TIDMGWMO

RNS Number : 4574N

Great Western Mining Corp. plc

30 September 2021

Great Western Mining Corporation PLC

("Great Western", "GWM" or the "Company")

Half Yearly Report and Unaudited Condensed Financial

Statements

Financial Highlights:

-- Loss for period EUR427,590 (30 June 2020: loss of EUR487,441 )

-- Basic and diluted loss per share 0.0001 cent: (30 June 2020: 0.0004 cent)

-- Net assets at 30 June 2021: EUR8,711,124 (30 June 2020: EUR6,449,718)

-- Issue of new shares raised GBP1,085,400 ( EUR1,250,449)

-- Strong cash position at date of this report

Operational Highlights:

-- Completion of first ever drilling at the Rock House Group

o Six holes drilled at the Southern Alteration Zone ("SAZ")

totalling 1,685 feet (515 metres)

-- Completion of first-phase drilling programme for gold and

silver at the Olympic Gold Project

o Eleven holes across four target areas

-- Appointment of Gemma Cryan as a Non-Executive Director

o Adding extensive background in mineral exploration and

geology

-- Test results indicate gravity separation to be a viable

production method for processing material from Mineral Jackpot

spoil heaps

-- 51 spoil heaps now identified covering 14,000m(2)

-- Consultant Metallurgist engaged to prepare specifications and

detailed costing for proposed processing operations

Post period End:

-- Results of Trafalgar Hill and West Ridge drilling programme

o High grade intercepts of up to 8.90 grams/tonne gold

achieved

o Drilling results support the potential for target

expansion

-- Rock House and Olympic Gold Drilling Results

o Major gold breakthrough at Rock House in virgin territory

o Best intercepts of 8.02 grams gold per tonne and 2.29 grams

gold per tonne

o Continuation of OMCO vein mineralisation identified at Olympic

Gold east of faulted zone

Brian Hall, Executive Chairman, commented : "This was an

extremely productive period for the Company as we made significant

progress across a number of our projects, with drilling and

subsequent results highlighting the potential for precious metals

over our large portfolio of assets in Nevada. We are focused on

fast-tracking the exploitation of precious metals to achieve early

gold and silver sales and are well funded both to extend our drill

programme and to finance the first phase of a processing plant for

spoil heap material."

For Further Information:

Great Western Mining Corporation PLC

Brian Hall, Chairman Via Walbrook PR

Max Williams, Finance Director

Davy (NOMAD, Euronext Growth Adviser

& Joint Broker)

John Frain +353 1 679 6363

Novum Securities (Joint Broker)

Jon Belliss +44 207 399 9400

ETX Capital (Joint Broker)

Thomas Smith +44 207 392 1494

Walbrook PR (PR advisers)

Nick Rome/Nicholas Johnson +44 207 933 8783

Interim Report

For the six months to 30 June 2021

Please find herewith Great Western Mining Corporation PLC's half

year, unaudited financial statements for the period ended 30 June

2021. Great Western is a mineral exploration and development

company which is not yet generating revenues and is therefore

reporting a net loss for the period of EUR427,590 (30 June 2020:

EUR487,441; 31 December 2020: EUR852,042), reflecting a reduction

on administrative expenses over the comparative period. The Company

has no borrowings or other debt beyond creditors in the normal

course of business and at the period end, net current assets were

EUR8.7 million.

During the period, the Company raised approximately GBP1.1

million cash through the issue of new shares, providing the

flexibility to extend its exploration activity beyond its firm 2021

drilling programme.

The Company has a land position of approximately 60km(2) in the

prolific Walker-Lane trend in Mineral County, Nevada where it has

already established an inferred copper resource and is currently

focusing its attention on the potential for commercial deposits of

gold and silver. The Covid pandemic has created some challenges,

particularly for Trans-Atlantic travel and availability of local

labour, but the Company has generally been able to meet them

successfully and proceed with its active exploration programme

largely unhindered, with the finance in place to do so.

Drilling Operations

During the year to date, Great Western has completed a 17-hole,

3,000 metre drill programme in pursuit of precious metals, covering

four separate prospects as well as sub-prospects. Although the

Company has previously carried out extensive drilling for copper

and established a copper resource, the 2021 drill programme is the

first that it has undertaken specifically for precious metals and

the results have been very encouraging.

Prospects drilled so far this year are: Trafalgar Hill (Olympic

Gold Project), OMCO Mine Area and OMCO Mine Extension (Olympic Gold

Project), West Hill (Olympic Gold Project) and Southern Alteration

Zone (Rock House Group of Prospects) with best assay results of

8.90 grams/tonne Au at Trafalgar Hill and 8.02grams/tonne Au at the

Southern Alteration Zone. All the prospects that have now been

drilled merit follow-up drilling, plans for which are now firm but

start of which will depend on rig availability in a currently very

tight market.

In 2020, Great Western acquired an option to purchase the

Olympic Gold Project for a total cost of $250,000 payable over 4

years together with a royalty over future production and the

options of (1) prepaying to complete an earlier acquisition or (2)

relinquishing at any time during the 4-year option period. In the

16 months since this agreement was signed, the Company has moved

forward rapidly to explore the area and it has now become a core

component of the asset portfolio, which the Board believes holds

great potential for the Company. In May 2021, the Company paid the

first anniversary option payment of $25,000 to extend the agreement

for another year.

The Rock House Group had never been drilled until this year and

its prospectivity was worked up by the Company's team based on

satellite imagery, followed by soil sampling, trenching and desktop

studies. As such this was quite high a risk venture but yielded

reportable grades of gold in all six holes, with two holes

delivering good grades.

The remaining phase 1 drill projects for this year, at Mineral

Jackpot and the M4 copper prospect, depend on the availability of a

track-mounted reverse circulation rig which the Company has

identified, to overcome access problems.

Processing Operations

At the end of 2020 the Company produced a small doré bar from

spoil heaps at one of the five old, abandoned gold and silver mines

which make up the Mineral Jackpot Group, proving the viability of

recovering precious metals from spoil heaps close to the Mineral

Jackpot group of mines. As a result of further measurements during

2021, the number of spoil heaps identified has been increased to 51

and the estimate of the area covered by those spoil heaps increased

to approximately 14,000m(2). A load of the same material was

air-freighted to a specialised laboratory in the UK for a 4-month

analysis which concluded that precious metals could most

effectively be recovered via a relatively simple gravity processing

method. A consultant metallurgist engaged by the Company has now

provided detailed design and economics for this plant which will

most likely be simplified to produce a concentrate for sale to a

refinery, rather than pouring precious metals in a remote location

with associated high security risks.

Surface samples from the spoil heaps are currently being

analysed in a laboratory to verify the viability of the planned

processing operation. An outstanding issue is the proposed upgrade

of part of a mountain road which will enable a suitable rig to

access the site for exploration drilling and the upgraded road but

which would also enable delivery of material from spoil heaps for

the proposed processing operations.

The Company also has access to significant tailings at the

Olympic Gold Project, left over from producing operations at the

OMCO Mine, together with a stockpile of material which has never

been processed. Again, surface samples from the tailings are

currently being analysed in a laboratory and a two-man portable rig

will be used to drill the tailings in order to obtain more detailed

assay results and to determine the volume of the heap. Initial

indications suggest that a cyanide-leaching procedure could produce

a profitable revenue stream for the Company from the tailings in

the future, while the stockpile of unprocessed material could

potentially be amalgamated with the Mineral Jackpot gravity

separation project.

Gold mines take time to develop but the tailings, spoil heaps

and stockpiles represent materials which have already been mined

and Great Western is seeking to exploit these assets to achieve

early revenues in the most effective and economical way.

Copper Projects

On the Black Mountain group of claims, the Company has already

generated an inferred resource of 4.3 million tonnes copper at a

grade of 0.45%, through approximately 5,000 metres of drilling. The

Board considers that there is potential for a major copper porphyry

on its claims but that it is too large a project for the Company to

carry on its own. It is therefore actively seeking a larger partner

to join this venture, with the financial and technical resources to

take it to the next stage. At East Mine claims, which have been

identified as another potential copper target, the Company is

waiting on contractor availability to conduct an induced

polarisation survey.

Other exploration activities

During the period, the Company completed a magnetometer survey

over the accessible part of Mineral Jackpot and has located a drone

survey company to conduct an aerial magnetometer survey over the

less accessible portion of the acreage. The drone survey, merged

with the land-based magnetometer survey already completed, will

provide a greatly enhanced picture of the various prospects at

Mineral Jackpot.

Corporate

Earlier this month Great Western held an Investor-meet-Company

online session to ensure better shareholder engagement and this

means of communication is expected to be repeated. The session was

based around an updated Company presentation which is available on

www.greatwesternmining.com. The presentation sets out not only the

work currently in progress but also contains an appendix which

describes all the Company's inventory of multiple prospects for

gold, silver and copper, including those on which work has yet to

commence.

The Company is pleased to welcome Ms. Gemma Cryan to the Board

as a non-executive director, an experienced Mineral Exploration

Geologist who serves as Geology Manager at Greatland Gold PLC and

is an executive director at Starvest PLC, a mining investment

company. As the Company has a small team, the strong support of the

non-executive directors is invaluable to management and during the

short time Gemma Cryan has been with the Company, she has already

made an important contribution to its activities.

Looking ahead, the next phase of drilling is ready to start as

soon as suitable rigs become available in the current tight market

post-Covid. Plans will be developed for processing existing mined

materials as soon as possible, with updates being provided as

milestones are reached.

The Board would like to thank shareholders for their continuing

support and will ensure that regular communications are provided

around significant developments.

Unaudited Condensed Consolidated Income Statement

For the six months to 30 June 2021

Notes Unaudited Unaudited Audited

six months six months year

ended ended ended

30 Jun 30 Jun 31 Dec

2021 2020 2020

EUR EUR EUR

Continuing operations

Administrative expenses (427,703) (487,621) (852,270)

Finance income 4 113 180 228

------------------ ------------------ ------------------

Loss for the period before

tax (427,590) (487,441) (852,042)

Income tax expense 5 - - -

------------------ ------------------ ------------------

Loss for the financial period (427,590) (487,441) (852,042)

Loss attributable to:

Equity holders of the Company 3 (427,590) (487,441) (852,042)

================== ================== ==================

Loss per share from continuing

operations

Basic and diluted loss per

share (cent) 6 (0.0001) (0.0004) (0.001)

================== ================== ==================

All activities derived from continuing operations. All losses

are attributable to the owners of the Company.

Unaudited Condensed Consolidated Statement of Other

Comprehensive Income

For the six months to 30 June 2021

Notes Unaudited Unaudited

six months six months Audited

ended ended year ended

30 Jun 30 Jun 31 Dec

2021 2020 2020

EUR EUR EUR

Loss for the financial period (427,590) (487,441) (852,042)

Other comprehensive income

Items that are or may be reclassified

to profit or loss:

Currency translation differences 183,588 17,507 (512,730)

------------ -------------- ---------------

183,588 17,507 (512,730)

Total comprehensive expense for the

financial period

attributable to equity holders of

the Company (244,002) (469,934) (1,364,772)

============ ============== ===============

Unaudited Condensed Consolidated Statement of Financial

Position

For the six months to 30 June 2021

Notes Unaudited Unaudited

six months six months Audited

ended ended year ended

30 Jun 30 Jun 31 Dec

2021 2020 2020

Assets EUR EUR EUR

Non-current assets

Property, plant and equipment 9 68,781 73,999 66,612

Intangible assets 10 6,448,102 6,159,987 5,898,940

------------- ------------- ---------------

Total non-current assets 6,516,883 6,233,986 5,965,552

Current assets

Trade and other receivables 8 263,982 77,557 99,904

Cash and cash equivalents 9 2,714,948 430,952 2,287,172

------------- ------------- ---------------

Total current assets 2,978,930 508,509 2,387,076

Total assets 9,495,813 6,742,495 8,352,628

============= ============= ===============

Equity

Capital and reserves

Share capital 12 357,751 165,796 307,071

Share premium 12 13,572,027 10,271,969 12,543,606

Share based payment reserve 294,132 515,561 559,420

Foreign currency translation

reserve 204,761 551,410 21,173

Retained earnings (5,717,547) (5,055,018) (5,511,645)

------------- ------------- ---------------

Attributable to owners of

the Company 8,711,124 6,449,718 7,919,625

Total equity 8,711,124 6,449,718 7,919,625

Liabilities

Current liabilities

Trade and other payables 11 784,689 292,777 433,003

------------- ------------- ---------------

Total current liabilities 784,689 292,777 433,003

Total liabilities 784,689 292,777 433,003

Total equity and liabilities 9,495,813 6,742,495 8,352,628

============= ============= ===============

Unaudited Condensed Consolidated Statement of Changes in

Equity

For the six months to 30 June 2021

Notes Share Foreign

based currency

Share Share payment translation Retained

capital premium reserve reserve earnings Total

EUR EUR EUR EUR EUR EUR

Balance at 1

January 2020 112,205 9,687,151 435,962 533,903 (4,535,134) 6,234,087

Comprehensive

income for

the period

Loss for the period - - - - (487,441) (487,441)

Currency translation

differences - - - 17,507 - 17,507

------------------ ------------------ ------------------ ------------------ ------------------ --------------

Total comprehensive

income for the

period - - - 17,507 (487,441) (469,934)

Transactions with owners,

recorded

directly in equity

Shares issued 53,591 584,818 - - (32,443) 605,966

Share options charge - - 79,599 - - 79,599

Total

transactions

with owners,

recorded

------------------ ------------------ ------------------ ------------------ ------------------ --------------

directly in

equity 53,591 584,818 79,599 - (32,443) 685,565

Balance at 30

June 2020 165,796 10,271,969 515,561 551,410 (5,055,018) 6,449,718

================== ================== ================== ================== ================== ==============

Unaudited Condensed Consolidated Statement of Changes in

Equity

For the six months to 30 June 2021

Notes Share Foreign

based currency

Share Share payment translation Retained

capital premium reserve reserve earnings Total

EUR EUR EUR EUR EUR EUR

Balance at 1

July 2020 165,796 10,271,969 515,561 551,410 (5,055,018) 6,449,718

Comprehensive

income for

the period

Loss for the period - - - - (364,601) (364,601)

Currency translation

differences - - - (530,237) - (530,237)

------------------ ------------------ ------------------ ------------------ ------------------ -----------------

Total comprehensive

income for the

period - - - (530,237) (364,601) (894,838)

Transactions with owners,

recorded

directly in equity

Shares issued 141,275 2,096,103 - - (108,047) 2,129,331

Share warrants granted - - 25,521 - (25,521) -

Share warrants exercised - 175,534 (11,815) - - 163,719

Share warrants terminated - (41,542) - 41,542 -

Share options charge - - 71,695 - - 71,695

Total

transactions

with owners,

recorded

------------------ ------------------ ------------------ ------------------ ------------------ -----------------

directly in

equity 141,275 2,271,637 43,859 - (92,026) 2,364,745

Balance at 31

December 2020 307,071 12,543,606 559,420 21,173 (5,511,645) 7,919,625

================== ================== ================== ================== ================== =================

Unaudited Condensed Consolidated Statement of Changes in

Equity

For the six months to 30 June 2021

Notes Share Foreign

based currency

Share Share payment translation Retained

capital premium reserve reserve earnings Total

EUR EUR EUR EUR EUR EUR

Balance at 1

January 2021 307,071 12,543,606 559,420 21,173 (5,511,645) 7,919,625

Comprehensive

income for

the period

Loss for the period - - - - (427,590) (427,590)

Currency translation

differences - - - 183,588 - 183,588

------------------ ------------------ ------------------ ------------------ ------------------ --------------

Total comprehensive

income for the

period - - - 183,588 (427,590) (244,002)

Transactions with owners,

recorded

directly in equity

Shares issued 50,680 1,028,421 - - (69,206) 1,009,895

Share warrants granted - - 20,709 - (20,709) -

Share options exercised - - (4,777) - 4,777 -

Share options reserve

transfer - - (306,826) - 306,826 -

Share options charge - - 25,606 - - 25,606

Total

transactions

with owners,

recorded

------------------ ------------------ ------------------ ------------------ ------------------ --------------

directly in

equity 50,680 1,028,421 (265,288) - 221,688 1,035,501

Balance at 30

June 2021 357,751 13,572,027 294,132 204,761 (5,717,547) 8,711,124

================== ================== ================== ================== ================== ==============

Unaudited Condensed Consolidated Statement of Cash Flows

For the six months to 30 June 2021

Notes Unaudited Unaudited Audited

six months six months period

ended ended ended

30 Jun 30 Jun 31 Dec

2021 2020 2020

EUR EUR EUR

Cash flows from operating

activities

Loss for the period (427,590) (487,441) (852,042)

Adjustments for:

Depreciation - 2,803 3,733

Interest receivable and

similar income (113) (180) (228)

Movement in trade and

other receivables (164,078) 17,386 (4,961)

Movement in trade and

other payables 56,619 (57,657) (72,067)

Equity settled share-based

payment 25,606 79,599 151,294

---------------- ------------------------- ---------------

Net cash flows from operating

activities (509,556) (445,490) (774,271)

Cash flow from investing

activities

Expenditure on intangible

assets (263,497) (35,393) (196,982)

Interest received 113 180 228

---------------- ------------------------- ---------------

Net cash from investing

activities (263,384) (35,213) (196,754)

Cash flow from financing

activities

Proceeds from the issue

of new shares 1,250,449 638,409 3,130,705

Commission paid from the

issue of new shares (69,206) (32,443) (140,490)

---------------- ------------------------- ---------------

Net cash from financing

activities 1,181,243 605,966 2,990,215

Increase in cash and cash

equivalents 408,303 125,263 2,019,190

Exchange rate adjustment

on cash and

cash equivalents 19,473 (986) (38,693)

Cash and cash equivalents

at beginning

of the period 10 2,287,172 306,675 306,675

Cash and cash equivalents

at end of

the period 10 2,714,948 430,952 2,287,172

================ ========================= ===============

Unaudited Notes to the Condensed Financial Statements

For the six months to 30 June 2021

1. General information

Great Western Mining Corporation PLC ("the Company") is a

company domiciled in the Republic of Ireland. The Half Yearly

Report and Unaudited Condensed Consolidated Financial Statements

('the half yearly financial statements') of the Company for the six

months ended 30 June 2021 comprise the results and financial

position of company and its subsidiaries ("the Group").

The Group half yearly financial statements were authorised for

issue by the Board of Directors on 29 September 2021.

Basis of preparation

The half yearly financial statements for the six months ended 30

June 2021 are unaudited. The financial information presented herein

does not amount to statutory financial statements that are required

by Chapter 4 part 6 of the Companies Act 2014 to be annexed to the

annual return of the company. The statutory financial statements

for the financial year ended 31 December 2020 were annexed to the

annual return and filed with the Registrar of Companies. The audit

report on those financial statements was unqualified.

The Group half yearly financial statements have been prepared in

accordance with International Financial Reporting Standards

("IFRS") as adopted by the European Union ("EU").

The financial information contained in the half yearly financial

statements have been prepared on the historical cost basis, except

for the decommissioning provision, share-based payments and

warrants, which are based on fair values determined at the grant

date. The accounting policies have been applied consistently in

accordance with the accounting policies set out in the annual

report and financial statements for the year ended 31 December 2020

except as outlined below.

Accounting policies

The accounting policies adopted are consistent with those of the

annual Financial Statements for the year ended 31 December 2020.

New and amended standards that became applicable for the Group in

the current reporting period have not resulted in changes to

accounting policies or retrospective adjustments.

Use of estimates and judgements

The preparation of half-yearly financial statements in

conformity with IFRS requires management to make judgements,

estimates and assumptions that affect the application of accounting

policies and the reported amounts of assets, liabilities, income

and expenses. The estimates and associated assumptions are based on

historical experience and various other factors that are believed

to be reasonable under the circumstances, the results of which form

the basis of making judgements about carrying values of assets and

liabilities that are not readily apparent from other sources.

In particular, significant areas of estimation uncertainty in

applying accounting policies that have the most significant effect

on the amount recognised in the financial statements are in the

following area:

-- Note 13 - Share based payments

-- Note 14 - Share warrants - financial liability

In particular, significant areas of critical judgements in

applying accounting policies that have the most significant effect

on the amount recognised in the financial statements are in the

following areas:

-- Note 7 - Property, plant and equipment; consideration of impairment

-- Note 8 - Intangible asset; consideration of impairment

-- Note 11 - Trade and other payables - Decommissioning provision.

2. Going concern

The financial statements of the Group are prepared on a going

concern basis.

In order to assess the appropriateness of the going concern

basis in preparing the financial statements for the six months

ended 30 June 2021, the Directors have considered a time period of

at least twelve months from the date of approval of these financial

statements.

The Group incurred an operating loss during the half-year ended

30 June 2021. As the Group is not generating revenues, an operating

loss is expected for the next twelve months. However at the balance

sheet date, the Group had cash and cash equivalents amounting to

EUR2.71 million which includes approximately EUR1.18 million raised

in the period which the Board considers will enable the Group to

meet continuing operating expenditure and the planned work

programme.

The future of the Company is dependent on the successful outcome

of its exploration activities and implementation of

revenue-generating operations. The Directors believe that the

Group's ability to make additional capital expenditure on its

claims interests in Nevada can be assisted if necessary by raising

additional capital or from future revenues. The Directors have

taken into consideration the Company's successful completion of

placings and the exercise of warrants by warrant holders during

2020 and 2021 to provide additional cash resources.

The Directors have concluded that the Group will have sufficient

resources to continue as a going concern for the period of

assessment period of not less than 12 months from the date of

approval of the unaudited condensed consolidated financial

statements without material uncertainties. Accordingly, the

unaudited condensed consolidated financial statements have been

prepared on a going concern basis and do not include any

adjustments that would be necessary if this basis were

inappropriate.

3. Segment information

The Group has one principal reportable segment, Nevada, USA,

which represents the exploration for and development of copper,

silver, gold and other minerals in Nevada, USA.

Other operations are disclosed under "Corporate Activities"

which includes cash resources held by the Group and other

operational expenditure incurred by the Group. These assets and

activities are not within the definition of an operating

segment.

In the opinion of the Directors the operations of the Group

comprise one class of business, being the exploration and

development of copper, silver, gold and other minerals. The Group's

main operations are located within Nevada, USA. The information

reported to the Group's chief executive officer (the Executive

Chairman), who is the chief operating decision maker, for the

purposes of resource allocation and assessment of segmental

performance is particularly focussed on the exploration activity in

Nevada.

It is the opinion of the Directors, therefore, that the Group

has only one reportable segment under IFRS 8 'Operating Segments',

which is exploration carried out in Nevada. Other operations

"Corporate Activities" includes cash resources held by the Group

and other operational expenditure incurred by the Group. These

assets and activities are not within the definition of an operating

segment.

Information regarding the Group's results, assets and

liabilities is presented below.

Segment results

Unaudited Unaudited

6 months 6 months Audited

ended ended year ended

30 Jun 2021 30 Jun 2020 31 Dec 2020

EUR EUR EUR

Exploration activities -

Nevada (5,382) (8,598) (12,865)

Corporate activities (422,208) (478,843) (839,177)

------------- ------------- --------------

Consolidated loss before

tax (427,590) (487,441) (852,042)

============= ============= ==============

Segment assets

Unaudited Unaudited

6 months 6 months Audited

ended ended year ended

30 Jun 2021 30 Jun 2020 31 Dec 2020

EUR EUR EUR

Exploration activities -

Nevada 6,986,794 6,287,461 6,615,904

Corporate activities 2,509,019 455,034 2,036,724

------------- ------------- --------------

Consolidated total assets 9,495,813 6,742,495 8,352,628

============= ============= ==============

Segment liabilities

Unaudited Unaudited

6 months 6 months Audited

ended ended year ended

30 Jun 2021 30 Jun 2020 31 Dec 2020

EUR EUR EUR

Exploration activities -

Nevada 225,372 4,111 86,571

Corporate activities 559,317 288,666 346,432

------------- ------------- --------------

Consolidated total liabilities 784,689 292,777 433,003

============= ============= ==============

The Group operates in three principal geographical areas -

Republic of Ireland (country of residence of Great Western Mining

Corporation PLC), Nevada, U.S.A. (country of residence of Great

Western Mining Corporation, Inc., a wholly owned subsidiary of

Great Western Mining Corporation PLC) and the United Kingdom

(country of residence of GWM Operations Limited, a wholly owned

subsidiary of Great Western Mining Corporation PLC).

The Group has no revenue. Information about the Group's

non-current assets by geographical location are detailed below:

Unaudited Unaudited

6 months 6 months Audited

ended ended year ended

30 Jun 2021 30 Jun 2020 31 Dec 2020

EUR EUR EUR

Nevada - exploration activities 6,516,883 6,233,986 5,965,552

Republic of Ireland - - -

United Kingdom - - -

------------- ------------- --------------

6,516,883 6,233,986 5,965,552

============= ============= ==============

4. Finance income

Unaudited Unaudited

6 months 6 months Audited

ended ended year ended

30 Jun 2021 30 Jun 2020 31 Dec 2020

EUR EUR EUR

Bank interest receivable 113 180 228

------------- ------------- --------------

113 180 228

============= ============= ==============

5. Income tax

The Group has not provided any tax charge for the six months

periods ended 30 June 2021 and 30 June 2020 or the year ended 31

December 2020. The Group has accumulated losses which are expected

to exceed profits earned for the foreseeable future.

6. Loss per share

Basic earnings per share

The basic and weighted average number of ordinary shares used in

the calculation of basic earnings per share are as follows:

Unaudited Unaudited

6 months 6 months Audited

ended ended year ended

30 Jun 2021 30 Jun 2020 31 Dec 2020

EUR EUR EUR

Loss for the period (427,590) (487,441) (852,042)

================ ================ ================

Number of ordinary shares

at start of period 3,070,714,550 1,122,055,459 1,122,055,459

Number of ordinary shares

issued during the period 506,795,455 535,909,091 1,948,659,091

---------------- ---------------- ----------------

Number of ordinary shares

at end of period 3,577,510,005 1,657,964,550 3,070,714,550

================ ================ ================

Weighted average number

of ordinary shares for the

purposes of basic earnings

per share 3,458,536,520 1,365,161,520 1,844,253,806

================ ================ ================

Basic loss per ordinary

share (cent) (0.0001) (0.0004) (0.001)

================ ================ ================

Diluted earnings per share

There were no potentially dilutive ordinary shares that would

increase the basic loss per share.

7. Property, plant and equipment

Unaudited Unaudited

6 months 6 months Audited

ended ended year ended

30 Jun 2021 30 Jun 2020 31 Dec 2020

EUR EUR EUR

Cost

Opening cost 86,432 94,410 94,410

Exchange rate adjustment 2,814 303 (7,978)

------------- ------------- --------------

89,246 94,713 86,432

Depreciation

Opening depreciation 19,820 17,854 17,854

Charge for period - 2,803 3,733

Exchange rate adjustment 645 57 (1,767)

------------- ------------- --------------

20,465 20,714 19,820

Net book value

------------- ------------- --------------

Opening net book value 66,612 76,556 76,556

Closing net book value 68,781 73,999 66,612

============= ============= ==============

8. Intangible assets

Unaudited Unaudited

6 months 6 months Audited

ended ended year ended

30 Jun 2021 30 Jun 2020 31 Dec 2020

EUR EUR EUR

Cost

Opening cost 5,898,940 6,106,347 6,106,347

Additions 368,557 35,393 196,982

Increase in decommissioning

cost 4,969 - 75,287

Exchange rate adjustment 175,636 18,247 (479,676)

------------- ------------- --------------

6,448,102 6,159,987 5,898,940

Amortisation

Opening amortisation - - -

Charge for period - - -

Exchange rate adjustment - - -

------------- ------------- --------------

- - -

Net book value

------------- ------------- --------------

Opening net book value 5,898,940 6,106,347 6,106,347

Closing net book value 6,448,102 6,159,987 5,898,940

============= ============= ==============

The Directors have reviewed the carrying value of the

exploration and evaluation assets. These assets are carried at

historical cost and have been assessed for impairment in particular

with regards to the requirements of IFRS 6 'Exploration for and

Evaluation of Mineral Resources' relating to remaining licence or

claim terms, likelihood of renewal, likelihood of further

expenditures, possible discontinuation of activities over specific

claims and available data which may suggest that the recoverable

value of an exploration and evaluation asset is less than carrying

amount. The Directors also considered other factors in assessing

potential impairment including cash available to the Group,

commodity prices and markets, taxation and regulatory regime,

access to equipment and services and the impact of Covid-19

restrictions. The Directors are satisfied that no impairment is

required as at 30 June 2021. The realisation of the intangible

assets is dependent on the successful identification and

exploitation of copper, silver, gold and other mineral in the

Group's licence area. This is dependent on several variables

including the existence of commercial mineral deposits,

availability of finance and mineral prices.

9. Trade and other receivables

Unaudited Unaudited

6 months 6 months Audited

ended ended year ended

30 Jun 2021 30 Jun 2020 31 Dec 2020

EUR EUR EUR

Amounts falling die within

one year:

Other debtors 191,782 30,453 61,399

Prepayments 72,200 47,104 38,505

------------- ------------- --------------

263,982 77,557 99,904

============= ============= ==============

All amounts above are current and there have been no impairment

losses during the period (30 June 2019: EURNil, 31 December 2020:

EURNil).

10. Cash and cash equivalents

For the purposes of the consolidated statement of cash flows,

cash and cash equivalents include cash in hand, in bank and bank

deposits with maturity of less than three months.

Unaudited Unaudited

6 months 6 months Audited

ended ended year ended

30 Jun 2021 30 Jun 2020 31 Dec 2020

EUR EUR EUR

Cash in bank and in hand 355,498 29,585 307,658

Short term bank deposits 2,359,450 401,367 1,979,514

------------- ------------- --------------

2,714,948 430,952 2,287,172

============= ============= ==============

11. Trade and other payables

Unaudited Unaudited

6 months 6 months Audited

ended ended year ended

30 Jun 2021 30 Jun 2020 31 Dec 2020

EUR EUR EUR

Amounts falling die within

one year:

Trade payables 50,773 24,439 8,285

Other payables 3,995 755 670

Accruals 196,093 58,267 80,235

Other taxation and social

security 12,880 8,862 12,872

Share warrant provision 440,691 164,396 255,654

Share option provision - 36,058 -

Decommissioning provision 80,257 - 75,287

------------- ------------- --------------

784,689 292,777 433,003

============= ============= ==============

The Group has financial risk management policies in place to

ensure that payables are paid within the pre-agreed credit

terms.

12. Share capital

No of shares Value of shares

EUR

Authorised at 1 January 2020 2,700,000,000 270,000

Authorised at 30 June 2020 2,700,000,000 270,000

============== ================

Authorised at 1 July 2020 2,700,000,000 270,000

Increase in authorised share

capital 2,300,000,000 230,000

-------------- ----------------

Authorised at 1 December 2020 5,000,000,000 500,000

============== ================

Authorised at 1 January 2021 5,000,000,000 500,000

Increase in authorised share

capital 2,000,000,000 200,000

-------------- ----------------

Authorised at 30 June 2021 7,000,000,000 700,000

============== ================

Number of

ordinary

shares of Share Share Total

EUR0.0001 capital premium capital

each

EUR EUR EUR

Issued, called up

and fully paid:

At 1 January 2020 1,122,055,459 112,205 9,687,151 9,799,356

Ordinary shares issued 535,909,091 53,591 584,818 638,409

-------------- ---------- ----------- -----------

At 30 June 2020 1,657,964,550 165,796 10,271,969 10,437,765

============== ========== =========== ===========

Issued, called up

and fully paid:

At 1 July 2020 1,657,964,550 165,796 10,271,969 10,437,765

Ordinary shares issued 1,000,000,000 100,000 1,379,386 1,479,386

Ordinary shares issued

on exercise of warrants 412,750,000 41,275 716,717 757,992

Released on exercise

of warrants - - 175,534 175,534

-------------- ---------- ----------- -----------

At 31 December 2020 3,070,714,550 307,071 12,543,606 12,850,677

============== ========== =========== ===========

Issued, called up

and fully paid:

At 1 January 2021 3,070,714,550 307,071 12,543,606 12,850,677

Ordinary shares issued 454,545,455 45,455 916,611 962,066

Ordinary shares issued

on exercise of warrants 46,250,000 4,625 86,203 90,828

Ordinary shares issued

on exercise of options 6,000,000 600 5,591 6,191

Released on exercise

of warrants - - 20,016 20,016

-------------- ---------- ----------- -----------

At 30 June 2021 3,577,510,005 357,751 13,572,027 13,929,778

============== ========== =========== ===========

On 5 February 2020, the Company completed a placing of

12,500,000 new ordinary shares of EUR0.0001 at a price of GBP0.0011

(EUR0.0013) per ordinary share, raising gross proceeds of GBP13,750

(EUR16,283) and increasing share capital by EUR1,250. The premium

arising on the issue amounted to EUR15,033.

On 12 March 2020, the Company completed a placing of 290,909,091

new ordinary shares of EUR0.0001 at a price of GBP0.0011

(EUR0.0012) per ordinary share, raising gross proceeds of

GBP320,000 (EUR361,080) and increasing share capital by EUR29,091.

The premium arising on the issue amounted to EUR331,989.

On 3 June 2020, the Company completed a placing of 217,500,000

new ordinary shares of EUR0.0001 at a price of GBP0.0010

(EUR0.0011) per ordinary share, raising gross proceeds of

GBP217,500 (EUR244,204) and increasing share capital by EUR21,750.

The premium arising on the issue amounted to EUR222,454. In

addition, on 3 June 2020, the Company issued 15,000,000 new

ordinary shares of EUR0.0001 at the placing price of GBP0.0010 for

services provided to the Company. The issue increased share capital

by EUR1,500 and share premium by EUR15,342.

On 30 July 2020, the Company completed a placing of 450,000,000

new ordinary shares of EUR0.0001 at a price of GBP0.0010

(EUR0.0011) per ordinary share, raising gross proceeds of

GBP450,000 (EUR498,516) and increasing share capital by EUR45,000.

The premium arising on the issue amounted to EUR368,519. The share

issue included warrants granted giving the right to acquire

225,000,000 Ordinary shares of EUR0.0001 at an exercise price of

GBP0.0020 with a fair value of EUR84,997. Details of issues of

shares during the period ended 30 June 2021 arising from the

exercise of these warrants are detailed within this note.

On 24 September 2020, the Company completed the issue of

50,000,000 new ordinary shares following the exercise of warrants

granted in conjunction with the placing in November 2019. The

exercise price was GBP0.0016 (EUR0.0018) per ordinary share,

raising gross proceeds of GBP80,000 (EUR87,692) and increasing

share capital by EUR5,000. The premium arising on the issue

amounted to EUR82,692.

On 28 September 2020, the Company completed the issue of

200,000,000 new ordinary shares following the exercise of warrants

granted in conjunction with the placing in November 2019. The

exercise price was GBP0.0016 (EUR0.0018) per ordinary share,

raising gross proceeds of GBP320,000 (EUR353,560) and increasing

share capital by EUR20,000. The premium arising on the issue

amounted to EUR333,560.

On 8 October 2020, the Company completed the issue of 27,000,000

new ordinary shares following the exercise of broker warrants

granted in conjunction with the placing in July 2020. The exercise

price was GBP0.0010 (EUR0.0011) per ordinary share, raising gross

proceeds of GBP27,000 (EUR29,659) and increasing share capital by

EUR2,700. The premium arising on the issue amounted to EUR26,959.

In addition the Company issued 10,000,000 new ordinary shares

following the exercise of warrants granted in conjunction with the

placing in July 2020. The exercise price was GBP0.0020 (EUR0.0011)

per ordinary share, raising gross proceeds of GBP20,000 (EUR21,969)

and increasing share capital by EUR1,000. The premium arising on

the issue amounted to EUR20,969.

On 14 October 2020, the Company completed the issue of

25,000,000 new ordinary shares following the exercise of warrants

granted in conjunction with the placing in July 2020. The exercise

price was GBP0.0020 (EUR0.0022) per ordinary share, raising gross

proceeds of GBP50,000 (EUR55,313) and increasing share capital by

EUR2,500. The premium arising on the issue amounted to

EUR52,813.

On 30 October 2020, the Company completed the issue of

31,250,000 new ordinary shares following the exercise of warrants

granted in conjunction with the placing in November 2019. The

exercise price was GBP0.0016 (EUR0.0018) per ordinary share,

raising gross proceeds of GBP50,000 (EUR55,427) and increasing

share capital by EUR3,125. The premium arising on the issue

amounted to EUR52,302.

On 3 November 2020, the Company completed the issue of

69,500,000 new ordinary shares following the exercise of warrants

granted in conjunction with the placing in July 2020. The exercise

price was GBP0.0020 (EUR0.0022) per ordinary share, raising gross

proceeds of GBP139,000 (EUR154,372) and increasing share capital by

EUR6,950. The premium arising on the issue amounted to

EUR147,422.

On 24 November 2020, the Company completed a placing of

550,000,000 new ordinary shares of EUR0.0001 at a price of

GBP0.0020 (EUR0.0022) per ordinary share, raising gross proceeds of

GBP1,100,000 (EUR1,235,788) and increasing share capital by

EUR55,000. The premium arising on the issue amounted to

EUR1,010,867. The share issue included warrants granted giving the

right to acquire 275,000,000 Ordinary shares of EUR0.0001 at an

exercise price of GBP0.0030 with a fair value of EUR169,921, which

remain unexercised at period end 30 June 2021.

On 21 January 2021, the Company completed the issue of

15,000,000 new ordinary shares following the exercise of warrants

granted in conjunction with the placing in July 2020. The exercise

price was GBP0.0020 (EUR0.0023) per ordinary share, raising gross

proceeds of GBP30,000 (EUR33,850) and increasing share capital by

EUR1,500. The premium arising on the issue amounted to

EUR32,350.

On 12 February 2021, the Company completed the issue of

31,250,000 new ordinary shares following the exercise of warrants

granted in conjunction with the placing in November 2019. The

exercise price was GBP0.0016 (EUR0.0018) per ordinary share,

raising gross proceeds of GBP50,000 (EUR56,978) and increasing

share capital by EUR3,125. The premium arising on the issue

amounted to EUR53,853.

On 15 February 2021, the Company completed the issue of

6,000,000 new ordinary shares following the exercise of options

granted in April 2020. The exercise price was GBP0.0009 (EUR0.0010)

per ordinary share, raising gross proceeds of GBP5,400 (EUR6,191)

and increasing share capital by EUR600. The premium arising on the

issue amounted to EUR5,591.

On 13 April 2021, the Company completed a placing of 454,545,455

new ordinary shares of EUR0.0001 at a price of GBP0.0022

(EUR0.0025) per ordinary share, raising gross proceeds of

GBP1,000,000 (EUR1,153,429) and increasing share capital by

EUR45,455. The premium arising on the issue amounted to EUR916,610.

The share issue included warrants granted giving the right to

acquire 227,272,727 Ordinary shares of EUR0.0001 at an exercise

price of GBP0.0030 with a fair value of EUR191,364, which remain

unexercised at period end 30 June 2021.

Transaction expenses including commission arising on the issue

of new shares amounted to EUR69,206 during the year (30 June 2020:

EUR32,443 and 31 December 2020: EUR140,490). A total of EUR175,534

was released from the share warrant financial liability following

the exercise of warrants during the year ended 31 December

2020.

13. Share based payments

Share options

Great Western Mining Corporation PLC operates a share option

scheme, "Share Option Plan 2014", which entitles Directors and

employees of Great Western Mining Corporation PLC and its

subsidiary companies to purchase ordinary shares in the Company at

the market value of a share on the award date, subject to a maximum

aggregate of 10% of the issued ordinary share capital of the

Company on that date.

Options are granted at market price, in accordance with the

rules, with reference to the average closing price for the ten

dealing days prior to the grant of options. Options granted prior

to 2020 vest if the option holder remains in service for three

years from the date of grant. Options granted in 2020 vest

immediately. All options expire at a date seven years after their

date of grant.

Measure of fair values of options

No options were granted In the six months ended 30 June 2021.

The fair values of options granted in the comparative periods in

accordance with the terms of the Share Option Plan 2014 were

calculated using the following inputs into the binomial

option-pricing model:

22 April 2020

Fair value at grant date Stg 0.070

p

Share price at grant date Stg 0.095

p

Exercise price Stg 0.090

p

Number of options granted 47,000,000

Expected volatility 137%

Expected life 7 Years

Expected dividend 0%

Risk free interest rate 0.1%

During the period an expense of EUR25,606 (30 June 2020:

EUR79,599 and 31 December 2020: EUR151,294) was recognised in the

statement of profit and loss related to share options vesting

during the period. An amount of EUR4,777 was released from the

share options reserve to retained earnings on the exercise of

6,000,000 options granted in April 2020. An amount of EUR306,826

was released from the share options reserve to retained earnings on

the termination of certain options.

On 30 June 2021, there were options outstanding over 67,666,67

(30 June 2020: 112,000,000 and 31 December 2020: 112,000,000)

Ordinary Shares which are exercisable at prices ranging from Stg

0.09 pence to Stg 1.6 pence per share and which expire at various

dates up to 22 April 2027.

Equity-settled warrants

In July 2020, the Group granted warrants to Novum Securities

Limited in connection with a share placing. 27,000,000 warrants

were granted exercisable at GBP0.0010 (EUR0.0011) each with

immediate vesting and a contractual life of 2 years.

In November 2020, the Group granted warrants to Monecor (London)

Limited in connection with a share placing. 20,000,000 warrants

were granted exercisable at GBP0.0020 (EUR0.0022) each with

immediate vesting and a contractual life of 2 years.

In April 2021, the Group granted warrants to Novum Securities

Limited in connection with a share placing. 22,727,272 warrants

were granted exercisable at GBP0.0022 (EUR0.0025) each with

immediate vesting and a contractual life of 2 years.

Measure of fair values of warrants

The fair value of the warrants issued has been measured using

the binomial lattice option pricing model. There are no service or

non-market performance conditions attached to the arrangement and

the warrants are considered to have vested immediately.

The inputs used in the measurement of the fair values at grant

date of the warrants were as follows:

Apr 2021 Nov 2020 Jul 2020

Fair value at grant date EUR0.0009 EUR0.0007 EUR0.0004

Share price at grant date EUR0.0029 EUR0.0022 EUR0.0014

Exercise price EUR0.0022 EUR0.0022 EUR0.0011

Number of warrants granted 22,727,272 20,000,000 27,000,000

Sub-optimal exercise factor 1.5x 1.5x 1.5x

Expected volatility 109% 112% 120%

Expected life 2 Years 2 Years 2 Years

Expected dividend 0% 0% 0%

Risk free interest rate 0.1% 0.1% 0.1%

In October 2020, the warrants over 27,000,000 shares granted in

July 2020 were exercised and the amount of EUR11,816 released from

the share-based payment reserve to share premium.

In July 2020, warrants granted in July 2017 over 4,687,500

shares lapsed unexercised and an amount of EUR41,542 released from

the share-based payment reserve to retained earnings.

At 30 June 2021, the balance on the share-based payment reserve

amounted to EUR605,735 (30 June 2020: EUR515,561 and 31 December

2020: EUR559,420).

14. Share warrants - financial liability

Warrants granted during the year

In July 2020, the Group granted warrants in connection with a

share placing. 225,000,000 warrants were granted exercisable at

GBP0.0020 each with immediate vesting and a contractual life of 2

years.

In November 2020, the Group granted warrants in connection with

a share placing. 275,000,000 warrants were granted exercisable at

GBP0.0030 each with immediate vesting and a contractual life of 2

years.

In March 2021, the Group granted warrants in connection with a

share placing. 227,272,727 warrants were granted exercisable at

GBP0.0030 each with immediate vesting and a contractual life of 2

years.

No warrants were granted during the period ending 30 June 2020.

In November 2019, the Group granted warrants in connection with a

share placing. 375,000,000 warrants were granted exercisable at

GBP0.0016 (EUR0.0019) each with immediate vesting and a contractual

life of 3 years. The inputs used in the measurement of the fair

values at grant date of the warrants were as follows:

Measure of fair values of warrants

The fair value of the warrants issued has been measured using

the binomial option pricing model. There are no service or

non-market performance conditions attached to the arrangement and

the warrants are considered to have vested immediately.

The inputs used in the measurement of the fair values at grant

date of the warrants were as follows:

Apr 2021 Nov 2020 Jul 2020

Fair value at grant date GBP0.0007 GBP0.0006 GBP0.0004

Share price at grant date GBP0.0025 GBP0.0020 GBP0.0012

Exercise price GBP0.0030 GBP0.0030 GBP0.0020

Number of warrants granted 227,272,727 275,000,000 225,000,000

Sub-optimal exercise factor 1.5x 1.5x 1.5x

Expected volatility 109% 112% 120%

Expected life 2 Years 2 Years 2 Years

Expected dividend 0% 0% 0%

Risk free interest rate 0.1% 0.1% 0.1%

Expected volatility has been based on an evaluation of the

historical volatility of the Company's share price. The expected

life is based on the contractual life of the warrants.

13. Related party transactions

In accordance with International Accounting Standards 24 -

Related Party Disclosures, transactions between group entities that

have been eliminated on consolidation are not disclosed.

14. Events after the reporting date

There were no significant post balance sheet events which would

require amendment to or disclosure in the half yearly financial

statements.

15. Approval of financial statements

The half yearly financial statements were approved by the Board

of Directors on 29 September 2021.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR BIGDCDDDDGBC

(END) Dow Jones Newswires

September 30, 2021 02:00 ET (06:00 GMT)

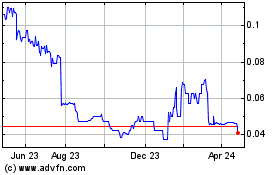

Great Western Mining (LSE:GWMO)

Historical Stock Chart

From Mar 2024 to Apr 2024

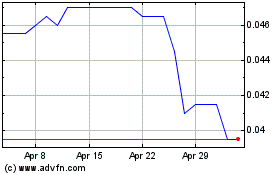

Great Western Mining (LSE:GWMO)

Historical Stock Chart

From Apr 2023 to Apr 2024