Interim Results

23 November 2006 - 6:02PM

UK Regulatory

RNS Number:5648M

Dart Group PLC

23 November 2006

DART GROUP PLC

Interim Results for the Six Months Ended 30 September 2006

Dart Group PLC, the aviation and distribution group, announces its interim

results for the six months ended 30 September 2006

CHAIRMAN'S STATEMENT

I am pleased to report on the Group's trading for the six months ended 30

September 2006. Profit before tax, goodwill amortisation and exceptional items

amounted to #22.1m (2005 restated: #14.7m) whilst profit before tax but after

goodwill amortisation and exceptional items was #24.0m (2005 restated: #18.1m).

The usual pattern of seasonal profitability for the Group is likely to be

repeated this year, with Jet2.com being profitable in the summer and loss making

in the winter.

The Group has material exposures to both the US Dollar exchange rate and the

price of aviation fuel. The Group's treasury operations manage the risks of

these exposures. In accordance with our current treasury policy, both of these

exposures have been fully hedged for the current financial year. For the year

ending 31 March 2008, 76% of the forecast US Dollar exposure has been hedged

together with 57% of the jet fuel tonnage.

The Group completed the sale of its non-core Channel Islands' logistics business

on 3 July 2006. The exceptional credit of #2.2m relates to surplus of proceeds

over book cost.

Capital expenditure in the first half amounted to #26.0m (2005 : #22.7m) and

primarily related to the purchase of two Boeing 757-200 aircraft. Net debt at 30

September 2006 was #5.8m (2005 : #7.7m), representing gearing of 7.8 % (2005 :

13%).

The Board is pleased to declare an increased interim dividend of 0.65p per share

(2005 : 0.5625p), an increase of 15.6%. The dividend will be paid on 4 January

2007 to shareholders on the register as at 1 December 2006.

Jet2.com

Jet2.com, the low-cost airline, has had an encouraging summer's business from

its six Northern bases which, whilst serving separate catchment areas, have

considerable synergies in terms of marketing and operations. Predominately a

leisure-based airline, the company is benefiting from its customers' growing

propensity to fly on flexible scheduled services rather than with traditional

charter carriers for their leisure needs.

The owned aircraft fleet consists of 21 Boeing 737-300s and five Boeing

757-200s. Additional capacity is leased in as required. Six of the Boeing

737-300s are "Quick Change" versions enabling them to also operate night mail

services for Royal Mail.

We plan to expand both fleets during the winter months in order to serve the

increased range of destinations the company has announced for next summer. These

include seven new routes from Manchester, five each from Leeds-Bradford, Belfast

and Newcastle, four from Blackpool and two from Edinburgh. Several of these are

to existing destinations already served from other bases and their introduction

will considerably increase the choice of city breaks and sun offered from each

base and enhance the company's overall marketing presence. Full details can be

found on the company's website, www.jet2.com.

Ancillary revenue from associated commercial services such as onboard sales and

hotels, car hire, etc., booked through our sales website have shown good growth

in spend per passenger during the year and major efforts are being made to build

on these and to develop other revenue opportunities.

Our strategy continues to be to concentrate and grow Jet2.com's operations in

the North, building familiarity with the brand and delivering an attractive,

low-cost service. This is a competitive market but, with innovation, we believe

there are many future opportunities.

Fowler Welch-Coolchain

The Group's logistics company, Fowler Welch-Coolchain, made further progress in

the first half with increased sales and profits. Fowler Welch-Coolchain

primarily provides an integrated supply chain solution to supermarkets and their

suppliers, food manufacturers, growers and importers. Capabilities include both

chilled and ambient distribution together with warehousing and pick to order

operations.

The recently acquired business and assets of R F Fielding Cheshire Limited (In

Administration), which specialises in ambient distribution, made a small net

contribution to profits from a combination of network synergies, cost reductions

and new customer wins.

On 4 September 2006 an 11 acre freehold property was acquired in North East

England. Currently, the property is being partially fitted out with chilled

storage and loading docks and, when complete, the total cost will be in the

order of #5.25m. These facilities will enable the business to further grow its

operations out of this region as the previous property was too small to support

growth.

The business' warehousing and picking operations continue to expand, with our

Teynham, Kent site functioning at near capacity and a substantial operation

being undertaken at Spalding for Bernard Matthews Foods Limited, with whom a five-

year contract has just been signed.

Outlook

After an encouraging first half, we remain optimistic for a successful outcome

to the full year.

Philip Meeson,

Chairman 23 November 2006

www.dartgroup.co.uk

Enquiries:

Philip Meeson, Chairman Mobile: 07785 258666

Mike Forder, Group Finance Director Mobile: 07721 865850

UNAUDITED INTERIM CONSOLIDATED RESULTS

for the half year to 30 September 2006

Note Half Year to Half Year to Half Year to Half Year to Half Year to Half Year to Year to 31 Year to 31 Year to 31

30 September 30 September 30 September 30 September 30 September 30 September March 2006 March 2006 March 2006

2006 2006 2006 2005 2005 2005 (audited) (audited) (audited)

(unaudited) (unaudited) (unaudited) (unaudited) (unaudited) (unaudited) before exceptional Total

Before Exceptional Total Before exceptional Total exceptional items(restated)

exceptional items exceptional items (restated) items

items items (restated)

(restated)

#m #m #m #m #m #m #m #m #m

-------- -------- -------- -------- -------- -------- -------- -------- --------

Turnover

- continuing

operations 198.6 - 198.6 168.7 - 168.7 298.6 - 298.6

- discontinued

operations 3.2 - 3.2 15.6 - 15.6 21.0 - 21.0

------ -------- -------- --------- -------- -------- -------- -------- --------

2 201.8 - 201.8 184.3 - 184.3 319.6 - 319.6

------ -------- -------- -------- -------- -------- -------- -------- --------

Net operating (178.4) - (178.4) (169.2) - (169.2) (305.6) (6.2) (311.8)

expenses,

excluding

amortisation

of goodwill

Amortisation

of goodwill (0.3) - (0.3) (0.3) - (0.3) (0.5) - (0.5)

Net operating (178.7) - (178.7) (169.5) - (169.5) (306.1) (6.2) (312.3)

expenses ------ ------- ------- ------- -------- ------- ------- -------- -------

Operating

Profit

- continuing

operations 23.0 - 23.0 13.8 - 13.8 12.4 (6.2) 6.2

-

discontinued

operations 0.1 - 0.1 1.0 - 1.0 1.1 - 1.1

-------- -------- -------- -------- -------- -------- -------- ------- --------

23.1 - 23.1 14.8 - 14.8 13.5 (6.2) 7.3

-------- -------- -------- -------- -------- -------- -------- ------- --------

Profit on

disposal of

discontinued

operations - 2.2 2.2 - 3.7 3.7 - 3.7 3.7

Profit on

disposal of

fixed assets - - - - - - - 3.3 3.3

-------- -------- -------- -------- -------- -------- -------- -------- --------

Net interest

(payable) /

receivable 3 (1.3) - (1.3) (0.4) - (0.4) 0.5 - 0.5

-------- -------- -------- -------- -------- -------- -------- -------- --------

Profit on

ordinary

activities

before

taxation 21.8 2.2 24.0 14.4 3.7 18.1 14.0 0.8 14.8

Taxation (7.0) (0.2) (7.2) (4.7) - (4.7) (4.7) 0.9 (3.8)

-------- -------- -------- -------- -------- -------- -------- -------- --------

Profit for

the period 14.8 2.0 16.8 9.7 3.7 13.4 9.3 1.7 11.0

-------- -------- -------- -------- -------- -------- -------- -------- --------

Note Half Year to Half Year to Half Year to Half Year to Year to 31 Year to 31

30 September 30 September 30 September 30 September March 2006 March 2006

2006 2006 2005 2005 (unaudited) (unaudited)

(unaudited) (unaudited) (audited) (audited) Before Total

Before Total Before Total exceptional (restated)

exceptional exceptional (restated) items

items items (restated)

(restated)

------------------------------------------------------------------------------------------------------------------------

Earnings per share - total

- basic 10.60p 12.07p 7.09p 9.75p 6.75p 7.95p

- diluted 10.51p 11.96p 7.03p 9.67p 6.70p 7.89p

Earnings per share - continuing operations

- basic 10.48p 10.48p 6.45p 6.45p 6.44p 4.98p

- diluted 10.39p 10.39p 6.40p 6.40p 6.40p 4.95p

Earnings per share - discontinued operations

- basic 0.12p 1.58p 0.64p 3.30p 0.31p 2.97p

- diluted 0.11p 1.57p 0.63p 3.27p 0.31p 2.95p

STATEMENT OF TOTAL RECOGNISED GAINS AND LOSSES

for the half year to 30 September 2006

Half Year to Half Year to Year to 31

30 September 30 September March 2006

2006 2005

(unaudited) (unaudited) (audited)

Total Total Total

(restated) (restated)

#m #m #m

---------------------------------------

Profit for the period 16.8 13.4 11.0

---------------------------------------

Total recognised gains and losses relating to the period 16.8 13.4 11.0

======== =======

Prior year adjustment

- FRS 20 Share based payment expense (note 1) (0.3)

--------

Total recognised gains and losses since previous annual report 16.5

========

CONSOLIDATED BALANCE SHEET

at 30 September 2006

Note 30 September 30 September 31 March

2006 2005 2006

(unaudited) (unaudited) (audited)

(restated) (restated)

#m #m #m

--------- ---------- --------

Fixed assets 6.5 7.0 6.8

Intangible assets

Tangible assets 143.6 112.7 131.5

--------- ---------- --------

150.1 119.7 138.3

--------- ---------- --------

Current assets

Stock 6.5 5.8 7.5

Debtors 26.1 25.5 23.8

Cash at bank and in hand 12.7 13.2 26.0

--------- ---------- --------

45.3 44.5 57.3

Current liabilities

Creditors: amounts falling

due within one year (91.4) (78.0) (98.6)

--------- ---------- --------

Net current liabilities (46.1) (33.5) (41.3)

--------- ---------- --------

Total assets less current

liabilities 104.0 86.2 97.0

Creditors: amounts falling

due after more than one year (16.4) (18.1) (28.0)

Provisions for liabilities and

charges (12.9) (6.2) (9.7)

--------- ---------- --------

Net assets 74.7 61.9 59.3

--------- ---------- --------

Capital and reserves

Called up share capital 1.8 1.7 1.7

Share premium account 8.8 8.1 8.6

Profit and loss account 5 64.1 52.1 49.0

--------- ---------- --------

Shareholders' funds - equity

interests 6 74.7 61.9 59.3

--------- ---------- --------

CONSOLIDATED CASH FLOW STATEMENT

for the half year to 30 September 2006

Note Half year to Half year to Year to

30 September 30 September 31 March

2006 2005 2006

(unaudited) (unaudited) (audited)

#m #m #m

--------- --------- ---------

Net cash inflow from operating

activities 7 23.8 16.4 41.0

---------- --------- ---------

Returns on investment and

servicing of finance

Interest paid: bank and other loans (0.7) (0.6) (1.9)

Interest received: bank 0.3 0.2 0.3

---------- --------- ---------

(0.4) (0.4) (1.6)

---------- --------- ---------

Taxation

Corporation and overseas tax paid (1.2) (5.6) (5.2)

---------- --------- ---------

Capital expenditure and financial investment

Purchase of tangible fixed assets (26.0) (22.7) (48.7)

Disposal of tangible fixed assets 2.2 - 3.2

---------- --------- ---------

(23.8) (22.7) (45.5)

---------- --------- ---------

Acquisitions and disposals 4

Proceeds from disposal of

discontinued operations (net of

disposal costs) 3.8 4.9 4.9

Net cash balances leaving the

Group with disposal of

discontinued operations - (0.9) (0.9)

---------- --------- ---------

3.8 4.0 4.0

---------- --------- ---------

Equity dividends paid (1.8) (1.6) (2.4)

---------- --------- ---------

Cash inflow / (outflow) before

financing 0.4 (9.9) (9.7)

---------- --------- ---------

Financing

Ordinary share capital issued 0.2 0.1 0.6

Other loans repaid (13.0) (4.4) (14.2)

Other loans advanced - - 20.4

---------- --------- ---------

(12.8) (4.3) 6.8

---------- --------- ---------

(Decrease) in cash in the

period (12.4) (14.2) (2.9)

---------- --------- ---------

NOTES TO THE INTERIM RESULTS

at 30 September 2006

1. Accounting Policies

The accounting policies adopted by the Group are consistent with those disclosed

in the Group's financial statements for the year ended 31 March 2006 except for

the adoption and impact of FRS 20.

FRS 20: Share-based Payment

The fair value of employee share option plans is measured at the date of grant

of the option using a binomial valuation model. The resulting cost, as adjusted

for the expected and actual level of vesting of the options, is charged to

income over the period in which the options vest. At each balance sheet date

before vesting the cumulative expenses is calculated, representing the extent to

which the vesting period has expired and management's best estimate of the

achievement or otherwise of non-market conditions, of the number of equity

instruments that will ultimately vest. Cumulative expense since the previous

balance sheet date is recognised in the income statement with a corresponding

entry in reserves. The Group has taken advantage of the transitional provisions

of FRS 20 in respect of the fair value of equity settled awards so as to apply

FRS 20 only to those equity-settled awards granted after 7 November 2002 that

had not vested before 1 January 2006.

The fair value of equity-settled share options granted is estimated as at the

date of grant using a binomial valuation model, taking into account the terms

and conditions upon which the options were granted. The following table lists

the inputs to the models for the options granted in the year:

Half year to

30 September 2006

Dividend yield 1.8%

Expected share price volatility 33%

Historical volatility 33%

Risk-free interest rate 4.46%

Expected life of options 10 years

Weighted average share price 55p

The expected life of the options is based on historical data and is not

necessarily indicative of exercise patterns that may occur. The expected

volatility reflects the assumption that the historical volatility is indicative

of future trends, which may also not necessarily be the actual outcome. No other

features of options grant were incorporated into the measurement of fair value.

The share-based payment charge has been recorded in the income statement as

follows:

Half year to Half year to Year to

30 September 30 September 31 March

2006 2005 2006

(unaudited) (unaudited) (audited)

#m #m #m

- Employee costs 0.1 0.1 0.2

---------- --------- --------

2. Turnover

Half year to Half year to Year to

30 September 30 September 31 March

2006 2005 2006

(unaudited) (unaudited) (audited)

#m #m #m

Distribution --------- --------- -------

- continuing operations 52.9 49.1 104.2

- discontinued operations (see note 4) 3.2 6.1 11.5

Aviation

- continuing operations 145.7 119.6 194.4

- discontinued operations - 9.5 9.5

--------- --------- -------

201.8 184.3 319.6

--------- --------- -------

Turnover arising:

Continuing operations

Within the United Kingdom and the

Channel Islands 93.2 92.3 173.3

Between the United Kingdom and

Mainland Europe 105.4 76.4 125.3

Discontinued operations

Within the United Kingdom and the

Channel Islands 3.2 15.2 20.6

Within the Far East - 0.4 0.4

--------- --------- -------

201.8 184.3 319.6

--------- --------- -------

Analyses of profit before taxation and net assets between the different segments

of the Group are not given as, in the opinion of the directors, such analyses

would be seriously prejudicial to the commercial interests of the Group.

3. Net interest and currency (losses)/gains (payable) / receivable

Half year to Half year to Year to

30 September 30 September 31 March

2006 2005 2006

(unaudited) (unaudited) (audited)

#m #m #m

--------- --------- --------

On other loans (0.9) (0.6) (1.5)

Other interest payable - - (0.6)

--------- --------- --------

(0.9) (0.6) (2.1)

Interest receivable 0.3 0.2 0.3

Interest payable capitalised within

fixed assets 0.2 - 0.3

Foreign exchange (loss) / gain (0.9) - 2.0

--------- --------- --------

(1.3) (0.4) 0.5

--------- --------- --------

4. Exceptional items

Half year to Half year to Year to

30 September 30 September 31 March

2006 2005 2006

(unaudited) (unaudited) (audited)

#m #m #m

Operating items

Re-organisation costs - - (2.2)

A300 closure costs - - (0.7)

Impairment of fixed assets - - (3.3)

Profit on disposal of investments and fixed assets

Profit on disposal of discontinued operations 2.2 3.7 3.7

Gain on disposal of A300 - - 3.3

--------- --------- --------

Net exceptional items before taxation 2.2 3.7 0.8

--------- --------- --------

On 3rd July 2006, the Group completed the sale of the trade, assets and

liabilities of Channel Express (CI) Limited to a third party specialising in

Channel Islands distribution. The disposal is analysed as follows:

#m

Net Assets disposed of:

Fixed Assets 0.8

Debtors 2.2

Cash at bank -

Creditors (1.4)

--------

1.6

Costs of disposal 0.2

Profit on disposal 2.2

--------

Proceeds 4.0

========

Satisfied by:

Cash 4.0

========

The profit attributable to members of the parent company for the half year to 30

September 2006 includes profits of #0.2m earned by Channel Express (CI) Limited

up to the date of disposal.

During the half year to 30 September 2006 Channel Express (CI) Limited

contributed #0.4m to the Group's net operating cashflows, received #0.1m in

respect of net returns on investments and servicing of finance, paid #0.1m in

respect of taxation and utilised #nil for capital expenditure and financial

investment.

5. Profit and loss account reserve

Half year to Half year to Year to

30 September 30 September 31 March

2006 2005 2006

(unaudited) (unaudited) (audited)

(restated) (restated)

#m #m #m

Balance at the beginning of the 49.0 40.2 40.2

period

Profit for the period 16.8 13.4 11.0

Dividends paid in the period (1.8) (1.6) (2.4)

Reserves movement arising from share

based payment charge 0.1 0.1 0.2

--------- --------- --------

64.1 52.1 49.0

--------- --------- --------

6. Reconciliation of movements in shareholders' funds

Half year to Half year to Year to

30 September 30 September 31 March

2006 2005 2006

(unaudited) (unaudited) (audited)

(restated) (restated)

#m #m #m

Profit for the period 16.8 13.4 11.0

Dividends paid in the period (1.8) (1.6) (2.4)

Reserves movement arising from share

based payment charge 0.1 0.1 0.2

--------- --------- --------

Net addition to Profit and Loss reserve 15.1 11.9 8.8

Issue of shares under share option schemes 0.3 0.1 0.6

--------- --------- --------

Net addition to shareholders' funds 15.4 12.0 9.4

--------- --------- --------

Opening shareholders' funds 59.3 49.9 49.9

--------- --------- --------

Closing shareholders' funds 74.7 61.9 59.3

--------- --------- --------

7. Reconciliation of operating profit to net cash flow from operating activities

Half year to Half year to Year to

30 September 30 September 31 March

2006 2005 2006

(unaudited) (unaudited) (audited)

(restated)

#m #m #m

Operating profit 23.1 14.8 7.3

Depreciation and impairment 10.8 9.1 16.6

Amortisation of goodwill 0.3 0.3 0.5

Profit on disposal of fixed assets 0.1 - -

Share based payments 0.1 0.1 0.2

Decrease / (increase) in stock 1.0 (1.2) (2.9)

(Increase) / decrease in debtors (4.4) - 1.7

(Decrease) / increase in creditors (7.2) (6.7) 17.6

--------- --------- --------

Net cash flow from operating activities 23.8 16.4 41.0

--------- --------- --------

8. Reconciliation of net cash flow to movement in net debt

Half year to Half year to Year to

30 September 30 September 31 March

2006 2005 2006

(unaudited) (unaudited) (audited)

(restated)

(Decrease) in cash in the period (12.4) (14.2) (2.9)

Cash outflow / (inflow) from decrease

/(increase) in net debt 13.0 4.4 (6.2)

in the period

------- -------- -------

Change in net debt resulting from

cashflows in the period 0.6 (9.8) (9.1)

Exchange differences (0.9) (0.3) 1.2

Net (debt) / funds at beginning of period (5.5) 2.4 2.4

-------- -------- -------

Net (debt) at end of period (5.8) (7.7) (5.5)

-------- -------- -------

9. Other matters

The financial information for the year ended 31 March 2006 does not constitute

statutory accounts, as defined in Section 240 of the Companies Act 1985, but is

based on the statutory accounts for the year then ended. Those accounts, upon

which the auditors issued an unqualified opinion, have been delivered to the

Registrar of Companies.

The calculation of basic earnings per share is based on earnings for the period

ended 30 September 2006 of #16.8m (2005 restated - #13.4m). The calculation of

basic earnings per share before exceptional items is based on earnings before

exceptional items for the period ended 30 September 2006 of #14.8m (2005

restated - #9.7m). Both calculations are based on 139,501,501 shares (2005 -

138,205,196) being the weighted average number of shares in issue for the

period.

This report will be posted on the Company's website, www.dartgroup.co.uk.

23 November 2006

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR EAPFAASPKFFE

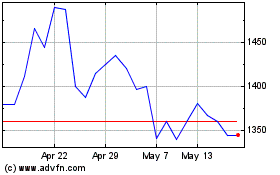

Jet2 (LSE:JET2)

Historical Stock Chart

From Jun 2024 to Jul 2024

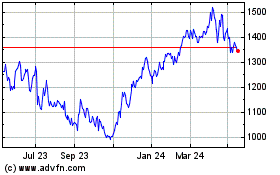

Jet2 (LSE:JET2)

Historical Stock Chart

From Jul 2023 to Jul 2024