reflective of the

scale of opportunities available to the Company across Continental

Europe. Since its IPO in 2017, the Company has entered five

European countries outside of Ireland (being France, Germany,

Finland, Spain and Sweden), with the ability to scale demonstrated

and a dedicated team of over 15 professionals focused on European

opportunities in place added with in-country presence in Ireland,

Germany and France.

As the portfolio has grown into new geographies, the business

has benefitted from increased diversification both in terms of

weather systems and power markets, with low correlation of wind

speeds between Continental Europe and Ireland ensuring stability of

cashflows in periods of lower regional wind resource. The Company

continues to see excellent opportunities for continued

diversification across geographies, technologies and pricing

structures in both existing and new European markets and has an

active pipeline of near-term acquisitions in Europe.

The portfolio continues to remain highly contracted with stable

risk-adjusted returns in line with the investment strategy. The

continued diversification in Europe enables the Company to seek the

best returns while reducing exposure to local variations in

renewable resource. Acquisitions in Europe have delivered risk

adjusted returns in line with the Company's Investment Policy and

this is expected to continue as the Company grows further in

Europe. As the largest owner of wind operating assets in Ireland,

the Company will also continue to capitalise on its leading

position to further consolidate an attractive growing market in

Ireland.

The circular which includes the notice of the EGM (the

"Circular") and a Form of Proxy have been posted to shareholders

today. The Board strongly urges shareholders to review the contents

of the Circular in their entirety, including the documents referred

to therein, and consider the Board's recommendation to vote in

favour of the Resolution.

The Circular, the Form of Proxy and the proposed revisions to

the Investment Policy are available to view on the Company's

website, www.greencoat-renewables.com , and will be available for

inspection during normal business hours on any business day from

the date of this letter until the EGM at the registered office of

the Company.

Public Health Guidelines and the EGM

The well-being of our Shareholders and our people is a primary

concern for the Directors. We are closely monitoring the COVID-19

situation and any advice by the Government of Ireland in relation

to the pandemic. We will take all recommendations and applicable

law into account in the conduct of the EGM. Any relevant updates

regarding the EGM, including any changes to the arrangements

outlined in this Notice, will be announced via a Regulatory

Information Service and will be available at

www.greencoat-renewables.com .

Those Shareholders unable to attend the EGM may appoint a proxy.

By submitting a Form of Proxy in favour of the chairman of the EGM

you can ensure that your vote on the Resolution is cast in

accordance with your wishes without attending in person.

Proxy forms can be submitted in advance of the EGM by availing

of one of the options set out in the notice of the EGM:

-- by post to the Registrars of the Company, Computershare

Investor Services (Ireland) Limited, 3100 Lake Drive, Citywest

Business Campus, Dublin 24, D24 AK82, Ireland, so as to be received

in any case no later than 48 hours before the time appointed for

the EGM ;

-- electronically by accessing www.eproxyappointment.com ; or

-- by Euroclear Nominees Limited in respect of the shares

registered in its name as nominee for Euroclear Bank SA/NV

("Euroclear Bank"), through the use of a secured mechanism to

exchange electronic messages as agreed by the Company with

Euroclear Bank.

Persons who hold their interests in ordinary shares as Belgian

law rights through the Euroclear system or as CDIs through the

CREST system, should consult with their stockbroker or other

intermediary at the earliest opportunity for further

information.

For voting services offered by custodians holding Irish

corporate securities directly with Euroclear Bank, please contact

your custodian.

A copy of the Circular can be inspected at the National Storage

Mechanism website at

https://www.fca.org.uk/markets/primary-markets/regulatory-disclosures/national-storage-mechanism

.

Important Note

Announcements relating to the EGM contain (or may contain)

certain forward-looking statements with respect to certain of the

Company's current expectations and projections about future events,

including Migration, and the Company's future financial condition

and performance. These statements, which sometimes use words such

as "aim", "anticipate", "believe", "may", "will", "should",

"intend", "plan", "assume", "estimate", "expect" (or the negative

thereof) and words of similar meaning, reflect the directors'

current beliefs and expectations and involve known and unknown

risks, uncertainties and assumptions, many of which are outside the

Company's control and difficult to predict.

Due to such uncertainties and risks, readers are cautioned not

to place undue reliance on such forward-looking statements, which

speak only as of the date hereof. In light of these risks,

uncertainties and assumptions, the events described in the

forward-looking statements in this announcement may not occur. The

information contained in this announcement, including the

forward-looking statements, speaks only as of the date of this

announcement and is subject to change without notice and the

Company does not assume any responsibility or obligation to, and

does not intend to, update or revise publicly or review any of the

information contained herein save where indicated in the Circular,

whether as a result of new information, future events or otherwise,

except to the extent required by Euronext Growth Dublin or AIM or

by applicable law.

END

For further information on the Announcement, please contact:

Greencoat Renewables PLC +44 20 7832 9400

Bertrand Gautier

Paul O'Donnell

Tom Rayner

Davy (Joint Broker, Nomad and

Euronext Growth Adviser) +353 1 6796363

Ronan Veale

Barry Murphy

RBC (Joint Broker) +44 20 7653 4000

Matthew Coakes

Duncan Smith

Elizabeth Evans

FTI Consulting (Media Enquiries) +353 1 765 0886

Jonathan Neilan

Melanie Farrell

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

NOGEAXNKAAXAEFA

(END) Dow Jones Newswires

September 27, 2022 02:02 ET (06:02 GMT)

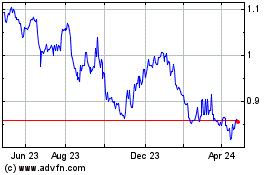

Greencoat Renewables (LSE:GRP)

Historical Stock Chart

From Mar 2024 to Apr 2024

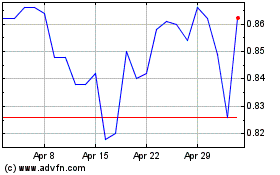

Greencoat Renewables (LSE:GRP)

Historical Stock Chart

From Apr 2023 to Apr 2024