TIDMKEFI

RNS Number : 0771B

Kefi Gold and Copper PLC

30 May 2023

30 May 2023

KEFI Gold and Copper plc

("KEFI" or the "Company")

Institutional Placing to Raise GBP5.5 million

Conditional Subscription to raise GBP0.7 million

Primary Bid Offering to raise up to GBP1 million

Notice of Annual General Meeting

KEFI Gold and Copper (AIM: KEFI), the gold and copper

exploration and development company with projects in the Federal

Democratic Republic of Ethiopia and the Kingdom of Saudi Arabia, is

pleased to announce a fundraising to raise gross cash proceeds of

up to GBP7.2 million through:

1) a firm placing of 785,714,285 new ordinary shares of 0.1

pence each in the capital of the Company ("Ordinary Shares") at a

price of 0.7 pence per Ordinary Share (the "Placing Price") to

raise GBP5.5 million (the "Firm Placing"), arranged by Tavira

Financial Limited ("Tavira" or the "Broker");

2) a conditional subscription for 98,325,128 Ordinary Shares at

the Placing Price (the "Conditional Subscription Shares"), subject

to approval by shareholders at the Company's Annual General Meeting

("AGM"), arranged by KEFI to raise approximately GBP0.7 million

(the "Conditional Subscription"); and

3) an offer via the PrimaryBid platform of up to 142,857,142 new

Ordinary Shares at the Placing Price (the "Retail Shares") to be

issued subject to approval by shareholders at the AGM to raise up

to GBP1.0 million (the "Retail Offer")

(together, the "Capital Raise").

Firm Placing

The Company will raise GBP5.5 million through the issue of

785,714,285 new Ordinary Shares (the "Firm Placing Shares") at a

placing price of 0.7 pence per Ordinary Share.

Application has been made to the London Stock Exchange for

admission of the new Ordinary Shares to trade on AIM ("Admission")

and it is expected that Admission will become effective and that

dealings in the Firm Placing Shares will commence at 8.00 a.m. on

or around 5 June 2023 ("First Admission").

Conditional Subscription

The Conditional Subscription requires shareholder approval at

the Annual General Meeting of the Company, to be held on 30 June

2023. The Conditional Subscription consists of 98,325,128

Conditional Subscription Shares to be subscribed. A circular

containing the notice of AGM will be posted to shareholders in the

next week. The Conditional Subscription is conditional, inter alia,

on First Admission becoming effective, the passing of the

resolutions to be proposed at the Annual General Meeting and the

admission of the Conditional Subscription Shares to trading on AIM

becoming effective at 8.00 a.m. on or around 3 July 2023 ("Second

Admission").

Shareholders are reminded that because the Conditional

Subscription is conditional, among other things, on the passing of

the share allotment and disapplication of pre-exemption rights

resolutions to be proposed at the AGM, should the resolutions not

be passed, the Conditional Subscription will not proceed.

Retail Offer

The Directors recognise the importance of giving retail

shareholders and investors an opportunity to participate in the

Company's ongoing funding, should they be unable to participate in

the Firm Placing or Conditional Subscription. Consequently, the

Company intends to make an offer on the PrimaryBid platform of new

Ordinary Shares at the Placing Price (the "Retail Offer"). In

total, the Company expects to issue up to 142,857,142 Retail Shares

subject to approval of shareholders at the AGM. To the extent it is

able, the Company will prioritise existing KEFI shareholders in the

Retail Offer. Further details of the Retail Offer will be announced

shortly. The Retail Offer is conditional upon the approval of

shareholders at the AGM.

The Retail Offer will be made on terms outlined in a separate

announcement by the Company to be made shortly regarding the Retail

Offer and its terms.

Participation by Management

Once KEFI has released its Annual Report for the year ending 31

December 2022 and is no longer in a closed period, the Company

intends to offer the opportunity for certain Directors and PDMRs of

the Company to accept ordinary shares at the Placing Price in lieu

of cash remuneration fees.

Use of Proceeds

The expected gross Capital Raise proceeds of up to GBP7.2

million (the "Gross Proceeds") will mainly be used to fund:

-- Completion of project financing and launch of the Company's

Tulu Kapi Gold Project. As previously reported, a US$390 million

project finance package has been assembled. The Final Umbrella

Agreement was signed in April 2023 (see RNS 27 April 2023 for

further information). The Company expects binding terms to be

entered into within the next month or so subject to ongoing

successful satisfaction of outstanding conditions precedent which

are normal for a transaction of this nature;

-- Funding for the Company's share of costs for a GBP10 million

exploration and study programme in Saudi Arabia. This programme

include the completion of a Definitive Feasibility Study ("DFS") at

Jibal Qutman ("Jibal Qutman") and a Pre-Feasibility Study ("PFS")

at Hawiah Gold and Copper ("Hawiah"), as well as additional

exploration drilling and studies across the project portfolio,

which includes 15 exploration licences. The potential combined

identified gold-equivalent resources at Jibal Qutman and Hawiah

already exceed those at Tulu Kapi;

-- The extinguishing of certain current liabilities and advances

to strengthen the Company's balance sheet ahead of proposed project

development; and

-- General working capital.

Placing Agreement

Tavira acted as broker to the Firm Placing. The Company has

appointed the Broker as its agent pursuant to the terms of a

placing agreement executed on or about today's date (the "Placing

Agreement").

The Company has agreed to pay the Broker certain commissions and

fees, some of which will be satisfied through the grant of

39,285,714 warrants over KEFI ordinary shares (the "Broker

Warrants") subject to shareholder approval at the Annual General

Meeting. Each Broker Warrant will entitle the Broker to subscribe

for one new KEFI ordinary share at a price of 0.7 pence per share,

exercisable for a period of three years from the date of Second

Admission.

Notice of Annual General Meeting

A circular convening the Annual General Meeting (AGM) to be held

30 June 2023 will be circulated shortly. The Annual General Meeting

is to be held at 11:00 a.m. (EEST) (9:00 a.m. (BST)) on 30 June

2023 at 1 Achaion Street, Engomi, Nicosia, 2413, Cyprus to consider

and, if thought appropriate, pass the resolutions that are required

to issue and allot the Conditional Subscription Shares, the Retail

Shares and the Broker Warrants, and also to deal with other usual

business at the AGM .

Once published, the circular will be available to download from

the Company's website at www.kefi-goldandcopper.com. It is

important that shareholders lodge their votes in advance of the

General Meeting through submission of their proxy votes.

If the resolutions required to approve the Conditional

Subscription are not approved at the Annual General Meeting, the

Company will need to seek an increased amount of additional funding

from alternative sources to support its operations. However, there

is no guarantee that such increased amount of additional funding

could be obtained in the requisite time frame or at all. If the

Resolutions are not approved at the Annual General Meeting, and no

alternative funding can be raised, the Company's ability to operate

as a going concern may be put at risk .

Investor Webinar

The Company will host an investor webinar at 12:00 p.m. (EEST)

(10:00 a.m. (BST)) on Friday 30 June 2022 which will be accessed

via: https://www.kefi-goldandcopper.com/

Shareholders are encouraged to submit questions by emailing:

questions@brrmedia.co.uk . The webinar will subsequently be

available on the Company's website at:

http://www.kefi-goldandcopper.com/news/webcasts.

Admission to AIM

Application has been made for admission of 785,714,285 new

ordinary shares of the Company and it is expected that First

Admission will take place and that trading will commence on AIM at

8.00 a.m. on or around 5 June2023.

Conditional on shareholder approval, application will be made

for admission of the Conditional Subscription Shares and the Retail

Shares to trading on AIM after the Annual General Meeting and it is

expected that Second Admission will become effective and dealings

will commence in the Conditional Subscription Shares and Retail

Shares at 8:00 a.m. on or around 3 July 2023.

The Firm Placing Shares, the Conditional Subscription Shares and

the Retail Shares will rank pari passu in all respects with the

existing ordinary shares of the Company.

Harry Anagnostaras Adams, Chairman of KEFI Gold and Copper

commented:

"We are pleased that, despite weak and turbulent financial

markets, KEFI is able to reduce its balance sheet risk in

preparation for the Tulu Kapi project financing at the same time as

elevating its rate of progress in Saudi Arabia.

"Tulu Kapi Gold in Ethiopia is planned to start production in

2025 and at gold price of c. US$2,000/oz, KEFI's beneficial

interest in the estimated Net Operating Cash Flow from Tulu Kapi

alone is estimated to be c. GBP100 million average per annum and in

the NPV is estimated at GBP178 million, or respectively 2.6 pence

and 4.55 pence per current KEFI share in issue.

"The targeted next cab off the rank for development and then

cash flow generation is Jibal Qutman Gold in Saudi Arabia which is

being driven to start production in 2025 alongside Tulu Kapi. We

wish to then develop and start-up Hawiah Copper and Gold, also in

Saudi Arabia. A gross GBP10 million budget is being applied to the

Saudi operations via operating JV company Gold & Minerals.

Drilling is underway and the Company expects to release its PFS on

Hawiah and other progress reports as from the coming month.

"The combination of these three advanced projects is expected to

have a transformative effect on KEFI as will the pipeline of less

advanced projects being tackled in both countries."

Total Voting Rights

Application has been made to the London Stock Exchange for

Admission of the Firm Placing Shares to trade on AIM and it is

expected that First Admission will become effective and that

dealings in the Firm Placing Shares will commence at 8.00 a.m. on

or around 5 June 2023. Following First Admission of the Firm

Placing Shares, the total issued share capital of the Company will

consist of 4,724,833,335 Ordinary Shares each with voting rights.

The Company does not hold any Ordinary Shares in treasury.

Therefore, the total number of voting rights in the Company will be

4,724,833,335 and this figure may be used by shareholders as the

denominator for the calculations by which they will determine if

they are required to notify their interest in, or a change in their

interest in, the share capital of the Company under the FCA's

Disclosure Guidance and Transparency Rules.

Market Abuse Regulation (MAR) Disclosure

This announcement contains inside information for the purposes

of Article 7 of the Market Abuse Regulation (EU) 596/2014 as it

forms part of UK domestic law by virtue of the European Union

(Withdrawal) Act 2018 ("MAR"), and is disclosed in accordance with

the Company's obligations under Article 17 of MAR.

Enquiries

KEFI Gold and Copper plc

Harry Anagnostaras-Adams (Executive Chairman) +357 994 57843

John Leach (Finance Director) +357 992 08130

SP Angel Corporate Finance LLP (Nominated Adviser +44 (0) 20 3470

and Joint Broker) 0470

Jeff Keating, Adam Cowl

+44 (0) 20 7100

Tavira Financial Limited (Joint Broker) 5100

Oliver Stansfield, Jonathan Evans

+44 (0) 20 3934

IFC Advisory Ltd (Financial PR and IR) 6630

Tim Metcalfe, Florence Chandler

Further information can be viewed at www.kefi-minerals.com

IMPORTANT NOTICES

THIS ANNOUNCEMENT, INCLUDING THE APPICES AND THE INFORMATION

CONTAINED IN THEM, IS RESTRICTED AND IS NOT FOR PUBLICATION,

RELEASE, FORWARDING OR DISTRIBUTION, DIRECTLY OR INDIRECTLY, IN

WHOLE OR IN PART, IN OR INTO THE UNITED STATES OF AMERICA

(INCLUDING ITS TERRITORIES AND POSSESSIONS, ANY STATE OF THE UNITED

STATES AND THE DISTRICT OF COLUMBIA (COLLECTIVELY THE "UNITED

STATES")), AUSTRALIA, CANADA, THE REPUBLIC OF SOUTH AFRICA, JAPAN

OR ANY OTHER JURISDICTION IN WHICH SUCH PUBLICATION, RELEASE OR

DISTRIBUTION WOULD BE UNLAWFUL.

No public offering of the securities referred to herein is being

made in any such jurisdiction or elsewhere.

The Firm Placing Shares and the Conditional Subscription Shares

(together, the "Firm Placing and Subscription Shares") have not

been, and will not be, registered under the US Securities Act of

1933, as amended (the "US Securities Act"), or with any securities

regulatory authority or under any securities laws of any state or

other jurisdiction of the United States and may not be offered,

sold, resold, pledged, transferred or delivered, directly or

indirectly, in or into the United States except pursuant to an

applicable exemption from, or in a transaction not subject to, the

registration requirements of the US Securities Act and in

compliance with the securities laws of any state or other

jurisdiction of the United States. No public offering of securities

is being made in the United States. The Firm Placing and

Subscription Shares have not been approved, disapproved or

recommended by the U.S. Securities and Exchange Commission, any

state securities commission in the United States or any other U.S.

regulatory authority, nor have any of the foregoing authorities

passed upon or endorsed the merits of the offering of the Firm

Placing and Subscription Shares. Subject to certain exceptions, the

securities referred to herein may not be offered or sold in the

United States, Australia, Canada, Japan, New Zealand, the Republic

of South Africa or to, or for the account or benefit of, any

national, resident or citizen of the United States, Australia,

Canada, Japan, New Zealand, the Republic of South Africa.

No public offering of the Firm Placing and Subscription Shares

is being made in the United States, United Kingdom or elsewhere.

All offers of the Firm Placing and Subscription Shares will be made

pursuant to an exemption from the requirement to produce a

prospectus under the Prospectus Regulation (EU) 2017/1129 (as

supplemented by Commission Delegated Regulation (EU) 2019/980 and

Commission Delegated Regulation (EU) 2019/979) as it forms part of

UK domestic law by virtue of the European Union (Withdrawal) Act

2018 (the "UK Prospectus Regulation").

No action has been taken by the Company, the Broker or any of

their respective affiliates, or any of its or their respective

directors, officers, partners, employees, advisers or agents

(collectively, "Representatives") that would, or is intended to,

permit an offer of the Firm Placing and Subscription Shares or

possession or distribution of this Announcement or any other

publicity material relating to such Firm Placing and Subscription

Shares in any jurisdiction where action for that purpose is

required. Persons receiving this Announcement are required to

inform themselves about and to observe any restrictions contained

in this Announcement. The distribution of this Announcement, and

the Placing and/or the offer or sale of the Firm Placing and

Subscription Shares, may be restricted by law in certain

jurisdictions. Persons (including, without limitation, nominees and

trustees) who have a contractual or other legal obligation to

forward a copy of this Announcement should seek appropriate advice

before taking any action. Persons distributing any part of this

Announcement must satisfy themselves that it is lawful to do

so.

Members of the public are not eligible to take part in the Firm

Placing and the Conditional Subscription. This Announcement is for

information purposes only and is directed only at: (a) persons in

Member States of the European Economic Area ("EEA") who are

qualified investors within the meaning of article 2(e) of the

Prospectus Regulation (EU) 2017/1129; (b) in the United Kingdom,

qualified investors within the meaning of Article 2(e) of the UK

Prospectus Regulation who are persons who (i) have professional

experience in matters relating to investments falling within the

definition of "investment professionals" in article 19(5) of the

Financial Services and Markets Act 2000 (Financial Promotion) Order

2005, as amended (the "Order"); or (ii) are persons falling within

article 49(2)(a) to (d) ("high net worth companies, unincorporated

associations, etc") of the Order; and (c) otherwise, persons to

whom it may otherwise lawfully be communicated, (all such persons

in (a), (b) and (c) together being referred to as "Relevant

Persons"). This Announcement must not be acted on or relied on by

persons who are not Relevant Persons. Persons distributing this

Announcement must satisfy themselves that it is lawful to do

so.

This Announcement may contain, and the Company may make, verbal

statements containing "forward-looking statements" with respect to

certain of the Company's plans and its current goals and

expectations relating to its future financial condition,

performance, strategic initiatives, objectives and results.

Forward-looking statements sometimes use words such as "aim",

"anticipate", "target", "expect", "estimate", "intend", "plan",

"goal", "believe", "seek", "may", "could", "outlook" or other words

of similar meaning. By their nature, all forward-looking statements

involve risk and uncertainty because they relate to future events

and circumstances which are beyond the control of the Company. As a

result, the actual future financial condition, performance and

results of the Company may differ materially from the plans, goals

and expectations set forth in any forward-looking statements. Any

forward-looking statements made in this Announcement by or on

behalf of the Company speak only as of the date they are made.

These forward-looking statements reflect the Company's judgment at

the date of this Announcement and are not intended to give any

assurance as to future results and cautions that its actual results

of operations and financial condition, and the development of the

industry in which it operates, may differ materially from those

made in or suggested by the forward looking statements contained in

this Announcement and/or information incorporated by reference into

this Announcement. The information contained in this Announcement

is subject to change without notice and except as required by

applicable law or regulation, the Company expressly disclaims any

obligation or undertaking to publish any updates, supplements or

revisions to any forward-looking statements contained in this

Announcement to reflect any changes in the Company's expectations

with regard thereto, or any changes in events, conditions or

circumstances on which any such statements are based, except where

required to do so under applicable law.

The Firm Placing and Subscription Shares and the Retail Shares

to be issued or sold pursuant to the Placing will not be admitted

to trading on any stock exchange other than AIM.

, the news service of the London Stock Exchange. RNS is approved by

the Financial Conduct Authority to act as a Primary Information

Provider in the United Kingdom. Terms and conditions relating to

the use and distribution of this information may apply. For further

information, please contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IOEEAKSEDDEDEFA

(END) Dow Jones Newswires

May 30, 2023 12:32 ET (16:32 GMT)

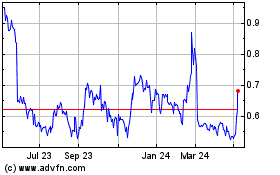

Kefi Gold And Copper (LSE:KEFI)

Historical Stock Chart

From Feb 2025 to Mar 2025

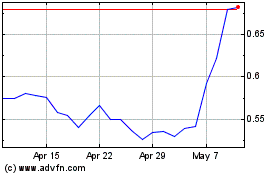

Kefi Gold And Copper (LSE:KEFI)

Historical Stock Chart

From Mar 2024 to Mar 2025