TIDMGSF

RNS Number : 7100W

Gore Street Energy Storage Fund PLC

14 December 2023

14 December 2023

Gore Street Energy Storage Fund plc

(the "Company" or "GSF")

Half Year Results for the 6-months ending 30 September 2023

Strong performance and positive revenue trends continue

Operational highlights:

-- The portfolio generated GBP19.3m of revenue during the

period, amounting to GBP12.2m in operational EBITDA.

-- During the September-end quarter, the Company generated

operational EBITDA of GBP8.3m, resulting in an operational dividend

cover of 1.15x.

-- For the six month period, total portfolio revenue per MW per

hour was GBP15.10, with non-GB assets achieving 2.6x more revenue

than the GB portfolio, underscoring the benefits of the

diversification strategy:

-- GB revenue: GBP7.54/MW/hr

-- Non-GB revenue: GBP19.66/MW/hr

-- The 79.9 MW Stony asset was energised during the reporting period.

-- Energisation and commencement of commissioning for the 49.9

MW Ferrymuir asset is awaiting completion of grid connection

works.

-- The Company's cash balance as of 30 September was GBP75.0m

with a further GBP13.9m held across its subsidiaries, sufficient to

meet all outstanding contractual commitments.

-- As at 30 September, Fund level gearing remained at 0%.

-- Additional project-level debt funding of $60m secured

post-period through a First Citizens loan to support the build-out

of the Company's 200MW / 400MWh Big Rock asset in California.

Between the Santander and First Citizens facilities, GSF has

available debt financing of c.GBP99.0m. If fully drawn, total debt

would represent c. 15% of GAV.

Net Asset Value (NAV):

The Company continued to demonstrate strong operational

performance. However, adjustments to short-term inflation and

discount rates (+25bps) reflecting the macroeconomic landscape

drove a decrease in NAV:

-- NAV as of 30 September 2023 was GBP543.3m or 112.9 pence per

share, bringing NAV total return since IPO to 48.8%.

-- Despite the NAV per ordinary share decrease of 2.3% to 112.9p

(115.6p as at 31 March 2023), NAV total return for the period,

including the 3.5p in dividend payments, remained positive at

0.7%.

-- Portfolio valuation increased by 8%.

Movement in NAV since Changes in NAV per

March 2023 share in pence

============================= ==================

NAV March 2023 115.6

============================= ==================

Fund + Subsidiary Holding

Companies Operating Expense (0.8)

============================= ==================

Dividends (3.5)

============================= ==================

Cash Generation 2.9

============================= ==================

Discount Rate Increases (2.8)

============================= ==================

Inflation (1.2)

============================= ==================

Opex Savings 1.6

============================= ==================

De-risking of Assets 1.2

============================= ==================

Revenue Curves (0.9)

============================= ==================

Other DCF Changes and

Rollover 0.8

============================= ==================

NAV 30 September 2023 112.9

============================= ==================

Dividend Declaration

The Company's Board of Directors has approved a dividend of 2.0

pence per share for the September end quarter. The ex-dividend date

will be 28 December 2023, and the record date of 29 December 2023.

The dividend will be paid on or around 12 January 2024.

Any such dividend payment to Shareholders may take the form of

either dividend income or "qualifying interest income", which may

be designated as an interest distribution for UK tax purposes and,

therefore, subject to the interest streaming regime applicable to

investment trusts. Of this dividend declared of 2.0 pence per

share, 1.15 pence is treated as qualifying interest income.

Alex O'Cinneide, CEO of Gore Street Capital, the Investment

Manager of the Company, commented :

"I am pleased to report that the Company's strategy, enabled by

the active role of the Investment Manager, despite difficult stock

market conditions, has allowed the business to continue to meet its

objectives. Since inception, the operational portfolio has

generated an average of 20% per annum cash yield over invested

capital, and during the September-end quarter, the Company

delivered an operational dividend cover of 1.15x. This positive

trajectory is reflected in portfolio performance, which maintained

the highest revenue on both a per MW and absolute basis among our

listed peers during the period whilst being the cost leader on

capital cost per MW/MWh fully installed. This was achieved through

diversification, with assets in Ireland, Texas and Germany

overachieving against base case. With a NAV Total Return of 48.8%

since IPO, an excellent balance sheet given our minimum level of

debt, and a strong cash position, the Company remains in a

compelling and sustainable position."

The interim report will shortly be available to download from

the Company's website www.gsfenergystoragefund.com . Please click

on the following link to view the document:

http://www.rns-pdf.londonstockexchange.com/rns/7100W_1-2023-12-13.pdf

The Company has also submitted its interim report to the

National Storage Mechanism and it will shortly be

available for inspection at https://data.fca.org.uk/#/nsm/nationalstoragemechanism.

For further information:

Gore Street Capital Limited

Alex O'Cinneide / Paula Travesso Tel: +44 (0) 20 3826 0290

Shore Capital (Joint Corporate Broker)

Anita Ghanekar / Rose Ramsden / Iain Sexton (Corporate Advisory) Tel: +44 (0) 20 7408 4090

Fiona Conroy (Corporate Broking)

J.P. Morgan Cazenove (Joint Corporate Broker) Tel: +44 203 493

8000

William Simmonds / Jérémie Birnbaum (Corporate Finance) Tel: +44

(0) 20 3493 8000

Buchanan (Media Enquiries)

Charles Ryland / Henry Wilson / George Beale Tel: +44 (0) 20

7466 5000

Email: gorestreet@buchanan.uk.com

Notes to Editors

About Gore Street Energy Storage Fund plc

Gore Street is London's first listed and internationally

diversified energy storage fund dedicated to the low-carbon

transition. It seeks to provide Shareholders with sustainable

returns from their investment in a diversified portfolio of

utility-scale energy storage projects. In addition to growth

through increasing operational capacity and a considerable

pipeline, the Company aims to deliver consistent and robust

dividend yield as income distributions to its Shareholders.

https://www.gsenergystoragefund.com

Half Year Report Gore Street Energy Storage Fund Plc

For the six months ended 30 September 2023

Highlights and Key Metrics

Key Metrics

For the period ending 30 September 2023

NAV PER SHARE

112.9p

(March 2023: 115.6p)

OPERATIONAL CAPACITY

291.6 MW**

(March 2023: 291.6 MW)

DIVID YIELD

8.9%

(March 2023: 6.9%)

NAV TOTAL RETURN

for the 6 month period

0.7%

(September 2022: 4.6%)

OPERATIONAL EBITDA

for the 6 month period

GBP12.2m

(September 2022: GBP14.8m)

DIVIDS PAID DURING THE PERIOD

3.5p

(September 2022: 3.0p)

As at As at

30 September 31 March

Table 1: Key Metrics 2023 2023

---------------------------------------------------------- ------------- -------------

Net Asset Value (NAV) GBP543.3m GBP556.3m

---------------------------------------------------------- ------------- -------------

NAV per share 112.9p 115.6p

---------------------------------------------------------- ------------- -------------

NAV Total Return since IPO * 48.8% 48.0%

---------------------------------------------------------- ------------- -------------

Share price based on closing price at indicated date 78.8p 100.8p

---------------------------------------------------------- ------------- -------------

Market capitalisation based on closing price GBP379.3m GBP485.3m

---------------------------------------------------------- ------------- -------------

Share price total return since IPO * 13.3% 31.8%

---------------------------------------------------------- ------------- -------------

(Discount)/Premium to NAV * -30.2% -12.8%

---------------------------------------------------------- ------------- -------------

Portfolio's total capacity 1.17 GW 1.17 GW

---------------------------------------------------------- ------------- -------------

Portfolio's operational capacity 291.6 MW** 291.6 MW

---------------------------------------------------------- ------------- -------------

Operational dividend cover for the period * 0.72x 0.90x

---------------------------------------------------------- ------------- -------------

Operational dividend cover for quarter ended 30 September

* 1.15x 1.30x

---------------------------------------------------------- ------------- -------------

Dividend Yield * 8.9% 6.9%

---------------------------------------------------------- ------------- -------------

Ongoing charges Figure * 1.39% 1.37%

---------------------------------------------------------- ------------- -------------

Fund level gearing 0.00% 0.00%

---------------------------------------------------------- ------------- -------------

As at As at

30 September 30 September

Key Metrics for the period (1 April - 30 September) 2023 2022

---------------------------------------------------------- ------------- -------------

NAV Total Return for the six month period * 0.7% 4.6%

---------------------------------------------------------- ------------- -------------

Share Price Total return for the six month period

* -18.4% 0.0%

---------------------------------------------------------- ------------- -------------

Operational EBITDA for the six month period * GBP12.2m GBP14.8m

---------------------------------------------------------- ------------- -------------

Total Fund EBITDA for the six month period * GBP8.5m GBP10.4m

---------------------------------------------------------- ------------- -------------

Dividends per Ordinary Share paid during the period 3.5p 3.0p

---------------------------------------------------------- ------------- -------------

* Some of the financial measures above are classified as

Alternative Performance Measures, as defined by the European

Securities and Markets Authority and are indicated with an asterisk

(*). Definitions of these performance measures, and other terms

used in this report, are given on page 37 of the Interim Report for

the period ending 30 September 2023 together with supporting

calculations where appropriate.

** The 79.9 MW Stony asset was energised during the reporting period.

Chair's Statement

On behalf of the Board, it is my pleasure to present the

Company's Interim report covering the six months ending 30

September 2023.

Overview and Performance

Following advice from the Company's independent valuers and

reflecting the financial conditions as at the end of the period, we

have adjusted our inflation assumptions and raised discount rates

across the board by 0.25%, leading to a new weighted average of

10.3%. The Net Asset Value (NAV) per share, as of 30 September, was

112.9p, representing a reduction of 2.7p per share over the period.

These adjustments have been made in light of the macroeconomic

conditions experienced over the reporting period, while the

operational performance of the Company and its assets remains

strong. Overall growth is evidenced by NAV total returns of 48.8%

since IPO in May 2018 and an 8.9% dividend yield to shareholders,

based on the 30 September share price.

Despite challenging market conditions - especially in Great

Britain - over the six months to 30 September, the Company's

internationally diversified portfolio has performed well. Revenue

for the reporting period was GBP19.3m, representing an average of

GBP15.10/MW/hr, with the Company's international assets delivering

2.6x more revenue on a MW basis than those in Great Britain.

The strength of this revenue generation during the period was

supported by exceptional performance in August , which delivered

the highest revenues reached in a single month across the Company's

five-year history. This record-breaking achievement was led by the

Company's Texas assets following their pre-qualification to deliver

a newly launched grid service, ERCOT Contingency Reserve Service

(ECRS), illustrating the success of the Company's international

diversification, which underpins the potential and sustained

profitability of our asset class.

We are, therefore, committed to building out our construction

portfolio to ensure greater access to revenue-generating activities

across multiple markets in future, some of which have progressed

well in the reporting period. The 80 MW Stony asset - our largest

operational asset to date - was energised in September, a key

milestone in achieving our stated target of an energised portfolio

of over 800 MW by the end of 2024.

By remaining focused on the key metrics of cost per MW fully

installed and revenue generation per MW, the Company anticipates

that deployment across multiple international markets will have a

positive impact on the current operational dividend cover of 0.72x

while lowering exposure to the GB market as a percentage of its

total operational portfolio.

I look forward to updating shareholders as additional

revenue-generating capacity is added to the operational portfolio

in the coming months.

The Company continuously evaluates how best to optimise the c.

1.2 GW portfolio it holds across five energy grids. This includes

the potential sale of assets to enhance shareholder returns when it

would prove accretive to reinvest capital in other opportunities.

This would also prove to be a valuable exercise in NAV discovery,

given the uncertainty over a wide range of asset valuations seen

elsewhere within the sector.

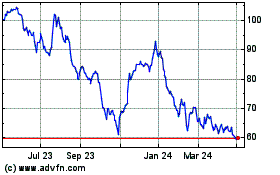

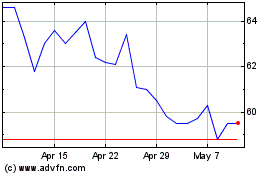

Share Price

The extreme volatility seen across the stock market over the

last six months, has been reflected in the share prices of the

entire asset class, and is not reflective of the Company's

sustained performance in operations and revenue generation. As

market conditions improve, we expect our industry-leading portfolio

to continue delivering sustainable returns to investors.

The Company continues to demonstrate best-in-class operational

performance, notwithstanding challenging market dynamics, and

offers healthy returns to long-term stockholders who recognise

energy storage's fundamental value within the energy

transition.

Dividends

We remain committed to the dividend target of 7% of NAV, which

has been met consistently. The Company paid a dividend of 2.0 pence

for the June end quarter in line with this target, with an

additional dividend of 2.0 pence for the September end quarter to

be paid on or around 12 January 2024.

Outlook

Despite challenges, the Company remains resilient and focused on

outperforming revenue benchmarks, increasing EBITDA margin, and

building its portfolio. It has energised 80 MW during the period,

with 50 MW expected to follow through Ferrymuir in Q4 FY23/24 and

57 MW at Enderby in Q1 FY24/25. In total we are targeting the

energisation of 442 MW by the end of 2024, including expanding

assets in Ireland and the United States.

This will support the Company's uniquely diversified approach

across international markets, which has allowed us to tap into

diverse revenue streams and positions it well for continued success

in the years to come.

Since the quarter end we have already seen inflation rates come

down, a fall in the yield on government bonds and markets have

started to expect falls in interest rates rather than further

increases. This has led to a strong rally in our share price and,

though it remains well short of our NAV, we are hopeful this is the

start of a trend that may go significantly further in 2024.

Patrick Cox

Chair

13 December 2023

Investment Manager's Interim Report

Dr Alex O'Cinneide

CEO of Gore Street Capital, the Investment Manager

"I am pleased to report that the Company's strategy, enabled by

the active role of the Investment Manager, has ensured the business

continued to overachieve during a challenging period. Since

inception, the operational portfolio has generated an average 20%

per annum cash yield over invested capital, and during the

September-end quarter, the Company delivered an operational

dividend cover of 1.15x. This positive trajectory is reflected in

portfolio performance, which maintained the highest revenue on both

a per MW and absolute basis among our listed peers during the

period. This was achieved through diversification, with assets in

Ireland, Texas and Germany overachieving against base case. The

slight decrease in NAV is wholly due to changes in discount rate

and inflation assumptions, with high-interest rates expected to

continue, and does not reflect the exemplary performance of the

Company's commercial operations. With a NAV Total Return of 48.8%

since IPO, an excellent balance sheet given our minimum level of

debt, and a strong cash position, the Company remains in a

compelling and sustainable position."

Operational Highlights:

-- The portfolio generated GBP19.3m of revenue during the

period, amounting to GBP12.2m in operational EBITDA;

- Total portfolio revenue per MW per hour was GBP15.10, with

non-GB assets achieving 2.6x more revenue than the GB portfolio,

showcasing the benefits of the diversification strategy;

- GB revenue: GBP7.54/MW/hr

- Non-GB revenue: GBP19.66/MW/hr

- During the September-end quarter, the Company generated

operational EBITDA of GBP8.3m, resulting in an operational dividend

cover of 1.15x .

- The Company achieved an operational dividend cover of 0.72x

for the reporting period and a fund-level dividend cover of

0.50x.

-- The 79.9 MW Stony asset was energised during the reporting period.

-- Energisation and commencement of commissioning for 49.9 MW

Ferrymuir asset are awaiting completion of grid connection

works.

-- The Company's cash balance as of 30 September was GBP75.0m

with a further GBP13.9m across its subsidiaries, sufficient to meet

all outstanding contractual commitments.

-- As at 30 September, Fund level gearing remained at 0%.

-- Additional project level debt funding of $60.0m secured

post-period through a First Citizens loan to support the build out

of the Company's 200.0MW/400.0MWh Big Rock asset in California.

Between the Santander and First Citizens facilities, the Company

has available debt financing of c.GBP99.0m. If fully drawn, total

debt would represent c.15% of GAV.

Net Asset Value (NAV):

-- NAV as of 30 September 2023 was GBP543.3m or 112.9 pence per

share, bringing NAV total return since IPO to 48.8%.

-- NAV per ordinary share decreased by 2.3% to 112.9p (115.6p as at 31 March 2023).

-- Portfolio valuation increased by 8%.

While the Company continued to demonstrate strong operational

performance, adjustments to short-term inflation and discount rates

(+ 25bps) were needed in response to the macroeconomic landscape

and were the primary drivers of the decrease in Net Asset Value

(NAV).

Table 2

Changes in

NAV per share

Movement in NAV since March 2023 in pence

------------------------------------------------------ --------------

NAV March 2023 115.6

------------------------------------------------------ --------------

Fund + Subsidiary Holding Companies Operating Expense (0.8)

------------------------------------------------------ --------------

Dividends (3.5)

------------------------------------------------------ --------------

Cash Generation 2.9

------------------------------------------------------ --------------

Discount Rate Increases (2.8)

------------------------------------------------------ --------------

Inflation (1.2)

------------------------------------------------------ --------------

Opex Savings 1.6

------------------------------------------------------ --------------

De-risking of Assets 1.2

------------------------------------------------------ --------------

Revenue Curves (0.9)

------------------------------------------------------ --------------

Other DCF Changes and Rollover 0.8

------------------------------------------------------ --------------

NAV 30 September 2023 112.9

------------------------------------------------------ --------------

Revenue Generation and Portfolio Performance

As energy grids around the world continue to move toward a

cleaner, more secure energy mix, the requirement for flexible

technologies able to provide stability to this transition is

increasing. This system need is stemming from not just from the

deployment of renewable generators, like wind turbines and solar

panels, but also from the increased volatility caused by climate

change and global conflicts.

Extreme weather events in recent years have become more frequent

and exposed the vulnerabilities of traditional energy

infrastructure, while shortages in fossil fuels have caused energy

prices to spike as demand outstripped supply.

The Company is one of the only energy storage providers to be

delivering crucial grid services across multiple jurisdictions,

bringing the benefits of the asset class to five different energy

systems (Great Britain, Ireland, Germany, Texas and California).

The international spread of the Company's portfolio allows it to

access a wide range of revenue streams, requiring active management

to ensure optimal performance.

The Company's commercial performance across the period improved

through adjustments in strategy, driven by transfers to new route-

to-market (RTM) providers in various markets, enabling access to

additional value from ancillary services and wholesale trading

markets.

The Company switched RTMs for its German (March '23) and Texan

(June '23) assets for the first time. The processes associated with

the selection of these new service partners differed significantly

from equivalent actions taken by the Company previously in GB and

involved engagement with new contractors, as well as enrolling into

new services the Company had not yet delivered.

The successful transition to new partners resulted in almost

immediate upsides as the Company's assets were able to capture

revenue previously unavailable to them. The US fleet provided

additional ancillary services beyond Response Reserve Service

(RRS), with ERCOT's Contingency Reserve Service (ECRS) being a

particular highlight across periods of higher load experienced

during, hotter temperatures in summer. Early prequalification of

the Company's Texan assets in late July through a new RTM partner

contributed to a +53% increase in revenue for the remainder of the

period, when benchmarked against a passive strategy focused on

pre-existing ancillary services.

The US, German and Irish assets also saw additional value in the

wholesale market as trading opportunities became more frequent,

with new and existing RTMs incorporating new opportunities into the

assets' revenue stacks. Whilst the Company maintains the view that,

over the short-term, ancillary services will continue to drive

revenues across all grids with currently operational assets,

exposure to a variety of trading strategies is integral to

sustaining revenue. The Company's German asset has demonstrated

this with the successful transition to a new data driven RTM

provider, which yielded a +38% increase through increased wholesale

trading activity against a passive strategy focused on the market's

Frequency Containment Reserve (FCR) service. The Company also

utilised its exposure to this kind of strategy in the Irish market

at times when opportunities from DS3 (Delivering a Secure,

Sustainable Electricity System) ancillary services, which provide

the bulk of revenue, were low, due to variations in renewable

energy.

Wind generation volumes will continue to drive these variations

as the single Irish electricity market progresses towards net-zero

targets. During the period, information was released on the Future

Arrangements market reform, starting in 2025, which will ultimately

transform the current DS3 market for providers of flexibility

whilst ensuring sustainability and security for consumers. The

Company is prepared to embrace these changes in network operations

as it has done in GB, which continues to present an ever-changing

volume of capacity procurement.

The Company's extensive experience with battery energy storage

system operations positions it well to maintain optionality between

RTMs whilst reducing the risk of unforeseen delays or issues when

switching contractors. This will facilitate the Company's ongoing

ability to capture new revenue opportunities and begin operations

in new markets.

Great Britain (GB) market

Table 3

TSO National Grid

--------------------------------- -----------------------

GB Portfolio (operational) 109.7 MW / 101.0 MWh

--------------------------------- -----------------------

Share of the market 3.5%(1)

--------------------------------- -----------------------

Revenue during the period (GBP) 3.6m

--------------------------------- -----------------------

Revenue per MW (GBP) 33,100 (GBP7.54/MW/hr)

--------------------------------- -----------------------

Revenue per MWh (GBP) 36,000 (GBP8.19/MWh/hr)

--------------------------------- -----------------------

EBITDA GB grid % of Total EBITDA 8.8%

--------------------------------- -----------------------

(1) Modo Energy Q3 battery build out report

While ancillary services continue to dominate the GB market, the

current level of saturation has resulted in a downward pressure on

prices. During the summer months, these reached their lowest levels

to date in stark contrast to the record highs observed during the

same period in 2022, particularly in Dynamic Containment (DC)

markets.

Despite a notable increase in the procurement volume of all

dynamic services, battery supply outpaced demand and, towards the

period-end, market participants sought additional value outside

ancillary markets. June saw a brief respite as National Grid ESO

reacted to increasing volatility in network frequency by increasing

levels of DC procurement. This event underscores energy storage's

ability to quickly and efficiently alleviate grid issues, which are

readily caused by increasing renewables penetration on the grid. As

this continues to rise the grid operator will require more

flexibility to manage system operators, creating higher demand for

energy storage.

Summer months in GB markets have historically seen lower

marginal prices in wholesale markets due to lower demand and

increased gas availability (with 2022 being an exception). High

renewables penetration occasionally drove prices negative during

the reporting period, creating arbitrage opportunities, though

these were short-lived. Consequently, asset owners/operators

primarily reverted to single-sided trading stacked alongside

ancillary services. Over the period, the Company participated in

pure arbitrage less than 1% of the time due to the limited

available margins.

The Company actively engaged in consultations related to the

Balancing Mechanism (BM), the near real-time market permitting

National Grid ESO to take final energy and system actions to

balance supply and demand and manage constraints. Despite

dispatching an average of 3 GW of power continuously, energy

storage systems faced under-utilisation due to the ESO's selection

of out-of-merit assets, despite not offering the best available

pricing.

It remains unclear why energy storage assets are skipped in

favour of larger, higher carbon assets, however, it is widely

considered to be linked to human error and technological

limitations in the National Grid ESO control room on the volume of

dispatch decisions. Energy storage market participants continue to

face these barriers and are, therefore, unable to properly factor

opportunities within the BM into their commercial strategy.

Anticipated reforms to the BM, including the introduction of a Bulk

Dispatch Operator in December 2023, aim to materially improve the

utilisation of energy storage systems active in the BM.

The Company acknowledges the complexity of the ESO's

decision-making process when assessing value for the consumer,

which is rightly a priority. Given the uncertainty around the

upside in value from forthcoming reforms, the Company maintains a

prudent approach, refraining from becoming reliant on potential

improvements to the BM for revenue growth.

Irish market

Table 4

TSO SONI (Northern Ireland), EirGrid (Republic

of Ireland)

------------------------------------ ------------------------------------------

Irish portfolio (operational) 130.0 MW / 72.6 MWh

------------------------------------ ------------------------------------------

Share of the market 50% in NI, 6% in RoI(2)

------------------------------------ ------------------------------------------

Revenue during the period (GBP) 9.7m

------------------------------------ ------------------------------------------

Revenue per MW (GBP) 74,800 (GBP17.04/MW/hr)

------------------------------------ ------------------------------------------

Revenue per MWh (GBP) 134,000 (GBP30.51/MWh/hr)

------------------------------------ ------------------------------------------

EBITDA Irish grid % of Total EBITDA 59.5%

------------------------------------ ------------------------------------------

(2) Energy Storage Ireland

While DS3 has continued to represent the dominant revenue stream

available to assets connected to the Irish grid, this value has

historically exhibited seasonal variations caused by changes in

wind volumes. These variations result in lower revenue under DS3

uncapped contracts during summer months, as the contractual tariffs

are directly proportional to the volume of renewable generation

(mostly wind) on the grid at any given time.

The reporting period defied these expectations due to regular

episodes of high wind penetration from May to August. This

significantly improved revenue, surpassing projections and

generating 57% of the FY2023 revenue within the six-month reporting

period, a notable increase compared to 36% in the same period the

previous FY. Towards the end of the reporting period, the Company's

Northern Irish fleet actively engaged in wholesale trading to

enhance baseline revenue from uncapped DS3 payments, which vary

throughout the day. The Company utilised advanced forecasting to

estimate when these variations would occur and diverted capacity

towards more lucrative opportunities in the wholesale market

compared to a passive DS3 strategy. The combination of increased

trading activity and uncapped DS3 revenues, which exceeded

forecasts for both the Mullavilly and Drumkee assets during the

period, presents a promising opportunity for long-term increased

revenue.

Mullavilly began trading at 5 MW to test the frequency of

dispatches and opportunities for higher revenues. September

experienced almost a full month under this strategy before an

increase to 10 MW on 29 September. The initial findings represent a

potential 46% increase in revenue on a MW basis when compared to

the availability- adjusted DS3 only strategy utilising 5 MW in

isolation, equivalent to GBP1,100/MW upside in revenue from

exploiting low DS3 events and aligning them with wholesale value.

Post-period, the Company has scaled up its volumes accessing

wholesale markets as well as deploying the strategy to other assets

across the Irish portfolio.

Wind volumes will continue to play a key role as the single

Irish electricity market progresses towards net-zero targets.

During the period, information was released on the future

arrangements market reform starting in 2025, which will ultimately

transform the current DS3 market whilst ensuring sustainability and

security for consumers. The Company remains well positioned to deal

with changes in procurement mechanisms due to its experience in GB,

which has offered varying levels of procurement since the Company's

inception.

German market

Table 5

TSO 50 Hertz, Amperion, Tennet, Transnet

BW

--------------------------------------- ------------------------------------

German portfolio (operational) 22.0 MW / 29.0 MWh

--------------------------------------- ------------------------------------

Share of the market (MaStR) (50 Hertz) <1% (Germany), <5% (50 Hertz(3) )

--------------------------------------- ------------------------------------

Revenue during the period (GBP) 0.8m

--------------------------------------- ------------------------------------

Revenue per MW (GBP) 38,600 (GBP8.79/MW/hr)

--------------------------------------- ------------------------------------

Revenue per MWh (GBP) 29,300 (GBP6.67/MWh/hr)

--------------------------------------- ------------------------------------

EBITDA German grid % of Total EBITDA 3.5%

--------------------------------------- ------------------------------------

(3) MaStR database

Following spikes in FCR prices experienced over the previous FY

caused by shortages in gas supplies, the Company prepared for

normalisation of the gas market and a subsequent fall in FCR prices

by opening its German strategy to increased trading activity.

Over the period, the Cremzow asset was, therefore, optimised

using a blend of FCR and wholesale trading. This was particularly

effective across June to August, when FCR accounted for a lower

percentage of the revenue stack (c.25%), meaning wholesale markets

offered more flexibility and higher revenues.

Working with the newly-selected RTM provider in Germany has

exposed the Company to new methods of algorithmic wholesale

trading, allowing for higher frequency trading with the optionality

for positions to be deployed physically. This is demonstrated in

just under 50 GWh of energy capacity being traded during the

period, with only a fraction of that being charged/discharged from

the grid.

The asset was also prequalified for the "secondary reserve

service" aFRR towards the end of the period. This product has two

elements focused on energy (akin to FCR) and power, procured in

15-minute blocks. The additional revenue stream will be secured in

conjunction with wholesale trading and FCR upon delivery, which

will begin this fiscal year.

ERCOT market (Texas, US)

Table 6

TSO ERCOT

------------------------------------ ------------------------

ERCOT portfolio (operational) 29.85 MW / 59.7 MWh

------------------------------------ ------------------------

Share of the market (ERCOT) <1%(4)

------------------------------------ ------------------------

Revenue during the period (GBP) 5.1m

------------------------------------ ------------------------

Revenue per MW (GBP) 171,600 (GBP39.08/MW/hr)

------------------------------------ ------------------------

Revenue per MWh (GBP) 85,800 (GBP19.54/MWh/hr)

------------------------------------ ------------------------

EBITDA ERCOT grid % of Total EBITDA 28.2%

------------------------------------ ------------------------

(4) ERCOT September GIS report

The Texas assets also transitioned to a new RTM provider towards

the end of June 2023, a month that experienced the first heatwave

of the summer period. This resulted in RRS prices spiking to just

under $2,500/MW across the peak hours of multiple days in a row,

contributing to $800k generated in revenue over the full month of

June.

The selection of a new RTM allowed assets to provide a wider

suite of services and trading activity in the wholesale market.

This included the newly introduced ECRS, which requires two hours

of delivery and constituted a pivotal factor in the overall

performance of this period. Without transitioning to the new RTM,

it is unlikely the Company would have been exposed to this service

and would, therefore, have captured lower revenue.

As June heatwaves cooled into July, prices across ancillary

services returned to baseline levels as requirements were easily

satisfied. In August, however, temperatures increased to over

40degC (105degF) for sustained periods, with peak demand of over 85

GW reached due to increased use of air-conditioning, in particular.

With thermal generation (gas and coal) typically used to meet high

demand on annual maintenance or unable to come online due to

temperatures, the TSO went to the market for reserves (RRS, ECRS)

in the absence of interconnections with surrounding regions. As the

situation progressed throughout the month, ECRS clearing prices

moved from over $2,500/MW, given the low volume of providers

pre-qualified for the service, to reach a maximum of over

$4,000/MW.

The RTM adjusted the strategy to a blend of ECRS, RRS and

wholesale trading as calls for the new two-hour service grew,

ensuring the maximum value for delivering energy was achieved for a

given day. This allowed the Company's Texas assets to generate

$3.5m in August from just ECRS.

One final temperature spike early in September saw prices

achieve $2,000/MW before dropping away towards the end of the

period. The assets were able to deliver GBP5.1m in the first six

months of FY23/24 compared to GBP3.8m across the entire previous

the full financial year, equating to an 85% increase in revenue

compared to the same period in 2022.

The Company expects these market conditions to continue until

2025 on the basis that the availability of flexible capacity (15

GW) will remain consistent with the levels seen during the period

(14 GW in 2023)(5) . The Company has evaluated the expected load

profile over the coming two years and concluded that should the

necessary generation not come online to meet the increased demand

on the system from consumers, as the latest forecasts suggest,

ERCOT will experience frequent scarcity events. As seen during the

period, these scarcity events enable high battery revenues through

reserve services and wholesale volatility.

(5) Calculated based on Aurora Energy Research October 2023

ERCOT Flexible Energy Market Forecast Data

Table 7

1 April -

30 September

2023 % within

GBP(000s) grid % of portfolio

--------------------------------------- ------------- ---------- ----------------

GB - 109.7 MW / 101.0 MWh

--------------------------------------- ------------- ---------- ----------------

Ancillary Services 2,590 71%

--------------------------------------- ------------- ---------- ----------------

Capacity Market 618 17%

--------------------------------------- ------------- ---------- ----------------

Wholesale Trading 426 12%

--------------------------------------- ------------- ---------- ----------------

GB Total(6) 3,634 19%

--------------------------------------- ------------- ---------- ----------------

Ireland - 130.0 MW / 72.6 MWh

--------------------------------------- ------------- ---------- ----------------

DS3 Capped/Uncapped 9,480 97%

--------------------------------------- ------------- ---------- ----------------

Capacity Market 216 2.2%

--------------------------------------- ------------- ---------- ----------------

Wholesale Trading 32 0.3%

--------------------------------------- ------------- ---------- ----------------

Ireland total 9,728 50%

--------------------------------------- ------------- ---------- ----------------

Germany - 22.0 MW / 29.0 MWh

--------------------------------------- ------------- ---------- ----------------

Ancillary Services 303 36%

--------------------------------------- ------------- ---------- ----------------

Wholesale Trading 547 64%

--------------------------------------- ------------- ---------- ----------------

Germany Total(7) 849 4%

--------------------------------------- ------------- ---------- ----------------

ERCOT - 29.9 MW/59.7 MWh

--------------------------------------- ------------- ---------- ----------------

Ancillary Services 4,633 90%

--------------------------------------- ------------- ---------- ----------------

Wholesale Trading 490 10%

--------------------------------------- ------------- ---------- ----------------

ERCOT Total 5,123 27%

--------------------------------------- ------------- ---------- ----------------

Portfolio Total - 291.6 MW / 262.3 MWh 19,334

--------------------------------------- ------------- ---------- ----------------

Market Revenue GBP(000s) GBP/MW/hr GBP/MWh/hr

---------------- ----------------- --------- ----------

GB 3,634 7.54 8.19

---------------- ----------------- --------- ----------

Irish 9,728 17.04 30.51

---------------- ----------------- --------- ----------

German 849 8.79 6.67

---------------- ----------------- --------- ----------

ERCOT 5,123 39.08 19.54

---------------- ----------------- --------- ----------

Weight averages 15.10 16.78

---------------- ----------------- --------- ----------

September

June - end -

Total Revenue GBP(000s) quarter end quarter

------------------------ ---------- ------------

GB 1,859 1,775

------------------------ ---------- ------------

NI 3,552 5,413

------------------------ ---------- ------------

RoI 378 384

------------------------ ---------- ------------

Germany 340 509

------------------------ ---------- ------------

ERCOT 798 4,325

------------------------ ---------- ------------

TOTAL 6,929 12,406

------------------------ ---------- ------------

(6) The Company holds a 49% ownership interest in Cenin (4.0 MW)

and retains 49% of the generated revenue

(7) The Company holds a 90% ownership interest in Cremzow (22

MW) and retains 90% of the generated revenue, while Enertrag

maintains a minority stake in the asset

Asset Performance

The portfolio performed well with average availability

incorporating all commercial operations downtime, including planned

preventive maintenance, exceeding 95% across the reporting

period.

Great Britain:

Cenin, Lower Road, and Port of Tilbury achieved availability

above 99%, with Breach, Hulley, Larport and Lascar following

closely with over 97% availability on average. Ancala faced

challenges, with efforts underway to resolve issues at Heywood

Grange and Brook Hall. Boulby achieved lower availability during

the period, with ongoing initiatives for improvement.

Ireland (Northern Ireland and the Republic of Ireland):

In Ireland, all three operational assets-Mullavilly, Drumkee,

and Porterstown-consistently demonstrated high availability and

reliable performance during the reporting period. Mullavilly and

Drumkee in Northern Ireland achieved over 99% availability, with no

major risks identified. Porterstown maintained near-faultless

performance, achieving 100% availability.

Germany:

The Cremzow project, developed in two phases, encountered

availability issues primarily due to extended lead times for spare

parts related to the 2.0 MW pilot project. As necessary spares are

being procured and issues addressed, an increase in availability is

anticipated in the next reporting period.

Texas:

The projects in Texas-Snyder, Sweetwater, and Westover-exhibited

impressive resilience, achieving 94% availability despite high

temperatures. Inverter failures in September affected Snyder,

however, ongoing resolutions with suppliers are expected to rectify

the issue. Sweetwater maintained strong performance, achieving over

95% availability during the period, while a failed network switch

affected Westover's availability for a short time before additional

spares were procured to minimise future impacts.

Project progress overview

Great Britain (GB):

Stony was energised in September 2023.

Energisation and commencement of commissioning for Ferrymuir are

awaiting completion of the last remaining non--contestable work

packages carried out by Scottish Power Energy Networks, including

telecommunication and SCADA works. All other material

non-contestable works, including the Point of Connection circuit

breaker modification, have been completed. The slight delay to the

grid connection works program has been driven by resourcing

problems at the distribution network operator and the insolvency of

the main sub-contractor undertaking contestable works on behalf of

the Project.

Procurement, manufacturing, and delivery of key battery

components for Enderby are complete, with works progressing well on

site. The project is on track to meet its energisation target of

May 2024.

California:

The Big Rock asset in California is progressing well and, as of

the date of publication, is in construction. Contractors have been

mobilised, with the construction of civil engineering works

underway, and batteries have been delivered, with the first

enclosures shipped. Key high- voltage equipment for the substation

has been procured, manufactured and stored in project controlled

warehouses. The Investment Manager remains confident of the asset's

energisation date.

Texas:

Initial contracts have been signed, and design, as well as

procurement, has been kicked off for the advanced engineering and

delivery of a high-voltage grid connection customer substation for

Dogfish. Contracting for the battery system is nearing completion.

The project is progressing in accordance with the planned timeline,

aligning with the energisation target.

Ireland:

Transformer and civil engineering works for Porterstown Phase II

are complete, with detailed engineering and procurement for the

battery system underway. Despite a minor delay, energisation is

targeted for October 2024.

Kilmannock, designed to accommodate Phase I and II, has

finalised layout and earthworks designs. Consent updates are in

progress, and both phases remain on schedule.

Pre-Construction development (Middleton and Dallas &

Surrounds portfolio)

Pre-construction efforts at Middleton and the broader Dallas

& Surrounds portfolio (Mineral Wells, Mesquite, Wichita Falls,

and Cedar Hill) are progressing in accordance with grid

availability. The projects are on track to meet their respective

energisation targets.

There is an active exploration of site expansion across the

Company's existing portfolio, with an initial focus on capacity

(MW) expansions as this represents greater additional value in most

markets. The Investment Manager is also exploring and progressing

with opportunities for augmentation of assets with additional

duration (MWh) in specific locations where market signals support

the investment case.

Table 8

Project Target Energisation Capacity

----------------- ------------------- --------

Stony Energised 79.9 MW

----------------- ------------------- --------

Ferrymuir Jan - end 2024 49.9 MW

----------------- ------------------- --------

Enderby May - end 2024 57.0 MW

----------------- ------------------- --------

Porterstown Ph II Oct - end 2024 60.0 MW

----------------- ------------------- --------

Big Rock Dec - end 2024 200.0 MW

----------------- ------------------- --------

Dogfish Dec - end 2024 75.0 MW

----------------- ------------------- --------

Mineral Wells Jun - end 2025 9.95 MW

----------------- ------------------- --------

Mesquite Jun - end 2025 9.95 MW

----------------- ------------------- --------

Cedar Hill Jun - end 2025 9.95 MW

----------------- ------------------- --------

Wichita Falls Jun - end 2025 9.95 MW

----------------- ------------------- --------

Kilmannock Ph I H2 2025 30.0 MW

----------------- ------------------- --------

Kilmannock Ph II H2 2026 90.0 MW

----------------- ------------------- --------

Middleton H2 2026 200.0 MW

----------------- ------------------- --------

Q&A with Sumi Arima

Sumi Arima

CIO and CFO of Gore Street Capital, the Investment Manager

Q: What new revenue streams has the Company pursued during the

reporting period?

We sought out new RTM partners during the period to secure

additional opportunities and ultimately increase revenue generation

from the global portfolio.

Following the selection of a new RTM in Texas, the Company was

able to secure prequalification for ECRS, a daily procured

ancillary service introduced in June 2023. The first of the

Company's assets began providing ECRS on 29 July, and in the months

since, the Texas sites have been delivering portfolio- leading

revenue, including an average of GBP156/MW/hr in August alone -

totaling GBP3.5m for the month.

We have also entered day-ahead and real-time energy trading

markets in Texas as part of a more diverse strategy. The Company

has always had some capability in the real-time market, but this

has now been more fully enabled to create a more effective trading

strategy.

We were also able to select a data-driven RTM provider in

Germany and achieved prequalification to start delivering aFRR

post-period, in addition to continuing to provide FCR. Germany also

has the deepest wholesale market opportunity from the grids we are

active in by a significant margin and, therefore, is providing the

Company with unique insight into high-frequency trading. We have

been able to apply this knowledge to the strategies we are enacting

across the portfolio, which has been optimised across four energy

grids to maximise profitability while delivering a valuable

contribution to grid stability.

In Ireland, for example, there are periods where ancillary

services revenue is lower. We are, therefore, ensuring the

Company's assets are able to take advantage of wholesale trading as

a higher-value alternative revenue stream when appropriate.

Should the depth and additional liquidity come to the GB market,

as is expected in the coming years as more renewables are deployed,

we will be well placed to deploy this kind of strategy.

Q: How are the Company's operational assets in Texas delivering

value from the volatile market?

We've seen in recent years how volatility caused by weather

events in Texas has created massive demand for energy storage. The

Company's near 30 MW/60 MWh operational portfolio plays a

significant role in responding to these periods, which often

experience spikes in pricing up to $4,000 in ancillary services and

over $5,000 in real-time markets. Scarcity has the potential to

last for longer periods, as we saw this summer when the fleet

generated $1.7m across 24-27 August due to high temperatures

creating the same conditions on each day. Maintaining fleet

availability during these spikes has been a crucial means of

success for the Company's Texas assets, allowing material revenues

to be captured in a short period. From the beginning of June

through to the end of August, the Manager's in-house asset

performance team kept the three Texas assets at an average

availability rate of 94%, ensuring they could respond to the

increased volatility experienced on the ERCOT grid during heatwaves

experienced over this summer period.

These assets began delivering the ECRS service, which responds

to both losses of load on the ERCOT grid and ramping of load or

demand, often caused by changes in renewable generation. In summer

months, the change from daytime solar generation to evening

capacity is stark (often referred to as a duck curve due to the

shape of the evening net demand curve), and our assets are adding

resilience to the Texas grid by helping manage this transition.

While this ramping is not as prominent in winter due to reduced

daylight hours, we expect to see some revenue generation from the

changes in output from the state's fleet of wind turbines. These

months, however, have different requirements from the ERCOT energy

system, as cold snaps can result in failures across traditional

infrastructure. This increases volatility as the assets available

on the grid can attract higher prices for their deliverability,

creating opportunities for energy storage.

Q: How are the varying system durations across the portfolio

suited to the markets in which they operate?

GSF is unique in being the only listed vehicle with four

different durations within its portfolio: sub-30 minutes in

Northern Ireland, both 30 minutes and one hour in both the Republic

of Ireland and Great Britain, 90 minutes in Germany and two hours

in Texas, with a two-hour system to follow in California. For those

assets built on behalf of the Company, minimising capex has always

been a focus, and we have, therefore, sized their technical

capabilities to suit the revenues available in each market.

The Northern Ireland portfolio has illustrated the success of

this approach during the reporting period, earning

industry--leading revenues from the uncapped DS3 suite of ancillary

services from less than half an hour of energy delivery achieving

5.8x of the GB revenue in the period on a MWh basis.

The capabilities of the Company's two-hour operational Texas

assets have also proved advantageous following the introduction of

ECRS in June. This service requires providers to have two hours of

capacity reserved for delivery at all times, and while this could

be served by a one-hour system delivering half its capacity across

the period in which it is triggered, we have been able to utilise

the full pre-qualified capacity of 9 MW of the operational Texas

assets since they first entered the service on 29 July to secure

high revenues as an early pre-qualified asset.

The 200 MW/400 MWh size of the Big Rock asset in California is

strategically designed to enable the asset to qualify for the

Resource Adequacy (RA) mechanism, which requires four hours of

delivery. The asset has 100 MW of RA deliverability and will also

operate within ancillary services and wholesale trading markets

within California with 200 MW capacity.

To date, the Company has deployed optimal duration for the

markets in which it operates to avoid overspending on energy

storage systems with underutilised excess duration. In certain

markets, like GB, it is still not evident when the commercial

opportunity to utilise larger MWh capacity will materialise. Today

the opportunities aren't there to allow a trading strategy that

would justify the added expense of building longer duration

systems. The only other market to reward such systems in GB -

Dynamic Regulation - is significantly oversubscribed, reducing the

value than can be accrued to justify higher capex for larger

capacity. The Manager has ensured the Company is prepared for any

changes to these realities and maintains the flexibility to upgrade

assets if and when the market signals provide an incentive to do

so.

Q: You've spoken about diversification, but does it work?

For a largely merchant asset-class like energy storage,

diversification is a fundamental necessity to reduce revenue

volatility. Within Great Britain, opportunities to diversify are

limited due to uniform revenue streams and consistent wholesale

electricity prices across all regions. This uniformity results in

significant fluctuations in revenue year on year. Seasonal

variation also creates large fluctuations in quarterly revenue,

with Spring and Summer historically yielding higher revenues

compared to the Fall and Winter seasons.

The Company has always factored these revenue variations into

its decision making, which is why international diversification has

been a key strategic objective. Today, it is unique in holding

assets across five distinct and uncorrelated energy systems. This

enables the Company to navigate the challenges posed by individual

market fluctuations by accruing more stable and reliable revenue

generation throughout the year from multiple markets. This can be

seen in the Company's revenue over this reporting period, when

revenue from its GB fleet was GBP7.54 per MW/hr, compared with

GBP15.10 per MW/hr on a consolidated portfolio basis, representing

c.2x vs a GB-only portfolio.

Figure 3 in the 2023 Interim Report shows the standard deviation

in revenue generated per quarter since IPO by GSF's GB fleet, which

amounts to c.GBP 4.95 per MW/h. When analysing the consolidated

fleet, however, which also includes assets in Ireland, Germany and

Texas, this quarterly figure drops to GBP2.68 per MW/h. The

reduction of approximately 50% (post-FX) showcases the tangible

impact of diversification on revenue stability and, thus, the

Company's ability to sustainably pay dividends to its investors. As

the Company continues to build out new capacity outside of GB,

volatility in revenues is expected to reduce further.

Q: How is the Company's acquisition strategy delivering better

value for shareholders than alternatives?

The Company made a choice early on to acquire ready-to- build

projects - those with land rights, planning permission and a grid

connection all secured - where possible in order to manage the

buildout process leveraging the Investment Manager's in- house

technical teams. This ultimately leads to higher returns compared

to an operational asset purchase strategy due to the successful

management of the higher risk profile of construction projects,

which can be built at cost without a markup included in the

purchase price. In addition, the Company's strategy ensures the

best quality operational assets due to the tight controls in place

from start to finish while continually bolstering the knowledge and

expertise kept in the Investment Manager to be applied to future

projects.

As the Company's presence continues to grow in scale, it is able

to leverage its experience as an international owner to select

favourable markets and projects whilst also evaluating any

potentially advantageous capital recycling programs. The

composition of the international portfolio is, therefore,

continuously evaluated to ensure all capacity remains wedded to the

Company's goals.

Q: To what extent is the market saturation experienced in GB

emerging in other markets?

As a first mover, the Company factors in declining revenue

streams in all the markets it operates in as we understand new

entrants will follow and place downward pressure on prices. This

has been seen in GB every two to three years since 2017, generally

driven by new project lead times, and leaves the market's 3 GW

operational fleet competing over reducing revenues. The reductions

seen in ancillary services prices over the reporting period are a

strong indication this saturation is tightening.

The Company has been deploying capacity in other markets to

increase access to a wider range of revenue streams. The early

moves into these markets allowed the Company to establish itself

ahead of others, who are likely to face high barriers of entry and

lack the experience operating in such markets that the Manager has

built up over the past two years.

In the single integrated Irish grid, for example, which remains

a nascent market, connection delays and limitations on grid needs

for new capacity means for those already operating assets,

saturation is not an immediate concern. The potential for more

frequent procurement of ancillary services following the retirement

of the DS3 program bodes well for the Company, which will be able

to leverage its experience in other markets with competitive

auctions and shorter-term contracts.

Concerns over the potential for market saturation in the ERCOT

market in Texas, given the rapid deployment of energy storage in

recent years, fail to consider the scale of renewables capacity

planned for the coming years, alongside the retirement of

traditional thermal generation.

Wind and solar generation, which is already being curtailed in

the state, could more than double from 50 GW at the end of 2022 to

104 GW(8) by 2035, ensuring an ongoing need for energy storage

through services like ECRS. It is not a correct comparison to judge

energy storage growth in ERCOT against today's ancillary service

needs, which will only grow as the system continues to

decarbonise.

The continued cycle of extreme weather events witnessed in Texas

in recent years adds to this need. Price spikes continue to

increase as each heatwave causes increasing demand for supply

resources to serve both the ancillary services and energy

markets.

As with ECRS, more opportunities will always emerge for energy

storage, including in GB, where the full suite of ancillary

services has yet to be deployed. Procurement levels for the 2024

introduction of quick and slow reserve have yet to be revealed, but

these new services could help reduce the current market saturation.

Additional reforms planned for the Balancing Mechanism and a

subsequent shift in merchant trading opportunities may also help

alleviate the revenue issues seen in GB. These upcoming market

drivers could reduce downward pressure on prices as more

opportunities for market participants emerge, increasing demand for

energy storage.

We would expect to see this cycle of tightening market

saturation restricting new entrants, followed by more opportunities

for existing market players, in every market.

(8) Aurora EOS:

https://eos.auroraer.com/dragonfly/insights/region/erc/home/content/2102

Q: How is the Company managing its cash flow and future

deployments?

The scale of the Company's international portfolio and

assessment of potential pipeline opportunities requires a prudent

approach to capital deployment. Despite the diversified assets

generating cashflows, the Company must strategically prioritise

asset buildouts, taking into account capital requirements, contract

structures and expected returns to contribute to dividend cover

once operational.

As at period-end, the Company and its subsidiaries had GBP89m of

cash and cash equivalents and a GBP50m Revolving Credit Facility

("RCF") with Santander, which are sufficient to cover its

contractual obligations of c. GBP64m. The RCF also features an

accordion option to increase beyond GBP50m to up to 30% of Gross

Asset Value ("GAV").

Post-period, the Company secured a $60m loan facility from First

Citizens Bank. The Investment Manager intends to draw down from

this loan to optimise returns through the construction of the 200

MW Big Rock asset in CAISO, which is expected to be backed by up to

40% of contracted revenues.

The Company is continuously monitoring the use of debt given its

prevailing costs and intends to make drawdowns only when it is

advantageous to do so. As at 30 September, gearing stood at 0% of

GAV. The Investment Manager has been incrementally making use of

the competitively priced First Citizens loan since the period

end.

NAV Overview & Drivers

Cash generation during the reporting period was GBP14m.

Net Asset Value (NAV) movements during the period reflected the

macroeconomic context in which the Company is operating.

Adjustments in inflation assumptions and an increase to discount

rates (+25bps across the portfolio), required to ensure the

Company's valuation assumptions remained aligned with the

prevailing macroeconomic environment, resulted in a GBP19m

reduction in NAV. Revenue forecasts were updated to reflect the

current pricing trends in GB, resulting in an additional GBP4m

reduction in NAV.

Positive drivers of NAV during the period included the Company

achieving key milestones for portfolio assets under construction.

As the assets are de-risked through stages of construction,

discount rates are naturally unwound to reflect the updated risk

profile. During the period this resulted in an NAV uplift of GBP6m.

Operational expenditure savings achieved during the period also

provided a material GBP8m uplift to NAV.

A further increase of GBP4m was due to other Discounted Cash

Flow (DCF) changes, including updated repowering assumptions and,

due to the proportion of construction assets, the rollover across

the portfolio added to the net positive effect on NAV.

Table 9

Construction

and

FV Breakdown by Grid (in GBPm) pre-construction Operation

------------------------------- ----------------- ---------

GB 151.9 43.6

------------------------------- ----------------- ---------

Ireland 13.9 74.6

------------------------------- ----------------- ---------

Germany n/a 14.0

------------------------------- ----------------- ---------

ERCOT 12.5 20.7

------------------------------- ----------------- ---------

CAISO 140.6 n/a

------------------------------- ----------------- ---------

Revenue Forecasts

GB:

GB's updated third-party revenue forecasts have been reflected

with a central blend of forecasts and have seen a decrease in

forecasted prices driven by the current drop in market prices. The

prior application of prudent valuation assumptions has largely

mitigated the effect of lower third-party curves.

IRE:

Updated third-party revenue forecasts reflecting a central blend

of forecasts were used. The net effect of the updated curves on the

Irish portfolio was an uplift compared to the previous financial

year-end.

The Porterstown asset in the Republic of Ireland has secured a

Capacity Market contract for the period from September 2023 to

October 2024, which was reflected in the valuations.

GER:

Updated central case scenario third-party revenue forecasts were

used in the model, creating an uplift in the German asset's

valuation. The application of a hybrid business model curve

(ancillary services & trading) supported this uplift. The

adoption of this hybrid curve followed the German asset's material

participation in the trading market during the reporting

period.

ERCOT:

Updated third-party central case scenario forecasts have been

applied to the models and did not cause material changes in price

levels.

CAISO:

Third-party base case scenario merchant revenue forecasts have

been updated and, similar to ERCOT, did not have material changes

in price levels.

Table 10: MW Capacity by Grid in Respective

Years

2023 2024 2025 2026

-------------------------------------------- ---- ---- ---- ----

GB 190 297 297 497

-------------------------------------------- ---- ---- ---- ----

ERCOT 30 105 145 145

-------------------------------------------- ---- ---- ---- ----

CAISO 0 200 200 200

-------------------------------------------- ---- ---- ---- ----

GER 22 22 22 22

-------------------------------------------- ---- ---- ---- ----

NI 100 100 100 100

-------------------------------------------- ---- ---- ---- ----

RoI 30 90 120 210

-------------------------------------------- ---- ---- ---- ----

Inflation

The inflation assumptions have been updated to reflect a

decrease in inflation throughout 2023 and 2024 compared to the

assumptions at the previous financial year end. The long-term

inflation assumption remains consistent with those disclosed

previously.

Table 11

CPI Assumptions 2023 2024 2025+

---------------- ----- ----- -----

GB 4.63% 2.75% 2.50%

---------------- ----- ----- -----

EUR 3.11% 2.75% 2.50%

---------------- ----- ----- -----

US 3.31% 2.75% 2.50%

---------------- ----- ----- -----

Discount rates

The weighted average discount rate across the portfolio was

10.3% (10.1% in FY23 end) as at 30 September. A 25 bps increase was

applied to discount rates across the portfolio, reflecting the

increased risk-free rate. For relevant assets, construction premia

have been reduced in line with major construction milestones

completed.

Table 12

Pre-construction Construction Energised

Discount Rate Matrix phase phase phase

--------------------- ---------------- ------------ ----------

Contracted Income 10.40-11.00% 9.25-10.25% 7.25-9.25%

--------------------- ---------------- ------------ ----------

Uncontracted Income 10.40-11.00% 9.25-10.25% 8.75-9.25%

--------------------- ---------------- ------------ ----------

MW 694.8 106.9 371.5

--------------------- ---------------- ------------ ----------

Opex

The Investment Manager's experienced in-house asset management

team enables the portfolio assets to benefit from lower costs and

increased technical supervision.

Material operating expenditure savings were achieved during the

period by taking several third-party services in-house, including

asset management and certain O&M workstreams for operational

Irish assets; asset management for Cenin, Stony, Enderby, and

Ferrymuir in GB; and RTM fee reductions for the Texas operational

portfolio.

Newly executed contracts with opex impacts have been reflected

in the US assets' models, such as insurance and substation

facilities expenses.

Capex

Repowering curve assumptions have been updated, reflecting a

slight increase in the long-term forecast of battery prices.

However, the Company's assets have a significant portion of their

useful life left before they are scheduled to be repowered.

For relevant construction assets, the upfront capex schedules

have been revised based on developing discussions with

contractors.

Sensitivities

NAV sensitivities were applied to analyse the impact of changes

in macroeconomic factors and key valuation assumptions on the NAV

of the portfolio. The following sensitivities were applied:

a. Inflation rate: +/- 1.0%

b. FX volatility: +/- 3.0%

c. Discount rate: +/- 1.0%

d. EPC costs +/- 10.0%

Outlook Message from Alex O' Cinneide

Dr Alex O'Cinneide

CEO of Gore Street Capital, the Investment Manager

CEO Statement

I am pleased to report that the Company's strategy, enabled by

the active role of the Investment Manager, despite difficult stock

market conditions, has allowed the business to continue to

overachieve during a challenging period. Since inception, it has

generated a 20% per annum cash yield over invested capital, and

during the September end quarter, the Company delivered an

operational dividend cover of 1.15x. This positive trajectory is

reflected in portfolio performance, which maintained the highest

revenue on both a per MW and absolute basis among our listed peers

during the period. This was achieved through diversification, with

assets in Ireland, Texas and Germany overachieving against base

case. The slight decrease in NAV is wholly due to changes in the

discount rate and inflation assumptions, with high-interest rates

expected to continue, and does not reflect the exemplary

performance of the Company's commercial operations. With a NAV

Total Return of 48.8% since IPO, an excellent balance sheet given

our minimal level of debt, and a strong cash position, the Company

remains in a compelling and sustainable position.

While we expect energy storage to continue to play a crucial

role in the decarbonisation of GB, the growth of the market in just

a short number of years has resulted in new entrants exceeding

demand for their services. The expected market saturation we are

currently experiencing caused reduced prices during the reporting

period, particularly in the summer months.

Due to the international spread of the Company's operational

assets, these market dynamics did little to impact the industry-

leading revenues that were achieved during the period, in part, by

tackling volatility caused by the climate crisis.

Heatwaves have become a predictable feature of summer months in

Texas, as seen by the record-breaking temperatures experienced

across the latest reporting period. As power demand achieved new

heights across the state, the Company's operational portfolio in

the ERCOT market was able to capture value from price spikes as

high as $4,000/MW/hr while supporting the constrained grid system

to deliver capacity when needed most. Early prequalification for

the new ECRS service allowed the Company to reach average monthly

revenues of GBP156/MW/h in Texas in August, with its three

operational assets generating GBP3.46m in August alone.

This first mover mentality continues to pay off in the single

integrated Irish electricity market, where the Company was among

the first to establish itself with the DS3 program.

While DS3 services have proven effective in responding to the

needs of an increasingly decarbonised grid, the structure of future

delivery of ancillary services is uncertain after the Irish

transmission system operators and regulator set out proposals to

reform the suite of ancillary services in the reporting period. The

Investment Manager is already engaging in the development of this

process to safeguard future revenue streams for the Company's

assets.

In addition to these ancillary service activities across the

portfolio, the assets have also derived additional value from the

wholesale market as trading opportunities became more frequent.

While the Company has always taken a realistic view of the

emergence of trading as a dominant revenue stream for energy

storage, the reporting period has shown we are ready to act on any

opportunity as it arises. With the support of new and existing