TIDMHDD

RNS Number : 5025R

Hardide PLC

12 December 2016

Press Release 12 December 2016

Hardide plc

("Hardide" or "the Group" or "the Company")

Preliminary results for the year ended 30 September 2016

Hardide plc (AIM: HDD), the developer and provider of advanced

surface coating technology, announces its preliminary results for

the year ended 30 September 2016.

Key Points

Financial

-- Sales of GBP2.14m (2015: GBP3.00m). Affected by the oil and gas downturn as expected

-- Sales in H2 25% ahead of H1. Signs of slow recovery from

existing oil and gas customers and conversion of new

opportunities

-- Gross profit of GBP0.69m (2015: GBP1.81m)

-- Group operating loss of GBP1.47m (2015: loss of GBP0.22m)

-- Loss before interest, tax, depreciation and amortisation of

GBP1.30m (2015: loss of GBP0.33m), before crediting reversal of

fixed asset impairment and release of provision

-- Successful fundraising of GBP1.60m completed during September

2016. Enables implementation of growth plans

-- Cash at bank at 30 September 2016 of GBP1.97m

Business/ Operational

-- Good progress made towards increasing aerospace business

-- US coatings facility now operational and generating regular revenue

-- Increasing sales in precision engineering - up 126% from prior year

-- Board expects growth in both aerospace and precision

engineering markets and a slow return in oil and gas activity to

contribute towards improved performance in 2017

-- Costs reduced in response to lower orders from the oil and gas sector

Commenting on the results, Robert Goddard, Chairman of Hardide

plc, said:

"In common with most companies operating in the oil and gas

supply chain, Hardide's full year performance was, as anticipated,

adversely affected by depressed demand. This was due to the

sector's longest and most severe downturn in decades. H2 saw an

improvement over H1 with signs of a tentative recovery from oil and

gas. New opportunities are emerging from key customers in this

sector and we saw a substantial rise in sales to precision

engineering customers.

"Despite weak demand in the oil and gas sector, the underlying

picture is encouraging. Good progress is being made with Airbus and

other aerospace companies in Europe and North America as well as

with our new X-ray machine customer. For the first time, sales to

customers in North America were higher than to UK customers. The

new facility in Virginia is producing regular revenue following

customers' exhaustive verification trials and approvals.

"Accurate forecasting of demand from our oil and gas customers

is always difficult but indications are that the bottom of the

cycle has been reached. With the market reported to be close to

balance, demand is expected to continue on an upward trend during

2017 and beyond. The board remains positive about the Group's

progress in diversifying by end-user and geography, and therefore

the medium and longer-term prospects.

"The cost base is stable and under tight control and the recent

fundraising of GBP1.6m significantly strengthens the balance sheet

and will enable the Group to move forward with its development

plans."

For further information:

Hardide plc

Philip Kirkham, CEO Tel: +44 (0) 1869 353

Jackie Robinson, Communications 830

Manager

finnCap Tel: +44 (0)20 7220

Stuart Andrews / Grant Bergman/James 0500

Thomson

Notes to editors:

www.hardide.com

Hardide develops, manufactures and applies advanced technology

tungsten-carbide coatings to a wide range of engineering

components. Its patented technology is unique in combining, in one

material, a mix of toughness and resistance to abrasion, erosion

and corrosion; together with the ability to coat accurately

interior surfaces and complex geometries. The material is proven to

offer dramatic improvements in component life, particularly when

applied to components that operate in very aggressive environments.

This results in cost savings through reduced downtime and increased

operational efficiency. Customers include leading companies

operating in oil and gas exploration and production, valve and pump

manufacturing, nuclear, precision engineering and aerospace

industries.

chairman's and ceo's report

INTRODUCTION

In common with most companies operating in the oil and gas

sector, over the last 18 months Hardide's revenue was adversely

affected by the longest and most severe downturn in global oil and

gas activity in decades. The Group is reporting full year sales of

GBP2.14m (2015: GBP3.00m), primarily reflecting the fall in demand

from customers in oil and gas exploration drilling. In response to

this industry-wide slump, the Company took a number of actions

throughout the year to cut costs and limit cash outflow. This was

achieved while completing the new US coatings facility in Virginia,

which became operational in February 2016.

H2 saw a 25% improvement in sales over H1, with sales to

customers in oil and gas and precision engineering sectors both

rising by over 50%. Indications from major oil and gas customers

are that the bottom of the cycle has been reached, the oil market

is close to balance and so drilling activity is expected to pick up

in 2017.

Significant progress was made with our strategic plan to develop

the aerospace market with technical approval by Airbus of the

coating in late 2015. Our new, highly-experienced aerospace

business development manager is successfully identifying further

applications with potential new customers and a number of new test

programmes are underway. Also, after a lengthy development

programme, sales commenced to the manufacturer of a new type of

high-speed X-ray screening machine for airport baggage. We expect

that sales for this ground-breaking aviation security technology

will grow in line with its adoption and demand for the coating will

rise. Even during this oil and gas downturn, many new applications

have come to us from engineers in the sector as they become

increasingly aware of the potential for Hardide coatings to further

improve tool life, efficiency and reduce operating costs.

A placing of 200,202,000 new ordinary shares at 0.8p per share

was completed during September 2016 and raised GBP1.60m (gross).

The proceeds are to be used to invest in a range of projects and

activities that the board believes will enhance shareholder

value.

FINANCIAL RESULTS

The Company generated total sales of GBP2.14m in the year ended

30 September 2016. This compares with GBP3.00m for the prior year,

with the slowdown in the global oil and gas sector beginning in H2

2015 and continuing throughout 2016. Some signs of a pick-up have

emerged recently and our key oil and gas customers are signalling

that they expect a slow recovery as 2017 progresses.

Gross profit for the year decreased to GBP0.69m (2015: GBP1.81m)

and gross margin reduced to 32% (2015: 60%). This sharp reduction

was due mainly to the mix of product being processed and the fixed

nature of production salaries. In addition, managing component

manufacturing for a growing customer, Virginia site validation and

the recruitment of additional production staff in Virginia also

depressed percentage margins.

After accounting for the reversal of fixed asset impairment and

the release of provision, the Company incurred an operating loss of

GBP1.47m (2015: loss of GBP0.22m). The impairment reversal related

to the redeployment of plant in the US which had previously been

written off; and the release of a provision that covered the final

months of the lease on the Group's former site in Houston, which we

fully-exited in October 2015. The loss before interest, tax,

depreciation and amortisation was GBP1.30m (2015: GBP0.33m loss).

Cash grants of GBP0.18m were received from the Martinsville Henry

County Economic Development Corporation and the Commonwealth of

Virginia.

On the balance sheet, net assets at 30 September 2016 were

GBP4.38m (2015: GBP3.86m). This included a cash balance of GBP1.97m

(2015: GBP2.33m). Final one-off capex costs of GBP0.60m were

incurred in completing the installation and commissioning of the

Virginia facility. Capital expenditure for the Group totalled

GBP0.66m.

OPERATIONAL OVERVIEW

Customers and Markets

The diversification of our customer and market base remains an

important strategic goal. Over the year, we made good progress in

increasing sales to customers in the precision engineering sector.

These rose 126%, with volume orders being received for components

for the new airport X-ray baggage screening machine.

Significant headway was made with Airbus, with the coating being

technically approved for use as an alternative to hard chrome

plating by design engineers and the sub-contractor network.

Life-testing of the coating on specific high-volume Airbus A320

components is now underway, with commercial discussions taking

place regarding these and other volume components for both

single-aisle and wide-body aircraft. Announcements of further

progress are expected during 2017.

The dramatic drop in exploration and drilling by our customers

in the oil and gas and flow control sectors, both in the UK and

North America, resulted in falls in revenue of 47% and 17%

respectively. During the year, we worked closely with a major oil

service company in North America to enhance the performance of an

onshore hydraulic fracturing tool. The technology is now proven and

we expect a strengthening of demand from this customer as North

American onshore drilling activity continues to rise. The

Baker-Hughes rig count, an accepted measure of the state of the

North American drilling industry, has shown encouraging

month-on-month increases since March 2016. After extensive testing

and trials, the coating was specified by a major global

manufacturer for a series of subsea flow control applications and

first orders are now being received for these components. For the

first time, the Company's sales to North America exceeded those to

the UK.

The take-or-pay supply agreement with GE, which had an original

term of two years but as has been previously announced was extended

to three years, expires at the end of February 2017. GE has

indicated that they expect to be left with an excess of inventory

due to reduced customer demand from the oil & gas sector. As

expected by Hardide management, GE needs time to reduce this

overstocking before re-ordering. Clearly, how long that takes will

depend upon their rate of usage. We have current orders in

production that will complete the contract by February 2017. GE has

made clear that the coating has been very successful and as a

result they have now standardised on use of the coating on all

variants of their product and will resume ordering as soon as their

current inventory levels have reduced.

To raise awareness further in new geographies and industries, a

programme of presentations of technical papers at prestigious

international industry conferences was undertaken by Hardide's

technical director. In July, we exhibited at the Farnborough

International Airshow in July where some promising new customer

contacts were made.

Major new customer trials and industry accreditations

The Hardide coating has been technically approved by Airbus and

Leonardo Helicopters (formerly AgustaWestland) as a replacement for

hard chrome plating (HCP). The HCP process uses hexavalent chrome,

which has a sunset date of 21 September 2017 imposed by EU REACh

regulations. While this creates opportunities for Hardide, it is

important to realise that demand for Hardide coatings within the

aerospace sector is not limited to just hard chrome replacement.

For example, the application of Hardide coating to components on

the Eurofighter Typhoon aircraft is related to its anti-galling

properties. Also, the coating is currently being tested as an

alternative to HCP, HVOF (high velocity oxy-fuel) and other hard

coatings in several aerospace companies in Europe and North

America.

The component testing programme with Leonardo Helicopters has

progressed much more slowly than expected. This has been due to the

unavailability of the customer's highly-specialised rig used to

test these safety-critical components. It is now expected that the

tests will begin in early 2017. Post-period we received new parts

from this customer for coating and testing. These are for

less-critical applications, which do not need the specialised rig

and so we expect the testing of them to be quicker.

Trials have also been underway for some time on hydraulic

actuators with a major European manufacturer of aircraft landing

gear. They are now considering the use of Hardide on additional

components.

For some while now, industries traditionally using hard chrome

have been lobbying the EU for an extension of the REACh sunset

date. Part of their argument for this has been the difficulty that

a ban on HCP would present for replacement parts for aircraft no

longer in production. The Company has been in dialogue with its

aerospace customers for some time about the possible extension and

as a result we are confident that if the seven-year extension now

proposed by the European Chemicals Agency is accepted by the

European parliament, it will have no material impact on our

progress in the aerospace markets. None of our aerospace test

programmes or current revenue opportunities are for 'legacy' parts

and none are expected to be affected by any deferral of the sunset

date.

In November 2015, Hardide Coatings Ltd passed its triennial

re-certification audit for the aerospace AS9100:Rev C and ISO9001

quality management systems. During the year, we also upgraded our

environmental certification to the new ISO14001:2015 standard.

Certification of the facility in Virginia is intended to take place

in 2017. For some time now we have been preparing for the aerospace

industry's global accreditation standard, Nadcap. Audit of the

Bicester site has been scheduled by the assessors for the second

quarter of calendar 2017.

Production, Technology, Research & Development

The new production facility in Virginia became production-ready

in February 2016 and is now integral to supporting sales to North

America. Additional production personnel were recruited in

Virginia, bringing the US headcount there to seven. Led by a team

from the UK, procurement, installation and commissioning of

equipment was managed smoothly within time and budget. Validation

of the production process by major US customers took several months

and the site is now approved for production and is producing

regular revenue.

The UK-based technical team was strengthened by the recruitment

of a R&D engineer and the total number of staff in the UK was

reduced during the year to better align with sales revenues.

The Group continued with various test programmes aimed at

developing further potential new applications. These programmes

include both in-house and third-party projects.

Intellectual Property

The IP committee met quarterly to review the IP portfolio.

During the year, a US patent was granted for the coating for

industrial diamonds, a process that enables their secure bonding to

metallic substrates. Research continues into the development of new

coating variants, and if successful these will strengthen and widen

the Group's IP portfolio.

Brexit effect

To the extent that it can predict the effects of Brexit, the

Group expects no particular negative effects on its business and is

currently benefitting modestly from the weaker pound, more than 50%

of its revenue being denominated in US dollars. None of the

existing development programmes with customers should be adversely

affected.

STRATEGY

Hardide's coatings are technologically advanced and can convey

considerable commercial advantage by helping to solve complex and

difficult engineering problems. Our coatings provide a unique

combination of advantageous physical properties and enhance the

range of many other companies' offerings. While the acceptance

process for a new application is typically long and involved,

particularly for large customers, there is significant potential

for long-term revenues once Hardide's technology is adopted and

embedded in a design.

The board continues to maintain its positive view of the

Company's potential for growth and accordingly will continue to

invest in marketing, business development, R&D and process

development so as to grow revenue and gross profit. Presently, this

has to be considered in the light of the longest downturn for over

20 years in our current main market of oil and gas, and a

commercial landscape with low visibility. Nonetheless, the board is

confident in the medium and longer-term outlook and encouraged by

the progress being made in diversifying and developing the customer

base. The Group will use its new production base in the US to

develop North American business across multiple market sectors and

we will expand our presence in selected European markets. The civil

aerospace market represents a significant growth potential for our

coating range, as do new applications in the oil and gas sector. We

are also targeting expansion in other precision engineering

sectors.

At all times, the Group aims to operate in a safe,

environmentally-conscious and socially-responsible manner, valuing

its employees' contributions.

OUTLOOK

Visibility from our oil and gas customers remains limited as the

industry adjusts to the lower oil price. However, current market

indications give the board confidence that demand will slowly

return during 2017 as drilling activity picks up. The Company is

well-positioned to benefit when this happens. The board is further

encouraged by progress with the North American fracking tool

manufacturer referred to earlier and is optimistic about potential

opportunities when the sector recovers.

We are in the early stages of growth with our X-ray machine

customer and are moving forward with commercial discussions with

Airbus and tests on new applications with Leonardo Helicopters and

several aerospace component manufacturers.

Our balance sheet is sound and costs are under tight control.

Based on the progress of customers' tests and the range of

strategic development projects underway, the board is positive

about the medium and longer term prospects for the Group.

Robert Goddard Philip Kirkham

Chairman CEO

9 December 2016 9 December 2016

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

for the year ended 30 September 2016

2016 2015

GBP000 GBP000

Revenue 2,142 3,003

Cost of sales (1,457) (1,198)

Gross profit 685 1,805

-------------------------------- -------- --------

Administrative expenses (1,989) (2,130)

Depreciation and amortisation (418) (161)

Reversal of fixed asset 232 -

impairment

Release of onerous lease

provision 23 269

Operating profit / (loss) (1,467) (217)

-------------------------------- -------- --------

Finance income 6 12

Finance costs (1) (2)

Profit / (loss) on ordinary

activities before taxation (1,462) (207)

-------------------------------- -------- --------

Taxation 121 91

Profit / (loss) on ordinary

activities after taxation (1,341) (116)

-------------------------------- -------- --------

Profit / (loss) per share:

Basic (0.1)p (0.01)p

Profit / (loss) per share:

Diluted (0.1)p (0.01)p

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

at 30 September 2016

2016 2015

GBP000 GBP000

Assets

Non-current assets

Goodwill 69 69

Intangible assets 1 3

Property, plant & equipment 1,872 1,262

--------------------------------- -------- --------

Total non-current assets 1,942 1,334

--------------------------------- -------- --------

Current assets

Inventories 60 59

Trade and other receivables 566 469

Other current financial

assets 270 271

Cash and cash equivalents 1,967 2,327

--------------------------------- -------- --------

Total current assets 2,863 3,126

--------------------------------- -------- --------

Total assets 4,805 4,460

--------------------------------- -------- --------

Liabilities

Current liabilities

Trade and other payables 408 544

Financial liabilities 17 16

Provision for lease obligation - 21

Total current liabilities 425 581

--------------------------------- -------- --------

Net current assets 2,438 2,545

--------------------------------- -------- --------

Non-current liabilities

Financial liabilities 3 20

Total non-current liabilities 3 20

--------------------------------- -------- --------

Total liabilities 428 601

--------------------------------- -------- --------

Net assets 4,377 3,859

--------------------------------- -------- --------

Equity attributable to

equity holders of the parent

Share capital 3,242 3,041

Share premium 10,305 8,935

Retained earnings (8,964) (7,623)

Share-based payments reserve 184 154

Translation reserve (390) (648)

--------------------------------- -------- --------

Total equity 4,377 3,859

--------------------------------- -------- --------

CONSOLIDATED STATEMENT OF CASH FLOWS

for the year ended 30 September 2016

2016 2015

GBP000 GBP000

Cash flows from operating activities

Operating profit / (loss) (1,467) (217)

Impairment of intangibles 2 1

Depreciation 416 160

Reversal of fixed asset impairment (232) -

Share option charge 28 27

Increase in inventories 1 (9)

(Increase) / Decrease in receivables (18) 67

Increase / (Decrease) in payables (160) 81

Increase / (Decrease) in provisions (23) (269)

Exchange rate variance 31 -

Cash generated from operations (1,422) (159)

-------------------------------------- -------- --------

Finance income 6 12

Finance costs (1) (2)

Tax received / (paid) 64 53

Net cash generated from operating

activities (1,353) (96)

-------------------------------------- -------- --------

Cash flows from investing activities

Purchase of property, plant

and equipment (561) (1,029)

Net cash used in investing

activities (561) (1,029)

-------------------------------------- -------- --------

Cash flows from financing activities

Net proceeds from issue of

ordinary share capital 1,571 1

Finance lease repayment (17) (16)

Net cash used in financing

activities 1,554 (15)

-------------------------------------- -------- --------

Net increase / (decrease) in

cash and cash equivalents (360) (1,140)

-------------------------------------- -------- --------

Cash and cash equivalents at

the beginning of the year 2,327 3,467

-------------------------------------- -------- --------

Cash and cash equivalents at

the end of the year 1,967 2,327

-------------------------------------- -------- --------

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

for the year ended 30 September 2016

Share Share Share-based Foreign Retained Total

Capital Premium Payments Translation Earnings Equity

---------------------- --------- --------- ------------ ------------- ---------- --------

At 1 October

2014 3,041 8,934 127 (639) (7,507) 3,956

---------------------- --------- --------- ------------ ------------- ---------- --------

Issue of new

shares - 1 - - - 1

Share options - - 27 - - 27

Combined instruments - - - - - -

Exchange translation - - - (9) - (9)

Loss for the

year - - - - (116) (116)

---------------------- --------- --------- ------------ ------------- ---------- --------

At 30 September

2015 3,041 8,935 154 (648) (7,623) 3,859

---------------------- --------- --------- ------------ ------------- ---------- --------

At 1 October

2015 3,041 8,935 154 (648) (7,623) 3,859

---------------------- --------- --------- ------------ ------------- ---------- --------

Issue of new

shares 201 1,370 - - - 1,571

---------------------- --------- --------- ------------ ------------- ---------- --------

Share options - - 28 - - 28

---------------------- --------- --------- ------------ ------------- ---------- --------

Combined instruments - - - - - -

---------------------- --------- --------- ------------ ------------- ---------- --------

Exchange translation - - 2 258 - 260

---------------------- --------- --------- ------------ ------------- ---------- --------

Loss for the

year - - - - (1,341) (1,341)

---------------------- --------- --------- ------------ ------------- ---------- --------

At 30 September

2016 3,242 10,305 184 (390) (8,964) 4,377

---------------------- --------- --------- ------------ ------------- ---------- --------

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR LLFFDFSLAIIR

(END) Dow Jones Newswires

December 12, 2016 02:00 ET (07:00 GMT)

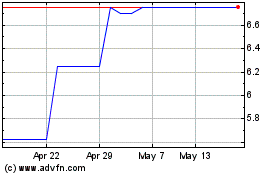

Hardide (LSE:HDD)

Historical Stock Chart

From Jun 2024 to Jul 2024

Hardide (LSE:HDD)

Historical Stock Chart

From Jul 2023 to Jul 2024