TIDMKEFI

RNS Number : 6715I

Kefi Gold and Copper PLC

20 April 2022

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION

20 April 2022

KEFI Gold and Copper plc

("KEFI" or the "Company")

Firm and Conditional Placing to raise GBP8 million and Issue of

Warrants

KEFI Gold and Copper (AIM: KEFI), the gold exploration and

development company with projects in the Federal Democratic

Republic of Ethiopia and the Kingdom of Saudi Arabia, is pleased to

announce an oversubscribed fundraising to raise gross cash proceeds

of GBP8.0 million through a Firm Placing of 550,000,000 new

ordinary shares of 0.1 pence each in the capital of the Company

("Ordinary Shares") at a price of 0.8 pence per Ordinary Share (the

"Placing Price") to raise GBP4.4 million (the "Firm Placing") and a

Conditional Placing of 450,000,000 new Ordinary Shares at the

Placing Price to raise GBP3.6 million (the "Conditional Placing")

(together, the "Placing"), arranged by Tavira Securities Limited

("Tavira").

Firm Placing

The Company will raise GBP4.4 million through the issue of

550,000,000 new Ordinary Shares (the "Firm Placing Shares") at a

placing price of 0.8 pence per Ordinary Share.

Application has been made to the London Stock Exchange for

admission of the Firm Placing Shares to trade on AIM ("Admission")

and it is expected that Admission will become effective and that

dealings in the Firm Placing Shares will commence at 8.00 a.m. on

or around 25 April 2022 ("Admission").

The Placing Price represents a discount of 25% against the

ten-day VWAP to 19 April 2022, being the date prior to the release

of this announcement.

Conditional Placing

Conditional on shareholder approval at a General Meeting of the

Company (the "General Meeting") to be convened in due course, the

Company will raise a further GBP3.6 million through the issue of

450,000,000 Ordinary Shares (the "Conditional Placing Shares",

together with the Firm Placing Shares, the "Placing Shares") at the

Placing Price. The Conditional Placing is subject to the passing of

certain resolutions at the General Meeting.

Shareholders are reminded that because the Conditional Placing

is conditional, among other things, on the passing of the

resolutions to be proposed at the General Meeting, should the

resolutions not be passed, the Conditional Placing will not

proceed.

Use of Proceeds

The gross Placing proceeds of GBP8.0 million ("Gross Proceeds")

will mainly be used to fund the following:

-- selected development activities at the Company's Tulu Kapi

Gold Project ("Tulu Kapi") which will continue as authorised by the

Ethiopian Government, particularly with a view to confirming

security conditions are conducive for full project launch and

financial close at the end of Q2 2022;

-- commencement of additional exploration works at satellite

deposits in the Tulu Kapi District, Ethiopian Government

permitting, in order to implement longstanding plans designed to

expand or extend production and uplift the community benefits and

the economics of the Tulu Kapi development still further;

-- to contribute the Company's share of exploration at the

Hawiah Gold and Copper Project ("Hawiah"), with a view to

increasing the existing resources of 24.9 million tonnes at 0.90%

copper, 0.85% zinc, 0.62 g/t gold and 9.81 g/t silver. In addition,

funds will enable further work at the adjacent Al Godeyer licence

areas following the highly encouraging results as announced in Q1

2022, which suggested the potential for another discovery similar

to Hawiah; and

-- for general working capital purposes.

Investor Warrants and Warrant Trigger Event

Conditional on shareholder approval at the General Meeting, the

Company will grant one warrant per two Placing Shares at an

exercise price of 1.6 pence ("Warrants") exercisable for a period

of two years from Admission of the Conditional Placing Shares.

The Company has elected that the Warrants will become

exercisable if, during a two-year period following the date of

Admission, the on-market share closing price of the Ordinary Shares

for five consecutive days reaches or exceeds 2.4 pence (being a 50%

premium on the Warrant exercise price) (the "Warrant Trigger

Event").

If the Warrant Trigger Event occurs then:

(i) the holders of the Warrants must exercise the Warrants

within 30 days from the occurrence of the Warrant Trigger Event;

and

(ii) the Warrants will expire following the end of the 30-day

period referenced above if not exercised.

If the Warrant Trigger Event has not occurred within two years

following the date of admission of the Conditional Placing Shares,

then the Warrants shall lapse and will no longer be capable of

being exercised.

The Warrants will be issued in certificated form and will not be

admitted to trading on AIM. The Warrants will be transferable in

accordance with the terms of the Warrant instrument to be entered

into by the Company. Any Ordinary Shares issued pursuant to the

Warrants will, when issued, be admitted to trading on AIM.

The Warrants, along with those issued in January 2022, may raise

a further GBP14.3 million, at the 1.6 pence exercise price,

assuming that all investors exercise their warrants. It is expected

that these funds will be sufficient to fund any necessary KEFI

equity capital subscription in its subsidiary Tulu Kapi Gold Mines

Share Company required as part of the broader identified US$356

million Tulu Kapi development funding syndicate.

These equity funds are in addition to the KEFI equity capital

contribution which had already been conditionally arranged with

convertible note investors and the equity amounts which will have

been historically invested prior to financial close. Details of the

composition of the identified funding syndicate can be found in

prior Company announcements and also in the corporate presentation

uploaded to the Company's website on 4 April 2022.

The proposed timing for Tulu Kapi financial close remains the

end of Q2 2022 with all being parties to be asked to sign up to the

normal binding commitments and the associated conditions and

sequence for disbursement of funds for a transaction of this

nature.

General Meeting

A circular convening the General Meeting to be held during May

2022 will be circulated shortly. The General Meeting will propose

resolutions to shareholders to grant the board authority to allot

the Conditional Placing Shares on a non-pre-emptive basis, and to

grant the Warrants. Once published, the circular will be available

to download from the Company's website at www.kefi-minerals.com. It

is important that shareholders lodge their votes in advance of the

General Meeting through submission of their proxy votes.

Harry Anagnostaras Adams, Chairman of KEFI Gold and Copper

commented:

"The Placing is to reinforce the rapid advancement of our three

advanced projects in Ethiopia and Saudi Arabia. The Placing Shares,

combined with the exercise of the Warrants and those from the

placing announced on 21 December 2021, are intended to provide an

additional c. GBP22.3 million (c. US$29 million) of share capital,

designed not only to complete the last piece of the planned Tulu

Kapi project financing package of c. US$356 million, but also build

on the ongoing success we are seeing in our exploration programmes

in Saudi Arabia.

"In Ethiopia our subsidiary has historically invested

approximately US$70 million in the Tulu Kapi project and we are now

at the stage to increase development and also exploration

activities, as allowed by the Government authorities, to

demonstrate both our good faith and to also show that security is

appropriate for full project launch from mid-2022. This is very

important as we have now conditionally lined up all the equity and

debt funds required for full development project financing and the

finance syndicate is keen to work very closely with the Government

to ensure security and all regulatory clearances are in order.

"For our two projects in Saudi Arabia, Hawiah Copper-Gold and

Jibal Qutman Gold, we must contribute our 30% share to the joint

venture to ensure that we accelerate the drilling and development

studies on our significant discoveries.

"At the recently granted Al Godeyer Licence we will look to

undertake further drilling on identified targets which have yielded

rock chip grades of up to 1.8% copper and 7.2g/t gold from surface

trenching . KEFI remains optimistic that discoveries here are

similar to those reported for the adjacent Hawiah deposit, which

itself remains subject to further extensive exploration in 2022 as

the existing resources remain open and additional targets have been

identified.

"At our Jibal Qutman Gold Project, our joint venture is also

optimistic of receiving a Mining Licence this year and this capital

raise will ensure the Company is well positioned to meet its share

of preliminary development planning for the low-cost/quick-to-start

heap leach operation.

"We have the opportunity to build substantial value from

de-risking and advancing the three projects. The Company's internal

NPV (8% after tax) on the three projects (at current metal prices

as at 18 April 2022) indicates a combined NPV of 12 pence per

share, after dilution from the Placing announced today. Therefore,

we know that there is considerable merit in putting the capital in

the ground and pushing the Company towards its goal of becoming a

mid-tier gold and copper producer."

Placing Agreement

The Company has appointed Tavira (the "Broker") as its agent

pursuant to the terms of a placing agreement executed on 19 April

2022 (the "Placing Agreement").

The Company has agreed to pay the Broker certain commissions and

fees, some of which will be satisfied through the grant of

75,000,000 warrants over KEFI ordinary shares (the "Broker

Warrants"), subject to shareholder approval, at the General

Meeting, in connection with its appointment. Each Broker Warrant

will entitle the Broker to subscribe for one new KEFI ordinary

share at a price of 0.80 pence per share, exercisable for a period

of three years from the date of Admission of the Conditional

Placing Shares.

Total Voting Rights

Application has been made to the London Stock Exchange for

Admission of the Firm Placing Shares to trade on AIM and it is

expected that Admission will become effective and that dealings in

the Firm Placing Shares will commence at 8.00 a.m. on or around 25

April 2022. Following Admission of the Firm Placing Shares, the

total issued share capital of the Company will consist of

3,489,119,050 Ordinary Shares each with voting rights. The Company

does not hold any Ordinary Shares in treasury. Therefore, the total

number of voting rights in the Company will be 3,489,119,050 and

this figure may be used by shareholders as the denominator for the

calculations by which they will determine if they are required to

notify their interest in, or a change in their interest in, the

share capital of the Company under the FCA's Disclosure Guidance

and Transparency Rules.

Market Abuse Regulation (MAR) Disclosure

This announcement contains inside information for the purposes

of Article 7 of the Market Abuse Regulation (EU) 596/2014 as it

forms part of UK domestic law by virtue of the European Union

(Withdrawal) Act 2018 ("MAR"), and is disclosed in accordance with

the Company's obligations under Article 17 of MAR.

Enquiries

KEFI Gold and Copper plc

Harry Anagnostaras-Adams (Executive Chairman) +357 994 57843

John Leach (Finance Director) +357 992 08130

SP Angel Corporate Finance LLP (Nominated Adviser

and Joint Broker) +44 (0) 20 3470 0470

Jeff Keating, Adam Cowl

Tavira Securities Limited (Broker) +44 (0) 20 7100 5100

Oliver Stansfield, Jonathan Evans

IFC Advisory Ltd (Financial PR and IR) +44 (0) 20 3934 6630

Tim Metcalfe, Florence Chandler

Further information can be viewed at www.kefi-minerals.com

IMPORTANT NOTICES

THIS ANNOUNCEMENT, INCLUDING THE APPENDICES AND THE INFORMATION

CONTAINED IN THEM, IS RESTRICTED AND IS NOT FOR PUBLICATION,

RELEASE, FORWARDING OR DISTRIBUTION, DIRECTLY OR INDIRECTLY, IN

WHOLE OR IN PART, IN OR INTO THE UNITED STATES OF AMERICA

(INCLUDING ITS TERRITORIES AND POSSESSIONS, ANY STATE OF THE UNITED

STATES AND THE DISTRICT OF COLUMBIA (COLLECTIVELY THE "UNITED

STATES")), AUSTRALIA, CANADA, THE REPUBLIC OF SOUTH AFRICA, JAPAN

OR ANY OTHER JURISDICTION IN WHICH SUCH PUBLICATION, RELEASE OR

DISTRIBUTION WOULD BE UNLAWFUL.

No public offering of the securities referred to herein is being

made in any such jurisdiction or elsewhere.

The Placing Shares have not been, and will not be, registered

under the US Securities Act of 1933, as amended (the "US Securities

Act"), or with any securities regulatory authority or under any

securities laws of any state or other jurisdiction of the United

States and may not be offered, sold, resold, pledged, transferred

or delivered, directly or indirectly, in or into the United States

except pursuant to an applicable exemption from, or in a

transaction not subject to, the registration requirements of the US

Securities Act and in compliance with the securities laws of any

state or other jurisdiction of the United States. No public

offering of securities is being made in the United States. The

Placing Shares have not been approved, disapproved or recommended

by the U.S. Securities and Exchange Commission, any state

securities commission in the United States or any other U.S.

regulatory authority, nor have any of the foregoing authorities

passed upon or endorsed the merits of the offering of the Placing

Shares. Subject to certain exceptions, the securities referred to

herein may not be offered or sold in the United States, Australia,

Canada, Japan, New Zealand, the Republic of South Africa or to, or

for the account or benefit of, any national, resident or citizen of

Australia, Canada, Japan, New Zealand, the Republic of South

Africa.

No public offering of the Placing Shares is being made in the

United States, United Kingdom or elsewhere. All offers of the

Placing Shares will be made pursuant to an exemption from the

requirement to produce a prospectus under the Prospectus Regulation

(EU) 2017/1129 (as supplemented by Commission Delegated Regulation

(EU) 2019/980 and Commission Delegated Regulation (EU) 2019/979) as

it forms part of UK domestic law by virtue of the European Union

(Withdrawal) Act 2018 (the "UK Prospectus Regulation").

No action has been taken by the Company, Broker or any of their

respective affiliates, or any of its or their respective directors,

officers, partners, employees, advisers or agents (collectively,

"Representatives") that would, or is intended to, permit an offer

of the Placing Shares or possession or distribution of this

Announcement or any other publicity material relating to such

Placing Shares in any jurisdiction where action for that purpose is

required. Persons receiving this Announcement are required to

inform themselves about and to observe any restrictions contained

in this Announcement. The distribution of this Announcement, and

the Placing and/or the offer or sale of the Placing Shares, may be

restricted by law in certain jurisdictions. Persons (including,

without limitation, nominees and trustees) who have a contractual

or other legal obligation to forward a copy of this Announcement

should seek appropriate advice before taking any action. Persons

distributing any part of this Announcement must satisfy themselves

that it is lawful to do so.

Members of the public are not eligible to take part in the

Placing. This Announcement is for information purposes only and is

directed only at: (a) persons in Member States of the European

Economic Area ("EEA") who are qualified investors within the

meaning of article 2(e) of the Prospectus Regulation (EU)

2017/1129; (b) in the United Kingdom, qualified investors within

the meaning of Article 2(e) of the UK Prospectus Regulation who are

persons who (i) have professional experience in matters relating to

investments falling within the definition of "investment

professionals" in article 19(5) of the Financial Services and

Markets Act 2000 (Financial Promotion) Order 2005, as amended (the

"Order"); or (ii) are persons falling within article 49(2)(a) to

(d) ("high net worth companies, unincorporated associations, etc")

of the Order; and (c) otherwise, persons to whom it may otherwise

lawfully be communicated, (all such persons in (a), (b) and (c)

together being referred to as "Relevant Persons"). This

Announcement must not be acted on or relied on by persons who are

not Relevant Persons. Persons distributing this Announcement must

satisfy themselves that it is lawful to do so.

This Announcement may contain, and the Company may make, verbal

statements containing "forward-looking statements" with respect to

certain of the Company's plans and its current goals and

expectations relating to its future financial condition,

performance, strategic initiatives, objectives and results.

Forward-looking statements sometimes use words such as "aim",

"anticipate", "target", "expect", "estimate", "intend", "plan",

"goal", "believe", "seek", "may", "could", "outlook" or other words

of similar meaning. By their nature, all forward-looking statements

involve risk and uncertainty because they relate to future events

and circumstances which are beyond the control of the Company. As a

result, the actual future financial condition, performance and

results of the Company may differ materially from the plans, goals

and expectations set forth in any forward-looking statements. Any

forward-looking statements made in this Announcement by or on

behalf of the Company speak only as of the date they are made.

These forward-looking statements reflect the Company's judgment at

the date of this Announcement and are not intended to give any

assurance as to future results and cautions that its actual results

of operations and financial condition, and the development of the

industry in which it operates, may differ materially from those

made in or suggested by the forward looking statements contained in

this Announcement and/or information incorporated by reference into

this Announcement. The information contained in this Announcement

is subject to change without notice and except as required by

applicable law or regulation, the Company expressly disclaims any

obligation or undertaking to publish any updates, supplements or

revisions to any forward-looking statements contained in this

Announcement to reflect any changes in the Company's expectations

with regard thereto, or any changes in events, conditions or

circumstances on which any such statements are based, except where

required to do so under applicable law.

The Placing Shares to be issued or sold pursuant to the Placing

will not be admitted to trading on any stock exchange other than

AIM.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IOEEAFLNFLFAEAA

(END) Dow Jones Newswires

April 20, 2022 02:10 ET (06:10 GMT)

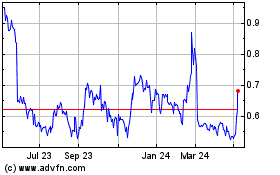

Kefi Gold And Copper (LSE:KEFI)

Historical Stock Chart

From Dec 2024 to Jan 2025

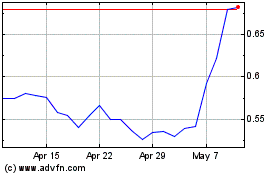

Kefi Gold And Copper (LSE:KEFI)

Historical Stock Chart

From Jan 2024 to Jan 2025