TIDMHEIT

RNS Number : 3006Q

Harmony Energy Income Trust PLC

17 October 2023

THIS ANNOUNCEMENT AND THE INFORMATION CONTAINED IN IT ARE NOT

FOR RELEASE, PUBLICATION, TRANSMISSION, FORWARDING OR DISTRIBUTION,

DIRECTLY OR INDIRECTLY, IN WHOLE OR IN PART, IN OR INTO OR FROM THE

UNITED STATES OR ANY JURISDICTION WHERE TO DO SO MIGHT CONSTITUTE A

VIOLATION OF LOCAL APPLICABLE SECURITIES LAWS OR REGULATIONS.

17 October 2023

Harmony Energy Income Trust plc

(the "Company" or "HEIT")

Company Update

Harmony Energy Income Trust plc, which invests in battery energy

storage systems ("BESS") in Great Britain, is pleased to announce

the successful energisation of two BESS projects: the 198 MWh / 99

MW Bumpers project, located in Buckinghamshire; and the 99 MWh /

49.5 MW Little Raith Project in Fife, Scotland.

Both projects were energised ahead of schedule and take the

Company's total operational capacity to 555 MWh / 277.5 MW, which

means that the Company's portfolio is c.70 per cent. operational

based on total capacity.

The Bumpers project becomes the Company's largest BESS project,

and the largest in Europe (by MWh), being 2 MWh larger in capacity

than the Company's Pillswood project. The Company now owns two of

the three largest operational BESS assets in Europe (by MWh).

The projects were developed by Harmony Energy Limited and

construction was managed by Tesla with oversight from the

Investment Adviser's project delivery team. They will be operated

through Autobidder, Tesla's algorithmic trading platform, along

with the Company's existing Pillswood, Broadditch and Farnham

projects.

The Company's final seed portfolio project, Rusholme (70 MWh /

35 MW), has completed construction and has been cold commissioned.

This project is currently awaiting confirmation of the energisation

date from the relevant DNO which is now expected to be in Q1

2024.

The Company's Wormald Green and Hawthorn Pit projects (acquired

in December 2022) are under construction, which is progressing in

line with their timeframes, with the Investment Adviser's project

delivery team overseeing progress.

An overview of the Company's portfolio is as follows:

Project MWh / MW Location Target Commercial Status

Operations Date

(1)

Pillswood 196 / 98 Yorkshire Operational Operational

Broadditch 22 / 11 Kent Operational Operational

Farnham 40 / 20 Surrey Operational Operational

Bumpers 198 / 99 Bucks. Operational Operational

Little Raith 99 / 49.5 Fife Operational Operational

Total Operational

Capacity 555 / 277.5

Rusholme 70 / 35 Yorkshire Q1 2024 Cold Commissioned

Wormald Green 66 /33 Yorkshire Q1 2024 Under Construction

Hawthorn Pit 99.8 / 49.9 County Durham Q2 2024 Under Construction

------------------ ----------- ------------- ----------------- ------------------

Total Portfolio 790.8 /

Capacity 395.4

(1) Dates are calendar quarters.

UK BESS Market Update

Whilst the UK Market for mainstream ancillary services has moved

towards saturation, as fully expected, the Market for longer

duration 2-hr batteries has seen positive trends in recent

weeks.

Portfolio revenues have trended upwards during September, driven

by a 25% increase in day-ahead wholesale market price spreads

compared to August, as Europe demand for gas increases in

preparation for winter. September also saw various instances of

negative wholesale pricing caused by high wind generation. As

previously seen in July, negative wholesale prices provide an

opportunity for BESS to be paid to charge, increasing demand on the

network. 2023 has seen more instances of negative pricing than any

previous year, which coincides with the milestone achieved in June

when the total capacity of installed wind generation in GB overtook

combined cycle gas generation for the first time.

Longer duration batteries can trade more MWh than shorter

duration batteries, and therefore any widening of wholesale spreads

is advantageous for longer duration batteries.

From October onwards, the Company's portfolio also began to

benefit from contracted Capacity Market payments as Pillswood,

Broadditch and Farnham commence delivery of their respective T-1

contracts. As previously announced, the early energisations of

Bumpers and Little Raith has allowed the Company to procure an

additional GBP403k of revenue (not previously budgeted) by

acquiring additional T-1 Capacity Market contract capacity. The

Company expects to procure further contracts in the coming

weeks.

A further update on the Market and portfolio operations will be

provided alongside the Company's next NAV update for the period to

31 October 2023.

Norman Crighton, Chair of Harmony Energy Income Trust plc,

said:

"The Board is very pleased with progress, as the portfolio is

now approximately 70 per cent. operational in advance of the winter

period. The fact that the projects are being delivered earlier than

expected, in a challenging environment where delays are well

publicised, is a testament to the strength of Harmony's delivery

team and the strength of our relationships with suppliers and DNOs.

To have delivered 555 MWh / 277.5 MWh through construction to

operational by the second anniversary of the Company's IPO is a

significant achievement."

END

For further information, please contact:

Harmony Energy Advisors Limited

Paul Mason

Max Slade

Peter Kavanagh

James Ritchie

info@harmonyenergy.co.uk

Berenberg

Gillian Martin

Ben Wright

Dan Gee-Summons +44 (0)20 3207 7800

Stifel Nicolaus Europe Limited

Mark Young

Edward Gibson-Watt

Rajpal Padam

Madison Kominski +44 (0)20 7710 7600

Camarco

Eddie Livingstone-Learmonth

Georgia Edmonds +44 (0)20 3757 4980

JTC (UK) Limited

Uloma Adighibe

Harmony.CoSec@jtcgroup.com +44 (0)20 3832 3877

LEI: 254900O3XI3CJNTKR453

About Harmony Energy Advisors Limited (the "Investment

Adviser")

The Investment Adviser is a wholly owned subsidiary of Harmony

Energy Limited.

The management team of the Investment Adviser have been

exclusively focussed on the energy storage sector (across multiple

projects) in Great Britain for over seven years, both from the

point of view of asset owner/developer and in a third-party

advisory capacity. The Investment Adviser is an appointed

representative of Laven Advisors LLP, which is authorised and

regulated by the Financial Conduct Authority.

Important Information

This announcement does not constitute an offer to sell or the

solicitation of an offer to acquire or subscribe for shares in the

Company in any jurisdiction. This distribution of this announcement

outside the UK may be restricted by law. No action has been taken

by the Company that would permit possession of this announcement in

any jurisdiction outside the UK where action for that purpose is

required. Persons outside the UK who come into possession of this

announcement should inform themselves about the distribution of

this announcement in their particular jurisdiction.

This announcement contains (or may contain) certain

forward-looking statements with respect to certain of the Company's

plans and/or the plans of one or more of its investee companies and

their respective current goals and expectations relating to their

respective future financial condition and performance and which

involve a number of risks and uncertainties. The Company's target

returns are a target only and there is no guarantee that these will

be achieved. This Company cautions readers that no forward-looking

statement is a guarantee of future performance and that actual

results could differ materially from those contained in the

forward-looking statements.

It should also be noted that any future NAV per Share announced

by the Company in due course will, in addition to the matters

described in this announcement, also be affected by valuation

movements in the Company's portfolio and other factors including,

without limitation, purchase prices of battery energy storage

systems and components, project development and construction costs,

income and pricing from contracts with National Grid ESO and other

counterparties, the potential for trading profitability in the

wholesale electricity markets and/or Balancing Mechanism,

performance of the Company's investments, and the availability of

projects which meet the

Company's minimum return parameters in accordance with the Company's investment policy .

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDFLFEAITLRLIV

(END) Dow Jones Newswires

October 17, 2023 02:00 ET (06:00 GMT)

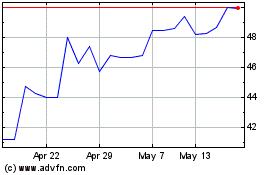

Harmony Energy Income (LSE:HEIT)

Historical Stock Chart

From Apr 2024 to May 2024

Harmony Energy Income (LSE:HEIT)

Historical Stock Chart

From May 2023 to May 2024