Interim Results

17 November 2005 - 6:01PM

UK Regulatory

RNS Number:2601U

Dart Group PLC

17 November 2005

DART GROUP PLC

Interim Results for the Six Months Ended 30 September 2005

Dart Group PLC, the aviation and distribution group, announces its interim

results for the six months ended 30 September 2005.

CHAIRMAN'S STATEMENT

I am pleased to report on the Group's trading for the six months ended 30

September 2005. Profit before tax, goodwill amortisation and exceptional

items amounted to #14.8m (2004 restated : #11.9m) whilst profit before tax

but after goodwill amortisation and exceptional items was #18.2m (2004 restated

: #6.2m). The seasonal pattern of profitability seen in recent years is

likely to be repeated this year, with Jet2.com being profitable in the summer

and loss making in the winter.

The exceptional credit of #3.7m relates to the surplus of disposal proceeds over

the book value on the sale of the Benair companies, whose business is air and

sea freight forwarding and which were considered non-core to the Group's main

businesses. The restated prior year exceptional charge relates to the first

half effect of the change in the accounting policies covering foreign exchange

and maintenance accounting and the impairment review which was analysed fully

in the 2005 Annual Report and Accounts.

Capital expenditure in the first half amounted to #22.7m (2004 : #22.8m) and

related mainly to the acquisition of two Boeing 757 aircraft and ongoing

maintenance of the aircraft fleet. Net debt at 30 September was #7.7m

(2004 : #14.4m), representing gearing of 13% (2004 : 30%).

On 15 August 2005, the Company transferred its share listing from the main

market to AIM.

The Board is pleased to declare an increased interim dividend of 2.25p per share

(2004 : 2.04p), an increase of 10%. The dividend will be paid on 5 January 2006

to shareholders on the register as at 25 November 2005.

Aviation

During the past six months, Channel Express (Air Services) has operated 24

Boeing 737-300 aircraft (of which, 20 are owned) and three Airbus A300

"Eurofreighters". The company flies seven Boeing 737-300 "Quick Change"

aircraft nightly for Royal Mail in freight configuration. These are then

quickly re-configured into passenger aircraft to operate both charter flights

and Jet2.com 's low-cost services.

The main customer for our Airbus A300's, United Parcel Service, recently advised

us that its aircraft needs had changed with the ongoing development of its

European business. Consequently, we have taken the decision to cease operating

the type and to dispose of the Group's two owned aircraft and return the third

to its lessor. One aircraft has now been sold and there is encouraging

interest in the second. As far as possible, employees on this fleet are being

offered other jobs within the company.

Between 1 April and 30 September, Jet2.com has flown over 1.25 million

passengers (2004: 570,000) from its main Leeds Bradford and Manchester bases.

Operations were also commenced from Newcastle on 4 September and from Blackpool

on 29 September. In addition, new services have recently been announced from

Belfast and Edinburgh. The company's route structure is easily accessible at

www.jet2.com. Almost 97% of bookings are made over the internet, with our

contracted call centre (now based in India) handling the remainder as well as

flight enquiries.

We plan to continue to grow Jet2.com's low-cost services from the North,

primarily flying to leisure destinations from regional airports. As routes

develop, 148-seat Boeing 737-300 aircraft will be replaced by 235-seat Boeing

757-200s. The Boeing 757-200 offers both a competitive seat rate and greater

range, widening our choice of destinations. The Group purchased two Boeing

757-200s in May and the first of these is now in service from Leeds Bradford,

with the second joining it this month. This winter, services to Tenerife, Faro

and ski destinations are being flown with these aircraft. They will primarily

fly to southern Spain next summer.

The company will be operating these two aircraft types for the foreseeable

future and both fleets will be expanded as the business grows. We believe that

there is considerable potential for substantial growth in the low-cost sector

and that by offering a friendly product at the lowest possible price Jet2.com

will be a successful competitor in this exciting field.

Distribution

The Group's temperature-controlled distribution company, Fowler Welch-Coolchain,

is one of the country's largest providers of these specialist distribution

services to supermarkets, importers and producers. Operating from its primary

distribution centres in Spalding, Lincs, and Teynham, Kent, together with

operations in Portsmouth, Southampton, Bristol and Gateshead, the company

collects and distributes fresh produce and chilled foods throughout the UK and

from The Netherlands. This is a growing sector increasingly dominated by the

supermarkets, therefore, the business is geared to offering the highest

standard of service at the lowest possible price.

The company works closely with its customers to maximise business opportunities

and has won both additional business from existing customers and new

distribution business from Somerfield Stores during the period. Since then

further distribution business has also been won at both Gateshead and Teynham.

The summer saw the start of significant warehousing and distribution contracts

which formed a basis for further opportunities for the company. The new

operation from Teynham involves the picking and despatch of up to 150,000 cases

of cheeses and pasta per week whilst in Spalding our chilled foods pick and

despatch business has now reached 350,000 cases per week. In the short-term we

have incurred some start up costs as these new operations have been brought

on-stream. However, we believe that the long-term opportunities for the

division in this business are significant.

Outlook

We have made an encouraging start to the second half of the financial year and,

therefore, remain optimistic for a successful outcome to the full year.

Philip Meeson,

Chairman 17 November 2005

www.dartgroup.co.uk

Enquiries: Philip Meeson, Chairman

Tel: 01202 597676

Mobile: 07785 258666

Mike Forder, Group Finance Director

Tel: 01202 597676

Mobile: 07721 865850

UNAUDITED INTERIM CONSOLIDATED RESULTS

for the half year to 30 September 2005

Half Year Half Year Half Year Half Year Half Year Half Year Year to Year to Year to

to 30 to 30 to 30 to 30 to 30 to 30 31 March 31 March 31 March

September September September September September September 2005 2005 2005

2005 2005 2005 2004 2004 2004 (audited) (audited) (audited)

(unaudited) (unaudited) (unaudited) (unaudited) (unaudited) (unaudited) Before Except- Total

Before Exceptional Total Before Exceptional Total except- tional (restated)

exceptional items exceptional items (restated) ional items

items items items

(restated) (restated)

Note #m #m #m #m #m #m #m #m #m

--------- --------- -------- -------- -------- --------- -------- -------- --------

Turnover

- continuing

operations 174.8 - 174.8 129.0 - 129.0 246.0 - 246.0

- discontinued

operations 9.5 - 9.5 11.4 - 11.4 22.0 - 22.0

--------- -------- -------- -------- -------- -------- -------- -------- --------

2 184.3 - 184.3 140.4 - 140.4 268.0 - 268.0

-------- -------- -------- -------- -------- -------- -------- -------- --------

Net operating

expenses,

excluding

amortisation

of goodwill (169.1) - (169.1) (128.6) (4.4) (133.0) (254.0) (8.2) (262.2)

Amortisation

of goodwill (0.3) - (0.3) (0.3) - (0.3) (0.5) - (0.5)

Net operating

expenses (169.4) - (169.4) (128.9) (4.4) (133.3) (254.5) (8.2) (262.7)

-------- -------- -------- -------- -------- -------- -------- -------- --------

Operating

Profit

- continuing

operations 14.5 - 14.5 10.9 (4.4) 6.5 12.8 (8.2) 4.6

- discontinued

operations 0.4 - 0.4 0.6 - 0.6 0.7 - 0.7

-------- -------- -------- -------- -------- -------- -------- -------- --------

14.9 - 14.9 11.5 (4.4) 7.1 13.5 (8.2) 5.3

-------- -------- -------- -------- -------- -------- -------- -------- --------

Profit on

disposal of

discontinued

operations - 3.7 3.7 - - - - - -

Profit on

disposal of

fixed assets - - - - - - - 0.8 0.8

Net interest

(payable)/

receivable 3 (0.4) - (0.4) 0.1 (1.0) (0.9) (0.1) 2.4 2.3

-------- -------- -------- -------- -------- -------- -------- -------- --------

Profit on

ordinary

activities

before

taxation 14.5 3.7 18.2 11.6 (5.4) 6.2 13.4 (5.0) 8.4

Taxation (4.7) - (4.7) (3.8) 1.6 (2.2) (4.3) 1.5 (2.8)

-------- -------- -------- -------- -------- -------- -------- -------- --------

Profit for

the period 9.8 3.7 13.5 7.8 (3.8) 4.0 9.1 (3.5) 5.6

-------- -------- -------- -------- -------- -------- -------- -------- --------

Half Year Half Year Half Year Half Year Year to Year to

to 30 to 30 to 30 to 30 31 March 31 March

September September September September 2005 2005

2005 2005 2004 2004 (audited) (audited)

(unaudited) (unaudited) (unaudited) (unaudited) Before Total

Before Total Before Total except- (restated)

exceptional exceptional (restated) ional

items items items

(restated) (restated)

-----------------------------------------------------------------------------------------------------

Earnings per share

- total

- basic 28.53p 39.18p 22.77p 11.73p 26.52p 16.32p

- basic, excluding

the amortisation

of goodwill 29.24p 39.89p 23.49p 12.45p 27.96p 17.76p

- diluted 28.27p 38.83p 22.69p 11.69p 26.34p 16.21p

Earnings per share

- continuing

operations

- basic 27.60p 27.60p 21.48p 10.44p 24.96p 14.76p

- basic, excluding

the amortisation

of goodwill 28.31p 28.31p 22.20p 11.16p 26.40p 16.20p

- diluted 27.36p 27.36p 21.41p 10.41p 24.79p 14.66p

Earnings per share

- discontinued

operations

- basic 0.93p 11.58p 1.29p 1.29p 1.56p 1.56p

- basic, excluding

the amortisation

of goodwill 0.93p 11.58p 1.29p 1.29p 1.56p 1.56p

- diluted 0.91p 11.47p 1.28p 1.28p 1.55p 1.55p

STATEMENT OF TOTAL RECOGNISED GAINS AND LOSSES

for the half year to 30 September 2005

Half Year Half Year Year to

to 30 to 30 31 March

September September 2005

2005 2004 (audited)

(unaudited) (unaudited) Total

Total Total

(restated)

#m #m #m

----------------------------------------

Profit for the period 13.5 4.0 5.6

Exchange gain on foreign

equity investment - - 0.1

----------------------------------------

Total recognised gains and losses

relating to the period 13.5 4.0 5.7

======== =======

Prior year adjustment

- FRS 21 Proposed

dividends (note 1) 1.6

-------

Total recognised gains and

losses since previous annual report 15.1

=======

CONSOLIDATED BALANCE SHEET

at 30 September 2005

Note 30 September 30 September 31 March

2005 2004 2005

(unaudited) (unaudited) (audited)

(restated) (restated)

#m #m #m

--------- ---------- --------

Fixed assets

Intangible assets 7.0 7.5 7.3

Tangible assets 112.7 86.6 99.3

--------- ---------- --------

119.7 94.1 106.6

--------- ---------- --------

Current assets

Stock 5.8 1.6 4.6

Debtors 25.5 34.1 25.5

Cash at bank and in hand 13.2 18.4 27.4

--------- ---------- --------

44.5 54.1 57.5

Current liabilities

Creditors: amounts falling

due within one year (78.0) (63.8) (88.6)

--------- ---------- --------

Net current liabilities (33.5) (9.7) (31.1)

--------- ---------- --------

Total assets less current

liabilities 86.2 84.4 75.5

Creditors: amounts falling

due after more than one year (18.1) (29.6) (19.4)

Provisions for liabilities and

charges (6.2) (6.2) (6.2)

--------- ---------- --------

(24.3) (35.8) (25.6)

--------- ---------- --------

Net assets 61.9 48.6 49.9

--------- ---------- --------

Capital and reserves

Called up share capital 1.7 1.7 1.7

Share premium account 8.1 7.7 8.0

Profit and loss account 5 52.1 39.2 40.2

--------- ---------- --------

Shareholders' funds - equity

interests 6 61.9 48.6 49.9

--------- ---------- --------

CONSOLIDATED CASH FLOW STATEMENT

for the half year to 30 September 2005

Note Half year to Half year to Year to

30 September 30 September 31 March

2005 2004 2005

(unaudited) (unaudited) (audited)

(restated)

#m #m #m

---------- --------- ---------

Net cash inflow from operating

activities 7 16.4 24.4 68.3

---------- --------- ---------

Returns on investment and

servicing of finance

Interest paid: bank and other

loans (0.6) (0.3) (0.8)

Interest received: bank 0.2 0.3 0.7

---------- --------- ---------

(0.4) - (0.1)

---------- --------- ---------

Taxation

Corporation and overseas tax

paid (5.6) (0.5) (1.4)

---------- --------- ---------

Capital expenditure and

financial investment

Purchase of tangible fixed

assets (22.7) (22.8) (51.6)

Disposal of tangible fixed

assets - 1.9 2.5

---------- --------- ---------

(22.7) (20.9) (49.1)

---------- --------- ---------

Acquisitions and disposals 4

Proceeds from disposal of

discontinued operations (net of

disposal costs) 4.9 - -

Net cash balances leaving the

Group with disposal of

discontinued operations (0.9) - -

---------- --------- ---------

4.0 - -

---------- --------- ---------

Equity dividends paid (1.6) (1.5) (2.2)

---------- --------- ---------

Cash (outflow)/ inflow before

financing (9.9) 1.5 15.5

---------- --------- ---------

Financing

Ordinary share capital issued 0.1 - 0.3

Other loans repaid (4.4) (4.8) (31.9)

Other loans advanced - 8.8 29.4

---------- --------- ---------

(4.3) 4.0 (2.2)

---------- --------- ---------

(Decrease) / Increase in cash

in the period (14.2) 5.5 13.3

---------- --------- ---------

NOTES TO THE INTERIM RESULTS

at 30 September 2005

1. Accounting Policies

The accounting policies adopted by the Group are consistent with those disclosed

in the Group's financial statements for the year ended 31 March 2005 except for

the adoption and impact of FRS 21 and FRS 22.

FRS 21: Post Balance Sheet Events

This standard requires that dividends declared after the period end should not

be recognised as a liability at the balance sheet date. The comparative profit

and loss accounts and the balance sheets for the periods ended 30 September 2004

and 31 March 2005 have been restated in accordance with FRS21. The impact of

these changes on the profit and loss reserve and shareholders' funds can be seen

in notes 5 and 6.

FRS 22: Earnings per Share

This standard has had no impact on the calculation of earnings per share.

However, it requires the Group to present earnings per share from continuing

operations on the face of the profit and loss account and to disclose earnings

per share for discontinued operations.

Previous changes in accounting policies

In addition the comparatives for the half year ended 30 September 2004 have been

restated in order to be consistent with the accounting policies disclosed in the

Group's financial statements for the year ended 31 March 2005 as follows:

Half year to 30 September 2004

Net Operating Net Interest Profit before Taxation Profit after

Expenses taxation taxation

#m #m #m #m #m

As originally

stated (129.6) 0.1 10.9 (3.5) 7.4

Foreign

currency

branch (4.7) (1.0) (5.7) 1.6 (4.1)

Aircraft

maintenance

costs 1.0 - 1.0 (0.3) 0.7

--------- -------- -------- ------- ---------

As restated (133.3) (0.9) 6.2 (2.2) 4.0

--------- -------- -------- ------- ---------

At 30 September 2004

Tangible Fixed Creditors due Provisions for Net Assets

Assets within one year liabilities and

charges

#m #m #m #m

As originally

stated 86.4 (61.1) (10.1) 47.2

Foreign

currency

branch (4.7) (2.3) 3.7 (3.3)

Aircraft

maintenance

costs 4.9 (1.1 ) 0.2 4.0

Proposed

dividend - 0.7 - 0.7

--------- --------- ---------- ----------

As restated 86.6 (63.8) (6.2) 48.6

--------- --------- ---------- ----------

2. Turnover

Half year to Half year to Year to

30 September 30 September 31 March

2005 2004 2005

(unaudited) (unaudited) (audited)

#m #m #m

---------- ---------- ----------

Distribution

- continuing operations 55.2 51.0 100.1

Aviation Services

- continuing operations 119.6 78.0 145.9

- discontinued operations 9.5 11.4 22.0

(see note 4)

---------- ---------- ----------

184.3 140.4 268.0

---------- ---------- ----------

Turnover arising within:

Continuing operations

United Kingdom and the

Channel Islands 170.7 126.2 240.4

Mainland Europe 4.1 2.8 5.6

Discontinued operations

United Kingdom and the

Channel Islands 9.1 10.9 21.0

Far East 0.4 0.5 1.0

---------- ---------- ----------

184.3 140.4 268.0

---------- ---------- ----------

Analyses of profit before taxation and net assets between the different segments

of the Group are not given as, in the opinion of the directors, such analyses

would be seriously prejudicial to the commercial interests of the Group.

3. Net interest (payable) / receivable

Half year to Half year to Year to

30 September 30 September 31 March

2005 2004 2005

(unaudited) (unaudited) (audited)

#m #m #m

---------- ---------- ----------

On other loans (0.6) (0.2) (0.5)

Other interest payable - - (0.3)

---------- ---------- ----------

(0.6) (0.2) (0.8)

Interest receivable 0.2 0.3 0.7

Realised foreign exchange

(loss) / gain - (1.0) 2.4

---------- ---------- ----------

(0.4) (0.9) 2.3

---------- ---------- ----------

4. Exceptional items

Half year to Half year to Year to

30 September 30 September 31 March

2005 2004 2005

(unaudited) (unaudited) (audited)

#m #m #m

Operating items

Impairment of fixed assets - (4.4) (8.2)

Profit on disposal of investments

and fixed assets

Profit on disposal of

discontinued operations 3.7 - -

Gain on disposal of F27

fleet - - 0.8

Net interest

including exchange

(losses)/gains - (1.0) 2.4

--------- --------- ---------

Net exceptional items before

taxation 3.7 (5.4) (5.0)

--------- --------- ---------

On 31st August 2005, the Group completed the sale of Benair Freight

International Limited and Benair Freight Pte Limited, representing the entire

freight forwarding activities of the Group. The disposal is analysed as follows:

#m

Net Assets disposed of:

Fixed Assets 0.3

Debtors 4.0

Cash at bank 0.9

Creditors (4.0)

---------

1.2

Costs of

disposal 0.2

Profit on

disposal 3.7

---------

5.1

=========

Satisfied by:

Cash 5.1

=========

The profit attributable to members of the parent company for the half year to 30

September 2005 includes profits of #0.5m earned by Benair Freight International

Limited and Benair Freight Pte Limited up to the date of disposal.

During the half year to 30 September 2005 Benair Freight International Limited

and Benair Freight Pte Limited utilised #0.1m of the Group's net operating

cashflows, received #nil in respect of net returns on investments and servicing

of finance, paid #0.1m in respect of taxation and utilised #nil for capital

expenditure and financial investment.

5. Profit and loss account reserve

Half year to Half year to Year to

30 September 30 September 31 March

2005 2004 2005

(unaudited) (unaudited) (audited)

(restated) (restated)

#m #m #m

Balance at the beginning of

the period as previously

reported 38.6 31.2 31.2

Prior period adjustments 1.6 5.5 5.5

--------- --------- ---------

Balance at the beginning of

the period as restated 40.2 36.7 36.7

Profit for the period 13.5 4.0 5.6

Dividends paid in the period (1.6) (1.5) (2.2)

Currency translation

differences - - 0.1

--------- --------- ---------

52.1 39.2 40.2

--------- --------- ---------

Half year Half year Year to

to 30 September to 30 September 31 March

2005 2004 2005

(unaudited) (unaudited) (audited)

#m #m #m

Prior period adjustments

- Foreign currency branch - 0.7 0.7

- Aircraft maintenance cost - 3.3 3.3

- FRS 21 Proposed dividends

(note 1) 1.6 1.5 1.5

--------- --------- ---------

1.6 5.5 5.5

--------- --------- ---------

6. Reconciliation of movements in shareholders' funds

Half year to Half year to Year to

30 September 30 September 31 March

2005 2004 2005

(unaudited) (unaudited) (audited)

(restated) (restated)

#m #m #m

Profit for the period 13.5 4.0 5.6

Dividends paid in the period (1.6) (1.5) (2.2)

--------- -------- --------

11.9 2.5 3.4

Currency translation

differences - - 0.1

Issue of shares under share

option schemes 0.1 - 0.3

--------- -------- --------

Net addition to

shareholders' funds 12.0 2.5 3.8

--------- -------- --------

Opening shareholders' funds

as previously reported 48.3 40.6 40.6

Prior period adjustments

(note 5) 1.6 5.5 5.5

--------- -------- --------

Opening shareholders' funds

as restated 49.9 46.1 46.1

--------- -------- --------

Closing shareholders' funds 61.9 48.6 49.9

--------- -------- --------

7. Reconciliation of operating profit to net cash flow from

operating activities

Half year to Half year to Year to

30 September 30 September 31 March

2005 2004 2005

(unaudited) (unaudited) (audited)

(restated)

#m #m #m

---------- --------- --------

Operating profit 14.9 7.1 5.3

Depreciation 9.1 14.8 31.2

Amortisation of goodwill 0.3 0.3 0.5

Profit on disposal of fixed assets - - (0.1)

(Increase) / Decrease in stock (1.2) 0.6 (2.4)

(Increase) / Decrease in debtors - (2.9) 5.7

(Decrease) / Increase in creditors (6.7) 4.5 28.1

---------- --------- --------

Net cash flow from operating

activities 16.4 24.4 68.3

---------- --------- --------

8. Reconciliation of net cash flow to movement in net debt

Half year to Half year to Year to

30 September 30 September 31 March

2005 2004 2005

(unaudited) (unaudited) (audited)

(restated)

#m #m #m

---------- --------- --------

(Decrease) / Increase in cash in the

period (14.2) 5.5 13.3

Cash outflow / (inflow) from decrease

/(increase) in net debt in the period 4.4 (4.0) 2.5

---------- --------- --------

Change in net debt resulting from

cashflows in the period (9.8) 1.5 15.8

Exchange differences (0.3) (0.9) 1.6

Net funds / (debt) at beginning of

period 2.4 (15.0) (15.0)

---------- --------- --------

Net (debt) / funds at end of period (7.7) (14.4) 2.4

---------- --------- --------

9. Other matters

The financial information for the year ended 31 March 2005 does not constitute

statutory accounts, as defined in Section 240 of the Companies Act 1985, but is

based on the statutory accounts for the year then ended. Those accounts, upon

which the auditors issued an unqualified opinion, have been delivered to the

Registrar of Companies.

The calculation of basic earnings per share is based on earnings for the period

ended 30 September 2005 of #13.5m (2004 restated - #4.0m). The calculation of

basic earnings per share before exceptional items is based on earnings before

exceptional items for the period ended 30 September 2005 of #9.8m (2004 restated

- #7.8m). Both calculations are based on 34,551,299 shares (2004 - 34,358,217)

being the weighted average number of shares in issue for the period.

This report is being sent to all shareholders and copies are available from the

Company Secretary at the registered office of the Company, Building 470,

Bournemouth International Airport, Christchurch, Dorset, BH23 6SE.

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR EAPFKFSLSFFE

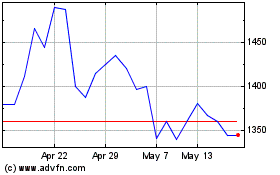

Jet2 (LSE:JET2)

Historical Stock Chart

From Jun 2024 to Jul 2024

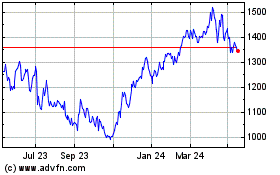

Jet2 (LSE:JET2)

Historical Stock Chart

From Jul 2023 to Jul 2024