TIDMDTG

RNS Number : 1296E

Dart Group PLC

14 July 2016

DART GROUP PLC

PRELIMINARY UNAUDITED RESULTS FOR YEARED 31 MARCH 2016

Dart Group PLC, the Leisure Travel and Distribution &

Logistics group ("the Group"), announces its preliminary results

for the year ended 31 March 2016. These results are presented under

International Financial Reporting Standards ("IFRS").

Financial Highlights Year ended Year ended Change

31 March 31 March

2016 2015

(Unaudited) (Audited)

------------------------------------------- ------------- ------------ ----------

Group revenue GBP1,405.4m GBP1,253.2m +12%

------------------------------------------- ------------- ------------ ----------

Group operating profit (Underlying(1) ) GBP105.0m GBP50.2m +109%

Operating profit margin (Underlying(1) ) 7.5% 4.0% +3.5 ppts

------------------------------------------- ------------- ------------ ----------

Group operating profit GBP105.0m GBP33.2m +216%

Operating profit margin 7.5% 2.6% +4.9 ppts

------------------------------------------- ------------- ------------ ----------

Profit before tax (Underlying(1) ) GBP104.2m GBP57.2m +82%

Profit before tax GBP104.2m GBP40.2m +159%

------------------------------------------- ------------- ------------ ----------

Basic earnings per share (Underlying(1) ) 60.22p 31.72p +90%

Basic earnings per share 60.22p 22.42p +169%

------------------------------------------- ------------- ------------ ----------

Proposed final dividend per share 3.10p 2.25p +38%

Resulting total dividend per share 4.00p 3.00p +33%

------------------------------------------- ------------- ------------ ----------

1: The "Underlying" prior year results are stated excluding a

separately disclosed exceptional provision of GBP17.0m, in relation

to possible passenger compensation claims for historical flight

delays.

* Group revenue increased 12% to GBP1,405.4m (2015: GBP1,253.2m)

while Group operating profit increased 109% to GBP105.0m (2015

Underlying: GBP50.2m), reflecting strong trading in our Leisure

Travel business together with an improved performance from the

Group's Distribution & Logistics business.

* Profit before tax grew 82% to GBP104.2m (2015 Underlying:

GBP57.2m) and Basic earnings per share increased 90% to 60.22p

(2015 Underlying: 31.72p).

* In consideration of the Group's encouraging results, the Board

is recommending a final dividend of 3.10p (2015: 2.25p), bringing

the proposed total dividend to 4.00p per share for the year ended

31 March 2016 (2015: 3.00p).

* Leisure Travel revenue grew 15% to GBP1,261.4m (2015:

GBP1,101.5m) reflecting increased yields from both our flight-only

and package holidays products and a 22% increase in package holiday

customers, who represented 40% of total departing passengers (2015:

33%).

* Distribution & Logistics improved its profit before tax by

GBP2.1m to GBP5.4m (2015: GBP3.3m) on reduced revenues of GBP144.0m

(2015: GBP151.7m) as lower fuel costs were passed on to

customers.

* The current financial year has started well in both our

Leisure Travel and Distribution businesses. Although we were

disappointed at the result of the recently held referendum on

whether the UK should remain in the EU, we are confident that our

customers will need our specialist food distribution services and

will be keen to travel from our rainy islands to the sun spots of

the Mediterranean, The Canaries and to European Leisure Cities.

CHAIRMAN'S STATEMENT

I am pleased to report the Group's strong trading for the year

ended 31 March 2016. Operating profit increased by 109% to

GBP105.0m (2015 Underlying: GBP50.2m) and profit before tax by 82%

to GBP104.2m (2015 Underlying: GBP57.2m). Growth in basic earnings

per share was 90% to 60.22p (2015 Underlying: 31.72p).

In consideration of the Group's encouraging results, the Board

is recommending a final dividend of 3.10p per share (2015: 2.25p)

which will bring the total proposed dividend to 4.00p per share for

the year (2015: 3.00p), an increase of 33%. This final dividend is

subject to shareholders' approval at the Company's Annual General

Meeting on 8 September 2016 and will be payable on 21 October 2016

to shareholders on the register at the close of business on 16

September 2016.

The increase in profitability reflects the strength of the

Group's Leisure Travel business, which combines both Jet2.com, our

leisure airline and Jet2holidays, our package holidays provider,

together with an improved performance from Fowler Welch, our

Distribution and Logistics business.

Revenue in our Leisure Travel business increased by 15% to

GBP1,261.4m (2015: GBP1,101.5m) and operating profit improved by

112% to GBP99.6m (2015 Underlying: GBP46.9m) as over 3.0m departing

customers took a flight or package holiday to our sun, city and ski

destinations during the year.

Jet2.com flew a total of 6.07m passenger sectors (2015: 6.05m)

and achieved an average load factor of 92.5% (2015: 91.2%)

alongside an increase in average net ticket yield of 14%.

Jet2holidays took 1.22m customers (2015: 1.00m) on holiday, an

increase of 22%, representing 40% of departing customers (2015:

33%).

To meet our programme of aircraft fleet replacement and our

planned Leisure Travel business growth, on 3 September 2015 we were

delighted to announce an agreement with Boeing to purchase 27 new

Boeing 737-800NG aircraft, and subsequently in December 2015, an

agreement to purchase a further 3 new aircraft. These aircraft will

be delivered between September 2016 and April 2018.

Fowler Welch improved its profit before tax by GBP2.1m to

GBP5.4m (2015: GBP3.3m) on reduced revenues of GBP144.0m (2015:

GBP151.7m) as lower fuel costs were passed on to customers.

The Group generated increased net cash flow from operating

activities of GBP243.9m (2015: GBP116.1m). Total capital

expenditure of GBP213.5m (2015: GBP76.4m) included the purchase of

three used Boeing 737-800NG aircraft, one for summer 2015 and two

for summer 2016, deposits and pre-delivery payments for the new

Boeing aircraft order, and continued investment in the long-term

maintenance of our existing fleet of aircraft and engines. The new

aircraft pre-delivery payments have been substantially

financed.

As at 31 March 2016, the Group's cash and money market deposit

balances had increased by GBP109.2m (2015: GBP39.1m) to GBP412.0m

(2015: GBP302.8m) and included advance payments from Leisure Travel

customers of GBP385.8m (2015: GBP318.7m), in respect of their

future holidays and flights.

Leisure Travel

We take people on holiday! Our Leisure Travel business

specialises in scheduled flights by our airline Jet2.com to holiday

destinations in the Mediterranean, the Canary Islands and to

European Leisure Cities and the provision of ATOL licensed package

holidays by our tour operator Jet2holidays.

Our core principles are to be family friendly, offer value for

money and give great customer service. For those customers who have

arranged their own accommodation, our flights offer competitive

fares, convenient flight times, allocated seating and a 22kg

baggage allowance. Our package holidays, however, give us the

opportunity to deliver an 'end-to-end' experience to which we add

value through innovation and customer service. Importantly, our

customer volumes allow us to serve many destinations daily and

others several times a week during the spring, summer and autumn

months, and enable us to offer a great choice of variable duration

holidays at affordable prices.

Real package holidays take considerable organisation and

attention to detail. Jet2holidays employs over 900 colleagues

contracting and administering hotels, managing the finances and

providing operational support. The business has contractual

relationships with over 2,700 hotels, encompassing a wide range of

great value 2 to 5-star hotel products, catering for young &

old and families alike. Many have adjacent waterparks and other

great attractions included in the package, adding enjoyment and

interest to the overall holiday experience.

Nearly 40% of our package holidays were sold on an all-inclusive

basis. The all-inclusive package offers a 'Defined Price' for the

whole holiday experience, including flights, transfers, meals,

alcohol for the adults and ice lollies for the kids. This is a

resilient, great value offering for families on a tight budget and

is particularly attractive for challenging economic times. And to

ensure that each of our customers has a happy holiday experience we

employ nearly 300 representatives in holiday resorts, backed up by

24-hour customer helplines, to give practical assistance in all

eventualities.

The last day of a holiday can often be stressful and with this

in mind the business has introduced its "In-resort Flight Check-in"

service at many hotels. This allows Jet2holidays customers to

check-in their baggage for their return flight home at their hotel,

allowing them to enjoy their final day, bag and hassle free.

On 7 July 2016 we were very pleased to announce that from April

2017 we will be offering our flights and package holidays from

Birmingham Airport - our eighth UK aircraft base. We know that

there is strong demand for our services in the Midlands.

During the financial year, Jet2.com operated 59 aircraft from

our then seven Northern UK airport bases to 61 destinations,

serving 379 holiday resorts and added three new destinations,

Antalya, Kefalonia and Malta. The fleet has grown to 63 aircraft

for summer 2016, with a commensurate increase in pilots, engineers

and cabin crew. To ensure we have well trained colleagues to

support continued growth, our flight simulator and training centre

in Bradford has recently taken delivery of a fourth flight

simulator.

We are fully focused on our package holidays offering and its

inherent higher margin and are encouraged that sales continue to

grow, outstripping the market, as our reputation for providing

'package holidays you can trust' develops. We ensure that the

customer is at the heart of everything we do as we strive to

provide wonderful holidays through sustained investment in product,

brand and customer service. We believe we have a great future in

the Leisure Travel marketplace.

Distribution & Logistics

Fowler Welch is one of the UK's leading providers of

distribution and logistics services to the food industry supply

chain, serving retailers, processers, growers and importers across

its network of nine sites, encompassing circa 900k square foot of

warehouse space.

Our major temperature-controlled operations are in the key

produce growing and importing areas of Spalding in Lincolnshire,

Teynham and Paddock Wood in Kent and Hilsea near Portsmouth, with

two further regional distribution sites located at Washington, Tyne

and Wear and at Newton Abbot, Devon. Ambient

(non-temperature-controlled) consolidation and distribution

services are provided at Heywood near Bury and Desborough,

Northamptonshire.

In May 2014, Fowler Welch, together with our partner Direct

Produce Supplies Limited, a leading supplier of fruits to multiple

retailers, commenced a joint venture business, "Integrated Service

Solutions" (ISS) at our Teynham facility in Kent. This provides a

full range of fruit ripening and packing services to the produce

sector. I am very pleased to report that the business is now

contributing positively towards overall Group profitability and

feeding considerable volumes of packed fruits into our distribution

system.

To meet the growing operational needs of ISS and to provide more

distribution space at Teynham, which serves local Kent growers and

is located close to the port of Dover and the Channel Tunnel - main

arteries for fruit and produce imported into the UK, an extension

of the facility was completed on 9 July 2016, adding over 50k

square foot of much needed capacity.

On 6 June 2016 Fowler Welch agreed a contract with Dairy Crest

Limited, to take over its Nuneaton based UK distribution. On this

date, the Dairy Crest fleet of 51 tractor units, along with

associated distribution colleagues transferred to Fowler Welch.

This provides an important additional revenue stream, which will be

developed by the integration of the Dairy Crest and Fowler Welch

fleets and the achievement of supply chain efficiencies.

The improvement in profitability and operating margins achieved

in the year are expected to continue. By developing its revenue

streams and delivering value adding, innovative supply-chain

services, we believe the outlook for Fowler Welch is

encouraging.

Outlook

We have a resilient Leisure Travel business. Our strategy is to

grow both our flight-only and package holidays products. However,

pleasingly, the sales of our higher margin package holidays

continue to outperform the market and to provide an increasingly

larger proportion of the departing passengers on our flights. At

the end of the financial year, package holidays represented 40% of

our departing passengers (2015: 33%) and this trend is continuing

in this new financial year. The provision of real package holidays

is not easily replicated by non-specialists. As discussed earlier

in this statement, the Group dedicates significant resources to

deliver an innovative and industry leading product. These holidays,

especially all-inclusive packages, which give families certainty of

price, have proven particularly successful in challenging economic

times.

The current financial year has started well in both our Leisure

Travel and Distribution businesses. Although we were disappointed

at the result of the recently held referendum on whether the UK

should remain in the EU, we are confident that our customers will

need our specialist food distribution services and will be keen to

travel from our rainy islands to the sun spots of the

Mediterranean, The Canaries and to European Leisure Cities.

Philip Meeson

Chairman

14 July 2016

BUSINESS AND FINANCIAL REVIEW

The Group's financial performance for the year ended 31 March

2016 is reported in line with International Financial Reporting

Standards ("IFRS"), as adopted by the EU, which were effective at

31 March 2016.

Summary Income Statement

Unaudited Audited Audited Audited Change

2016 2015 2015 2015

Total Before Separately Total (2016

separately disclosed vs. 2015

disclosed items before

items (see note separately

7) disclosed

items)

GBPm GBPm GBPm GBPm

------------------------------------ ----------

Revenue 1,405.4 1,253.2 - 1,253.2 12%

Net operating expenses (1,300.4) (1,203.0) (17.0) (1,220.0) (8%)

------------------------------------ ---------- ------------ ------------ ---------- ------------

Operating profit 105.0 50.2 (17.0) 33.2 109%

Net financing income 0.5 0.6 - 0.6 (17%)

Revaluation of derivative

hedges - 1.6 - 1.6 (100%)

Net FX revaluation (losses)/gains (1.3) 4.8 - 4.8 (127%)

------------------------------------ ---------- ------------ ------------ ---------- ------------

Net financing (costs)/income (0.8) 7.0 - 7.0 (111%)

Group profit before tax 104.2 57.2 (17.0) 40.2 82%

Net financing costs /

(income) 0.8 (7.0) - (7.0) 111%

Depreciation 88.7 71.3 - 71.3 24%

------------------------------------ ----------

EBITDA 193.7 121.5 (17.0) 104.5 59%

==================================== ========== ============ ============ ========== ============

Operating profit margin 7.5% 4.0% - 2.6% 3.5 ppts

Group profit before tax

margin 7.4% 4.6% - 3.2% 2.8 ppts

EBITDA margin 13.8% 9.7% - 8.3% 4.1 ppts

----------------------------------- ---------- ------------ ------------ ---------- ------------

A strong summer season for the Leisure Travel business was

followed by a better than expected winter, as customer demand for

our flight-only and package holidays remained buoyant. Net ticket

yields and average package holiday prices showed healthy increases,

resulting in the business increasing its revenue by 12% to

GBP1,405.4m (2015: 1,253.2m).

An improved forward booking position entering summer 2015,

consistent demand and the continuing growth of our higher margin

package holidays product as a percentage of overall sales all

contributed to the Group's improved operating profit of GBP105.0m,

more than double the previous year's underlying result of GBP50.2m.

On a statutory basis, operating profit increased by 216% from

GBP33.2m, after an exceptional charge of GBP17.0m in the previous

year.

Net financing costs of GBP0.8m (2015: income GBP7.0m) included a

net GBP1.3m charge in relation to the revaluation of foreign

currency and pre-delivery payment loan balances held at the

reporting date (2015: income GBP4.8m).

As a result, the Group achieved a statutory profit before tax of

GBP104.2m (2015 Underlying: GBP57.2m). Group EBITDA increased by

59% to GBP193.7m (2015 Underlying: GBP121.5m).

The Group's effective tax rate of 15% (2015: 18%) was lower than

the headline rate of corporation tax of 20% due to its decreasing

deferred tax liability. Earnings per share increased by 90% to

60.22p (2015 Underlying: 31.72p). Overall basic earnings per share

increased by 169% from 22.42p after adjusting for the exceptional

provision of GBP17.0m charged in the previous year.

Summary of Cash Flows

Unaudited Audited Change

2016 2015

GBPm GBPm

----------------------------------------- ---------- -------- ---------

EBITDA 193.7 104.5 85%

Other P&L adjustments 0.1 0.1 -

Movements in working capital 61.0 19.1 219%

Interest and taxes (10.9) (7.6) (43%)

----------------------------------------- ---------- -------- ---------

Net cash generated from operating

activities 243.9 116.1 110%

Purchase of property, plant & equipment (213.5) (76.4) (179%)

Movement on borrowings 81.9 (0.8) 10,338%

Other items (3.1) 0.2 (1,650%)

----------------------------------------- ----------

Increase in net cash and money market

deposits 109.2 39.1 179%

========================================= ========== ======== =========

Net cash generated from operating activities was GBP243.9m

(2015: GBP116.1m) out of which capital expenditure of GBP213.5m

(2015: GBP76.4m) was incurred. The Group generated a net cash

inflow(a) of GBP109.2m (2015: GBP39.1m), resulting in a year end

cash position, including money market deposits, of GBP412.0m (2015:

GBP302.8m). The Group continues to be funded, in part, by payments

received in advance of travel from its Leisure Travel customers,

which at the reporting date amounted to GBP385.8m (2015:

GBP318.7m).

Of these customer advances, GBP68.5m (2015: GBP97.5m) was

considered restricted by the Group's merchant acquirers as

collateral against a proportion of forward bookings paid for by

credit or debit card. These balances become unrestricted once our

customers have travelled. The business also had GBP5.2m (2015:

GBP51.7m) of cash placed with various counterparties in the form of

margin calls to cover out-of-the-money hedge instruments.

Summary Balance Sheet

Unaudited Audited Change

2016 2015

GBPm GBPm

---------------------------------- ---------- -------- -------

Non-current assets (c) 426.6 302.1 41%

Net current assets(b) 288.9 252.4 14%

Deferred revenue (767.5) (580.3) (32%)

Other liabilities (36.7) (19.4) (89%)

Derivative financial instruments (4.6) (100.4) 95%

Cash and money market deposits 412.0 302.8 36%

---------------------------------- ---------- -------- -------

Total shareholders' equity 318.7 157.2 103%

================================== ========== ======== =======

(a) Cash flows are reported including the movement on money

market deposits (cash deposits with maturity of more than three

months from point of placement) to give readers an understanding of

total cash generation. The Consolidated Cash Flow Statement reports

net cash flow excluding these movements.

(b) Stated excluding cash and cash equivalents, money market

deposits, deferred revenue and derivative financial

instruments.

(c) Stated excluding derivative financial instruments.

The Group is continuing to meet the UK Civil Aviation

Authority's required levels of "available liquidity", which is

defined as free cash plus available undrawn banking facilities.

Total shareholders' equity increased by GBP161.5m (2015: reduced

GBP24.4m) as profit after tax of GBP88.8m (2015: GBP32.8m) was

augmented by favourable movements in the cash flow hedging reserve,

a result of the reversal of adverse net mark-to-market balances on

jet fuel and currency forward contracts held at the end of the

previous financial year.

During the financial year the Group entered into an agreement

with Boeing to purchase 30 new Boeing 737-800NG aircraft to meet

its programme of aircraft fleet replacement and planned Leisure

Travel growth. These aircraft have an approximate list price of USD

2.9 billion, however the Group has negotiated significant discounts

from this price. The aircraft will be funded through a combination

of internal resources and debt and will be delivered between

September 2016 and April 2018.

Segmental Performance - Leisure Travel

The Group's Leisure Travel business which incorporates

Jet2.com,our leading leisure airline and Jet2holidays, our ATOL

licensed package holidays operator, takes customers on holiday to

the Mediterranean, the Canary Islands and to European Leisure

Cities.

Planning efforts were concentrated on improving flight departure

times, our hotel product and increasing the mix of package holiday

customers, resulting in a 22% increase to 1.22m customers (2015:

1.00m) choosing a full package holiday, 40% of total departing

passengers (2015: 33%). The remaining 1.81m departing passengers

chose a flight only (2015: 2.02m).

The average load factor for the year of 92.5% (2015: 91.2%) was

supplemented by a 14% increase in net ticket price per passenger to

GBP91.11 (2015: GBP79.87). The average price of a package holiday

increased by 4% to GBP616.30 (2015: GBP590.69), reflecting not only

increased flight ticket yields but also an increasing number of

customers choosing 4 and 5-star packages as the variety of hotels

we offer continues to grow.

Non-ticket retail revenue per passenger increased by 3% to

GBP31.98 (2015: GBP30.91). This revenue stream, which is primarily

discretionary in nature, continues to be optimised through our

customer contact programme as we focus on Pre-Departure Sales

(principally hold bags and advanced seat assignment) and In-Flight

Sales (pre-ordered meals, drinks, snacks, cosmetics and perfumes)

and ancillary products (car hire and travel insurance).

As a result, total Leisure Travel revenue grew by 15% to

GBP1,261.4m (2015: GBP1,101.5m) whilst operating profit grew 112%

to GBP99.6m (2015 Underlying: GBP46.9m).

The delivery of a smooth customer booking journey is of

paramount importance to the business whichever booking channel is

chosen. As customers' online browsing and purchasing habits evolve,

our websites and mobile applications are continuously developed and

refined by our team of software developers to ensure that the

search and booking experience is as effortless and efficient as

possible, whether the customer uses a PC, tablet or mobile phone.

Approximately half of our package holidays are sold online via

Jet2holidays.com, whilst 99% of our flight-only seats are booked on

the Jet2.com website.

Our customer contact centre in Leeds employs over 300 sales and

customer service advisors. Demanding service levels are maintained

to ensure that customers' calls are answered swiftly. Our sales

colleagues are trained to handle calls in a friendly and

informative manner and to have an intimate knowledge of our

products, so that customers' individual needs can be catered for

and to maximise opportunities for sales conversion. Currently 17%

of package holiday bookings are made through our call centre. Once

a booking has been made, our pre-travel services team takes over,

answering queries and ensuring that customers are updated with

post-booking information or provided with any further pre-travel

assistance as required.

A third of our package holiday sales come through high street

travel agents, who are considered very valuable and important

distribution partners for the business. Our packages are sold by

major travel agent chains, key multiple retailers, homeworker

companies and independent agents.

As it has grown, our Leisure Travel business has continually

invested in marketing and in improving customer service standards.

Jet2holidays benefits from its breadth of hotel choice and a

family-focused approach, which includes free child places at

hundreds of hotels and a consistently low deposit. Repeat bookings

from satisfied customers and our continuing investment in product

and in marketing has paid dividends with bookings for summer 2016

on course to surpass last year, whilst at the same time brand

awareness continues to improve as a result of our broad marketing

strategy.

During the year, Jet2.com expanded its route network, operating

a total of 227 routes (2015: 217). Jet2CityBreaks, which offers a

packaged flight and hotel product in leading European Leisure

Cities proved popular as increasing numbers of customers took the

opportunity to visit some of Europe's most exciting city

destinations.

Investment in our attractive product and depth of service

offering, together with the growing opportunity to cross-sell

between flight-only and package holiday customers means the

business remains confident of delivering its growth plans.

Leisure Travel Financials

Unaudited Audited Audited Audited Change

2016 2015 2015 Separately 2015

Total Before disclosed Total (2016

separately items vs. 2015

disclosed (see note before

items 7) separately

disclosed

items)

GBPm GBPm GBPm GBPm

------------------------------------ ----------

Revenue 1,261.4 1,101.5 - 1,101.5 15%

Net operating expenses (1,161.8) (1,054.6) (17.0) (1,071.6) (10%)

------------------------------------ ---------- ------------ ----------------- ---------- --------------

Operating profit 99.6 46.9 (17.0) 29.9 112%

-

Net financing income 0.5 0.6 - 0.6 (17%)

Revaluation of derivative

hedges - 1.6 - 1.6 (100%)

Net FX revaluation (losses)/gains (1.3) 4.8 - 4.8 (127%)

------------------------------------ ---------- ------------ ----------------- ---------- --------------

Net financing (costs) /

income (0.8) 7.0 - 7.0 (111%)

Profit before tax 98.8 53.9 (17.0) 36.9 83%

Net financing income &

Revaluations 0.8 (7.0) - (7.0) 111%

Depreciation 86.4 69.1 - 69.1 25%

------------------------------------ ---------- ------------ ----------------- ---------- --------------

EBITDA 186.0 116.0 (17.0) 99.0 60%

==================================== ========== ============ ================= ========== ==============

Operating profit margin 7.9% 4.3% - 2.7% 3.6 ppts

Profit before tax margin 7.8% 4.9% - 3.3% 2.9 ppts

EBITDA margin 14.7% 10.5% - 9.0% 4.2 ppts

----------------------------------- ---------- ------------ ----------------- ---------- --------------

Leisure Travel KPIs

Unaudited Audited Change

2016 2015

------------------------------------------------------------- ----------------- ---------- ------------

Owned aircraft at 31 March 45 44 2%

Aircraft on operating leases at 31 March 14 11 27%

Number of routes operated during the

year 227 217 5%

Leisure Travel sector seats available

(capacity) 6.56m 6.63m (1%)

Leisure Travel passenger sectors flown 6.07m 6.05m 0.3%

Leisure Travel load factor 92.5% 91.2% 1.3 ppts

Flight-only passenger sectors flown 3.63m 4.05m (10%)

Package holiday passenger sectors flown 2.44m 2.00m 22%

Package holiday customers 1.22m 1.00m 22%

Net ticket yield per passenger sector

(excl. taxes) GBP91.11 GBP79.87 14%

Average package holiday price GBP616.30 GBP590.69 4%

Non-ticket revenue per passenger sector GBP31.98 GBP30.91 3%

Average hedged price of fuel (US$ per

tonne) $674 $922 27%

Fuel requirement hedged for 2016/17 99% 98% 1.0 ppt

Advance sales made as at 31 March GBP767.5m GBP580.3m 32%

------------------------------------------------------------- ----------------- ---------- ------------

Segmental Performance - Distribution & Logistics

The Group's distribution business, Fowler Welch, is one of the

UK's leading temperature-controlled logistics providers to the food

industry supply chain, serving retailers, processors, growers and

importers across its network of nine distribution sites. A full

range of added value services is provided, including storage,

case-level picking and the packing of fruits, together with an

award winning national distribution network.

Revenue reduced by 5% to GBP144.0m (2015: GBP151.7m) primarily

due to lower fuel costs which were passed onto customers. The

business performed well operationally as varying seasonal volumes

were handled efficiently. Further gains were made as a result of a

concentrated focus on fleet utilisation. In addition, Fowler

Welch's joint venture, Integrated Service Solutions, which stores,

ripens and packs stone-fruit and exotic and organic fruits at

Teynham, Kent contributed positively to the overall result.

Fowler Welch's Kent operations, at its Teynham and Paddock Wood

distribution centres, sit in the heart of that county's fruit

growing areas and their proximity to both the port of Dover and the

Channel Tunnel make them ideally positioned to provide packing and

distribution services for local growers and for fruit and produce

imported from across the Channel. The 50,000 square foot extension

of the Teynham depot has now been completed adding much needed

capacity for further revenue opportunities and the expansion of our

joint venture fruit packing business.

Spalding, our key distribution centre in the major growing

county of Lincolnshire, delivered improved underlying revenue(a) .

This increase was generated both through existing and new customer

volume growth.

The Heywood "Hub", Fowler Welch's 500,000 square foot ambient

(non-temperature-controlled) shared user storage and distribution

centre, located near Bury, Greater Manchester, saw underlying

revenue(a) decrease by 17% year-on-year, reflecting declines within

its customer base. Following a review of the site's product profile

and increased sales efforts this valuable site is attracting

further new customers.

The Hilsea depot, which is located near to Portsmouth

International Port, had a strong year with encouraging underlying

revenue(a) growth of 9.0%. New contract wins and growth with

existing customers underlined the strength of the range of

warehousing, consolidation and distribution services offered.

The dedicated site at Desborough, Northamptonshire, providing

distribution services to a major confectionery manufacturer,

renewed its contract for a further three years. Investment in state

of the art trailers which can be automatically unloaded or used as

a conventional trailer will add value for both this customer and

Fowler Welch over the new three year term. Our regional

distribution sites at Washington, Tyne and Wear and at Newton

Abbot, Devon provide direct store delivery services on behalf of

leading retailers to over 100 stores every day.

Continued focus on building a quality revenue pipeline and

developing creative added value services for its customers remains

fundamental to Fowler Welch's growth strategy. Following the

reporting date, the business completed and successfully implemented

a 10 year commercial venture to provide a transport and

distribution solution for Dairy Crest Limited. This has increased

the core vehicle fleet of Fowler Welch by approximately 10%.

Based at Dairy Crest's National Distribution Centre at Nuneaton

near Coventry, a new region for the business, we expect the

operation to progressively expand using Dairy Crest's products as

the initial volume, as it is integrated into the Fowler Welch

distribution network.

With its strong and committed team, an enhanced national network

of sites and the expertise and flexibility to operate effectively

in both the temperature-controlled (chill and produce) and ambient

arenas, Fowler Welch has a strong operational foundation. The

continued addition of better quality revenue streams, supplemented

by added value, innovative supply services to key customers, such

as those recently implemented for Dairy Crest and our joint venture

fruit packing business, provide us with continued confidence for

the company's future profitable growth.

(a) References to "underlying revenue" are stated excluding fuel

supplement income, which is linked to recognised industry

indices.

Distribution & Logistics Financials

Unaudited Audited Change

2016 2015

GBPm GBPm

------------------------------------- ---------- -------- ---------

Revenue 144.0 151.7 (5%)

Operating expenses (138.6) (148.4) 7%

------------------------------------- ---------- -------- ---------

Operating profit 5.4 3.3 64%

Net financing costs - - -

-------------------------------------

Profit before tax 5.4 3.3 64%

Depreciation 2.3 2.2 5%

------------------------------------- ---------- -------- ---------

EBITDA 7.7 5.5 40%

===================================== ========== ======== =========

Operating profit margin 3.8% 2.2% 1.6 ppts

Profit before tax margin 3.8% 2.2% 1.6 ppts

EBITDA margin 5.3% 3.6% 1.7 ppts

------------------------------------- ---------- -------- ---------

Distribution & Logistics KPIs

Unaudited Audited Change

2016 2015

-------------------------------------- ---------- -------- -------

Warehouse space as at 31 March

(square foot) 847,000 847,000 -

Number of tractor units in operation 428 467 (8%)

Number of trailer units in operation 629 655 (4%)

Miles per gallon 9.1 9.2 (1%)

Annual fleet mileage 39.0m 41.5m (6%)

-------------------------------------- ---------- -------- -------

Gary Brown

Group Chief Financial Officer

14 July 2016

For further information please contact:

Dart Group PLC Tel: 0113 239 7817

Philip Meeson, Group Chairman and Chief

Executive

Gary Brown, Group Chief Financial Officer

Smith & Williamson Corporate Finance Tel: 020 7131 4000

Limited

Nominated Adviser

David Jones / Ben Jeynes / Russell

Cook

Canaccord Genuity - Joint Broker Tel: 020 7523 8000

Guy Marks

Arden Partners - Joint Broker Tel: 020 7614 5900

Christopher Hardie

Buchanan - Financial PR Tel: 020 7466 5000

Richard Oldworth

COnsolidated income statement

for the year ended 31 March 2016

Unaudited Audited

results for results for the

the year ended

year ended 31 March

31 March 2015

2016

------------------------------------------------ ------------------------------------------

Total Results Separately Total

before disclosed

separately items

disclosed

items

GBPm GBPm GBPm GBPm

------------------------------------ ---------- ----------------- ----------- ----------

Revenue 1,405.4 1,253.2 - 1,253.2

Net operating expenses (1,300.4) (1,203.0) (17.0) (1,220.0)

------------------------------------ ---------- ----------------- ----------- ----------

Operating profit 105.0 50.2 (17.0) 33.2

Finance income 2.4 1.7 - 1.7

Finance costs (1.9) (1.1) - (1.1)

Revaluation of derivative

hedges - 1.6 - 1.6

Net FX revaluation (losses)/gains (1.3) 4.8 - 4.8

------------------------------------- ---------- ----------------- ----------- ----------

Net financing (costs)

/ income (0.8) 7.0 - 7.0

Profit before taxation 104.2 57.2 (17.0) 40.2

Taxation (15.4) (10.8) 3.4 (7.4)

------------------------------------ ---------- ----------------- ----------- ----------

Profit for the year 88.8 46.4 (13.6) 32.8

(all attributable to equity shareholders

of the parent)

================================================= ================= =========== ==========

Earnings per share

- basic 60.22 p 31.72 p (9.30)p 22.42 p

- diluted 59.89 p 31.40 p (9.20)p 22.20 p

Consolidated statement of comprehensive income

for the year ended 31 March 2016

Unaudited Audited

year ended year ended

31 March 31 March

2016 2015

GBPm GBPm

------------ ------------

Profit for the year 88.8 32.8

Other comprehensive income / (expense)

Cash flow hedges:

Fair value gains / (losses) in year 19.0 (98.7)

Add back losses transferred to income

statement in year 76.9 32.0

Related tax (charge) / credit (19.2) 13.1

------------ ------------

76.7 (53.6)

Total comprehensive income / (expense)

for the period 165.5 (20.8)

(all attributable to equity shareholders

of the parent)

============ ============

Consolidated Statement of Financial Position

at 31 March 2016

Unaudited Audited

2016 2015

GBPm GBPm

Non-current assets

Goodwill 6.8 6.8

Property, plant and equipment 419.8 295.3

Derivative financial instruments 15.2 1.5

441.8 303.6

---------- --------

Current assets

Inventories 1.1 2.0

Trade and other receivables 503.9 365.6

Derivative financial instruments 49.3 27.0

Money market deposits 70.0 65.5

Cash and cash equivalents 342.0 237.3

---------- --------

966.3 697.4

---------- --------

Total assets 1,408.1 1,001.0

---------- --------

Current liabilities

Trade and other payables 109.4 85.7

Deferred revenue 766.4 579.6

Borrowings 83.4 0.8

Provisions 23.3 28.7

Derivative financial instruments 64.5 103.8

---------- --------

1,047.0 798.6

---------- --------

Non-current liabilities

Other non-current liabilities 0.1 0.5

Deferred revenue 1.1 0.7

Borrowings 7.5 8.2

Derivative financial instruments 4.6 25.1

Deferred tax liabilities 29.1 10.7

---------- --------

42.4 45.2

Total liabilities 1,089.4 843.8

Net assets 318.7 157.2

========== ========

Shareholders' equity

Share capital 1.8 1.8

Share premium 12.4 11.9

Cash flow hedging reserve (3.7) (80.4)

Retained earnings 308.2 223.9

Total shareholders' equity 318.7 157.2

========== ========

consolidated statement of cash flows

for the year ended 31 March 2016

Unaudited Audited

2016 2015

Cash flows from operating activities: GBPm GBPm

Profit on ordinary activities before

taxation 104.2 40.2

Finance income (2.4) (1.7)

Finance costs 1.9 1.1

Revaluation of derivative hedges - (1.6)

Net FX revaluation (losses)/gains 1.3 (4.8)

Depreciation 88.7 71.3

Equity settled share based payments 0.1 0.1

Operating cash flows before movements in

working capital 193.8 104.6

Decrease in inventories 0.9 1.1

Increase in trade and other receivables (138.3) (79.4)

Increase / (decrease) in trade and

other payables 16.6 (24.3)

Increase in deferred revenue 187.2 95.4

(Decrease) / increase in provisions (5.4) 26.3

Cash generated from operations 254.8 123.7

Interest received 2.4 1.7

Interest paid (1.9) (1.1)

Income taxes paid (11.4) (8.2)

Net cash from operating activities 243.9 116.1

---------- --------

Cash flows used in investing activities

Purchase of property, plant and equipment (213.5) (76.4)

Proceeds from sale of property, plant 0.2 -

and equipment

Net increase in money market deposits (4.5) (13.0)

Net cash used in investing activities (217.8) (89.4)

---------- --------

Cash used in financing activities

Repayment of borrowings (0.9) (0.8)

New loans advanced 82.8 -

Proceeds on issue of shares 0.5 0.5

Equity dividends paid (4.6) (4.2)

Net cash from / (used in) financing

activities 77.8 (4.5)

---------- --------

Effect of foreign exchange rate changes 0.8 3.9

Net increase in cash in the year 104.7 26.1

Cash and cash equivalents at beginning

of year 237.3 211.2

Cash and cash equivalents at end

of year 342.0 237.3

========== ========

Consolidated statement of changes in equity

for the year ended 31 March 2016

Share Share Cash flow Retained Total shareholders'

capital premium hedging earnings equity

reserve

GBPm GBPm GBPm GBPm GBPm

--------- --------- ---------- ---------- --------------------

Audited

Balance at 31 March

2014 1.8 11.4 (26.8) 195.2 181.6

Total comprehensive

income for the year - - (53.6) 32.8 (20.8)

Issue of share capital - 0.5 - - 0.5

Dividends paid in

the year - - - (4.2) (4.2)

Share based payments - - - 0.1 0.1

Audited

Balance at 31 March

2015 1.8 11.9 (80.4) 223.9 157.2

Total comprehensive

income for the year - - 76.7 88.8 165.5

Issue of share capital - 0.5 - - 0.5

Dividends paid in

the year - - - (4.6) (4.6)

Share based payments - - - 0.1 0.1

Unaudited

Balance at 31 March

2016 1.8 12.4 (3.7) 308.2 318.7

========= ========= ========== ========== ====================

Notes to the consolidated financial statements

for the year ended 31 March 2016

1. General information

The Group's financial statements consolidate the financial

statements of Dart Group PLC and its subsidiaries and have been

prepared and approved by the Directors in accordance with

International Financial Reporting Standards ("IFRS"), as adopted by

the European Union ("Adopted IFRS").

2. Basis of preparation

The financial statements have been prepared under the historical

cost convention except for all derivative financial instruments,

which have been stated at fair value.

Whilst the information included in this preliminary announcement

has been computed in accordance with Adopted IFRS, this

announcement does not itself contain sufficient information to

comply with Adopted IFRS. Dart Group PLC expects to publish full

financial statements in August 2016 (see note 9).

The Group utilises foreign exchange forward contracts and

monthly fuel swaps to hedge its exposure to movements in euro and

US dollar exchange rates, and its exposure to jet fuel price

movements that arise through its Leisure Travel activities. The

Group also uses forward EU Allowance contracts and forward

Certified Emissions Reduction contracts to hedge exposure to Carbon

Emissions Allowance price volatility. Such derivative financial

instruments are stated at fair value.

Going concern

The Directors have prepared financial forecasts for the Group,

comprising operating profit, balance sheets and cash flows through

to 31 March 2019.

For the purpose of assessing the appropriateness of the

preparation of the Group's accounts on a going concern basis, the

Directors have considered the current cash position, the

availability of banking facilities, the Group's net current

liability position, and sensitised forecasts of future trading

through to 31 March 2019, including performance against financial

covenants and the assessment of principal areas of uncertainty and

risk.

Having considered the points outlined above, the Directors have

a reasonable expectation that the Company and the Group will be

able to operate within the levels of available banking facilities

and cash for the foreseeable future. Consequently, they continue to

adopt the going concern basis in preparing the financial statements

for the year ended 31 March 2016.

3. Segmental reporting

Business segments

The Chief Operating Decision Maker ("CODM") is responsible for

the overall resource allocation and performance assessment of the

Group. The Board of Directors approves major capital expenditure,

assesses the performance of the Group and also determines key

financing decisions. Consequently, the Board of Directors is

considered to be the CODM.

For management purposes, the Group is organised into two

operating segments: Leisure Travel and Distribution &

Logistics. These operating segments are consistent with how

information is presented to the CODM for the purpose of resource

allocation and assessment of their performance and as such, they

are also deemed to be the reporting segments.

The Leisure Travel business specialises in scheduled flights by

its airline Jet2.com to holiday destinations in the Mediterranean,

the Canary Islands and to European Leisure Cities and the provision

of ATOL licensed package holidays by its tour operator

Jet2holidays. Resource allocation decisions are based on the

business's entire route network and the deployment of its entire

aircraft fleet.

The Distribution & Logistics business is run on the basis of

the evaluation of distribution centre-level performance data.

However, resource allocation decisions are made based on the entire

distribution network. The objective in making resource allocation

decisions is to maximise the segment results rather than the

results of the individual distribution centres within the

network.

Group eliminations include the removal of inter-segment asset

and liability balances.

Following the identification of the operating segments, the

Group has assessed the similarity of their characteristics. Given

the different performance targets, customer bases and operating

markets of each, it is not currently appropriate to aggregate the

operating segments for reporting purposes and, therefore, both are

disclosed as reportable segments for the year ended 31 March

2016:

-- Leisure Travel, which incorporates the Group's ATOL licensed

package holidays operator, Jet2holidays and its leisure airline,

Jet2.com; and

-- Distribution & Logistics, incorporating the Group's logistics company, Fowler Welch.

The Board assesses the performance of each segment based on

operating profit, and profit before and after tax. Revenue from

reportable segments is measured on a basis consistent with the

income statement. Revenue is principally generated from within the

UK, the Group's country of domicile.

Segment results, assets and liabilities include items directly

attributable to a segment, as well as those that can be allocated

on a reasonable basis. No customer represents more than 10% of the

Group's revenue.

Leisure Distribution Group Total

Travel & Logistics eliminations

Unaudited

Year ended 31 March GBPm GBPm GBPm GBPm

2016

Revenue 1,261.4 144.0 - 1,405.4

Operating profit 99.6 5.4 - 105.0

Finance income 2.4 - - 2.4

Finance costs (1.9) - - (1.9)

Net FX revaluation

losses (1.3) - - (1.3)

---------- ------------- -------------- ----------

Net financing income (0.8) - - (0.8)

Profit before taxation 98.8 5.4 - 104.2

Taxation (14.5) (0.9) - (15.4)

---------- ------------- -------------- ----------

Profit after taxation 84.3 4.5 - 88.8

========== ============= ============== ==========

Assets and liabilities

Segment assets 1,331.6 82.2 (5.7) 1,408.1

Segment liabilities (1,065.0) (30.1) 5.7 (1,089.4)

---------- ------------- -------------- ----------

Net assets 266.6 52.1 - 318.7

========== ============= ============== ==========

Other segment information

Property, plant and

equipment additions 210.6 2.9 - 213.5

Depreciation, amortisation

and impairment (86.4) (2.3) - (88.7)

Share based payments (0.1) - - (0.1)

Leisure Distribution Group Total

Travel & Logistics eliminations

Audited GBPm GBPm GBPm GBPm

Year ended 31 March

2015

Revenue 1,101.5 151.7 - 1,253.2

Underlying operating

profit 46.9 3.3 - 50.2

Finance income 1.7 - - 1.7

Finance costs (1.1) - - (1.1)

Revaluation of derivative

hedges 1.6 - - 1.6

Net FX revaluation

gains 4.8 - - 4.8

-------------- ------------------- ------------------- ----------------

Net financing income 7.0 - - 7.0

Underlying profit before

taxation 53.9 3.3 - 57.2

Separately disclosed

items (17.0) - - (17.0)

Profit before taxation 36.9 3.3 - 40.2

Taxation (6.7) (0.7) - (7.4)

-------------- ------------------- ------------------- ----------------

Profit after taxation 30.2 2.6 - 32.8

============== =================== =================== ================

Assets and liabilities

Segment assets 923.3 84.2 (6.5) 1,001.0

Segment liabilities (813.7) (36.6) 6.5 (843.8)

-------------- ------------------- ------------------- ----------------

Net assets 109.6 47.6 - 157.2

============== =================== =================== ================

Other segment information

Property, plant and

equipment additions 74.4 2.0 - 76.4

Depreciation, amortisation

and impairment (69.1) (2.2) - (71.3)

Share based payments (0.1) - - (0.1)

4. Net operating expenses

Unaudited Audited

2016 2015

GBPm GBPm

Direct operating costs

Fuel 208.9 233.3

Landing, navigation and third party handling 132.8 137.7

Aircraft and vehicle rentals 38.5 33.7

Maintenance costs 62.4 58.0

Subcontractor charges 38.2 41.0

Accommodation costs 344.0 283.9

Agent commission 29.0 22.5

In-flight cost of sales 19.2 20.3

Other direct operating costs 45.6 42.7

Staff costs 204.4 190.6

Depreciation of property, plant and equipment

including

aircraft and engines 88.7 71.3

Other operating charges 89.7 68.3

Other operating income (1.0) (0.3)

-------------- --------

Net operating expenses before separately

disclosed items 1,300.4 1,203.0

Separately disclosed items (note 7) - 17.0

Total net operating expenses 1,300.4 1,220.0

============== ========

5. Net financing (costs) / income

Unaudited Audited

2016 2015

GBPm GBPm

Finance income 2.4 1.7

Finance costs (1.9) (1.1)

Revaluation of derivative hedges (cash

flow hedge ineffectiveness) - 1.6

Net FX revaluation (losses)/gains (1.3) 4.8

---------- --------

Net financing (costs) / income (0.8) 7.0

========== ========

6. Earnings per share

Unaudited Audited

2016 2015

No. No.

Basic weighted average number of shares

in issue 147,454,373 146,278,585

Dilutive potential ordinary shares:

employee share options 809,398 1,455,645

Diluted weighted average number of shares

in issue 148,263,771 147,734,230

============ ============

Year to Year to

Basis of calculation - earnings (basic 31 March 31 March

and diluted) 2016 2015

Profit for the purposes of calculating GBP88.8m GBP32.8m

basic and diluted earnings

Earnings per share - basic 60.22p 22.42p

Earnings per share - diluted 59.89p 22.20p

7. Separately disclosed items

Separately disclosed items are presented in the middle column of

the year ended 31 March 2015 Consolidated Income Statement in order

to assist the reader's understanding of underlying business

performance and to provide a more meaningful presentation. The

right hand column presents the results for the year showing all

gains and losses recorded in the Consolidated Income Statement.

EU Regulation 261

The prior year results include a separately disclosed

exceptional provision of GBP17.0m, in relation to possible

passenger compensation claims for historical flight delays under

Regulation (EC) No 261/2004.

8. Financial information

The financial information set out above does not constitute Dart

Group PLC's statutory accounts for the years ended 31 March 2016 or

31 March 2015. The financial information for 2015 is derived from

the statutory accounts for the year ended 31 March 2015, which have

been delivered to the Registrar of Companies. The auditor has

reported on the year ended 31 March 2015 accounts; their

report:

i. was unqualified;

ii. did not include a reference to any matters to which the

auditor drew attention by way of emphasis without qualifying their

report; and

iii. did not contain a statement under section 498 (2) or (3) of the Companies Act 2006.

The statutory accounts for the year ended 31 March 2016 will be

finalised on the basis of the financial information presented by

the directors in this preliminary announcement and will be

delivered to the Registrar of Companies in due course.

9. Annual report and accounts

The 2016 Annual Report and Accounts (together with the Auditor's

Report) will be made available to shareholders during the week

ending 12 August 2016. The Dart Group PLC Annual General Meeting

will be held on 8 September 2016.

10. Market Abuse Regulation (MAR) Disclosure

Certain information contained in this announcement would have

been deemed inside information for the purposes of Article 7 of

Regulation (EU) No 596/2014 until the release of this

announcement.

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR ZMGMNNFVGVZM

(END) Dow Jones Newswires

July 14, 2016 02:00 ET (06:00 GMT)

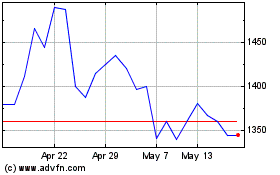

Jet2 (LSE:JET2)

Historical Stock Chart

From Jun 2024 to Jul 2024

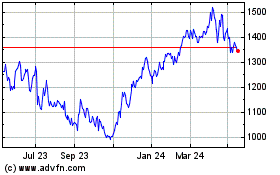

Jet2 (LSE:JET2)

Historical Stock Chart

From Jul 2023 to Jul 2024