i3 Energy PLC Result of General Meeting (5476U)

30 March 2019 - 2:58AM

UK Regulatory

TIDMI3E

RNS Number : 5476U

i3 Energy PLC

29 March 2019

29 March 2019

i3 Energy plc

("i3" or the "Company")

Result of General Meeting

Capitalised terms used in this announcement (this

"Announcement") have the meanings given to them in the announcement

made 12(th) March 2019 regarding the proposed placing (the "Placing

Announcement"), unless the context provides otherwise.

Result of General Meeting

i3 Energy plc, an independent oil and gas company with assets

and operations in the UK, is pleased to announce that, following

the conclusion of its general meeting held earlier today, all

resolutions as set out in the circular sent to shareholders of the

Company on 13 March 2019 were duly passed. This includes the

passing of the resolutions in relation to the Placing so that the

Second Tranche of 32,237,716 New Ordinary Shares may be issued,

allotted and admitted to trading.

Admission

Admission of the Second Tranche of 32,237,716 New Ordinary

Shares will become effective at 8.00 a.m. on 1(st) April 2019 and

dealings will also commence at that time.

Further to the announcement of 25th May 2018, 925,926 Ordinary

Shares previously issued to James Card Asset Management ("JCAM") on

25th May 2018 pursuant to the conversion by JCAM of part of the

loan then owed to it by the Company have also been applied to be

admitted to trading. Admission of these shares is expected to

commence on or around 4(th) April 2019.

In accordance with the provisions of the Disclosure Guidance and

Transparency Rules of the Financial Conduct Authority, the Company

confirms that, following the issue of the Second Tranche of New

Ordinary Shares on 1(st) April 2019 its issued ordinary share

capital will comprise 84,260,681 Ordinary Shares of GBP0.0001 each.

All of the Ordinary Shares have equal voting rights and none of the

Ordinary Shares are held in Treasury. The total number of voting

rights in the Company will therefore be 84,260,681 on Admission of

the Second Tranche of New Ordinary Shares. The above figure may be

used by shareholders, at the appropriate dates above, as the

denominator for the calculations to determine if they are required

to notify their interests in, or change to their interest in, the

Company.

Further to the announcement on 22(nd) March 2019, application

will be made for the 2,131,538 Ordinary Shares issued to management

and the board to be admitted to trading. It is expected that

admission of these shares will commence on or around 4(th) April

2019.

In accordance with the provisions of the Disclosure Guidance and

Transparency Rules of the Financial Conduct Authority, the Company

confirms that, following admission to trading of the Ordinary

Shares to directors and management, as announced on 22 March 2019,

its issued ordinary share capital will comprise 86,392,219 Ordinary

Shares of GBP0.0001 each from 4(th) April 2019. All of the Ordinary

Shares have equal voting rights and none of the Ordinary Shares are

held in Treasury. The total number of voting rights in the Company

will therefore be 86,392,219 on admission these new Ordinary

Shares. The above figure may be used by shareholders, at the

appropriate dates above, as the denominator for the calculations to

determine if they are required to notify their interests in, or

change to their interest in, the Company.

ENDS

CONTACT DETAILS:

i3 Energy plc

Majid Shafiq (CEO) / Graham Heath c/o Camarco

(CFO) Tel: +44 (0) 203 781 8331

WH Ireland Limited (Nomad and Joint

Broker)

James Joyce, James Sinclair-Ford Tel: +44 (0) 207 220 1666

Canaccord Genuity Limited (Joint

Broker)

Henry Fitzgerald- O'Connor, James Tel: +44 (0) 207 523 8000

Asensio

GMP FirstEnergy (Joint Broker)

Jonathan Wright Tel: +44 (0) 207 448 0200

Camarco

Jennifer Renwick, Jane Glover, James Tel: +44 (0) 203 781 8331

Crothers

Notes to Editors:

i3 is an oil and gas development company initially focused on the North Sea. The Company's

core asset is the Greater Liberator Area, located in Blocks 13/23d and 13/23c, containing

11 MMBO of 2P Reserves, 22 MMBO of 2C Contingent Resources and 47 MMBO of mid-case Prospective

Resources. The Greater Liberator Area consists of the Liberator oil field discovered by well

13/23d-8 and the Liberator West extension, both of which i3 hold a 100% working interest in.

The Company's strategy is to acquire high quality, low risk producing and development assets,

to broaden its portfolio and grow its reserves and production.

The information contained within this announcement is deemed by the Company to constitute

inside information under the Market Abuse Regulation (EU) No. 596/2014.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

ROMEASDNASKNEFF

(END) Dow Jones Newswires

March 29, 2019 11:58 ET (15:58 GMT)

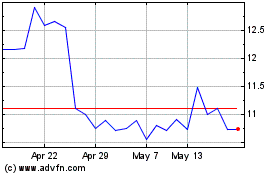

I3 Energy (LSE:I3E)

Historical Stock Chart

From Apr 2024 to May 2024

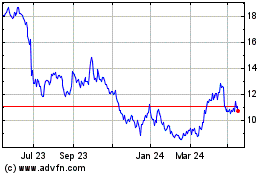

I3 Energy (LSE:I3E)

Historical Stock Chart

From May 2023 to May 2024