Kerry Group PLC Kerry Strategic Update -- Capital Markets Day (8674O)

13 October 2021 - 5:00PM

UK Regulatory

TIDMKYGA

RNS Number : 8674O

Kerry Group PLC

13 October 2021

Date: 13 October 2021

LEI: 635400TLVVBNXLFHWC59

KERRY GROUP

Kerry Presents its Strategic Update at Virtual Capital Markets

Day

Kerry Group plc ("Kerry"), the global taste & nutrition

company, today presents its updated strategy, mid-term financial

targets for the period 2022-2026, and sustainability commitments

for 2030.

CEO Edmond Scanlon commented "We have made significant strategic

progress in recent years, as we continue to evolve our business as

the world's leading taste & nutrition partner for the food,

beverage and pharmaceutical markets . We have a truly unique

business with strong leadership positions, aligned to today's

consumer demands and customer needs. Today's update is the next

evolution of Kerry, as we strive to create value for our customers

every day, by solving their complex challenges with differentiated

solutions. This supports our vision to be our customers' most

valued partner, creating a world of sustainable nutrition". The

updated strategic framework continues to reflect Kerry's

overarching strategic priorities of Taste, Nutrition and Emerging

Markets. The Group's annual revenue volume growth target has been

updated to 4-6% on average across the plan, supported by the key

growth platforms of Authentic Taste, Plant-Based, Food Waste, and

Health & Bio-Pharma.

The Group has set an EBITDA (1) margin target of 18%+ by 2026 .

This will be underpinned by expanding the EBITDA (1) margin in

Taste & Nutrition to 20%+. The key pillars of Kerry's margin

expansion target are enhanced portfolio mix, operating leverage,

and operational efficiencies, partially offset by reinvestment for

growth initiatives. As part of the operational efficiencies pillar,

the Group is today announcing its Accelerate Operational Excellence

Transformation programme, beginning in 2022 and running until 2024.

The programme will focus on manufacturing and supply chain

excellence, with an investment of approximately EUR120m over the

period, delivering a full annual recurring benefit of c. EUR70m per

annum from 2025, following the completion of the programme.

Included within the Group's average mid-term targets are cash

conversion of 80%+ and Return on Average Capital Employed of

10-12%.

As part of Kerry's Beyond the Horizon sustainability strategy,

the company also announces an enhancement of its targets. Kerry is

increasing its target for scope 1 and 2 emissions reduction from

33% to 55% by 2030, aligning with the most ambitious goal of the

Paris Agreement. As part of its broader Diversity, Inclusion and

Belonging strategy, Kerry is extending its commitment to equal

gender representation across all senior management roles by

2030.

The virtual Capital Markets Day will begin at 1pm Irish time and

will run until approximately 4:30pm. Access to the webcast will be

available on the Investor Relations section of the Kerry Group

website on www.kerrygroup.com/investors . A replay of the webcast

and slides will be available on the Group's website later in the

day.

About Kerry Group

Kerry is the world's leading taste and nutrition partner for the

food, beverage and pharmaceutical markets. We innovate with our

customers to create great tasting products, with improved nutrition

and functionality, while ensuring better impact for the planet. Our

leading consumer insights, global RD&A team of 1,100+ food

scientists and extensive global footprint enable us to solve our

customers' complex challenges with differentiated solutions. At

Kerry, we are driven to be our customers' most valued partner,

creating a world of sustainable nutrition, and to reach over 2

billion consumers with sustainable nutrition solutions by 2030. For

more information, vi sit www.kerrygroup.com .

Disclaimer: Forward Looking Statements

This Announcement contains forward looking statements which

reflect management expectations based on currently available data.

However actual results may differ materially from those expressed

or implied by these forward looking statements. These forward

looking statements speak only as of the date they were made, and

the Company undertakes no obligation to publicly update any forward

looking statement, whether as a result of new information, future

events or otherwise. No statement in the Announcement is intended

as a profit forecast or a profit estimate.

(1) EBITDA represents profit before finance income and costs,

income taxes, depreciation (net of capital grant amortisation),

intangible asset amortisation and non-trading items (net of related

tax).

CONTACT INFORMATION

=============================================

Investor Relations

Marguerite Larkin , Chief Financial

Officer

+353 66 7182292 | investorrelations@kerry.ie

William Lynch , Head of Investor

Relations

+353 66 7182292 | investorrelations@kerry.ie

Media

Catherine Keogh , Chief Corporate

Affairs & Brand Officer

+353 45 930188 | corpaffairs@kerry.com

Website

www.kerrygroup.com

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDEAEEAFAAFFAA

(END) Dow Jones Newswires

October 13, 2021 02:00 ET (06:00 GMT)

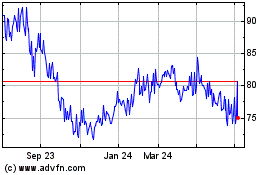

Kerry (LSE:KYGA)

Historical Stock Chart

From Mar 2024 to Apr 2024

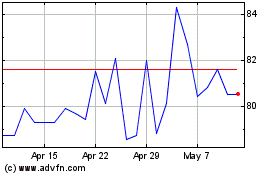

Kerry (LSE:KYGA)

Historical Stock Chart

From Apr 2023 to Apr 2024