GlaxoSmithKline PLC Adjusted Free Cash Flow Performance Measure (7999U)

01 August 2015 - 2:22AM

UK Regulatory

TIDMGSK

RNS Number : 7999U

GlaxoSmithKline PLC

31 July 2015

GlaxoSmithKline plc

(the 'Company')

Adjusted Free Cash Flow Performance Measure for 2015-17

awards

under GlaxoSmithKline Share Plans

GSK has today set out the Adjusted Free Cash Flow (AFCF)

Performance Measures for the conditional award of shares under the

Group's Performance Share Plan and Deferred Annual Bonus Plan for

the period 2015-2017. Conditional awards are subject to the

achievement of three equally weighted performance measures:

1) Total Shareholder Return (TSR)

2) R&D new product performance

3) Adjusted Free Cash Flow (AFCF)

The use of cash flow as a performance measure is intended to

recognise the importance of effective working capital management

and of generating cash to fund the Group's operations, investments,

and ordinary dividends to shareholders.

Details of the TSR and R&D new product performance measures

were set out in an announcement on 12 February 2015 and in the

company's Annual Report. At the time of the grant it was determined

that, given the transformational nature of the three-part

transaction with Novartis, the AFCF measure and associated vesting

levels would be established following the completion of the

transaction.

In considering the AFCF performance measures for the period

2015-17, the Remuneration Committee has considered GSK's future

business performance and the scale of restructuring triggered by

the Novartis transaction across the Group's three businesses.

As a result, the Remuneration Committee has determined a

threshold performance level for AFCF of GBP11.5 billion over the

period 2015-17. This level reflects an estimated reduction of

GBP2.2 billion due to currency movements for the period 2015-17

compared to 2014-16.

In addition, in order to fully assess disciplined use of

restructuring funds over the period 2015-2017, the Remuneration

Committee has decided to exclude the costs and associated capital

expenditure for the Group's restructuring and integration

programmes, triggered by the Novartis transaction, from the AFCF

used to set the performance measures. The Committee has set a

specific target of GBP3.3 billion for this restructuring and

capital expenditure.

The vesting schedule is as outlined below:

Performance Level Adjusted Free Cash Proportion Vesting

Flow (GBPbillions) %

------------------- -------------------- -------------------

Below threshold <11.5 0%

------------------- -------------------- -------------------

Threshold 11.5 25%

------------------- -------------------- -------------------

11.9 50%

------------------- -------------------- -------------------

13.0 75%

------------------- -------------------- -------------------

Maximum 13.6 100%

------------------- -------------------- -------------------

V A Whyte

Company Secretary

31 July 2015

This information is provided by RNS

The company news service from the London Stock Exchange

END

MSCPKDDBABKDKON

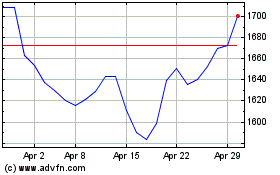

Gsk (LSE:GSK)

Historical Stock Chart

From Apr 2024 to May 2024

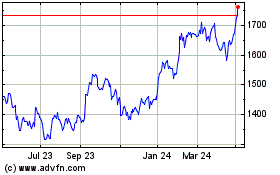

Gsk (LSE:GSK)

Historical Stock Chart

From May 2023 to May 2024