Kenmare Resources Kenmare Resources Plc : Debt Financing Update

01 August 2014 - 4:02PM

UK Regulatory

TIDMKMR

Kenmare Resources plc ("Kenmare" or "the Company")

1 August 2014

Debt Financing Update

Kenmare Resources (LSE: KMR, ISE: KMR), one of the leading producers of

titanium minerals, is pleased to announce that it has agreed an

amendment to the project financing terms for the Moma Mine in Mozambique,

as well as an extension to the corporate loan provided by Absa Bank

Limited ("Absa"), a member of Barclays.

The project financing amendment removes the requirement to make

scheduled principal payments of Senior Debt and payments of interest and

principal of Subordinated Debt falling due in August 2014, February 2015

and August 2015. Instead, project lenders will receive payments under a

cash sweep dependent on the level of cash generation at the mine.

Simultaneously, Kenmare has agreed with Absa an extension to Absa's

US$20 million corporate loan, which will now mature on 31 March 2016.

Managing Director Michael Carvill commented: "We are pleased to have

concluded this agreement with the project lenders and Absa which will

enable us to conserve cash and provide greater flexibility during the

current period of low product prices."

The principal amendments to the project financing are as follows:

-- Principal repayments of Senior Debt and principal repayments and interest

due in respect of Subordinated Debt that in each case fall due on the 1

August, 2014, 1 February, 2015 and 1 August, 2015 payment dates will now

be paid only to the extent the Kenmare group cash balance exceeds US$80

million in accordance with a cash sweep mechanism.

-- To the extent scheduled amounts are not paid on the due dates under this

cash sweep mechanism, the balances would then be payable on the earlier

of the next payment date (to the extent payable under the cash sweep) and

the Deferral Amount Payment Date.

-- The Deferral Amount Payment Date is the earlier of 31 December 2015 and

30 days after a change of control of Kenmare.

In addition, Absa has agreed that the repayment date for the US$20

million loan provided to Kenmare will be extended from the current date

of 31 March 2015 to 31 March 2016. The terms of the extension provide

that the loan is repayable upon a change of control of Kenmare.

In return for this increased flexibility, Kenmare and the Project

Companies have agreed, amongst other things, to provide information to

project lenders in greater detail and on a more frequent basis, and to

meet the costs of providing the lenders with legal and other

professional advisers. In addition, the Project Companies are required

to deliver a budget for 2015 to the lenders by 31 January 2015. This

budget must show the Project Companies meeting their debts as they fall

due and be approved by the lenders, acting reasonably, failing which an

Event of Default would ensue.

The Kenmare group has also agreed to the payment of fees as follows:

-- In addition to fees payable to providers of political and commercial risk

insurance, guarantees to certain of the project lenders and payment of

reimbursable expenses, work fees of US$300,000 will be payable to the

project lenders, half of which will be payable to Senior Lenders and half

to Subordinated Lenders.

-- An extension fee equivalent to 4% (US$800,000) of the principal amount

will be payable to Absa in relation to the Absa Facility. It is expected

that this fee will be settled through the issuance of warrants for

Kenmare shares, unless these cannot be issued for regulatory reasons. The

warrants will not be issued before 1 September, 2014 and will have an

exercise price equal to the market price at the time of issue. The

warrants will be exercisable for a period of seven years and will

otherwise be on substantially the same terms as the warrants issued on 16

October 2013 in connection with Kenmare's placing at that time.

Kenmare group cash balances amounted to $37.3 million and the aggregate

group debt was $349.6 million at the 30 June 2014.

Kenmare's Half-Yearly Report is scheduled for release on 27 August 2014.

For further information, please contact:

Kenmare Resources plc

Michael Carvill, Managing Director

Tel: +353 1 671 0411

Mob: + 353 87 674 0110

Tony McCluskey, Financial Director

Tel: +353 1 671 0411

Mob: + 353 87 674 0346

Jeremy Dibb, Corporate Development & Investor Relations Manager

Tel: +353 1 671 0411

Mob: +353 87 943 0367

Murray Consultants

Joe Heron / Jim Milton

Tel: +353 1 498 0300

Buchanan

Bobby Morse / Louise Mason / Gordon Poole

Tel: +44 207 466 5000

Note: Kenmare Moma Mining (Mauritius) Limited and Kenmare Moma

Processing (Mauritius) Limited are wholly owned subsidiaries of Kenmare

Resources plc and collectively referred to herein as "the Project

Companies". The "Kenmare group" includes Kenmare Resources plc and its

subsidiaries.

The Directors of Kenmare accept responsibility for the information

contained in this announcement. To the best of their knowledge and

belief (having taken all reasonable care to ensure that such is the

case), the information contained in this announcement is in accordance

with the facts and does not omit anything likely to affect the import of

such information.

This announcement is not intended to, and does not, constitute or form

part of any offer, invitation or the solicitation of an offer to

purchase, otherwise acquire, subscribe for, sell or otherwise dispose of,

any securities whether pursuant to this announcement or otherwise. The

distribution of this announcement in jurisdictions outside Ireland or

the United Kingdom may be restricted by law and therefore persons into

whose possession this announcement comes should inform themselves about,

and observe, such restrictions. Any failure to comply with the

restrictions may constitute a violation of the securities law of any

such jurisdiction.

This announcement is distributed by NASDAQ OMX Corporate Solutions on

behalf of NASDAQ OMX Corporate Solutions clients.

The issuer of this announcement warrants that they are solely

responsible for the content, accuracy and originality of the information

contained therein.

Source: Kenmare Resources via Globenewswire

HUG#1845582

http://www.kenmareresources.com/

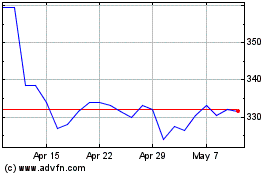

Kenmare Resources (LSE:KMR)

Historical Stock Chart

From Jun 2024 to Jul 2024

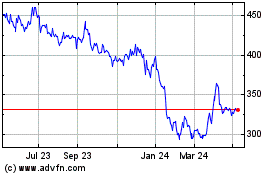

Kenmare Resources (LSE:KMR)

Historical Stock Chart

From Jul 2023 to Jul 2024