TIDMIHP

RNS Number : 4888O

IntegraFin Holdings plc

18 May 2018

IntegraFin Holdings plc - Interim Results for the Six Months

Ended 31 March 2018

IntegraFin Holdings plc was admitted to the London Stock

Exchange on 2 March 2018, and is pleased to report its Interim

Results for the six months to 31 March 2018 as a listed

company.

Highlights

-- Funds under direction GBP29.75bn

-- Gross inflows of GBP3bn in the first half of the year

Ian Taylor, Chief Executive Officer, commented:

"Following a successful IPO, we are pleased to announce a

pleasing set of results for the first half of the year. Despite the

backdrop of stock market volatility, Transact achieved its highest

ever H1 inflows.

Given our differentiated premium offering and the quality of the

service we offer to advisers and their clients, we remain confident

in our ability to sustain growth as we move into the second half of

the year."

Financial Highlights

Six months ended Six months ended Year ended 30

31 March 2018 31 March 2017 September 2017

GBPm GBPm GBPm

Fee generating

funds under direction 29,753 25,548 27,927

Revenue 44.6 38.7 80.2

Profit before tax 18.7 17.3 37.0

Basic and diluted

earnings per share 4.4p 4.2p 9.0p

Adjusted operating

profit 21.2 17.3 37.5

Adjusted operating

profit margin 48% 45% 47%

Adjusted basic

and diluted earnings

per share 5.2p 4.2p 9.2p

Contacts

Media

Lansons +44 (0)7979 692287, or +44 (0)20 7490 8828

Tony Langham

Maddy Morgan-Williams

Eva Murphy

Investors

Mark Mochalski +44 (0)20 7608 5339

Analyst Presentation

IntegraFin Holdings plc will be hosting an analyst presentation

on 18 May 2018 following the release of these results for the half

year ended 31 March 2018. Attendance is by invitation only. Slides

accompanying the analyst presentation will be available on the

IntegraFin Holdings plc website.

Cautionary Statement

These Interim Results have been prepared in accordance with the

requirements of English Company Law and the liabilities of the

Directors in connection with these Interim Results shall be subject

to the limitations and restrictions provided by such law.

These Interim Results are prepared for and addressed only to the

Company's shareholders as a whole and to no other person. The

Company, its Directors, employees, agents or advisers do not accept

or assume responsibility to any other person to whom these Interim

Results are shown or into whose hands it may come and any such

responsibility or liability is expressly disclaimed.

These Interim Results contain forward looking statements, which

are unavoidably subject to risk and uncertainty because they relate

to events and depend upon circumstances that will occur in the

future. It is believed that the expectations set out in these

forward looking statements are reasonable but they may be affected

by a wide range of variables which could cause future outcomes to

differ from those foreseen. All statements in these Interim Results

are based upon information known to the Company at the date of this

report. Except as required by law, the Company undertakes no

obligation to publicly update or revise any forward looking

statement, whether as a result of new information, future events or

otherwise.

Operating and Financial Review

The first six months of financial year 2018 saw good levels of

client inflows onto Transact, despite market volatility in the

second half of the period. Growth in Funds Under Direction (FUD)

was affected by this volatility in the three months to 31 March

2018, but still ended the interim period some GBP1.8bn higher than

at 2017 financial year end.

FUD, inflows and outflows

Six months Six months Year ended

ended 31 March ended 31 March 30 September

2018 2017 2017

GBPm GBPm GBPm

Opening fee generating

FUD 27,927 22,686 22,686

Inflows 3,007 2,470 5,310

Outflows (840) (774) (1,647)

------------------------ ---------------- ---------------- --------------

Net flows 2,167 1,696 3,663

Market movements (319) 1,093 1,425

Other movements(1) (22) 73 153

------------------------ ---------------- ---------------- --------------

Closing fee generating

FUD 29,753 25,548 27,927

Other FUD(2) 0 1,657 1

Total closing FUD 29,753 27,205 27,928

(1) Other movements includes dividends, interest, fees and tax

charges and rebates.

(2) FUD held historically for a single private client, for which

the only charge was a nominal fee for custody.

Gross inflows for the six months to 31 March 2018 increased by

GBP537m or 21.7% from the six months to 31 March 2017. Gross

inflows for the first half of financial year 2018 are the highest

since the platform's inception. Gross outflows grew by 8.5%. Lower

outflow growth than inflow growth led to an increase in net flows

of GBP471m (27.8%).

Despite significantly less favourable market conditions in the

second quarter, FUD continued to grow, ending the reporting period

6.5% higher than at the 2017 financial year end.

Financial performance

Six months ended Six months ended Year ended 30

31 March 2018 31 March 2017 September 2017

GBPm GBPm GBPm

Revenue 44.6 38.7 80.2

Cost of sales (0.4) (0.2) (0.6)

-------------------- ----------------- ----------------- ----------------

Gross profit 44.2 38.5 79.6

Operating expenses (25.7) (21.3) (42.8)

Operating profit

attributable

to shareholder

returns 18.5 17.2 36.8

Interest income 0.2 0.1 0.2

-------------------- ----------------- ----------------- ----------------

Profit before

tax attributable

to shareholder

returns 18.7 17.3 37.0

Tax on ordinary

shareholder only

activities (4.1) (3.3) (7.1)

-------------------- ----------------- ----------------- ----------------

Profit after

tax 14.6 13.9 29.9

Total gross profit in the six months to 31 March 2018 increased

by GBP5.7m, or 14.8%, from the same period in financial year 2017.

This growth was driven by the increase in value of FUD due to

strong inflows in the period and an increase in the number of tax

wrappers.

Components of revenue

Six months ended Six months ended Year ended 30

31 March 2018 31 March 2017 September 2017

GBPm GBPm GBPm

Annual commission

income 38.8 33.5 69.5

Wrapper fee income 3.9 3.5 7.3

Other income 1.9 1.7 3.4

-------------------- ----------------- ----------------- ----------------

Total revenue 44.6 38.7 80.2

Revenue comprises three elements. Of these, annual commission

income and wrapper fee income constitute the recurring revenue.

Other income includes "buy commission" and "dealing income".

Annual commission income increased by GBP5.3m, or 15.8%, in the

period versus the same period in the prior financial year. This

growth was due to increased value of FUD arising from strong

inflows and, in the first quarter, market growth. This increase in

annual commission was achieved even after a planned reduction in

the annual commission rate effective from 1 April 2017.

Wrapper fee income increased by GBP0.4m (11.4%) in the 2018

period. This was due to an increase in the number of both new and

existing clients on the platform with open tax wrappers. This has

been offset by wrappers being closed.

These recurring revenue streams constituted 95.7% of total fee

income in the six months to 31 March 2018.

The main constituent of other income is buy commission, which

accounts for GBP1.7m (89.5%) of other income in the 2018 six month

period, and GBP1.5m (88.2%) in the 2017 six month period.

Operating Expenses

Six months ended Six months ended Year ended 30

31 March 2018 31 March 2017 September 2017

GBPm GBPm GBPm

Staff costs 17.2 15.2 30.5

Occupancy 1.6 1.8 3.5

Regulatory and

professional

fees 4.5 2.2 4.5

Other costs 2.1 1.8 3.7

------------------- ----------------- ----------------- ----------------

Total expenses 25.4 21.0 42.2

Depreciation

and amortisation 0.3 0.3 0.6

------------------- ----------------- ----------------- ----------------

Total operating

expenses 25.7 21.3 42.8

Total operating expenses increased by GBP4.4m (21.0%) in the six

months to 31 March 2018, compared with the same period in the prior

financial year. This increase arose predominantly from professional

fees and additional staff costs associated with the listing of

IntegraFin Holdings plc (IHP) on the London Stock Exchange on 2

March 2018. Additionally there was an increase in client servicing

staff numbers in the period to 31 March 2018.

Staff costs increased by GBP2m, or 13.2%, in the six months to

31 March 2018, compared with the six months to 31 March 2017. This

is in line with staff numbers increasing to 507 from 451, an

increase of 12.4%. The main area of people growth was in the area

that provides service to advisers and clients and reflects the

increase in business volumes and the Group's commitment to

maintaining premium service. There were some increases in

governance staffing ahead of the listing.

The increase in regulatory and professional fees of GBP2.3m, or

104.5%, in the six months to 31 March 2018 compared with the six

months to 31 March 2017 was mostly due to the increase of GBP2.2m

in professional fees from GBP1.4m to GBP3.6m across the comparative

periods. The increase is attributable to non-recurring IPO expenses

which totalled GBP4.0m across all periods.

Profit Before Tax Attributable to Shareholder Returns

Profit before tax increased by GBP1.4m, or 8.1%, comparing the

six months to 31 March 2018 with the six months to 31 March 2017.

This growth was despite the IPO costs included in the financial

year 2018 period and reflects strong revenue growth and general

control of expenses.

Six months ended Six months ended

31 March 2018 31 March 2017

GBPm GBPm

Operating profit attributable

to shareholder returns 18.5 17.2

IPO adjustments 2.9 0.4

Other adjustments (0.2) (0.3)

---------------------------------------- ----------------- -----------------

Adjusted operating profit attributable

to shareholder returns 21.2 17.3

The operating margin was 41.5% in the six months to March 2018.

Allowing for IPO one off costs of GBP0.4m in the six months to

March 2017 and GBP2.9m in the six months to March 2018, offset by

other adjustments in both periods, the adjusted operating margin

increased from 44.7% in the six months to March 2017, to 47.5% in

the six months to March 2018.

Dividends

During the six month period to 31 March 2018 the Company paid an

interim dividend of GBP19.4m and a special dividend of GBP11.4m to

shareholders. This compares with an interim dividend of GBP13.5m in

the six month period to 31 March 2017.

Earnings Per Share

Six months ended Six months ended

31 March 2018 31 March 2017

Profit after tax for the period GBP14.6m GBP13.9m

Number of shares in issue 331.3m 331.3m(1)

Earnings per share - basic and

diluted 4.4p 4.2p

Adjusted profit after tax for GBP17.3m GBP14.0m

the period

Number of shares in issue 331.3m 331.3m(1)

Adjusted earnings per share -

basic and diluted 5.2p 4.2p

(1 Shares in issue restated for financial year 2017 periods to

reflect number of shares in issue following the IHP listing.)

Earnings per share has grown by 4.8% comparing the six months to

31 March 2018 with the six months to 31 March 2017, and adjusted

earnings per share has grown by 23.8%.

Principal Risks and Uncertainties

The principal risks and uncertainties which affect the Group are

those detailed on Pages 24 to 26 of the Group's Annual Report and

Financial Statements for the year ended 30 September 2017. The

principal risks and uncertainties remain unchanged from year end

and are not expected to change for the remainder of the financial

year. The key risks and uncertainties are listed below.

Financial risks:

-- Market risk - impact of changes in the following on the value

of client Portfolios, which can affect future charges and expenses:

equity, property market values, currency exchange rates, credit

spreads, interest rates and inflation;

-- Liquidity risk - the Group not having sufficient financial

resources to meet its obligations;

-- Outflow risk - loss of future profits due to unexpectedly high client outflows;

-- Expense risk - impact of expenses rising faster than expected.

Non-financial risks:

-- Regulatory risk - impact of new regulatory requirements on

the Group's business model, or the Group failing to comply with

regulations;

-- Operational risk - risk of loss from inadequate or failed

internal processes, people, systems, or external events;

-- Competition risk - risk of competitor activity reducing inflows, and increasing outflows;

-- Geopolitical risk - changes in the political landscape

disrupting the business, or requiring development spending;

-- Reputational risk - risk of clients no longer wishing do

business with the Group due to a poor perception of Transact

service in the market place.

Directors' Responsibility Statement

The Directors confirm to the best of their knowledge:

-- The unaudited condensed consolidated set of financial

statements has been prepared in accordance with IAS 34 "Interim

Financial Reporting" as adopted by the EU, and gives a true and

fair view of the assets, liabilities, financial position, and

profit and loss of the Group;

-- The interim management report includes a fair review of the

information required by sections 4.2.7R and 4.2.8R of the

Disclosure and Transparency Rules of the UK Financial Conduct

Authority; and

-- The condensed financial statements have been prepared in

accordance with ASB's 2007 statement half yearly reports.

By Order of the Board

David Johnson

Company Secretary

Registered Office

29 Clement's Lane

London

EC4N 7AE

17 May 2018

Independent Review Report to IntegraFin Holdings plc

Introduction

We have been engaged by the Company to review the condensed set

of financial statements in the half-yearly financial report for the

six months ended 31 March 2018 which comprises the condensed

consolidated profit and loss and other comprehensive income,

condensed consolidated statement of financial position, condensed

consolidated statement of cash flows and condensed consolidated

statement of changes in shareholder's equity; and the related

notes.

We have read the other information contained in the half-yearly

financial report and considered whether it contains any apparent

misstatements or material inconsistencies with the information in

the condensed set of financial statements.

Directors' responsibilities

The half-yearly financial report is the responsibility of and

has been approved by the directors. The directors are responsible

for preparing the half-yearly financial report in accordance with

the Disclosure Guidance and Transparency Rules of the United

Kingdom's Financial Conduct Authority.

As disclosed in note 1, the annual financial statements of the

group are prepared in accordance with International Financial

Reporting Standards (IFRSs) as adopted by the European Union. The

condensed set of financial statements included in this half-yearly

financial report has been prepared in accordance with International

Accounting Standard 34, "Interim Financial Reporting", as adopted

by the European Union.

Our responsibility

Our responsibility is to express to the Company a conclusion on

the condensed set of financial statements in the half-yearly

financial report based on our review.

Our report has been prepared in accordance with the terms of our

engagement to assist the Company in meeting its responsibilities in

respect of half-yearly financial reporting in accordance with the

Disclosure Guidance and Transparency Rules of the United Kingdom's

Financial Conduct Authority and for no other purpose. No person is

entitled to rely on this report unless such a person is a person

entitled to rely upon this report by virtue of and for the purpose

of our terms of engagement or has been expressly authorised to do

so by our prior written consent. Save as above, we do not accept

responsibility for this report to any other person or for any other

purpose and we hereby expressly disclaim any and all such

liability.

Scope of review

We conducted our review in accordance with International

Standard on Review Engagements (UK and Ireland) 2410, "Review of

Interim Financial Information Performed by the Independent Auditor

of the Entity", issued by the Financial Reporting Council for use

in the United Kingdom. A review of interim financial information

consists of making enquiries, primarily of persons responsible for

financial and accounting matters, and applying analytical and other

review procedures. A review is substantially less in scope than an

audit conducted in accordance with International Standards on

Auditing (UK) and consequently does not enable us to obtain

assurance that we would become aware of all significant matters

that might be identified in an audit. Accordingly, we do not

express an audit opinion.

Conclusion

Based on our review, nothing has come to our attention that

causes us to believe that the condensed set of financial statements

in the half-yearly financial report for the six months ended 31

March 2018 is not prepared, in all material respects, in accordance

with International Accounting Standard 34, as adopted by the

European Union, and the Disclosure Guidance and Transparency Rules

of the United Kingdom's Financial Conduct Authority.

BDO LLP

Chartered Accountants

London

United Kingdom

Date

BDO LLP is a limited liability partnership registered in England

and Wales (with registered number OC305127).

Interim Consolidated Profit and Loss and Other Comprehensive

Income

Unreviewed

Six months Six months

Note to 31 March to 31 March

2018 2017

GBP'000 GBP'000

Revenue

Fee income 4 44,596 38,743

Cost of sales (441) (254)

--------------------------------------- ------- ------------- -------------

Gross profit 44,155 38,489

Administrative expenses (25,685) (21,314)

Net income / (expense) attributable

to policyholder returns (5,744) 7,406

Operating profit 12,726 24,581

--------------------------------------- ------- ------------- -------------

Operating profit/(loss) attributable

to policyholder returns (5,744) 7,406

Operating profit attributable

to shareholder returns 18,470 17,176

Interest income 152 86

Profit on ordinary activities

before taxation 12,878 24,668

--------------------------------------- ------- ------------- -------------

Profit/(loss) on ordinary activities

before taxation attributable to

policyholder returns (5,744) 7,406

Profit on ordinary activities

before taxation attributable to

shareholder returns 18,622 17,262

Policyholder tax 5,807 (7,394)

Tax on profit on ordinary activities 6 (4,088) (3,345)

Profit after tax 14,596 13,928

Other comprehensive income

Exchange gains/(losses) arising

on translation of foreign operations (76) 49

Total other comprehensive income

for the period (76) 49

Profit for the period 14,520 13,976

--------------------------------------- ------- ------------- -------------

Earnings per share

Ordinary shares - basic and diluted 5 4.4p 4.2p

All activities of the Group are classed as continuing.

Interim Consolidated Statement of Financial Position

Restated

31 March 30 September

Note 2018 2017

GBP'000 GBP'000

Non-current assets

Loans and receivables 3,698 1,873

Intangible assets 12,976 12,986

Property, plant and equipment 1,860 1,858

Deferred acquisition costs 42,394 38,295

Investments and cash held for

the benefit of policyholders 12,877,070 11,947,652

-------------------------------------- ----- ----------- --------------

12,937,998 12,002,664

Current assets

Financial assets at fair value

through profit or loss 6,178 8,895

Other prepayments and accrued

income 10,516 10,252

Trade and other receivables 2,780 1,456

Cash and cash equivalents 97,205 105,829

-------------------------------------- ----- ----------- --------------

116,680 126,432

Current liabilities

Trade and other payables 18,956 15,208

Current tax liabilities 4,032 2,803

-------------------------------------- ----- ----------- --------------

22,987 18,011

Non-current liabilities

Provisions for liabilities 19,059 11,831

Deferred income liability 42,394 38,295

Liabilities for linked investment

contracts 12,877,070 11,947,652

Deferred tax liabilities 6,896 10,781

-------------------------------------- ----- ----------- --------------

12,945,418 12,008,559

Net assets 86,273 102,526

-------------------------------------- ----- ----------- --------------

Capital and reserves

Called up equity share capital 7 3,313 57

Capital redemption reserve 2 2

Share-based payment reserve 308 308

Foreign exchange reserve (34) 42

Other non-distributable reserves 8 5,722 5,722

Non-distributable insurance reserves 501 501

Profit or loss account 76,460 95,894

-------------------------------------- ----- ----------- --------------

Total equity 86,273 102,526

-------------------------------------- ----- ----------- --------------

These interim financial statements were approved by the Board of

Directors on 17 May 2018 and are signed on their behalf by:

Ian Taylor, Director

Company Registration Number: 08860879

Interim Consolidated Statement of Cash Flows

Unreviewed

Six months Six months

to 31 March to 31 March

2018 2017

GBP'000 GBP'000

Cash flows from operating activities

Profit before tax 12,878 24,667

Adjustments for:

Amortisation and depreciation 300 288

Interest (152) (86)

Increase in loans and receivables (3,414) (359)

Increase in payables 3,748 3,456

Decrease in current asset investments 2,717 37

Increase in provisions 3,343 1,941

Cash generated from operations 19,419 29,944

Income taxes (paid)/received 2,947 (10,592)

Net cash flows from operating

activities 22,366 19,352

Investing activities

Acquisition of tangible assets (291) (340)

Interest received 152 86

Net cash used in investing activities (140) (254)

Financing activities

Equity dividends paid (30,780) (13,521)

---------------------------------------- ------------- -------------

Net cash used in financing activities (30,780) (13,521)

Net increase/(decrease) in cash

and cash equivalents (8,554) 5,577

Cash and cash equivalents at

beginning of period 105,829 90,571

Exchange gains/(losses) on cash

and cash equivalents (70) 49

---------------------------------------- ------------- -------------

Cash and cash equivalents at

end of period 97,205 96,196

Interim Consolidated Statement of Changes in Equity

Restated

Share Non-distrib-utable Other

based insurance Non-distrib-utable

Share Other payment reserves reserves Retained Total

capital reserves reserve earnings equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

--------- --------- --------- ------------------- ------------------- --------- ---------

Balance at

1 October

2016 57 34 308 501 5,722 79,622 86,244

Comprehensive

income for

the year:

Profit for

the year - - - - - 13,928 13,928

Other

comprehensive

income - 49 - - - - 49

Other movement - - - - - (96) (96)

--------- --------- --------- ------------------- ------------------- --------- ---------

Total

comprehensive

income for

the year - 49 - - - 13,832 13,881

Distributions

to owners:

Dividends - - - - - (13,521) (13,521)

--------- --------- --------- ------------------- ------------------- --------- ---------

Total

distributions

to owners - - - - - (13,521) (13,521)

--------- --------- --------- ------------------- ------------------- --------- ---------

Balance at

31

March 2017 57 83 308 501 5,722 79,933 86,604

--------- --------- --------- ------------------- ------------------- --------- ---------

Balance at

1 October

2017 57 44 308 501 5,722 95,894 102,526

Comprehensive

income for

the year:

Profit for

the year - - - - - 14,596 14,596

Other

comprehensive

income - (76) - - - - (76)

Other movement - - - - - 6 6

--------- --------- --------- ------------------- ------------------- --------- ---------

Total

comprehensive

income for

the year - (76) - - - 14,602 14,526

Distributions

to owners:

Issue of share

capital 3,256 (3,256) -

Dividends - - - - - (30,780) (30,780)

--------- --------- --------- ------------------- ------------------- --------- ---------

Total

distributions

to owners 3,256 - - - - (34,036) (30,780)

--------- --------- --------- ------------------- ------------------- --------- ---------

Balance at

31 March 2018 3,313 (32) 308 501 5,722 76,460 86,273

--------- --------- --------- ------------------- ------------------- --------- ---------

Notes to the Financial Statements

1. Basis of preparation

The consolidated interim financial statements have been prepared

and approved by the Directors in accordance with International

Financial Reporting Standards (IFRSs) as adopted by the EU, and in

accordance with the International Accounting Standard (IAS) 34

Interim Financial Reporting, and the Disclosure Guidance and

Transparency Rules of the Financial Conduct Authority (FCA).

The financial information contained in these interim financial

statements does not constitute statutory accounts within the

meaning of Section 434 of the Companies Act 2006. The information

has been reviewed by the company's auditor, BDO LLP, and their

report is presented on page 7-8.

The same accounting policies, methods of calculation and

presentation have been followed in the preparation of the interim

financial statements for the six months to 31 March 2018 as were

applied in the Audited Annual Financial Statements for the year

ended 30 September 2017.

The financial statements have been prepared on a going concern

basis following an assessment by the Directors.

Principal risks and uncertainties

The Group's principal risks and uncertainties have not changed

from year end, and are listed on page 5.

Basis of consolidation

The consolidated financial statements incorporate the financial

statements of the Company and its subsidiaries.

Future standards, amendments to standards, and interpretations

not early-adopted in the 2018 consolidated interim statements

A full impact assessment of IFRS 9 Financial Instruments, IFRS

15 Revenue from Contracts with Customers, and IFRS 17 Insurance

Contracts was conducted at financial year 2017 year end. None of

the standards was found to have a material impact on the Group, and

this position has not changed.

An initial assessment of the impact of IFRS 16 Leases was

conducted at financial year 2017 year end, which indicated that

whilst there will be a material adjustment to gross assets and

liabilities as a result of bringing leased assets on balance sheet,

there is unlikely to be a material net impact at Group level. This

position has not changed.

2. Critical accounting estimates and judgements

The preparation of interim consolidated financial statements in

compliance with IAS 34 requires the use of certain critical

accounting estimates. There have been no material revisions to the

Group's critical accounting estimates and judgements methodology

from year ending 30 September 2017.

3. Financial instruments

Financial assets and liabilities have been classified into

categories that determine their basis of measurement and, for items

measured at fair value, whether changes in fair value are

recognised in the profit and loss and other comprehensive income

statement. The following tables show the carrying values of assets

and liabilities for each of these categories.

Financial assets:

Fair value through Loans and Receivables

profit or loss

31 Mar 30 Sep 31 Mar 30 Sep

2018 2017 2018 2017

GBP'000 GBP'000 GBP'000 GBP'000

Cash and cash equivalents - - 97,205 105,829

Listed shares and securities 95 83 - -

Loans and receivables - - 3,698 1,873

Investments in quoted

debt instruments 6,083 8,812 - -

Accrued income - - 8,673 7,951

Trade and other receivables - - 2,780 1,456

Investments and cash held

for the policyholders 12,877,070 11,947,652 - -

Total financial assets 12,883,248 11,956,547 112,357 117,109

Financial liabilities:

Fair value through Amortised cost

profit or loss

31 Mar 30 Sep 31 Mar 30 Sep

2018 2017 2018 2017

GBP'000 GBP'000 GBP'000 GBP'000

Trade and other payables - - 12,299 7,524

Accruals - - 5,538 6,454

Liabilities for linked

investments contracts 12,877,070 11,947,652 - -

----------- ----------- -------- --------

Total financial liabilities 12,877,070 11,947,652 23,090 18,010

Financial Instruments - Fair Value Hierarchy

The following table shows the Group's assets measured at fair

value and split into the three levels described below:

Level 1: quoted prices (unadjusted) in active markets for

identical assets;

Level 2: inputs other than quoted prices included within Level 1

that are observable for the asset either directly (i.e. as prices)

or indirectly (i.e. derived from prices); and

Level 3: inputs for the asset that are not based on observable

market data (unobservable inputs).

At 31 March 2018 Level 1 Level 2 Level 3 Total

GBP'000 GBP'000 GBP'000 GBP'000

Investments and

assets held for

the benefit of policyholders

* Policyholder cash 1,124,997 - - 1,124,997

* Investments and securities 336,312 102,898 1,019 440,228

* Bonds and other fixed-income securities 11,892 1,431 27 13,350

* Holdings in collective investment schemes 11,153,732 142,269 2,493 11,298,495

----------------- -------------- -------------- -----------------

12,626,933 246,598 3,539 12,877,070

Other investments 6,178 - - 6,178

----------------- -------------- -------------- -----------------

Total 12,633,111 246,598 3,539 12,883,248

----------------- -------------- -------------- -----------------

At 30 September Level 1 Level 2 Level 3 Total

2017

GBP'000 GBP'000 GBP'000 GBP'000

Investments and

assets held for

the benefit of

policyholders

* Policyholder cash 1,091,744 - - 1,091,744

* Investments and securities 351,308 94,521 1,541 447,370

* Bonds and other fixed-income securities 12,378 399 5 12,782

* Holdings in collective investment schemes 10,260,975 132,113 2,668 10,395,756

----------------- -------------- -------------- -----------------

11,716,405 227,033 4,214 11,947,652

Other investments 8,895 - - 8,895

----------------- -------------- -------------- -----------------

Total 11,725,300 227,033 4,214 11,956,547

----------------- -------------- -------------- -----------------

Level 1 valuation methodology

Financial assets included in Level 1 are measured at fair value

using quoted mid prices that are available at the reporting date

and are traded in active markets. These financial assets are mainly

collective investment schemes and listed equity instruments.

Level 2 and Level 3 valuation methodology

The Group regularly reviews whether a market is active, based on

available market data and the specific circumstances of each

market. Where the Group assesses that a market is not active, then

it applies one or more valuation methodologies to the specific

financial asset. These valuation methodologies use quoted market

prices where available, and may in certain circumstances require

the Group to exercise judgement to determine fair value.

Financial assets included in Level 2 are measured at fair value

using observable mid prices traded in markets that have been

assessed as not active enough to be included in Level 1.

Otherwise, financial assets are included in Level 3. These are

assets where one or more inputs to the valuation methodology are

not based on observable market data.

Level 3 sensitivity to changes in unobservable measurements

For financial assets assessed as Level 3, based on its review of

the prices used, the Company believes that any change to the

unobservable inputs used to measure fair value would not result in

a significantly higher or lower fair value measurement at year end,

and therefore would not have a material impact on its reported

results.

Changes to valuation methodology

There have been no changes in valuation methodology since year

end.

Transfers between Levels

There have been no material changes between Levels since year

end.

4. Segmental reporting

The revenue and profit before tax are attributable to activities

carried out in the UK and Isle of Man.

The Group has three classes of business as follows:

- provision of investment administration services

- transaction of ordinary long term insurance and underwriting life assurance

- provision of consultancy services.

Analysis by class of business is given below:

Six months Six months to

to 31 March 31 March 2017

2018

GBP'000 GBP'000

Revenue

Investment administration services 23,997 21,364

Insurance and life assurance

business 20,599 17,379

44,596 38,743

Profit before tax

Investment administration services 8,078 8,159

Insurance and life assurance

business 4,152 16,219

Consultancy services 648 290

------------- ---------------

12,878 24,668

As at 31 March As at 30 September

2018 2017

GBP'000 GBP'000

Net assets

Investment administration services 38,888 51,176

Insurance and life assurance

business 46,045 50,397

Consultancy services 1,340 953

-------------------- ------------------------

86,273 102,526

The figures above comprise the results of the companies that

fall directly into each segment, as well as a proportion of the

results from the other Group companies that only provide services

to the revenue-generating companies. This therefore has no effect

on revenue, but has an effect on the profit before tax and net

assets figures.

5. Earnings per share

Six months ended Six months ended

31 March 2018 31 March 2017

Profit

Profit for the year and earnings GBP14.6m GBP13.9m

used in basic and diluted earnings

per share

Number of shares

Number of shares used in basic

and diluted earnings per share 331.3m 331.3m

On 2 March 2018, as part of the IntegraFin Holdings plc IPO

process, a bonus share issue occurred resulting in the numbers of

shares in issue increasing from 1,137,278 to 331,322,014. The

nominal value of each share was also reduced through the bonus

share issue process, from 0.05p to 0.01p. The calculation of

earnings per share for the comparative period presented has been

adjusted retrospectively to reflect the new share structure.

Earnings per share is calculated based on the share capital of

IntegraFin Holdings plc and the earnings of the consolidated

Group.

6. Tax on profit on ordinary activities

Tax is charged at 22% for the six month period ended 31 March

2018 (31 March 2017: 19%), representing the best estimate of the

average annual effective tax rate expected to apply for the full

year, applied to the pre-tax income of the six month period. The

effective tax rate reflects entities in the Group operating in

non-UK tax jurisdictions, and includes the effect of IPO costs not

deductible for tax purposes.

7. Called up share capital - Company and Group

31 Mar 30 Sep 31 Mar 30 Sep

2018 2017 2018 2017

Allotted, called up and fully Number Number GBP'000 GBP'000

paid:

Ordinary shares of GBP0.01

each 331,322,014 - 3,313

Ordinary Class A shares of

GBP0.05 each 417,868 21

Ordinary Class B shares of

GBP0.05 each 357,000 18

Ordinary Class C shares of

GBP0.05 each 332,410 17

Ordinary Class D shares of

GBP0.05 each 30,000 1

------------------------------- ------------ ---------- -------- --------

331,322,014 1,137,278 3,313 57

Immediately prior to Admission to the London Stock Exchange, the

share capital of the Company was increased from GBP56,863.90 to

GBP3,313,220.14 by virtue of a bonus issue of a further:

122,017,456 A Ordinary Shares of 0.01p each; 102,244,000 B Ordinary

Shares of 0.01p each; 97,063,720 C Ordinary Shares of 0.01p each;

and, 6,859,560 D Ordinary Shares of 0.01p each.

Immediately prior to Admission each A, B, C and D share was then

re-designated into an Ordinary Share of 0.01p each.

8. Other non-distributable reserves

Restated

31 March 30 September

2018 2017

GBP'000 GBP'000

Other non-distributable reserves 5,722 5,722

The share premium account per the Audited Annual Financial

Statements for the year ended 30 September 2017 has been

reclassified as other non-distributable reserves. The share premium

is held by one of the Company's subsidiaries, Integrated Financial

Arrangements Limited, so it is more appropriate to classify this

within other reserves on a Group level.

9. Related parties

There were no material changes to the related party transactions

during the period.

10. Events after the reporting date

There are no events subsequent to the year-end that require

disclosure in, or amendment to the financial statements.

11. Dividends

During the six month period to 31 March 2018 the Company paid an

interim dividend of GBP19,418,436 (six months to 31 March 2017:

GBP13,527,336) and a special dividend of GBP11,372,780 (six months

to 31 March 2017: nil) to shareholders.

DIRECTORS, COMPANY DETAILS, ADVISERS

Executive Directors

Ian Taylor

Michael Howard

Alexander Scott

Non-Executive Directors

Christopher Munro

Patrick Snowball (appointed 1 October 2017)

Neil Holden

Company Secretary

David Johnson

Independent Auditors

BDO LLP London

Solicitors

Eversheds Sutherland, London

Principal Bankers

NatWest

Registrars

Equiniti

Registered Office

29 Clement's Lane, London, EC4N 7AE

Website

www.integrafin.co.uk

Company number

8860879

IntegraFin Holdings plc, 29 Clement's Lane, London, EC4N 7AE

Tel: (020) 7608 4900 Fax: (020) 7608 5300

(Registered office: as above; Registered in England and Wales

under number: 8860879)

The holding company of the Integrated Financial Arrangements Ltd

group of companies.

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR LLFIRESIDLIT

(END) Dow Jones Newswires

May 18, 2018 02:00 ET (06:00 GMT)

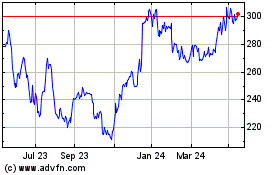

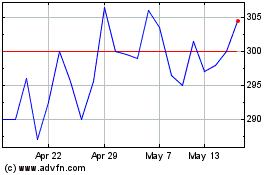

Integrafin (LSE:IHP)

Historical Stock Chart

From Mar 2024 to May 2024

Integrafin (LSE:IHP)

Historical Stock Chart

From May 2023 to May 2024