TIDMKGH

RNS Number : 0505U

Knights Group Holdings PLC

21 November 2023

21 November 2023

Knights Group Holdings plc

("Knights", the "Company" or the "Group")

Trading Update for the Six Months Ended 31 October 2023

Performance in line with expectations for the full year

Knights, a UK legal and professional services business, today

provides a trading update for the half year ended 31 October

2023.

The Group's first half performance is in line with the Board's

expectations. The Group anticipates half year revenue of

c.GBP75.3m, an increase of 6% compared to the prior year (H1 23:

GBP71.2m), with underlying PBT(1) anticipated to be c.GBP11.5m, an

increase of 28% on the prior year (H1 23: GBP9.0m) with underlying

PBT margin increasing from 12.6% to 15.3%.

This performance is supported by a return to low single-digit

organic growth in the period, notwithstanding a challenging

backdrop in the housing and M&A markets.

The Group's continued discipline on cash collection has

delivered debtor days of 31 as at 31 October 2023, in line with the

32 days achieved as at 31 October 2022 and 30 days at 30 April

2023, with total lock-up(2) improving to 93 days compared to 103

days at October 2022.

This focus on cash has resulted in net debt(3) of c.GBP38.3m at

31 October 2023 (H1 23, GBP35.6m, FY 23: GBP29.2m), after c.GBP7.5m

of acquisition consideration, debt and related costs in the first

half, providing significant headroom against the Group's recently

increased GBP70m revolving credit facility.

The Group has recruited 20 senior hires in the half year,

compared to nine in the same period last year, many of whom have

been attracted by Knights' differentiated ownership and business

model, which offers no financial risk, compared to traditional

equity partnership. Churn for the period was six percent, compared

with 11% for the same period last year.

The integration of prior year acquisitions, Coffin Mew

(Portsmouth) and Meade King (Bristol), has been successful and both

are performing well, despite challenging market conditions for the

residential property sector in the period.

During the first half, the Group completed the acquisition of St

James Law (Newcastle) and Baines Wilson (Carlisle), further

strengthening the Group's presence in the North. Both acquisitions

are integrating well and performing in line with the Board's

expectations.

David Beech, CEO of Knights, commented:

"We continue to execute our strategy successfully, delivering

profitable, cash generative growth, while focusing on delivering a

premium service.

"Entering the second half, we are encouraged by the Group's

strong performance, as we continue to attract high quality,

talented professionals, and monitor an attractive and growing

pipeline of potential acquisitions for the Group."

Knights will provide a further update on trading with its half

year results announcement in mid-January 2024.

Ends

Notes

(1) Underlying PBT is before amortisation of acquired

intangibles, non-underlying costs relating to acquisitions,

non-recurring finance costs, restructuring costs in the reporting

period, and non-underlying share based payments. The Board believes

that these underlying figures provide a more meaningful measure of

the Group's underlying performance.

(2) Lock up is calculated as the combined debtor and WIP days as

at a point in time. Debtor days are calculated on a count back

basis using the gross debtors at the period end and compared with

total fees raised over prior months. WIP days are calculated based

on the gross work in progress (excluding that relating to clinical

negligence claims, insolvency, and ground rents, as these matters

operate mainly on a conditional fee arrangement and a different

profile to the rest of the business) and calculating how many days

billing this relates to, based on average fees (again excluding

clinical negligence claims, insolvency, and ground rents fees) per

month for the last 3 months.

Lock up days excludes the impact of acquisitions in the last

quarter of the reporting period.

(3) Net debt excludes lease liabilities

Enquiries

Knights

David Beech, CEO Via MHP

Numis (Nomad and Broker)

Stuart Skinner, Kevin Cruickshank 020 7260 1000

MHP (Media enquiries)

Katie Hunt, Eleni Menikou, Rob 020 3128 8100

Collett-Creedy +44 (0)7736 464749

knights@mhpgroup.com

Notes to Editors

Knights is a legal and professional services business, ranked

within the UK's top 50 largest law firms by revenue. Knights was

one of the first law firms in the UK to move from the traditional

partnership model to a corporate structure in 2012 and has since

grown rapidly. Knights has specialists in all key areas of

corporate and commercial law so that it can offer end-to-end

support to businesses of all sizes and in all sectors. It is

focussed on key UK markets outside London and currently operates

from 23 offices located in Birmingham, Brighton, Bristol, Carlisle,

Cheltenham, Chester, Exeter, Kings Hill, Leeds, Leicester, Lincoln,

Manchester, Newbury, Newcastle-upon-Tyne, Nottingham, Oxford,

Portsmouth, Sheffield, Stoke, Teesside, Weybridge, Wilmslow and

York.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTFEAFASEDSEFF

(END) Dow Jones Newswires

November 21, 2023 02:00 ET (07:00 GMT)

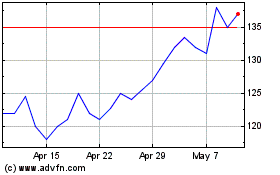

Knights (LSE:KGH)

Historical Stock Chart

From Dec 2024 to Jan 2025

Knights (LSE:KGH)

Historical Stock Chart

From Jan 2024 to Jan 2025